Money and Credit Lecture 6 Money market and

- Slides: 21

Money and Credit Lecture 6 Money market and demand for money

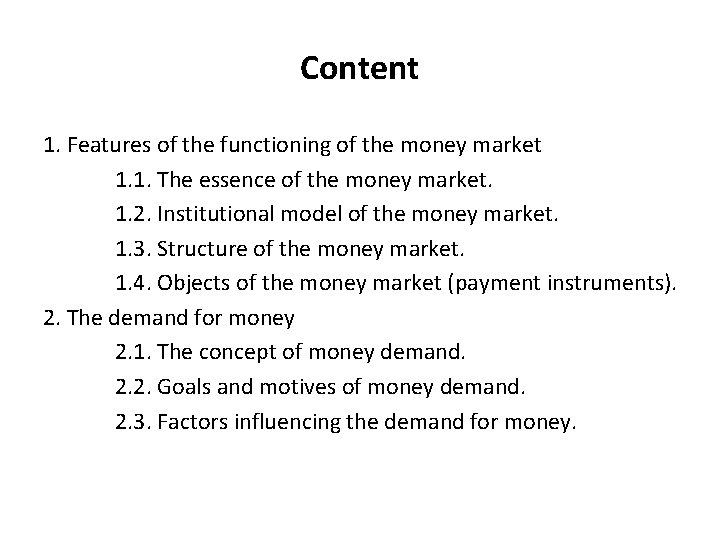

Content 1. Features of the functioning of the money market 1. 1. The essence of the money market. 1. 2. Institutional model of the money market. 1. 3. Structure of the money market. 1. 4. Objects of the money market (payment instruments). 2. The demand for money 2. 1. The concept of money demand. 2. 2. Goals and motives of money demand. 2. 3. Factors influencing the demand for money.

Main definitions: o money market o commitments o claims o debt and non-debt o financial instruments o speculations o …………. .

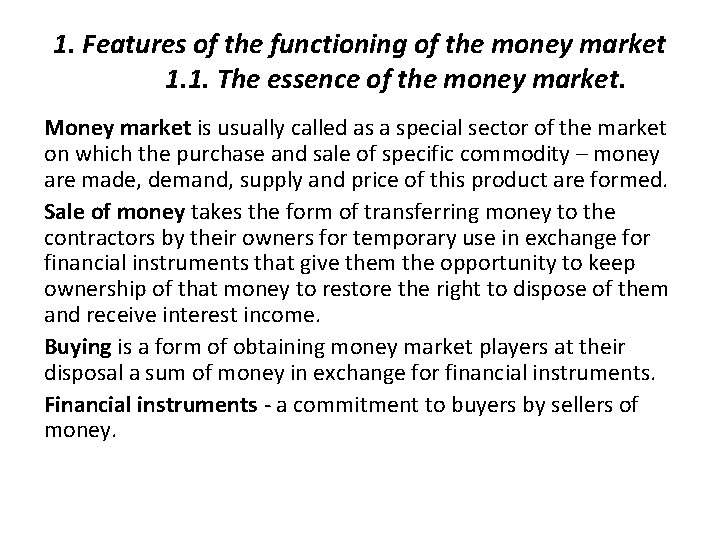

1. Features of the functioning of the money market 1. 1. The essence of the money market. Money market is usually called as a special sector of the market on which the purchase and sale of specific commodity – money are made, demand, supply and price of this product are formed. Sale of money takes the form of transferring money to the contractors by their owners for temporary use in exchange for financial instruments that give them the opportunity to keep ownership of that money to restore the right to dispose of them and receive interest income. Buying is a form of obtaining money market players at their disposal a sum of money in exchange for financial instruments. Financial instruments - a commitment to buyers by sellers of money.

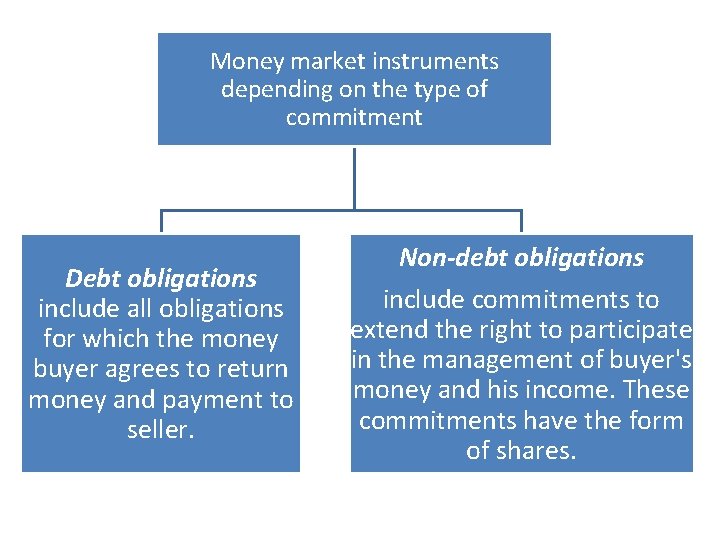

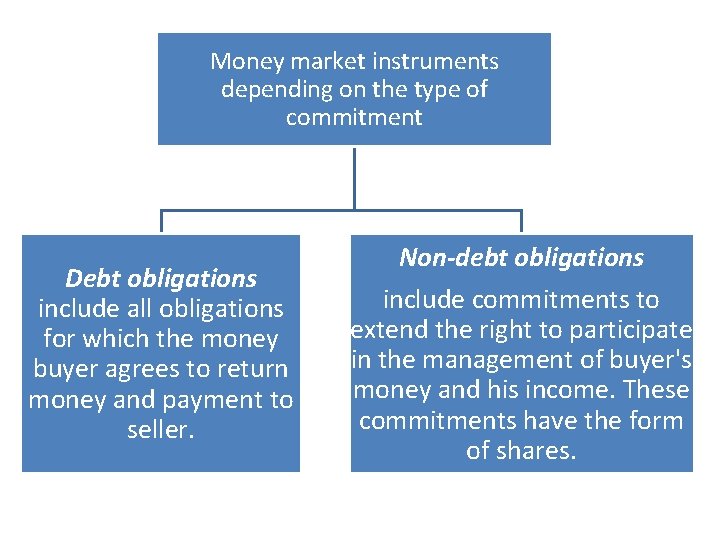

Money market instruments depending on the type of commitment Debt obligations include all obligations for which the money buyer agrees to return money and payment to seller. Non-debt obligations include commitments to extend the right to participate in the management of buyer's money and his income. These commitments have the form of shares.

1. 2. Institutional model of the money market. direct financing sector Money 1. Capital financing Shares creditors borrowers Money 2. Loans Bonds Money Commitments Money Banks Non-bank financial institutions Commitments indirect financing sector Claims Money Claims

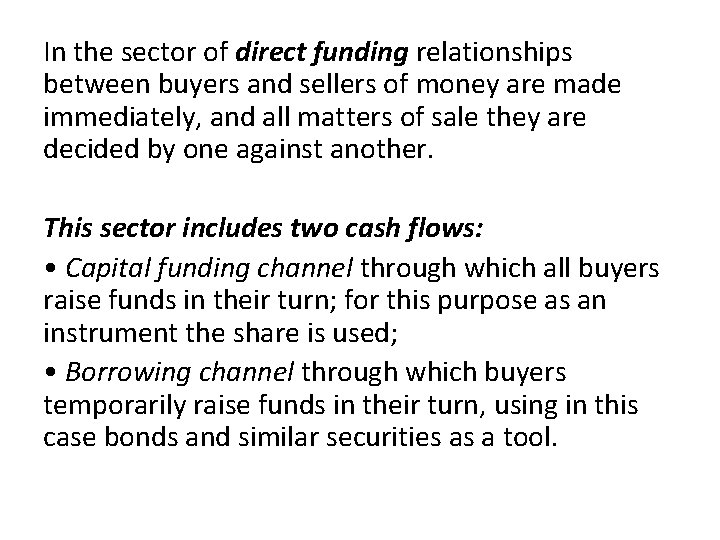

In the sector of direct funding relationships between buyers and sellers of money are made immediately, and all matters of sale they are decided by one against another. This sector includes two cash flows: • Capital funding channel through which all buyers raise funds in their turn; for this purpose as an instrument the share is used; • Borrowing channel through which buyers temporarily raise funds in their turn, using in this case bonds and similar securities as a tool.

In the sector of indirect funding relationships between buyers and sellers of money are realized through financial intermediaries, which initially accumulate resources available in the market and then sell them to end-customers on their behalf. Sector of indirect financing is objectively necessary component of the money market. It is not just complement the direct financing sector, it creates a special mechanism implementation of the linkages between lenders and borrowers.

1. 3. Structure of the money market. Market segments can be pointed out by several criteria: • by type of instruments used to move in money from sellers to buyers; • by institutional features of cash flows; • by the economic purpose of money that bought on the market.

Type of structuration By economic purpose of resources By institutional features By type of financial instruments Money market Market of money Market of bank loans Market of loan commitments Market of capitals Market of products of other financial institutions Foreign exchange market Stock exchange Equity market

The money market by type of financial instruments • Market of loan commitments - covers banking relationships with their clients on the formation and location of credit. • Stock exchange - covers both credit relations and relations of co-ownership, which are made by special instruments (securities) that can be sold, bought, redeemed. • Foreign exchange market - covers the relationship between economic agents about buying and selling currency based on supply and demand.

The money market by type of financial instruments • Market of bank loans - provides accumulation of free funds and grant them as loans on terms of repayment, maturity and payment. Institutional bodies are commercial banks. • Market of services of non-bank financial institutions provides accumulation of savings and placing them in earning assets. Institutional bodies are: insurance companies, pension funds, investment funds. • Stock market – carries out the movement of non-bank loan capital, which is driven by financial values. Institutional bodies are stock exchanges.

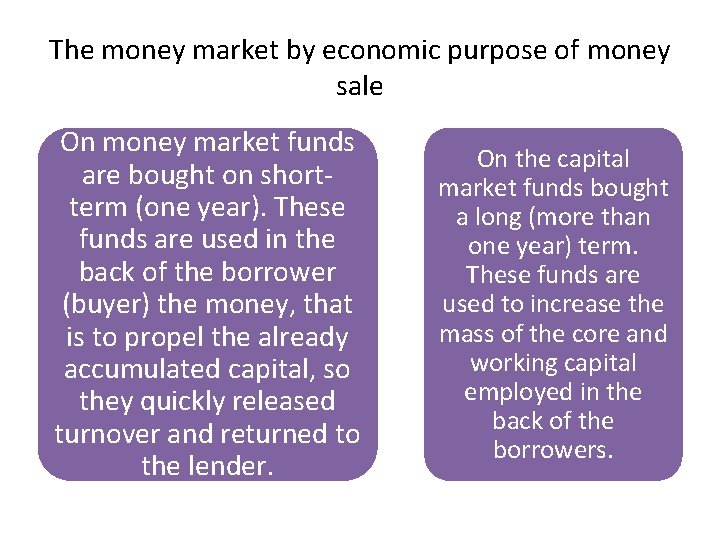

The money market by economic purpose of money sale On money market funds are bought on shortterm (one year). These funds are used in the back of the borrower (buyer) the money, that is to propel the already accumulated capital, so they quickly released turnover and returned to the lender. On the capital market funds bought a long (more than one year) term. These funds are used to increase the mass of the core and working capital employed in the back of the borrowers.

1. 4. Objects of the money market (payment instruments) Any payment transaction has two sides - the flow of information, containing details of payment, and direct cash flow. These two streams are always linked, but can move in different ways and have a discrepancy in time. In payment transactions the main elements can identified: • obligations that must be performed; • side, making the payment (payer); • party receiving payment (receiver); • methods of payment; • one or more financial intermediaries (usually a bank) that transfer payments, writing off the required amount from the payer and assigns it to the beneficiary.

Payment instruments • • Bill of exchange Promissory note Cheque Bank plastic card

2. The demand for money 2. 1. The concept of money demand. Unlike conventional demand on commodity markets, which is formed as a stream of purchased goods for a certain period, the demand for money appears as money supply, which tend to have an economic actors at some point. If the stock of money considered as an element of wealth, which is owned by economic agents, the demand for money can be interpreted as their desire to have a portion of their portfolio assets (wealth) in liquid form.

Money demand is closely related to the velocity of money in inversely proportional dependence: with increasing of demand for money each currency that is in circulation will longer be in possession of a separate economic entity, its circulation is slower, and vice versa.

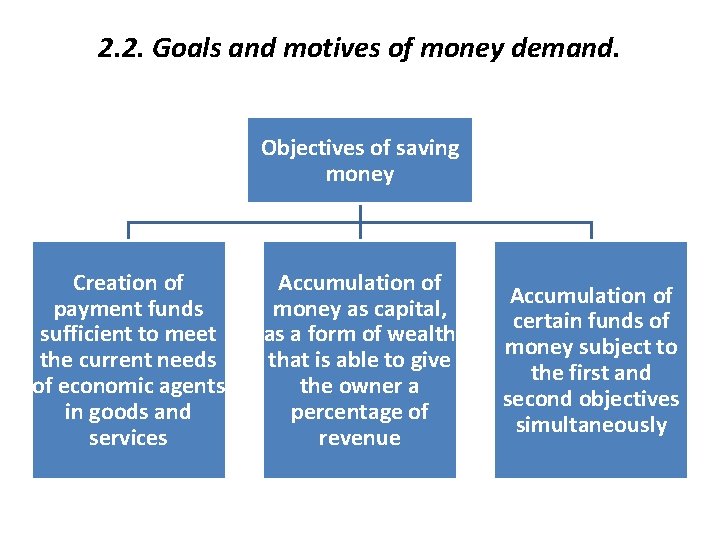

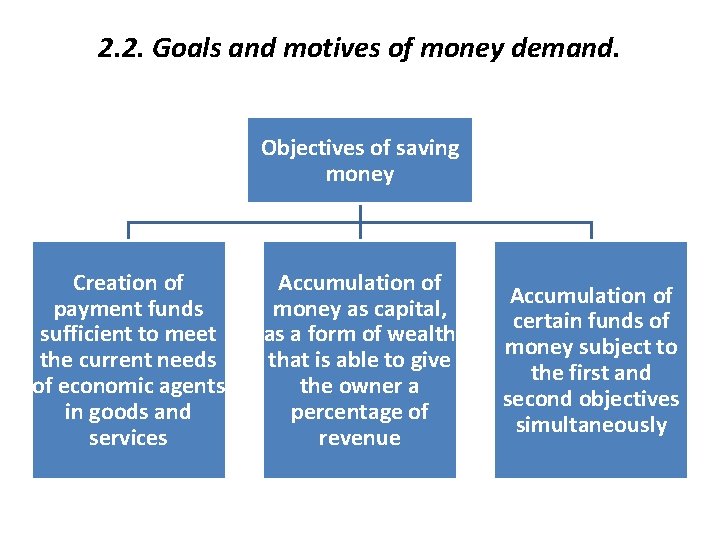

2. 2. Goals and motives of money demand. Objectives of saving money Creation of payment funds sufficient to meet the current needs of economic agents in goods and services Accumulation of money as capital, as a form of wealth that is able to give the owner a percentage of revenue Accumulation of certain funds of money subject to the first and second objectives simultaneously

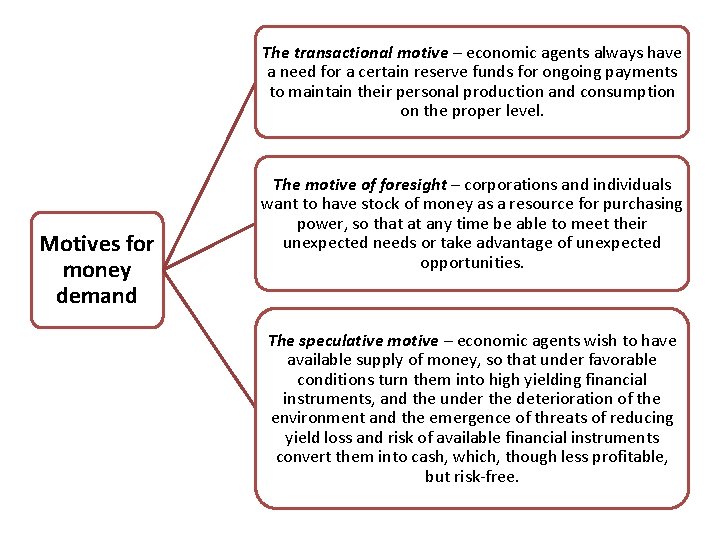

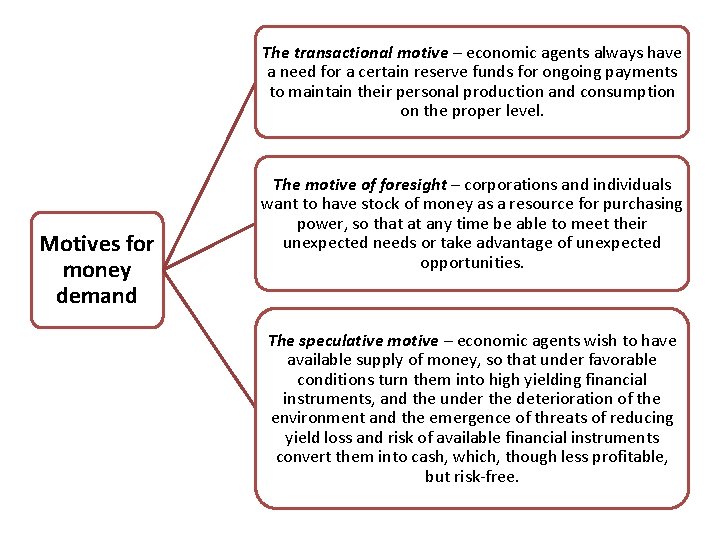

The transactional motive – economic agents always have a need for a certain reserve funds for ongoing payments to maintain their personal production and consumption on the proper level. Motives for money demand The motive of foresight – corporations and individuals want to have stock of money as a resource for purchasing power, so that at any time be able to meet their unexpected needs or take advantage of unexpected opportunities. The speculative motive – economic agents wish to have available supply of money, so that under favorable conditions turn them into high yielding financial instruments, and the under the deterioration of the environment and the emergence of threats of reducing yield loss and risk of available financial instruments convert them into cash, which, though less profitable, but risk-free.

2. 3 Factors influencing the demand for money Changes in the production volume • the larger the volumes of gross national product, and thus national income, the greater may be the volume of transactions on its implementation and the greater must be the supply of money to perform these operations. Velocity of money • the higher the velocity of money, the lower the demand for money, and vice versa. That is the effect of this parameter is inversely proportional to the demand. Changes of rate of interest • with increase of expected return (rate of interest) on alternative cash assets the storage time will reduce and money demand will decline, and in decrease of the expected revenue - to grow. Increase of wealth • economic subjects accumulating wealth in the form of various assets relatively equally place their growth among all types of assets, including stock in the form of money. As a result, with the increase of mass of wealth the demand for money will grow. Inflation • in terms of inflationary price increases money supply, which have the economic actors inevitably devalues, and they suffer from losses, which itself provokes the reduction of their demand for money. Expectations of worsening the conjuncture of markets • in the case of commodity supply reduction, increase of trade deficit, deterioration of product quality, etc. economic subjects prefer accumulation of wealth in the form of commodities, but not in money, and so the demand for money will decline.

Taking into account the new factors of influence on the demand for money, its formula can be written in the next way: • • • where Υ – real amount of GNP; Ρ – average level of prices; R – level of expected return on alternative assets; В – amount of wealth; І – inflation rate; О – expectations towards the changes of conjuncture of markets.

Dana damian

Dana damian Money market

Money market Money market components

Money market components Segmentation targeting positioning

Segmentation targeting positioning 01:640:244 lecture notes - lecture 15: plat, idah, farad

01:640:244 lecture notes - lecture 15: plat, idah, farad Market leader market challenger market follower

Market leader market challenger market follower This can be avoided by giving credit where credit is due.

This can be avoided by giving credit where credit is due. Liquidity adjustment facility

Liquidity adjustment facility Lecture about money

Lecture about money Market risk assessment

Market risk assessment Money market equilibrium

Money market equilibrium The great gatsby historical background

The great gatsby historical background Money smart money match

Money smart money match Money on money multiple

Money on money multiple Satire in the great gatsby

Satire in the great gatsby Context of the great gatsby

Context of the great gatsby Primary target market and secondary target market

Primary target market and secondary target market 6 markets model

6 markets model Concept of market identification

Concept of market identification Difference between primary market and secondary market

Difference between primary market and secondary market Financial intermediaries ppt

Financial intermediaries ppt Expansionary monetary policy effects

Expansionary monetary policy effects