DIGITAL TRANSFORMATION OF TAX ADMINISTRATION Peter Green Head

- Slides: 7

DIGITAL TRANSFORMATION OF TAX ADMINISTRATION Peter Green Head of OECD’s Forum on Tax Administration Secretariat Moscow, 6 September 2018

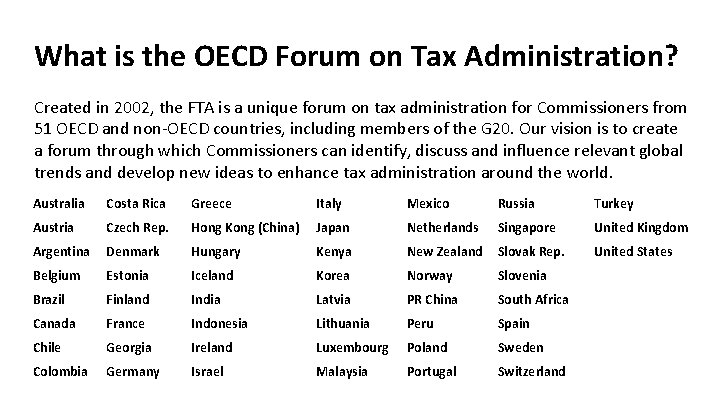

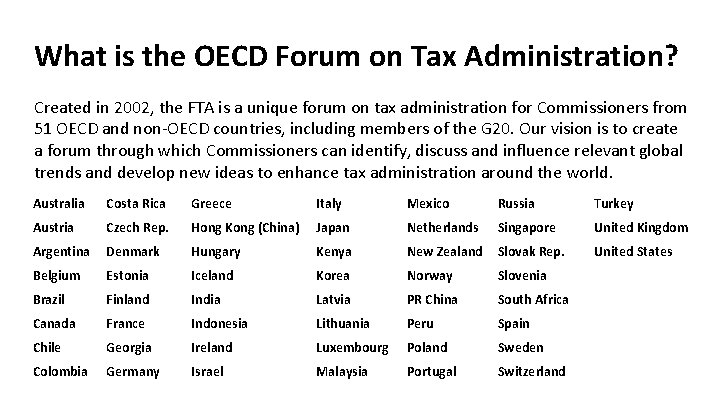

What is the OECD Forum on Tax Administration? Created in 2002, the FTA is a unique forum on tax administration for Commissioners from 51 OECD and non-OECD countries, including members of the G 20. Our vision is to create a forum through which Commissioners can identify, discuss and influence relevant global trends and develop new ideas to enhance tax administration around the world. Australia Costa Rica Greece Italy Mexico Russia Turkey Austria Czech Rep. Hong Kong (China) Japan Netherlands Singapore United Kingdom Argentina Denmark Hungary Kenya New Zealand Slovak Rep. United States Belgium Estonia Iceland Korea Norway Slovenia Brazil Finland India Latvia PR China South Africa Canada France Indonesia Lithuania Peru Spain Chile Georgia Ireland Luxembourg Poland Sweden Colombia Germany Israel Malaysia Portugal Switzerland

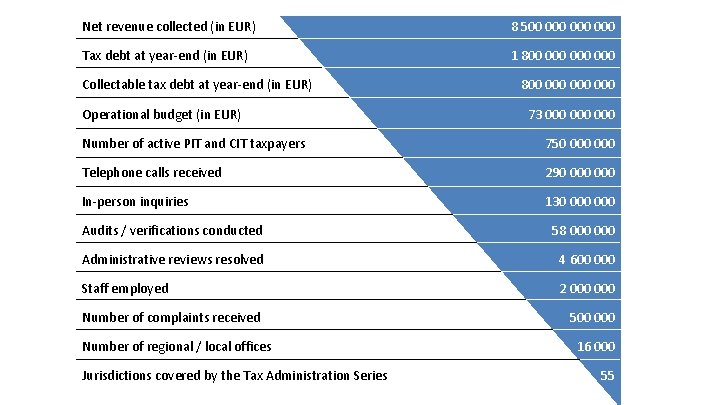

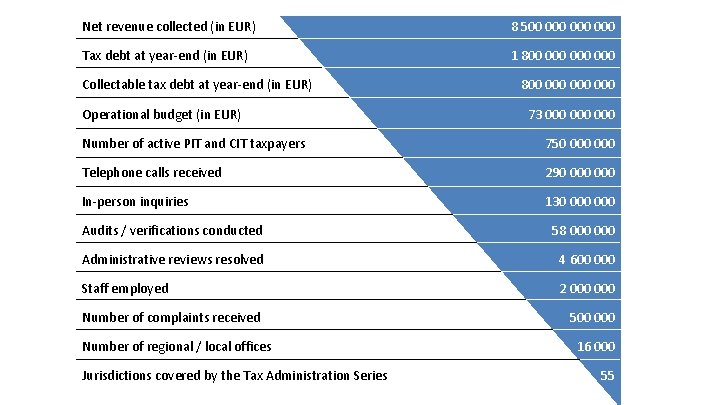

Net revenue collected (in EUR) 8 500 000 000 Tax debt at year-end (in EUR) 1 800 000 000 Collectable tax debt at year-end (in EUR) Operational budget (in EUR) 800 000 000 73 000 000 Number of active PIT and CIT taxpayers 750 000 Telephone calls received 290 000 In-person inquiries 130 000 Audits / verifications conducted 58 000 Administrative reviews resolved 4 600 000 Staff employed 2 000 Number of complaints received Number of regional / local offices Jurisdictions covered by the Tax Administration Series 500 000 16 000 55

Objectives and the Changing Environment Objectives of tax administration: • • Effective compliance Minimising compliance burden Efficient administration of the tax system Good taxpayer services What is changing in the tax environment? • Almost everything…….

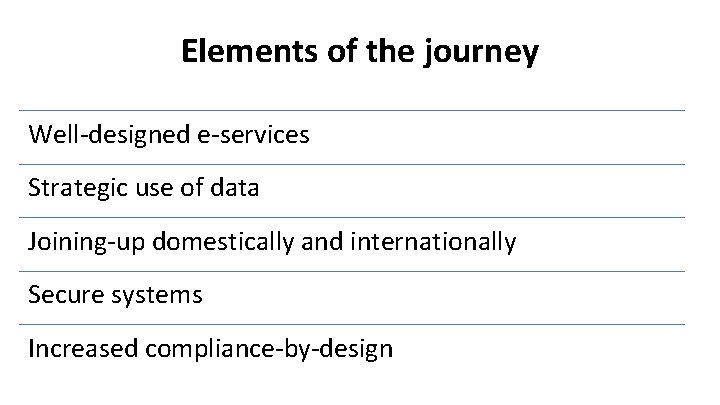

Elements of the journey Well-designed e-services Strategic use of data Joining-up domestically and internationally Secure systems Increased compliance-by-design

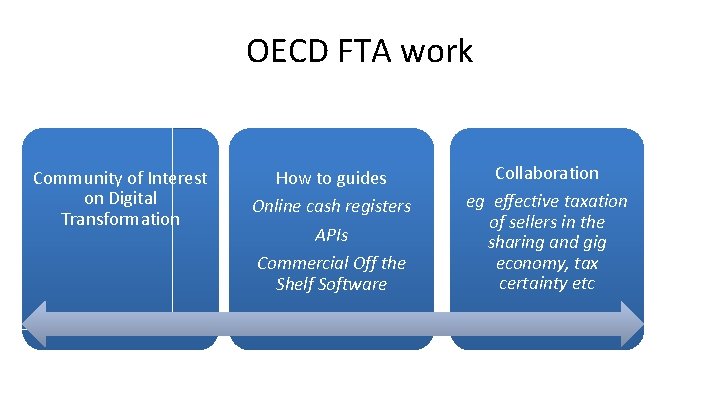

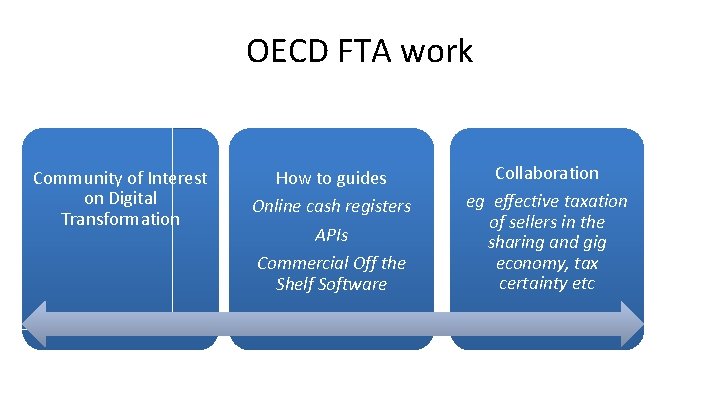

OECD FTA work Community of Interest on Digital Transformation How to guides Online cash registers APIs Commercial Off the Shelf Software Collaboration eg effective taxation of sellers in the sharing and gig economy, tax certainty etc