Accounting Concepts principles policies Accounting Principles Accounting Concepts

- Slides: 14

Accounting Concepts, principles & policies

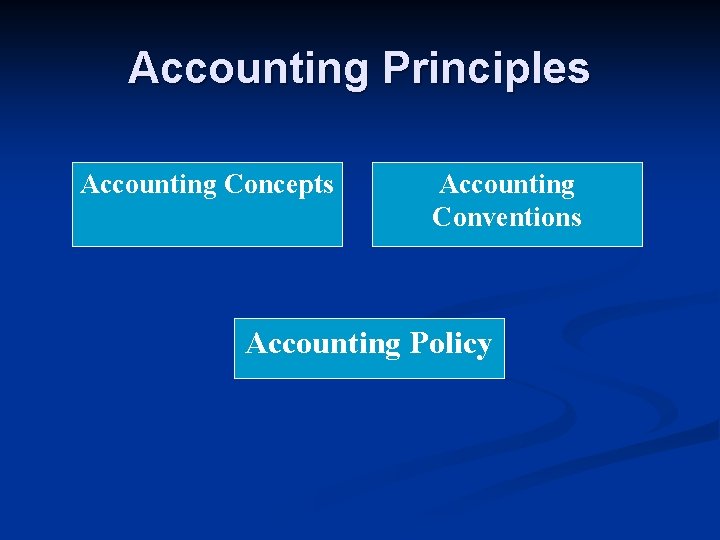

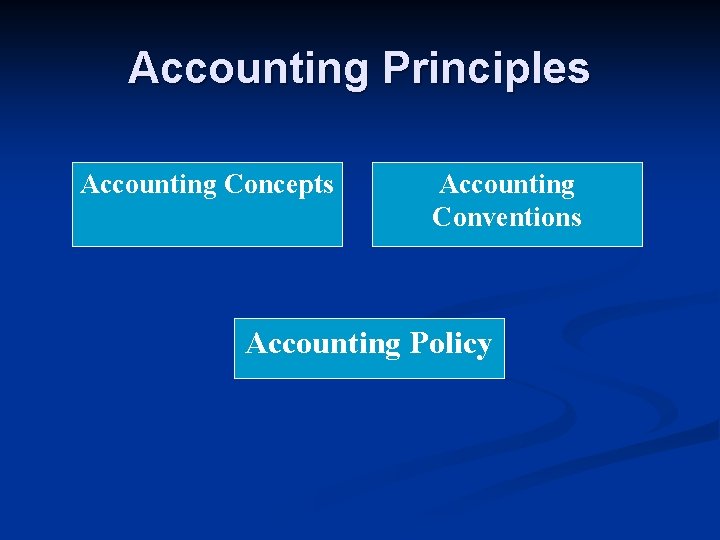

Accounting Principles Accounting Concepts Accounting Conventions Accounting Policy

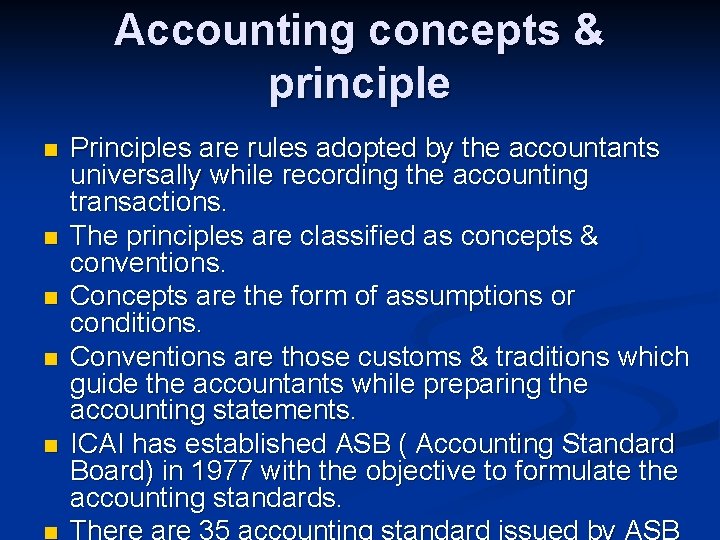

Accounting concepts & principle n n n Principles are rules adopted by the accountants universally while recording the accounting transactions. The principles are classified as concepts & conventions. Concepts are the form of assumptions or conditions. Conventions are those customs & traditions which guide the accountants while preparing the accounting statements. ICAI has established ASB ( Accounting Standard Board) in 1977 with the objective to formulate the accounting standards.

Accounting Concepts Business Entity Concept n Going concern concept n Money measurement concept n Periodicity concept n Accrual concept n

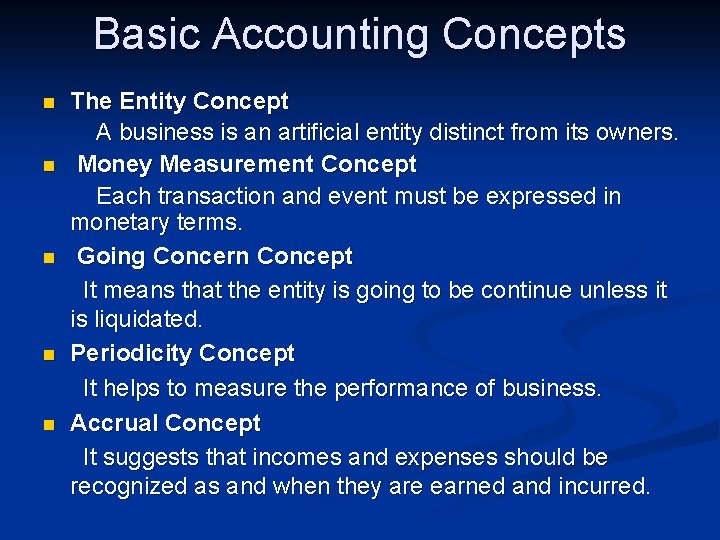

Basic Accounting Concepts n n n The Entity Concept A business is an artificial entity distinct from its owners. Money Measurement Concept Each transaction and event must be expressed in monetary terms. Going Concern Concept It means that the entity is going to be continue unless it is liquidated. Periodicity Concept It helps to measure the performance of business. Accrual Concept It suggests that incomes and expenses should be recognized as and when they are earned and incurred.

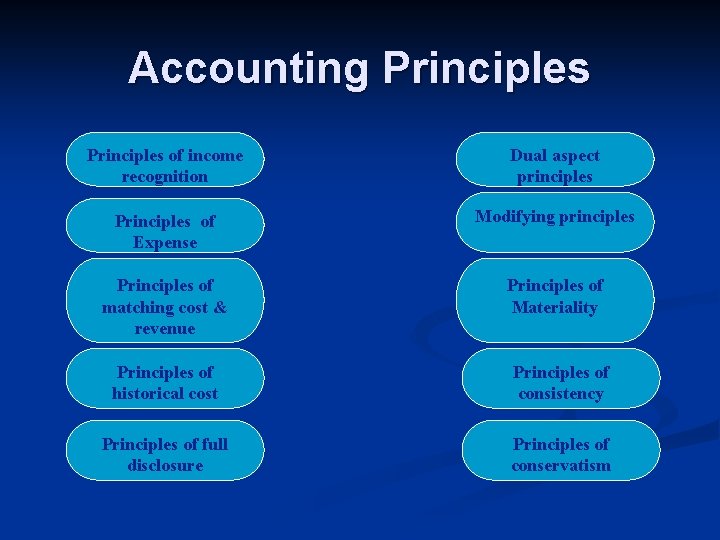

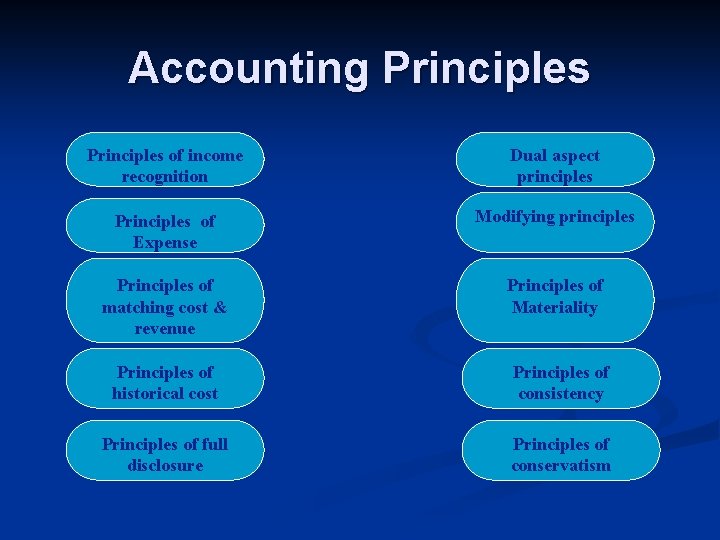

Accounting Principles of income recognition Dual aspect principles Principles of Expense Modifying principles Principles of matching cost & revenue Principles of Materiality Principles of historical cost Principles of consistency Principles of full disclosure Principles of conservatism

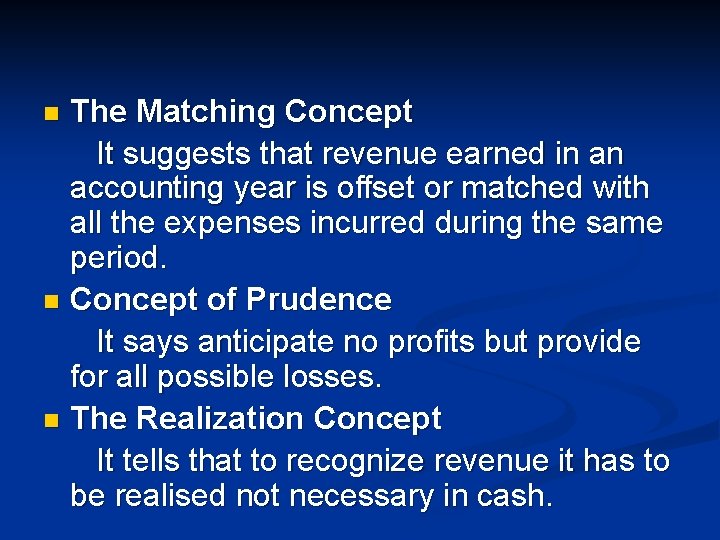

The Matching Concept It suggests that revenue earned in an accounting year is offset or matched with all the expenses incurred during the same period. n Concept of Prudence It says anticipate no profits but provide for all possible losses. n The Realization Concept It tells that to recognize revenue it has to be realised not necessary in cash. n

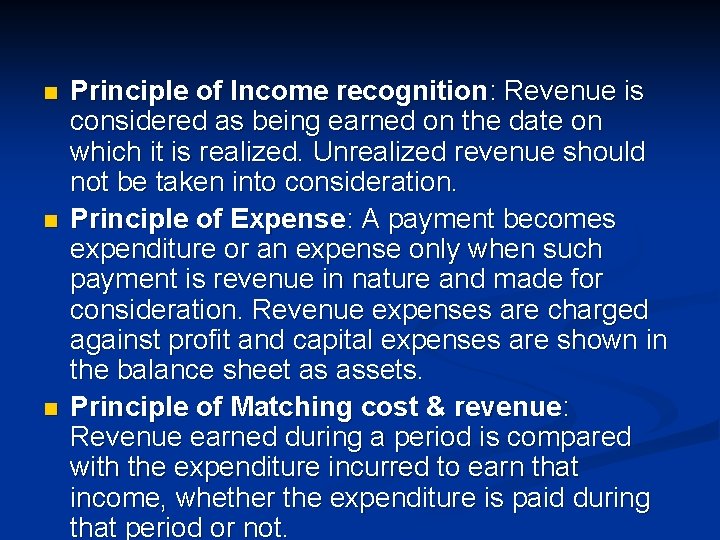

n n n Principle of Income recognition: Revenue is considered as being earned on the date on which it is realized. Unrealized revenue should not be taken into consideration. Principle of Expense: A payment becomes expenditure or an expense only when such payment is revenue in nature and made for consideration. Revenue expenses are charged against profit and capital expenses are shown in the balance sheet as assets. Principle of Matching cost & revenue: Revenue earned during a period is compared with the expenditure incurred to earn that income, whether the expenditure is paid during that period or not.

Principle of Historical cost: All assets are recorded at the cost of acquisition and this cost is the basis for all subsequent accounting for the assets. n Principle of Full disclosure: The Companies Act 1956 requires that income statement and balance sheet of a company must give a fair and true view of the state of affairs of the company. n Principle of Dual aspect: For every debit there is an equivalent credit. n

Principle of Materiality: Important details of financial status must be informed to all relevant parties. What is material and what is not material depends upon the nature of information and the party to whom the information is provided. n Modifying Principle: The cost of applying a principle should not be more than the benefit derived from. If it is so, that principle should be modified. n

Principle of Consistency: Consistency is required to help comparison of financial data from one period to another. Eg. FIFO in stock register. n Principle of Conservatism or Prudence: Accountant follow the rule ‘anticipate no profit but provide for all anticipated losses. ’ n

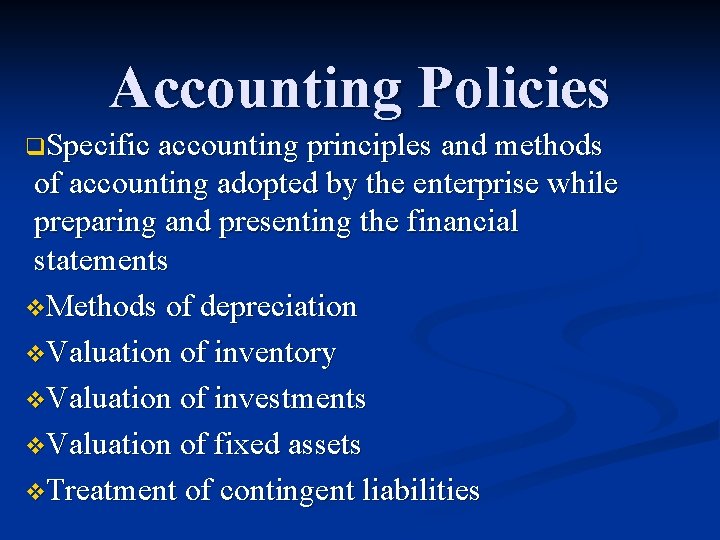

Accounting Policies q. Specific accounting principles and methods of accounting adopted by the enterprise while preparing and presenting the financial statements v. Methods of depreciation v. Valuation of inventory v. Valuation of investments v. Valuation of fixed assets v. Treatment of contingent liabilities

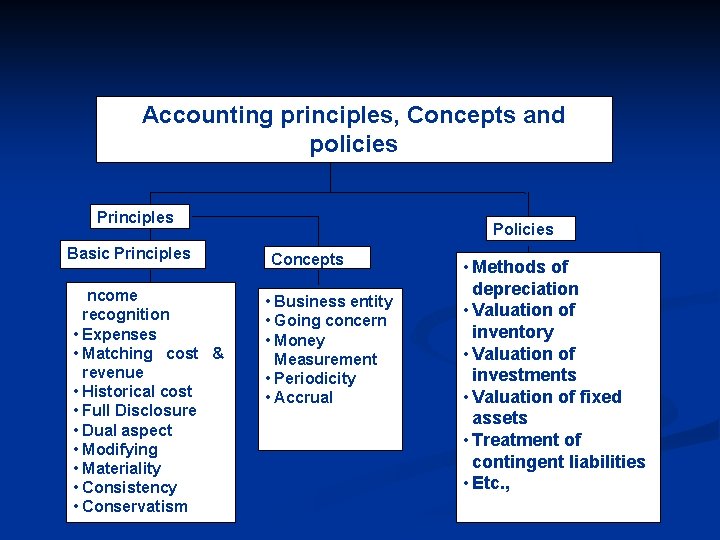

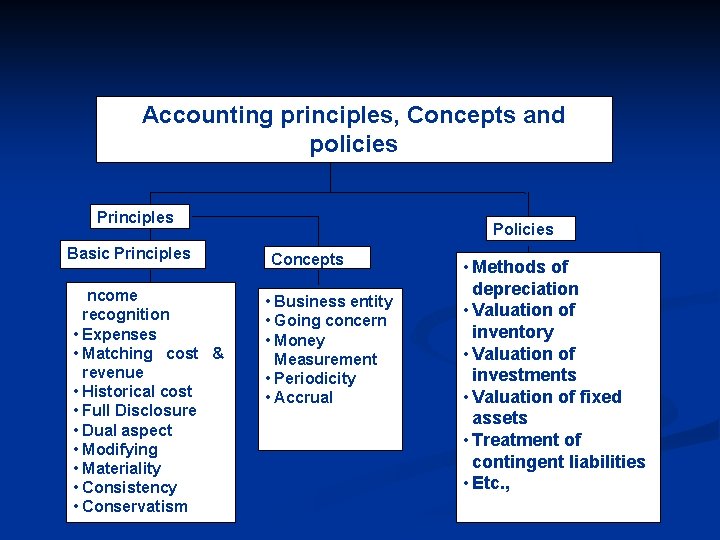

Accounting principles, Concepts and policies Principles Basic Principles • Income recognition • Expenses • Matching cost & revenue • Historical cost • Full Disclosure • Dual aspect • Modifying • Materiality • Consistency • Conservatism Policies Concepts • Business entity • Going concern • Money Measurement • Periodicity • Accrual • Methods of depreciation • Valuation of inventory • Valuation of investments • Valuation of fixed assets • Treatment of contingent liabilities • Etc. ,

THANKS

Accounting principles and policies

Accounting principles and policies Security program and policies principles and practices

Security program and policies principles and practices Security program and policies principles and practices

Security program and policies principles and practices Security program and policies principles and practices

Security program and policies principles and practices Security program and policies principles and practices

Security program and policies principles and practices Security program and policies principles and practices

Security program and policies principles and practices Tricker corporate governance

Tricker corporate governance Accounting principles and concepts

Accounting principles and concepts Managerial accounting and cost concepts

Managerial accounting and cost concepts Nps management policies

Nps management policies Nixons foreign policies

Nixons foreign policies Crime control policies

Crime control policies What are policies

What are policies Manuel roxas programs and policies

Manuel roxas programs and policies Disk structure in os

Disk structure in os