The Institute of Cost Accountants of India ERODE

- Slides: 19

The Institute of Cost Accountants of India ERODE CHAPTER GST—Composition Rules & Forms 22 nd July 2017 --6. 00 p. m to 9. 00 p. m. By CMA. L. Rajesh B. Com. , ACMA Practicing Cost Accountant . ,

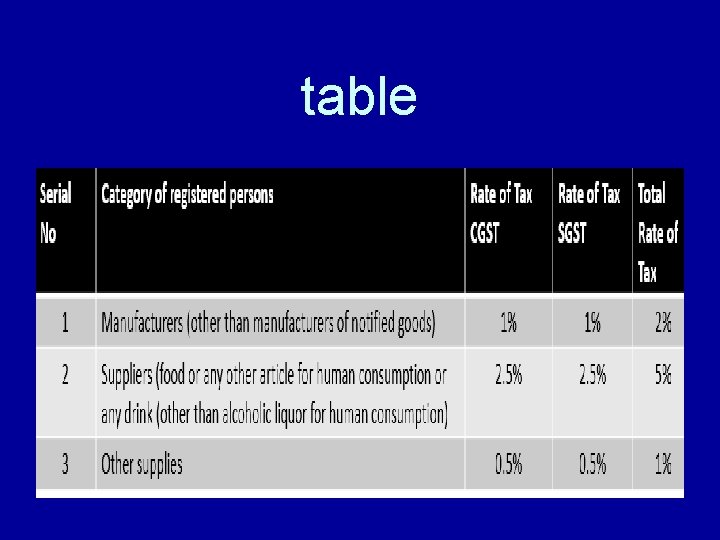

Composition Scheme • GST Composition Scheme is an option available to a registered taxpayer who needs to inform the tax authorities of his intention to be registered under the scheme. In case the registered taxpayer fails to comply with the same he would be treated a normal tax payer and administered accordingly. • Turnover and Rate of Tax • A registered taxpayer, whose aggregate turnover does not exceed Rs seventy five lakh in the preceding financial year pay tax at a rate more than 1% for manufacturer, 2. 5% for restaurant sector and 0. 5% for other suppliers of turnover.

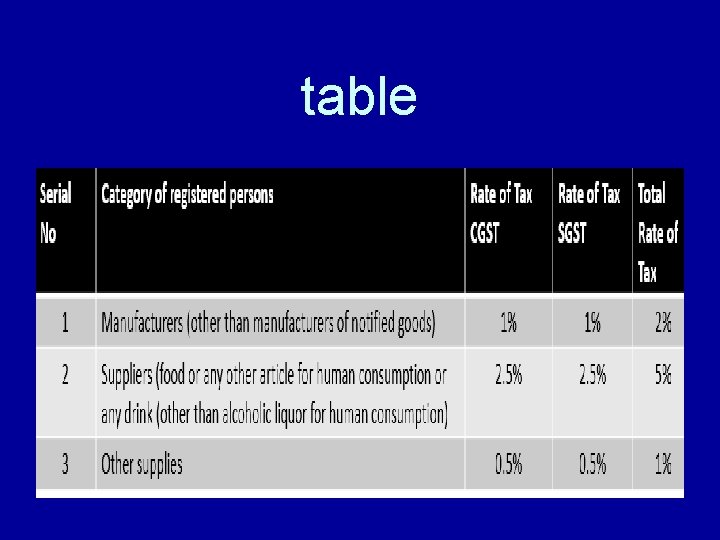

table

. . • Taxable Persons Excluded from the Composition Scheme • Following taxable persons are not granted permission to opt for the scheme who: • Supplies goods not leviable under the Act • Supplies services • Makes a supply of goods other than intra state i. e. interstate or import/ export • Makes a supply of goods through Electronic Commerce Operator i. e. Ecommerce and liable to collect taxes • Manufactures such goods as may be notified ( ice-cream, tobacco products) and service provider • Further, it is also if in case a taxable person has different business segments having same PAN as held by the taxable person, he must register all such businesses under the scheme

If an individual has different business segments such as: • Textile • Electronics and accessories • Groceries Then he must register all the above segments collectively under the composite scheme or simply opt not for the scheme.

No Tax, No Credit • • No Credit of Input Tax There has been no provision of input credit on B 2 B transactions. Thus, if any taxable person is carrying out business on B 2 B model, such person will not be allowed the credit of input tax paid from the output liability. Also, the buyer of such goods will not get any credit of tax paid, resulting in price distortion and cascading. This will further result into a loss of business as buyers might avoid purchases from a taxpayer under composition scheme. Scheme holder cannot claim input tax credit even if he makes taxable purchases from a regular taxable dealer. Ideally, the taxable amount would be added to the composite tax payer’s cost. No Collection of Tax Though the rate of composition tax is kept very nominal at 0. 5% or 1% or 2. 5%, a taxpayer under composition scheme is not allowed to recover such tax from his buyer, as he is not allowed to raise a tax invoice. Consequently, the burden of such tax is kept on the taxpayer himself and this must be paid out of his own pocket. Thus, the fundamental principle of limited compliance and tax burden on small taxpayer is defeated here

Merits of the Scheme • Below are some of the prominent reasons why you should choose to get registered as a supplier under the composition scheme: • Limited Compliance: Lesser compliance w. r. t. furnishing of returns, maintenance of books of records, issuance of invoices more focus on business • Limited Tax Liability: on comparison with regular taxpayers, person taxed under Composite Scheme will be liable to pay tax at a rate not more than 2. 5% instead of a standard rate. • High Liquidity: Unlike normal tax payers, tax payers under Composite Scheme will be liable to pay taxes at a lower rate resulting in lesser chunk on his working capital

Demerits of the Scheme • • • The demerits of registering under Composite Scheme by a taxable person are as follows: Limited Territory for Business: A taxpayer registered under the composition scheme is barred from carrying out inter-state transactions and cannot affect import-export of goods and services. No Credit of Input Tax: Under the scheme, the credit of input tax paid on the purchases of inputs from a normal tax payer will not be allowed. The buyer of goods supplier by scheme holder will also not enjoy input tax credit resulting in price distortion, cascading, loss of business to scheme holders. No Collection of Tax: Though the rate of tax for a scheme holder is lower the burden of such tax is kept on the taxpayer himself, leading to higher cost of sales. Penal Provision: As per the Model GST Law, if the taxpayer who has previously been given registration under composition scheme is found to be not eligible to the composition scheme or if the permission granted earlier was incorrectly granted, then such taxpayer will be liable to pay the differential tax along with a penalty Not applicable to the supplier supplying goods through E-commerce

COMPOSITION RULES • • • • A) Intimation and Effective date for Composition Levy For persons already registered under pre-GST regime Any person being granted registration on a provisional basis (registered under VAT Act, Service Tax, Central Excise laws etc) and who opts for Composition Levy shall file an intimation in FORM GST CMP-01, duly signed, before or within 30 days of appointed date. If intimation is filed after the appointed day, the registered person: a) Will not collect taxes b) Issue bill of supply for supplies FORM GST CMP- 03 must also be filed within 60 days of exercise of option: a) Details of stock b) Inward supply of goods received from unregistered persons held by him on the date preceding the day of exercise of option 2. For persons who applied for fresh register under GST to opt scheme For fresh registration under the scheme, intimation in FORM GST REG- 01 must be filed. 3. Registered under GST and person switches to Composition Scheme Every registered person under GST and opts to pay taxes under Composition Scheme, must follow the following: a) Intimation in FORM GST CMP- 02 for exercise option b) Statement in FORM GST ITC- 3 for details of ITC relating to inputs lying in stock, inputs contained in semi-finished or finished goods within 60 days of commencement of the relevant financial year

B. Effective date for composition levy • a) The option to pay tax under Composition Scheme shall be effective: • For persons already registered under pre-GST regime: Appointed Day • Registered under GST and person switches to Composition Scheme: Filing of Intimation • b) For persons who applied for fresh register under GST to opt scheme • Option to pay tax under Composition Scheme shall be effective from: • where the application for registration has been submitted within thirty days from the day he becomes liable for registration, such date. • In the above case, the effective date of registration shall be the date of grant of registration.

C. Conditions and Restrictions for Composition Levy • The person opting for the scheme must neither be a casual taxable person nor a non-resident taxable person. • The goods held by him in stock on the appointed date must not be purchased from a place outside his state. The goods should therefore not be classified as: • Inter- state purchase • Imported Goods • Branch situated outside the State • Agents or Principal situated outside the State • 3. Where the taxpayers deals with unregistered person, tax must be paid or no stock must be held

. . • 4. Mandatory display on invoices of the words ” composition taxable person, not eligible to collect tax on supplies” • 5. Mandatory display of the words “Composition Taxable Person” on every notice and signboard displayed at a prominent place.

D. Validity of Composition Levy • It depends on fulfillment of conditions (discussed above), however an eligible person for scheme may also opt out of the scheme by filing an application. In case Proper Officer has reasons to believe that taxpayer is not eligible for scheme or contravened any Rules or ACT, he may issue show cause notice followed by an order denying the entailment of scheme.

s: • Composition Scheme Rules under GST provides for submission of different forms meant for respective purposes followed by due date for submission of such forms, which are as follow

Thanks • Query plz? ? ?

Institute of cost and management accountants of pakistan

Institute of cost and management accountants of pakistan Cma institute in erode

Cma institute in erode Institute of certified public accountants in israel

Institute of certified public accountants in israel The institute of management accountants adopted the ______.

The institute of management accountants adopted the ______. Chapter 1 managerial accounting

Chapter 1 managerial accounting Fiji institute of accountants

Fiji institute of accountants A wartime alliance begins to erode

A wartime alliance begins to erode Tips erode

Tips erode Top 10 iit coaching in india

Top 10 iit coaching in india Code of ethics for professional accountants

Code of ethics for professional accountants Hazlems fenton

Hazlems fenton Accountants professional indemnity insurance

Accountants professional indemnity insurance Strategic finance

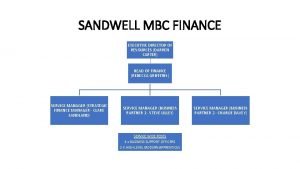

Strategic finance Background

Background Iranian association of certified public accountants (iacpa)

Iranian association of certified public accountants (iacpa) New jersey association of public accountants

New jersey association of public accountants Primary users of accounting information are accountants

Primary users of accounting information are accountants Michigan association of certified public accountants

Michigan association of certified public accountants Ritter corporation's accountants prepared

Ritter corporation's accountants prepared Dfg legal costs accountants

Dfg legal costs accountants