Allegheny Intermediate Unit Education Association Retirement Workshop March

- Slides: 38

Allegheny Intermediate Unit Education Association Retirement Workshop March 1, 2021 Via Zoom Keynote Speaker: Darlene Geddes Past President of AIUEA 1

Terminology 1. PSERS Monthly Benefit: This is the lifetime monthly payment you will receive. 2. Premium Assistance: This is the nontaxable, lifetime $100 monthly payment you will receive for health care, if you qualify. 3. Premium Share: This is the out-of-pocket expense you must submit monthly in addition to the Premium Assistance for your health care until Medicare. 2

Defined Benefit PSERS The retirement benefit is paid in two components. 1)Employee contributions and interest are paid in a lump sum. In a defined benefit plan, a retiree can take none, part or all of their contribution. You may move it to a rollover: i. e. IRA, 403 B, etc. 2)State and IU contributions are paid out monthly as per your option choice. The monthly benefit is based on the option chosen. The PSERS retirement process requires you to complete three forms: (a. ) the application to retire, (b. ) your contribution decision form, and (c. ) a direct deposit form. 3

When will I be able to retire? Regular Retirement • 35 years of service, retire at any age • 30 years of service, retire at age 60 • Age 62, retire with 1 year or more of service Early Retirement • After 25 years of service, and a minimum age 55, with a penalty of 3% per year below normal retirement with a 15% maximum penalty. • After 5 years of credited service (vested) at any age with a penalty of 7% per year below normal retirement with no maximum cap. 4

Retirement Timeline - To be eligible for the retirement benefits, employees shall notify the Allegheny Intermediate Unit no later than March 30 th of each year of their intent to retire at the end of that school year. - Retirement at any other time requires 60 calendar days notice to be eligible for retirement benefits. 5

Recommended Procedure 1)Contact PSERS to obtain a retirement estimate form. The form is available on the PSERS website. www. psers. state. pa. us 2)Schedule an exit interview with PSERS. **The option you choose is a lifetime choice and cannot be changed after 45 days. ** 3)Complete a retirement application with the assistance of the PSERS staff. 4)Schedule an appointment with Janet Breiding for the AIU benefit exit interview. 6

PSERS Beneficiary • You need to be certain to check your beneficiary or beneficiaries on your PSERS account. Look at the last statement sent to you. • You may change your beneficiary or beneficiaries at any time. 7

DART Employees For DART Employees who retire after June 30 th due to the stretch calendar, retirement benefits will be granted per the school year for which the DART stretch calendar is being completed. 8

Social Security How to Apply: 1. ) You must be 62 years of age and retired to receive the early reduced benefit or wait until you are full retirement age for the full benefit. 2. ) You can apply 3 months before your 62 nd or full retirement age birthday. 3. ) If you take the early benefit at age 62 your lifetime benefit will be 75% of the full retirement age benefit. In 2021, if you are under full retirement age*, you are only allowed to earn $18, 960. 00 annually without losing benefits. The year you reach full retirement age*, you can earn up to $50, 520 annually before you reach full retirement age without losing benefits. After you reach full retirement age, you can earn any amount and not lose benefits. * Full retirement age: Born 1943 -1954 Age 66; Born 1955 -1959 Two months are added for every birth year (example, born 1957, 66 years+4 months), Born after 1960 Age 67 4. ) You can apply online and complete with a telephone interview or you can go in person to a Social Security Office (COVID update, you may be able to get an appointment. ) 5. ) For more information go to: http: //www. ssa. gov/. Advantage: Let’s say that you earn about $80, 000. 00 in benefits between ages 62 and 66. You could have more money while you are young and can enjoy it. If you wait until your full retirement age with a higher benefit, you may need to live to an older age to recoup this same amount of benefit. You should check your specific scenario to assist with 9 decision making.

403 B Tax Sheltered Annuity • It is a long term savings account. • You must be 59. 5 years of age before you can withdrawal without penalty under normal circumstances and work in public education, the medical field, or in the U. S. Postal Service. • You can invest up to $19, 500 or, if you are over 50 years age, $26, 000 into this account. • You can start a 403 B with a bank, an insurance company, or an investment firm that has been approved by the AIU Board. • You must begin to take withdrawals by age 70. 5. • This is tax deductible while you are working. When you file your federal taxes, the amount you pay is based on the amount taxed AFTER this money has been placed into 10 your account.

403 B Example: Let’s say that you make $100. 00 per pay and you contribute $15. 00 per pay to a 403 B. Your net taxable take home pay is $85. 00 per week. $100. 00 -$ 15. 00 403 B contribution $ 85. 00 net taxable pay *Your contributions ($15. 00 per pay) are not taxed until you withdraw them after age 59. 5 years of age. **The advantage is a long term savings account with compounding of interest ***With a Roth IRA, the taxes are paid before going into your account and are never taxed again. 11

Section 81 - Retirement Benefits The AIU values the experience of its veteran teachers and in no way wishes to hasten their retirement. 12

An employee at age 55 with ten (10) years of AIU service, who elects to retire after June 30, 2011, under this provision, shall be eligible for the continuation of the following benefits in effect at the time of retirement: - Choice of Allegheny County Schools Health Insurance Consortium standard health insurance plans, consistent with Section 70 – Fringe Benefits for the individual employees and dependents, if any. - Dental - Vision - Life Insurance, if carrier permits 13

Early Retirement Incentive In the event that an early retirement incentive is offered by the Commonwealth of Pennsylvania after March 30 th deadline, employees will be afforded the opportunity to retire regardless of age and receive the benefits of Section 81 – Retirement Benefits without penalty. 14

Health Insurance Benefits Paid by the AIU Section 81 – Retirement Benefits Eight (8) years of benefits for retirement in the 2020 -2021 school year or Medicare eligibility. 15

Premium Share • The employee shall contribute 9. 50% of the health care premium in the 2020 -21 school year with caps of $80 for individual coverage and $180 for family coverage plus the amount the retiree is eligible to receive from the PSERS Health Care Supplement. • For individuals who retire, the contribution and caps for health insurance will stay at the fixed rate of the year of retirement. 16

Rate Increases - All rate increases that occur in the foregoing benefits shall be shared by the Allegheny Intermediate Unit and the employee in the first eight (8) years in the 2020 -2021 school year of the employee’s retirement or Medicare eligibility (employee pays 9. 50% of the premium). - The employee’s share of the premium will not be greater than the cap as established at retirement. 17

Employee Insurance Purchase The employee may purchase health insurance for - Three (3) years at the end of the eight (8) year benefit period provided for retirement in the 20192020 school year. - At the Allegheny Intermediate Unit group rate. The monthly stipend from PSERS will go to the employee, not to the AIU. 18

Continued Benefits - Should the employee pass away prior to exhausting the benefit, the insurance for spouse/dependents shall continue for the remainder of the benefit time period of the employee. - Thereafter, the employee’s spouse/ dependents may purchase insurance for a period of up to three years at the Allegheny Intermediate Unit group rate. 19

Spousal Buyout - An employee may elect to withdraw from the Health Insurance benefit program provided by the Collective Bargaining Agreement. - In lieu thereof, the employee will receive a payment of $3, 000. 00 spousal buyout for each school year that the employee does not participate in the aforesaid insurance program. 20

HOP • This is the Health Options Program offered by PSERS once an individual reaches Medicare eligibility. • It is a health program which offers comprehensive medical coverage. • Find more information and options at www. hopbenefits. com or 1. 800. 773. 7725. 21

PSERS Premium Assistance • You are eligible for Premium Assistance if you are a retiree who meets one of the following requirements: – You have at least 24½ years of credited PSERS service regardless of age, or – You terminate school employment and retire at or after reaching age 62 with at least 15 years of credited service, or – You are receiving a disability retirement benefit from PSERS. 22

PSERS Premium Assistance - For an employee who qualifies, he/she receives $100 monthly insurance benefit from PSERS. - Each month, the employee remits $100 + the premium share to AMCA Systems. 23

PSERS Premium Assistance - For those who qualify, during the eight (8) years of insurance benefits, the monthly stipend of $100 from PSERS will be mailed to the employee, who will in turn render it to AMCA Systems. - You must write a check for the monthly bill, you cannot use a draft or credit card. - During the three (3) year period of employee insurance purchase, the monthly stipend of $100 from PSERS will be kept by the employee and not sent to AMCA Systems. 24

PSERS Premium Assistance • Even if you meet the eligibility requirements, you cannot receive Premium Assistance if you do not choose a medical plan offered through HOP or if you do not continue to participate in your former school employer’s plan. 25

PSERS Retirement Calculator PSERS retirement calculator www. psers. pa. gov Leaving employment tab Retirement calculator tab 20

FAQs 27

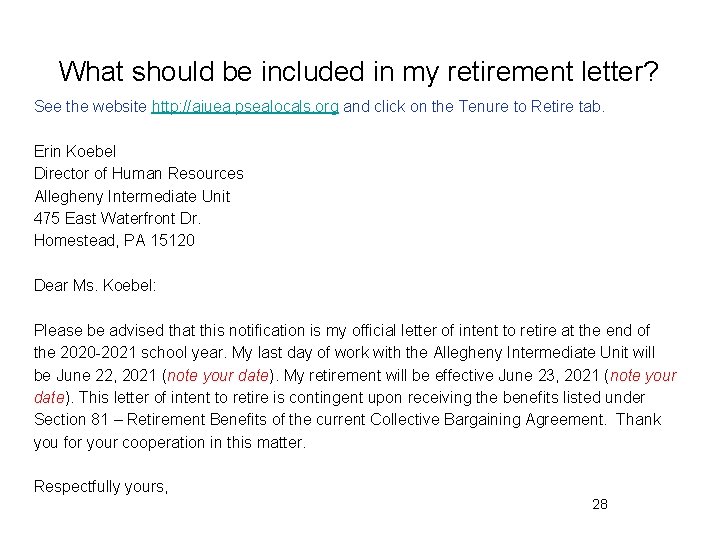

What should be included in my retirement letter? See the website http: //aiuea. psealocals. org and click on the Tenure to Retire tab. Erin Koebel Director of Human Resources Allegheny Intermediate Unit 475 East Waterfront Dr. Homestead, PA 15120 Dear Ms. Koebel: Please be advised that this notification is my official letter of intent to retire at the end of the 2020 -2021 school year. My last day of work with the Allegheny Intermediate Unit will be June 22, 2021 (note your date). My retirement will be effective June 23, 2021 (note your date). This letter of intent to retire is contingent upon receiving the benefits listed under Section 81 – Retirement Benefits of the current Collective Bargaining Agreement. Thank you for your cooperation in this matter. Respectfully yours, 28

How do I guarantee that my retirement letter has been received? We recommend using certified mail with a signature required. You may choose to use general mail delivery followed by an email to erin. koebel@aiu 3. net asking for confirmation of receipt of the correspondence. You may choose to email a copy of your retirement letter to Victoria. campbell@aiu 3. net. 29

Upon what date shall I make my retirement effective? • Date your retirement as the day after your last day of school. • If not sure of your last day of school, state in your letter ‘……. effective the day after the last day of school’. • Your retirement date determines the calculation of your PSERS payment. 30

May I rescind a letter of retirement? – No – Extenuating circumstances will be addressed on an individual basis. 31

What if I teach until August as in the DART Program? Retirement still occurs during the current school year. 32

What if I am working in ESY? - Still notify the IU that you intend to retire. - Notify PSERS that you have extenuating circumstances. - It is possible to retire from AIU and PSERS on different dates. 33

What if I miss teaching? – Act 63: You can substitute – Act 63: You can coach – Note that if you are receiving Social Security benefits and you are not full retirement age, there are limits for your earnings. If you earn more, you will lose a portion of your Social Security benefit. After full retirement age, you may earn any amount and not lose benefits. – If you want to sub you can enroll with a temporary service and not be involved with Act 63. 34

Is my spouse covered by my health benefits? - Benefits are tied to the employee. - If your spouse is older……. S/he is covered as long as you are. - If your spouse is younger……. . S/he is eligible for COBRA or a HOP Program. 35

Is my dependent child covered by my health benefits? - Benefits will continue for all children until the 1 st day of the month after the child turns 26 years of age as long as the employee is covered. - This is certified every 6 months by AMCA Systems. You will receive a correspondence from AMCA Systems. 36

May I continue my Association Membership? PSEA/NEA – Retired - Membership continues your Member Benefits and advocates for Retirees - The Unified Lifetime membership fee is $782 for September 1, 2020 until August 31, 2021. -Several payment options are available. -The Unified Annual membership fee is $72 for September 1, 2020 until August 31, 2021. Pennsylvania Association of School Retirees (PASR) is not affiliated with PSEA/NEA. 37

Contact Information PSERS 300 Cedar Ridge Drive, Pittsburgh, PA 15205 412. 488. 2031 www. psers. pa. gov Janet Breiding – AIU Human Resources janet. breiding@aiu 3. net 412. 394. 5848 Suzanne Brannagan – AIUEA Retirement Consultant suzanneaiuea@gmail. com Darlene Geddes – AIUEA Past President raedar 77@aol. com 724. 433. 1015 38