SEZs in India A Quantitative Assessment of Costs

- Slides: 22

SEZs in India : A Quantitative Assessment of Costs and Benefits Aradhna Aggarwal Associate Professor Department of Business Economics University of Delhi Consultant : ICRIER aradhna. aggarwal@gmail. com

Contents • • • The Rationale Benefits and costs: Theoretical approaches Net Benefits: A quantitative assessment Benefits and costs : Qualitative analysis Conclusion

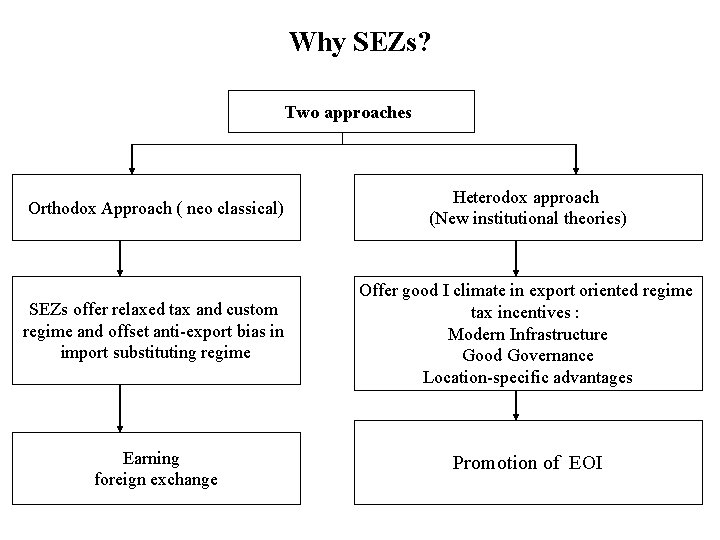

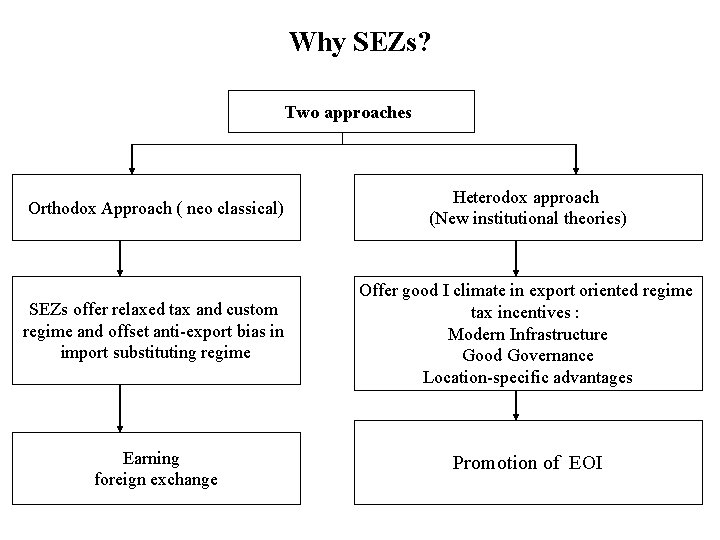

Why SEZs? Two approaches Orthodox Approach ( neo classical) Heterodox approach (New institutional theories) SEZs offer relaxed tax and custom regime and offset anti-export bias in import substituting regime Offer good I climate in export oriented regime tax incentives : Modern Infrastructure Good Governance Location-specific advantages Earning foreign exchange Promotion of EOI

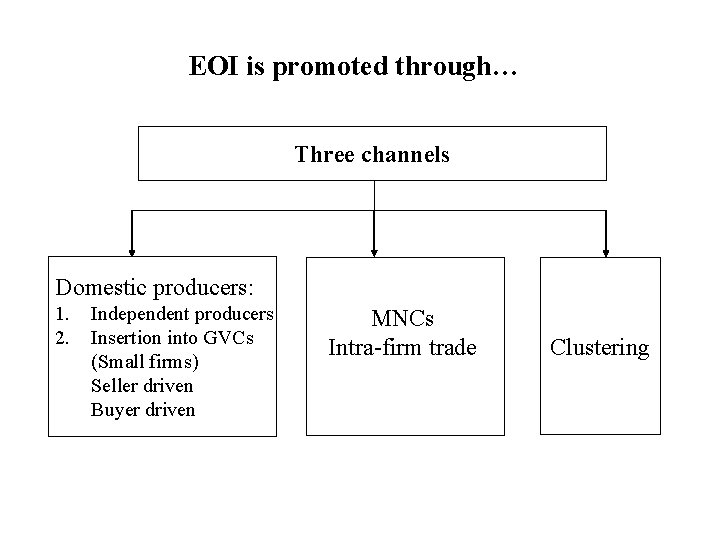

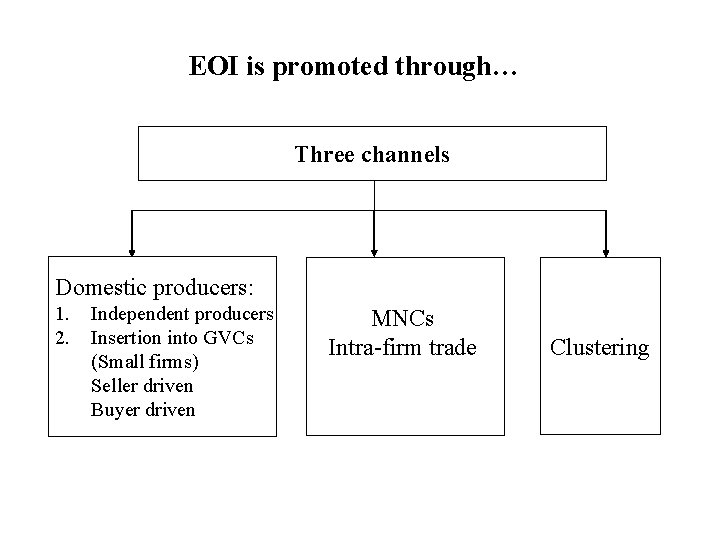

EOI is promoted through… Three channels Domestic producers: 1. 2. Independent producers Insertion into GVCs (Small firms) Seller driven Buyer driven MNCs Intra-firm trade Clustering

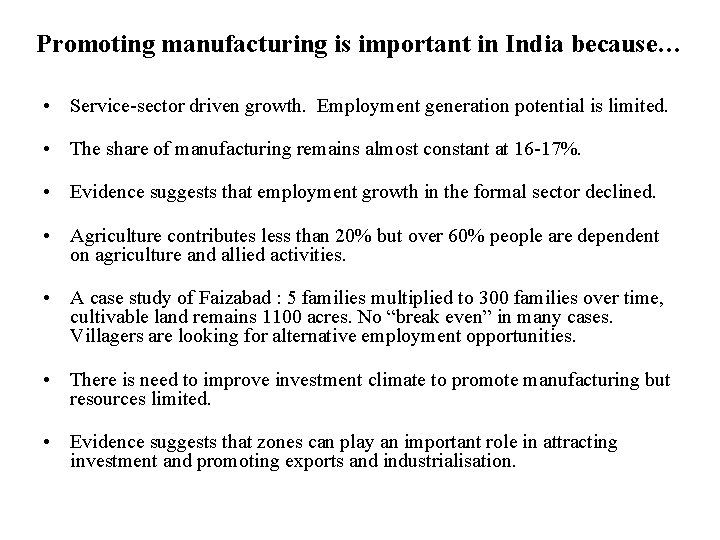

Promoting manufacturing is important in India because… • Service-sector driven growth. Employment generation potential is limited. • The share of manufacturing remains almost constant at 16 -17%. • Evidence suggests that employment growth in the formal sector declined. • Agriculture contributes less than 20% but over 60% people are dependent on agriculture and allied activities. • A case study of Faizabad : 5 families multiplied to 300 families over time, cultivable land remains 1100 acres. No “break even” in many cases. Villagers are looking for alternative employment opportunities. • There is need to improve investment climate to promote manufacturing but resources limited. • Evidence suggests that zones can play an important role in attracting investment and promoting exports and industrialisation.

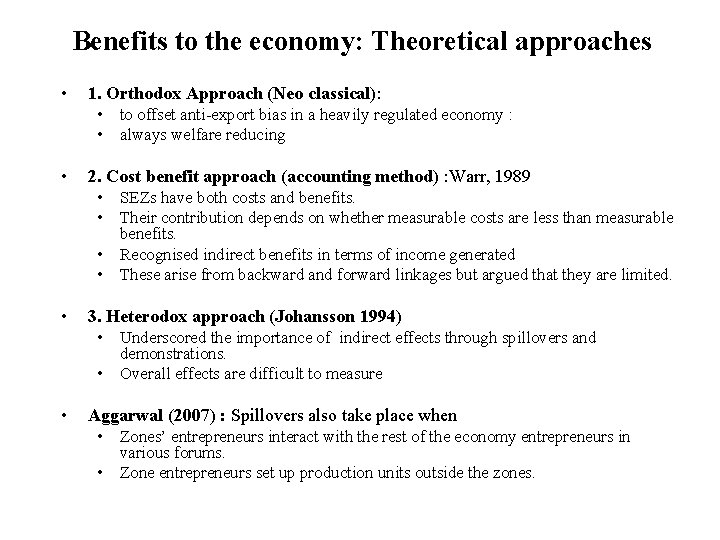

Benefits to the economy: Theoretical approaches • 1. Orthodox Approach (Neo classical): • to offset anti-export bias in a heavily regulated economy : • always welfare reducing • 2. Cost benefit approach (accounting method) : Warr, 1989 • SEZs have both costs and benefits. • Their contribution depends on whether measurable costs are less than measurable benefits. • Recognised indirect benefits in terms of income generated • These arise from backward and forward linkages but argued that they are limited. • 3. Heterodox approach (Johansson 1994) • Underscored the importance of indirect effects through spillovers and demonstrations. • Overall effects are difficult to measure • Aggarwal (2007) : Spillovers also take place when • Zones’ entrepreneurs interact with the rest of the economy entrepreneurs in various forums. • Zone entrepreneurs set up production units outside the zones.

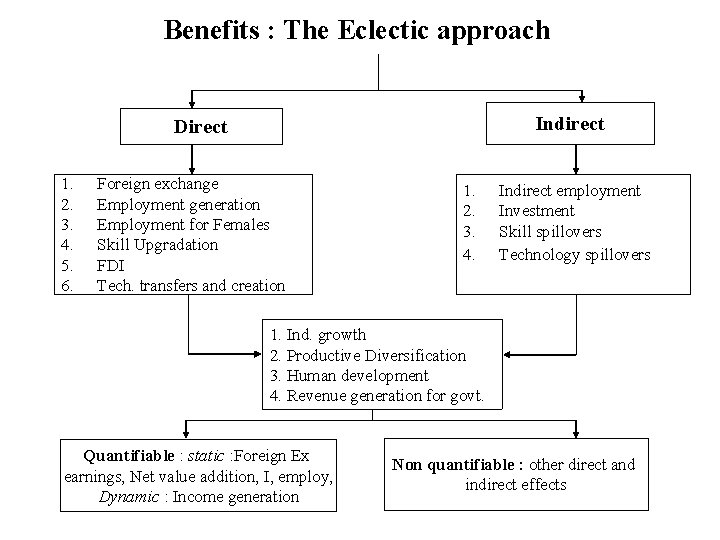

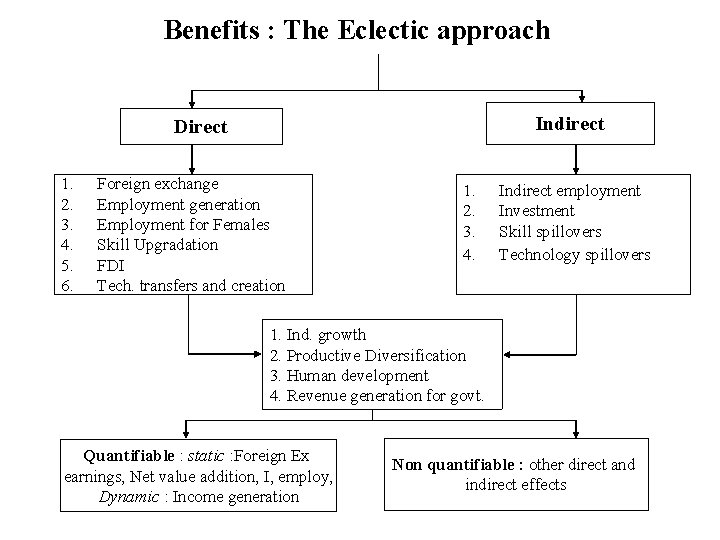

Benefits : The Eclectic approach Indirect Direct 1. 2. 3. 4. 5. 6. Foreign exchange Employment generation Employment for Females Skill Upgradation FDI Tech. transfers and creation 1. 2. 3. 4. Indirect employment Investment Skill spillovers Technology spillovers 1. Ind. growth 2. Productive Diversification 3. Human development 4. Revenue generation for govt. Quantifiable : static : Foreign Ex earnings, Net value addition, I, employ, Dynamic : Income generation Non quantifiable : other direct and indirect effects

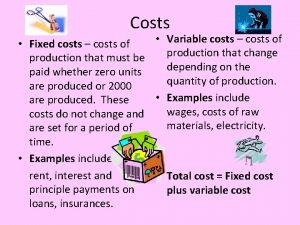

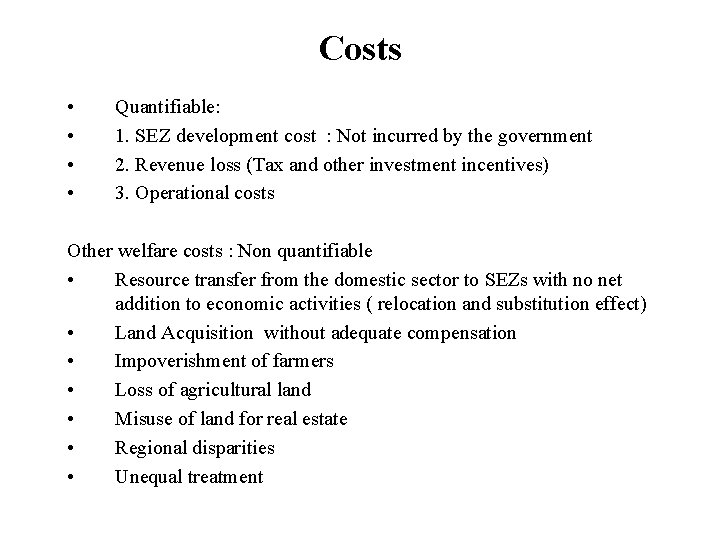

Costs • • Quantifiable: 1. SEZ development cost : Not incurred by the government 2. Revenue loss (Tax and other investment incentives) 3. Operational costs Other welfare costs : Non quantifiable • Resource transfer from the domestic sector to SEZs with no net addition to economic activities ( relocation and substitution effect) • Land Acquisition without adequate compensation • Impoverishment of farmers • Loss of agricultural land • Misuse of land for real estate • Regional disparities • Unequal treatment

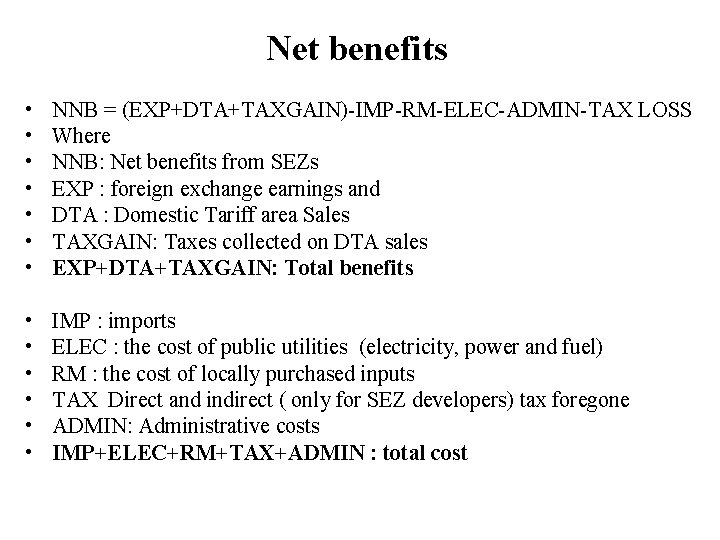

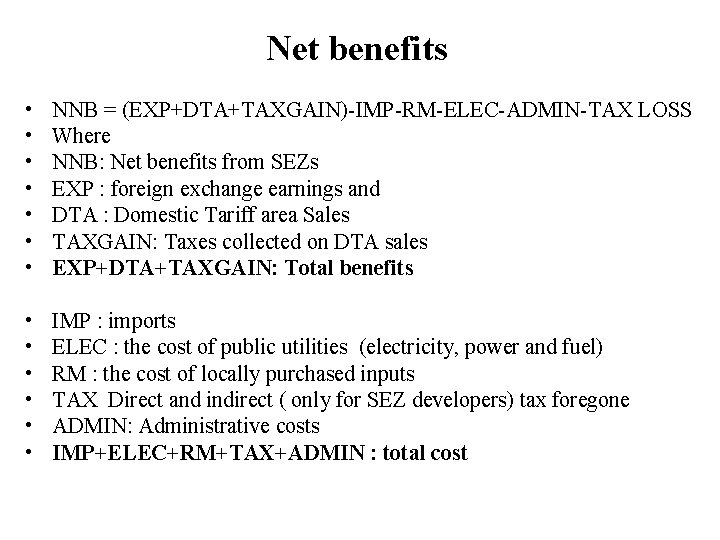

Net benefits • • NNB = (EXP+DTA+TAXGAIN)-IMP-RM-ELEC-ADMIN-TAX LOSS Where NNB: Net benefits from SEZs EXP : foreign exchange earnings and DTA : Domestic Tariff area Sales TAXGAIN: Taxes collected on DTA sales EXP+DTA+TAXGAIN: Total benefits • • • IMP : imports ELEC : the cost of public utilities (electricity, power and fuel) RM : the cost of locally purchased inputs TAX Direct and indirect ( only for SEZ developers) tax foregone ADMIN: Administrative costs IMP+ELEC+RM+TAX+ADMIN : total cost

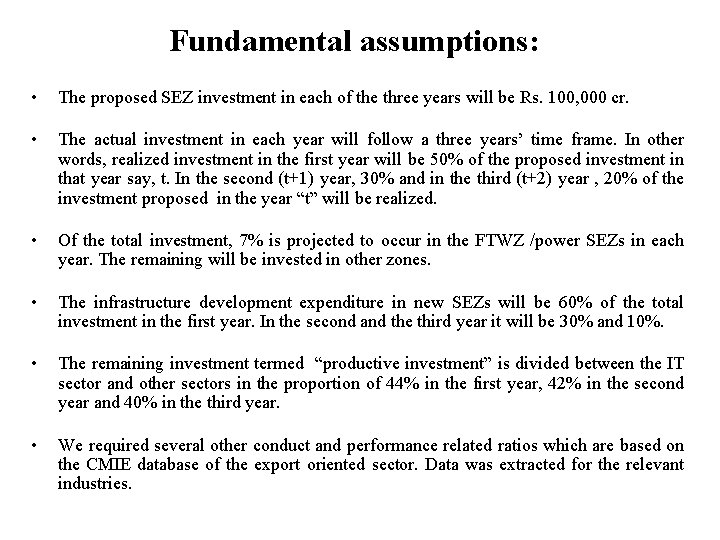

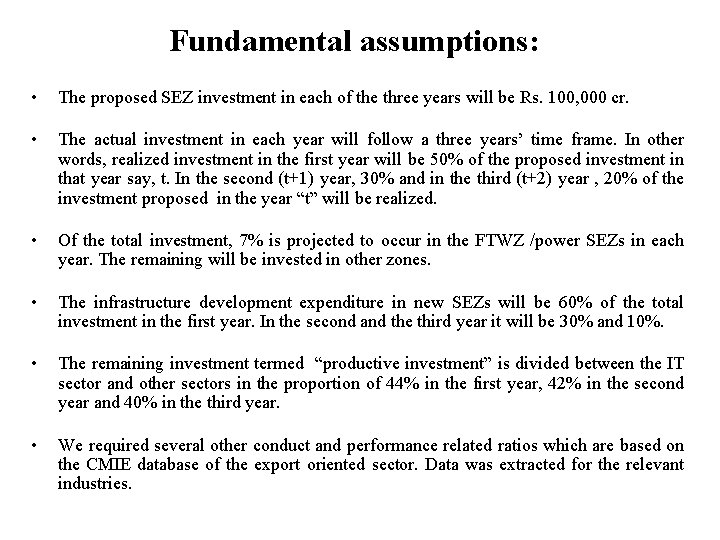

Fundamental assumptions: • The proposed SEZ investment in each of the three years will be Rs. 100, 000 cr. • The actual investment in each year will follow a three years’ time frame. In other words, realized investment in the first year will be 50% of the proposed investment in that year say, t. In the second (t+1) year, 30% and in the third (t+2) year , 20% of the investment proposed in the year “t” will be realized. • Of the total investment, 7% is projected to occur in the FTWZ /power SEZs in each year. The remaining will be invested in other zones. • The infrastructure development expenditure in new SEZs will be 60% of the total investment in the first year. In the second and the third year it will be 30% and 10%. • The remaining investment termed “productive investment” is divided between the IT sector and other sectors in the proportion of 44% in the first year, 42% in the second year and 40% in the third year. • We required several other conduct and performance related ratios which are based on the CMIE database of the export oriented sector. Data was extracted for the relevant industries.

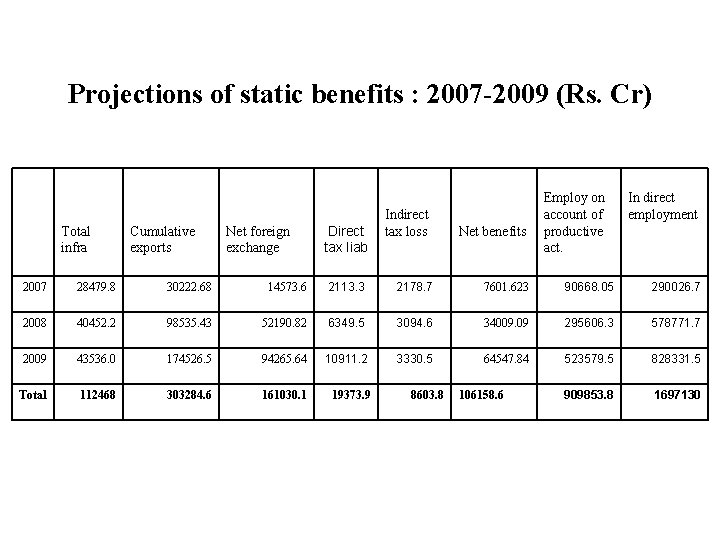

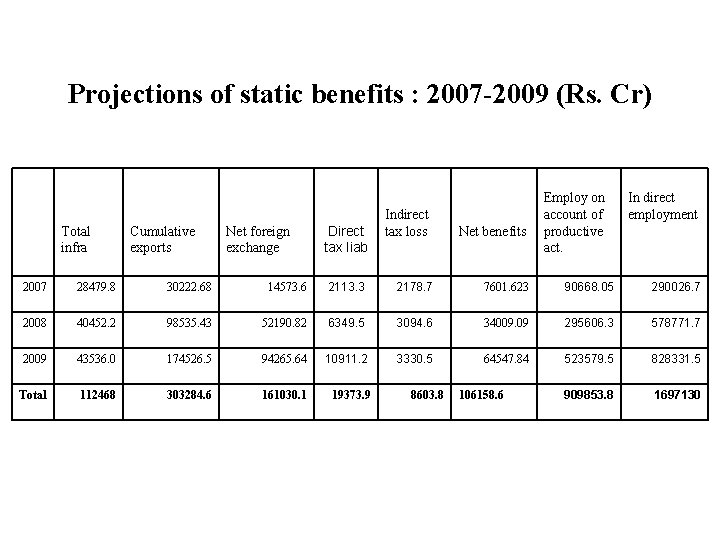

Projections of static benefits : 2007 -2009 (Rs. Cr) Total infra Cumulative exports Net foreign exchange Direct tax liab Indirect tax loss Net benefits Employ on account of productive act. In direct employment 2007 28479. 8 30222. 68 14573. 6 2113. 3 2178. 7 7601. 623 90668. 05 290026. 7 2008 40452. 2 98535. 43 52190. 82 6349. 5 3094. 6 34009. 09 295606. 3 578771. 7 2009 43536. 0 174526. 5 94265. 64 10911. 2 3330. 5 64547. 84 523579. 5 828331. 5 Total 112468 303284. 6 161030. 1 19373. 9 909853. 8 1697130 8603. 8 106158. 6

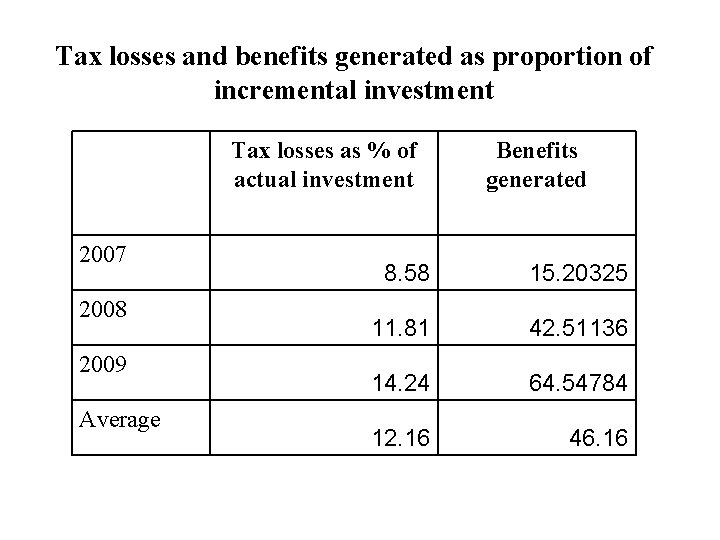

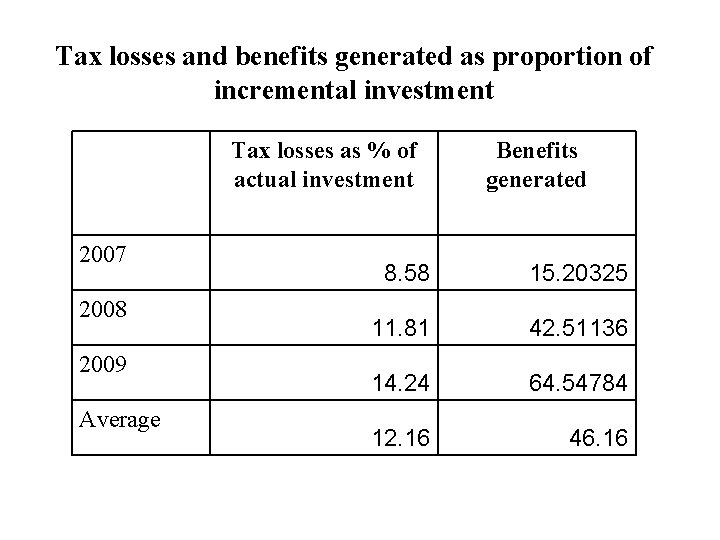

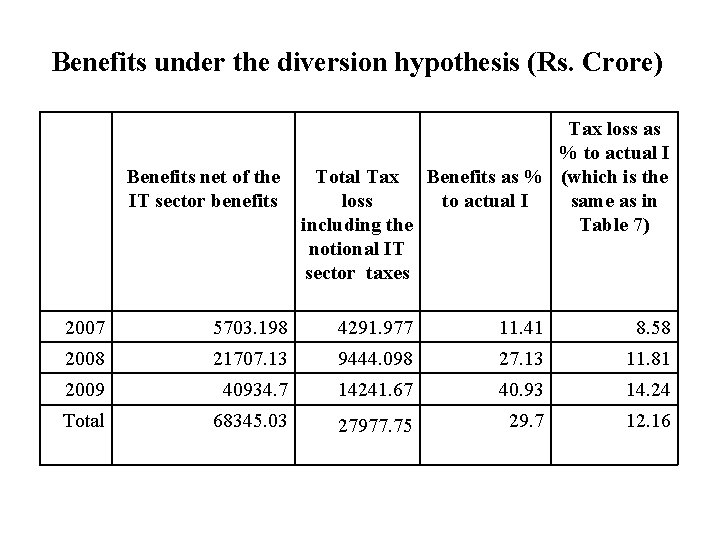

Tax losses and benefits generated as proportion of incremental investment Tax losses as % of actual investment 2007 2008 2009 Average Benefits generated 8. 58 15. 20325 11. 81 42. 51136 14. 24 64. 54784 12. 16 46. 16

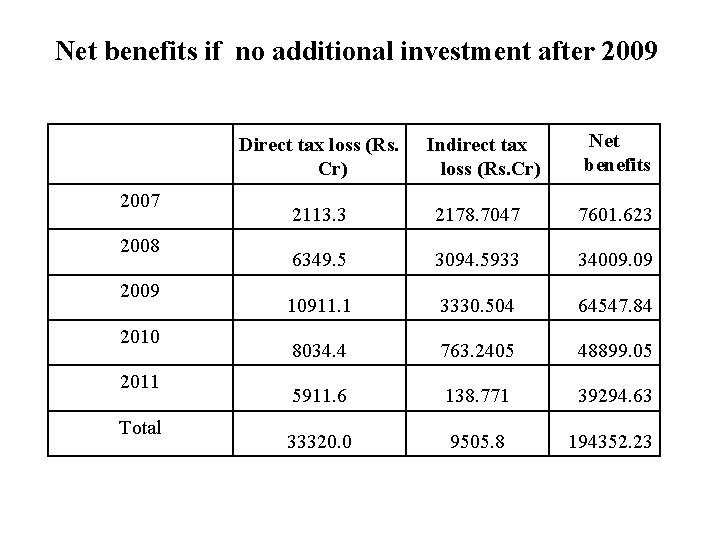

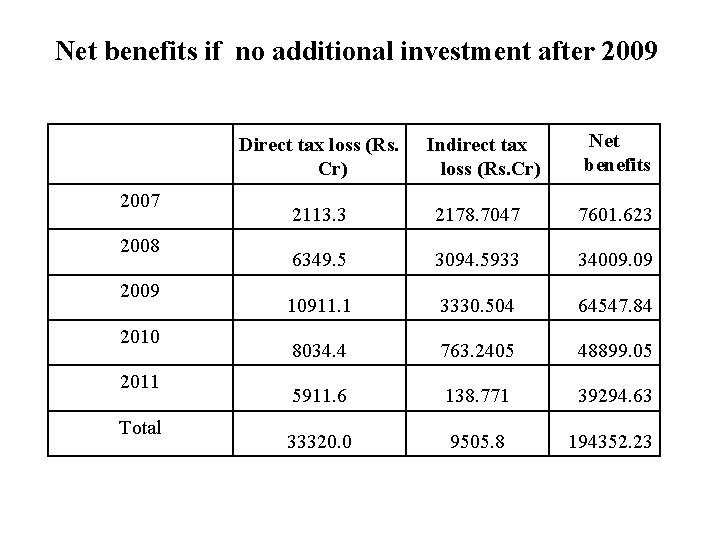

Net benefits if no additional investment after 2009 Direct tax loss (Rs. Cr) 2007 2008 2009 2010 2011 Total Indirect tax loss (Rs. Cr) Net benefits 2113. 3 2178. 7047 7601. 623 6349. 5 3094. 5933 34009. 09 10911. 1 3330. 504 64547. 84 8034. 4 763. 2405 48899. 05 5911. 6 138. 771 39294. 63 33320. 0 9505. 8 194352. 23

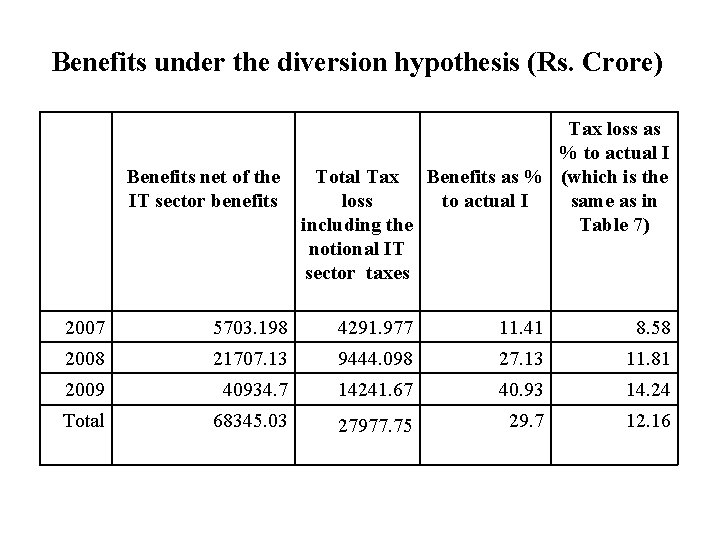

Benefits under the diversion hypothesis (Rs. Crore) Benefits net of the IT sector benefits Tax loss as % to actual I Total Tax Benefits as % (which is the loss to actual I same as in including the Table 7) notional IT sector taxes 2007 5703. 198 4291. 977 11. 41 8. 58 2008 21707. 13 9444. 098 27. 13 11. 81 2009 40934. 7 14241. 67 40. 93 14. 24 Total 68345. 03 27977. 75 29. 7 12. 16

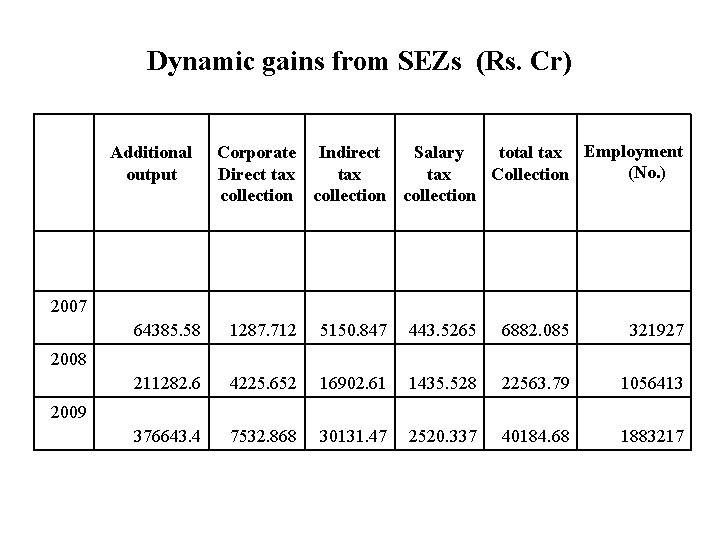

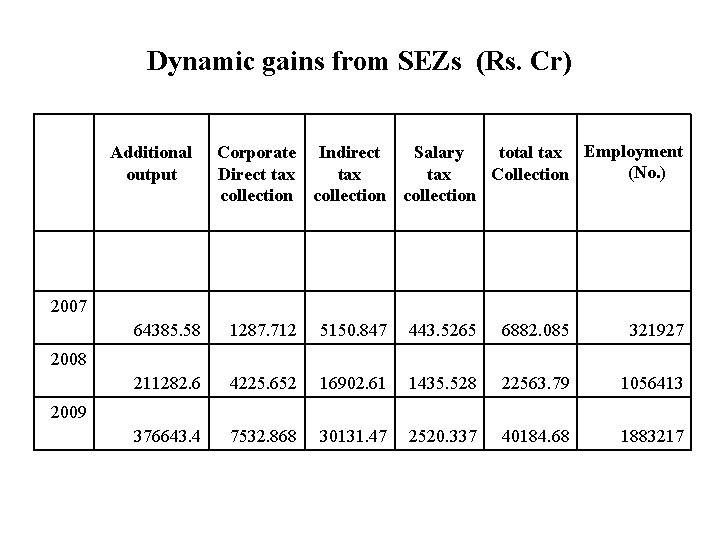

Dynamic gains from SEZs (Rs. Cr) Additional output Corporate Indirect Salary total tax Employment (No. ) Direct tax tax Collection collection 2007 64385. 58 1287. 712 5150. 847 443. 5265 6882. 085 321927 211282. 6 4225. 652 16902. 61 1435. 528 22563. 79 1056413 376643. 4 7532. 868 30131. 47 2520. 337 40184. 68 1883217 2008 2009

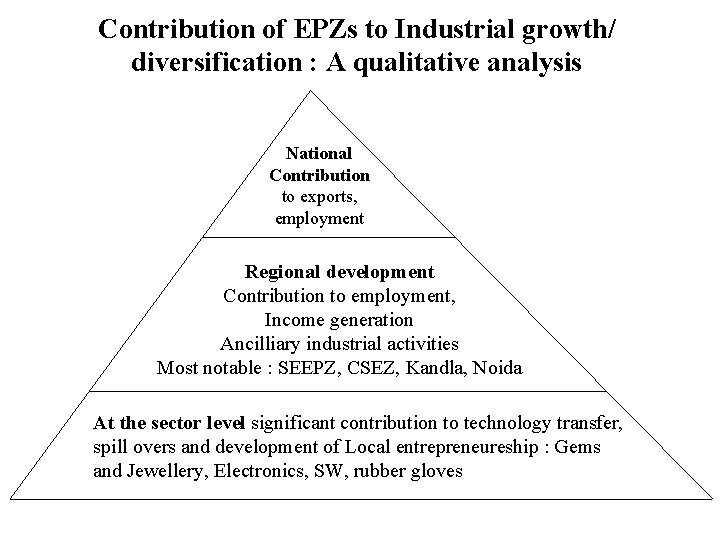

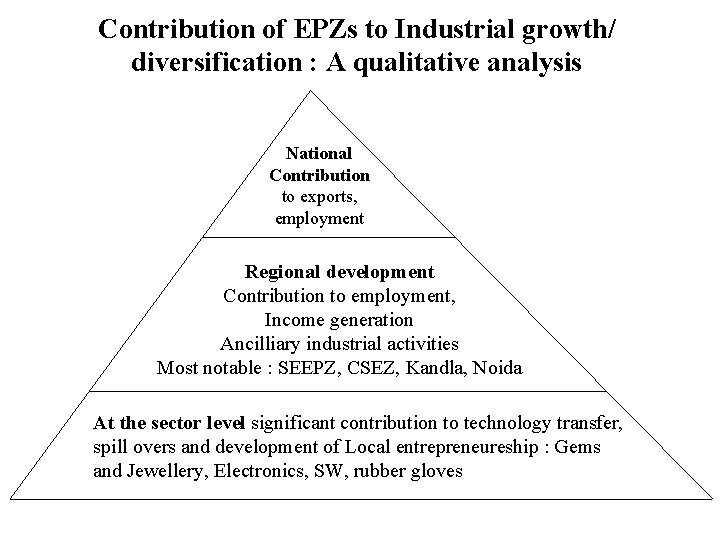

Contribution of EPZs to Industrial growth/ diversification : A qualitative analysis National Contribution to exports, employment Regional development Contribution to employment, Income generation Ancilliary industrial activities Most notable : SEEPZ, CSEZ, Kandla, Noida At the sector level significant contribution to technology transfer, spill overs and development of Local entrepreneureship : Gems and Jewellery, Electronics, SW, rubber gloves

Human development and Poverty Technology Transfers, creation. And Spillovers limited Skill formation : Industrial Training, improvement in skill, Better prospects outside. Remunerative employment for people with low Education level: : comparable wages and Better working conditions, satisfaction levels are higher Living conditions improved after joining the EPZs

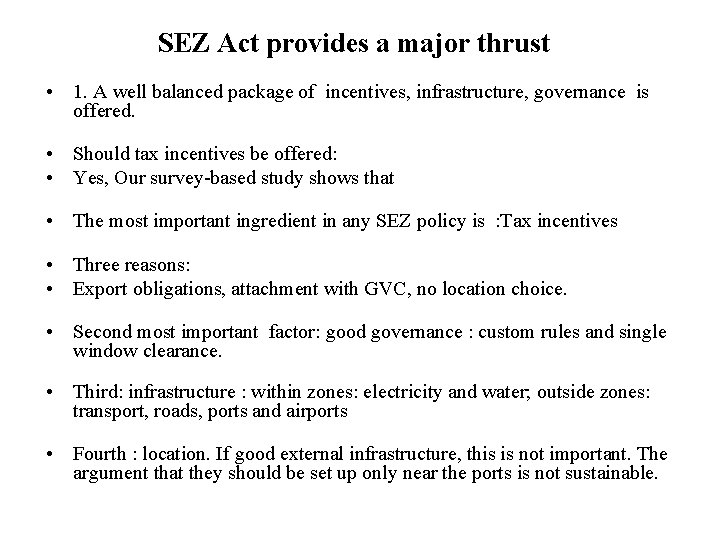

SEZ Act provides a major thrust • 1. A well balanced package of incentives, infrastructure, governance is offered. • Should tax incentives be offered: • Yes, Our survey-based study shows that • The most important ingredient in any SEZ policy is : Tax incentives • Three reasons: • Export obligations, attachment with GVC, no location choice. • Second most important factor: good governance : custom rules and single window clearance. • Third: infrastructure : within zones: electricity and water; outside zones: transport, roads, ports and airports • Fourth : location. If good external infrastructure, this is not important. The argument that they should be set up only near the ports is not sustainable.

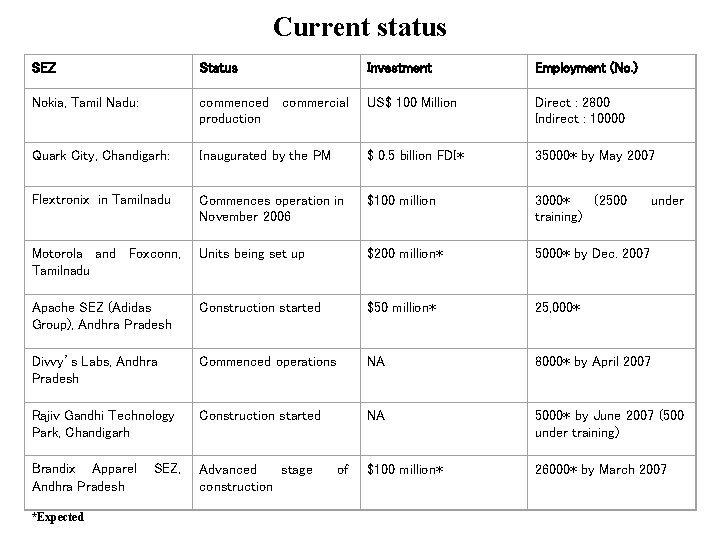

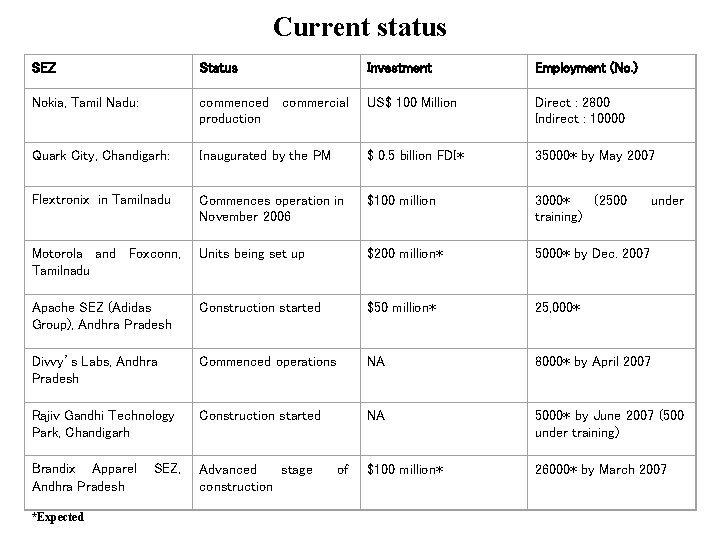

Current status SEZ Status Investment Employment (No. ) Nokia, Tamil Nadu: commenced commercial production US$ 100 Million Direct : 2800 Indirect : 10000 Quark City, Chandigarh: Inaugurated by the PM $ 0. 5 billion FDI* 35000* by May 2007 Flextronix in Tamilnadu Commences operation in November 2006 $100 million 3000* (2500 training) Motorola and Foxconn, Tamilnadu Units being set up $200 million* 5000* by Dec. 2007 Apache SEZ (Adidas Group), Andhra Pradesh Construction started $50 million* 25, 000* Divvy’s Labs, Andhra Pradesh Rajiv Gandhi Technology Park, Chandigarh Commenced operations NA 8000* by April 2007 Construction started NA 5000* by June 2007 (500 under training) Brandix Apparel Andhra Pradesh Advanced stage construction $100 million* 26000* by March 2007 *Expected SEZ, of under

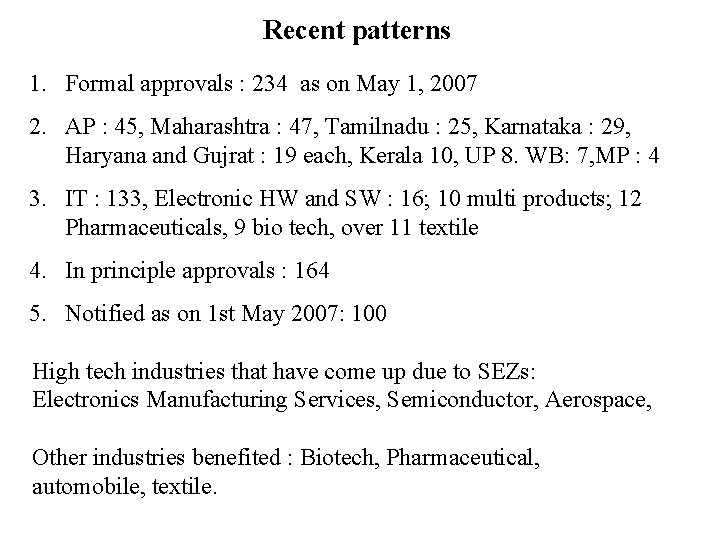

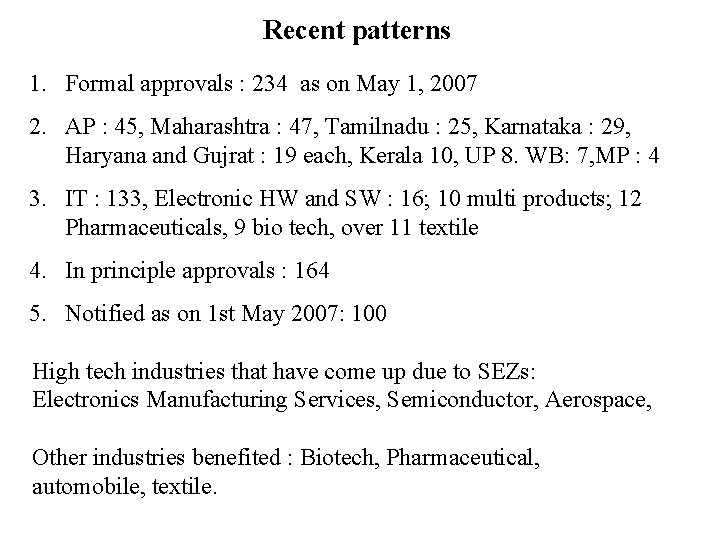

Recent patterns 1. Formal approvals : 234 as on May 1, 2007 2. AP : 45, Maharashtra : 47, Tamilnadu : 25, Karnataka : 29, Haryana and Gujrat : 19 each, Kerala 10, UP 8. WB: 7, MP : 4 3. IT : 133, Electronic HW and SW : 16; 10 multi products; 12 Pharmaceuticals, 9 bio tech, over 11 textile 4. In principle approvals : 164 5. Notified as on 1 st May 2007: 100 High tech industries that have come up due to SEZs: Electronics Manufacturing Services, Semiconductor, Aerospace, Other industries benefited : Biotech, Pharmaceutical, automobile, textile.

Costs : A qualitative Analysis • Relocation : Misplaced. but in the IT sector substitution effect is evident • Land Acquisition : Needs serious research, should not be left to the private parties. • Loss of agricultural land : Need to create “land bank” along the lines of TN. • Impoverishment of farmers : Needs research. But sharp rise in land prices, Huge compensations, They must be offered specifically designed investment plans for these funds to ensure regular incomes. This may provide them security. • Misuse of land for real estate : Need for exit policy and regular monitoring • Uneven growth : misplaced • Unequal treatment with exporters : Tax incentives to STPIs and EOUs. • A large number of IT sector SEZs : Once STPI incentives restored, this issue will be addressed.

Conclusion • SEZs can act as catalyst to industrial growth provided they are implemented effectively. • Effective implementation of a policy that aims at giving shock to the economy requires mobilization of public opinion. People often approach such an issue initially with strong, emotionally laden feelings and opinions. It must be shaped and formed so that important decisions are taken without creating instability in the society. • Four things are important : • The government must slow down the process of giving approvals. This is important not only for social or political reasons but also due to economic realities. • Legal institutions related to land acquisition ( including land acquisition modalities, compensation package and rehabilitation package) must be addressed. • Introduce a performance based exit policy for SEZ developers • Restore STPI and EOUs benefits • Finally, the policy should be treated as transitory.

Qualitative needs

Qualitative needs Qualitative v quantitative risk assessment

Qualitative v quantitative risk assessment Health technology assessment india

Health technology assessment india Regulatory impact assessment india

Regulatory impact assessment india Portfolio assessment matches assessment to teaching

Portfolio assessment matches assessment to teaching Static assessment vs dynamic assessment

Static assessment vs dynamic assessment Portfolio assessment matches assessment to teaching

Portfolio assessment matches assessment to teaching Unallocated costs

Unallocated costs Implicit costs

Implicit costs Distribution costs examples

Distribution costs examples Unemployment measures

Unemployment measures Overhead costs

Overhead costs Explicit costs

Explicit costs Shoe leather costs

Shoe leather costs Hidden costs of assisted living

Hidden costs of assisted living Costs of manifest destiny

Costs of manifest destiny Define unanticipated inflation

Define unanticipated inflation Standard costs and balanced scorecard

Standard costs and balanced scorecard Scheduling resources and costs

Scheduling resources and costs Trade off and opportunity cost

Trade off and opportunity cost Chapter 18 responsibilities and costs of credit

Chapter 18 responsibilities and costs of credit Internal failure costs examples

Internal failure costs examples Cost management tools and techniques

Cost management tools and techniques