Medicare Supplement Insurance Plans 2019 Your presenter today

![Medicare Supplement Insurance Plans 2019 Your presenter today: [ presenter name, title ] Medicare Supplement Insurance Plans 2019 Your presenter today: [ presenter name, title ]](https://slidetodoc.com/presentation_image_h2/efd87dbf4c8883da97ea8315dadca4d0/image-1.jpg)

![Thank You Now let us answer your questions! Contact Information: [Agent Name] [Agent Phone Thank You Now let us answer your questions! Contact Information: [Agent Name] [Agent Phone](https://slidetodoc.com/presentation_image_h2/efd87dbf4c8883da97ea8315dadca4d0/image-9.jpg)

- Slides: 9

![Medicare Supplement Insurance Plans 2019 Your presenter today presenter name title Medicare Supplement Insurance Plans 2019 Your presenter today: [ presenter name, title ]](https://slidetodoc.com/presentation_image_h2/efd87dbf4c8883da97ea8315dadca4d0/image-1.jpg)

Medicare Supplement Insurance Plans 2019 Your presenter today: [ presenter name, title ]

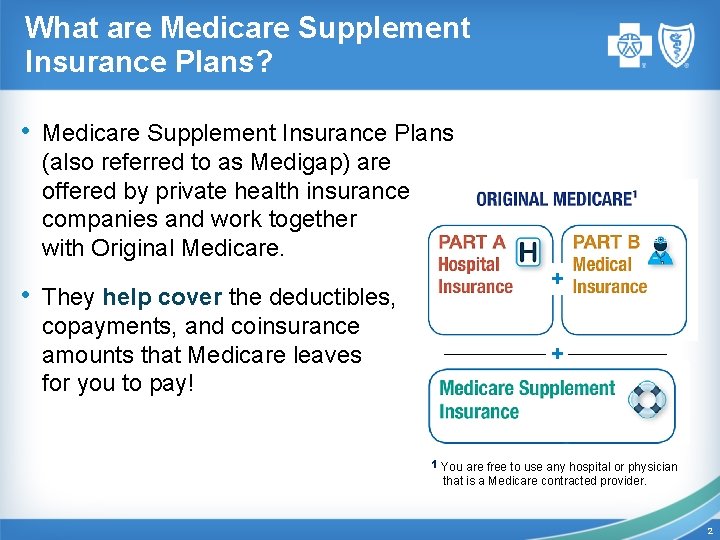

What are Medicare Supplement Insurance Plans? • Medicare Supplement Insurance Plans (also referred to as Medigap) are offered by private health insurance companies and work together with Original Medicare. • They help cover the deductibles, copayments, and coinsurance amounts that Medicare leaves for you to pay! + + 1 You are free to use any hospital or physician that is a Medicare contracted provider. 2

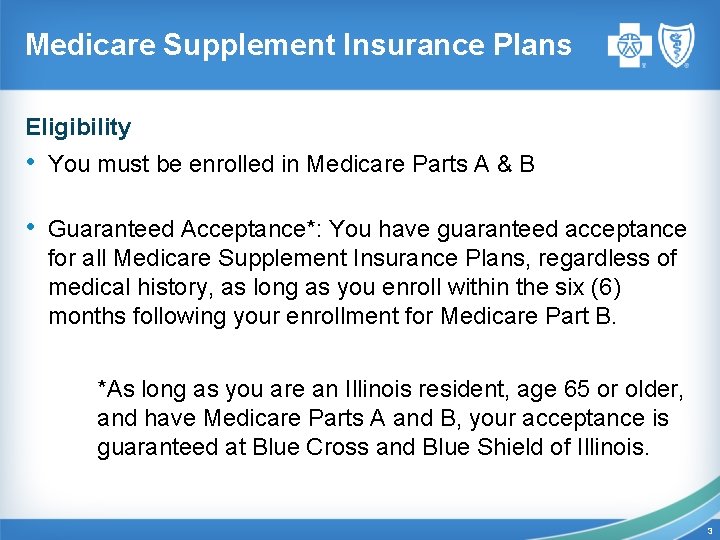

Medicare Supplement Insurance Plans Eligibility • You must be enrolled in Medicare Parts A & B • Guaranteed Acceptance*: You have guaranteed acceptance for all Medicare Supplement Insurance Plans, regardless of medical history, as long as you enroll within the six (6) months following your enrollment for Medicare Part B. *As long as you are an Illinois resident, age 65 or older, and have Medicare Parts A and B, your acceptance is guaranteed at Blue Cross and Blue Shield of Illinois. 3

Medicare Supplement Insurance Plans • Every Medicare Supplement Insurance policy must follow federal and state laws designed to protect you. Plans are identified by letters A-N. Each letter represents a different level of benefits. • All policies offer the same basic benefits, but some offer additional benefits so you can choose which one meets your individual needs. 4

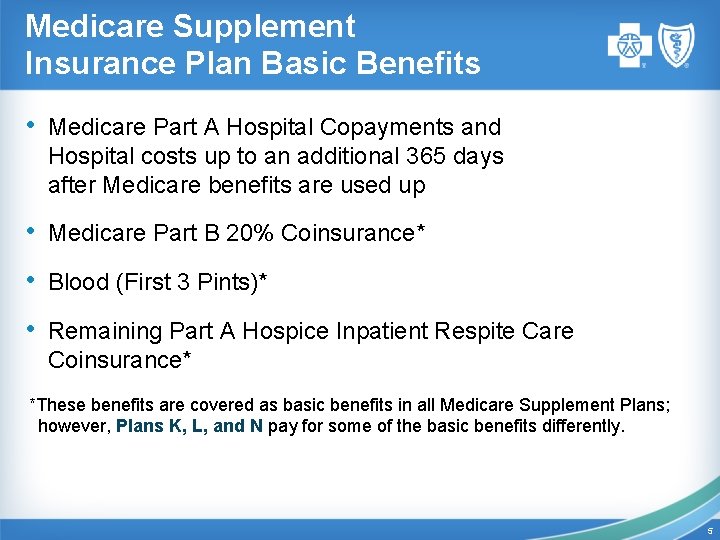

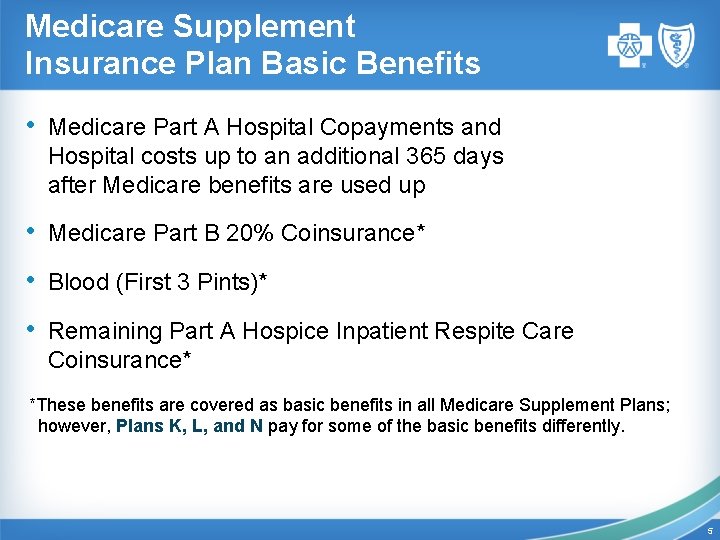

Medicare Supplement Insurance Plan Basic Benefits • Medicare Part A Hospital Copayments and Hospital costs up to an additional 365 days after Medicare benefits are used up • Medicare Part B 20% Coinsurance* • Blood (First 3 Pints)* • Remaining Part A Hospice Inpatient Respite Care Coinsurance* *These benefits are covered as basic benefits in all Medicare Supplement Plans; however, Plans K, L, and N pay for some of the basic benefits differently. 5

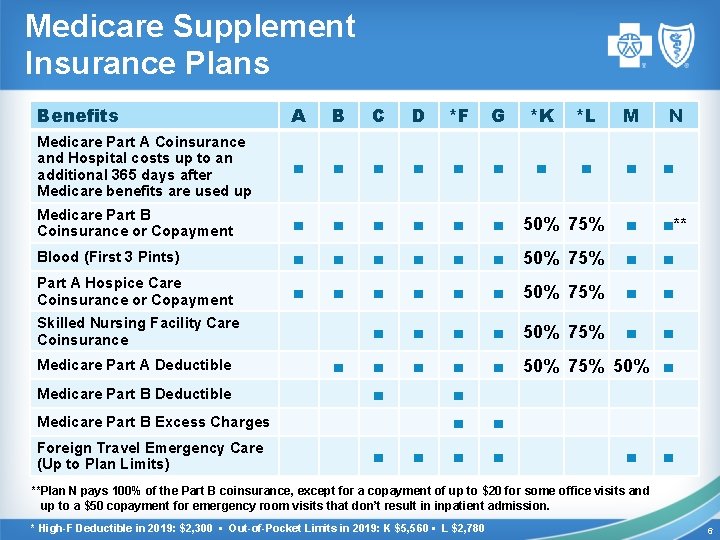

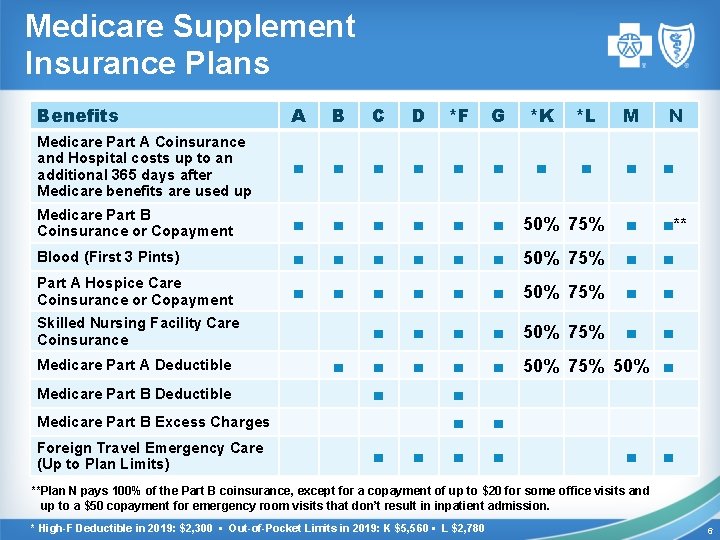

Medicare Supplement Insurance Plans • Benefits A B C D *F G *K *L M Medicare Part A Coinsurance and Hospital costs up to an additional 365 days after Medicare benefits are used up ■ ■ ■ ■ ■ Medicare Part B Coinsurance or Copayment ■ ■ ■ 50% 75% ■ ■** Blood (First 3 Pints) ■ ■ ■ 50% 75% ■ ■ Part A Hospice Care Coinsurance or Copayment ■ ■ ■ 50% 75% ■ ■ ■ 50% 75% 50% ■ Skilled Nursing Facility Care Coinsurance Medicare Part A Deductible Medicare Part B Deductible ■ ■ ■ Medicare Part B Excess Charges Foreign Travel Emergency Care (Up to Plan Limits) ■ N ■ ■ ■ ■ **Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in inpatient admission. * High-F Deductible in 2019: $2, 300 • Out-of-Pocket Limits in 2019: K $5, 560 • L $2, 780 6

Medicare Supplement Insurance Plan: Medicare Select Option – Lower Cost • Many of the Medicare Supplement Insurance Plans have a reduced premium Medicare Select Option available. • This option helps you save on premiums when you agree to use one of the hospitals in a Medicare Select Network for non-emergency elective admissions. You get the same solid benefits as the “standard” plans, but your premiums will cost less. • Ask your insurance company if they have the Medicare Select Option and review their list of health care providers. 7

Resources • Medicare • Call 1 -800 -MEDICARE (1 -800 -633 -4227) 24 hours a day / 7 days a week • Hearing or speech impaired: 1 -877 -486 -2048, 24 hours a day • “Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare” handbook, visit www. medicare. gov • Social Security • Call 1 -800 -772 -1213, 7 a. m. – 7 p. m. Monday – Friday • Hearing or speech impaired: 1 -800 -325 -0778, Monday – Friday, 7 a. m. – 7 p. m. • Visit www. socialsecurity. gov 8

![Thank You Now let us answer your questions Contact Information Agent Name Agent Phone Thank You Now let us answer your questions! Contact Information: [Agent Name] [Agent Phone](https://slidetodoc.com/presentation_image_h2/efd87dbf4c8883da97ea8315dadca4d0/image-9.jpg)

Thank You Now let us answer your questions! Contact Information: [Agent Name] [Agent Phone Number] [Agent Email] [Agency Name] [Agency Website] ILMEDSUPP 19 Medicare Supplement insurance plans are offered by Blue Cross and Blue Shield of Illinois, a Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield Association. Not connected with or endorsed by the U. S. Government or Federal Medicare Program.