TRADE AND INDUSTRY PORTFOLIO COMMITTEE HEARINGS 17 MARCH

- Slides: 25

TRADE AND INDUSTRY PORTFOLIO COMMITTEE HEARINGS 17 MARCH 2010 ROOM E 249 - NEW WING BUILDING

Outline 1. Introduction to the NAPM 2. Local & generic industry 3. Industrial Policy 4. IPAP – Impact of IPAP on industry – Industry specific challenges – NAPM recommendations.

Who we are § Oldest and longest standing trade Association for the Pharmaceutical Industry (1977) § Represent the interests of a diverse group of companies – small, medium sized, large and listed companies; local and Multinational § Total membership = 20 companies § 11 out of the top 15 generic companies are members (IMS – Feb 2007) § Representative of a number of empowered companies

Visions and Objectives Vision We aim to champion affordable healthcare by supporting and developing the South African Pharmaceutical Industry as a national asset. Objectives § Promote the use of Generics § Development of the South African Pharma Industry § To be the voice of the Pharmaceutical Industry in South Africa.

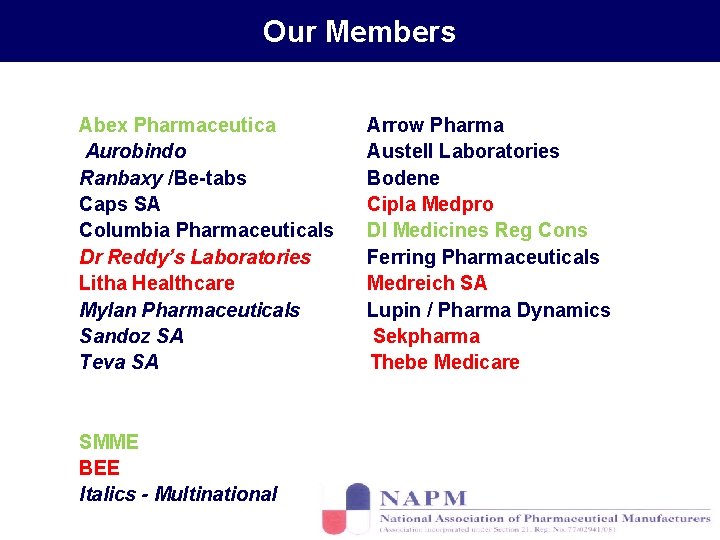

Our Members Abex Pharmaceutica Aurobindo Ranbaxy /Be-tabs Caps SA Columbia Pharmaceuticals Dr Reddy’s Laboratories Litha Healthcare Mylan Pharmaceuticals Sandoz SA Teva SA SMME BEE Italics - Multinational Arrow Pharma Austell Laboratories Bodene Cipla Medpro DI Medicines Reg Cons Ferring Pharmaceuticals Medreich SA Lupin / Pharma Dynamics Sekpharma Thebe Medicare

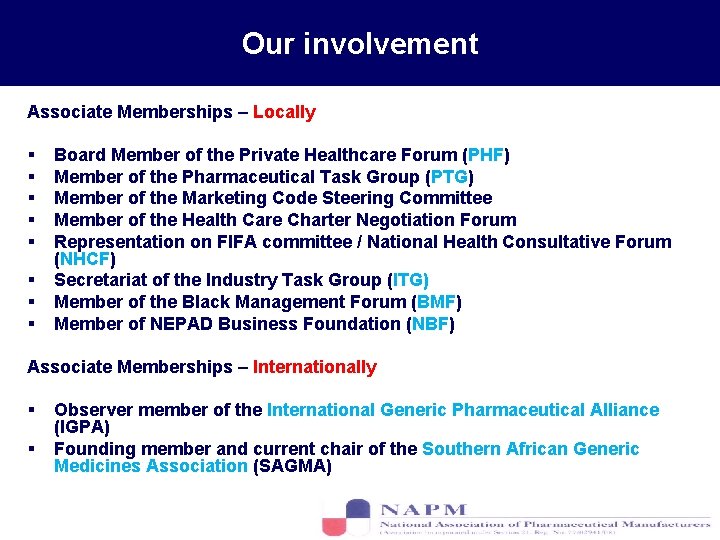

Our involvement Associate Memberships – Locally § § § § Board Member of the Private Healthcare Forum (PHF) Member of the Pharmaceutical Task Group (PTG) Member of the Marketing Code Steering Committee Member of the Health Care Charter Negotiation Forum Representation on FIFA committee / National Health Consultative Forum (NHCF) Secretariat of the Industry Task Group (ITG) Member of the Black Management Forum (BMF) Member of NEPAD Business Foundation (NBF) Associate Memberships – Internationally § § Observer member of the International Generic Pharmaceutical Alliance (IGPA) Founding member and current chair of the Southern African Generic Medicines Association (SAGMA)

Importance of the Local & Generic Industry § Affordability promotes greater patient access § Encourages and strengthens price competition thereby making medicines more cost effective and affordable § Creating self reliance in a critical sector – members scale up over time and move into production (BEE) § Skills development and technology acquisition § Employs people – more employed in sales & marketing, finance & admin than in manufacturing § Supportive of government initiatives e. g. Health Charter and economic transformation

INDUSTRIAL POLICY

National Industrial Policy Framework (NIPF ) 2007 § NAPM welcomes & applauds government for the extensive work it has done on the NIPF § Broad Agreement with the NIPF and would like to note the following: ü Thorough research is needed on developing a pharmaceutical sector strategy that incorporates all stakeholders ü Need to ensure any sector strategy or industrial policy does not adversely affect access to medicines ü Need to ensure competition introduced by government post-1994 by strategic partners from other emerging markets, like India and Brazil, is maintained or enhanced. This competition has resulted in greater access to medicines & forces local companies to up their game ü A balance is needed - should not exclude competition from developed markets, or from local non manufacturing companies

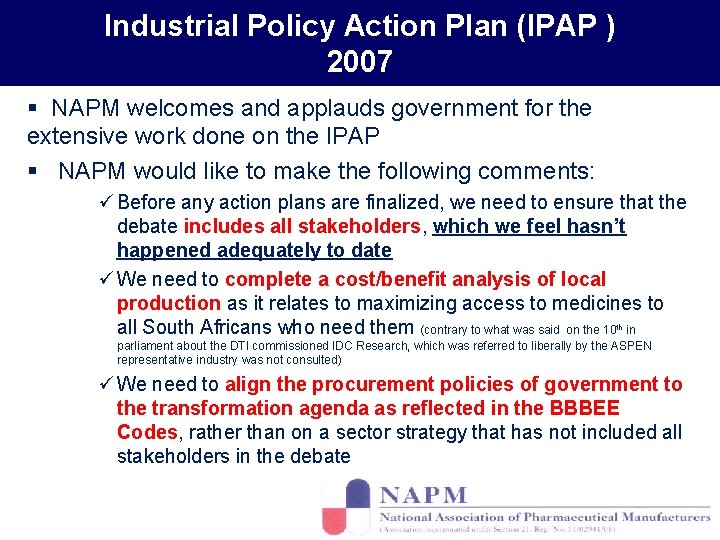

Industrial Policy Action Plan (IPAP ) 2007 § NAPM welcomes and applauds government for the extensive work done on the IPAP § NAPM would like to make the following comments: ü Before any action plans are finalized, we need to ensure that the debate includes all stakeholders, which we feel hasn’t happened adequately to date ü We need to complete a cost/benefit analysis of local production as it relates to maximizing access to medicines to all South Africans who need them (contrary to what was said on the 10 in th parliament about the DTI commissioned IDC Research, which was referred to liberally by the ASPEN representative industry was not consulted) ü We need to align the procurement policies of government to the transformation agenda as reflected in the BBBEE Codes, rather than on a sector strategy that has not included all stakeholders in the debate

IPAP II

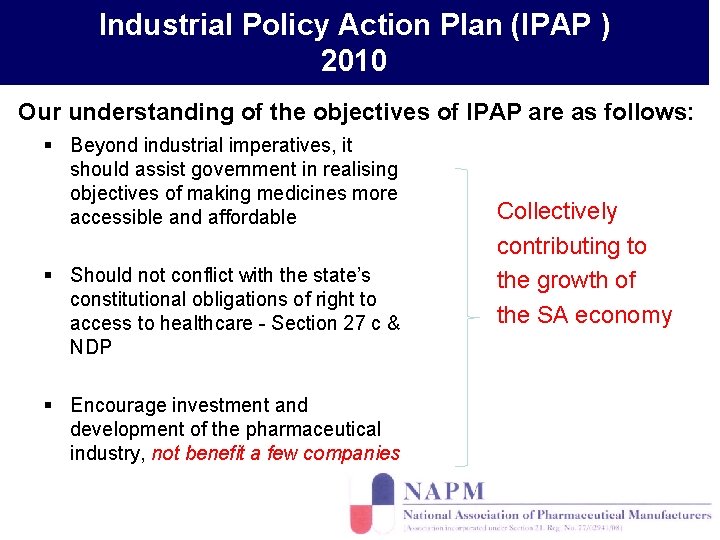

Industrial Policy Action Plan (IPAP ) 2010 Our understanding of the objectives of IPAP are as follows: § Beyond industrial imperatives, it should assist government in realising objectives of making medicines more accessible and affordable § Should not conflict with the state’s constitutional obligations of right to access to healthcare - Section 27 c & NDP § Encourage investment and development of the pharmaceutical industry, not benefit a few companies Collectively contributing to the growth of the SA economy

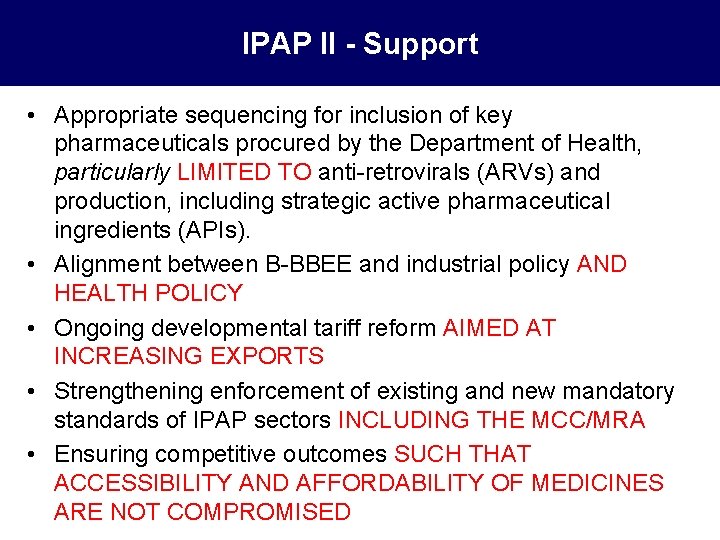

IPAP II - Support • Appropriate sequencing for inclusion of key pharmaceuticals procured by the Department of Health, particularly LIMITED TO anti-retrovirals (ARVs) and production, including strategic active pharmaceutical ingredients (APIs). • Alignment between B-BBEE and industrial policy AND HEALTH POLICY • Ongoing developmental tariff reform AIMED AT INCREASING EXPORTS • Strengthening enforcement of existing and new mandatory standards of IPAP sectors INCLUDING THE MCC/MRA • Ensuring competitive outcomes SUCH THAT ACCESSIBILITY AND AFFORDABILITY OF MEDICINES ARE NOT COMPROMISED

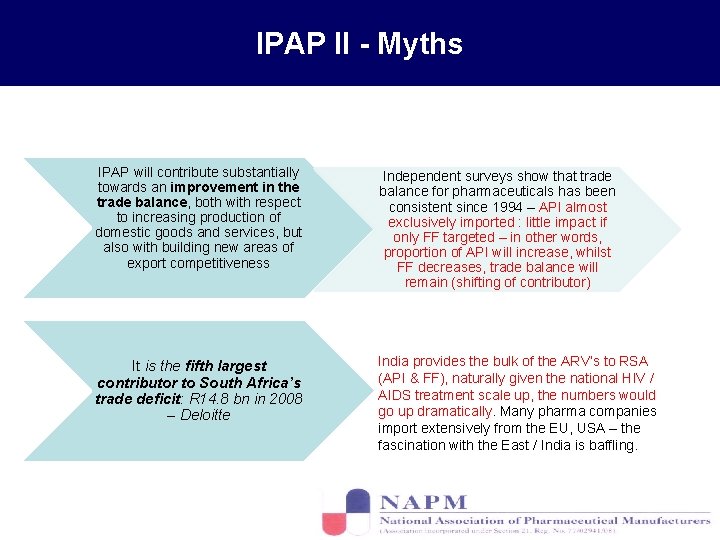

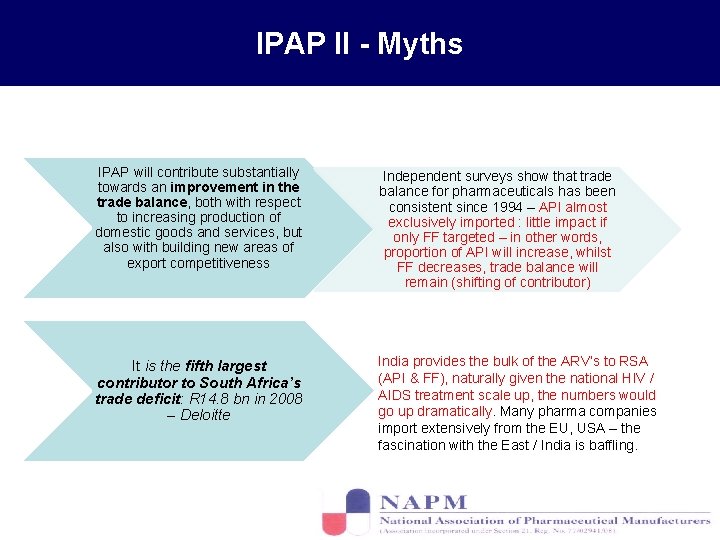

IPAP II - Myths IPAP will contribute substantially towards an improvement in the trade balance, both with respect to increasing production of domestic goods and services, but also with building new areas of export competitiveness Independent surveys show that trade balance for pharmaceuticals has been consistent since 1994 – API almost exclusively imported : little impact if only FF targeted – in other words, proportion of API will increase, whilst FF decreases, trade balance will remain (shifting of contributor) It is the fifth largest contributor to South Africa’s trade deficit: R 14. 8 bn in 2008 – Deloitte India provides the bulk of the ARV’s to RSA (API & FF), naturally given the national HIV / AIDS treatment scale up, the numbers would go up dramatically. Many pharma companies import extensively from the EU, USA – the fascination with the East / India is baffling.

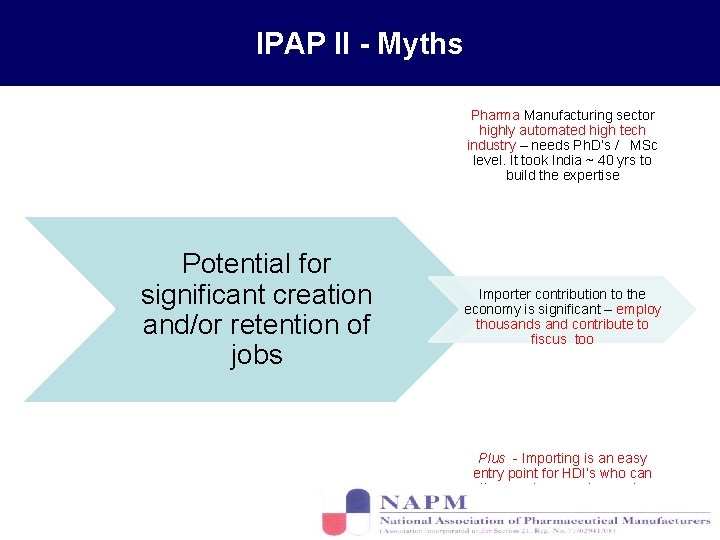

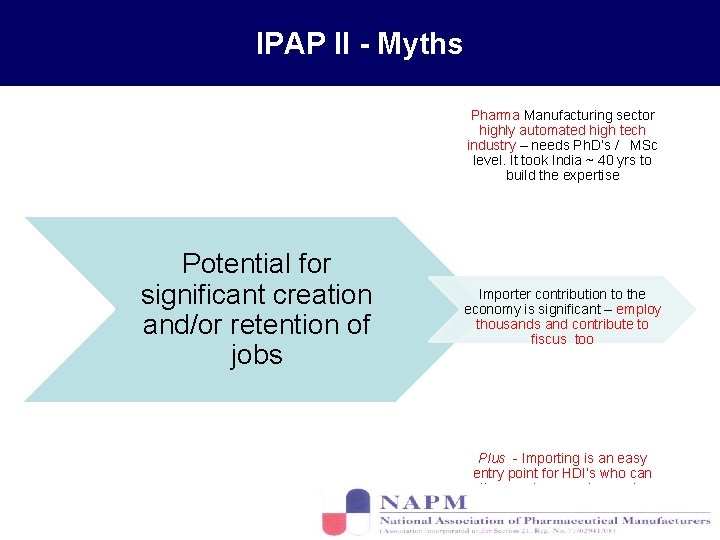

IPAP II - Myths Pharma Manufacturing sector highly automated high tech industry – needs Ph. D’s / MSc level. It took India ~ 40 yrs to build the expertise Potential for significant creation and/or retention of jobs Importer contribution to the economy is significant – employ thousands and contribute to fiscus too Plus - Importing is an easy entry point for HDI’s who can then scale up and move to production long term

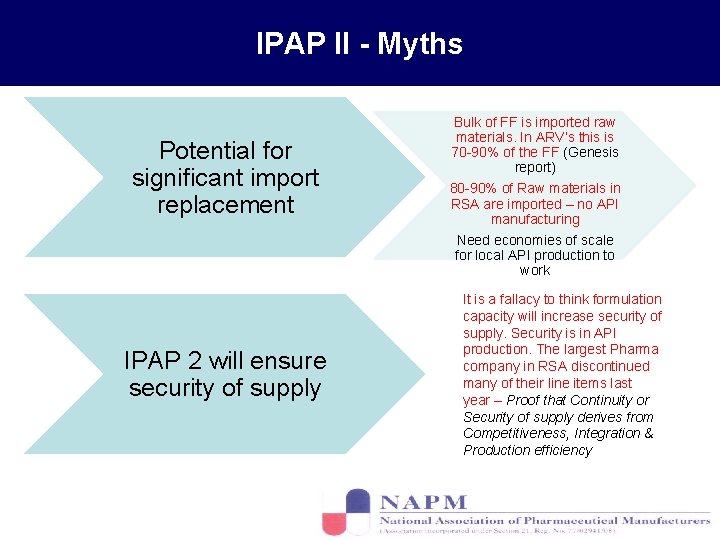

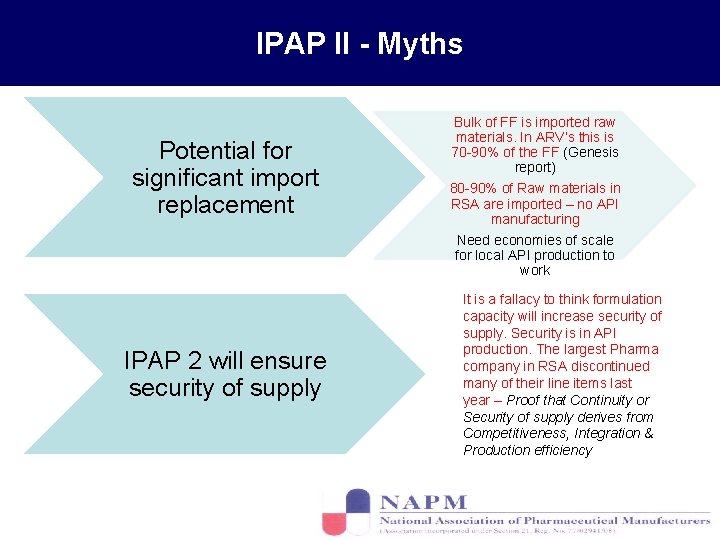

IPAP II - Myths Potential for significant import replacement IPAP 2 will ensure security of supply Bulk of FF is imported raw materials. In ARV’s this is 70 -90% of the FF (Genesis report) 80 -90% of Raw materials in RSA are imported – no API manufacturing Need economies of scale for local API production to work It is a fallacy to think formulation capacity will increase security of supply. Security is in API production. The largest Pharma company in RSA discontinued many of their line items last year – Proof that Continuity or Security of supply derives from Competitiveness, Integration & Production efficiency

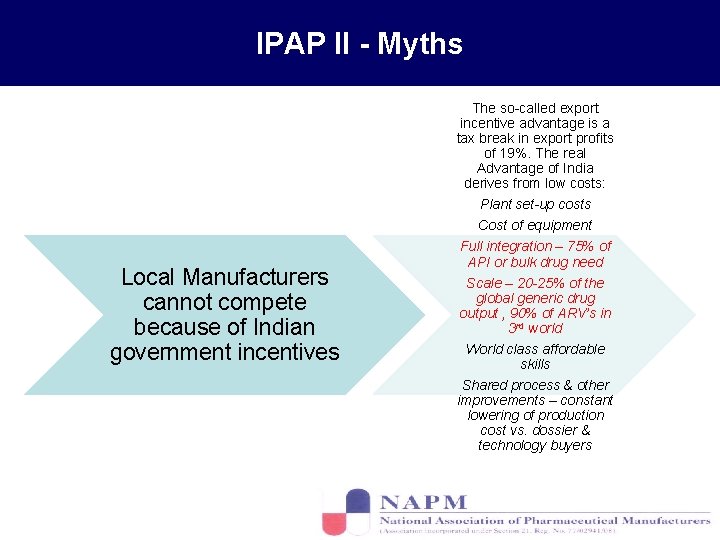

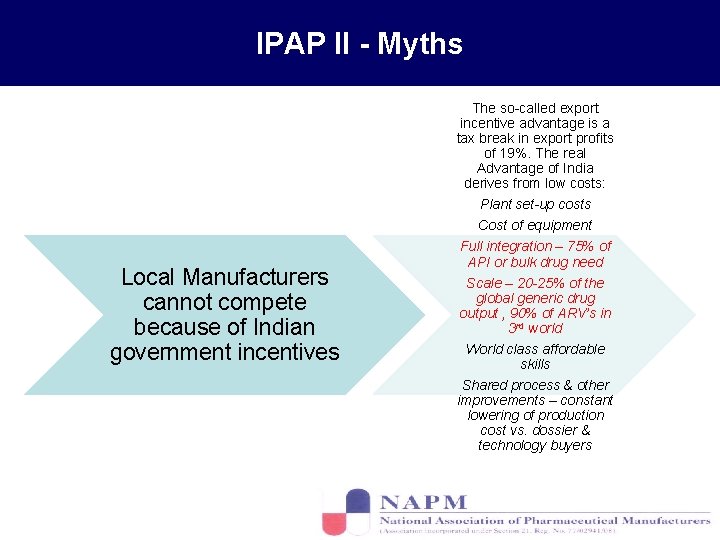

IPAP II - Myths Local Manufacturers cannot compete because of Indian government incentives The so-called export incentive advantage is a tax break in export profits of 19%. The real Advantage of India derives from low costs: Plant set-up costs Cost of equipment Full integration – 75% of API or bulk drug need Scale – 20 -25% of the global generic drug output , 90% of ARV’s in 3 rd world World class affordable skills Shared process & other improvements – constant lowering of production cost vs. dossier & technology buyers

IPAP II - Myths Importation poses risks to the security of supply of ARVs Many factors determine security of supply. But real Security is in API production. Heavy reliance only on domestic manufacturers will have the opposite effect incl price issues & affordability

IPAP II - Concerns § Could be unconstitutional. . . article 217 Procurement – § (1) When an organ of state in the national, provincial or local sphere of government, or any other institution identified in national legislation, contracts for goods or services, it must do so in accordance with a system which is fair, equitable, transparent, competitive and cost effective. § (2) Subsection (1) does not prevent the organs of state or institutions referred to in that subsection from implementing a procurement policy for providing for – § (a) categories of preference in the allocation of contracts; and § (b) the protection or advancement of persons, or categories of persons, disadvantaged by unfair discrimination Lack of integration or scale hardly qualifies as unfair discrimination § (3) National legislation must prescribe a framework within which the policy referred to in subsection (2) must be implemented

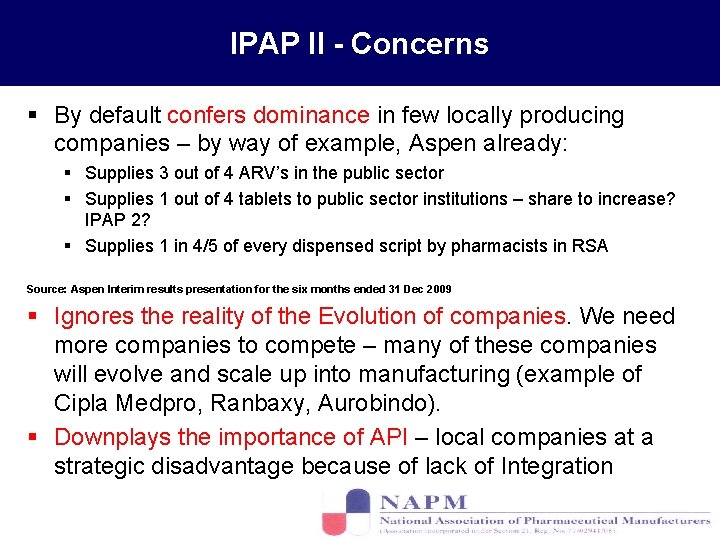

IPAP II - Concerns § By default confers dominance in few locally producing companies – by way of example, Aspen already: § Supplies 3 out of 4 ARV’s in the public sector § Supplies 1 out of 4 tablets to public sector institutions – share to increase? IPAP 2? § Supplies 1 in 4/5 of every dispensed script by pharmacists in RSA Source: Aspen Interim results presentation for the six months ended 31 Dec 2009 § Ignores the reality of the Evolution of companies. We need more companies to compete – many of these companies will evolve and scale up into manufacturing (example of Cipla Medpro, Ranbaxy, Aurobindo). § Downplays the importance of API – local companies at a strategic disadvantage because of lack of Integration

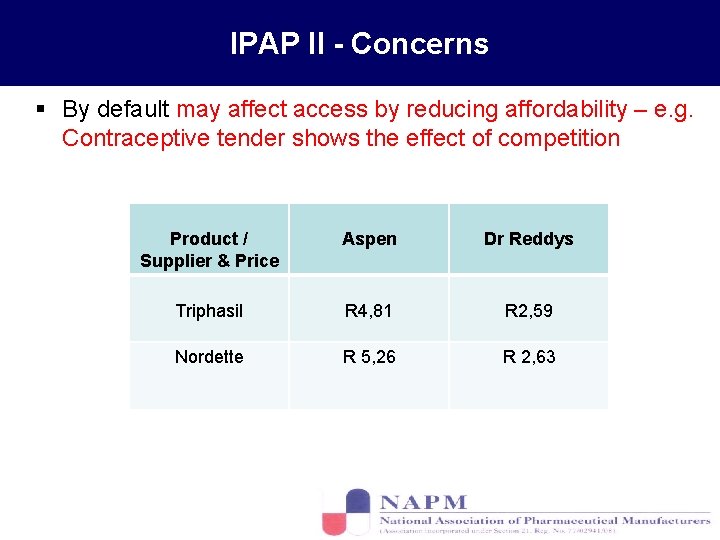

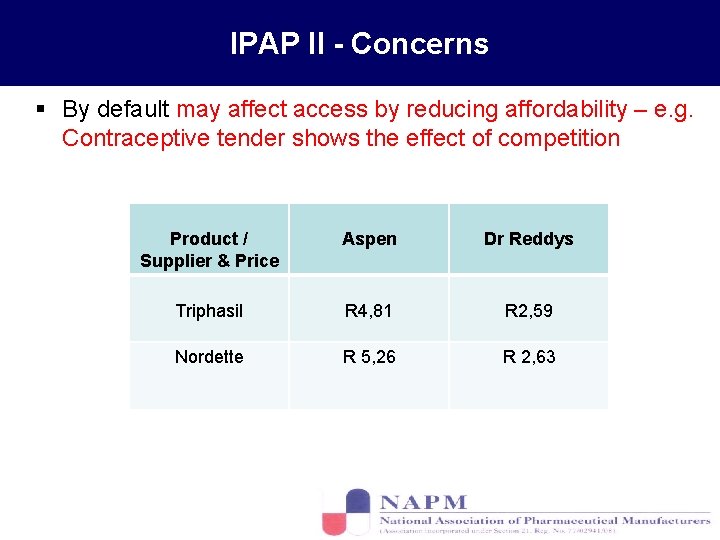

IPAP II - Concerns § By default may affect access by reducing affordability – e. g. Contraceptive tender shows the effect of competition Product / Supplier & Price Aspen Dr Reddys Triphasil R 4, 81 R 2, 59 Nordette R 5, 26 R 2, 63

IPAP II - Concerns § To align discretionary points with B-BBEE Codes and local procurement so that only suppliers providing domestically produced goods and services will be considered for preference points. They will earn these points according to their B-BBEE status. § “Point matching” by domestic producers - if a local supplier knows that he will get a second bite at the cherry, he will not have any incentive to offer the best price. Further, an importing competitor will not have any incentive to tender in the first place. This will have the real effect of limiting competition, thereby inflating prices artificially & limiting access. To some family out there, what we call “point matching” might translate into a “child in the hospital” or a “death in the family” § Overhaul of Preferential Procurement Policy Framework Act (PPPFA)

IPAP II - IMPACT § Unintended consequence of encouraging perverse pricing and business practice § Could encourage artificial monopolies resulting in decreased competition and consequently increased medicine prices in the long run. § Could impact on long term access and affordability of medicines § Market dominance will result in smaller players exiting and prevent the Transformation of the industry

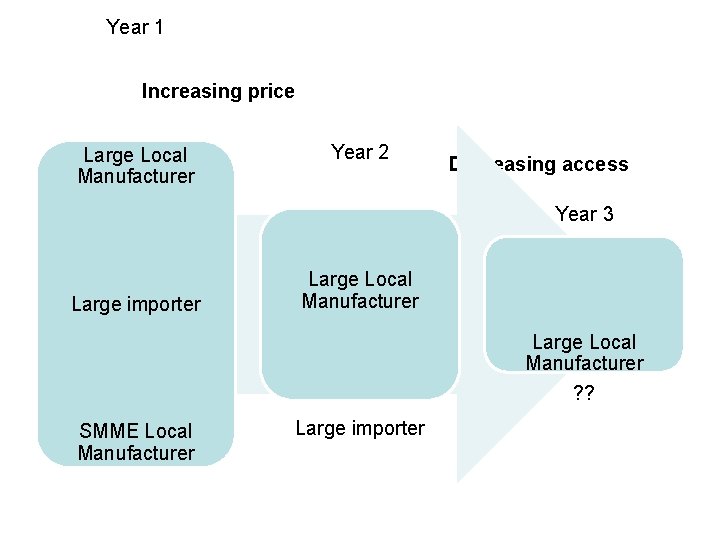

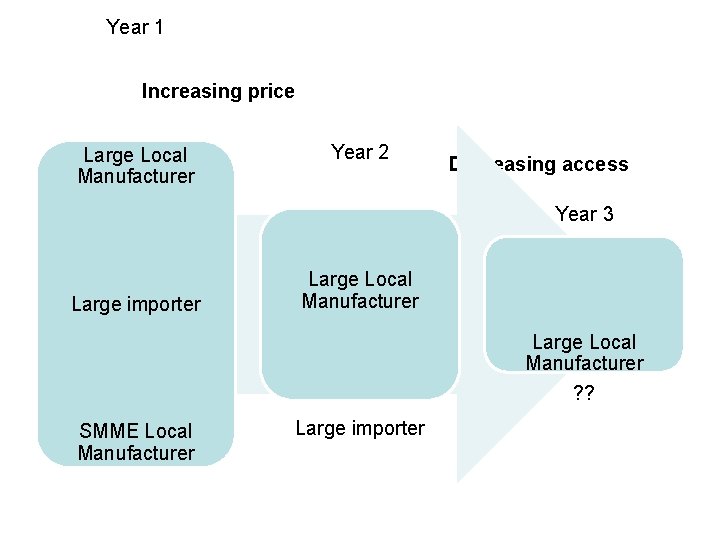

Year 1 Increasing price Large Local Manufacturer Year 2 Decreasing access Year 3 Large importer Large Local Manufacturer ? ? SMME Local Manufacturer Large importer

NAPM RECOMMENDATIONS - IPAP II Requirements for success § Government support for the whole industry § Clarity on the who is a local manufacturer and what constitutes local manufacturing § Promotion of fair and healthy competition § Alignment of policies and objectives relating to health, investment, capacity building and job creation § Strengthening / restructuring of the MCC/MRA § Encouraging and enhancing competition § Development of an industrial energy efficiency programme

Nye committee hearings

Nye committee hearings Defense office of hearings and appeals

Defense office of hearings and appeals Whats a crucible

Whats a crucible March march dabrowski

March march dabrowski Portfolio committee on mineral resources and energy

Portfolio committee on mineral resources and energy Portfolio committee

Portfolio committee Portfolio committee on basic education

Portfolio committee on basic education Portfolio committee on communications

Portfolio committee on communications Portfolio committee on basic education

Portfolio committee on basic education Portfolio committee on higher education

Portfolio committee on higher education Trade promotion coordinating committee

Trade promotion coordinating committee Trade union advisory committee

Trade union advisory committee Nuclear industry assessment committee

Nuclear industry assessment committee Ieee industry engagement committee

Ieee industry engagement committee Trade diversion and trade creation

Trade diversion and trade creation Trade diversion and trade creation

Trade diversion and trade creation Which is the most enduring free trade area in the world?

Which is the most enduring free trade area in the world? Trade diversion and trade creation

Trade diversion and trade creation Types of tramp chartering

Types of tramp chartering Ho chi minh city industry and trade college

Ho chi minh city industry and trade college Ministry of industry and trade yemen

Ministry of industry and trade yemen Weebly student portfolio

Weebly student portfolio The trade in the trade-to-gdp ratio

The trade in the trade-to-gdp ratio Fair trade not free trade

Fair trade not free trade Triangular trade definition

Triangular trade definition January february march season

January february march season