Power Point Slides for Financial Institutions Markets and

- Slides: 34

Power Point Slides for: Financial Institutions, Markets, and Money, 9 th Edition Authors: Kidwell, Blackwell, Whidbee & Peterson Prepared by: Babu G. Baradwaj, Towson University and Lanny R. Martindale, Texas A&M University Copyright© 2006 John Wiley & Sons, Inc. 1

CHAPTER 19 INVESTMENT BANKING Copyright© 2005 John Wiley & Sons, Inc

Investment Banking Investment Banks (IB) are the most important participant in the direct financial markets Assist firms and governments in selling new securities in the primary market. Assist in making (dealer) or arranging the buying and selling (broker) in the secondary market. Copyright© 2006 John Wiley & Sons, Inc. 3

Investment And Commercial Banks Differ Commercial Banks (CB) accept deposits and make commercial loans as a financial intermediary. CB traditionally could underwrite only low-risk securities of governments per the Glass-Steagall Act. Many large firms now use the direct financial markets to finance rather than bank loans. Copyright© 2006 John Wiley & Sons, Inc. 4

U. S. versus Other Developed Nations Until 1999, investment banks in the U. S. could not do commercial banking activities and vice-versa. Outside of Japan, in most other developed nations, financial institutions are allowed to do both investment and commercial banking activities. These institutions, called Universal banks, engage in deposit taking, making loans, brokerage activities, securities underwriting, and offering insurance services. Copyright© 2006 John Wiley & Sons, Inc. 5

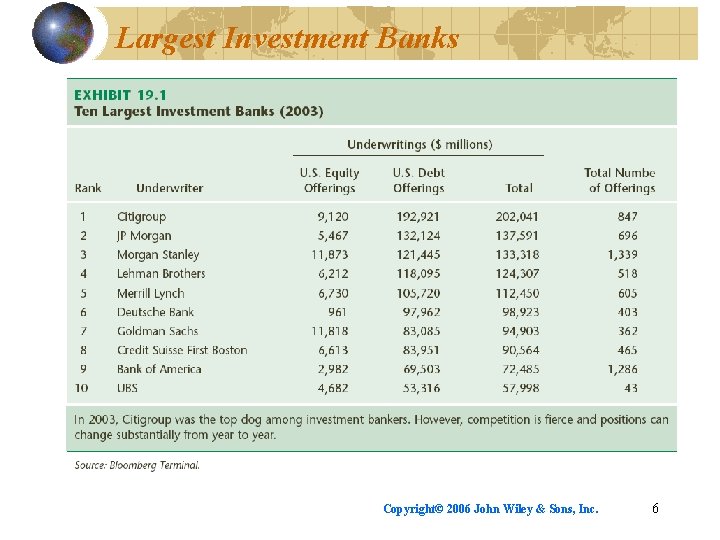

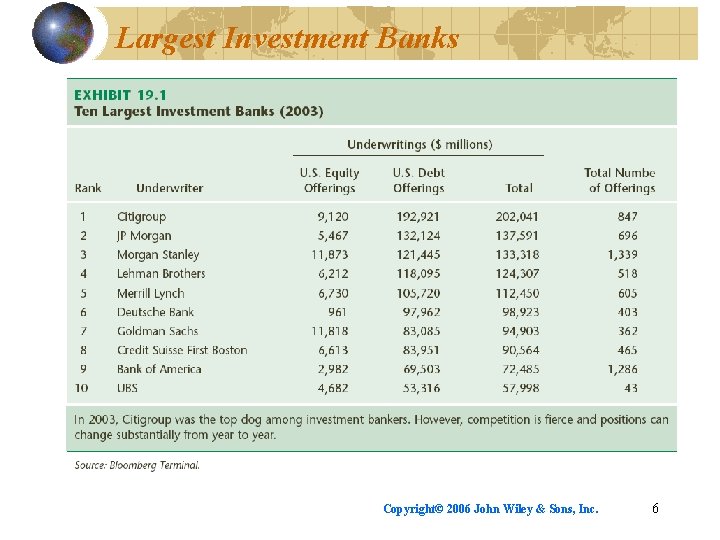

Largest Investment Banks Copyright© 2006 John Wiley & Sons, Inc. 6

Early History Investment banks trace their origins to European investment houses which branched to the U. S. Early U. S. commercial banks were chartered for note issue and business lending, separate from private investment banks, organized as partnerships. Investment banks grew with the growth of security issuance and trading in the Civil War and later in the railroad and steel industries. Commercial banks pressured for investment banking privileges from their regulators, and by the 1930 s, commercial banks could provide full investment banks services. Copyright© 2006 John Wiley & Sons, Inc. 7

Glass-Steagall Act The legislated separation of CB and IB in the United States is unique The Glass-Steagall Act of 1933 (Banking Act) restricted the asset powers of commercial banks to low-risk underwriting areas. In other countries, universal banks were able to combine commercial and investment banking functions. United States, IB, and CB had to compete with these firms. Copyright© 2006 John Wiley & Sons, Inc. 8

The Glass-Steagall Act (continued) CB could not underwrite (buy and resell) risky business securities. CB were limited as to the risk assumed in their investment portfolio-no risky corporate securities. IB firms were prohibited from engaging in CB. Firms became either IB or CB. Copyright© 2006 John Wiley & Sons, Inc. 9

The Objectives of the Glass-Steagall Act Discourage speculation in financial markets. Prevent conflict of interest and self-dealing. Restore confidence in the safety and soundness of the CB system. Copyright© 2006 John Wiley & Sons, Inc. 10

Commercial Banks & Securities Business >1980) In 1988, courts ruled in favor of banks to allow underwriting of securities in a limited fashion. They could underwrite commercial paper, municipal revenue bonds, and securities backed by mortgage loan or consumer loans. Business should be conducted by an independent subsidiary of the bank holding company. This business could not exceed 5% of the subsidiary’s gross revenue. In 1989, J. P. Morgan was allowed to underwrite and deal in corporate debt within the U. S. through its securities subsidiary, and in 1990 they were allowed to underwrite domestic corporate equity. Copyright© 2006 John Wiley & Sons, Inc. 11

Repealing the Glass-Steagall Act Relaxing the Glass-Steagall restrictions was one of the major financial issues of the last twenty years. CB increasingly had sought to be allowed to engage in investment banking activities. The Federal Reserve Board had increasingly allowed CBs to engage in some investment banking activities. In the late 1990 s, several commercial banks purchased investment banking firms. Copyright© 2006 John Wiley & Sons, Inc. 12

Gramm-Leach-Bliley Act Financial Services Modernization Act of 1999 Permitted commercial banking, investment banking and insurance underwriting under a financial holding company Citigroup Copyright© 2006 John Wiley & Sons, Inc. 13

Bringing New Securities to Market New issues are called primary issues, first issued in the primary market. If the issue is the first sold to the public, it is called an unseasoned offering or an initial public offering (IPO). If securities are already trading, the new issue of securities is called a seasoned offering. Copyright© 2006 John Wiley & Sons, Inc. 14

Bringing New Securities to Market (continued) Three steps of bringing a new security issue to market include: Origination - design of a security contract that is acceptable to the market; • prepare the state and federal Securities and Exchange Commission (SEC) registration statements and a summary prospectus, • obtain a rating on the issue, obtain bond counsel, a transfer agency and a trustee, and print the securities. Copyright© 2006 John Wiley & Sons, Inc. 15

Bringing New Securities to Market (concluded) Underwriting - the risk-bearing function in which the IB buys the securities at a given price and turns to the market to sell them. • Syndicates are formed to reduce the inventory risk. • Market price declines cut the IB's margin. Sales and distribution - selling quickly reduces inventory risk. Firm members of the syndicate and a wider selling group distribute the securities over a wide retail and institutional area. Copyright© 2006 John Wiley & Sons, Inc. 16

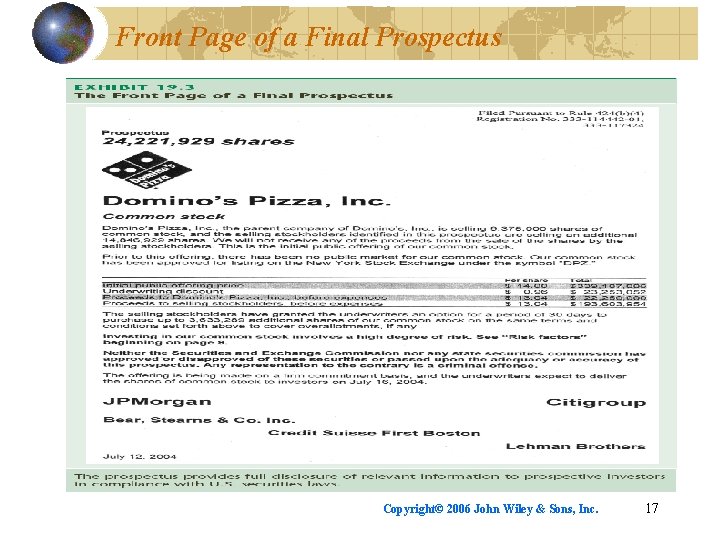

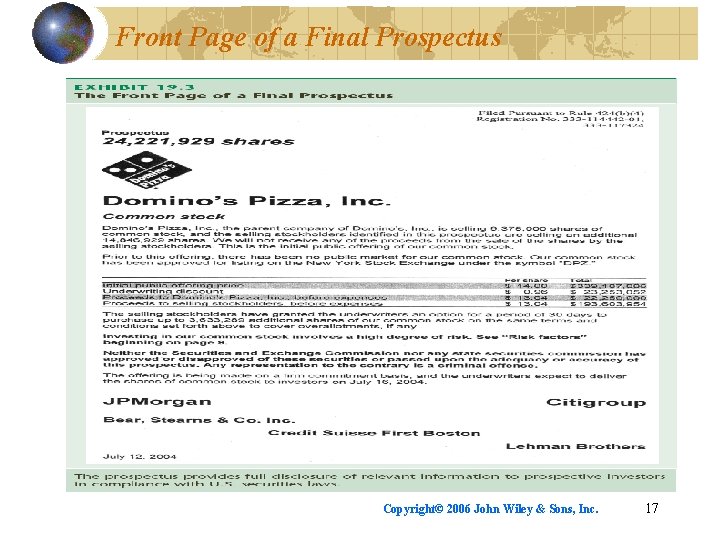

Front Page of a Final Prospectus Copyright© 2006 John Wiley & Sons, Inc. 17

Underwriting Agreements When the investment bank guarantees the issuing firm a certain price, it is called an underwritten offer. The risk of selling the issue at a price higher than that promised to the issuer is borne by the investment bank. The difference between the price at which the issue is sold and that promised to the issuer represents the underwriting spread or the profit earned by the investment bank. Copyright© 2006 John Wiley & Sons, Inc. 18

Underwriting Agreements In a best efforts offer, the investment bank does not guarantee a price or that the issue will be sold. The investment bank is compensated based on the number of securities sold. The risk of the securities not selling or not selling at a desired price is borne by the issuing firm, not the investment bank. Typically, the smaller and more risky issues are made to use this type of offering. Copyright© 2006 John Wiley & Sons, Inc. 19

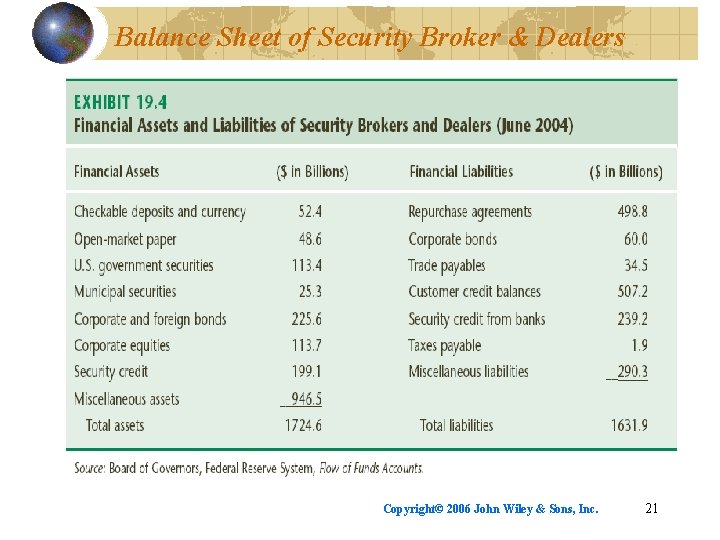

Trading and Brokerage The brokerage function is to bring a buyer and seller together. Dealer function - buying (bid) and selling (ask) from an inventory of securities owned by the seller. Providing loans to customers, who invest the margin proportion and borrow the rest. Dealer security inventories and customer credit are financed by bank call loans and repurchase agreements, the sale and later repurchase of securities held by the dealer. Copyright© 2006 John Wiley & Sons, Inc. 20

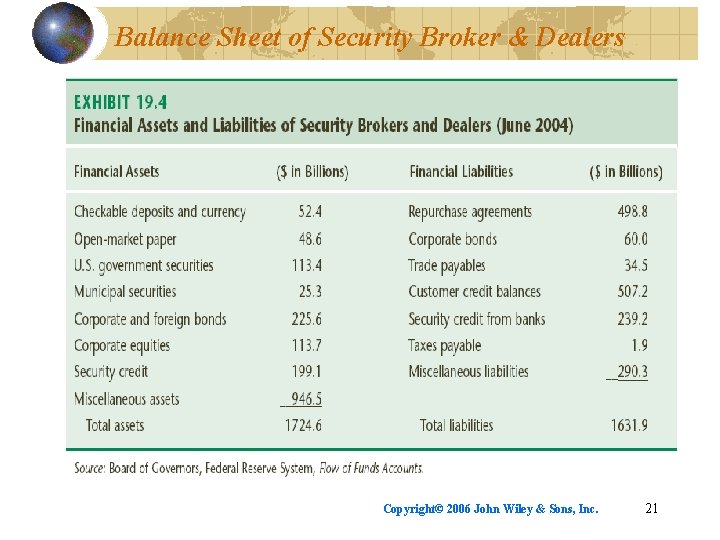

Balance Sheet of Security Broker & Dealers Copyright© 2006 John Wiley & Sons, Inc. 21

Trading and Brokerage (continued) Full service brokerage firms offer a wide range of financial services provided by licensed stockbrokers or account executives for commissions. Services include: Storage or safekeeping of securities. Execution of trades. Investment research and advice. Cash management service. Copyright© 2006 John Wiley & Sons, Inc. 22

Trading and Brokerage (concluded) Discount (Internet) brokerage firms offer fewer non-fee services than full-services brokers, but charge lower commissions on security purchases and sales. Banks may act as a broker on behalf of its customers under the Glass-Steagall Act. Banks moved into this area in the 1980 s and 1990 s usually as a discount broker. Arbitrage activities involving the simultaneous buying between two markets is another trading activity of IB. Copyright© 2006 John Wiley & Sons, Inc. 23

Private Placements The sale of securities directly to the ultimate investor and not through a public offering. The underwriting function/cost is avoided. A fee is earned for the origination/selling or uniting the supplier and user of funds. A private placement may reduce the total flotation costs for a business or government. The extremes of high credit quality firms and low or unknown credit quality firms use private placements. Copyright© 2006 John Wiley & Sons, Inc. 24

Private Placement, cont. Traditional two-year trading delay with private placement securities SEC Rule 144 A permits trading among institutional investors Increased liquidity of investment; lower liquidity risk premium; lower financing cost for borrower. Copyright© 2006 John Wiley & Sons, Inc. 25

Mergers and Acquisitions Specialized IB departments provide the following services. Arrange mergers which would produce economic synergy or increased total value after merger. Assist firms which have had unwanted merger offers (hostile takeovers). Help establish the value of target firms. Mergers and acquisitions have been a profitable aspect of the IB business. CB have expanded their merger and acquisition departments. Copyright© 2006 John Wiley & Sons, Inc. 26

Venture Capitalists Venture capital is private equity financing. Venture capital and managerial advice is provided, usually for an equity interest in the company involved, to higher risk businesses by institutional investors hoping for high returns. Venture capitalists typically invest in high-tech based firms that require large amounts of capital. Venture capital is usually the intermediate financing between founders' capital and the IPO. Copyright© 2006 John Wiley & Sons, Inc. 27

Venture Capital Organizations Private independent funds - most common, usually limited partnerships of institutional investors. Corporate subsidiaries - provides higher risk investments for large corporations. Small Business Investment Companies closed-end investment trusts authorized under the SBIC Act of 1958. Individuals and entrepreneurs may provide funds and advice for a "piece of the action. " Copyright© 2006 John Wiley & Sons, Inc. 28

Areas of Venture Capital Investment Venture capitalists invest in technologybased businesses such as: electronics. computer software. biotechnology. medical care. industrial products. Manufacturing business tend to be more intense users of venture capital than service businesses. Copyright© 2006 John Wiley & Sons, Inc. 29

Stages of Venture Capital Investments Seed financing is capital provided at the “idea” stage. Start-up financing is capital used in product development. First-stage financing is capital provided to initiate manufacturing and sales. Second-stage financing is for initial expansion. Third-stage financing allows for major expansion. Mezzanine financing prepares the company to go public. Copyright© 2006 John Wiley & Sons, Inc. 30

Structure of Venture Capital Investments Substantial control over management decisions, such as participating on the board of directors. Some protections against downside risk. A share of capital appreciation-convertible preferred stock is popular. Copyright© 2006 John Wiley & Sons, Inc. 31

Venture Capital Rates of Return Venture capitalists tend to think of rates of returns in terms of multiple of the amount invested. For example, a venture capitalist might expect to receive ten times the amount invested in a start-up company over six years. This would be a 47% annual rate of return. A less risky third-stage investment might return five times the amount invested over four years or 41% per year. Copyright© 2006 John Wiley & Sons, Inc. 32

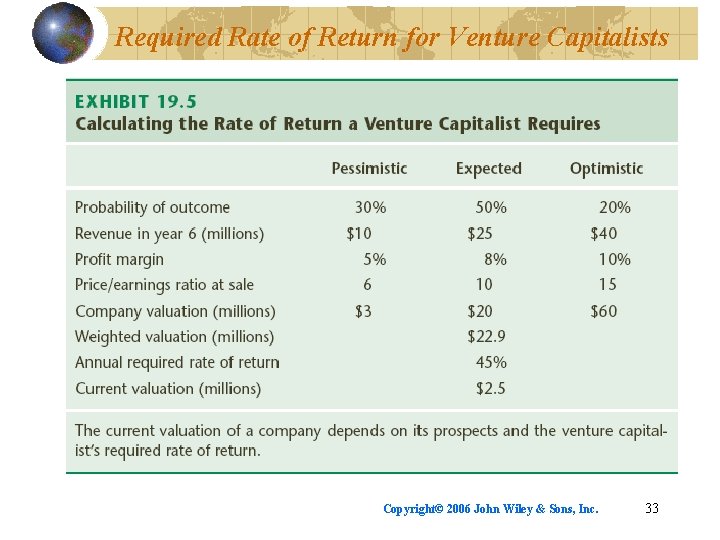

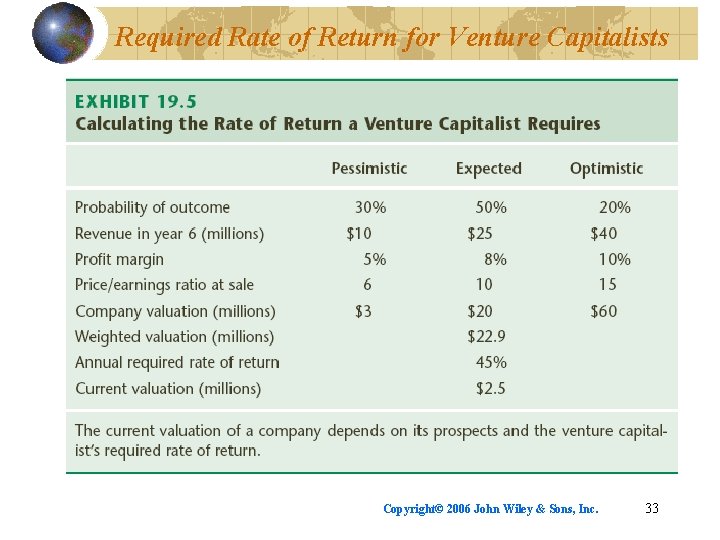

Required Rate of Return for Venture Capitalists Copyright© 2006 John Wiley & Sons, Inc. 33

Valuation of Venture Capital Investments Companies are compared to “comparable” public companies for valuation. comparable revenues, earnings, P/E ratios bench marking with adjustments for varied factors. Multiple-scenarios valuation such as optimistic expected pessimistic Copyright© 2006 John Wiley & Sons, Inc. 34