Utility Rates and Comparison of Investor Owned vs

- Slides: 18

Utility Rates and Comparison of Investor Owned vs. Municipal Utilities Presented by: Kent Taylor Chairman KTM Energy Consulting Services 777 29 th Street, Suite 200, Boulder, Colorado 80303 March 5, 2015 1

Outline I. Introduction II. Rate Making Process – Municipal vs IOU III. Cash Requirements vs Cost-of-Service Rate Making IV. Issue: Compliance with Ballot Issue 2 C V. Issue: Customer Classes and Cost Allocation/Rate Design 2

I. Introduction A. KTM’s industry credential B. Municipal utility appreciation C. KTM has no direct financial interest in an outcome D. Absence of evangelical fervor – getting it right E. Technicians vs zealots 3

II. Rate Making Process – Municipal vs IOU A. Muni 1. Cash requirements. 2. Utility management requests approval of next budget as the basis of new rates. 3. Governing Body (City Council) approves. 4. Absence of professional adversarial Staff. B. IOU 1. Cost-of-service. 2. Requests new rates from regulatory body. 3. CPUC Staff is paid to oppose. C. Intervention Process Comparison – executable models required in IOU rate cases. 4

III. Cash Requirements vs Cost-of-Service Rate Making A. Revenue Requirement Comparisons B. Cost Allocation and Rate Design C. Cost Causation Differences 5

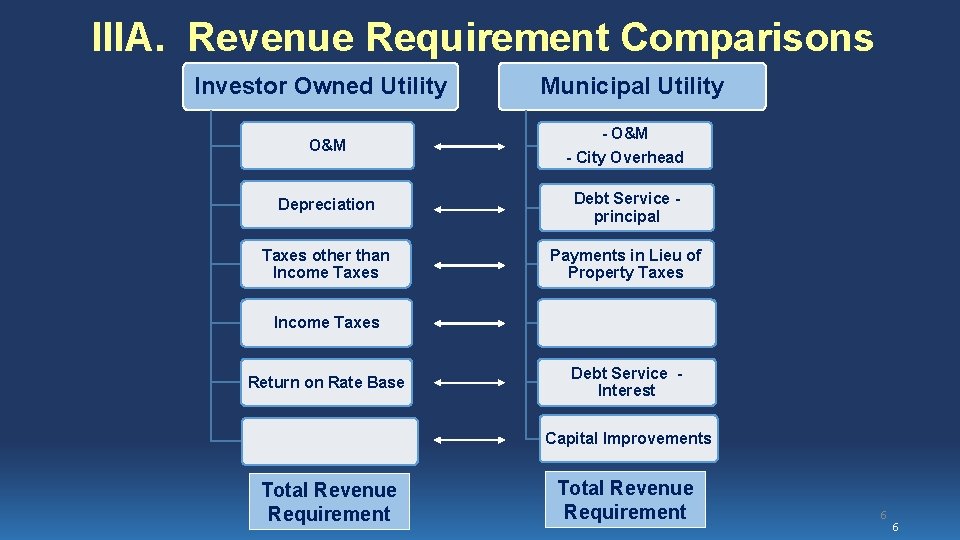

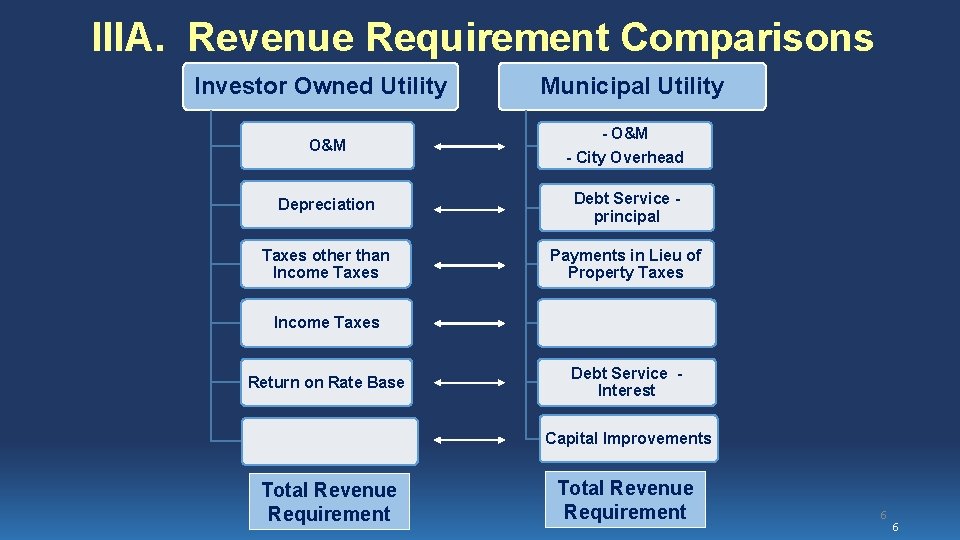

IIIA. Revenue Requirement Comparisons Investor Owned Utility O&M Municipal Utility - O&M - City Overhead Depreciation Debt Service principal Taxes other than Income Taxes Payments in Lieu of Property Taxes Income Taxes Return on Rate Base Debt Service Interest Capital Improvements Total Revenue Requirement 6 6

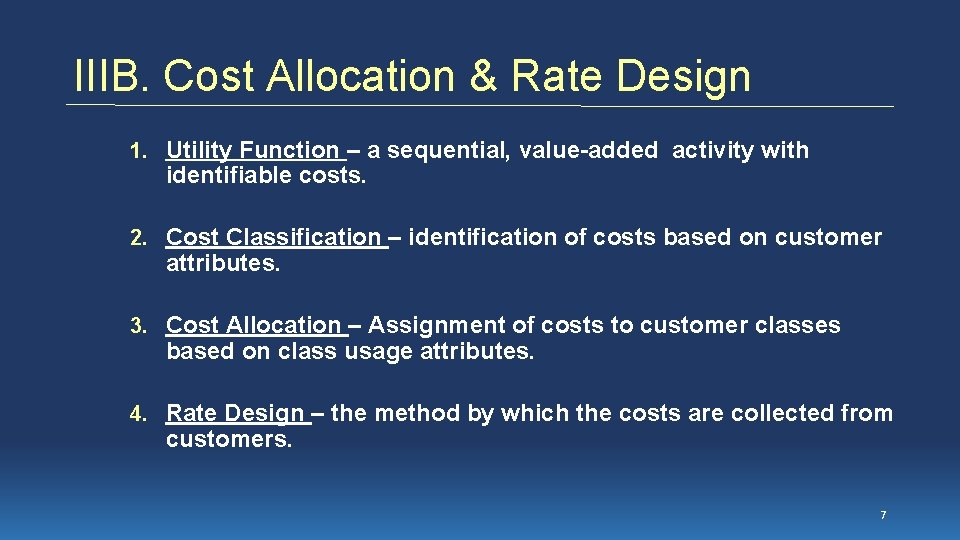

IIIB. Cost Allocation & Rate Design 1. Utility Function – a sequential, value-added activity with identifiable costs. 2. Cost Classification – identification of costs based on customer attributes. 3. Cost Allocation – Assignment of costs to customer classes based on class usage attributes. 4. Rate Design – the method by which the costs are collected from customers. 7

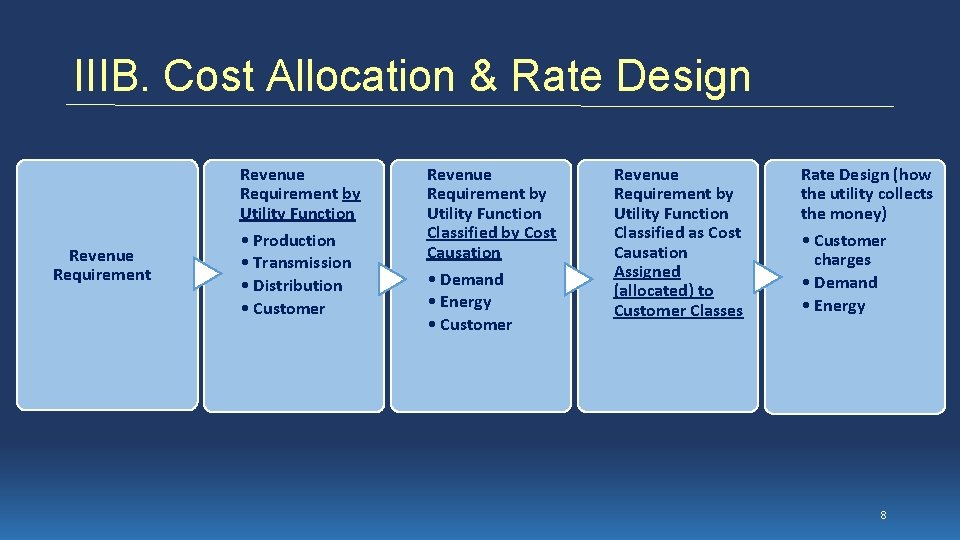

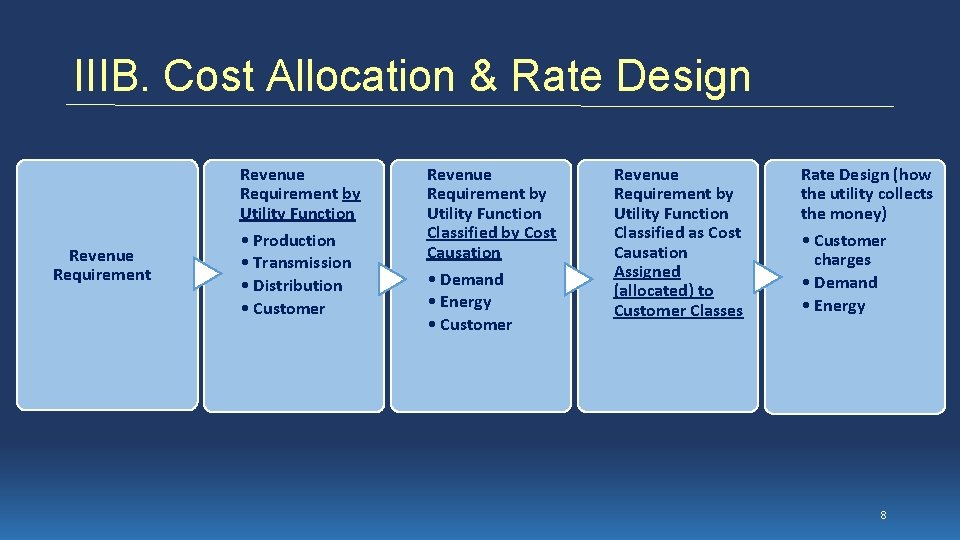

IIIB. Cost Allocation & Rate Design Revenue Requirement by Utility Function • Production • Transmission • Distribution • Customer Revenue Requirement by Utility Function Classified by Cost Causation • Demand • Energy • Customer Revenue Requirement by Utility Function Classified as Cost Causation Assigned (allocated) to Customer Classes Rate Design (how the utility collects the money) • Customer charges • Demand • Energy 8

IIIC. Cost Causation Differences 1. Cost causation differences exist because a. Different Customer Classes use different facilities. b. Usage Profiles – peak hour usage compared average hour usage. 9

IV. Issue: Compliance with Ballot Issue 2 C A. “and charge rates that do not exceed those rates charged by Xcel Energy at the time of acquisition and that such rates will produce revenues sufficient to pay for operating expenses and debt payments, plus an amount equal to twenty-five percent (25%) of the debt payments; and with the reliability comparable to Xcel Energy and a plan for reduced greenhouse gas emissions and other pollutants and increased renewable energy. ” B. Hypothesis: The City will not include debt service in revenue recovery. C. Test: 1. Examine the debt service schedules which support the cash flow model. 2. Ask the City if hypothesis is true. 10

IV. Issue: Compliance with Ballot Issue 2 C D. Tentative Conclusions: 1. The interest/principal on the debt related to assets in service on day one should be included in currently recovered operating revenue. 2. Operating revenues should be matched with the costs to provide the service. 3. Capitalizing the interest related to in-service assets perverts the regulatory principles on AFUDC. 4. If hypothesis is correct, Ballot Issue 2 C is not a constraint. 11

IV. Issue: Compliance with Ballot Issue 2 C E. Normal Regulatory Principles: 1. Allowance for Funds Used During Construction (AFUDC) 2. Special Situations for Capitalizing Interest a. Example: The City borrows money for system acquisition prior to service commencement 3. Current service should be responsible for current costs 12

V. Issue: Customer Classes and Cost Allocation/Rate Design A. Hypothesis: The City has not yet considered differences in customer class rates. B. Discussion: Xcel performs a series of calculations to functionalize, classify, and allocate its annual revenue requirement and then design rates based on those calculations. How will the City recognize cost causation between customer classes? C. Example: transmission customers take power on the high voltage side of a substation. Xcel assigns no distribution costs to that customer class. 13

V. Issue: Customer Classes and Cost Allocation/Rate Design D. Does the City intend to charge its transmission level customers for a portion of the distribution system costs. i. e. , debt service on the distribution system acquisition? E. Test: 1. Ask the City whether it intends to require primary general, secondary general, and transmission level customers to subsidize residential rate payers. 2. If the City intends to acknowledge cost causation attributes, what happens if a customer class does not satisfy the initial rate constraint of Ballot Issue 2 C? 14

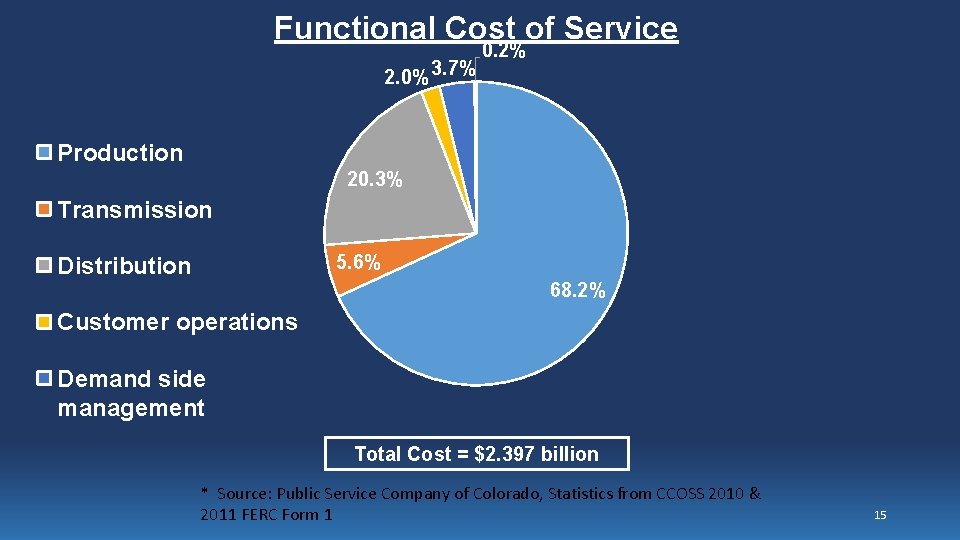

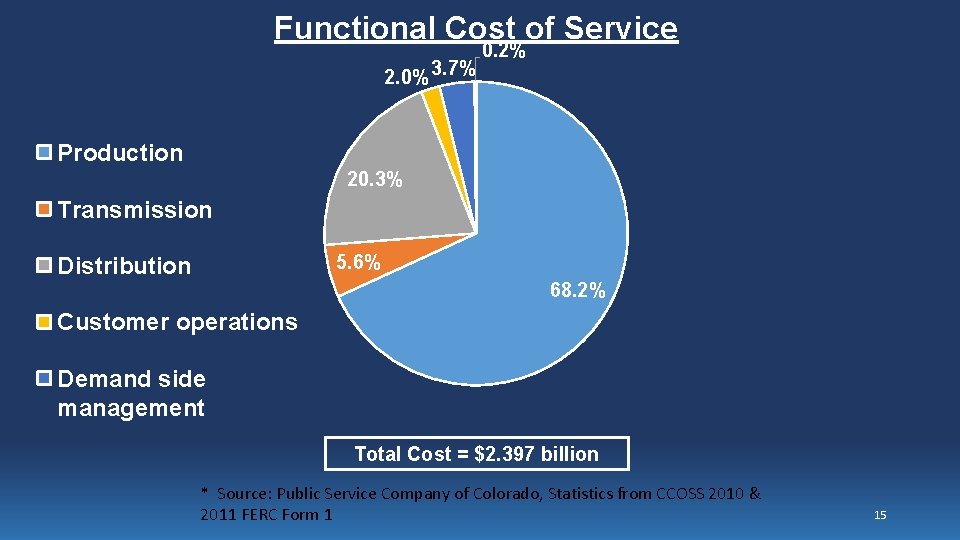

Functional Cost of Service 2. 0% 3. 7% 0. 2% Production 20. 3% Transmission 5. 6% Distribution 68. 2% Customer operations Demand side management Total Cost = $2. 397 billion * Source: Public Service Company of Colorado, Statistics from CCOSS 2010 & 2011 FERC Form 1 15

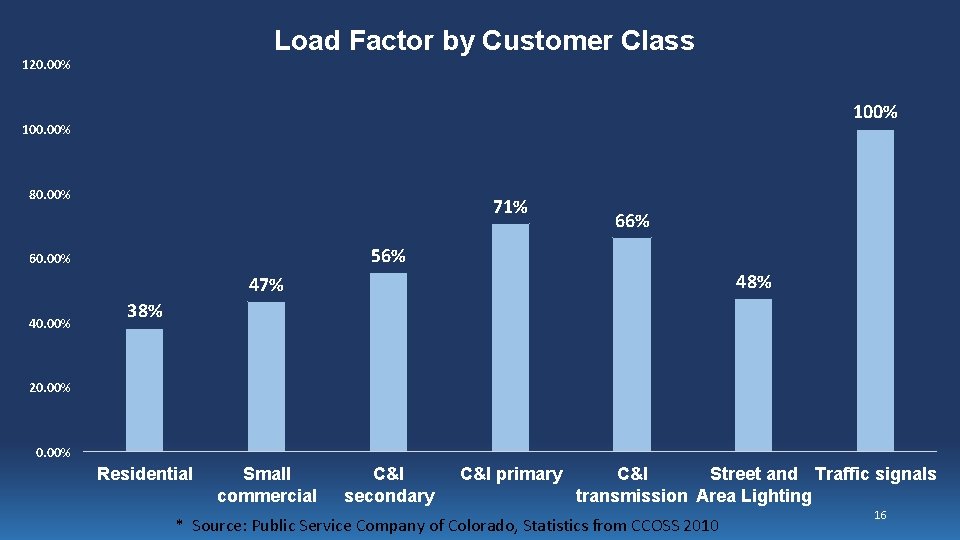

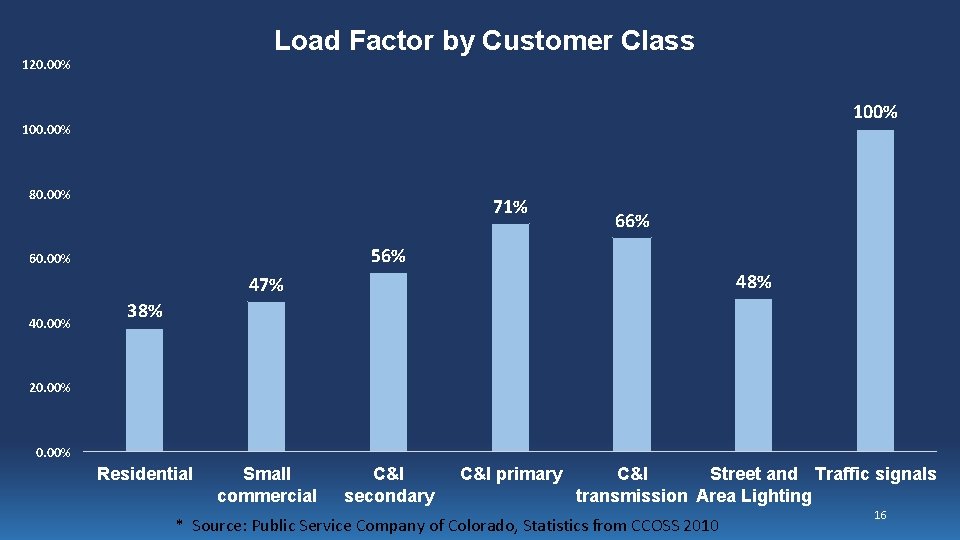

Load Factor by Customer Class 120. 00% 100. 00% 80. 00% 71% 66% 56% 60. 00% 48% 47% 40. 00% 38% 20. 00% Residential Small commercial C&I secondary C&I primary C&I Street and Traffic signals transmission Area Lighting * Source: Public Service Company of Colorado, Statistics from CCOSS 2010 16

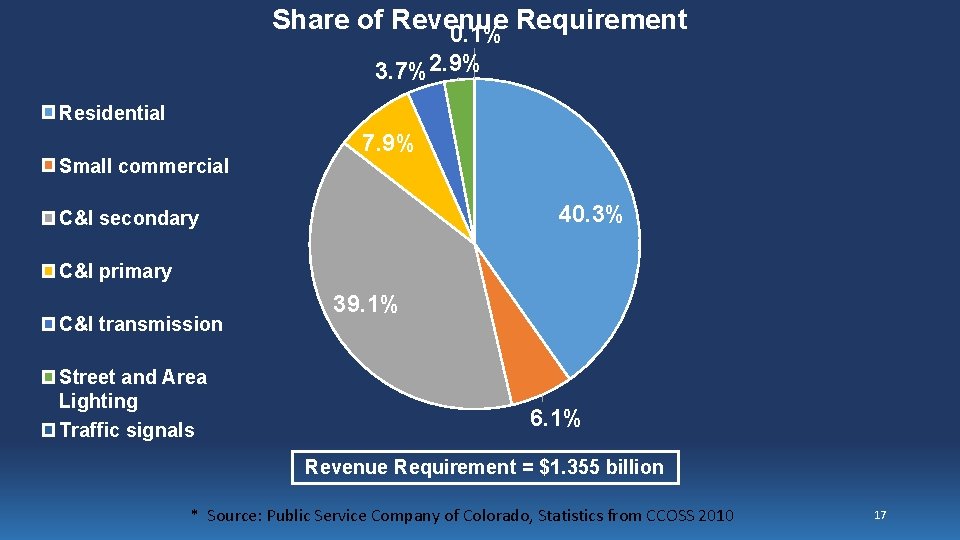

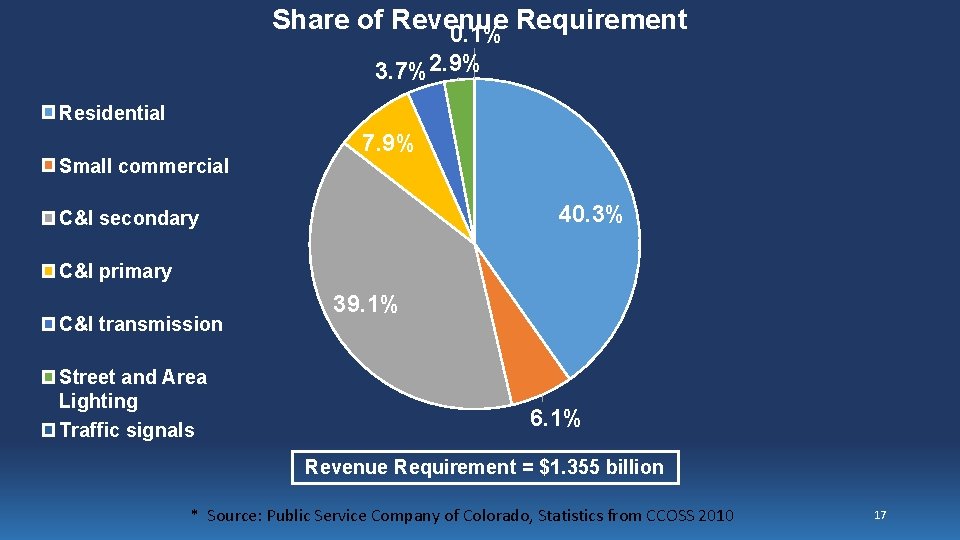

Share of Revenue Requirement 0. 1% 3. 7%2. 9% Residential Small commercial 7. 9% 40. 3% C&I secondary C&I primary C&I transmission Street and Area Lighting Traffic signals 39. 1% 6. 1% Revenue Requirement = $1. 355 billion * Source: Public Service Company of Colorado, Statistics from CCOSS 2010 17

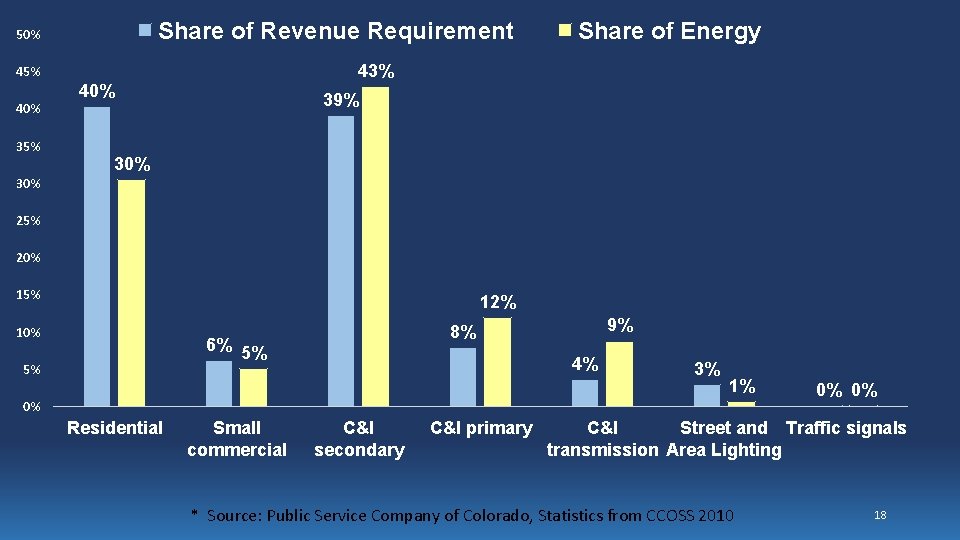

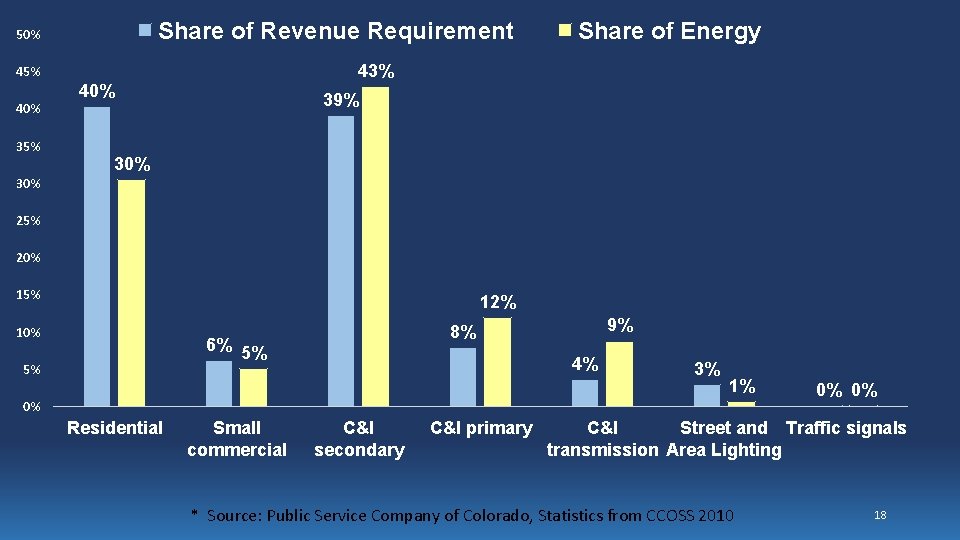

Share of Revenue Requirement 50% 43% 45% 40% 35% Share of Energy 40% 39% 30% 25% 20% 15% 12% 10% 6% 5% 5% 9% 8% 4% 3% 1% 0% Residential Small commercial C&I secondary C&I primary 0% 0% C&I Street and Traffic signals transmission Area Lighting * Source: Public Service Company of Colorado, Statistics from CCOSS 2010 18

Ratios rates and unit rates

Ratios rates and unit rates Equivalent ratios definition

Equivalent ratios definition Ratios rates and unit rates

Ratios rates and unit rates Ratios rates and unit rates

Ratios rates and unit rates Capital allocation to risky assets

Capital allocation to risky assets Budget constraint

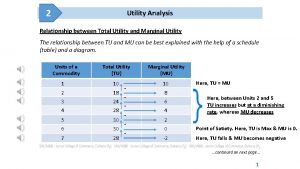

Budget constraint Relation between marginal utility and total utility

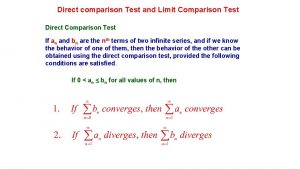

Relation between marginal utility and total utility Limit comparison test and direct comparison test

Limit comparison test and direct comparison test Family operated business

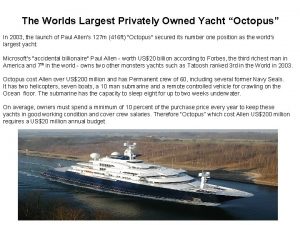

Family operated business Largest privately owned yacht

Largest privately owned yacht Fdi meaning

Fdi meaning Bank repossessed aircraft

Bank repossessed aircraft Government owned bank

Government owned bank Is chapstick owned by pfizer

Is chapstick owned by pfizer Resources owned by a business are referred to as

Resources owned by a business are referred to as A business owned by a single person

A business owned by a single person For the first time in forever meaning

For the first time in forever meaning Who owns the federal reserve rothschild

Who owns the federal reserve rothschild Owned goods examples

Owned goods examples