To identify evaluate whether its resources have got

- Slides: 16

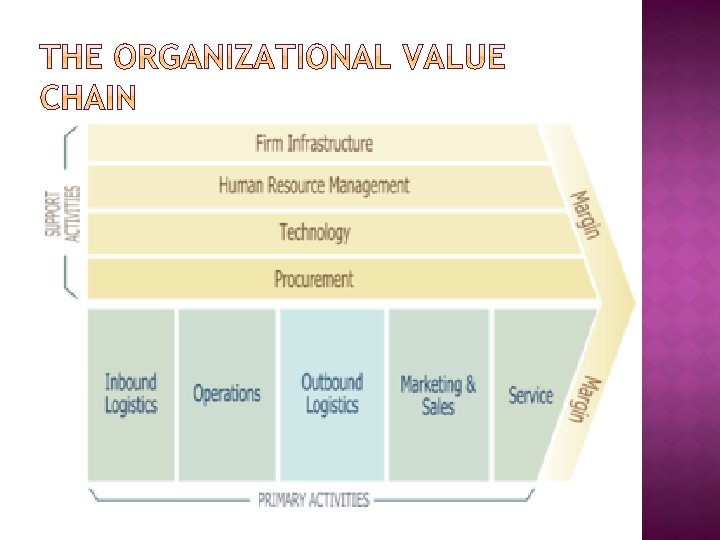

� To identify & evaluate whether its resources have got any strategic value or not a firm generally uses various approaches � The approaches are-----1. Value Chain Analysis (VCA)---Ø A value chain identifies & isolates the various economic value-adding activities (such as differentiating a product, lowering the cost, & meeting customer’s needs quickly) that occur in some way in every firm

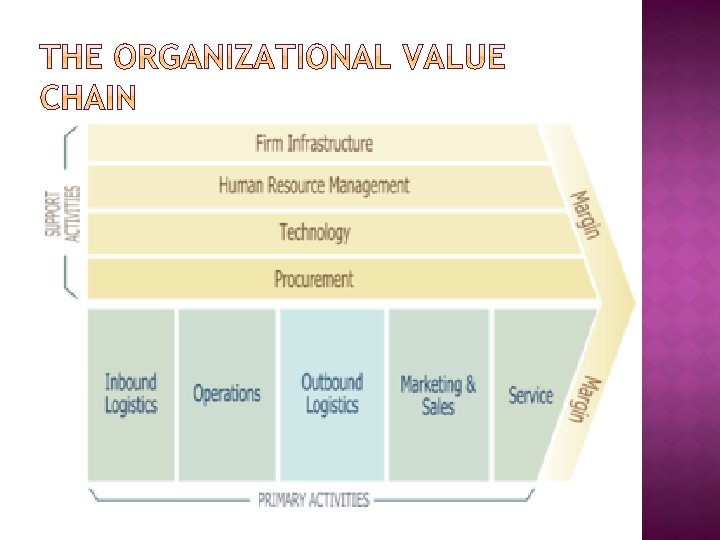

Value Chain Analysis offers an excellent means by which managers can find the strengths & weaknesses of each activity vis-à -vis the firm’s competitors Ø It tells where low cost advantage exists, in what ways each activity can be undertaken so as to differentiate it from that of a firm’s competitors Ø The value creating activities of a firm, according to porter, may be divided into two categories ----Primary & Secondary Activities Ø

Primary activities represent the important tasks a firm performs to produce & deliver a product or service to a customer Ø These include inbound logistics, operations, outbound logistics, marketing & sales etc. Ø Secondary or Support activities work to enhance or to help the functioning of primary activities Ø These include infrastructure, HRM, technology development etc. Ø

� VCA involves the following steps: q Identify Activities: v a firm needs to divide its operations into primary & support activity categories v Within each category a firm may typically perform a number of discrete activities that may reflect its key strengths or weaknesses q Allocate Costs: v VCA requires managers to assign costs & assets to each activity

Identify Activities that Differentiate the Firm: v Here managers should try to identify several sources of differentiation advantage relative to competitors q Examine the Value Chain: v Once the value chain has been described, managers should list the activities that are important to buyer satisfaction & market success v Keeping costs under strict monitoring, offering value added service at each stage, doing things better than rivals are part of this strategy q

2. Strategic Advantage Profile(SAP): � SAP tries to find out organizational strengths & weaknesses in relation to certain success factors (advantage factors or competence factors) within a particular industry � Many industries have relatively small but extremely important sets of factors that are essential for successfully gaining & maintaining competitive advantages, known as critical success factors (CSFs) � CSFs have a significant bearing on the overall growth of a firm within an industry

� Research has identified four major sources of CSFs in general------v Industry Characteristics: q CSFs are often industry specific. q CSF in supermarket chains include inventory turnover, product mix, sales promotion, pricing etc q CSF in airline industry would be fuel efficiency, load factors etc. q No one set of CSF applies to all industries q As industries change CSFs would also change

Competitive Position: q CSFs vary with a firm’s position relative to its rivals in the field q Every competitive move by the big players poses innumerable problems to smaller firms (e. g. price concessions, promotional offers etc) v General Environment: q Changes in any of the dimensions of the general environment i. e. , political, legal, socio-cultural, demographic etc. can affect the CSFs q E. g. – not giving tax exemptions to R&D expenditure of pharmaceutical firms would always come in the way of growth & expansion plans of players in this field v

v Organizational Developments: q Internal developments take the centre stage & give rise to CSFs 3. Benchmarking: � A benchmark is a reference point for taking measures against � The process of benchmarking is aimed at finding the best practices within & outside the industry to which an organization belongs � The purpose is to find the best performers in an area so that one could match one’s own performance with them & even surpass them

� When one is interested in finding out what is to be compared, then there are three types of benchmarking---v Performance Benchmarking: comparing one’s own performance with that of some other organization for the purpose of determining how good one’s own organization is v Process Benchmarking: comparing the methods & practices for performing processes v Strategic Benchmarking: comparing the long term, significant decisions & actions undertaken by other organizations to achieve their objectives

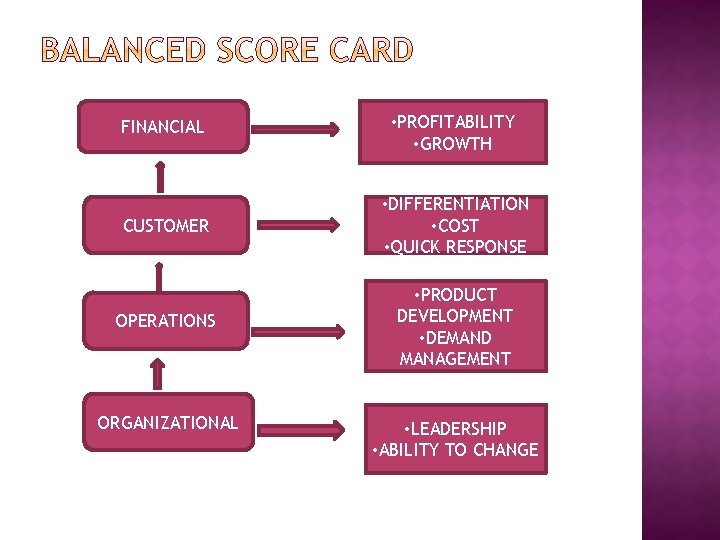

�R S Kaplan & D P Norton came out with a popular approach named as ‘Balanced Score Card’ � It allows managers to evaluate a firm from different perspectives � The performance as assessed in one perspective supports performance in other areas

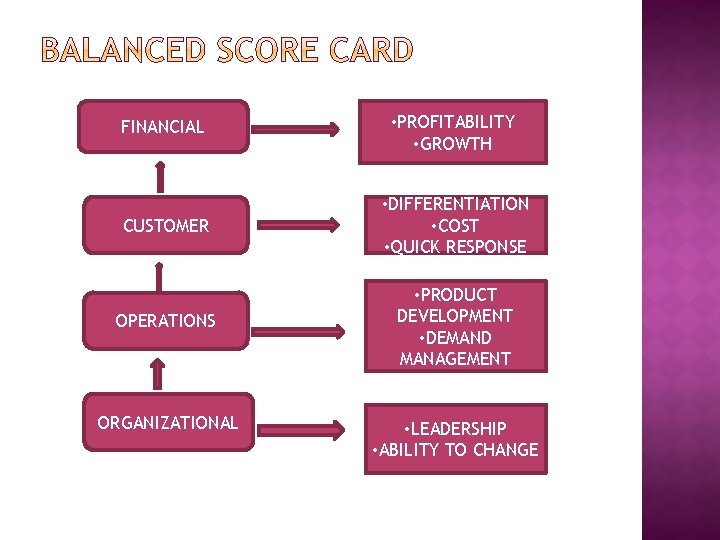

FINANCIAL • PROFITABILITY • GROWTH CUSTOMER • DIFFERENTIATION • COST • QUICK RESPONSE OPERATIONS • PRODUCT DEVELOPMENT • DEMAND MANAGEMENT ORGANIZATIONAL • LEADERSHIP • ABILITY TO CHANGE

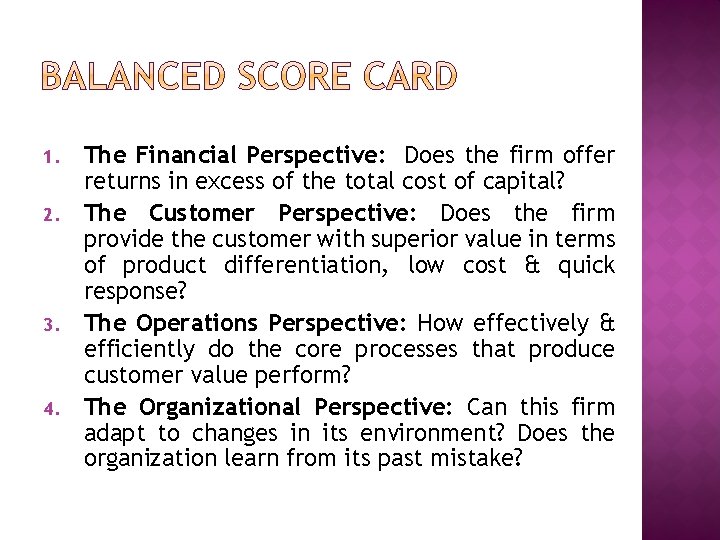

1. 2. 3. 4. The Financial Perspective: Does the firm offer returns in excess of the total cost of capital? The Customer Perspective: Does the firm provide the customer with superior value in terms of product differentiation, low cost & quick response? The Operations Perspective: How effectively & efficiently do the core processes that produce customer value perform? The Organizational Perspective: Can this firm adapt to changes in its environment? Does the organization learn from its past mistake?

THANK YOU