Unit 3 Lecture 3 EC 311 Susanto MONETARY

- Slides: 19

Unit 3 Lecture 3 – EC 311 Susanto MONETARY POLICY GOALS, STRATEGY AND TACTICS

Fed’s goals • Goals mentioned by Fed governors 1. High Employment – low unemployment 2. Economic Growth – want a growing economy 3. Price Stability – low or near-zero inflation 4. Interest Rate Stability – creates less uncertainty 5. Financial Market Stability 6. Foreign Exchange Market Stability • Goals often in conflict

Monetary Targeting in the U. S. • Monetary targeting: strategy aimed at maintaining price stability by focusing on the deviations of money growth from a pre-announced target • Fed began to announce publicly targets for money supply growth in 1975 • Paul Volker (1979) focused more in non-borrowed reserves • Greenspan announced in July 1993 that the Fed would not use any monetary aggregates as a guide for conducting monetary policy

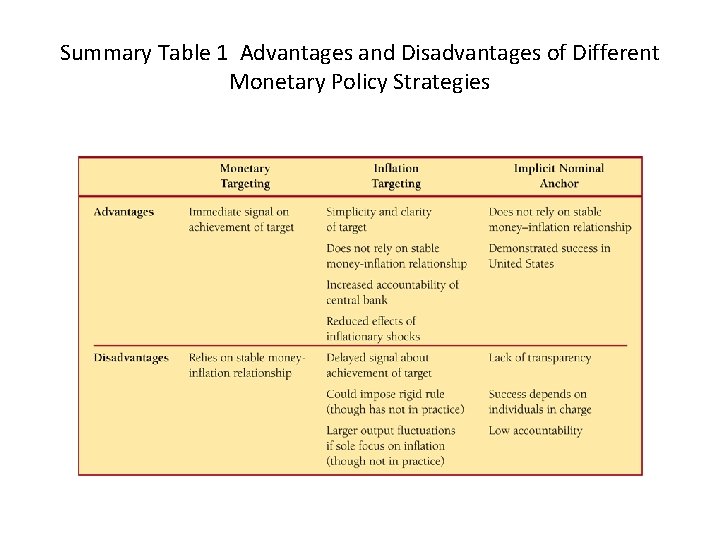

Monetary Targeting • Flexible, transparent, accountable • Advantages – Almost immediate signals help fix inflation expectations and produce less inflation – Almost immediate accountability • Disadvantages – Must be a strong and reliable relationship between the goal variable and the targeted monetary aggregate • If relationship is weak: hitting the target will not produce desired outcome

Inflation Targeting I • Public announcement of medium-term numerical target for inflation • Institutional commitment to price stability as the primary, long-run goal of monetary policy and a commitment to achieve the inflation goal • Information-inclusive approach in which many variables are used in making decisions • Increased transparency of the strategy • Increased accountability of the central bank

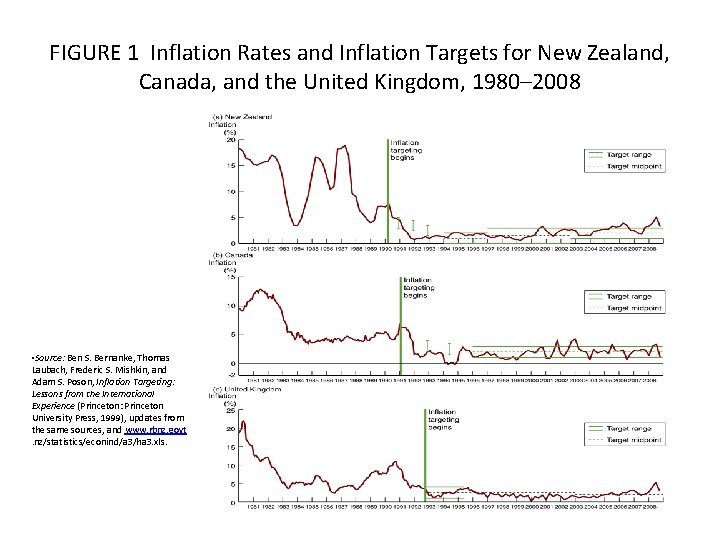

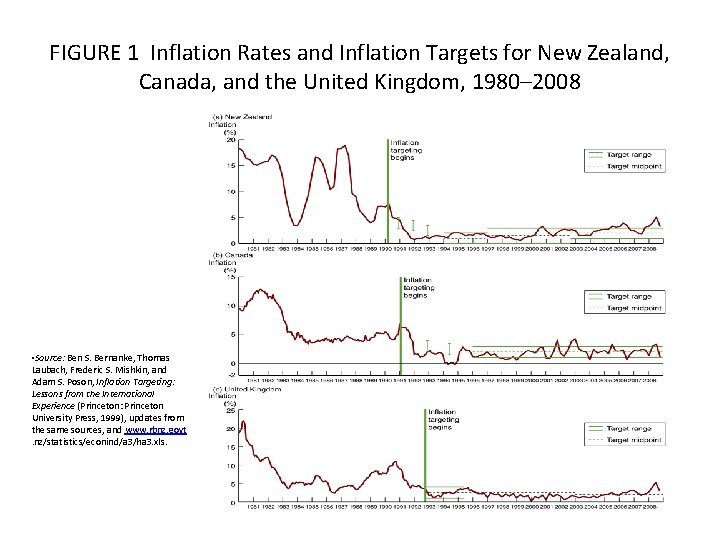

Inflation Targeting II • New Zealand (effective in 1990) – Inflation was brought down and remained within the target most of the time. – Growth has generally been high and unemployment has come down significantly • Canada (1991) – Inflation decreased since then, some costs in term of unemployment • United Kingdom (1992) – Inflation has been close to its target. – Growth has been strong and unemployment has been decreasing.

Inflation Targeting III • Advantages – Does not rely on one variable to achieve target – Easily understood – Reduces potential of falling in time-inconsistency trap – Stresses transparency and accountability • Disadvantages – Delayed signaling – Too much rigidity – Potential for increased output fluctuations – Low economic growth during disinflation

FIGURE 1 Inflation Rates and Inflation Targets for New Zealand, Canada, and the United Kingdom, 1980– 2008 • Source: Ben S. Bernanke, Thomas Laubach, Frederic S. Mishkin, and Adam S. Poson, Inflation Targeting: Lessons from the International Experience (Princeton: Princeton University Press, 1999), updates from the same sources, and www. rbnz. govt. nz/statistics/econind/a 3/ha 3. xls.

Monetary Policy with an Implicit Nominal Anchor • There is no explicit nominal anchor in the form of an overriding concern for the Fed. • Forward looking behavior and periodic “preemptive strikes” • The goal is to prevent inflation from getting started • Advantages – Uses many sources of information – Avoids time-inconsistency problem – Demonstrated success • Disadvantages – Lack of transparency and accountability – Strong dependence on the preferences, skills, and trustworthiness of individuals in charge – Inconsistent with democratic principles

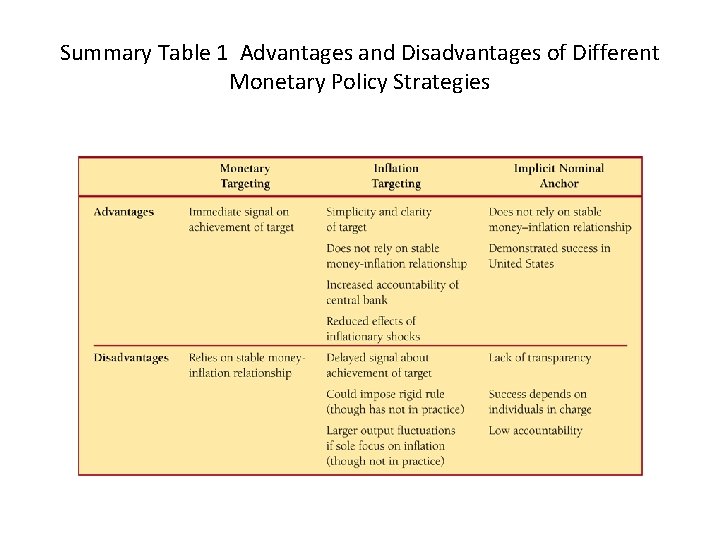

Summary Table 1 Advantages and Disadvantages of Different Monetary Policy Strategies

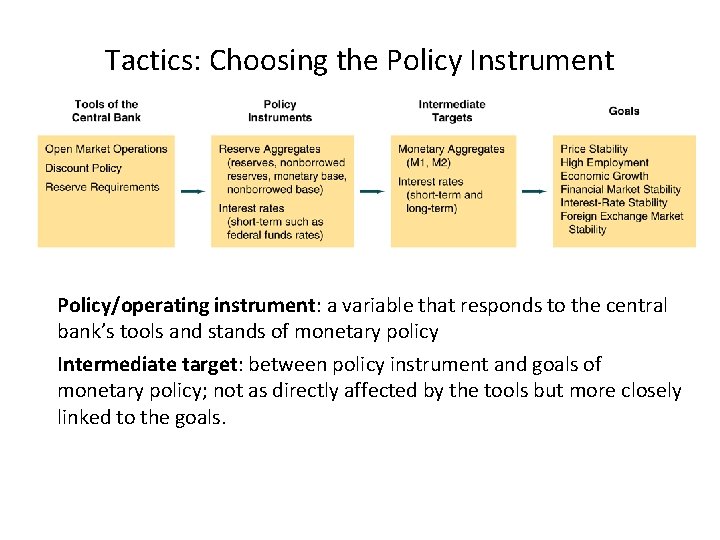

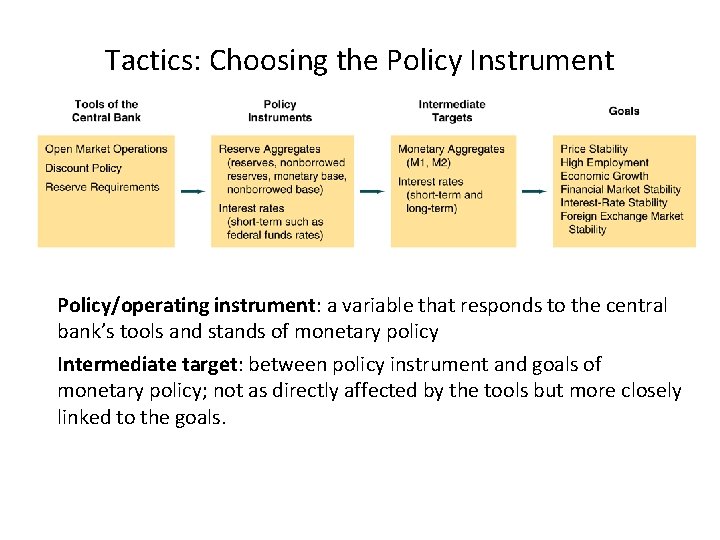

Tactics: Choosing the Policy Instrument Policy/operating instrument: a variable that responds to the central bank’s tools and stands of monetary policy Intermediate target: between policy instrument and goals of monetary policy; not as directly affected by the tools but more closely linked to the goals.

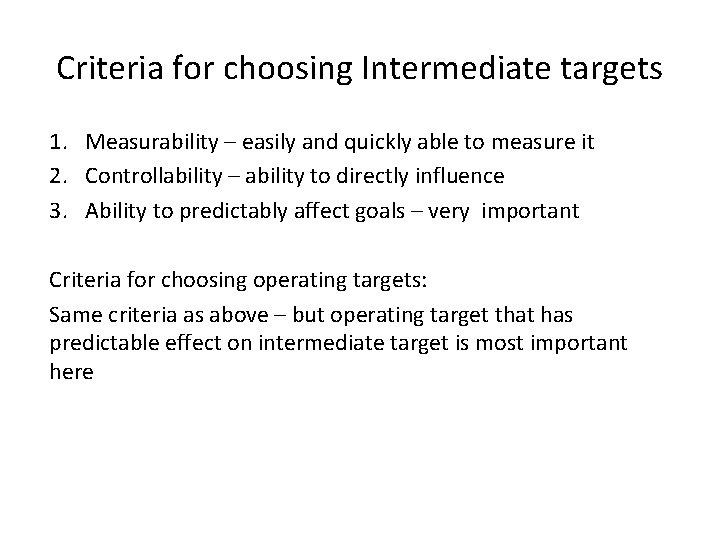

Criteria for choosing Intermediate targets 1. Measurability – easily and quickly able to measure it 2. Controllability – ability to directly influence 3. Ability to predictably affect goals – very important Criteria for choosing operating targets: Same criteria as above – but operating target that has predictable effect on intermediate target is most important here

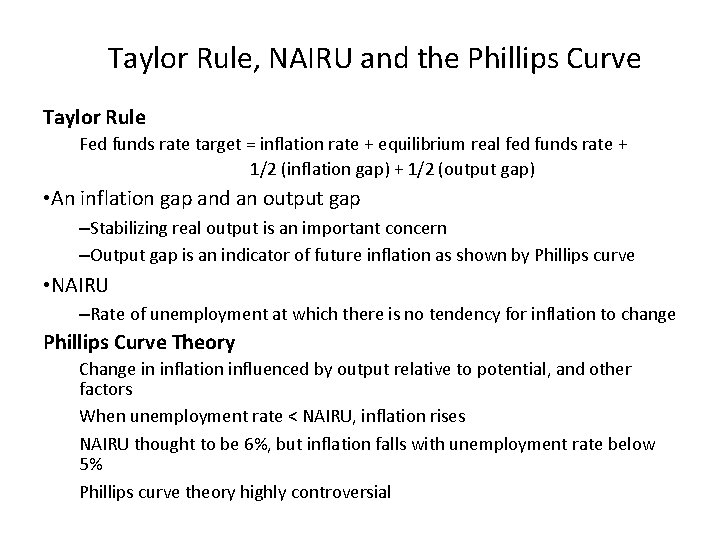

Taylor Rule, NAIRU and the Phillips Curve Taylor Rule Fed funds rate target = inflation rate + equilibrium real fed funds rate + 1/2 (inflation gap) + 1/2 (output gap) • An inflation gap and an output gap –Stabilizing real output is an important concern –Output gap is an indicator of future inflation as shown by Phillips curve • NAIRU –Rate of unemployment at which there is no tendency for inflation to change Phillips Curve Theory Change in inflation influenced by output relative to potential, and other factors When unemployment rate < NAIRU, inflation rises NAIRU thought to be 6%, but inflation falls with unemployment rate below 5% Phillips curve theory highly controversial

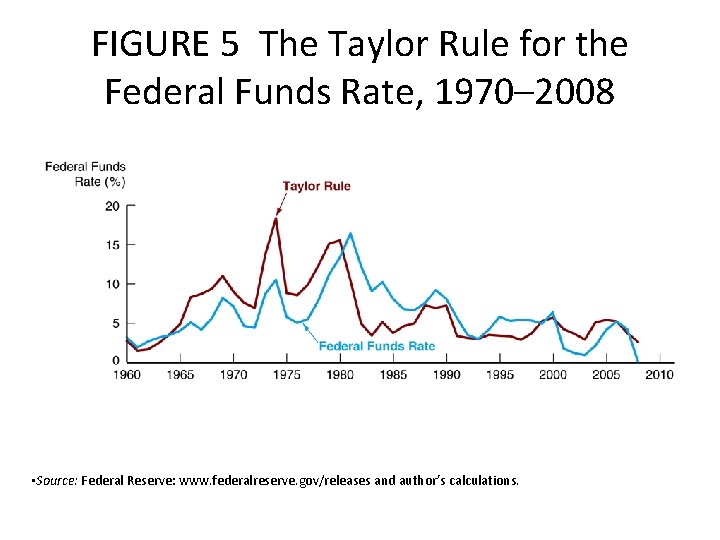

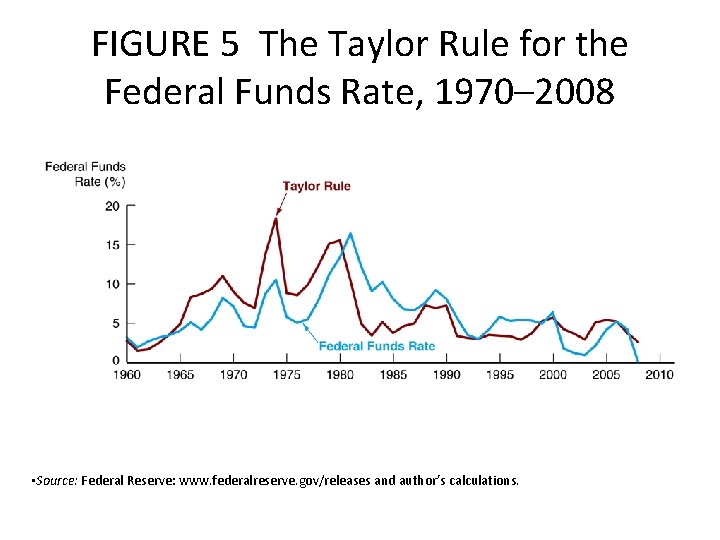

FIGURE 5 The Taylor Rule for the Federal Funds Rate, 1970– 2008 • Source: Federal Reserve: www. federalreserve. gov/releases and author’s calculations.

Central Bank’s Response to Asset Price Bubbles: Lessons From the Subprime Crisis • Asset-price bubble: pronounced increase in asset prices that depart from fundamental values, which eventually burst. • Types of asset-price bubbles: – Credit-driven bubbles • Easier credit more asset purchases value of collateral/net worth increases demand for more lending drives up prices • Feedback loop creates bubbles; also dangerous when the bubble burst and the loop is reversed • Example: Subprime financial crisis – Bubbles driven solely by irrational exuberance • Example: Tech boom of the late 1990 s

Central Bank’s Response to Asset Price Bubbles: Lessons From the Subprime Crisis • Should central banks respond to bubbles? – Strong argument for not responding to bubbles driven by irrational exuberance – Bubbles are easier to identify when asset prices and credit are increasing rapidly at the same time. – Monetary policy should not be used to prick bubbles. • Macropudential regulation: regulatory policy to affect what is happening in credit markets in the aggregate. • Central banks and other regulators should not have a laissezfaire attitude and let credit-driven bubbles proceed without any reaction.

History of Fed Policy Procedures Early Years: Discounting as Primary Tool 1. Real bills doctrine 2. Rise in discount rates in 1920: recession 1920– 21 Discovery of Open Market Operations 1. Made discovery when purchased bonds to get income in 1920 s Great Depression 1. Failure to prevent bank failures 2. Result: sharp drop in Ms Reserve Requirements as Tool 1. Banking Act of 1935 2. Required reserves in 1936, 1937 to reduce “idle” reserves: Result: Ms and severe recession in 1937– 38

Pegging of Interest Rates: 1942 -51 1. To help finance war, T-bill at 3/8%, T-bond at 2 1/2% 2. Fed-Treasury Accord in March 1951 Money Market Conditions: 1950 s and 60 s 1. Interest Rates A. Procyclical M Y i MB M e i MB M Targeting Monetary Aggregates: 1970 s 1. Fed funds rate as operating target with narrow band 2. Procyclical M

New Operating Procedures: 1979– 82 1. Deemphasis on fed funds rate 2. Nonborrowed reserves operating target 3. Fed still using interest rates to affect economy and inflation Deemphasis of Monetary Aggregates: 1982–Early 1990 s 1. Borrowed reserves (DL) operating target A. Procyclical M Y i DL MB M Fed Funds Targeting Again: Early 1990 s to the present 1. Fed funds target now announced International Considerations 1. M in 1985 to lower exchange rate, M in 1987 to raise it 2. International policy coordination