Diritto commerciale II Paola Lucantoni Professore associato di

- Slides: 13

Diritto commerciale II Paola Lucantoni Professore associato di Diritto dei mercati finanziari Università degli Studi di Roma “Tor Vergata”

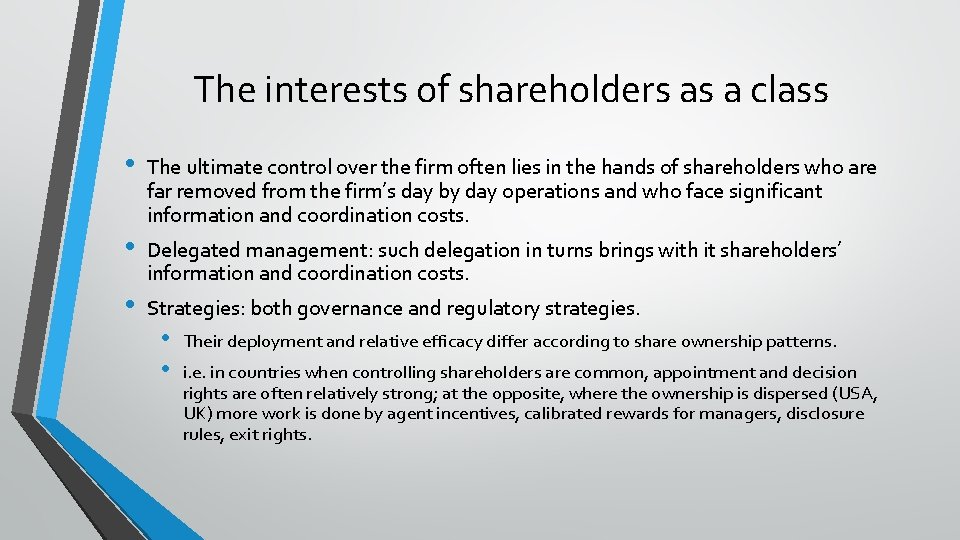

The interests of shareholders as a class • • • The ultimate control over the firm often lies in the hands of shareholders who are far removed from the firm’s day by day operations and who face significant information and coordination costs. Delegated management: such delegation in turns brings with it shareholders’ information and coordination costs. Strategies: both governance and regulatory strategies. • • Their deployment and relative efficacy differ according to share ownership patterns. i. e. in countries when controlling shareholders are common, appointment and decision rights are often relatively strong; at the opposite, where the ownership is dispersed (USA, UK) more work is done by agent incentives, calibrated rewards for managers, disclosure rules, exit rights.

Delegated management and corporate boards • • • One – tier board • USA, UK, Japan: unitary board has legal power both to manage and supervise the management of a corporation, either directly or through the board’s committees. Two – tier board • Germany, Brazil: monitoring powers are allocated to elected supervisory board of nonmanagers directors which then appoint and supervise management boards that include the principal executive officers in charge of designing and implementing business strategy. A mix • Italy and France

Appointment and decision rights • The most basic legal strategies implied by investor ownership are appointment rights: shareholders’ right to appoint or remove members of the board of directors. • The easier it is for shareholders to become informed, coordinate among themselves, and make collective choices that maximize their collective welfare, the more efficiently appointment and decision rights will control agency costs. • When shareholders are aggregated in the portfolios of institutional asset managers, a second tier of agency costs arises between the institutional asset managers and their ultimate clients.

Appointment rights: appointing directors • At the core of appointment rights lies shareholders’ power to vote on the selection of directors. • Shareholders’ information and coordination costs versus managerial agency costs. • Shareholders’ rational apathy • In the presence of high information and coordination costs, it may be preferable to let the board to select the candidates

Appointment rights: appointing directors • Qualified minority shareholders: in Germany and Italy have the chance to additional nominees to the agenda of the shareholders’ meeting. • USA, Delaware: board elections are more complex; attract policymakers’ attention. • If the election is uncontested: plurality voting rule (any number of votes suffices to elect a nominee to a board seat). • • Institutional investors: push to switch to majority voting. Proxy access: very widely spread.

Removing directors • • UK, France, Italy, Japan end Brazil: accord shareholders a non waivable right to remove directors at any time, regardless of cause or the nominal duration of their term – compensation for damages • A powerful check on agency costs Germany: provide weaker removal rights. • • • Removal without cause – only by 75 per cent majority Ratio: the presence of representatives of different constituencies However when a simple majority of the general meeting approves a “no confidence” resolution against the management board, this satisfies the “cause” requirement; and the supervisory board is entitled (and probably obliged) to remove the management board in such a situation.

Removing directors • Many USA jurisdictions treats the right to remove directors without cause as a statutory default subject to reversal by a charter provision on point. • i. e. Delaware: companies may disallow removal without cause if they choose a staggered board, that is a board where only a fraction of the members is elected each year.

Agent incentives: the trusteeship strategy. • Inclusion of independent directors • USA – Sarbanes – Oxley Act 2002 • EU – corporate governance codes • UK – most enthusiastic

Agent incentives: the reward strategy – executive compensation. • USA Delaware: stock options • Essential: disclosure to avoid excessive or incentive-distorting compensation • UK: not so common • Japan: not so common

Protecting minority shareholders: Private benefits of control • Shareholders appointment rights and deviation from one-share-one-vote • Italy: representation from minority shareholders in listed company • Japan: cumulative voting • France, UK and USA: cumulative voting but rarely for publicly traded firms. • Brazil: shareholders with 10 or 15 percent stakes – right to appoint a board member

Protecting minority shareholders: Deviation from oneshare-one-vote • Germany and Brazil: ban hares with multiple votes and cap the issuance of non-voting or limited-voting preferences shares of 50 percent of outstanding shares. • EU: fidelity shares. • With additional voting rights on a minimum holding period as a shareholder. • USA and UK: permit different classes of shares to carry any combination of cash flow and voting rights • USA and Japanese exchange listing rules ban recapitalizations that dilute the voting rights of outstanding shares.

Protecting minority shareholders: Deviation from oneshare-one-vote • New York Stock Exchange (NYSE): • • • 20 century – no deviation from proportional voting Recently – dual class shares for media and hi-tech corporations. i. e. giant Alibaba • UK: institutional investors have successfully discouraged dual class shares.

Paola lucantoni

Paola lucantoni Paola lucantoni

Paola lucantoni Paola lucantoni

Paola lucantoni Etero organizzazione diritto commerciale

Etero organizzazione diritto commerciale Assemblea totalitaria diritto commerciale

Assemblea totalitaria diritto commerciale Dipartimento di diritto privato e critica del diritto

Dipartimento di diritto privato e critica del diritto Kstudio associato

Kstudio associato Massimo bini

Massimo bini Testo ironico su un professore

Testo ironico su un professore La legge morale film

La legge morale film Luigi gaudio professore

Luigi gaudio professore Veille mercatique et commerciale

Veille mercatique et commerciale Formula sconto composto

Formula sconto composto Itc serra cesena

Itc serra cesena