Managing Risk Minimising Insurance Risks Legal requirements Premises

- Slides: 12

Managing Risk • Minimising Insurance Risks – – – – Legal requirements Premises Equipment Employees Theft and fraud Transport Insuring the risks • Risk Management – Risk Management Matrix • Two Most likely Causes of Failure

Legal Requirements • Risk Assessment (Health & Safety legislation) • Precautions to prevent injury (employers’ liability) • Fire regulations • Employment law • The Companies Act

Premises • Main risks: fire, water damage, malicious damage, weather damage • Improve security systems and procedures • A pro-active approach to managing your premises • Improve safety practices

Equipment • Identify risk areas e. g. computers • Regular checks of equipment you use to create and distribute your products

Employees • If a key employee: – Has an accident – becomes ill – Dies – (also non-insurable risks such as if he/she decides to leave or is poached by a competitor)

Theft and Fraud • Identify the likely favourite targets in your business • Theft by employees • Collaboration with other organisations can help prevent theft • Systems to look for symptoms of fraud • Theft of intellectual property

Transport • Ensure vehicles are properly maintained • Ensure drivers know about legal driving time limits • An accident could mean legal action against you • Use secure methods to transport valuables

Insuring the Risks • Comply with insurance policy conditions or lose protection • Increasing safety measures may reduce insurance premiums • Some risks are uninsurable • Think about risk management • Think about contingency plans

Risk Management 1. 2. 3. 4. 5. 6. 7. Identify your business processes Identify key elements in these processes Identify most worrying risks Assess likelihood AND severity Run through common causes Work up actions to minimise likelihood Prepare contingency plans for when the worst happens (including insurance)

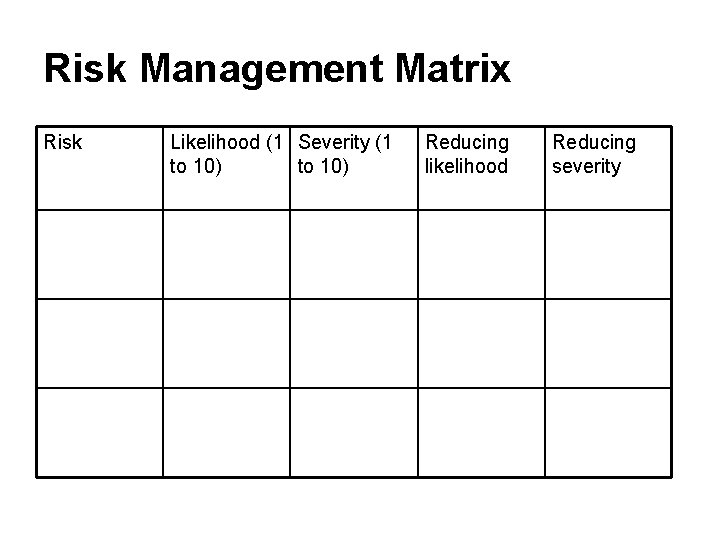

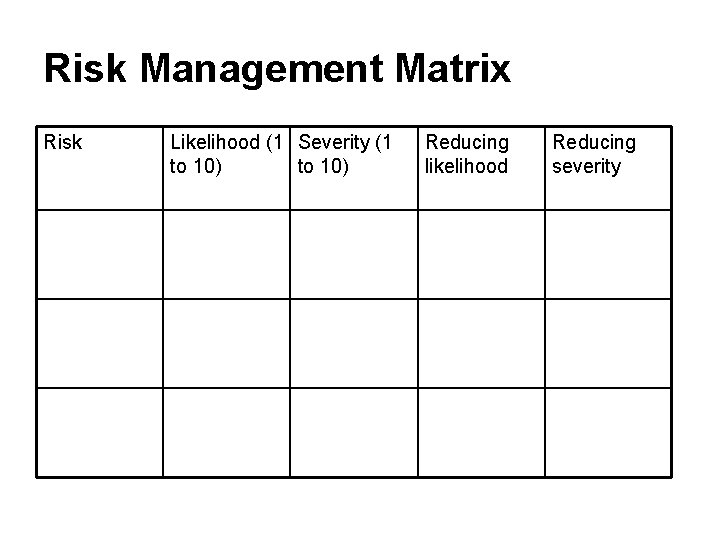

Risk Management Matrix Risk Likelihood (1 Severity (1 to 10) Reducing likelihood Reducing severity

Most Likely – Poor Cash Flow • This is when money is taking too long to flow into your business • Your sales may be fine, but you are not getting paid quickly enough • This means you will need more ‘working capital’ (more cash to use in the business) • There are many techniques you can use to manage your cash flow …

Most Likely – Rising Costs • • Compare actual figures with forecasts Watch your variable costs Beware of rising overheads Don’t hide from hard decisions: – Cut out luxuries? – Switch suppliers? – Sell more products? • Re-cost (and re-price) your products regularly

Legal aspects of catering premises

Legal aspects of catering premises Managing risks in school curriculum activities

Managing risks in school curriculum activities Managing risks in schools

Managing risks in schools Civil engineering completed risks insurance

Civil engineering completed risks insurance International business risk

International business risk Market risk assessment

Market risk assessment The biggest risk is not taking any risks

The biggest risk is not taking any risks Related risks that increase in effect with each added risk

Related risks that increase in effect with each added risk Nature and use of fire insurance

Nature and use of fire insurance Hyatt legal plans attorney list

Hyatt legal plans attorney list Understanding and managing clinical risk

Understanding and managing clinical risk Chapter 1 managing risk when driving

Chapter 1 managing risk when driving What is the ipde process

What is the ipde process