The Institute of Cost Accountants of India ERODE

- Slides: 16

The Institute of Cost Accountants of India ERODE CHAPTER GST- Valuation and ITC Rules & Forms 14 th July 2017 --6. 00 p. m to 9. 00 p. m. By CMA. M. SATHIYAMOORTHY M. Com. , M. Phil. , ACMA Practicing Cost Accountant . ,

GST & INPUT CREDIT • GST TAXES TO BE LEVIED • If Intra state supply SGST+CGST • If Inter State supply IGST

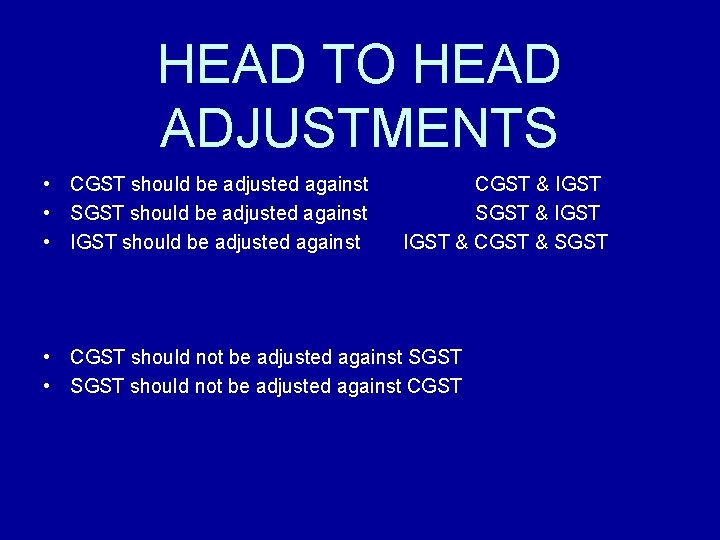

HEAD TO HEAD ADJUSTMENTS • CGST should be adjusted against • SGST should be adjusted against • IGST should be adjusted against CGST & IGST SGST & IGST & CGST & SGST • CGST should not be adjusted against SGST • SGST should not be adjusted against CGST

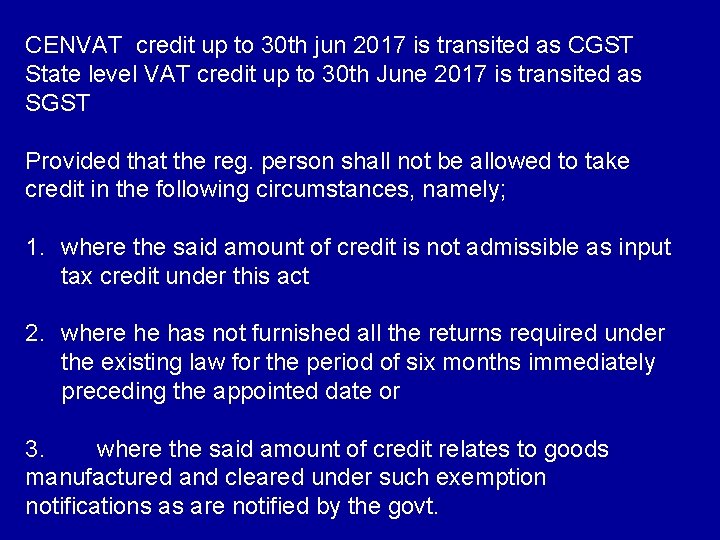

CENVAT credit up to 30 th jun 2017 is transited as CGST State level VAT credit up to 30 th June 2017 is transited as SGST Provided that the reg. person shall not be allowed to take credit in the following circumstances, namely; 1. where the said amount of credit is not admissible as input tax credit under this act 2. where he has not furnished all the returns required under the existing law for the period of six months immediately preceding the appointed date or 3. where the said amount of credit relates to goods manufactured and cleared under such exemption notifications as are notified by the govt.

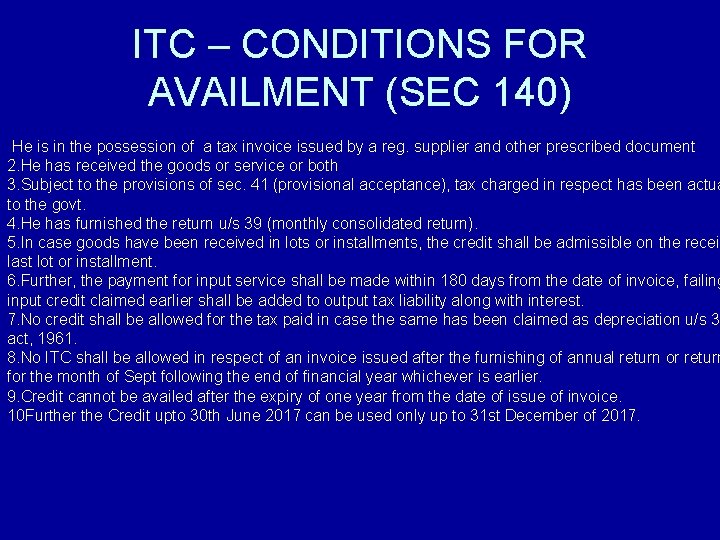

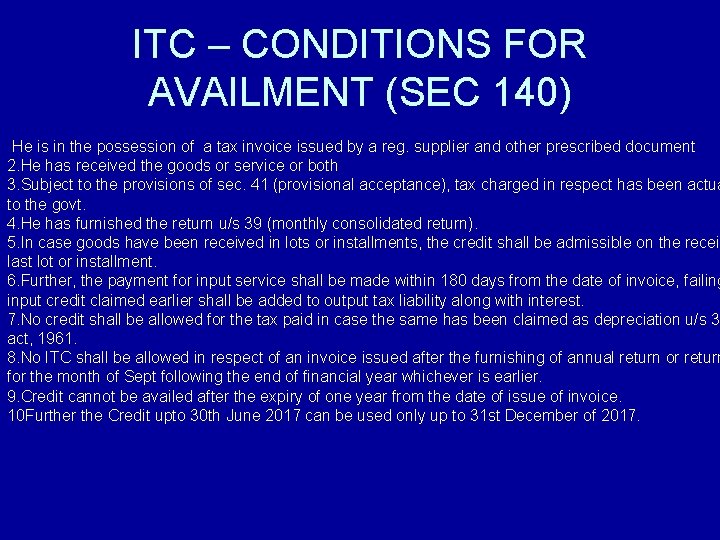

ITC – CONDITIONS FOR AVAILMENT (SEC 140) He is in the possession of a tax invoice issued by a reg. supplier and other prescribed document 2. He has received the goods or service or both 3. Subject to the provisions of sec. 41 (provisional acceptance), tax charged in respect has been actua to the govt. 4. He has furnished the return u/s 39 (monthly consolidated return). 5. In case goods have been received in lots or installments, the credit shall be admissible on the recei last lot or installment. 6. Further, the payment for input service shall be made within 180 days from the date of invoice, failing input credit claimed earlier shall be added to output tax liability along with interest. 7. No credit shall be allowed for the tax paid in case the same has been claimed as depreciation u/s 3 act, 1961. 8. No ITC shall be allowed in respect of an invoice issued after the furnishing of annual return or return for the month of Sept following the end of financial year whichever is earlier. 9. Credit cannot be availed after the expiry of one year from the date of issue of invoice. 10 Further the Credit upto 30 th June 2017 can be used only up to 31 st December of 2017.

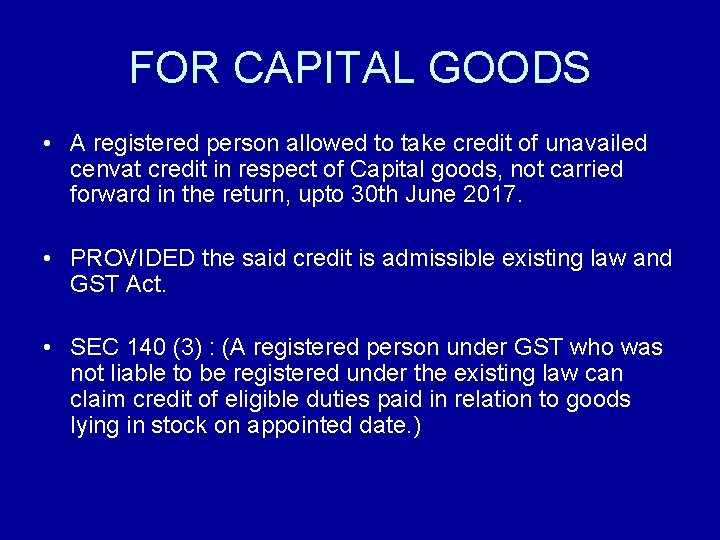

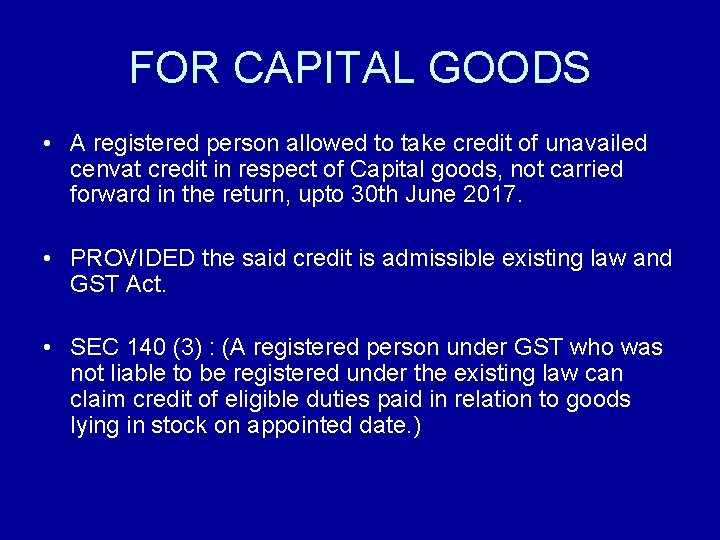

FOR CAPITAL GOODS • A registered person allowed to take credit of unavailed cenvat credit in respect of Capital goods, not carried forward in the return, upto 30 th June 2017. • PROVIDED the said credit is admissible existing law and GST Act. • SEC 140 (3) : (A registered person under GST who was not liable to be registered under the existing law can claim credit of eligible duties paid in relation to goods lying in stock on appointed date. )

Eligible persons: • 1. A regd. Person, not liable to be registered under existing law. • 2. Manufacturer of exempted goods or provision of exempted services • 3. Providing works contract service • 4. First stage dealer or second stage dealer • 5. Reg. importer or depot of a manufacturer. • Shall be entitled to take in his electronic credit ledger.

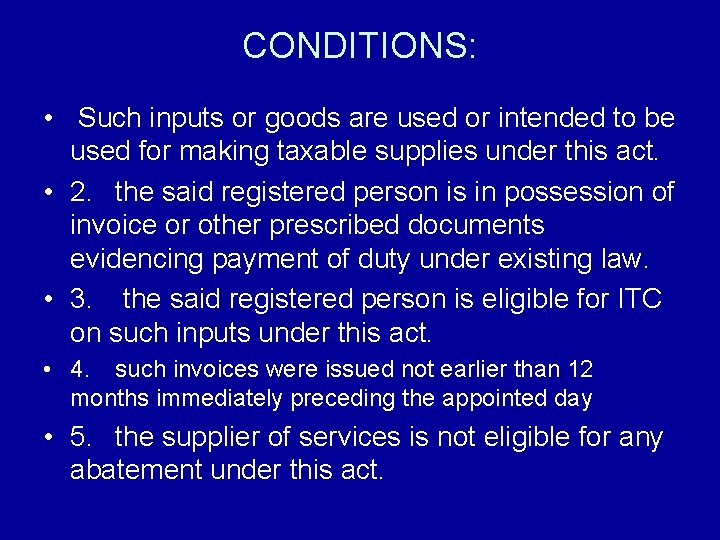

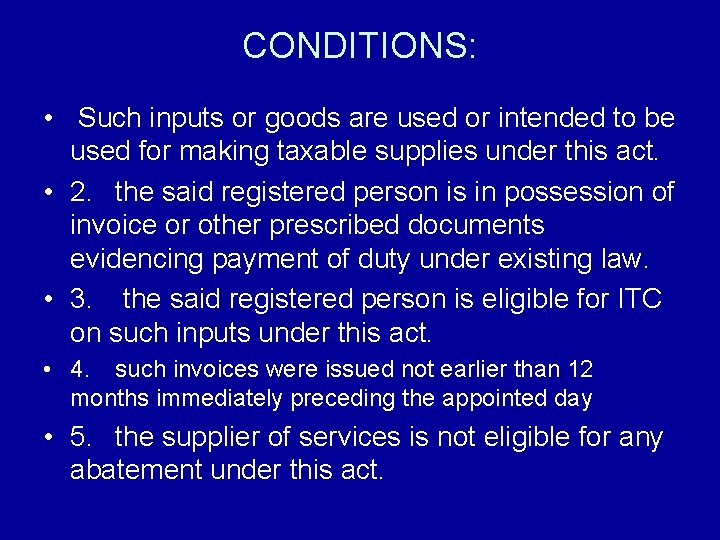

CONDITIONS: • Such inputs or goods are used or intended to be used for making taxable supplies under this act. • 2. the said registered person is in possession of invoice or other prescribed documents evidencing payment of duty under existing law. • 3. the said registered person is eligible for ITC on such inputs under this act. • 4. such invoices were issued not earlier than 12 months immediately preceding the appointed day • 5. the supplier of services is not eligible for any abatement under this act.

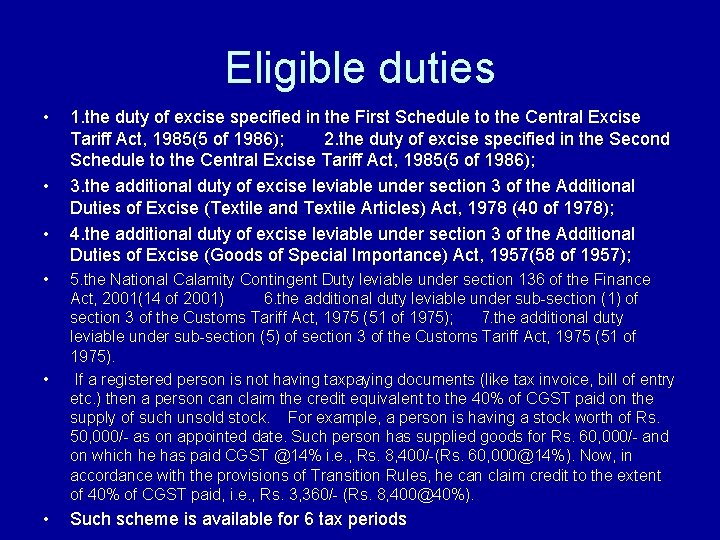

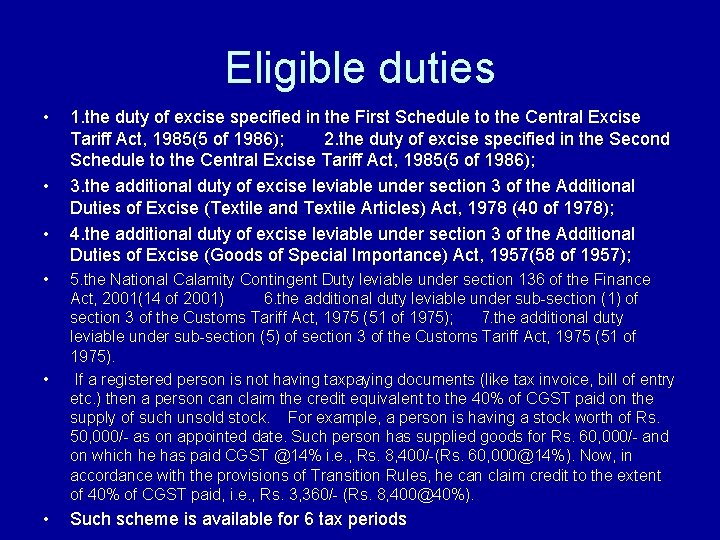

Eligible duties • • 1. the duty of excise specified in the First Schedule to the Central Excise Tariff Act, 1985(5 of 1986); 2. the duty of excise specified in the Second Schedule to the Central Excise Tariff Act, 1985(5 of 1986); 3. the additional duty of excise leviable under section 3 of the Additional Duties of Excise (Textile and Textile Articles) Act, 1978 (40 of 1978); 4. the additional duty of excise leviable under section 3 of the Additional Duties of Excise (Goods of Special Importance) Act, 1957(58 of 1957); • 5. the National Calamity Contingent Duty leviable under section 136 of the Finance Act, 2001(14 of 2001) 6. the additional duty leviable under sub-section (1) of section 3 of the Customs Tariff Act, 1975 (51 of 1975); 7. the additional duty leviable under sub-section (5) of section 3 of the Customs Tariff Act, 1975 (51 of 1975). If a registered person is not having taxpaying documents (like tax invoice, bill of entry etc. ) then a person can claim the credit equivalent to the 40% of CGST paid on the supply of such unsold stock. For example, a person is having a stock worth of Rs. 50, 000/- as on appointed date. Such person has supplied goods for Rs. 60, 000/- and on which he has paid CGST @14% i. e. , Rs. 8, 400/-(Rs. 60, 000@14%). Now, in accordance with the provisions of Transition Rules, he can claim credit to the extent of 40% of CGST paid, i. e. , Rs. 3, 360/- (Rs. 8, 400@40%). • Such scheme is available for 6 tax periods

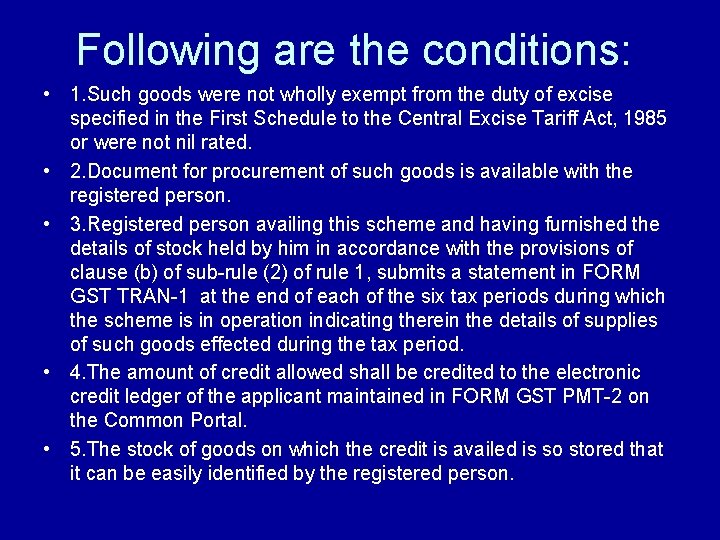

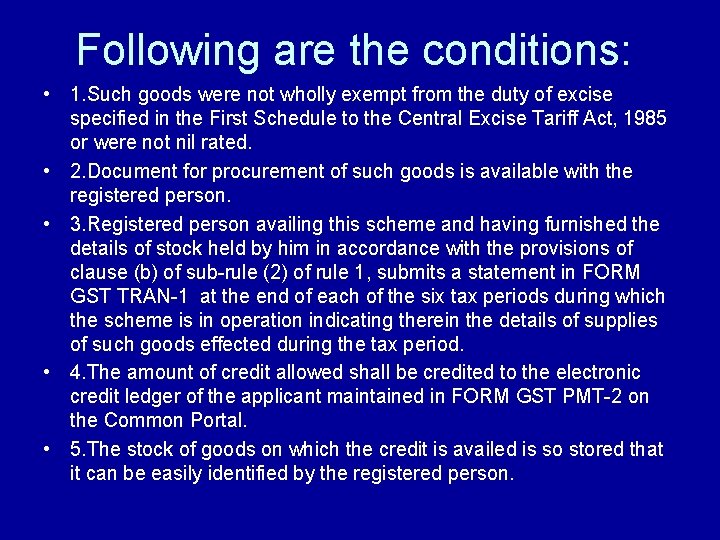

Following are the conditions: • 1. Such goods were not wholly exempt from the duty of excise specified in the First Schedule to the Central Excise Tariff Act, 1985 or were not nil rated. • 2. Document for procurement of such goods is available with the registered person. • 3. Registered person availing this scheme and having furnished the details of stock held by him in accordance with the provisions of clause (b) of sub-rule (2) of rule 1, submits a statement in FORM GST TRAN-1 at the end of each of the six tax periods during which the scheme is in operation indicating therein the details of supplies of such goods effected during the tax period. • 4. The amount of credit allowed shall be credited to the electronic credit ledger of the applicant maintained in FORM GST PMT-2 on the Common Portal. • 5. The stock of goods on which the credit is availed is so stored that it can be easily identified by the registered person.

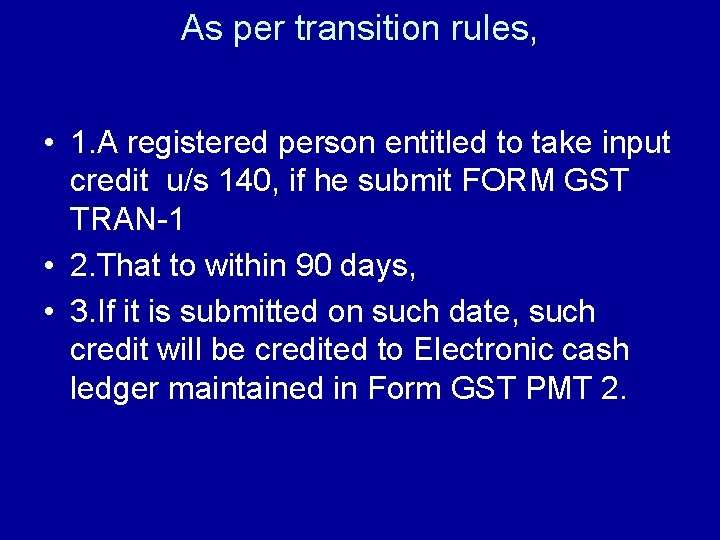

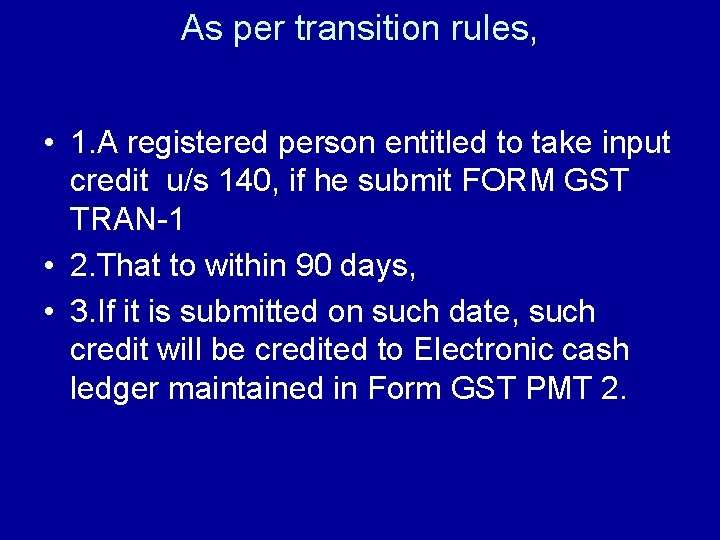

As per transition rules, • 1. A registered person entitled to take input credit u/s 140, if he submit FORM GST TRAN-1 • 2. That to within 90 days, • 3. If it is submitted on such date, such credit will be credited to Electronic cash ledger maintained in Form GST PMT 2.

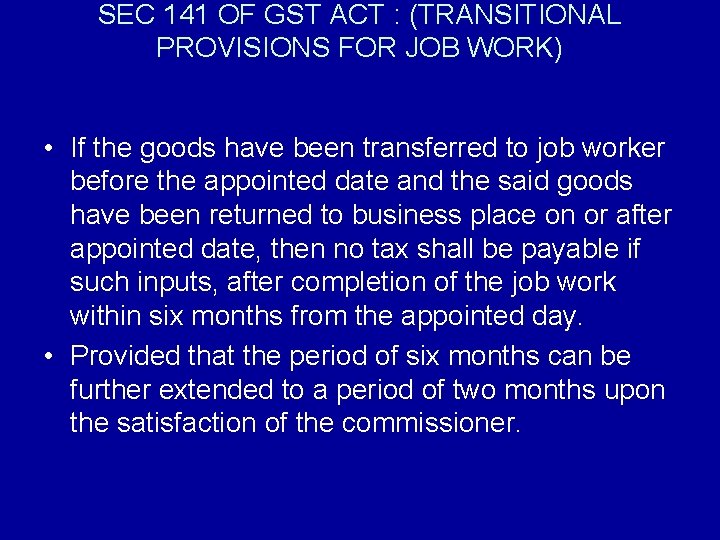

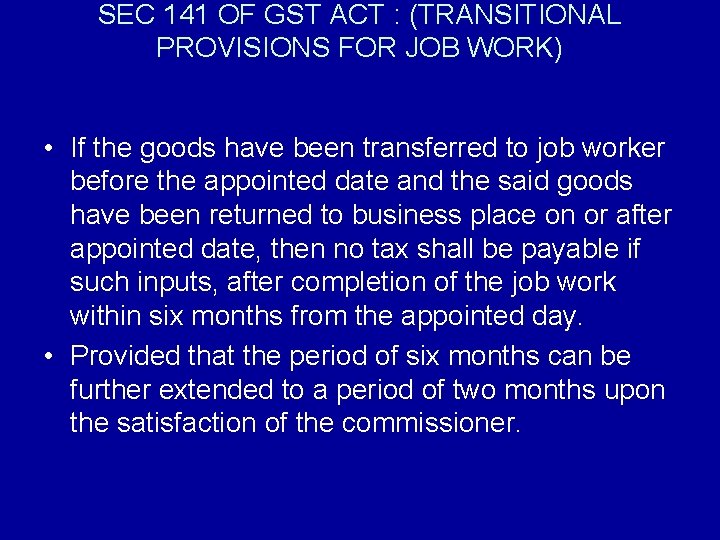

SEC 141 OF GST ACT : (TRANSITIONAL PROVISIONS FOR JOB WORK) • If the goods have been transferred to job worker before the appointed date and the said goods have been returned to business place on or after appointed date, then no tax shall be payable if such inputs, after completion of the job work within six months from the appointed day. • Provided that the period of six months can be further extended to a period of two months upon the satisfaction of the commissioner.

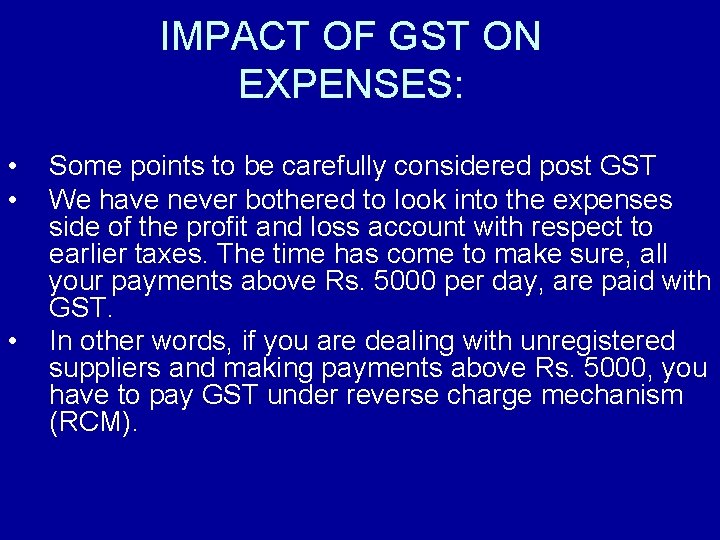

IMPACT OF GST ON EXPENSES: • • • Some points to be carefully considered post GST We have never bothered to look into the expenses side of the profit and loss account with respect to earlier taxes. The time has come to make sure, all your payments above Rs. 5000 per day, are paid with GST. In other words, if you are dealing with unregistered suppliers and making payments above Rs. 5000, you have to pay GST under reverse charge mechanism (RCM).

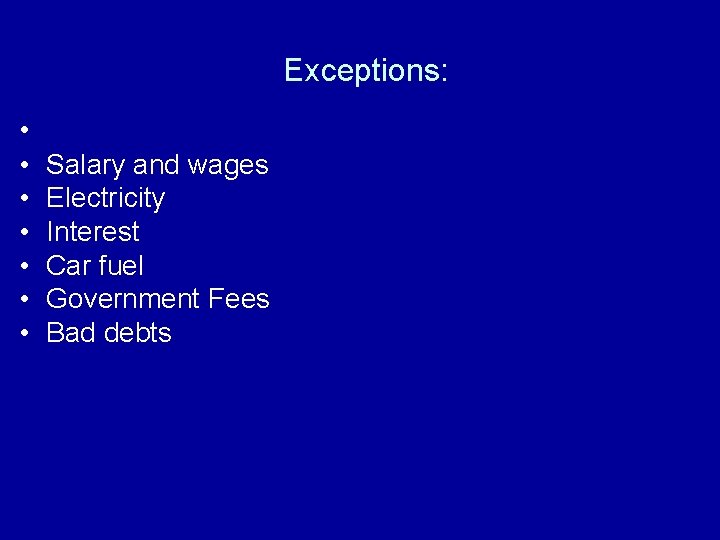

Exceptions: • • Salary and wages Electricity Interest Car fuel Government Fees Bad debts

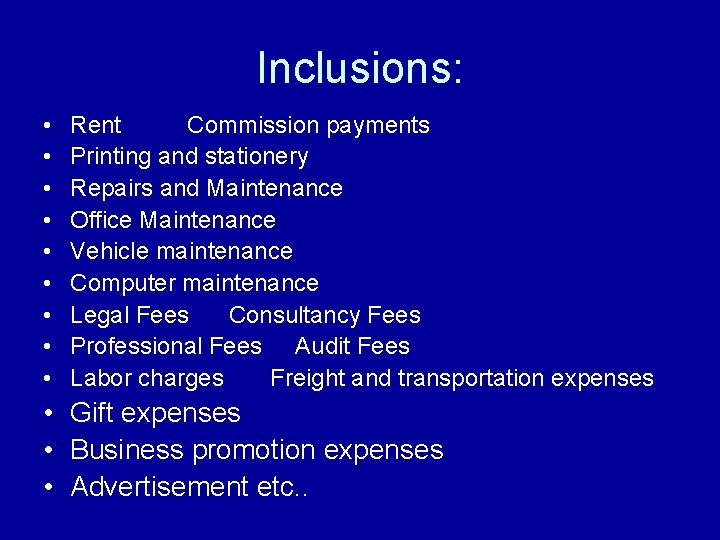

Inclusions: • • • Rent Commission payments Printing and stationery Repairs and Maintenance Office Maintenance Vehicle maintenance Computer maintenance Legal Fees Consultancy Fees Professional Fees Audit Fees Labor charges Freight and transportation expenses • Gift expenses • Business promotion expenses • Advertisement etc. .

Thanks • Query plz? ? ?

Institute of cost and management accountants of pakistan

Institute of cost and management accountants of pakistan Cma institute in erode

Cma institute in erode Institute of certified public accountants in israel

Institute of certified public accountants in israel The institute of management accountants adopted the ______.

The institute of management accountants adopted the ______. Chapter 1 managerial accounting

Chapter 1 managerial accounting Fiji institute of accountants

Fiji institute of accountants A wartime alliance begins to erode

A wartime alliance begins to erode Tips erode

Tips erode Top 10 coaching institute in india

Top 10 coaching institute in india Code of ethics for professional accountants

Code of ethics for professional accountants Hazlems fenton

Hazlems fenton Accountants professional indemnity insurance

Accountants professional indemnity insurance Strategic accountant

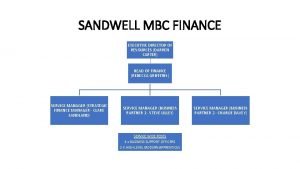

Strategic accountant Mdd forensic accountants

Mdd forensic accountants Iranian association of certified public accountants (iacpa)

Iranian association of certified public accountants (iacpa) New jersey association of public accountants

New jersey association of public accountants Primary users of accounting information are accountants

Primary users of accounting information are accountants