CHINESE INFORMATION AND NETWORKING ASSOCIATION CINA FOUNDERS AND

- Slides: 15

CHINESE INFORMATION AND NETWORKING ASSOCIATION (CINA) FOUNDERS AND STARTUP WORKSHOP May 15, 2004 Fred Greguras fgreguras@fenwick. com (650) 335 -7241 Andrew Luh aluh@fenwick. com (650) 335 -7964

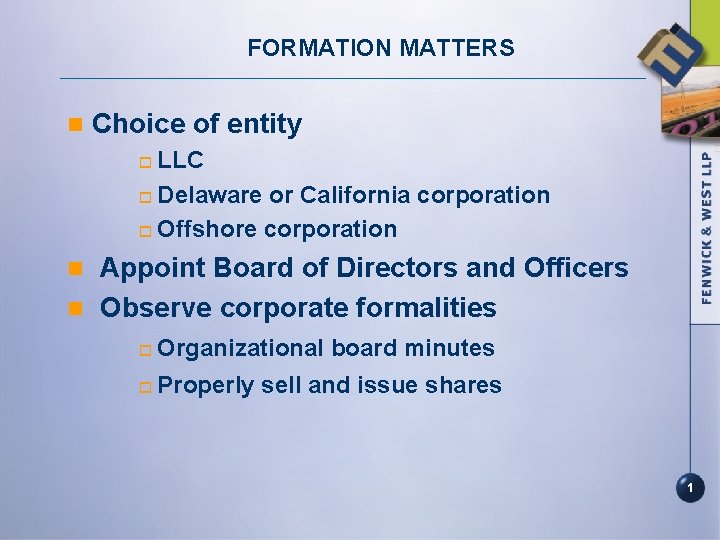

FORMATION MATTERS n Choice of entity LLC o Delaware or California corporation o Offshore corporation o Appoint Board of Directors and Officers n Observe corporate formalities n o Organizational board minutes o Properly sell and issue shares 1

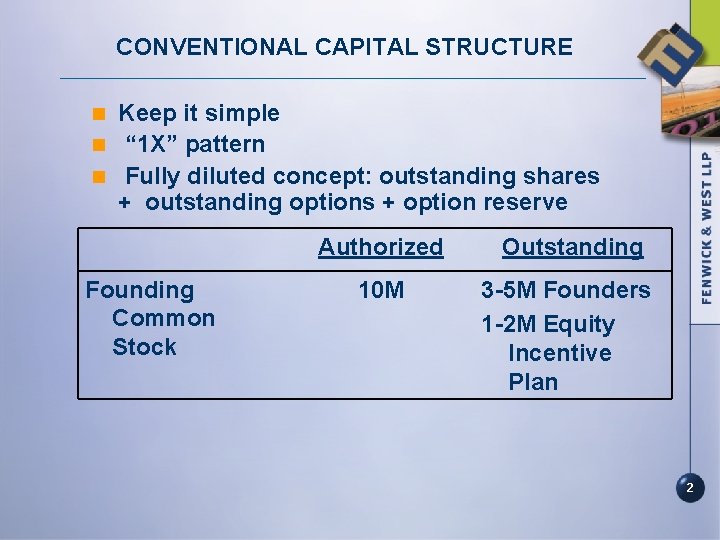

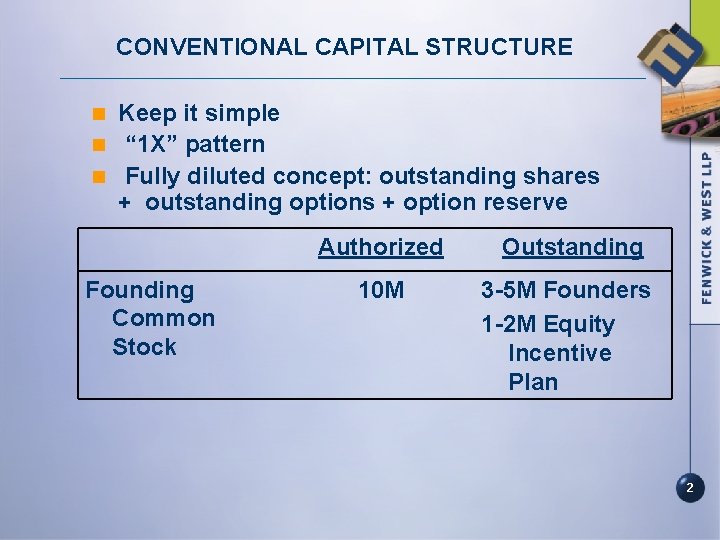

CONVENTIONAL CAPITAL STRUCTURE Keep it simple n “ 1 X” pattern n Fully diluted concept: outstanding shares + outstanding options + option reserve n Founding Common Stock Authorized Outstanding 10 M 3 -5 M Founders 1 -2 M Equity Incentive Plan 2

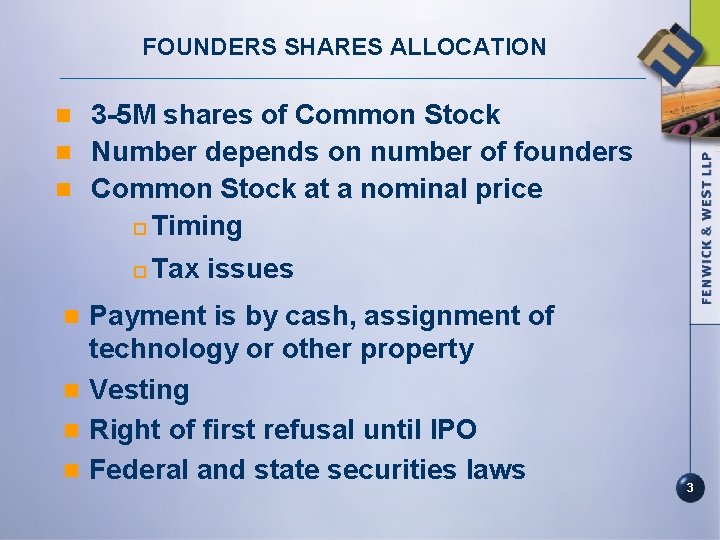

FOUNDERS SHARES ALLOCATION 3 -5 M shares of Common Stock n Number depends on number of founders n Common Stock at a nominal price o Timing n o Tax issues Payment is by cash, assignment of technology or other property n Vesting n Right of first refusal until IPO n Federal and state securities laws n 3

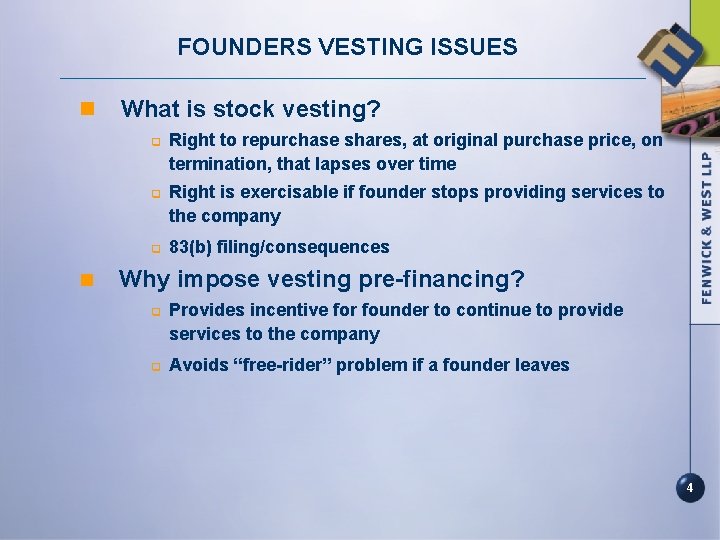

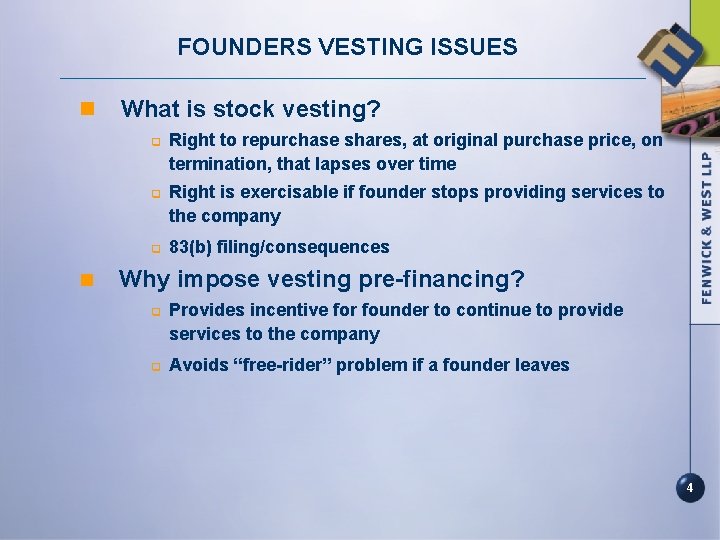

FOUNDERS VESTING ISSUES n What is stock vesting? q q q n Right to repurchase shares, at original purchase price, on termination, that lapses over time Right is exercisable if founder stops providing services to the company 83(b) filing/consequences Why impose vesting pre-financing? q q Provides incentive for founder to continue to provide services to the company Avoids “free-rider” problem if a founder leaves 4

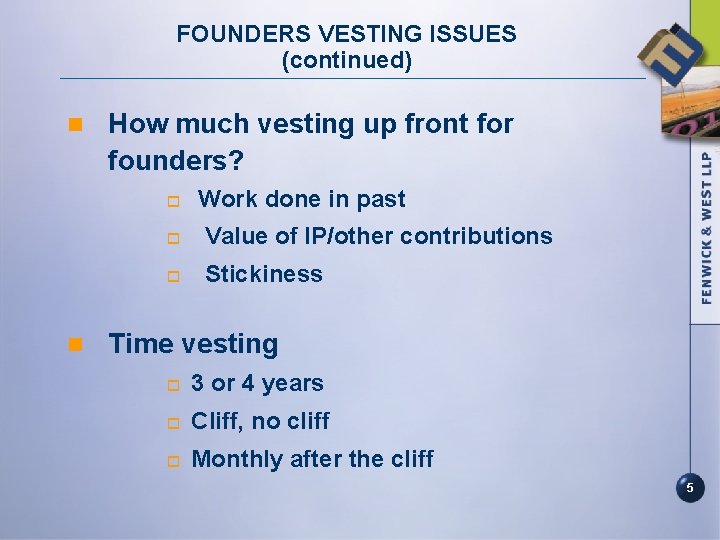

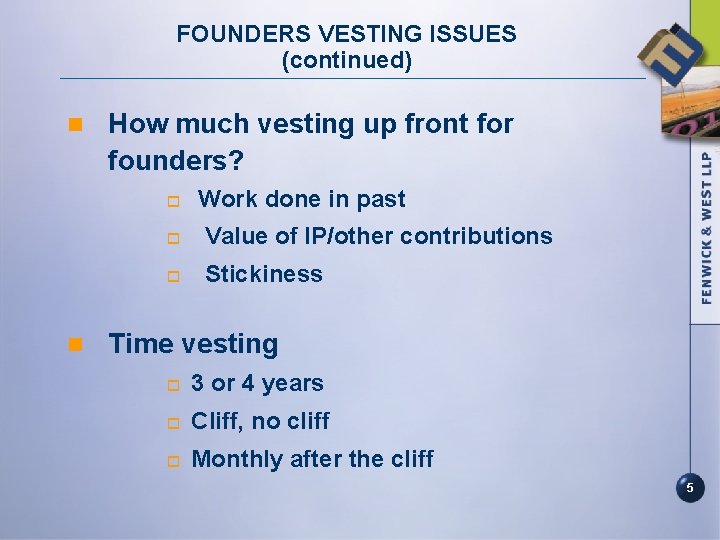

FOUNDERS VESTING ISSUES (continued) n How much vesting up front for founders? o n Work done in past o Value of IP/other contributions o Stickiness Time vesting o 3 or 4 years o Cliff, no cliff o Monthly after the cliff 5

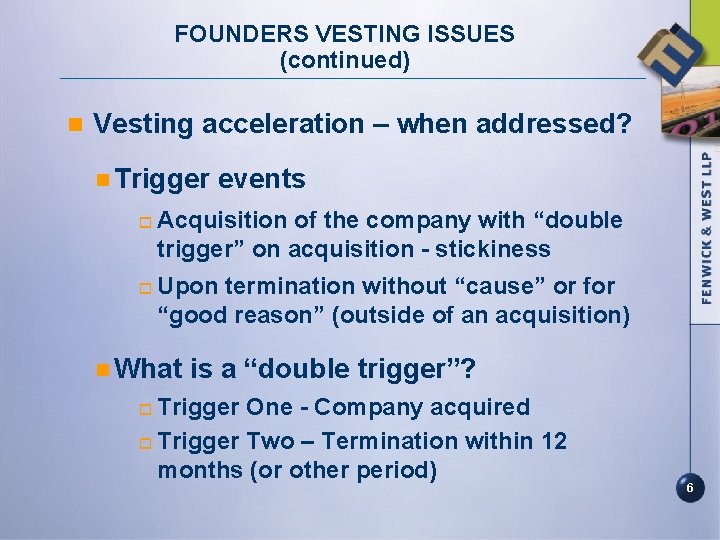

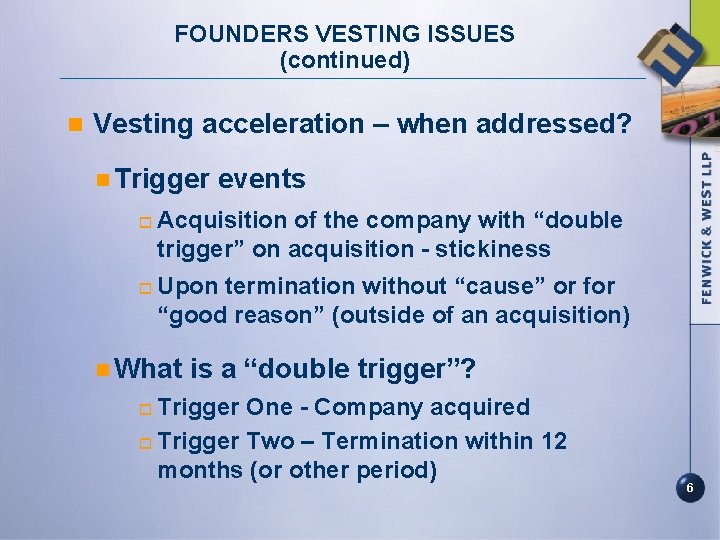

FOUNDERS VESTING ISSUES (continued) n Vesting acceleration – when addressed? n Trigger o o events Acquisition of the company with “double trigger” on acquisition - stickiness Upon termination without “cause” or for “good reason” (outside of an acquisition) n What is a “double trigger”? Trigger One - Company acquired o Trigger Two – Termination within 12 months (or other period) o 6

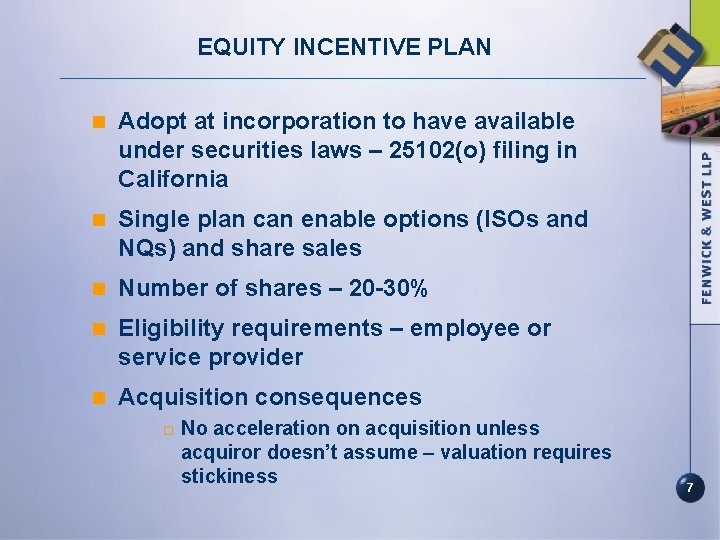

EQUITY INCENTIVE PLAN n Adopt at incorporation to have available under securities laws – 25102(o) filing in California n Single plan can enable options (ISOs and NQs) and share sales n Number of shares – 20 -30% n Eligibility requirements – employee or service provider n Acquisition consequences o No acceleration on acquisition unless acquiror doesn’t assume – valuation requires stickiness 7

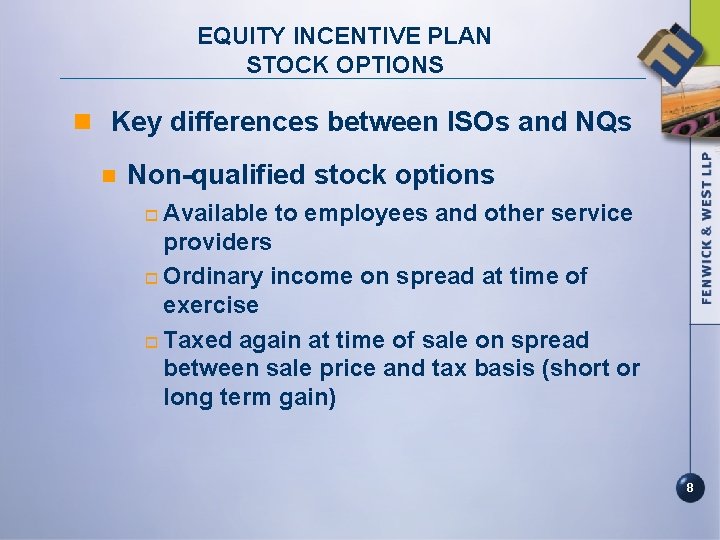

EQUITY INCENTIVE PLAN STOCK OPTIONS n Key differences between ISOs and NQs n Non-qualified stock options Available to employees and other service providers o Ordinary income on spread at time of exercise o Taxed again at time of sale on spread between sale price and tax basis (short or long term gain) o 8

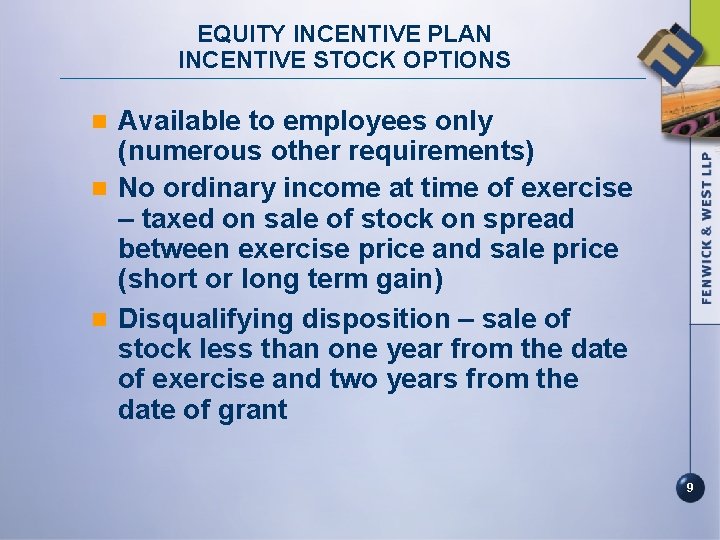

EQUITY INCENTIVE PLAN INCENTIVE STOCK OPTIONS Available to employees only (numerous other requirements) n No ordinary income at time of exercise – taxed on sale of stock on spread between exercise price and sale price (short or long term gain) n Disqualifying disposition – sale of stock less than one year from the date of exercise and two years from the date of grant n 9

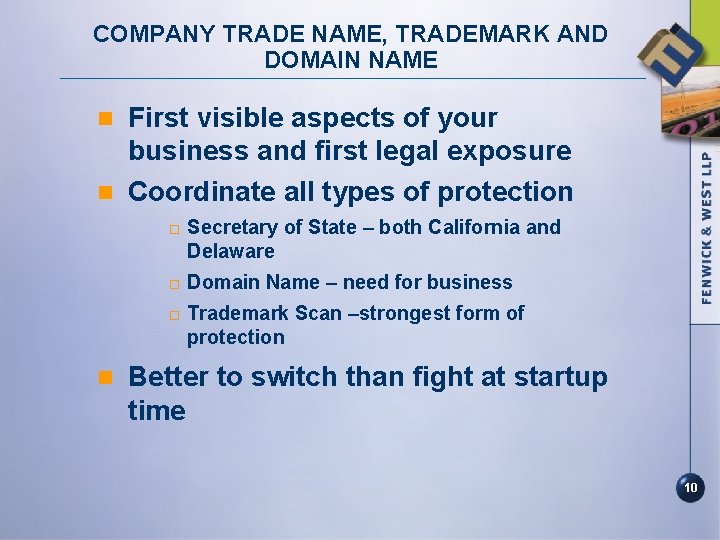

COMPANY TRADE NAME, TRADEMARK AND DOMAIN NAME First visible aspects of your business and first legal exposure n Coordinate all types of protection n o o o n Secretary of State – both California and Delaware Domain Name – need for business Trademark Scan –strongest form of protection Better to switch than fight at startup time 10

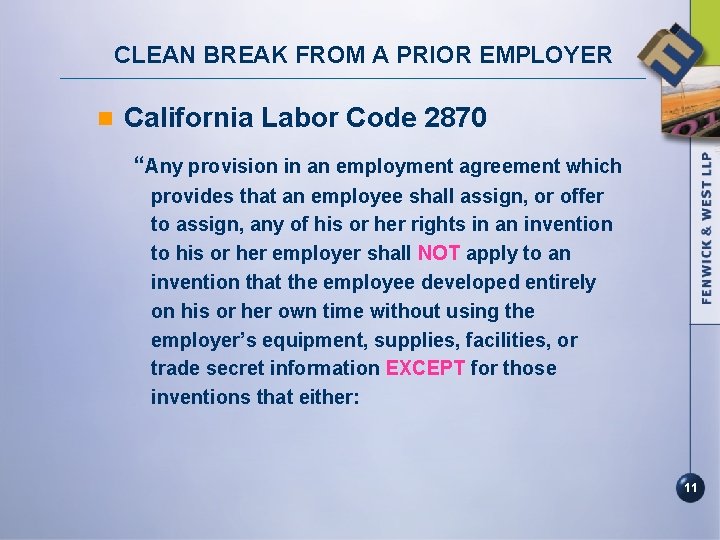

CLEAN BREAK FROM A PRIOR EMPLOYER n California Labor Code 2870 “Any provision in an employment agreement which provides that an employee shall assign, or offer to assign, any of his or her rights in an invention to his or her employer shall NOT apply to an invention that the employee developed entirely on his or her own time without using the employer’s equipment, supplies, facilities, or trade secret information EXCEPT for those inventions that either: 11

CLEAN BREAK FROM A PRIOR EMPLOYER (continued) n California Labor Code 2870 (continued) 1. Relate at the time of conception or reduction to practice of the invention to the employer’s business, or actual or demonstrably anticipated research or development of the employer; or o 2. Result from any work performed by the employee for the employer. ” o 12

CLEAN BREAK FROM A PRIOR EMPLOYER (continued) Working completely outside an employer’s premises and not using and employer’s resources may not be enough n “Moonlighting” by founder or others n Duties to previous employer n Solicitation, hiring of employees n 13

ADVANCES/SALARY DEFERRALS DURING STARTUP Loans to company n Salary deferrals n Document n Reflect in financial statements n 14 1432519

Traditional network vs sdn

Traditional network vs sdn Anglo chinese school chinese name

Anglo chinese school chinese name Religions that believe in reincarnation

Religions that believe in reincarnation Judaism vs christianity

Judaism vs christianity Walt disney world founders

Walt disney world founders Who founded samaritan's purse

Who founded samaritan's purse Edmodo основатели

Edmodo основатели Pony express gif

Pony express gif Gestaltists

Gestaltists Ebay ebates

Ebay ebates Baskin-robbins founders

Baskin-robbins founders Amdocs company profile

Amdocs company profile Ece344

Ece344 How is genetic drift different from gene flow

How is genetic drift different from gene flow Qnet founders

Qnet founders Information centric networking

Information centric networking