Chapter Five Consolidated Financial Statements IntraEntity Asset Transactions

- Slides: 16

Chapter Five Consolidated Financial Statements— Intra-Entity Asset Transactions Copyright © 2015 Mc. Graw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of Mc. Graw-Hill Education.

Intra-entity Transactions Ø Companies that make up a business combination frequently retain their legal identities as separate operating centers and maintain their own recordkeeping. Ø Inventory sales between the companies must be recorded. The seller records revenue, and the buyer enters the purchase into its accounts (Remember the parent and subsidiary continue to operate as separate legal entities). Ø For internal reporting purposes, recording an inventory transfer as a sale/purchase provides vital data to help measure the operational efficiency of each enterprise. 5 -2

Intra-entity Transactions Ø From a consolidated perspective neither a sale nor a purchase has occurred. An intra-entity transfer is merely the internal movement of inventory that creates no net change in the financial position of the business combination taken as a whole. Ø In the consolidated financial statements, the intra-entity transfers are eliminated. Ø The consolidated statements reflect only transactions with outside parties. Ø Worksheet entries report the perspective of the consolidated enterprise. 5 -3

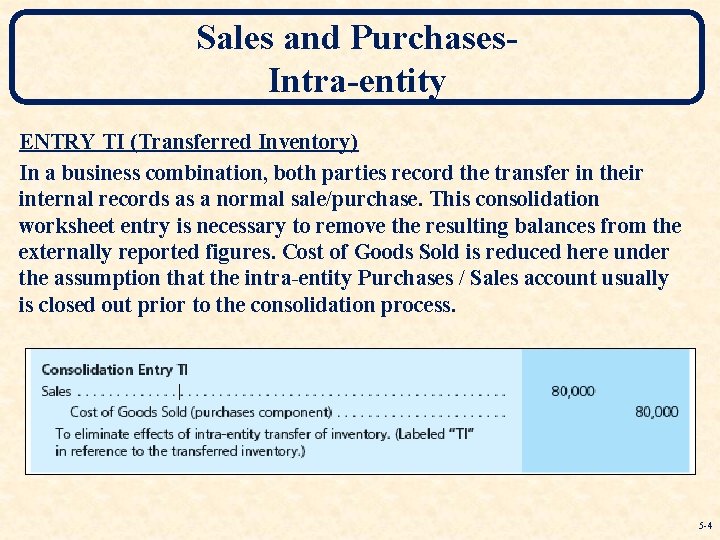

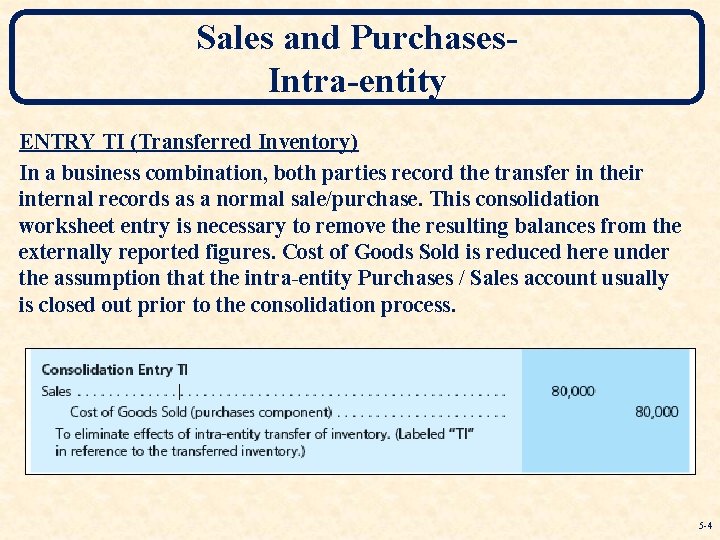

Sales and Purchases. Intra-entity ENTRY TI (Transferred Inventory) In a business combination, both parties record the transfer in their internal records as a normal sale/purchase. This consolidation worksheet entry is necessary to remove the resulting balances from the externally reported figures. Cost of Goods Sold is reduced here under the assumption that the intra-entity Purchases / Sales account usually is closed out prior to the consolidation process. 5 -4

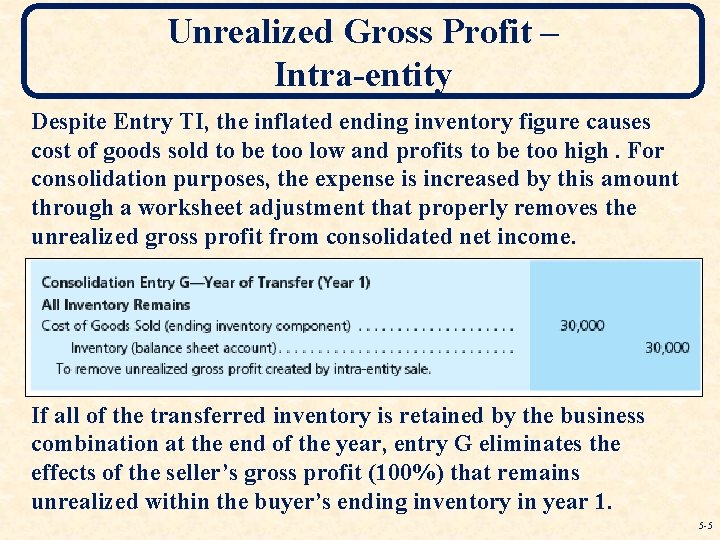

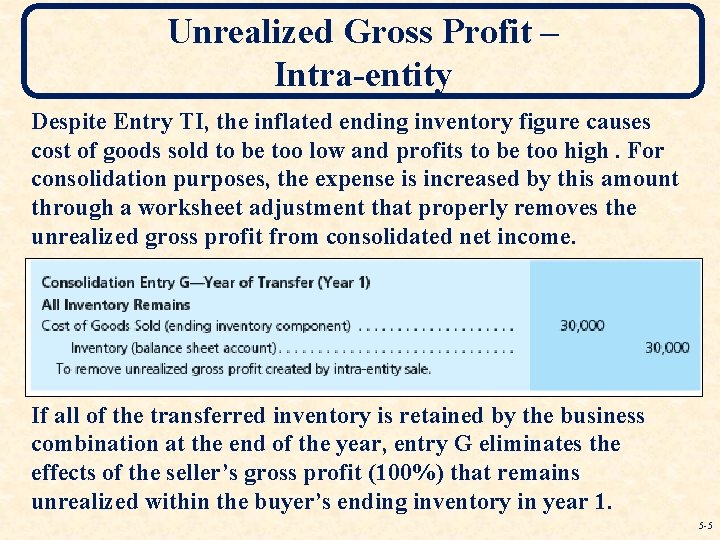

Unrealized Gross Profit – Intra-entity Despite Entry TI, the inflated ending inventory figure causes cost of goods sold to be too low and profits to be too high. For consolidation purposes, the expense is increased by this amount through a worksheet adjustment that properly removes the unrealized gross profit from consolidated net income. If all of the transferred inventory is retained by the business combination at the end of the year, entry G eliminates the effects of the seller’s gross profit (100%) that remains unrealized within the buyer’s ending inventory in year 1. 5 -5

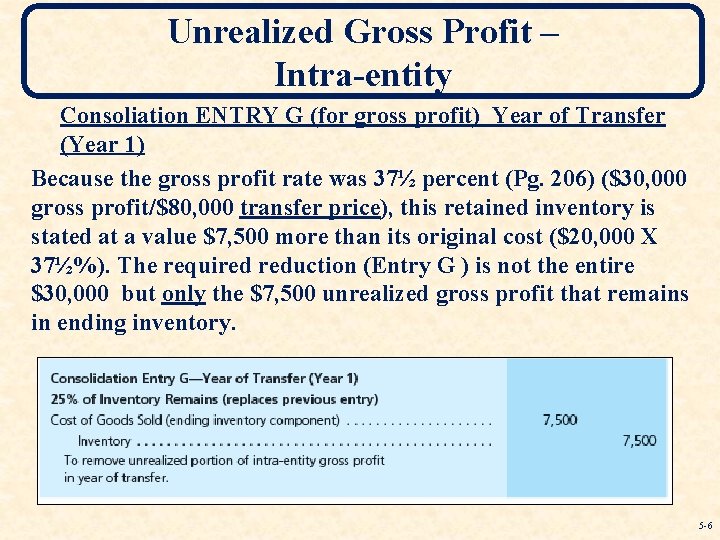

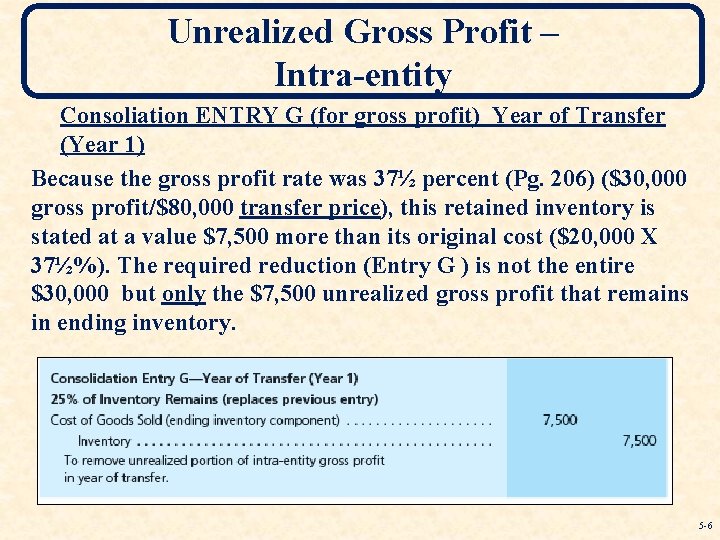

Unrealized Gross Profit – Intra-entity Consoliation ENTRY G (for gross profit) Year of Transfer (Year 1) Because the gross profit rate was 37½ percent (Pg. 206) ($30, 000 gross profit/$80, 000 transfer price), this retained inventory is stated at a value $7, 500 more than its original cost ($20, 000 X 37½%). The required reduction (Entry G ) is not the entire $30, 000 but only the $7, 500 unrealized gross profit that remains in ending inventory. 5 -6

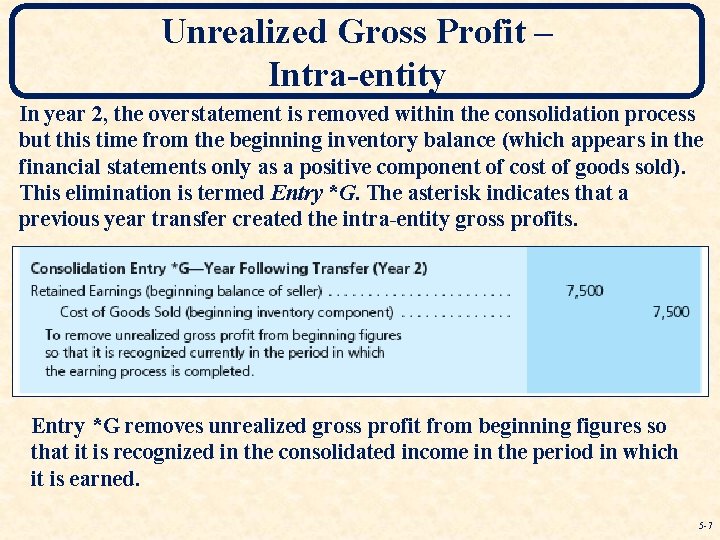

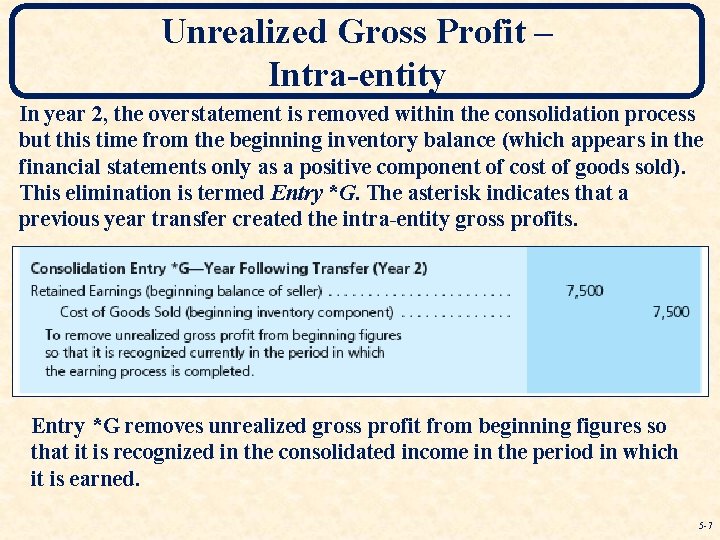

Unrealized Gross Profit – Intra-entity In year 2, the overstatement is removed within the consolidation process but this time from the beginning inventory balance (which appears in the financial statements only as a positive component of cost of goods sold). This elimination is termed Entry *G. The asterisk indicates that a previous year transfer created the intra-entity gross profits. Entry *G removes unrealized gross profit from beginning figures so that it is recognized in the consolidated income in the period in which it is earned. 5 -7

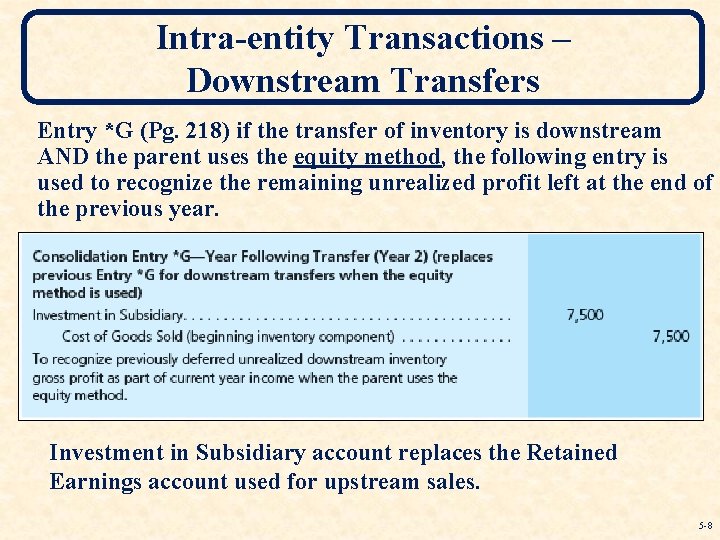

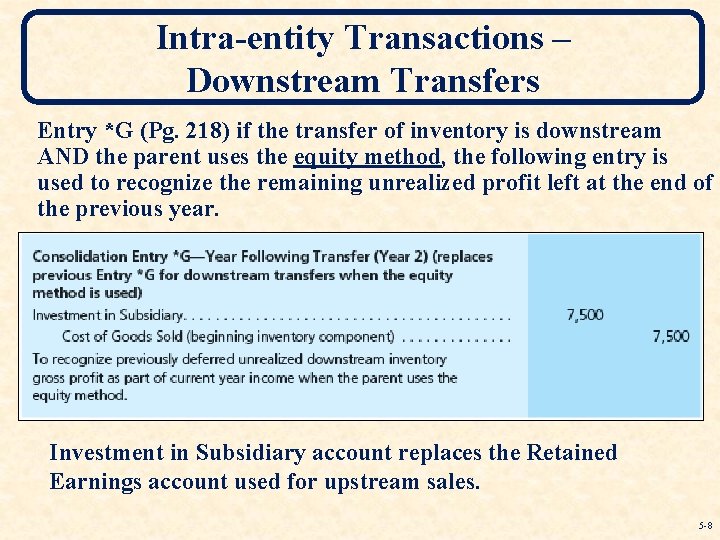

Intra-entity Transactions – Downstream Transfers Entry *G (Pg. 218) if the transfer of inventory is downstream AND the parent uses the equity method, the following entry is used to recognize the remaining unrealized profit left at the end of the previous year. Investment in Subsidiary account replaces the Retained Earnings account used for upstream sales. 5 -8

Unrealized Inventory Gain – Downstream Transfers Worksheet entries to eliminate sales/purchases balances (Entry TI) and to remove unrealized gross profit from ending Inventory in Year 1 (Entry G) are standard, regardless of the circumstances of the consolidation. BUT the procedure to eliminate intra-entity gross profit from Year 2’s beginning account balances differs from the Entry *G just presented IF: (1) the original transfer is downstream (parent’s) and (2) the parent applies the equity method for internal accounting purposes. 5 -9

Unrealized Inventory Gain Downstream Transfers For intra-entity beginning inventory profits resulting from downstream transfers when the parent applies the equity method: a. Parent’s retained earnings are appropriately stated due to intra-entity profit deferrals and recognition. b. The subsidiary retained earnings reflect none of the intra-entity profit and require no adjustment. c. The parent’s investment account at beginning of Year 2 contains a credit from the deferral of Year 1 downstream profits. d. Worksheet Entry *G transfers the Year 1 Investment account credit to a Year 2 earnings credit via COGS to recognize the profit in the year of sale to outsiders. 5 -10

Unrealized Gross Profits – Effect on Noncontrolling Interest According to FASB ASC paragraph 810 -10 -45 -6: The amount of intra-entity profit or loss to be eliminated is not affected by the existence of a noncontrolling interest. The complete elimination of the intra-entity profit or loss is consistent with the underlying assumption that consolidated financial statements represent the financial position and operating results of a single economic entity. The elimination of the intra-entity profit or loss may be allocated proportionately between the parent and noncontrolling interest. 5 -11

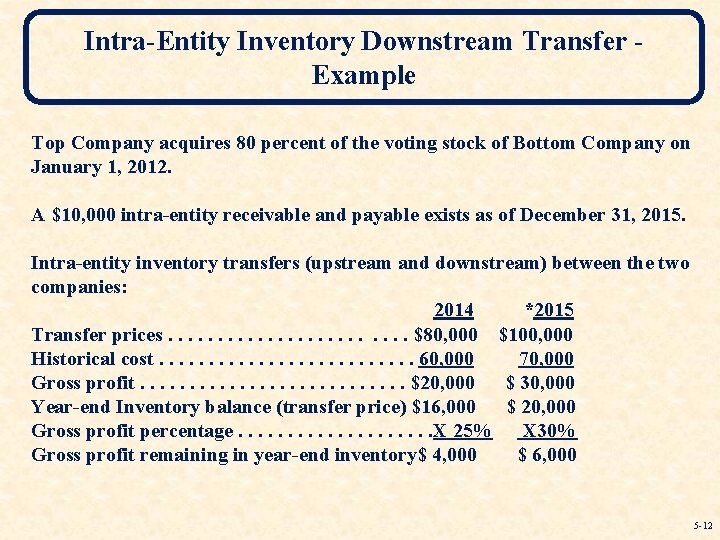

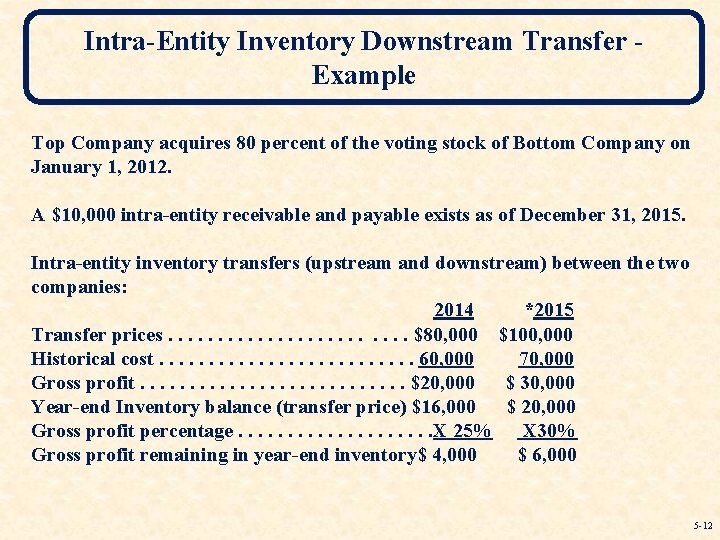

Intra-Entity Inventory Downstream Transfer Example Top Company acquires 80 percent of the voting stock of Bottom Company on January 1, 2012. A $10, 000 intra-entity receivable and payable exists as of December 31, 2015. Intra-entity inventory transfers (upstream and downstream) between the two companies: 2014 *2015 Transfer prices. . . $80, 000 $100, 000 Historical cost. . . 60, 000 70, 000 Gross profit. . . . $20, 000 $ 30, 000 Year-end Inventory balance (transfer price) $16, 000 $ 20, 000 Gross profit percentage. . . . . X 25% X 30% Gross profit remaining in year-end inventory$ 4, 000 $ 6, 000 5 -12

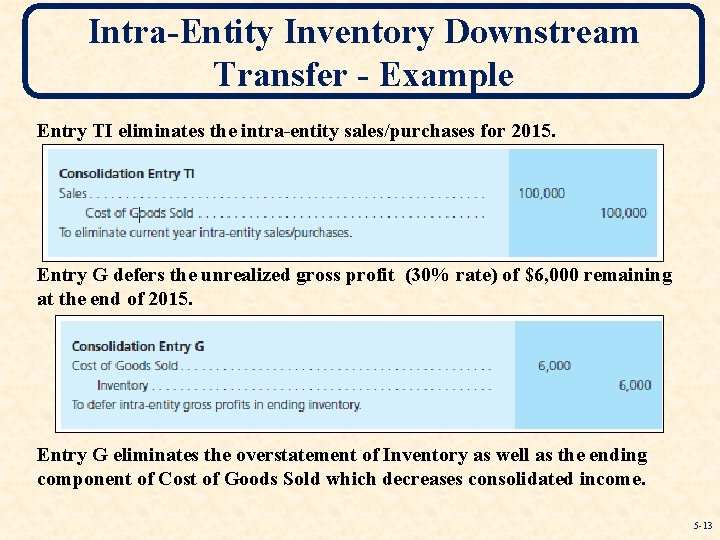

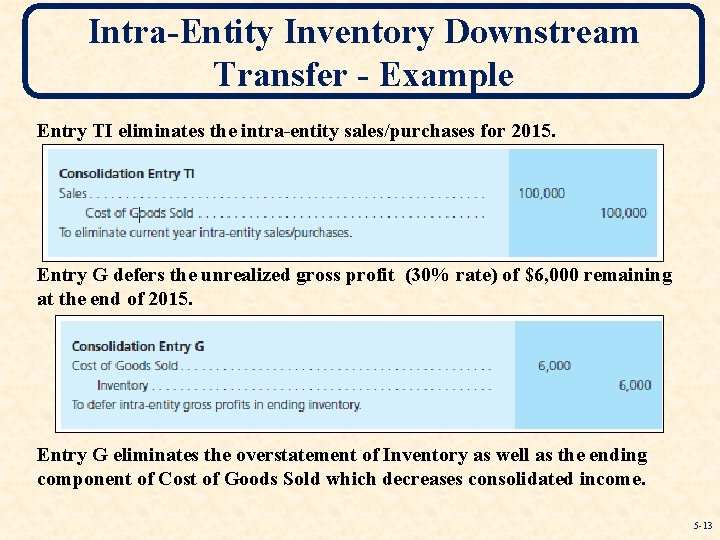

Intra-Entity Inventory Downstream Transfer - Example Entry TI eliminates the intra-entity sales/purchases for 2015. Entry G defers the unrealized gross profit (30% rate) of $6, 000 remaining at the end of 2015. Entry G eliminates the overstatement of Inventory as well as the ending component of Cost of Goods Sold which decreases consolidated income. 5 -13

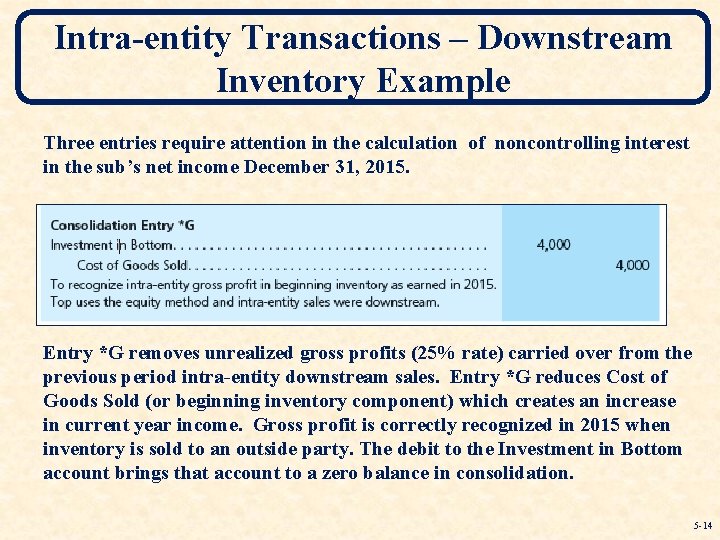

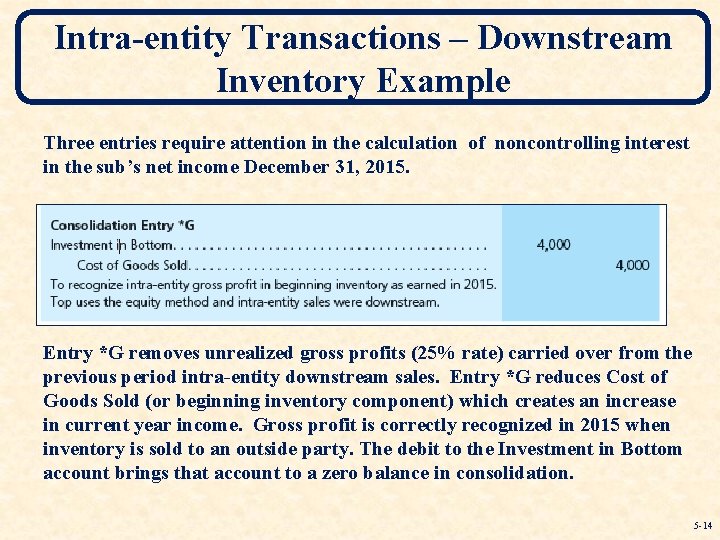

Intra-entity Transactions – Downstream Inventory Example Three entries require attention in the calculation of noncontrolling interest in the sub’s net income December 31, 2015. Entry *G removes unrealized gross profits (25% rate) carried over from the previous period intra-entity downstream sales. Entry *G reduces Cost of Goods Sold (or beginning inventory component) which creates an increase in current year income. Gross profit is correctly recognized in 2015 when inventory is sold to an outside party. The debit to the Investment in Bottom account brings that account to a zero balance in consolidation. 5 -14

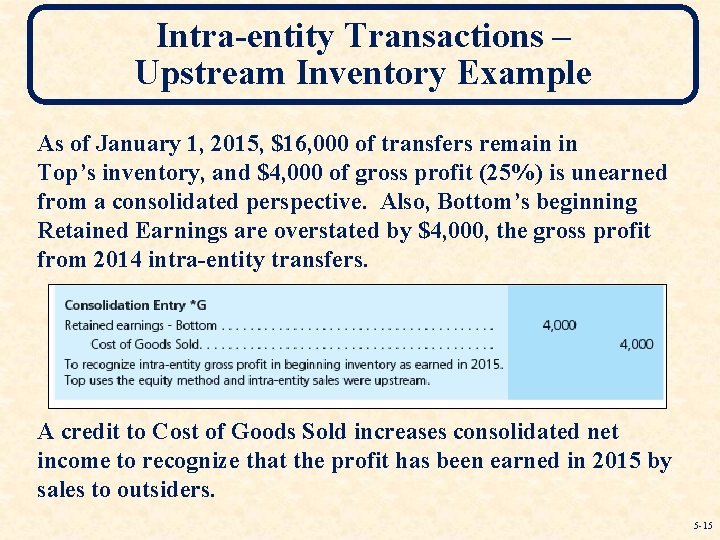

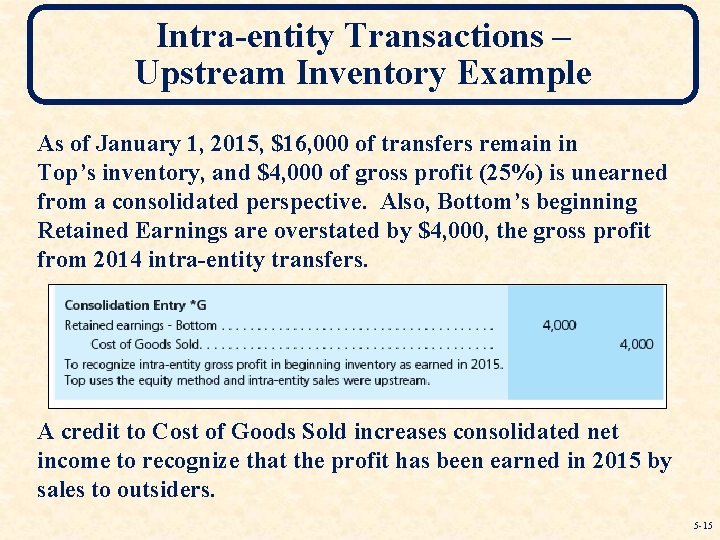

Intra-entity Transactions – Upstream Inventory Example As of January 1, 2015, $16, 000 of transfers remain in Top’s inventory, and $4, 000 of gross profit (25%) is unearned from a consolidated perspective. Also, Bottom’s beginning Retained Earnings are overstated by $4, 000, the gross profit from 2014 intra-entity transfers. A credit to Cost of Goods Sold increases consolidated net income to recognize that the profit has been earned in 2015 by sales to outsiders. 5 -15

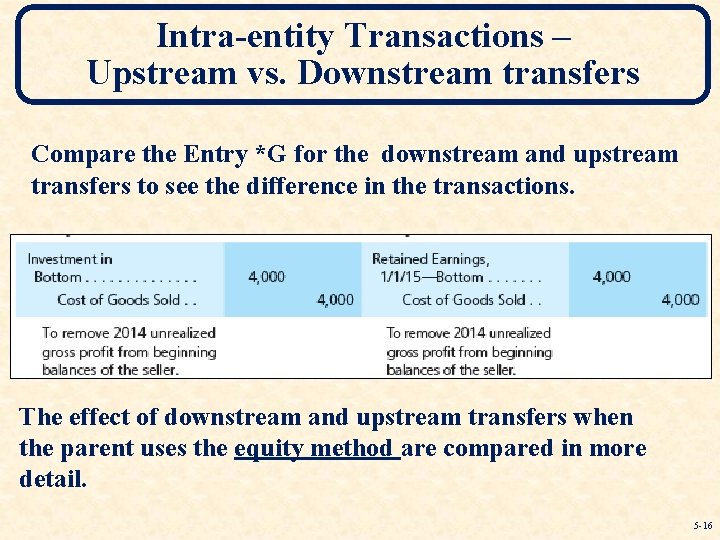

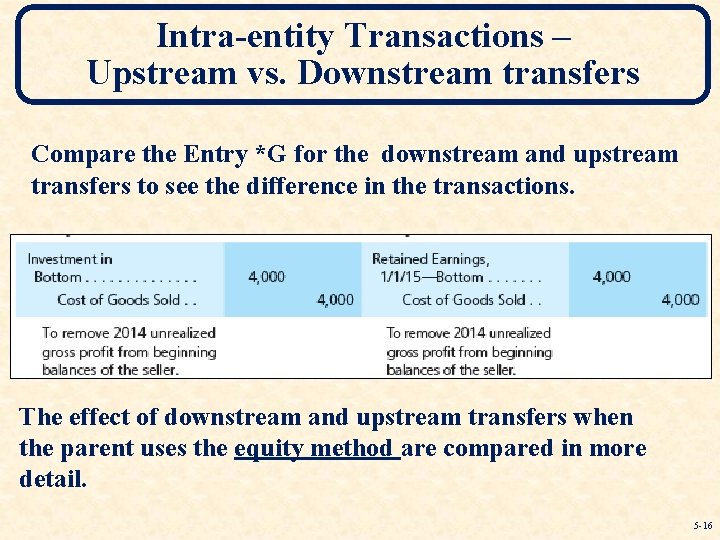

Intra-entity Transactions – Upstream vs. Downstream transfers Compare the Entry *G for the downstream and upstream transfers to see the difference in the transactions. The effect of downstream and upstream transfers when the parent uses the equity method are compared in more detail. 5 -16