IMF Statistics Department 11202012 FISIM Accounting Kim Zieschang

- Slides: 13

IMF Statistics Department 11/20/2012 FISIM Accounting Kim Zieschang IMF Productivity Perspectives 2012 Conference Australian Productivity Commission and Australian Bureau of Statistics November 20, 2012 Canberra, Australia Economic Measurement Group Workshop University of New South Wales November 21 -23, 2012 Sydney, Australia The views expressed herein are those of the author and should not necessarily be attributed to the IMF, its Executive Board, or its management 1

IMF Statistics Department 11/20/2012 Financial services in the SNA Financial services are a key, perhaps two-way transmission channel between economic developments in the “real” and “financial” sectors A key post crisis concern How do we characterize the metrics of this transmission channel in the national accounts? Clues from the history of thought on the System of National Accounts (SNA) Clues from the SNA’s modern critics in the economics literature Many good ideas, all valid in the proper context … … but, surprisingly (? ), these ideas collectively lead back to a treatment of “financial intermediation services indirectly measured” or FISIM in the spirit of the evolution of SNA thought on the subject 2

IMF Statistics Department 11/20/2012 What is FISIM? FISIM is a key component of the SNA’s nominal output of the financial corporations sector (9 types of financial enterprises, including banks) Explicit service charges Indirectly measured service charges (FISIM) 1993 SNA (paragraph 6. 127) on FISIM: (a) For those to whom the intermediaries lend funds, both resident and nonresident, the difference between the interest actually charged on loans, etc. and the amount that would be paid if a reference rate were used. (b) For those from whom the intermediaries borrow funds, both resident and nonresident, the difference between the interest they would receive if a reference rate were used and the interest they actually receive. 3

IMF Statistics Department 11/20/2012 Is FISIM important? It is important for economies specialized in financial services such as Luxembourg and Switzerland It also can be important in diversified economies with financial centers such as the US and UK, where the output of financial corporations—about half of which is FISIM—is in the range of 10 percent of nominal GDP 4

IMF Statistics Department 11/20/2012 What is the “reference rate? ” Thinking has evolved … 1953 SNA: de facto, the average return on the financial asset portfolio of the financial corporations sector 1968 SNA: de facto, ‘we have no idea, and if we did, we don’t have the data to do it’ 1993 SNA: “… the pure cost of borrowing funds - that is, a rate from which the risk premium has been eliminated to the greatest extent possible and which does not include any intermediation services. The type of rate chosen as the reference rate may differ from country to country but the inter-bank lending rate would be a suitable choice when available; alternatively, the central bank lending rate could be used. ” 2008 SNA: ”… The reference rate should contain no service element and reflect the risk and maturity structure of deposits and loans. The rate prevailing for inter-bank borrowing and lending may be a suitable choice as a reference rate. However, different reference rates may be needed for each currency in which loans and deposits are denominated, especially when a non-resident financial institution is involved. “ Basu, Inklaar, and Wang (2011) and Colangelo and Inklaar (2012): one reference rate per specific financial instrument on the balance sheet—a constellation of reference rates matched in risk and maturity to each balance sheet instrument 5

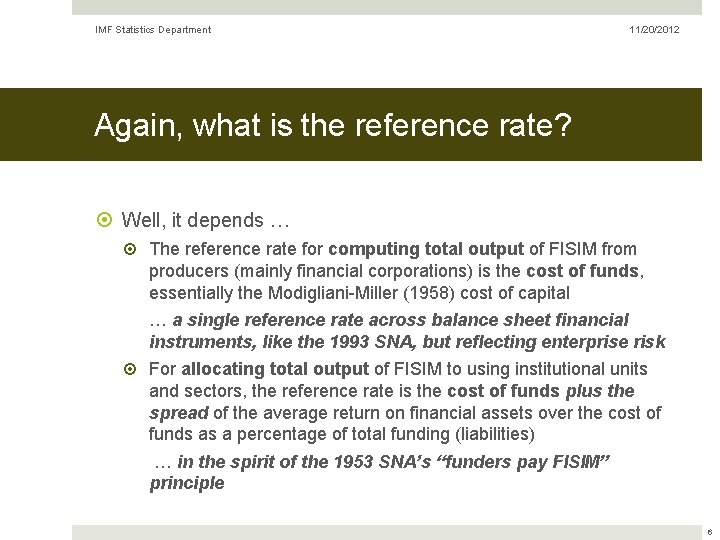

IMF Statistics Department 11/20/2012 Again, what is the reference rate? Well, it depends … The reference rate for computing total output of FISIM from producers (mainly financial corporations) is the cost of funds, essentially the Modigliani-Miller (1958) cost of capital … a single reference rate across balance sheet financial instruments, like the 1993 SNA, but reflecting enterprise risk For allocating total output of FISIM to using institutional units and sectors, the reference rate is the cost of funds plus the spread of the average return on financial assets over the cost of funds as a percentage of total funding (liabilities) … in the spirit of the 1953 SNA’s “funders pay FISIM” principle 6

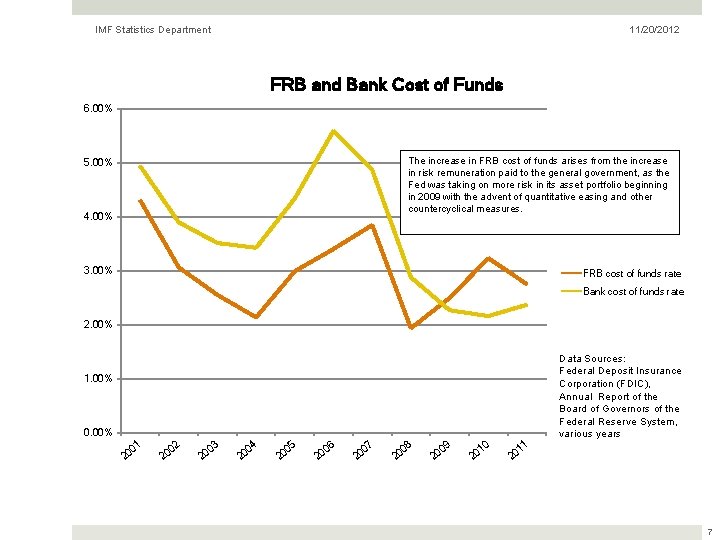

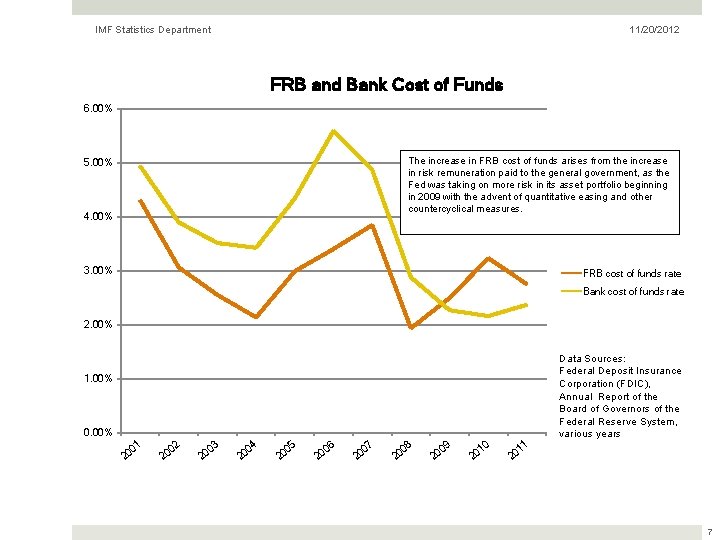

IMF Statistics Department 11/20/2012 FRB and Bank Cost of Funds 6. 00% The increase in FRB cost of funds arises from the increase in risk remuneration paid to the general government, as the Fed was taking on more risk in its asset portfolio beginning in 2009 with the advent of quantitative easing and other countercyclical measures. 5. 00% 4. 00% 3. 00% FRB cost of funds rate Bank cost of funds rate 2. 00% Data Sources: Federal Deposit Insurance Corporation (FDIC), Annual Report of the Board of Governors of the Federal Reserve System, various years 1. 00% 01 20 02 20 03 20 04 20 5 0 20 6 0 20 7 0 20 8 0 20 9 0 20 0 1 20 11 20 7

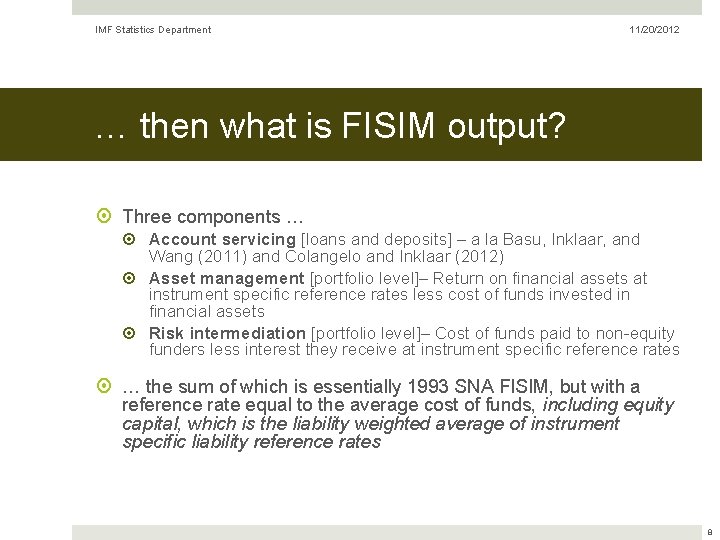

IMF Statistics Department 11/20/2012 … then what is FISIM output? Three components … Account servicing [loans and deposits] – a la Basu, Inklaar, and Wang (2011) and Colangelo and Inklaar (2012) Asset management [portfolio level]– Return on financial assets at instrument specific reference rates less cost of funds invested in financial assets Risk intermediation [portfolio level]– Cost of funds paid to non-equity funders less interest they receive at instrument specific reference rates … the sum of which is essentially 1993 SNA FISIM, but with a reference rate equal to the average cost of funds, including equity capital, which is the liability weighted average of instrument specific liability reference rates 8

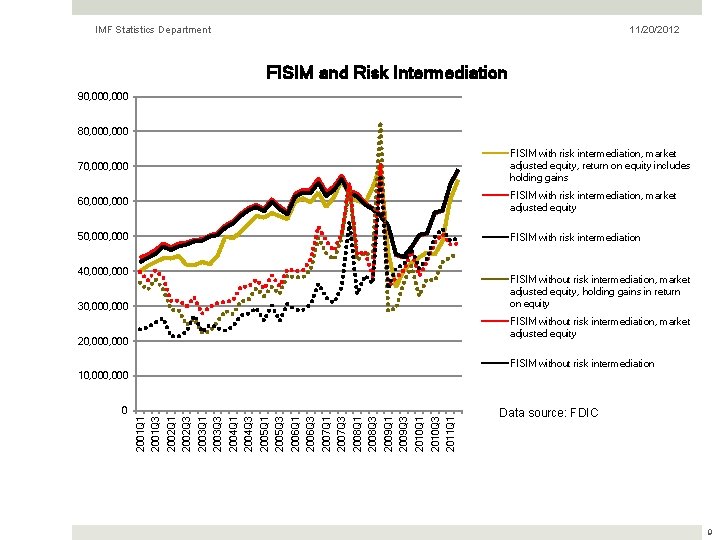

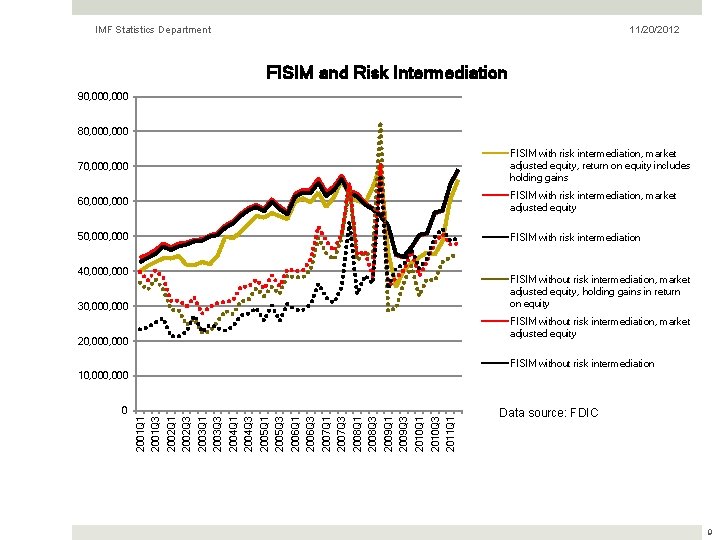

IMF Statistics Department 11/20/2012 FISIM and Risk Intermediation 90, 000 80, 000 70, 000 FISIM with risk intermediation, market adjusted equity, return on equity includes holding gains 60, 000 FISIM with risk intermediation, market adjusted equity 50, 000 FISIM with risk intermediation 40, 000 FISIM without risk intermediation, market adjusted equity, holding gains in return on equity 30, 000 FISIM without risk intermediation, market adjusted equity 20, 000 FISIM without risk intermediation 2011 Q 1 2010 Q 3 2010 Q 1 2009 Q 3 2009 Q 1 2008 Q 3 2008 Q 1 2007 Q 3 2007 Q 1 2006 Q 3 2006 Q 1 2005 Q 3 2005 Q 1 2004 Q 3 2004 Q 1 2003 Q 3 2003 Q 1 2002 Q 3 2002 Q 1 2001 Q 3 0 2001 Q 1 10, 000 Data source: FDIC 9

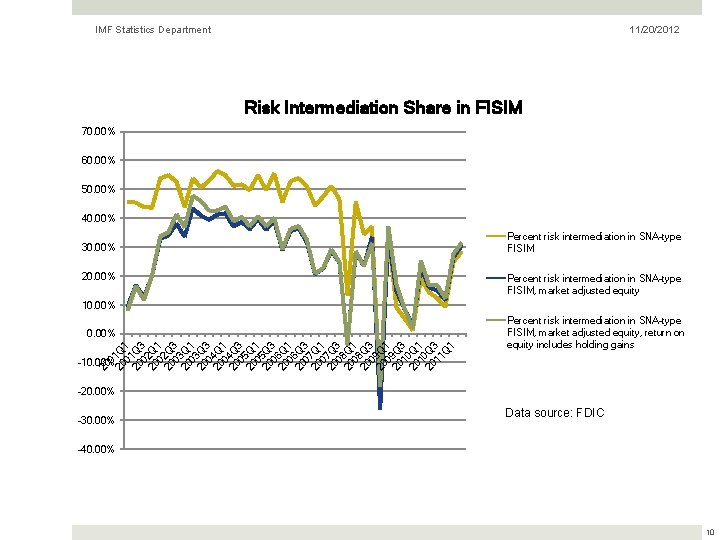

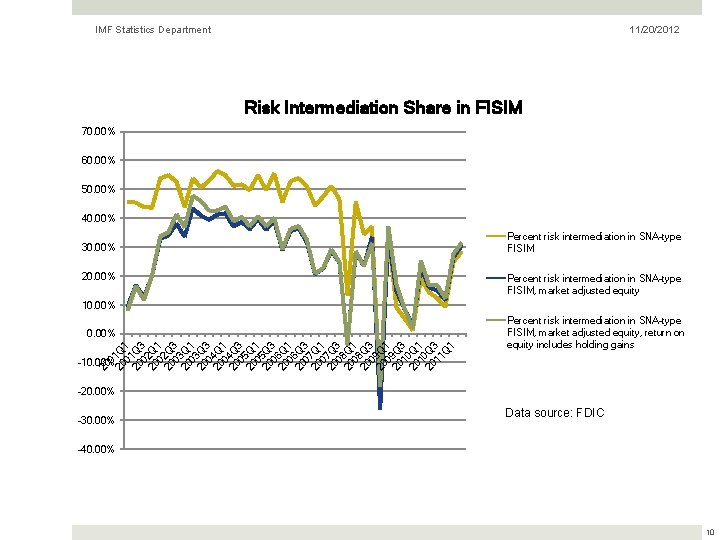

IMF Statistics Department 11/20/2012 Risk Intermediation Share in FISIM 70. 00% 60. 00% 50. 00% 40. 00% 30. 00% 20. 00% Percent risk intermediation in SNA-type FISIM, market adjusted equity 10. 00% 0 20 1 Q 1 0 20 1 Q 3 0 20 2 Q 1 0 20 2 Q 3 0 20 3 Q 1 0 20 3 Q 3 0 20 4 Q 1 0 20 4 Q 3 0 20 5 Q 1 0 20 5 Q 3 0 20 6 Q 1 0 20 6 Q 3 0 20 7 Q 1 0 20 7 Q 3 0 20 8 Q 1 0 20 8 Q 3 0 20 9 Q 1 0 20 9 Q 3 1 20 0 Q 1 1 20 0 Q 3 11 Q 1 0. 00% Percent risk intermediation in SNA-type FISIM, market adjusted equity, return on equity includes holding gains 20 -10. 00% -20. 00% -30. 00% Data source: FDIC -40. 00% 10

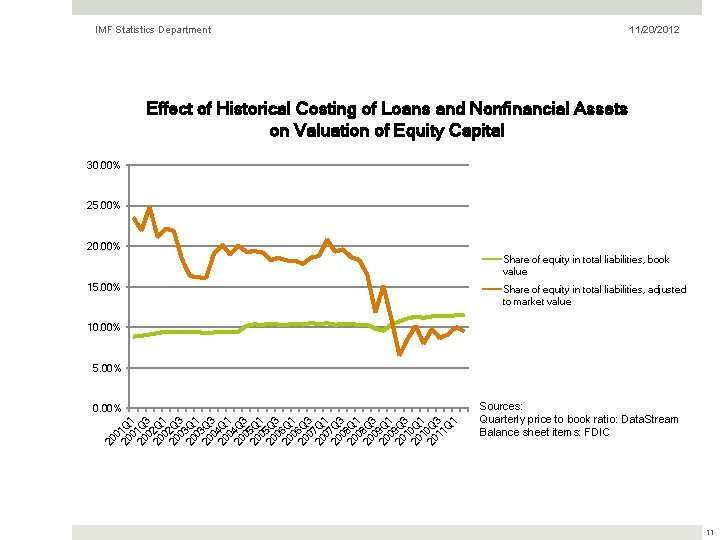

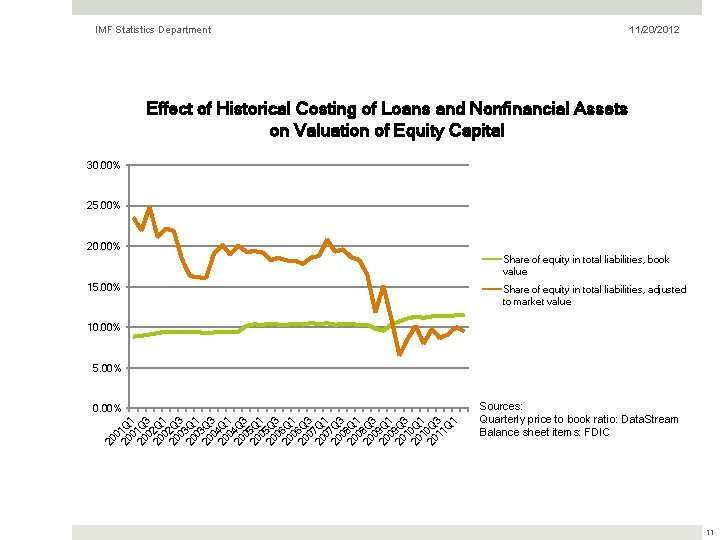

IMF Statistics Department 11/20/2012 Effect of Historical Costing of Loans and Nonfinancial Assets on Valuation of Equity Capital 30. 00% 25. 00% 20. 00% Share of equity in total liabilities, book value 15. 00% Share of equity in total liabilities, adjusted to market value 10. 00% 5. 00% 20 0 20 1 Q 0 1 20 1 Q 0 3 20 2 Q 0 1 20 2 Q 0 3 20 3 Q 0 1 20 3 Q 0 3 20 4 Q 0 1 20 4 Q 0 3 20 5 Q 0 1 20 5 Q 0 3 20 6 Q 0 1 20 6 Q 0 3 20 7 Q 0 1 20 7 Q 0 3 20 8 Q 0 1 20 8 Q 0 3 20 9 Q 0 1 20 9 Q 1 3 20 0 Q 1 1 20 0 Q 11 3 Q 1 0. 00% Sources: Quarterly price to book ratio: Data. Stream Balance sheet items: FDIC 11

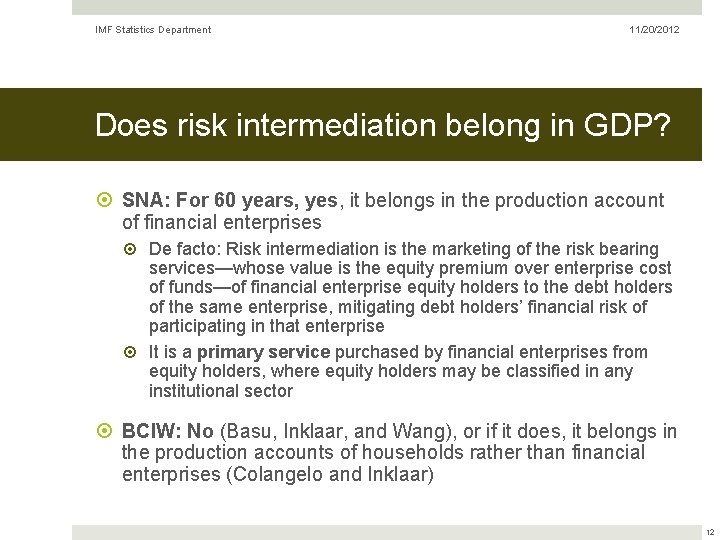

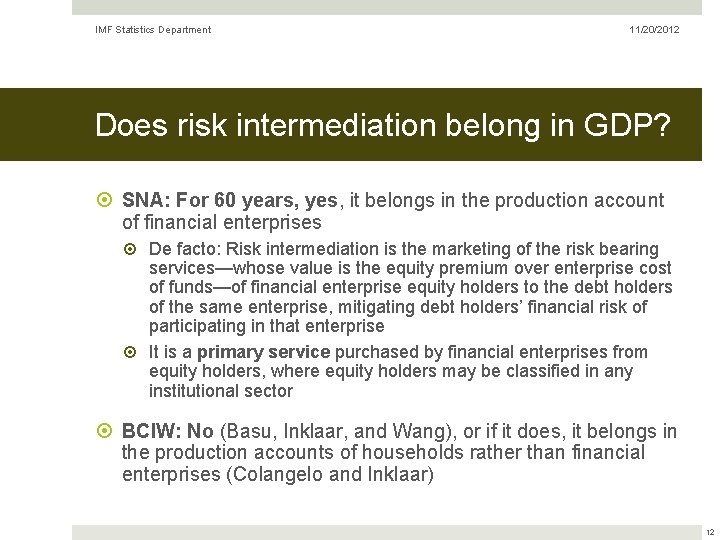

IMF Statistics Department 11/20/2012 Does risk intermediation belong in GDP? SNA: For 60 years, yes, it belongs in the production account of financial enterprises De facto: Risk intermediation is the marketing of the risk bearing services—whose value is the equity premium over enterprise cost of funds—of financial enterprise equity holders to the debt holders of the same enterprise, mitigating debt holders’ financial risk of participating in that enterprise It is a primary service purchased by financial enterprises from equity holders, where equity holders may be classified in any institutional sector BCIW: No (Basu, Inklaar, and Wang), or if it does, it belongs in the production accounts of households rather than financial enterprises (Colangelo and Inklaar) 12

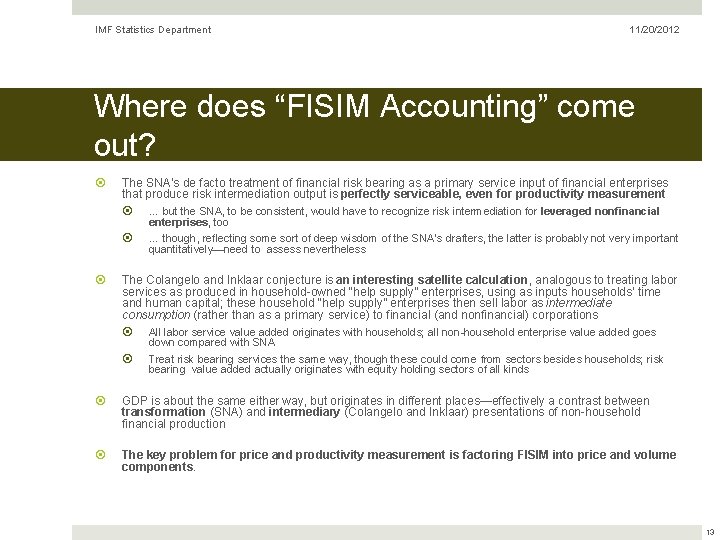

IMF Statistics Department 11/20/2012 Where does “FISIM Accounting” come out? The SNA’s de facto treatment of financial risk bearing as a primary service input of financial enterprises that produce risk intermediation output is perfectly serviceable, even for productivity measurement … but the SNA, to be consistent, would have to recognize risk intermediation for leveraged nonfinancial enterprises, too … though, reflecting some sort of deep wisdom of the SNA’s drafters, the latter is probably not very important quantitatively—need to assess nevertheless The Colangelo and Inklaar conjecture is an interesting satellite calculation, analogous to treating labor services as produced in household-owned “help supply” enterprises, using as inputs households’ time and human capital; these household “help supply” enterprises then sell labor as intermediate consumption (rather than as a primary service) to financial (and nonfinancial) corporations All labor service value added originates with households; all non-household enterprise value added goes down compared with SNA Treat risk bearing services the same way, though these could come from sectors besides households; risk bearing value added actually originates with equity holding sectors of all kinds GDP is about the same either way, but originates in different places—effectively a contrast between transformation (SNA) and intermediary (Colangelo and Inklaar) presentations of non-household financial production The key problem for price and productivity measurement is factoring FISIM into price and volume components. 13