FINANCIAL MARKETS PRIMARY AND SECONDARY MARKET Difference The

- Slides: 12

FINANCIAL MARKETS PRIMARY AND SECONDARY MARKET

Difference The industrial securities market consists of the new issue (NIM)/primary market and the secondary/ stock exchange market. The two parts of the market have some differences as well as some similarities. The difference between the NIM and stock exchanges pertain to the types of securities dealt with, the nature of financing and organization. The NIM deals in new securities, which are offered to the investing public for the first time. The stock market is a market for old securities, which have been issued already and granted a stock exchange quotation.

Difference Conti. . The NM provides additional funds to the issuing companies, directly. The contribution of the stock exchange to corporate financing is indirect as, the issuing company is not involved in the transaction. Organizationally, stock exchanges have a physical existence and are located in a particular geo-graphical area. An NIM has no physical/geographical existence and is recognized only by the services it renders at the time of flotation of new securities. The similarities between the two parts of the securities market relate to listing, control and economic interdependence.

Difference Conti. . The securities issued in the NIM are invariably listed on the stock exchange, enabling investors to dispose them off. It encourages holding of new securities and widens the primary market. The stock exchanges exercise considerable control over the NIM in terms of compliance with listing requirements, to ensure fair dealings. One aspect of the economic interdependence between the two segments of the market is that the activity in the NIM and the prices of securities in the stock exchange are broadly related. Similarly, prices of new issues are influenced by the price movements in the stock markets.

Functions of Stock Exchanges Stock exchanges discharge three vital functions in the orderly growth of capital formation: It creates a nexus between savings and investments As a nexus, the stock exchanges arrange for the preliminary distribution of new issues. Their members act as brokers and underwriters. It acts as a market place As a market place, they guarantee sale-ability of securities to investors who have already invested and surety of purchase to those who desire to invest. It facilitates continuous price formation. The collective judgment of many players in the market brings about changes in security prices in small graduation, thereby evening out wide swings in the price and ensuring continuous price formation.

Functions of NIM The main function of the NIM is to facilitate the transfer of resources from the savers to the entrepreneurs. Its general function is split, up operationally into a triple service function: Origination Under-writing Distribution

Origination refers to the investigation and analysis and processing of new issue proposals. One aspect is the preliminary investigation, entailing a careful study of the technical, economic, financial and legal aspects of the issuer to ensure that the issue is a sound one. To improve the quality of the capital issue, the sponsor also renders services of an advisory natures such as type and price, timing and magnitude of issues, methods of flotation and so on.

Under-writing Underwriting is a form of institutional guarantee that the issue would be sold by eliminating the risk arising from uncertainty of public response. Distribution The sale of securities to the ultimate investors is known as distribution.

Floatation of Issues The methods of flotation of issues are: Prospectus/public issue Under the prospectus/public issue method, issuing companies offer directly to the general public, through a prospectus, a fixed number of shares, at a stated (par/premium) price. To ensure success, issues are generally underwritten, It is, however, an expensive method and is, therefore, suitable only for larger issues

Floatation of Issues Conti. . Book building The book building method is a volume and price discovery method. The investors quote the number of securities and the price at which they wish to acquire them. Offer for sale The Offer for sale method involves offering/sale of shares by the existing holders (promoters) to dilute their holdings in existing companies.

Floatation of Issues Conti. . Placements Under the placement method, the entire block of securities is offered to a select group of investors. It is an inexpensive method and the success of an issue does not depend upon public response Securities can be sold through this method even at times when conditions in the market may not be favorable. Rights issues The existing shareholders are offered the right to subscribe to new shares in proportion to the number of shares held in the issuing company in rights issues. This method can be used only by existing companies.

Thank You

Difference between primary and secondary market

Difference between primary and secondary market Document sample

Document sample Primary vs secondary financial markets

Primary vs secondary financial markets Primary target market and secondary target market

Primary target market and secondary target market Primary and secondary market

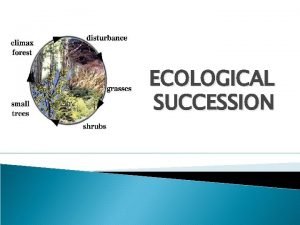

Primary and secondary market Mid succession

Mid succession Primary aldehyde

Primary aldehyde Primary processing and secondary processing

Primary processing and secondary processing What is the definition of ecological succession

What is the definition of ecological succession Air pollutants primary and secondary

Air pollutants primary and secondary Explain primary and secondary tillage

Explain primary and secondary tillage Difference between primary battery and secondary battery

Difference between primary battery and secondary battery Primary and secondary pollutants difference

Primary and secondary pollutants difference