Financial Intermediaries in India Samir K Mahajan Financial

- Slides: 22

Financial Intermediaries in India Samir K Mahajan

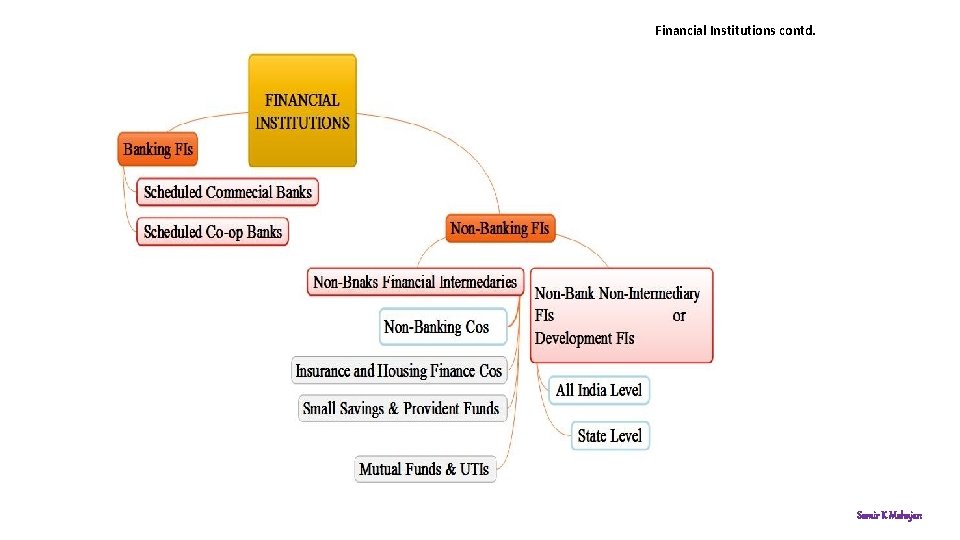

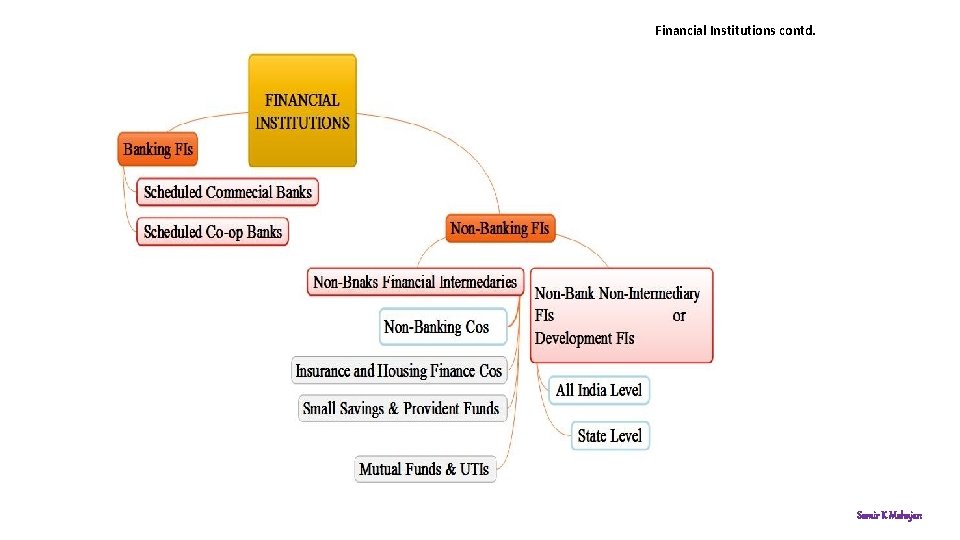

Financial Intermediaries /Institutions Financial Institutions are intermediaries that mobilizes saving and channelize the funds to the productive investment. These are responsible for efficient allocation and distribution of saving among those who demands it. Finical institutions are classified as: o Banking financial institutions (creators and purveyors of credit) o Non-banking financial institutions (purveyors of credit) Samir K Mahajan

History of Banking In modern times, the first bank in India was set up in 1683 in Madras by members of East India Company. The first joint stock bank was Bank of Bombay established in 1770 in Bombay followed by Bank of Hindustan in Calcutta which was established in 1770. Three presidency banks were o Bank of Bengal established in Calcutta Presidency in 1806. o Bank of Bombay in Bombay Presidency set up in 1840 o Bank of Madras in Madras Presidency set up in 1843 Three presidency banks were merged to form Imperial Bank of India in 1921. The role of Imperial Bank was that of commercial bank, a banker’s bank and a banker to the government. The Imperial Bank eventually became the State Bank of India. Samir K Mahajan

History of Banking contd. Reserve Bank of India was set up in 1935 to check bank failures and to cater to the requirement of agriculture. However, the RBI did not have enough power to regulate or control the commercial banks which were regulated by the Company Law. In order to enlarge the reach of banking services, the government nationalized Imperial Bank of India by converting it into State bank of India in 1955. This step is the first bank nationalization in India. By the late 1960 s, there had been significant rise in the number of bank and bank branches in the country but banking services did not extend to rural and agriculture sector of the country. In 1969, 14 private sector joint stock banks were nationalized to promote objectives of economic growth and regional balance. This was the second phase of bank nationalization. Further, 6 commercial banks in private sector were nationalized in 1980. This is the third phase of bank nationalization. At present there are 26 nationalized bank in the country. Samir K Mahajan

Financial Institutions contd. Samir K Mahajan

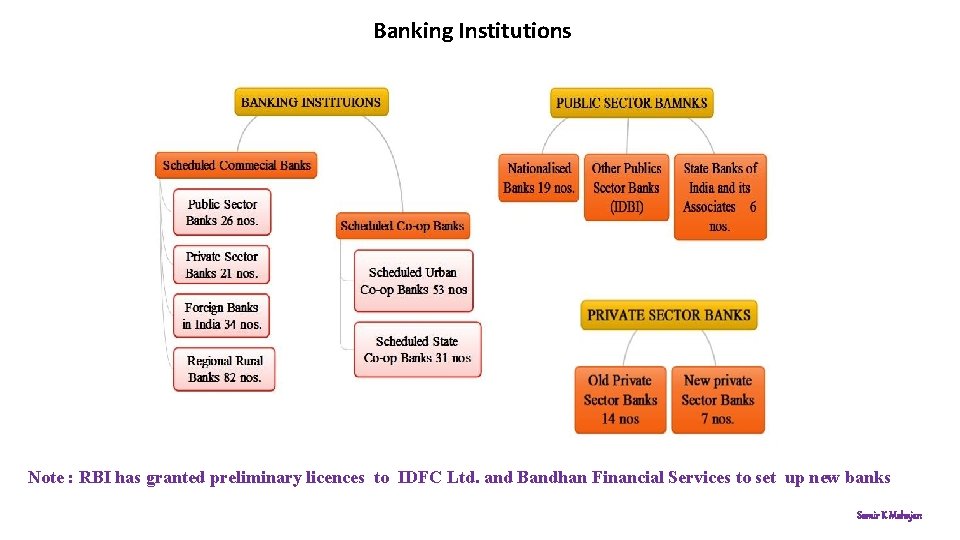

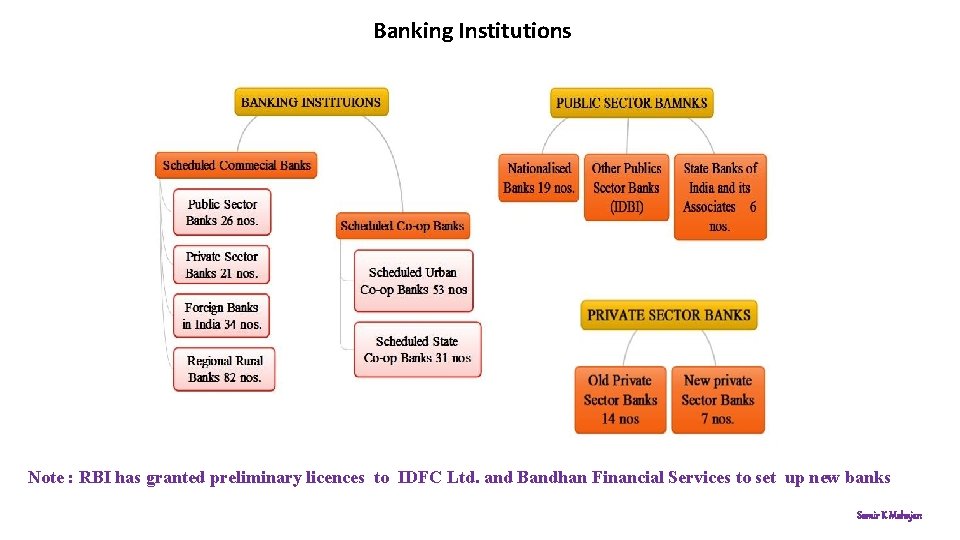

Banking Institutions Note : RBI has granted preliminary licences to IDFC Ltd. and Bandhan Financial Services to set up new banks Samir K Mahajan

Scheduled Commercial Banks Commercial banks are governed by Banking Regulation Act. Scheduled Commercial Banks are those which are included in the second schedule of Reserve Bank of India Act 1934. RBI in turn includes only those banks in this schedule which satisfy the criteria laid down vide section 42 (6) (a) of the Act. Scheduled Commercial Banks includes 26 Public Sector Banks (banks in which government has major holding) 21 Private Sector Banks 34 Foreign banks 82 Regional Rural Banks Samir K Mahajan

Scheduled Commercial Banks Public Sector Banks : Public sector banks has 19 nationalized banks, State bank of India and its five associates, IDBI. State bank of India and its five associates (SB of Patiala, SB of Travancore, SB of Bikaner and Jaipur, SB of Hyderabad , SB of Mysore ) is the largest banking institution in the country with 15000 bank branches and largest number of ATM network and 17 percent market share. Private Sector Banks : During bank nationalisation of 14 bank in 1969, no banks were allowed to be set up private sector. In the pre-reformed period there were 24 private sectors banks. However after economic reforms and guidelines of Narasimhan Committee, new private sector banks are allowed to operate in India. Today there are 21 private sector banks in the banking sector: 14 old private sector banks 7 ne private sector banks. Foreign Banks : Foreign banks have been operating in India for decades. A few banks have been operating in India for centuries. ANZ Grindlays had been operating in India for more than hundred years , while Standard Chartered Bank has been around since 1858. Many foreign banks form different countries set their branches in India during the 1991 – the liberalization period. A total of 27 new foreign banks open branches after economic reforms. Altogethere are 84 foreign banks in India. Samir K Mahajan

Scheduled Commercial Banks contd. Regional Rural Banks: Regional Rural Banks were established under the provisions of an Ordinance passed on 26 September 1975 and the RRB Act 1976 to provide sufficient banking and credit facility rural economy of India and to supplement cooperative credits structure. The Government of India, the concerned State Government and the sponsoring bank, contributed to the share capital of RRBs in the proportion of 50%, 15% and 35%, respectively. At present, the sources of funds of RRBs comprise of owned fund, deposits, borrowings from NABARD, Sponsor Banks and other sources including SIDBI and National Housing Bank. The area of operation of the RRBs is limited to notified few districts in a State. However, RRBs may have branches set up for urban operations and their area of operation may include urban areas too. The main purpose of RRB's is to mobilize financial resources from rural / semi-urban areas, and grant loans and advances mostly to small and marginal farmers, agricultural labourers and rural artisans. RRBs also carry out government operations like disbursement of wages of MGNREGA workers, distribution of pensions, providing Para-Banking facilities like locker facilities, debit and credit cards etc. There are 82 RRBs in the country. Samir K Mahajan

Co-operative Banks Co-operative banks are registered with Registrar of Co-operative Societies (Co-operative Societies Act 1904). These banks are organised and managed on the principles of co-operation, self help and mutual help. They mobilises savings, supply credit and provide remittance facilities but range of services offered by them are narrower, degree of product differentiation in service is much less compared to commercial banks. Co-operative banks are structured in into Urban Co-operative Banks (both Scheduled and Non-scheduled) and Rural Credit Institutions offering short –term and long-term loans. State Co-operative Bank is the apex of the rural co-operative credit structure (short term ). These banks gets financial and other help NABARD, central and state governments which they disburse to District Central Cooperative Banks and Primary Agricultural Credit Societies District Central Cooperative banks are the federation of Primary Agricultural Credit Societies are formed at grass root level. Samir K Mahajan

Samir K Mahajan

NABARD (NATIONAL BANK FOR AGRICULTURE AND RURAL DEVELOPMENT) 1982 NABARD is the apex institution for financing agriculture and rural sectors. It co-ordinates the rural financing activities of all institutions engaged in developmental work at the field level and maintains liaison with Government of India, State Governments, Reserve Bank of India (RBI) and other national level institutions concerned with policy formulation. NABARD is a refinancing agency to financial institutions such as state cooperative banks, regional rural banks, and commercial banks for promotion of both farm and non-farm sector in rural areas. It promotes credit for development of agriculture and allied activities (such as: minor irrigation, farm mechanization, land development, soil conservation, dairy, sheep rearing, poultry, piggery, plantation and agriculture, forestry, storage, biogas), small scale industries, cottage and village industries, handicrafts and other rural crafts and allied economics activities in rural areas. It oversees entire rural credit system and to that extent, it has taken over the role of RBI such as refinancing role of RBI relating to state cooperative banks and regionals and rural banks. Samir K Mahajan

Development FIs/ Non-Bank Non-Intermediary FIs Development Financial Institutions ( FIs) were set up in during the planning period to meet the needs of industrial economy mostly through legislation which would provide term finances to the public sector industrial economy of the country. They are not financial intermediaries because till recently they did not mobiles saving from the ultimate surplus spending units and instead obtain funds from Government or RBI. They can not be classed as banks though they some of them include the terms ‘bank’. Some of them have turned into companies, and private participation in ownership and functioning has been allowed after new economic reforms in 1990 s. Some of them entered in commercial banking and diversified their activities in financial sector of the country. Samir K Mahajan

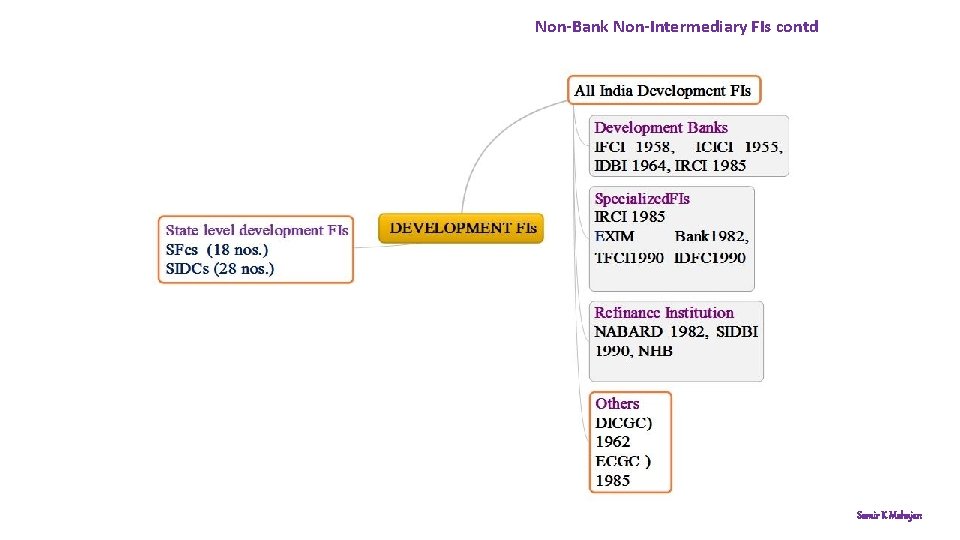

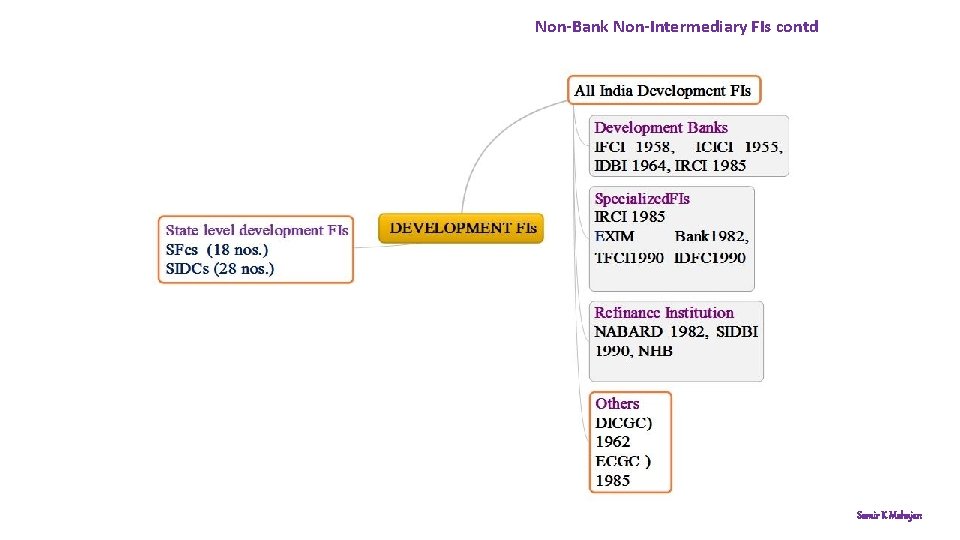

Non-Bank Non-Intermediary FIs contd Samir K Mahajan

Development FIs contd Classification of Development Financial Institutions q All-India Development FIs Ø o o o Development Banks (mainly confined to over all capital good sector industrial finances) such as : Industrial Finance Corporation of India (IFCI )1948, Industrial Credit and Investment Corporation of India (ICICI )1955 Industrial development bank of India( IDBI )1964, Ø Specialized FIs ( provides finance certain specific areas industrial and productive activities ) such as o Industrial Reconstruction Corporation of India IRCI 1985 now Industrial Investment Bank of India (IIBI )1997 o Export Import Bank of India (EXIM )bank 1982 o Tourism Finance Corporation of India (TFCI )1990 o Infrastructure Development Finance Companies ( IDFC)1990 Samir K Mahajan

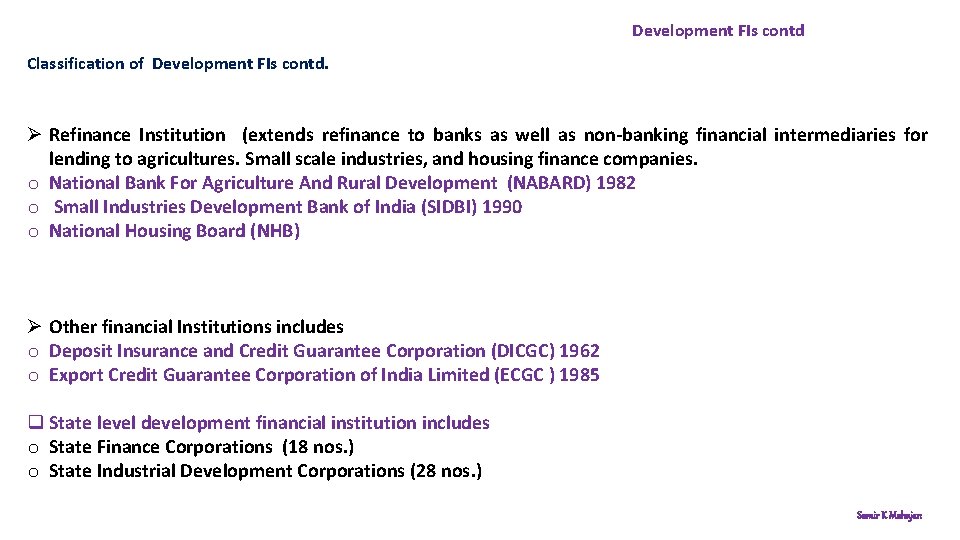

Development FIs contd Classification of Development FIs contd. Ø Refinance Institution (extends refinance to banks as well as non-banking financial intermediaries for lending to agricultures. Small scale industries, and housing finance companies. o National Bank For Agriculture And Rural Development (NABARD) 1982 o Small Industries Development Bank of India (SIDBI) 1990 o National Housing Board (NHB) Ø Other financial Institutions includes o Deposit Insurance and Credit Guarantee Corporation (DICGC) 1962 o Export Credit Guarantee Corporation of India Limited (ECGC ) 1985 q State level development financial institution includes o State Finance Corporations (18 nos. ) o State Industrial Development Corporations (28 nos. ) Samir K Mahajan

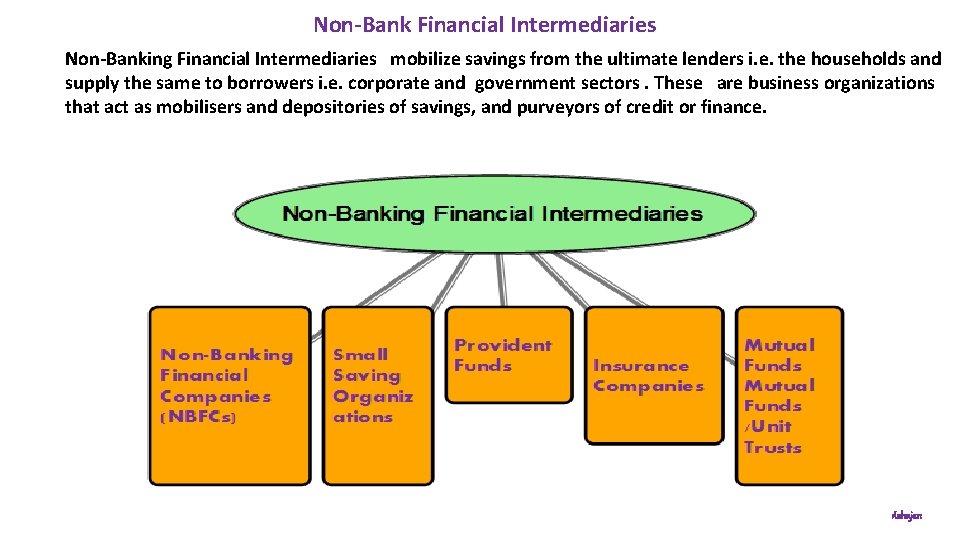

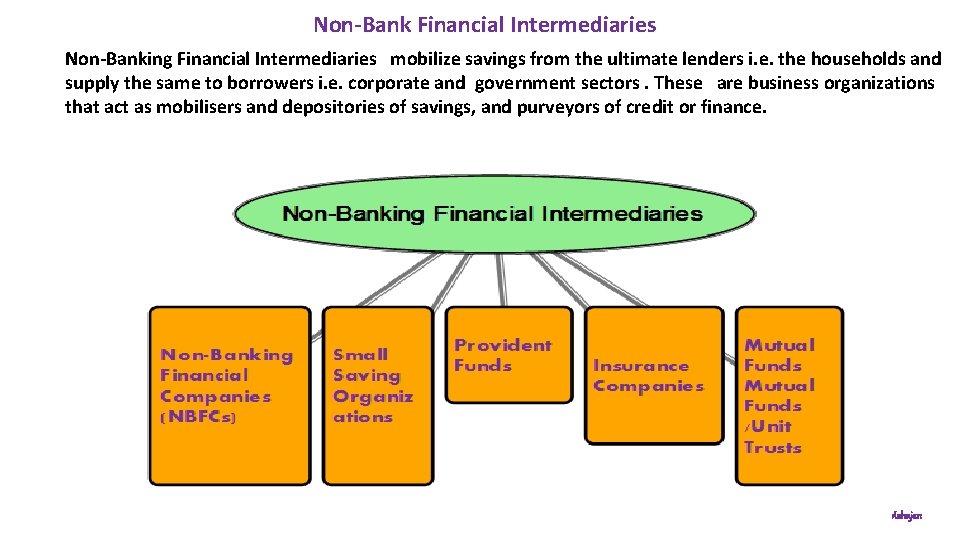

Non-Bank Financial Intermediaries Non-Banking Financial Intermediaries mobilize savings from the ultimate lenders i. e. the households and supply the same to borrowers i. e. corporate and government sectors. These are business organizations that act as mobilisers and depositories of savings, and purveyors of credit or finance. Samir K Mahajan

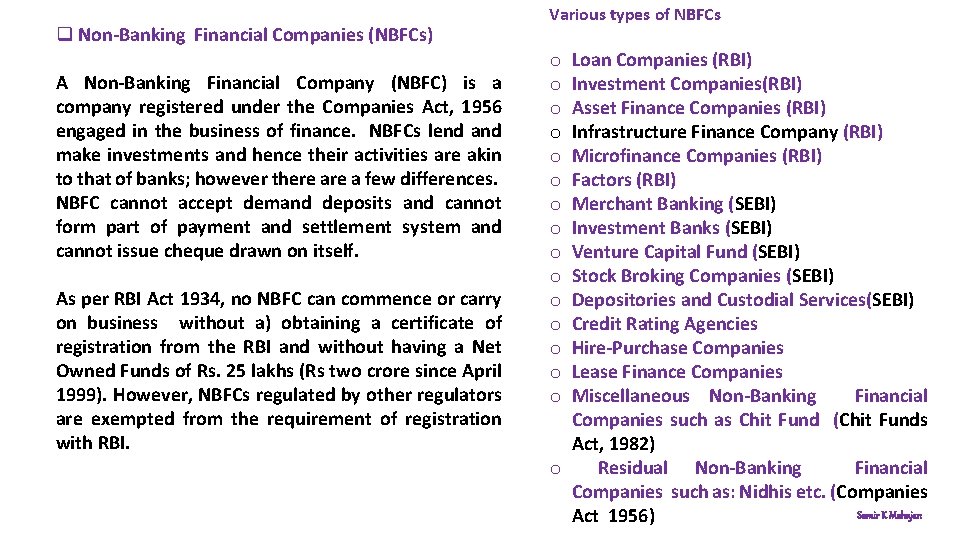

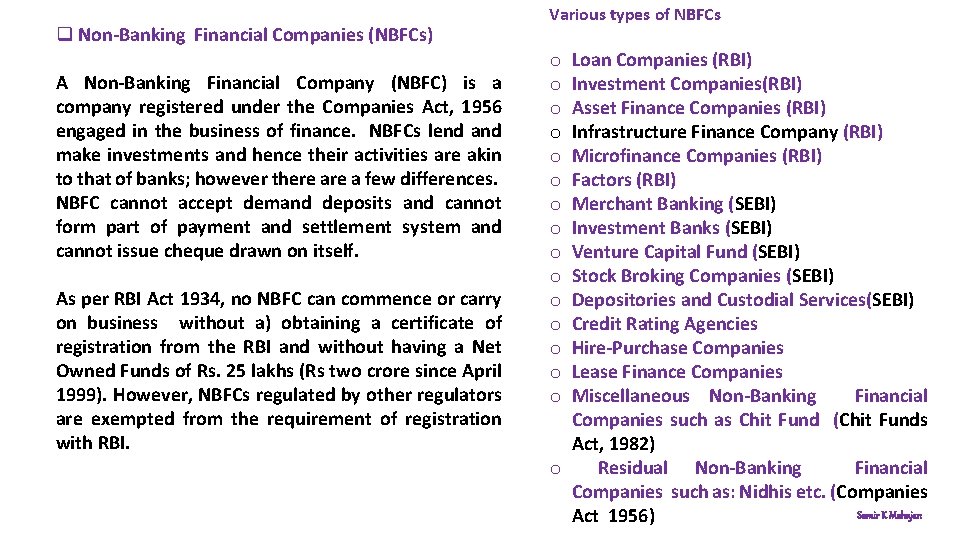

q Non-Banking Financial Companies (NBFCs) A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of finance. NBFCs lend and make investments and hence their activities are akin to that of banks; however there a few differences. NBFC cannot accept demand deposits and cannot form part of payment and settlement system and cannot issue cheque drawn on itself. As per RBI Act 1934, no NBFC can commence or carry on business without a) obtaining a certificate of registration from the RBI and without having a Net Owned Funds of Rs. 25 lakhs (Rs two crore since April 1999). However, NBFCs regulated by other regulators are exempted from the requirement of registration with RBI. Various types of NBFCs Loan Companies (RBI) Investment Companies(RBI) Asset Finance Companies (RBI) Infrastructure Finance Company (RBI) Microfinance Companies (RBI) Factors (RBI) Merchant Banking (SEBI) Investment Banks (SEBI) Venture Capital Fund (SEBI) Stock Broking Companies (SEBI) Depositories and Custodial Services(SEBI) Credit Rating Agencies Hire-Purchase Companies Lease Finance Companies Miscellaneous Non-Banking Financial Companies such as Chit Fund (Chit Funds Act, 1982) o Residual Non-Banking Financial Companies such as: Nidhis etc. (Companies Samir K Mahajan Act 1956) o o o o

Non-Bank Financial Intermediaries contd q Small Savings /Small Saving Organizations Next to commercial banks, Small Saving Organizations mobilize the largest volumes of savings, followed by co-operative banks, UTI. Among these, post office branches play a dominant role. Small Savings constitute non-marketable debt of public authorities. Though, technically, these saving go to Central Government, these mostly shared with state governments to meet their budgetary obligations. Various Types of Small Savings Instruments are o o o Post Office Saving Deposits Post Office Recurring Deposits Post office Time Deposits National Savings Certificates Kisan Vikas Patra National Savings Schemes Samir K Mahajan

Non-Banking Financial Intermediaries contd. q Provident Funds are maintained by salaried people to provide for old age security after superannuation or relief to the family after the income earner’s death during the tenure of the job. However, with the introduction of Public Provident Fund Schemes, it is possible for non-salaried earner to save in provident fund. Funds mobilized through provident fund, should be invested wholly or substantially in central and state government securities, and securities guaranteed by these public authorities; securities of public sector financial institutions including banks, and bonds of public sector enterprises, certificates of deposits issued by public sector banks. Various Types of Provident Funds Instruments are o Employees’ Provident Funds o Coal Mine Provident Funds o Assam Tea plantations Provident Funds o Public Provident Funds in Post Office or Banks Samir K Mahajan

Non-Banking Financial Intermediaries contd. q Mutual Funds /Unit Trusts mobilise savings from the public by selling units/share, and invests the mobilised funds/resources in large diversified and sound portfolios of equity shares, bods and money market instruments. It is a pure intermediaries which performs a basic functions of buying and selling of securities on behalf of its unit-holders. Mutual Fund was introduced in India with the setting up of Unit Trust of India (UTI) in the country in 1964. UTI maintained its monopoly and experienced a consistent growth in till 1987. The second phase witnessed the entry of mutual fund companies sponsored by nationalised banks and insurance companies since then. The third phase marked a turning point in the history of mutual finds when Securities Exchange Board of India issued Mutual Funds Regulations in January 1993. Samir K Mahajan

Non-Banking Financial Intermediaries contd. q Insurance Companies Insurance may be described as a social device to reduce or eliminate risk of life and property. Insurance is a collective bearing of risk. Insurance spreads the loss of the risks and losses of few people among large number of people who as whole subscribe to a common pool or fund which is collected by the insurers. Insurance cannot prevent the occurrence of risks but provides for the losses of risks. Insurance is also a means of savings and investment. The risks can be insured against loss of life/premature death, ailments, loss or theft of property, fire accidents and so on. The insurance sector is regulated by Insurance Regulatory Boards of India (IRDA) 1999. The major players are q Life Insurance Corporation of India (dealing with life/public sector) q General Insurance Corporation of India (dealing with property/public sector) o Oriental Insurance Companies o New India Insurance Company o National Insurance Company o United India Insurance Company q Private Insurers in Life and Property Samir K Mahajan

Financial markets and institutions - ppt

Financial markets and institutions - ppt Basic flow of funds through the financial system

Basic flow of funds through the financial system Financial intermediaries

Financial intermediaries Financial intermediary

Financial intermediary Financial intermediaries

Financial intermediaries Pavel babka

Pavel babka Types of financial intermediaries

Types of financial intermediaries Financial intermediaries

Financial intermediaries Financial intermediaries

Financial intermediaries Types of financial intermediaries

Types of financial intermediaries Money market participants

Money market participants Ratul mahajan

Ratul mahajan Multidatagram

Multidatagram Mandar mahajan

Mandar mahajan Meera mahajan

Meera mahajan Meera bai poems

Meera bai poems Ratul mahajan

Ratul mahajan Kshiteej mahajan

Kshiteej mahajan Mahajan meaning

Mahajan meaning Ratul mahajan

Ratul mahajan Amitt mahajan

Amitt mahajan Sunita mahajan

Sunita mahajan Offshore employment intermediaries

Offshore employment intermediaries