Money Monetary Policy and Fiscal Policy Who Am

- Slides: 38

Money, Monetary Policy, and Fiscal Policy

Who Am I?

Who Am I?

Who Am I?

Who Am I?

Who Am I?

Money l Anything that is generally accepted as final payment for goods and services l Money is NOT the same as wealth or income Wealth is the total collection of assets that store value l Income is a flow of earnings per unit of time l

Money l The Barter System: goods and services are traded directly. There is no money exchanged. l Problems: Before trade could occur, each trader had to have something the other wanted. 2. Some goods cannot be split. If 1 goat is worth five chickens, how do you exchange if you only want 1 chicken? 1.

Money l Example: A heart surgeon might accept only certain goods but not others because he doesn’t like broccoli. l To get the surgery, a pineapple grower must find a broccoli farmer that likes pineapples.

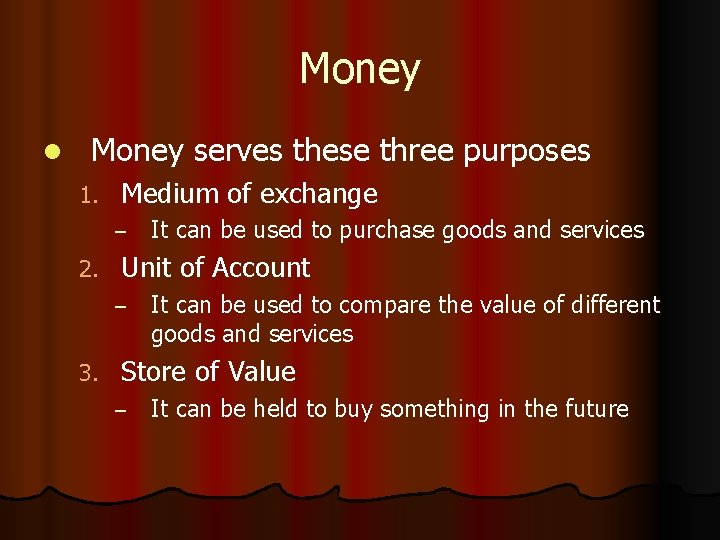

Money l Money serves these three purposes 1. Medium of exchange – 2. Unit of Account – 3. It can be used to purchase goods and services It can be used to compare the value of different goods and services Store of Value – It can be held to buy something in the future

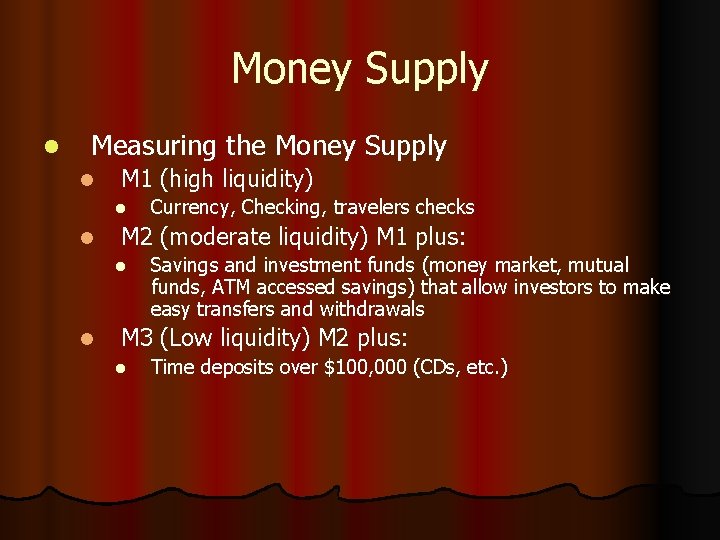

Money Supply l Measuring the Money Supply l M 1 (high liquidity) l l M 2 (moderate liquidity) M 1 plus: l l Currency, Checking, travelers checks Savings and investment funds (money market, mutual funds, ATM accessed savings) that allow investors to make easy transfers and withdrawals M 3 (Low liquidity) M 2 plus: l Time deposits over $100, 000 (CDs, etc. )

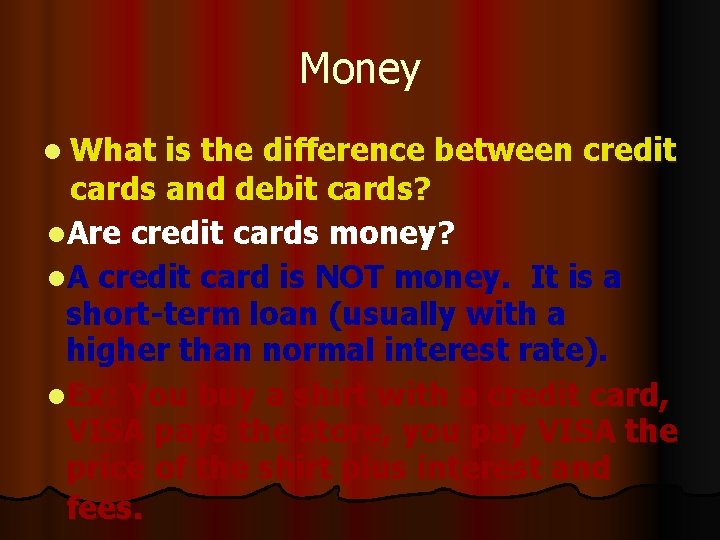

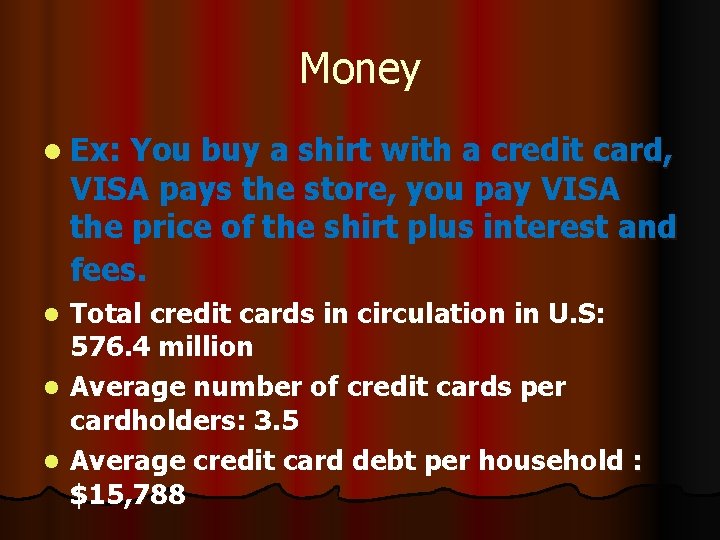

Money l What is the difference between credit cards and debit cards? l. Are credit cards money? l. A credit card is NOT money. It is a short-term loan (usually with a higher than normal interest rate). l. Ex: You buy a shirt with a credit card, VISA pays the store, you pay VISA the price of the shirt plus interest and fees.

Money l Ex: You buy a shirt with a credit card, VISA pays the store, you pay VISA the price of the shirt plus interest and fees. Total credit cards in circulation in U. S: 576. 4 million l Average number of credit cards per cardholders: 3. 5 l Average credit card debt per household : $15, 788 l

Money l Commodity l Gold, money silver, copper, etc. l Representative money l The gold standard, there must be gold backing all of the money in an economy l Fiat money is not worth anything by itself, it is only worth something because the government says so and we agree.

Money Supply There is no gold standard. Money is just an I. O. U. from the government “for all debts, public and private. ” l What makes money effective? 1. Generally Accepted - Buyers and sellers have confidence that it IS legal tender. 2. Scarce - Money must not be easily reproduced. 3. Portable and Dividable - Money must be easily transported and divided. l

Monetary Policy l The Federal Reserve System l Created in 1914 in response to previous bank failures in the U. S. l The Fed Board of Governors l 7 members appointed by the Pres. And confirmed by the Senate l 12 regional Fed Reserve Banks

Monetary policy l The Tools of Monetary Policy 1. Changes in the Discount Rate – – When the fed lowers the discount rate, banks are encouraged to make more loans and the money supply increases When the fed raises the discount rate, banks are encouraged to make fewer loans and the money supply decreases

Monetary policy l The Tools of Monetary Policy 2. Open Market Operations When the Fed buys or sells U. S. securities to influence the money supply l Fed buys, bank deposits increase, banks have more money to lend, and the money supply increases l Fed sells, bank deposits decrease, banks have less money to lend, and the money supply decreases l

Monetary policy l The Tools of Monetary Policy 3. Changes in the reserve requirement The reserve requirement is the minimum percentage that banks must keep to back up checking-type accounts l Lowering the reserve requirement will increase money supply l Raising the reserve requirement will decrease money supply l

Monetary Policy l l l l Example: Assume the reserve ratio in the US is 10% You deposit $1000 in the bank The bank must hold $100 (required reserves) The bank lends $900 out to Bob (excess reserves) Bob deposits the $900 in his bank Bob’s bank must hold $90. It loans out $810 to Jill deposits $810 in her bank SO FAR, the initial deposit of $1000 caused the CREATION of another $1710 (Bob’s $900 + Jill’s $810) Money Multiplier = 1/Reserve Ratio A reserve ratio of 10% has a money multiplier of 10 A $2 billion increase to money supply will actually increase the money supply by 20 billion

Monetary Policy l The Feds other responsibilities: l The Fed works as a clearing house for all checks l The Fed is also known as the lender of last resort l In cases of emergency the Fed will come to the aid of ailing banks l The Fed also performs stress tests on member banks.

Fiscal Policy l Changes in federal government spending of tax revenues designed to promote full employment, price stability, and reasonable rates of economic growth

Fiscal Policy l Expansionary l Increase Fiscal Policy in government spending and / or a decrease in taxes designed to increase aggregate demand in the economy. The intent is to increase GDP and decrease unemployment

Fiscal Policy l Contractionary l. A Fiscal Policy decrease in gov. spending and / or an increase in taxes designed to decrease aggregate demand in the economy. The intent is to control inflation

Fiscal Policy l Keynesian approach l Demand-side l Focuses economics on changing aggregate demand in order to promote full employment l Keynes argued that government stimulus could jolt the economy out of a severe recession or depression

Fiscal Policy l Supply-Side l The Fiscal Policy idea that fiscal policy might directly affect aggregate supply. For example, a corporate tax cut may give businesses incentive to expand or invest in capital goods with the money saved.

Fiscal Policy l Stagflation l. A contraction in the economies aggregate output (aggregate supply) combined with an increase in inflation. Stagflation occurred in the U. S. in 1973 and 1980. It usually results when the economy is already facing moderately high inflation and a price shock occurs (world wheat shortage or oil shortage)

Fiscal Policy l Laissez-faire l Classical economists believed that free markets without government intervention were the best way to achieve the economy’s potential output. l Classical economists believed that although there might be occasional downturns in the economy, natural market forces would correct things in the long term.

Fiscal Policy l Discretionary stabilizers l Discretionary fiscal policy vs. automatic Fiscal Policy requires congressional and presidential action to change gov. taxing or spending l Automatic stabilizers automatically adjust to the ups and downs of the economy. Unemployment insurance is a good example during a down economy, progressive taxing is a good example during an up economy

Fiscal policy l The problem with Lags l Recognition lag l Are we in a recession? How bad is the recession? How much needs to be done? Difficult questions because a recession isn’t identified until 6 months after it begins l Decision l Action making lag by policy makers usually takes months to approve

Fiscal Policy l The problem with lags l Implementation lag l The approved action then takes time to implement l The recent stimulus checks are a good example I received mine 4 months after the bill was passed l Effectiveness l Once lag implemented fiscal policy can take from 9 to 18 months for the full impact to be realized. Will the economy still need the agreed upon policy?

Fiscal or Monetary Policy l The President is advocating a bill that will cut taxes by 5%. l Fed chairman Bernanke is planning on lowering the discount rate by ¼ point. l The Fed Open Market Committee (F. O. M. C. ) announced today that it will selling U. S. securities l Both houses of the legislature have passed a bill that will spend $15 billion on infrastructure.

Fiscal or Monetary policy? l Zippy received his first unemployment check today. l The Fed increased the reserve requirement today to 28%. l The President announced today that the 2009 budget will be slashed in half. l The government announced a tax rebate today equaling $1000 person.

Bonds vs. Stocks l Pretend you are going to start a lemonade stand. You need some money to get your stand started. What do you do? • You ask your grandmother to lend you $100 and write this down on a piece of paper: "I owe you (IOU) $100, and I will pay you back in a year plus 5% interest. " • Your grandmother just bought a bond.

Stocks vs. Bonds l. Bonds are loans, or IOUs, that represent debt that the government or a corporation must repay to an investor. The bond holder has NO OWNERSHIP of the company. l. Ex: War Bonds During World War II l Corporate bonds, municipal bonds, government bonds, etc.

Stocks vs. Bonds • To get more money, you sell half of your company for $50 to your brother Tom. • You put this transaction in writing: "Lemo will issue 100 shares of stock. Tom will buy 50 shares for $50. " • Tom has just bought 50% of the business. He is allowed to make decisions and is entitled to a percent of the profits.

Stocks vs. Bonds Stockowners can earn a profit in two ways: 1. Dividends, which are portions of a corporation’s profits, are paid out to stockholders. The higher the corporate profit, the higher the dividend. l 2. A capital gain is earned when a stockholder sells stock for more than he or she paid for it. A stockholder that sells stock at a lower price than the purchase price suffers a capital loss. l

Expansionary fiscal policy graph

Expansionary fiscal policy graph Fiscal vs monetary policy

Fiscal vs monetary policy Unit 4 money banking and monetary policy

Unit 4 money banking and monetary policy Unit 4 money banking and monetary policy

Unit 4 money banking and monetary policy Unit 4 money and monetary policy

Unit 4 money and monetary policy Unit 4 money and monetary policy

Unit 4 money and monetary policy Unit 4 money and monetary policy

Unit 4 money and monetary policy Expansionary monetary policy aggregate demand

Expansionary monetary policy aggregate demand Money money money team

Money money money team Monetary base ap macro

Monetary base ap macro Unit 3 aggregate demand and aggregate supply

Unit 3 aggregate demand and aggregate supply Unit 3 aggregate demand aggregate supply and fiscal policy

Unit 3 aggregate demand aggregate supply and fiscal policy Non-discretionary fiscal policy

Non-discretionary fiscal policy Unit 3 aggregate demand aggregate supply and fiscal policy

Unit 3 aggregate demand aggregate supply and fiscal policy Transmission of monetary policy

Transmission of monetary policy Lesson quiz 16-1 monetary policy

Lesson quiz 16-1 monetary policy What are the objectives of monetary policy

What are the objectives of monetary policy What is the meaning of monetary policy

What is the meaning of monetary policy To type

To type What are the objectives of monetary policy

What are the objectives of monetary policy What are the objectives of monetary policy

What are the objectives of monetary policy Three tools of monetary policy

Three tools of monetary policy Monetary policy summary

Monetary policy summary Monetary policy simulation game

Monetary policy simulation game Monetary policy types

Monetary policy types Instruments of monetary policy

Instruments of monetary policy Cost-push inflation

Cost-push inflation Explain moral suasion

Explain moral suasion Ano ang tight money policy

Ano ang tight money policy Sama exchange rate

Sama exchange rate Instruments of monetary policy

Instruments of monetary policy Expansionary monetary policy flow chart

Expansionary monetary policy flow chart Expansionary policy

Expansionary policy Expansionary monetary policy

Expansionary monetary policy Contractionary policy

Contractionary policy Features of fiscal policy ppt

Features of fiscal policy ppt Ecb unconventional monetary policy

Ecb unconventional monetary policy Monetary policy baseline

Monetary policy baseline Example fiscal policy

Example fiscal policy