Power Point Slides for Financial Institutions Markets and

- Slides: 28

Power Point Slides for: Financial Institutions, Markets, and Money, 9 th Edition Authors: Kidwell, Blackwell, Whidbee & Peterson Prepared by: Babu G. Baradwaj, Towson University and Lanny R. Martindale, Texas A&M University Copyright© 2006 John Wiley & Sons, Inc. 1

CHAPTER 12 INTERNATIONAL MARKETS Copyright© 2005 John Wiley & Sons, Inc

The Difficulties of International Trade Information Asymmetry between Suppliers and Customers. Information about customers and suppliers is lacking or incorrect. Third party information gatherers are necessary and expensive. Differences in Legal & Business Systems Foreign trade and funds flow involve different legal systems and business procedures. The Role of Currency Conversion Foreign trade and funds flow must involve a conversion from one currency to another. Copyright© 2006 John Wiley & Sons, Inc. 3

Foreign Exchange Rates Foreign exchange rate - the price of a unit of one currency in terms of another. Foreign exchange rates are market determined. The increased (decreased) cost of a unit of foreign currency in terms of the U. S. dollar refers to the depreciation (appreciation) of the dollar. The U. S. dollar is considered to have depreciated relative to the Euro (€) if more dollars are required to purchase one €. The U. S. dollar is said to have appreciated if fewer dollars are required to buy one Euro. The relative value of all currencies to one another is maintained by continuous trading by arbitragers. Copyright© 2006 John Wiley & Sons, Inc. 4

Currency Quotation Currency quotations are shown in Exhibit 12. 3. Typically, quotes are provided in two forms – direct & indirect. Direct Quote - U. S. $ / foreign currency unit. Indirect Quote - Foreign currency unit / $. In practice, bank dealers quote in either the American term or European term. This is valid for deals between themselves. For non-bank customers, a direct quote is usually given. For major currencies like the yen, Swiss Franc, British pound, Canadian dollar, etc, not only is the spot rate provided, but also forward quotes for one month, three month and six month. Copyright© 2006 John Wiley & Sons, Inc. 5

The Euro (€) is the new common currency for nations that are members of the European Union. When first introduced in 1999, there were 11 original member nations who adopted this currency – Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Portugal, and Spain. Along with EU member Greece, other non EU members such as Monaco, the Vatican City and San Marino have also switched to the Euro. Copyright© 2006 John Wiley & Sons, Inc. 6

Foreign Exchange Rates Supply and demand for currencies depends on the underlying demand supply for goods and services between countries caused by: Relative costs of the factors of production in each country. Relative supply of factors between nations. Consumer tastes for certain goods and services. The ability of a country to supply its needs domestically. Barriers to trade such as import tariffs which affect the flow of goods and services. Copyright© 2006 John Wiley & Sons, Inc. 7

Foreign Exchange Rates Supply and demand for currencies depends on the underlying demand supply for goods and services between countries caused by: The rate of growth of national income of a country. Trade flows will continue, with corresponding purchase and sale of foreign exchange, until purchasing power parity is achieved, or the cost of an item in one country's currency is the same cost as in another country's currency. Copyright© 2006 John Wiley & Sons, Inc. 8

International Trade and Exchange Rates Factors that Influence Supply & Demand for a Currency Relative Prices – If one nation’s goods are cheaper, demand for that nation’s goods and hence its currency will increase, driving up the price of that currency. Barriers to Trade – Tariffs, taxes, quotas, and other restrictions are barriers to trade that will affect the demand for goods from a nation, the demand for the currency, and hence its price with respect to other currency. Copyright© 2006 John Wiley & Sons, Inc. 9

International Trade and Exchange Rates Resource Endowment – Availability of resources that determine the factors of production will determine demand for a nation’s goods and hence its currency price. Tastes – Shifts in consumer preferences will influence demand for goods from a country, demand for its currency and hence, its price. Productivity – The higher the productivity, the greater the growth rate of an economy, greater the demand for its goods, its currency, and hence, its currency’s price. Copyright© 2006 John Wiley & Sons, Inc. 10

Capital Flows and Exchange Rates Speculative capital flows - buying/selling of foreign exchange based on future exchange rate expectations. Investment capital flows - investment in real or financial assets (money or capital market) based on prospects of real returns. Covered (forward contract hedge) interest rate parity conditions are achieved by arbitragers, eliminating the spot conversion, interest rate, and forward exchange differences between countries. Political capital flows - transfer of wealth from one country to another, also called capital flight. Copyright© 2006 John Wiley & Sons, Inc. 11

Government Intervention in the Forex Markets. Support of a Nation’s Currency (undervalued) Government sells financial assets to foreigners and acquires foreign currencies. Government buys its currency with acquired foreign currency, bidding up the price of its own currency. Increased demand for domestic currency Promotes imports Copyright© 2006 John Wiley & Sons, Inc. 12

Government Intervention in the Forex Markets. Depression of currency value (overvalued) Buys assets foreign currencies More currency held by foreigners Value of currency falls Increased supply of domestic currency Promotes exports Copyright© 2006 John Wiley & Sons, Inc. 13

Inflation and Exchange Rates Inflation increases prices of goods and services and the higher level of inflation will mean imports would be cheaper. At the same time this country's exports will decline because their products will be more expensive for other nations. More money owed on imports, and less money coming in on exports will cause the trade deficit to worsen. The increased supply of the country’s currency to pays for its imports will drive down the value of the currency with respect to other currencies. Copyright© 2006 John Wiley & Sons, Inc. 14

Government Intervention in the Forex Markets. Politics & Exchange rates Strong Dollar Scenario • This scenario would attract capital to the U. S. and increase the demand for the dollar as investors seek to invest in a strong currency. • A strong dollar would make imports cheaper, and force domestic producers of goods with import substitutes to lower prices. • This lowers domestic cost of living and inflation. Copyright© 2006 John Wiley & Sons, Inc. 15

Government Intervention in the Forex Markets. Politics & Exchange rates Weak Dollar Scenario • U. S. products would be more price-competitive globally and exports would increase. • To meet the increased demand for U. S. made products both at home and abroad, production will go up, increase employment, and stimulate economic growth. • However, one has to watch out for an increase in inflation, as domestic firms increase prices on goods facing weak foreign competition. Copyright© 2006 John Wiley & Sons, Inc. 16

Structure of the Foreign Exchange Markets Characteristics of the market No single marketplace An OTC market Dealers Twenty-four hour trading Efficient communications systems Traditional code of ethics Major Participants Large multinational commercial banks Foreign exchange departments of investment banking firms Foreign central banks Business and individuals Copyright© 2006 John Wiley & Sons, Inc. 17

Trading Foreign Exchange Commercial banks are the major traders of currencies. Rapid pace of transaction Maintain inventory of currencies to meet customer needs. Must avoid large currency losses with changes in exchange rates. Regulation prohibits U. S. banks from making speculative currency trades. Trading is generally done by telephone, telex, or the Swift (Society for Worldwide Inter-bank Financial Telecommunications) system Inter-bank clearing system through correspondent relationships Trading by small group of traders Copyright© 2006 John Wiley & Sons, Inc. 18

Spot and Forward Transactions Foreign exchange traded for immediate delivery takes place in the spot market. Spot trading for immediate delivery (within two business days) - spot rate. Foreign exchange traded for delivery at some future point in time takes place in the forward market. Futures market – structured and trades on exchanges. Standard maturity terms - 30, 60, 90 or 180 days Standard contract sizes Copyright© 2006 John Wiley & Sons, Inc. 19

Spot and Forward Transactions Forward market - does not trade on exchange. Term tailored to business needs Two-party agreement Importer buys foreign exchange; exporter may sell if exporter is to be paid in the future in a foreign currency. Foreign exchange risk is hedged; so is opportunity to gain. Currency options may also be used to buy or sell a foreign currency at a future date. Copyright© 2006 John Wiley & Sons, Inc. 20

Three International Trade Problems Exporters lack information about importer's credit rating, and importers lack information about exporter’s reliability. Exact amounts of the trade and date of payment must be known before one party can hedge foreign exchange risk. Bank wants a clean deal without disputes and delay of funds flow. Copyright© 2006 John Wiley & Sons, Inc. 21

Specialized Financial Trade Instruments Letter of credit - guarantees payment upon submission of correct documents. Draft - a request for payment submitted to the guaranteeing bank by the exporter Sight draft - payable on demand. Time draft - payable on a particular date. Bill of lading - a receipt issued by the exporter to the shipping company. Copyright© 2006 John Wiley & Sons, Inc. 22

Euromarkets Eurocurrency - any currency held in timedeposit outside its country of origin. Large, unregulated short-term market with centers in Europe, the Middle East and Asia. A Eurocurrency is any currency held in a shortterm time deposit outside the country of origin – yen held outside of Japan. A Eurodollar is a short-term dollar time denominated deposit held outside of the U. S. Copyright© 2006 John Wiley & Sons, Inc. 23

Functions of the Eurocurrency Market Source of attractively priced working capital loans for multinational firms. Serve as a place to store excess liquidity for multinational corporations, countries and individuals. The market facilitates international trade by providing reasonably priced credit. Copyright© 2006 John Wiley & Sons, Inc. 24

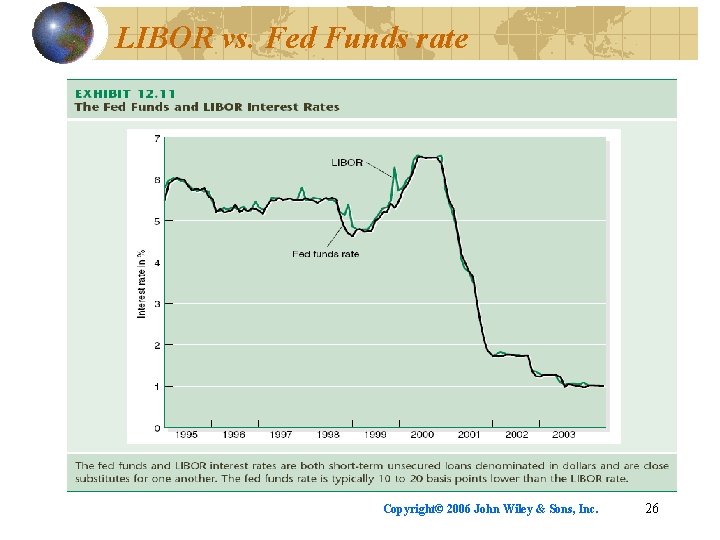

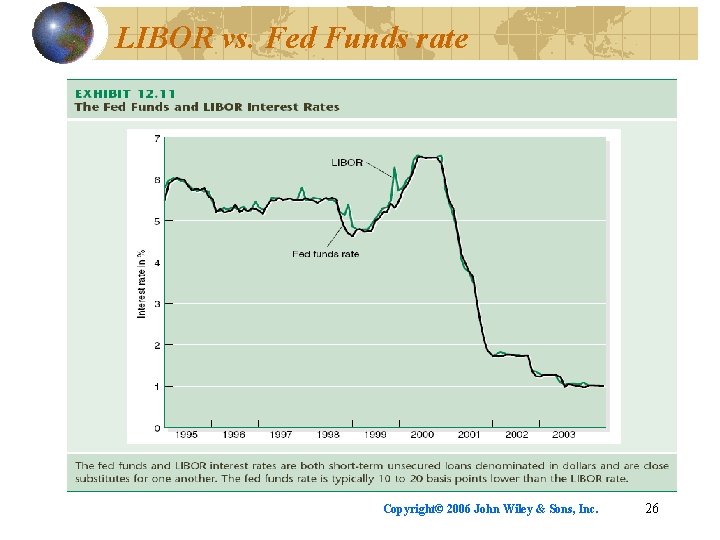

Eurocurrency markets Highly liquid assets that can be used to conduct international transactions. LIBOR - the rate international banks charge other banks. Used globally as a benchmark or base rate just like the prime rate in the U. S. LIBOR tends to be closely related to the Fed funds rate. (See Exhibit 12. 11). LIBOR is higher that the fed funds rate by an average of 10 to 12 basis points. Copyright© 2006 John Wiley & Sons, Inc. 25

LIBOR vs. Fed Funds rate Copyright© 2006 John Wiley & Sons, Inc. 26

The Eurobond Market - Medium Term Eurobonds are bonds sold in countries other than the country whose currency is the one in which the bond is denominated. They are underwritten by a multinational syndicate of investment banks. Eurobonds are bearer bonds and do not have to be registered which makes them more marketable. Interest or coupon payments are annual and are calculated on a 360 -day year. Minimum denominations are $5, 000 and $10, 000. U. S. firms issue dollar-denominated bonds in Europe because of cost savings ranging from 50 to 100 basis points (0. 5% - 1%). Today, the market is dominated by institutional investors such as mutual funds and pension funds. Copyright© 2006 John Wiley & Sons, Inc. 27

The Internationalization of Financial Markets Factors affecting the globalization of financial markets. The demise of fixed exchange rates and the movement towards a floating, market determined exchange rate system in the developing nations. The change in trading patterns and the concentration of wealth in the OPEC nations since the petroleum crises of 1974 and 1979 -1980. The extraordinary budget and trade deficits of the United States since 1981. The global economic expansion which began in 1982 leading to the rise of the multinational corporations. Improved telecommunications and computer technology. A strong dollar has become the new gold standard in a world where many currencies are rather volatile. Copyright© 2006 John Wiley & Sons, Inc. 28

Financial markets and institutions chapter 1

Financial markets and institutions chapter 1 Participants of money market

Participants of money market Financial markets and institutions - ppt

Financial markets and institutions - ppt Financial markets instruments and institutions

Financial markets instruments and institutions Madura j. financial markets and institutions

Madura j. financial markets and institutions Equity securities

Equity securities Madura j financial markets and institutions

Madura j financial markets and institutions Why study financial markets and institutions

Why study financial markets and institutions Chapter 12 money and financial institutions

Chapter 12 money and financial institutions Chapter 12 money and financial institutions

Chapter 12 money and financial institutions Financial intermediaries and markets

Financial intermediaries and markets International financial markets and instruments

International financial markets and instruments Capital markets and financial intermediation

Capital markets and financial intermediation Primary and secondary financial markets

Primary and secondary financial markets Efficient capital allocation

Efficient capital allocation Types of exchange rate

Types of exchange rate Pilbeam k. finance and financial markets

Pilbeam k. finance and financial markets Finance and financial markets keith pilbeam

Finance and financial markets keith pilbeam Chapter 6 consumers, savers, and investors answer key

Chapter 6 consumers, savers, and investors answer key Why study money banking and financial markets

Why study money banking and financial markets Why study money banking and financial markets

Why study money banking and financial markets A small child slides down the four frictionless slides

A small child slides down the four frictionless slides Energy of four forces quick check

Energy of four forces quick check Functions of financial institutions

Functions of financial institutions Daibb management accounting question solution

Daibb management accounting question solution Functions of financial system

Functions of financial system Types of non banking financial institutions

Types of non banking financial institutions Enterprise risk management for financial institutions

Enterprise risk management for financial institutions Louisiana office of financial institutions

Louisiana office of financial institutions