CHAPTER 1 Accounting Information Users and Uses Learning

- Slides: 25

CHAPTER 1 Accounting Information: Users and Uses

Learning Objective 1 Describe the purpose of accounting and explain its role in business and society.

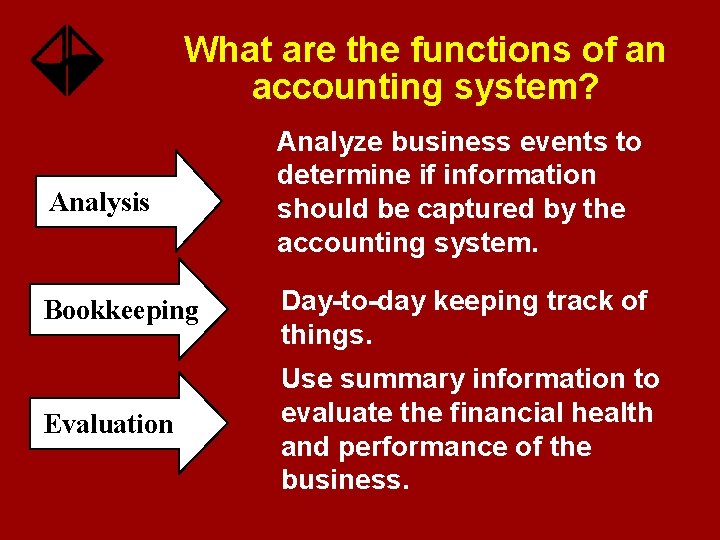

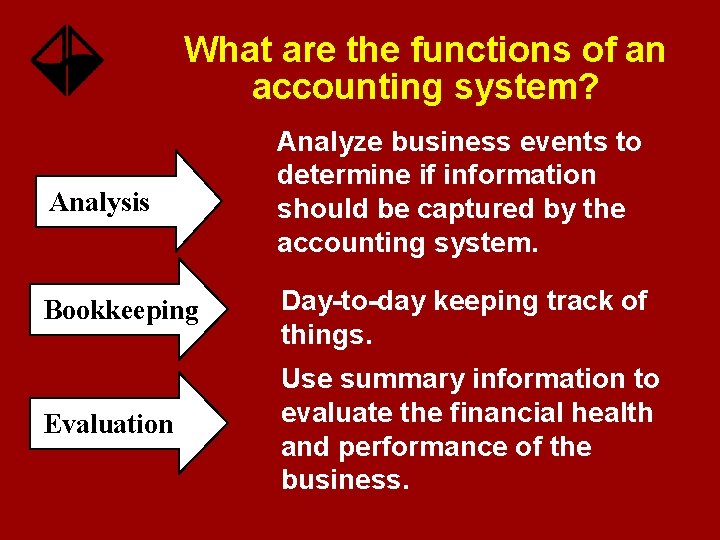

What are the functions of an accounting system? Analysis Analyze business events to determine if information should be captured by the accounting system. Bookkeeping Day-to-day keeping track of things. Evaluation Use summary information to evaluate the financial health and performance of the business.

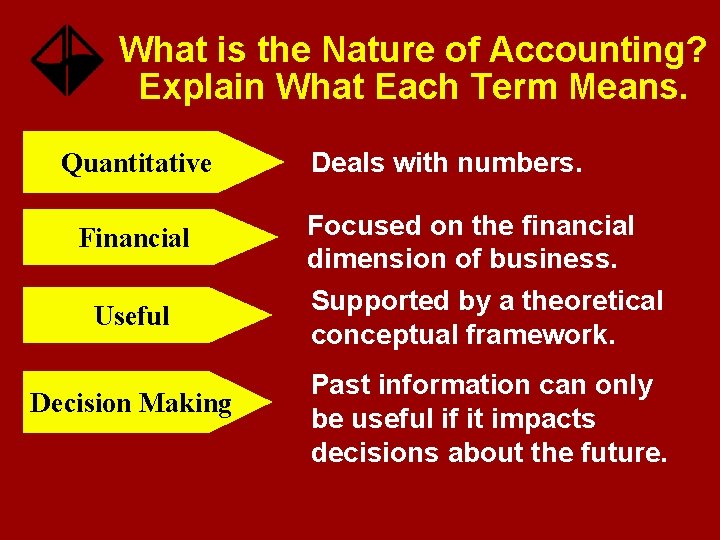

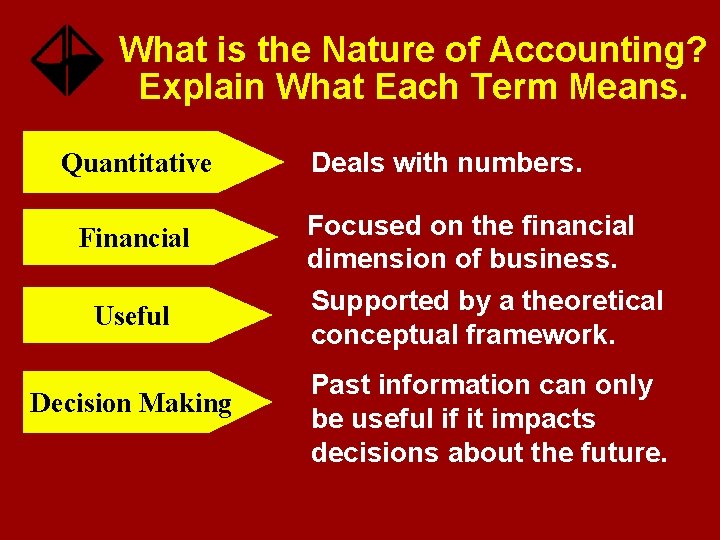

What is the Nature of Accounting? Explain What Each Term Means. Quantitative Financial Useful Decision Making Deals with numbers. Focused on the financial dimension of business. Supported by a theoretical conceptual framework. Past information can only be useful if it impacts decisions about the future.

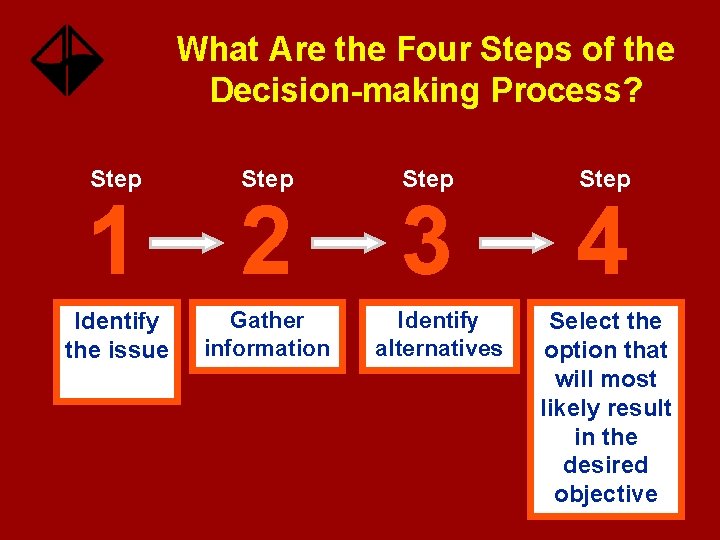

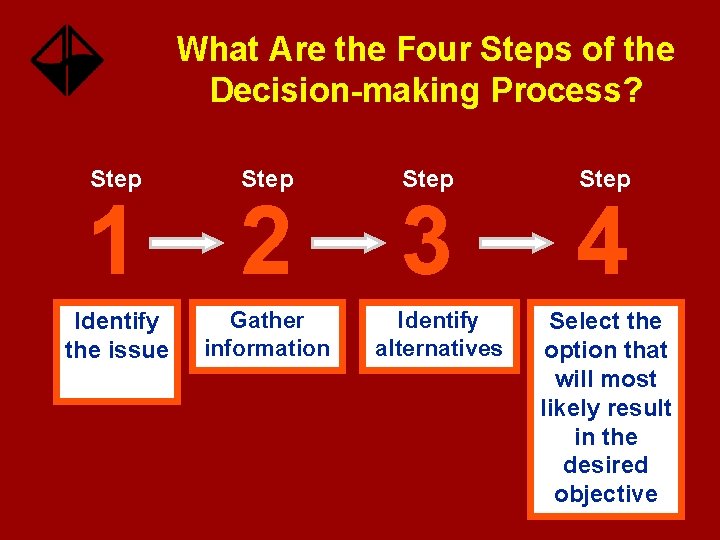

What Are the Four Steps of the Decision-making Process? Step 1 2 Identify the issue Gather information Step 3 Identify alternatives Step 4 Select the option that will most likely result in the desired objective

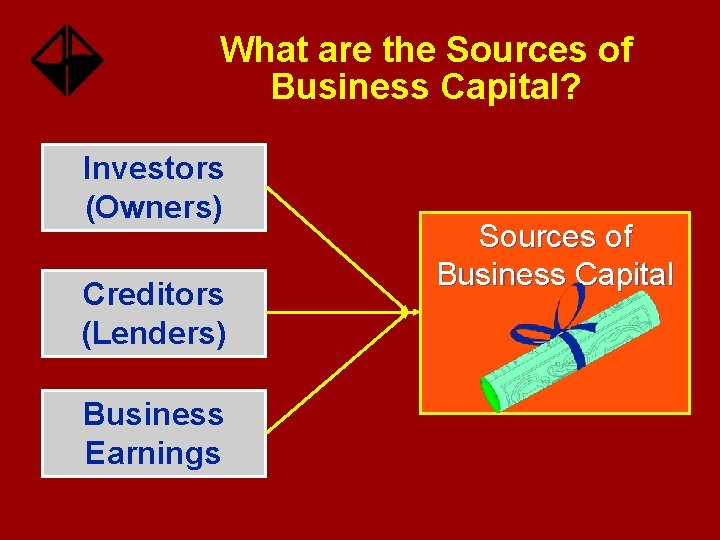

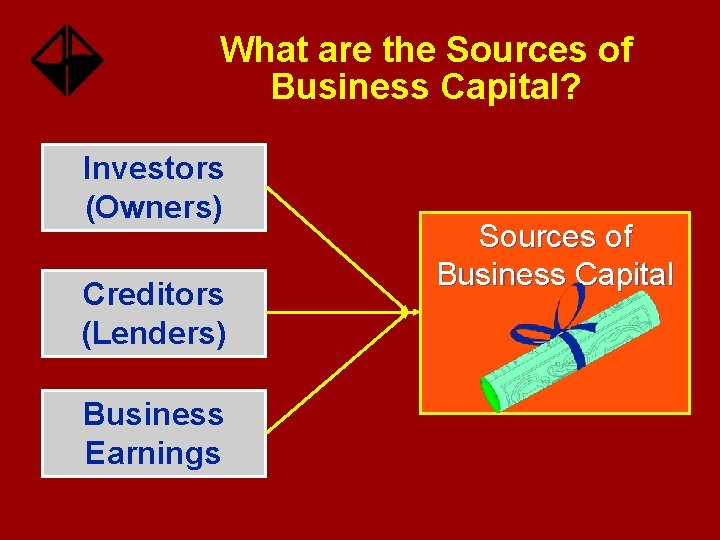

What are the Sources of Business Capital? Investors (Owners) Creditors (Lenders) Business Earnings Sources of Business Capital

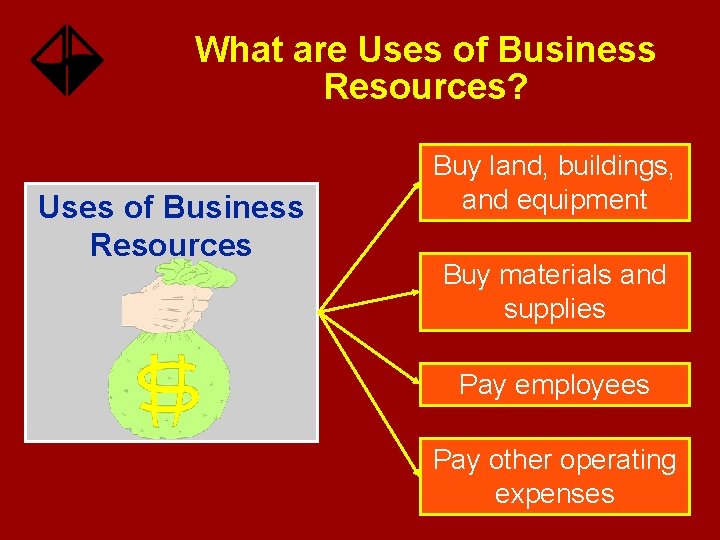

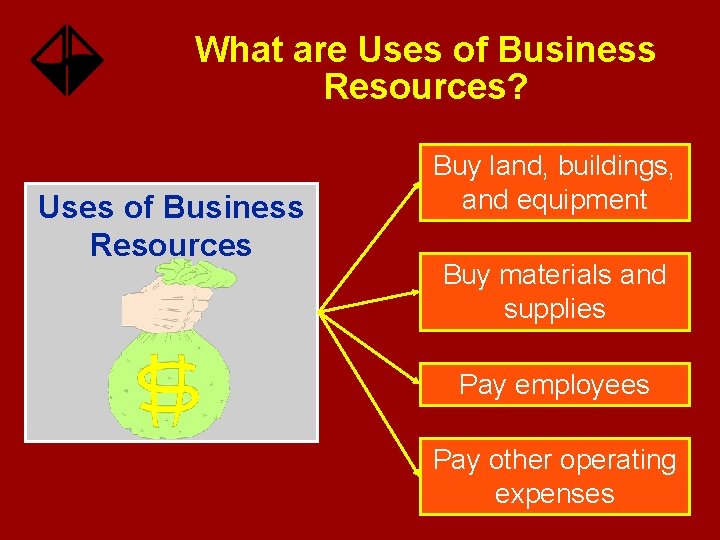

What are Uses of Business Resources? Uses of Business Resources Buy land, buildings, and equipment Buy materials and supplies Pay employees Pay other operating expenses

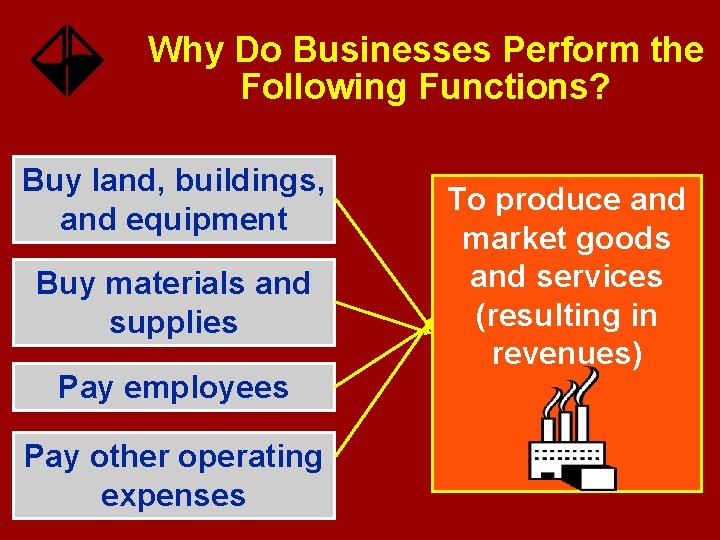

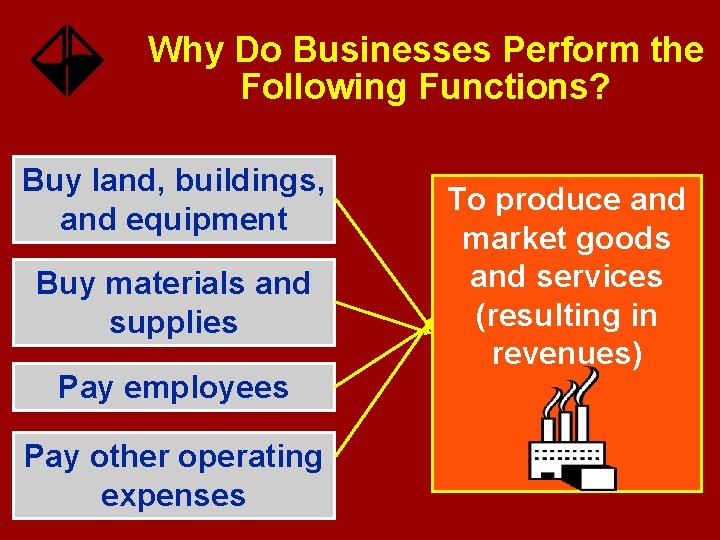

Why Do Businesses Perform the Following Functions? Buy land, buildings, and equipment Buy materials and supplies Pay employees Pay other operating expenses To produce and market goods and services (resulting in revenues)

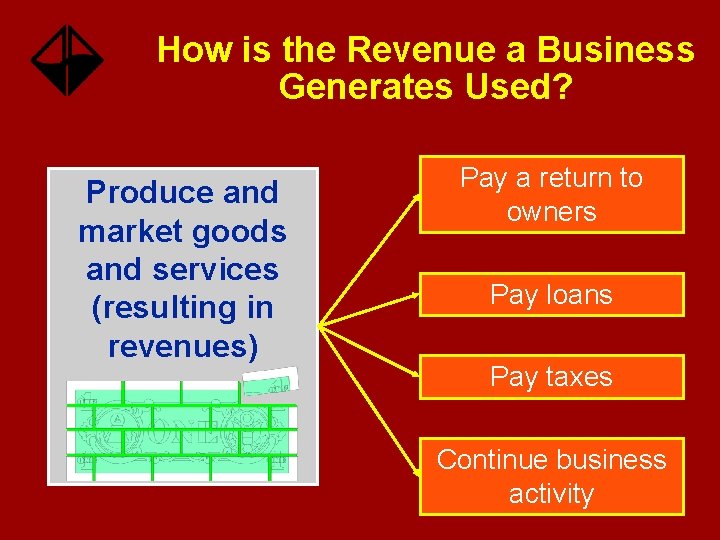

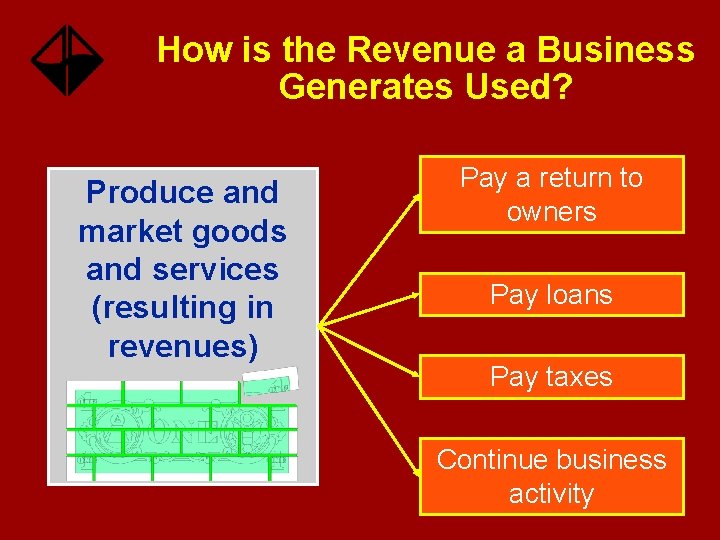

How is the Revenue a Business Generates Used? Produce and market goods and services (resulting in revenues) Pay a return to owners Pay loans Pay taxes Continue business activity

Learning Objective 2 Identify the primary users of accounting information.

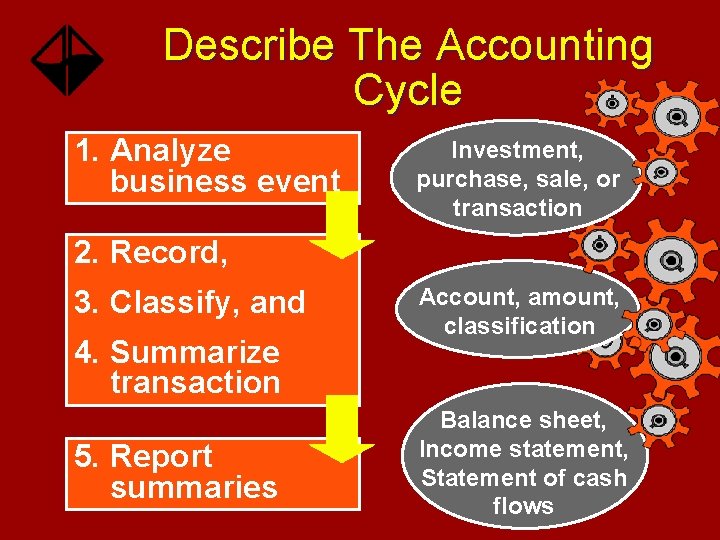

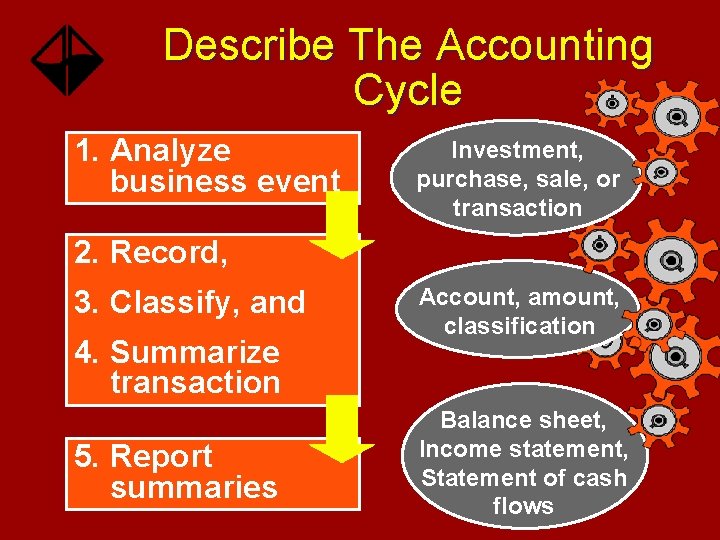

Describe The Accounting Cycle 1. Analyze business event Investment, purchase, sale, or transaction 2. Record, 3. Classify, and 4. Summarize transaction 5. Report summaries Account, amount, classification Balance sheet, Income statement, Statement of cash flows

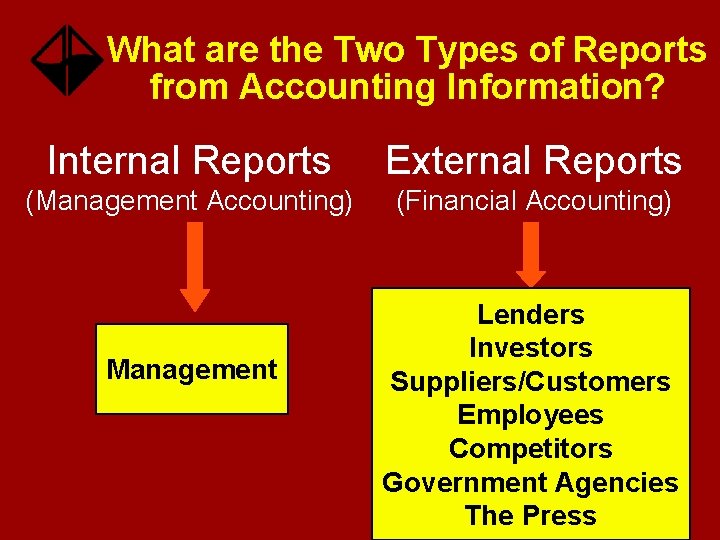

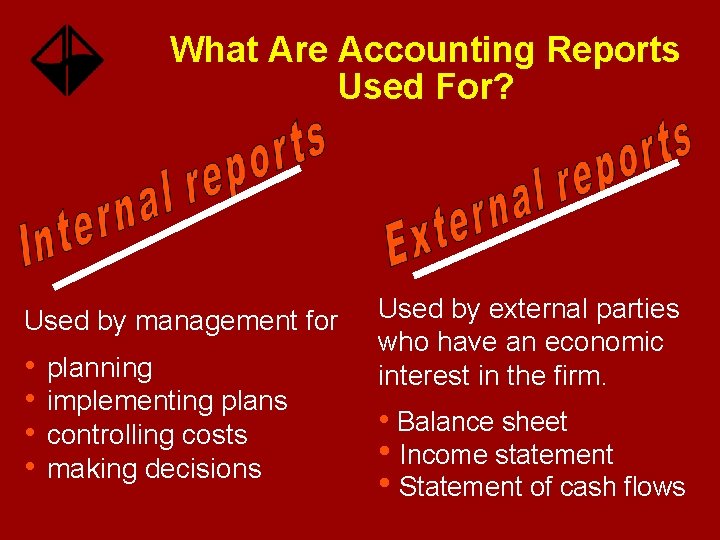

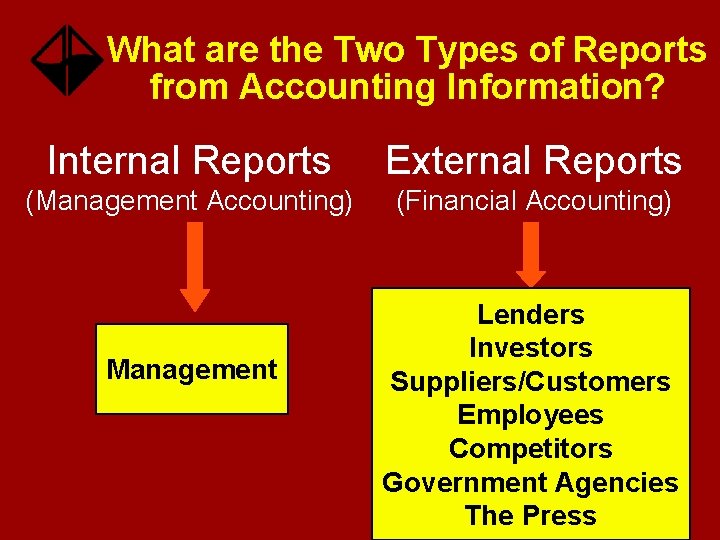

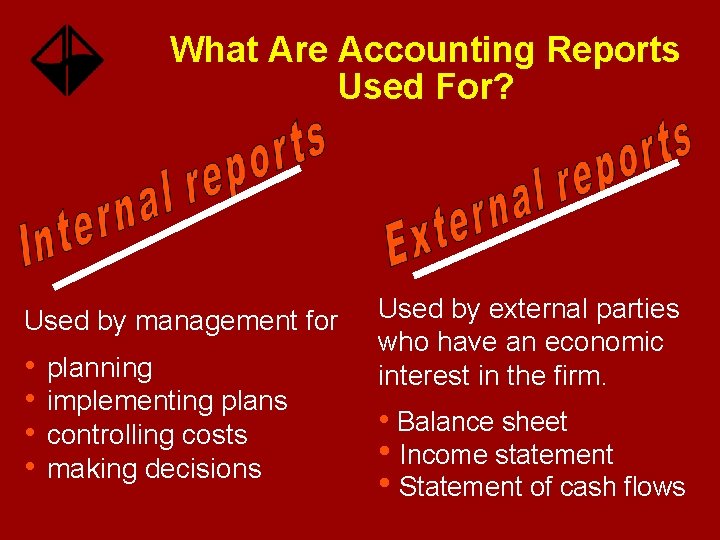

What are the Two Types of Reports from Accounting Information? Internal Reports External Reports (Management Accounting) (Financial Accounting) Management Lenders Investors Suppliers/Customers Employees Competitors Government Agencies The Press

What Are Accounting Reports Used For? Used by management for • • planning implementing plans controlling costs making decisions Used by external parties who have an economic interest in the firm. • Balance sheet • Income statement • Statement of cash flows

Learning Objective 3 Describe the environment of accounting, including the effects of generally accepted accounting principles, international business, ethical considerations, and technology.

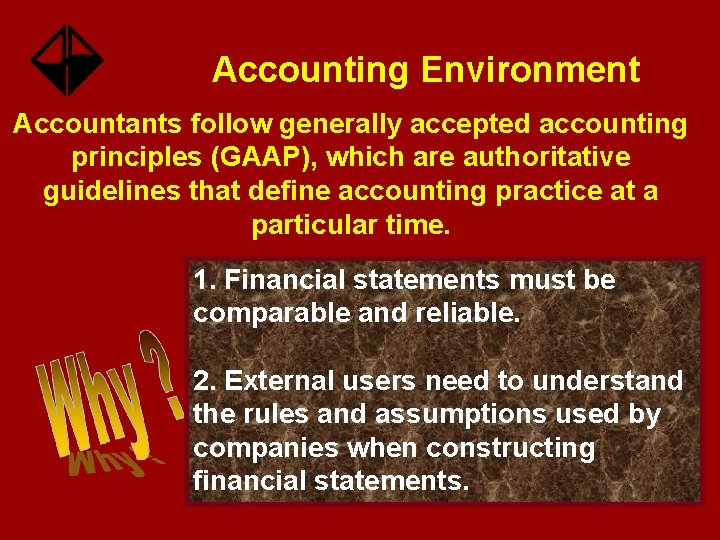

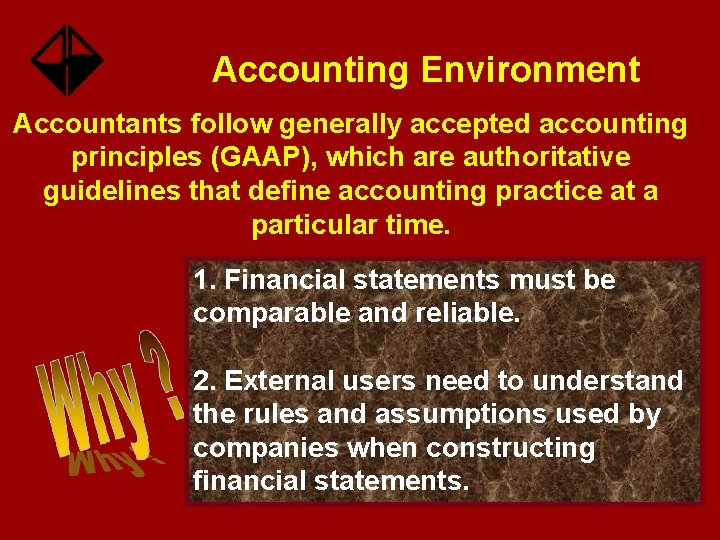

Accounting Environment Accountants follow generally accepted accounting principles (GAAP), which are authoritative guidelines that define accounting practice at a particular time. 1. Financial statements must be comparable and reliable. 2. External users need to understand the rules and assumptions used by companies when constructing financial statements.

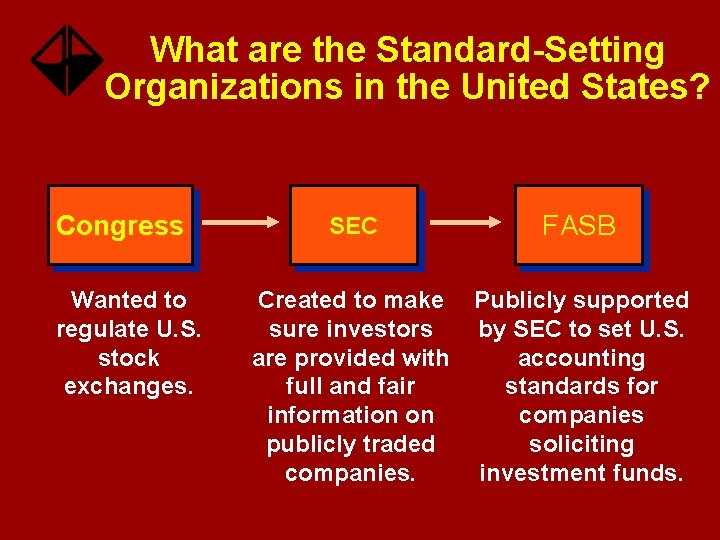

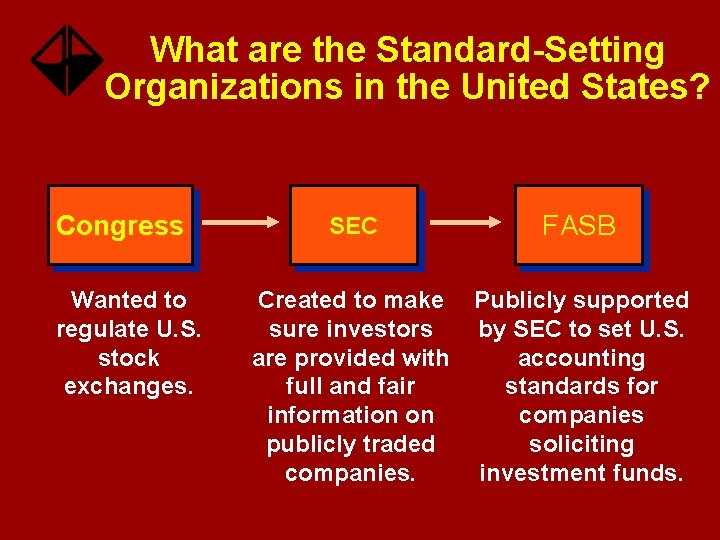

What are the Standard-Setting Organizations in the United States? Congress Wanted to regulate U. S. stock exchanges. SEC FASB Created to make Publicly supported sure investors by SEC to set U. S. are provided with accounting full and fair standards for information on companies publicly traded soliciting companies. investment funds.

What is a CPA? CPA: Certified Public Accountant • Has taken a minimum number of college-level accounting classes. • Has passed the exam administered by the AICPA. • Has met other requirements set by his/her state. AICPA: American Institute of Certified Public Accountants • The national organization of CPAs in the U. S. • Not a government agency.

Name Some Other Accounting Organizations AICPA: American Institute of Certified Public Accountants National organization of certified public accountants (CPAs) IMA: Institute of Management Accountants National organization of management accountants (CMAs) IRS: Internal Revenue Service Government agency--prescribes rules and regulates the collection of tax revenues in the U. S. SEC: Securities and Exchange Commission Created by Congress to regulate U. S. stock exchanges. IASC: International Accounting Standards Committee Formed to develop worldwide accounting standards.

Ethics in Accounting The Code of Professional Conduct. Adopted by the AICPA. Holds to what three key principles? Integrity Objectivity Independence Members are subject to disciplinary action.

What are Three Advantages of Technology? Allows companies to easily gather vast amounts of information about individual transactions. Allows large amounts of data to be compiled quickly and accurately, significantly reducing error. Creditors and investors can receive and process large amounts of data.

Why Doesn’t Technology Replace People? Because technology does not replace judgment. People must still analyze situations and input results. People must still analyze output.

Learning Objective 4 Analyze the reasons for studying accounting.

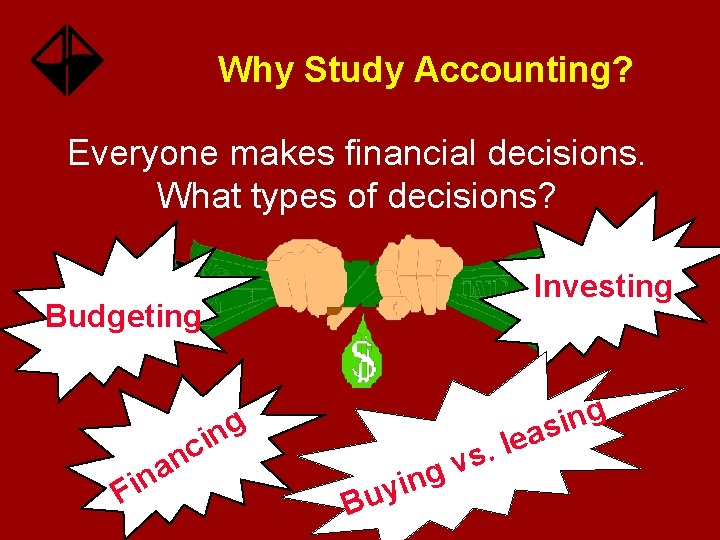

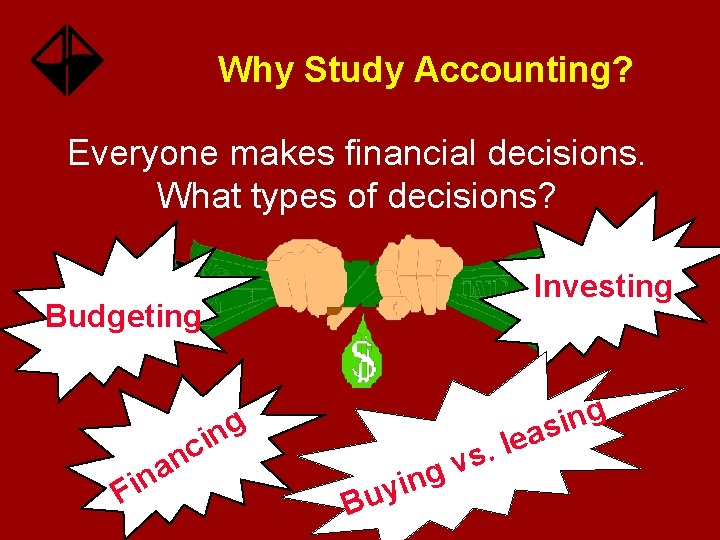

Why Study Accounting? Everyone makes financial decisions. What types of decisions? Investing Budgeting g n i as g n i a n Fi nc B g n i uy e l. vs

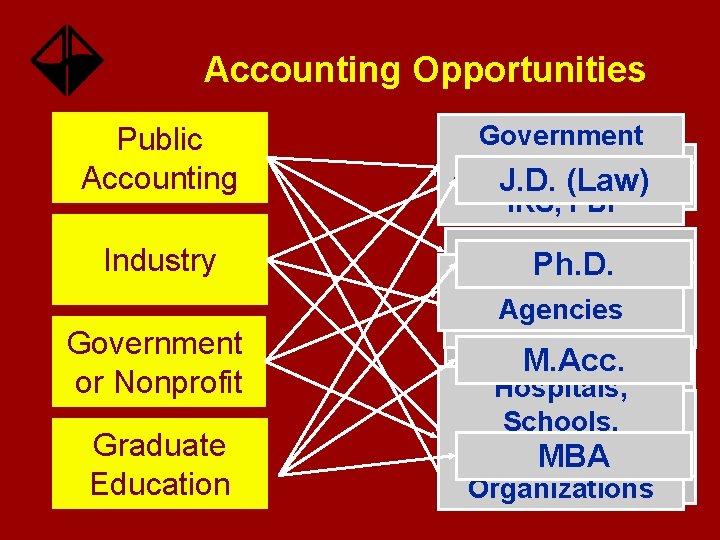

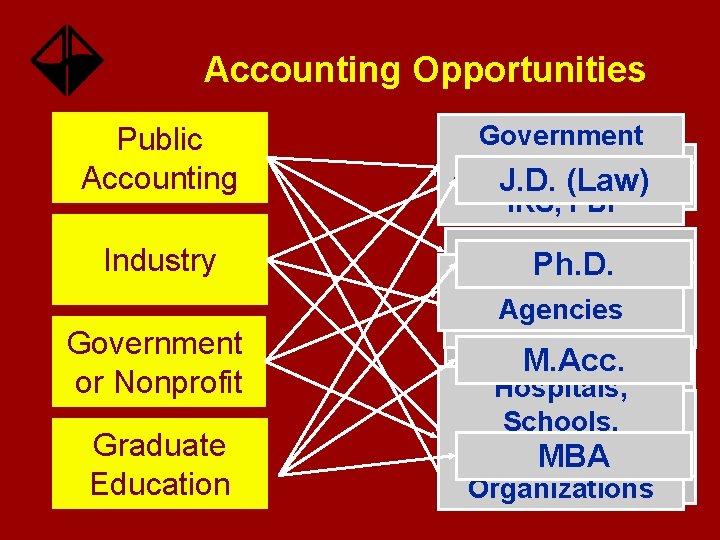

Accounting Opportunities Public Accounting Industry Government Agencies: GAO, Auditor J. D. (Law) Controller IRS, FBI Tax Consultant Ph. D. State and. Auditor Local Internal Agencies Government or Nonprofit Graduate Education Management M. Acc. Advisory Hospitals, Services Financial Schools, Executive Nonprofit MBA Consultant Organizations

The End of Chapter One