Depreciation Accounting Definition Depreciation is a measure of

- Slides: 19

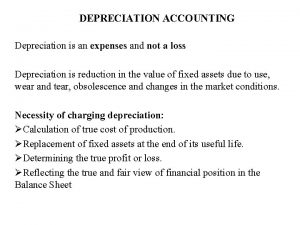

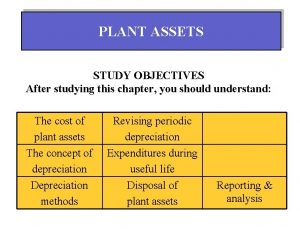

Depreciation Accounting Definition Depreciation is a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology and market changes.

Depreciable Assets Depreciable assets are assets which (i) Are expected to be used during more than one accounting period; (ii) Have a limited useful life; (iii) Are held by an enterprise for use in the production or supply of goods and services (i. e. not for the purpose of sale in ordinary course of business)

Applicability of the Accounting Standard 6 This accounting standard is applicable to all depreciable assets except, the following: (i) Forests, plantations and similar regenerative natural resources; (ii) Wasting assets including expenditure on the exploration for and extraction of minerals, oils, natural gas and similar non-regenerative resources; (iii) Expenditure on research and development; (iv)Goodwill; (v) Live stock- Cattle, Animal Husbandry

Calculation of depreciation The amount of depreciation is calculated as under: (i) Historical cost or other amount substituted for the historical cost of the depreciable asset when the asset has been revalued; (ii) Expected useful life of the depreciable asset; and (iii) Estimated residual value of the depreciable asset.

Methods of depreciation There are two methods of depreciation. These are: i) Straight Line Method (SLM) ii) Written down value Method (WDV) Selection of appropriate method It depends upon following methods: • Type of assets • Nature of assets • Circumstances of prevailing business Note- A combination of more than one standards may be used Accounting treatment- selected depreciation methods should be applied consistently applied from period to period

Change in depreciation methods: • Compliance of statute • Compliance of accounting standards • For more appropriate presentation of the financial statements Procedure to be followed in change of methods: • Depreciation should be recomputed applying new method from date of acquisition/installation till date of change of method. • Difference between total depreciation under two methods and accumulated depreciation under the old method till date of change may be surplus or deficiency. • Resultant surplus credited to profit and loss a/c under head “depreciation written back”. • Resultant deficiency charged to profit and loss a/c. Change in depreciation method should be treated as change in accounting policy (as per AS 5) and its effect should be quantified and disclosed.

Change in estimated useful life When there is change in estimated useful life of assets, outstanding depreciable amount on the date of change in estimated useful life of asset should allocated over the revised remaining useful life of assets.

Depreciation under GAAP Three Steps of the Depreciation Process: Find depreciable base of the asset Original Cost Less: Salvage Value Depreciable Base Estimate asset’s useful life XXXX

Depreciation under GAAP cont’d Three Important Notes About Depreciation: PP&E held for sale is not depreciated PP&E is not written up by an enterprise to reflect appraisal, market, or current values which are above cost to the enterprise Estimates of useful life and residual value, and the method of depreciation, are reviewed only when events or changes indicate that the current estimates or depreciation method no longer are appropriate

Depreciation under IFRS • Current Authoritative Source–IAS 16 Same as GAAP except for two main differences: • Estimates of useful life and residual value, and the method of depreciation, are reviewed at least at each annual reporting date • For a company currently using GAAP a change to IFRS could result in a greater frequency of revisions in depreciation rates, which in turn could mean less predictable depreciation expense

Depreciation under IFRS cont’d IFRS allows a company to choose between two different models in order to value PP&E (property, plant & equipment) after it has been recognized on the books Cost model–this model is like GAAP where PP&E is carried at its cost less any accumulated depreciation Revaluation model–this model allows a company to revalue PP&E on its books to fair value if fair value can be reliably measured

Example Facts: At the beginning of the year a company has a building with a carrying value of $100, 000 and a remaining useful life of 10 years that was recently valued at $300, 000 Under GAAP: depreciation expense for the year would be $10, 000 (assuming straight-line) Under IFRS: depreciation expense for the year could be either $30, 000 or $10, 000

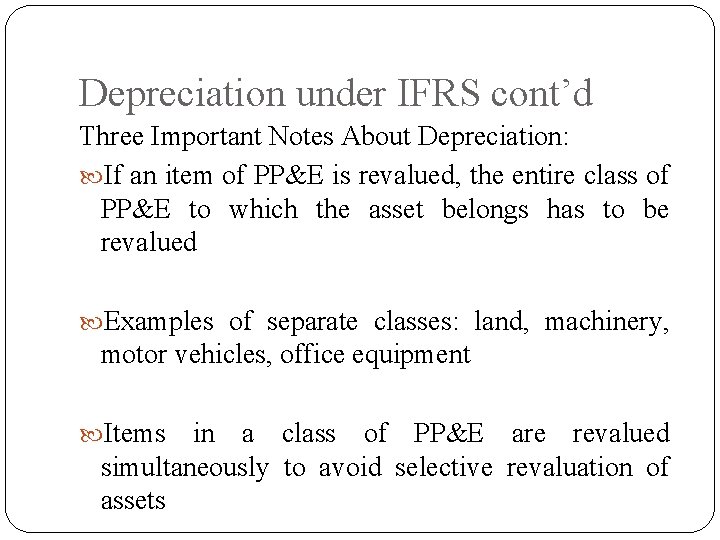

Depreciation under IFRS cont’d Three Important Notes About Depreciation: If an item of PP&E is revalued, the entire class of PP&E to which the asset belongs has to be revalued Examples of separate classes: land, machinery, motor vehicles, office equipment Items in a class of PP&E are revalued simultaneously to avoid selective revaluation of assets

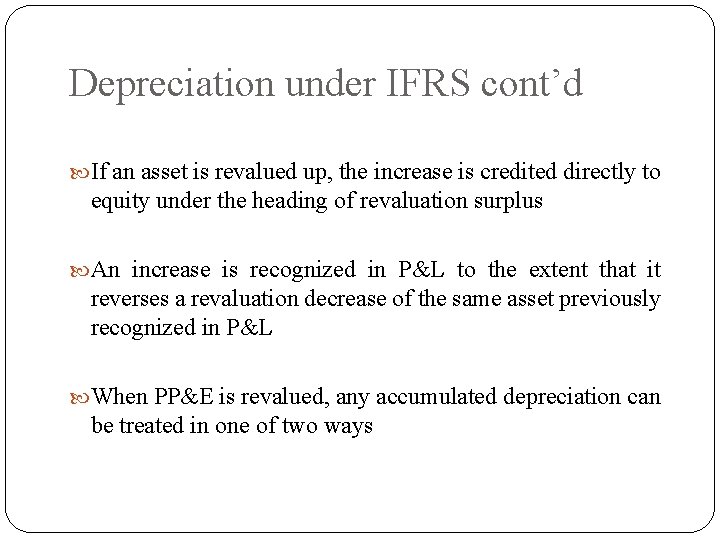

Depreciation under IFRS cont’d If an asset is revalued up, the increase is credited directly to equity under the heading of revaluation surplus An increase is recognized in P&L to the extent that it reverses a revaluation decrease of the same asset previously recognized in P&L When PP&E is revalued, any accumulated depreciation can be treated in one of two ways

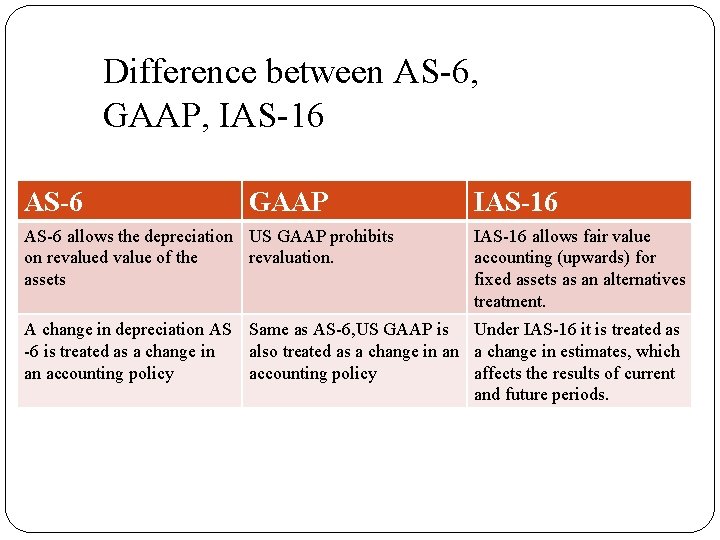

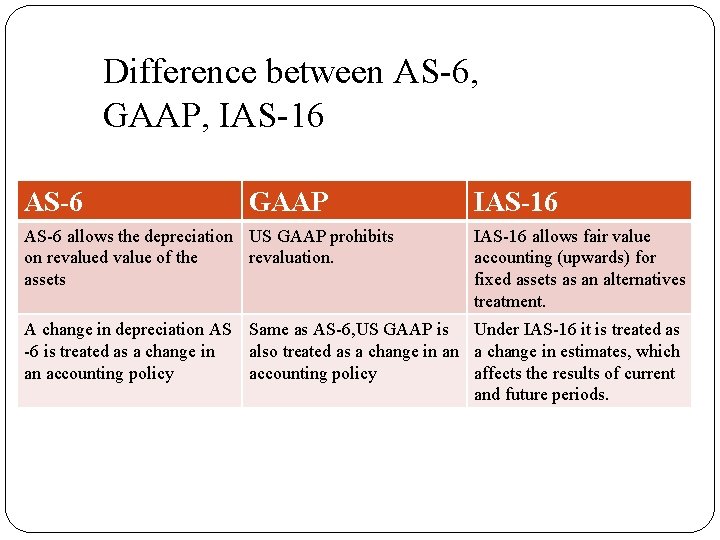

Difference between AS-6, GAAP, IAS-16 AS-6 GAAP AS-6 allows the depreciation US GAAP prohibits on revalued value of the revaluation. assets IAS-16 allows fair value accounting (upwards) for fixed assets as an alternatives treatment. A change in depreciation AS Same as AS-6, US GAAP is Under IAS-16 it is treated as -6 is treated as a change in also treated as a change in an a change in estimates, which an accounting policy affects the results of current and future periods.

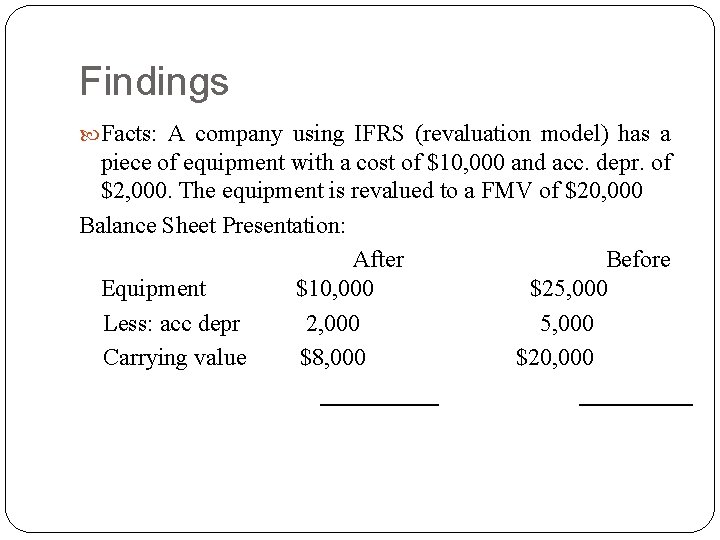

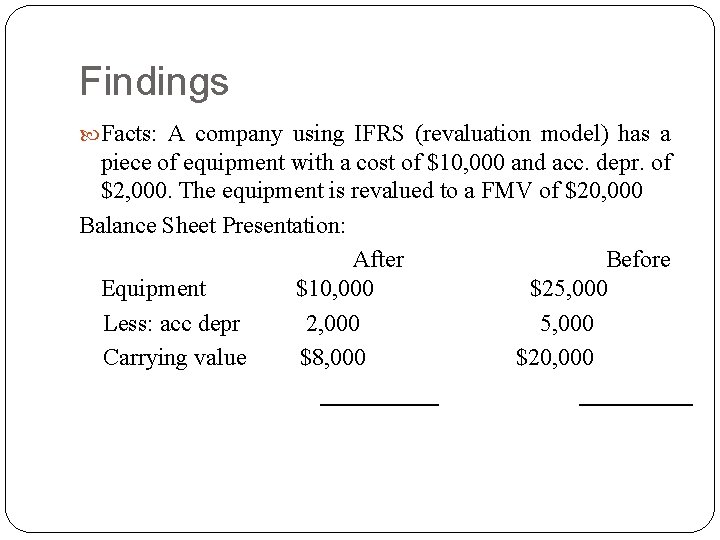

Findings Facts: A company using IFRS (revaluation model) has a piece of equipment with a cost of $10, 000 and acc. depr. of $2, 000. The equipment is revalued to a FMV of $20, 000 Balance Sheet Presentation: After Before Equipment $10, 000 $25, 000 Less: acc depr 2, 000 5, 000 Carrying value $8, 000 $20, 000

Objectives In general • The introduction accounting standards there was uniformity in the accounts of various companies within India. • Converged Accounting Standards along with IFRS was introduced so that accounts of India can be compared with companies of the world Related to Depreciation • It will charged according to the shelve life of fixed asset.

Recommendations • • • It There are two types of depreciation which are: Straight Line Depreciation Method Written Down Value Method would be better if only one kind of depreciation method is followed all over the world • There should be such accounting so that tax accounting and financial statement accounting could be done together • Slabs of tax accounting should be same with the financial statements.

Depreciation in accounting

Depreciation in accounting Closing transfers accounting

Closing transfers accounting Gibbons jacobean city comedy download

Gibbons jacobean city comedy download Barometer

Barometer What is depreciation in maths

What is depreciation in maths Financial accounting and accounting standards chapter 1

Financial accounting and accounting standards chapter 1 Conclusion of computerized accounting

Conclusion of computerized accounting Accounting period concept in accounting

Accounting period concept in accounting Responsibility accounting

Responsibility accounting Angle measure definition

Angle measure definition Radians quadrants

Radians quadrants Define measures of dispersion

Define measures of dispersion Annual depreciation formula

Annual depreciation formula Units-of-activity method of depreciation

Units-of-activity method of depreciation Units-of-activity method of depreciation

Units-of-activity method of depreciation Depreciation straight line method

Depreciation straight line method Isolux diagram for finding luminance on road surface is a

Isolux diagram for finding luminance on road surface is a Double declining method depreciation

Double declining method depreciation Reduced balance method

Reduced balance method Activity based method depreciation

Activity based method depreciation