8 th RCC Meeting South Gas Regional Initiative

- Slides: 12

8 th RCC Meeting South Gas Regional Initiative Madrid, 29 th January 2010

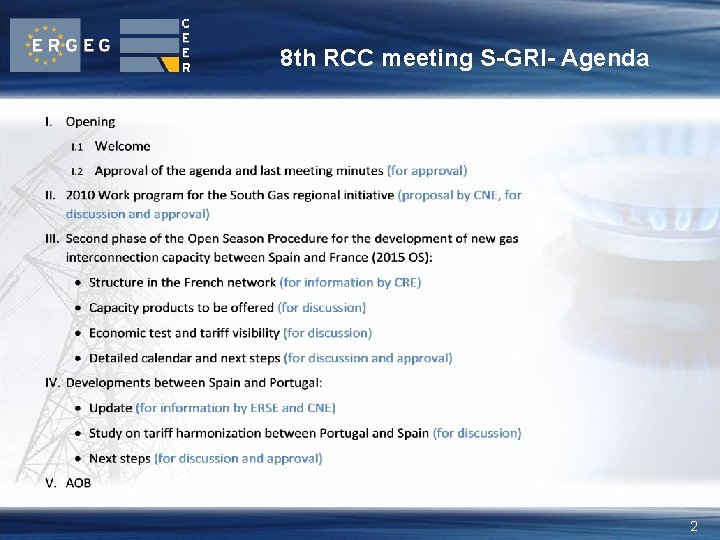

8 th RCC meeting S-GRI- Agenda 2

II. Work program for 2010 • INTERCONNECTION CAPACITIES 1. 2010 OSP: to continue allocating short term capacity at Larrau, November 2. 2013 OS: to monitor infrastructure construction associated to 2013 OS ü French TSOs and CRE to report on French investments decisions, January ü TSOs to provide a list of infrastructures, cost February and operational start dates, 15 th 3. 2015 OS: to launch 2015 OS ü Regulators to decide on economic test, tariff visibility and capacity products, January ü TSOs to provide a list of infrastructures, investments cost services’ availability dates, February and ü Regulators and TSOs to communicate Stakeholders the procedure details, early March ü Final documentation and procedure launch, to be decided ü Stakeholders to sign contracts before August 4. Regional investment plan to be developed: Regulation 715/2009 (art. 12), December 3

II. Work program for 2010 • INTEROPERABILITY 1. Study on CMPs at interconnection points: current status in each country, characterization, identification of problems taking into account CAM/CMP ERGEG paper, future action plan to solve them at the borders (Regulation 715/2009, art. 16), October (Possibility to have different timetable for the interconnection Fr-Sp, Pt-Sp) 2. Study on compatibility between LNG terminals and interconnected pipeline networks: regulation 715/2009, art. 17, to be developed once fulfilled the first priority • TRANSPARENCY 1. Update of Regulators’ 2007 Transparency Study: 1 st to check compliance (regulators) September with Regulation 715/2009, 2 nd to invite comments by Stakeholders afterwards 2. TSOs to update building status records of OS infrastructures, June and December 3. TSOs to report on ENTSOG progress, quaterly • REGULATORY HARMONIZATION 1. Regulatory proposals regarding common trading licence between Pt-Sp, Done January 2. Comparative study on cross border access tariffs between Pt and Sp, July 3. Regulatory proposal regarding cross border access tariffs between Pt-Sp, November, and Public Consultation on the proposal, December 4

III. Open Season Procedures Second Phase of 2015 OS STRUCTURE IN THE FRENCH NETWORK Information by CRE 5

III. Open Season Procedures Second Phase of 2015 OS CRE’s PROPOSAL ON ECONOMIC TEST, CAPACITY PRODUCTS AND OS PHASES Information by CRE 6

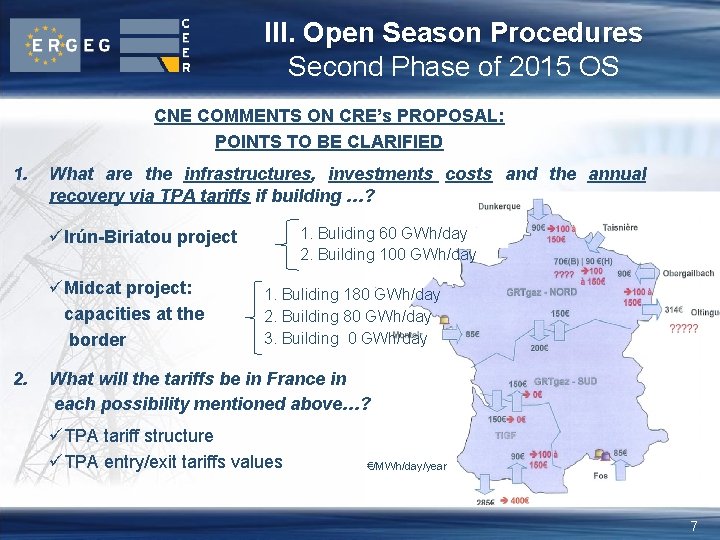

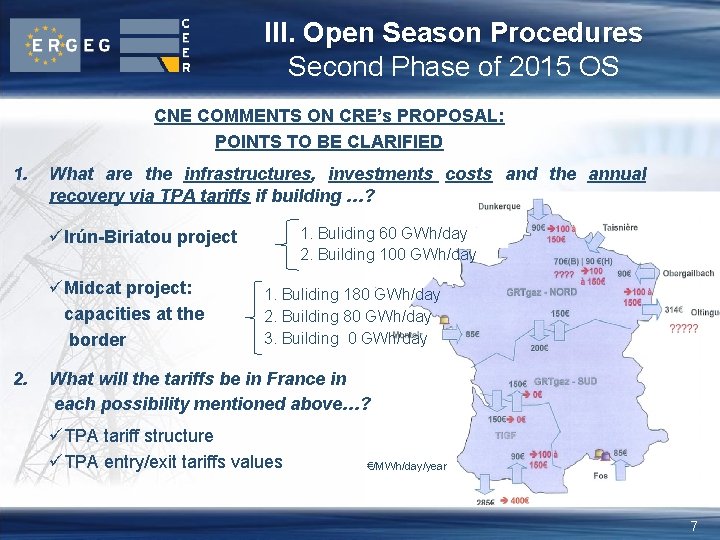

III. Open Season Procedures Second Phase of 2015 OS CNE COMMENTS ON CRE’s PROPOSAL: POINTS TO BE CLARIFIED 1. What are the infrastructures, investments costs and the annual recovery via TPA tariffs if building …? 1. Buliding 60 GWh/day 2. Building 100 GWh/day üIrún-Biriatou project üMidcat project: capacities at the border 2. 1. Buliding 180 GWh/day 2. Building 80 GWh/day 3. Building 0 GWh/day What will the tariffs be in France in each possibility mentioned above…? üTPA tariff structure üTPA entry/exit tariffs values €/MWh/day/year 7

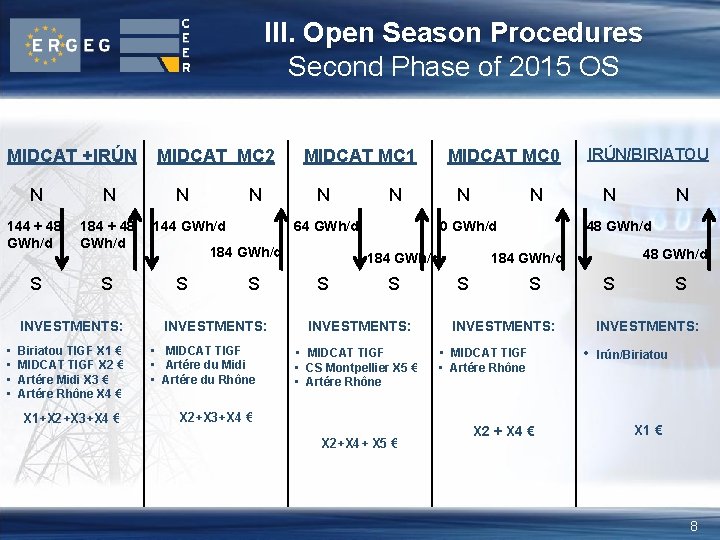

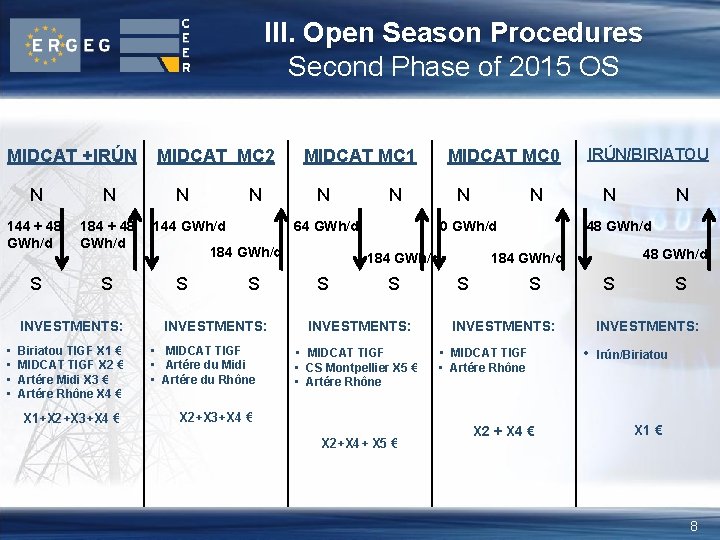

III. Open Season Procedures Second Phase of 2015 OS MIDCAT +IRÚN N N 144 + 48 GWh/d 184 + 48 GWh/d S S INVESTMENTS: • • MIDCAT MC 2 N N 144 GWh/d MIDCAT MC 1 N N N 64 GWh/d 184 GWh/d S MIDCAT MC 0 S INVESTMENTS: Biriatou TIGF X 1 € MIDCAT TIGF X 2 € Artére Midi X 3 € Artére Rhône X 4 € • MIDCAT TIGF • Artére du Midi • Artére du Rhône X 1+X 2+X 3+X 4 € N 0 GWh/d 184 GWh/d S S INVESTMENTS: N S 48 GWh/d S S INVESTMENTS: • MIDCAT TIGF • CS Montpellier X 5 € • Artére Rhône N 48 GWh/d 184 GWh/d • MIDCAT TIGF X 2+X 4+ X 5 € IRÚN/BIRIATOU X 2 + X 4 € S INVESTMENTS: • Irún/Biriatou X 1 € 8

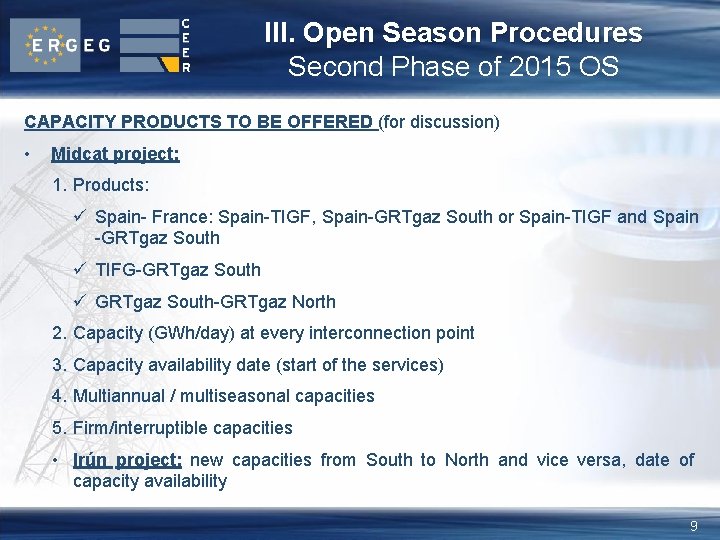

III. Open Season Procedures Second Phase of 2015 OS CAPACITY PRODUCTS TO BE OFFERED (for discussion) • Midcat project: 1. Products: ü Spain- France: Spain-TIGF, Spain-GRTgaz South or Spain-TIGF and Spain -GRTgaz South ü TIFG-GRTgaz South ü GRTgaz South-GRTgaz North 2. Capacity (GWh/day) at every interconnection point 3. Capacity availability date (start of the services) 4. Multiannual / multiseasonal capacities 5. Firm/interruptible capacities • Irún project: new capacities from South to North and vice versa, date of capacity availability 9

IV. Developments between Spain and Portugal UPDATE OF WORK: PROGRESS ON THE COMMON TRADING LICENSE A proposal containing required regulatory changes have been already sent to Ministries Information by ERSE and CNE 10

IV. Developments between Spain and Portugal CROSS BORDER ACCESS TARIFFS BETWEEN SPAIN AND PORTUGAL § Objective: To develop a proposal of cross border access tariffs between Spain and Portugal. It is an important step in order to reach the harmonization/integration of gas markets Creation of a task-force between ERSE and CNE to prepare a joint proposal for cross border access tariffs between the Spanish and Portuguese systems. 11

IV. Developments between Spain and Portugal CROSS BORDER ACCESS TARIFFS BETWEEN SPAIN AND PORTUGAL 1. Develop comparative study of current cross border access tariffs between Spain and Portugal Identify the problems and main impacts for Iberian network users. We need to analyze the distortions and difficulties that cross border access tariffs between Spain and Portugal may pose for the creation of an Iberian market due to a possible pancaking effect, and to separate treatment of cross-border and domestic flows. 2. Making a proposal of harmonization cross border access tariffs Cross border access tariffs should facilitate the development of Iberian Market. 3. Public consultation process of the document conducted by CNE and ERSE 12