RUSSIAS INWARD AND OUTWARD DIRECT INVESTMENTS AND THEIR

- Slides: 17

RUSSIA’S INWARD AND OUTWARD DIRECT INVESTMENTS AND THEIR IMPACT ON NATIONAL INNOVATION SYSTEM Nina Kazakova Saratov State Technical University, Saratov, Russia

The growing importance of FDI represents one of the defining features of globalization process • Over the past two decades, world FDI inflows have more than tripled, increasing from around 55 billion USD in the late 1980 s to 651 billion USD in 2002 (Narula&Portelli, 2004). • In 2002, more than 70% of total world FDI inflows have been directed toward developed countries. • Inward FDI stocks in developing countries have increased from 307. 5 billion USD in 1980 to 2 340 billion USD in 2002. • However, the increasingly important phenomenon of outward FDI from developing countries has been much less analyzed. • Most substantial contributors to outward FDI among developing and transition economies are the BRICS countries – Brazil, Russia, India, China, and South Africa. • The BRICS countries produced some 25 billion USD of outward FDI flows in 2004, corresponding to some 3 % of world FDI flows and well over half (61 %) of total developing country outflows (Gammeltoft, 2006).

Russian outward investments (mln. USD) 2006 2005 Outward Russian investments 51978 31128 Including: Direct investments 3208 558 % in total outward investments 6. 2 1. 8 Portfolio investments 798 406 % in total outward investments 1. 5 1. 3 47972 30164 92. 3 96. 9 Others % in total outward investments

Russian inward investments (mln. USD) 2006 2005 Inward Russian investments 55109 53651 Including: Direct investments 13768 13072 % in total inward investments 24. 8 24. 4 Portfolio investments 3182 453 5. 8 0. 8 38249 40126 69. 4 74. 8 % in total inward investments Others % in total inward investments

Some common features of BRICS countries in terms of FDI • Most of these countries began to promote inward and outward FDI after economic reforms and long period of protectionism. • Over the past decades, BRICS countries have acted as both big recipients as big donors. • They have big population and growing domestic markets. • They have rich natural resource bases (raw materials, forests, energy resources). • The prices of natural resources and work force are lower than in developed countries. • They have rather skilled work force. • They have big potential for growth. • They cooperate with international organizations and regional unions (WTO, OECD, APEC etc. ) but protect their autonomy. • Their governmental policy tends to stimulate inward and outward FDI.

The specific features of Russian economy in comparison with other BRICS countries • 1. High scientific and human potential but underdeveloped innovative potential. • A specific problem has been the difficulty in developing institutional arrangements which could convert the knowledge capital (the highly educated population, scientific institutions and technical infrastructures) of the Soviet era into a lever of innovation in the enterprise sector. • 2. Emerging market mechanisms consequently arise market stimuli to innovate. • Socialist economic system was completely different and had opposite mentality and stimuli for innovating than market economy. • Russia had to transform its economic system radically. • Old innovation stimuli were destroyed, but new ones not enough emerged yet. • 3. Big territory and rich natural resources but cold climate. • 4. Big territory but not very big population. • 5. Technical basis of Russian economy is very heterogeneous. • Modern production technologies are used in some industries. • However, the technical level is rather low in others.

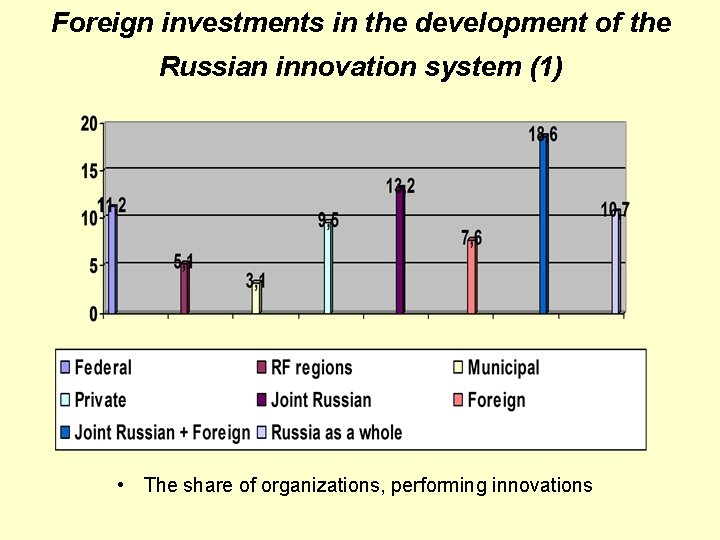

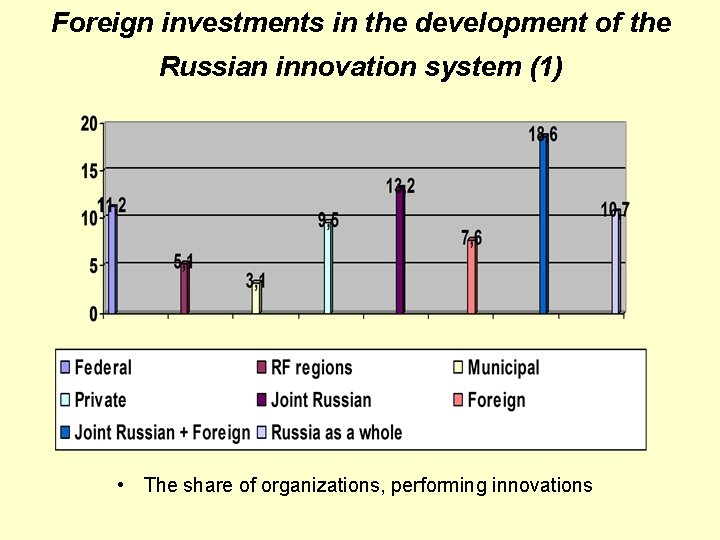

Foreign investments in the development of the Russian innovation system (1) • The share of organizations, performing innovations

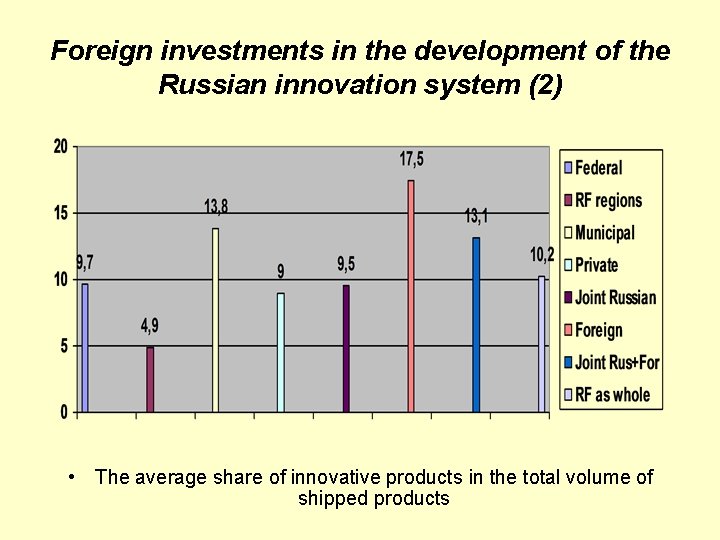

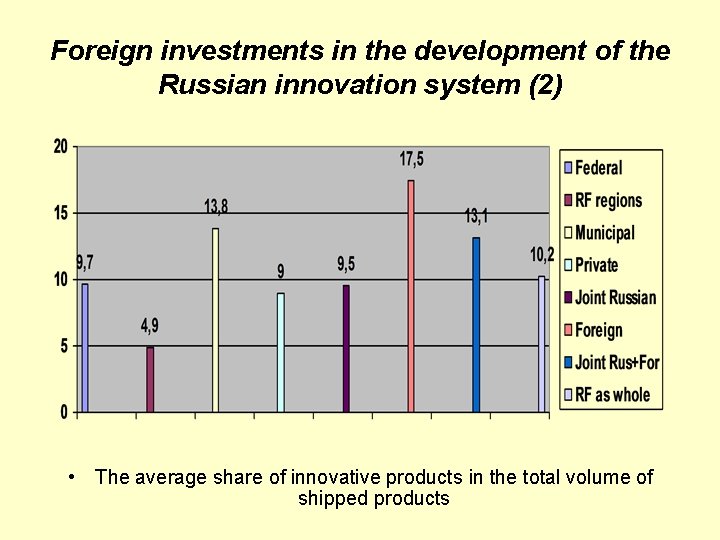

Foreign investments in the development of the Russian innovation system (2) • The average share of innovative products in the total volume of shipped products

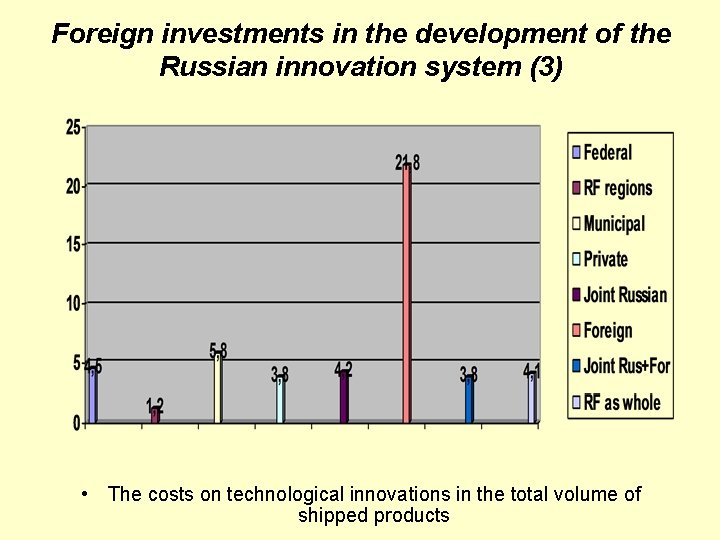

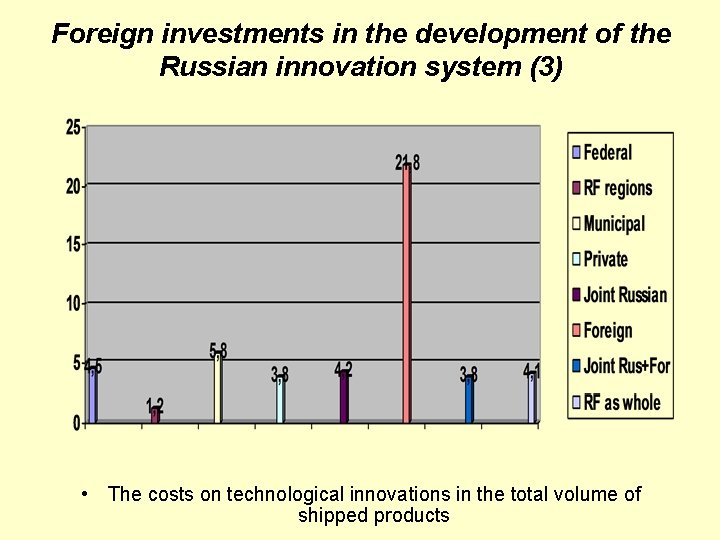

Foreign investments in the development of the Russian innovation system (3) • The costs on technological innovations in the total volume of shipped products

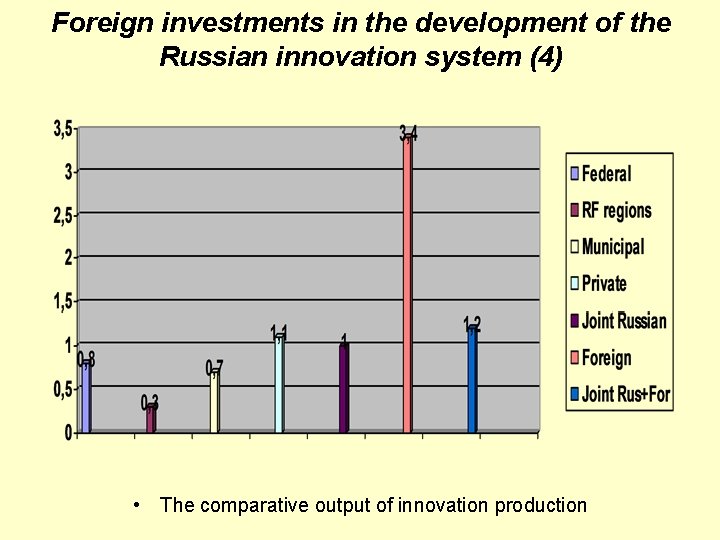

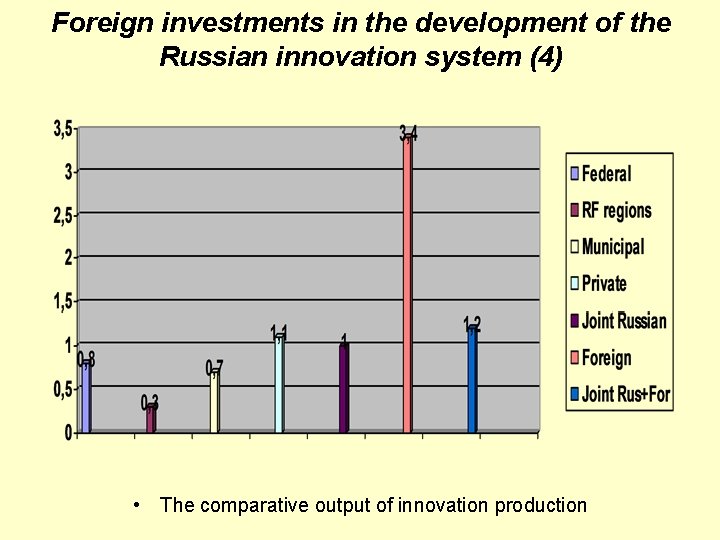

Foreign investments in the development of the Russian innovation system (4) • The comparative output of innovation production

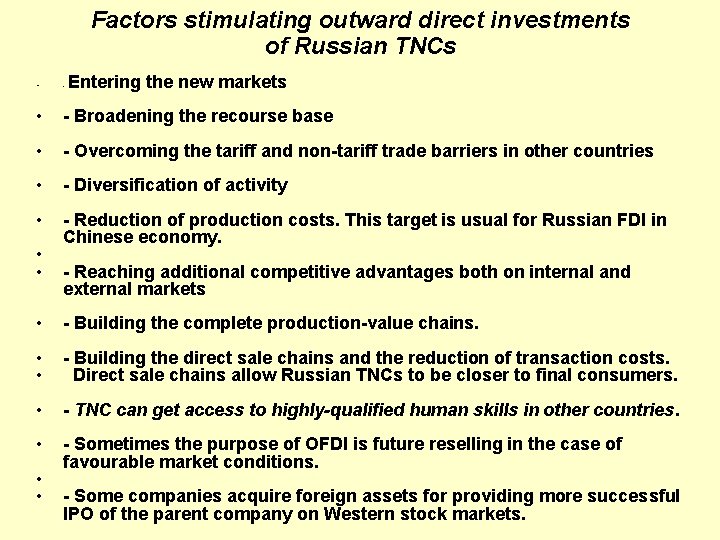

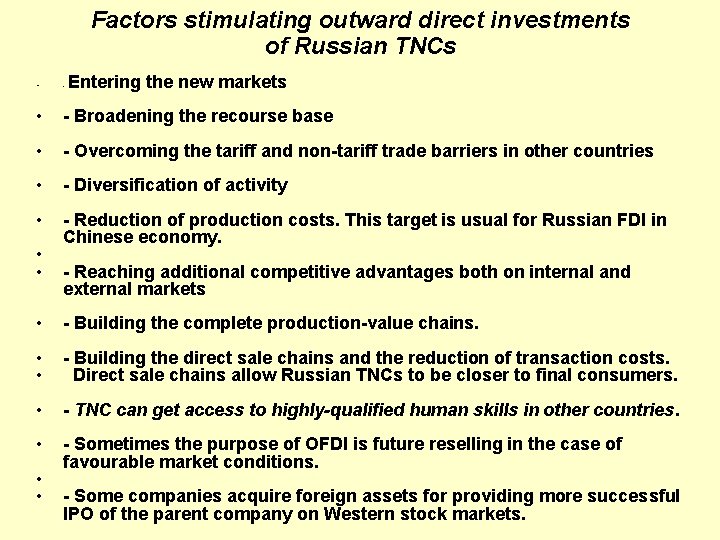

Factors stimulating outward direct investments of Russian TNCs Entering the new markets • - Broadening the recourse base • - Overcoming the tariff and non-tariff trade barriers in other countries • - Diversification of activity • - Reduction of production costs. This target is usual for Russian FDI in Chinese economy. • • - Reaching additional competitive advantages both on internal and external markets • - Building the complete production-value chains. • • - Building the direct sale chains and the reduction of transaction costs. Direct sale chains allow Russian TNCs to be closer to final consumers. • - TNC can get access to highly-qualified human skills in other countries. • - Sometimes the purpose of OFDI is future reselling in the case of favourable market conditions. • • - Some companies acquire foreign assets for providing more successful IPO of the parent company on Western stock markets.

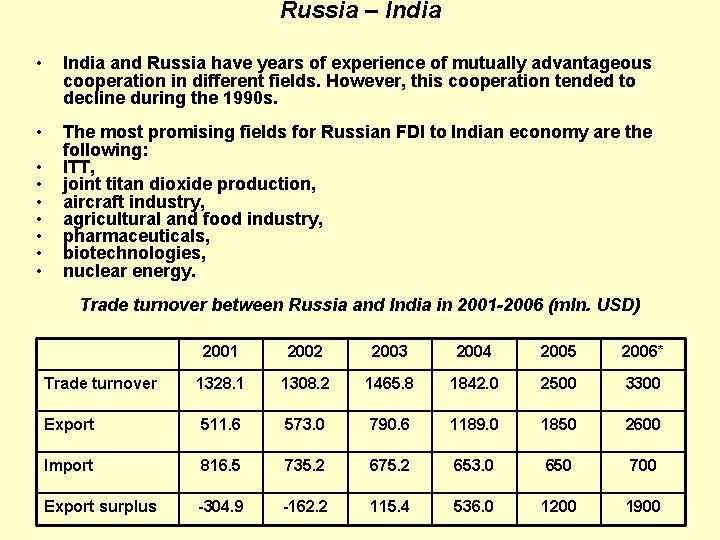

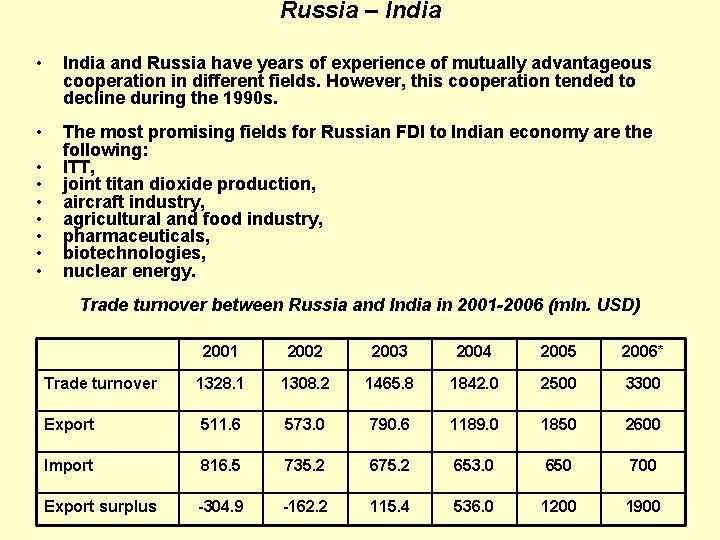

Russia – India • India and Russia have years of experience of mutually advantageous cooperation in different fields. However, this cooperation tended to decline during the 1990 s. • The most promising fields for Russian FDI to Indian economy are the following: ITT, joint titan dioxide production, aircraft industry, agricultural and food industry, pharmaceuticals, biotechnologies, nuclear energy. • • Trade turnover between Russia and India in 2001 -2006 (mln. USD) 2001 2002 2003 2004 2005 2006* Trade turnover 1328. 1 1308. 2 1465. 8 1842. 0 2500 3300 Export 511. 6 573. 0 790. 6 1189. 0 1850 2600 Import 816. 5 735. 2 675. 2 653. 0 650 700 Export surplus -304. 9 -162. 2 115. 4 536. 0 1200 1900

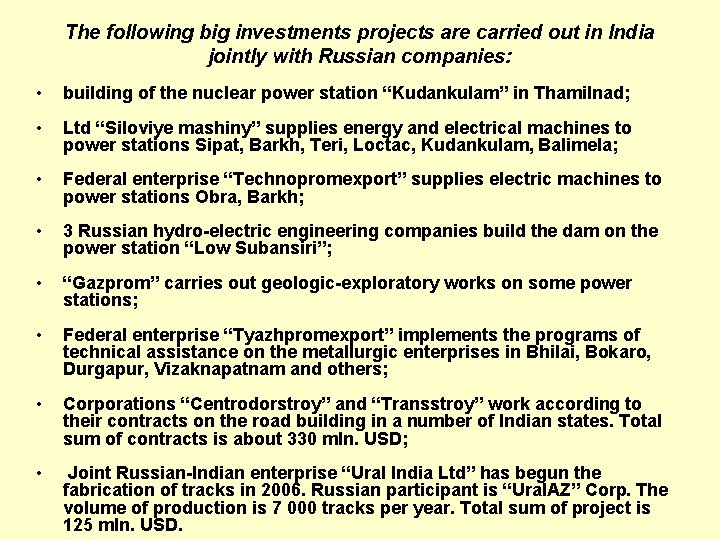

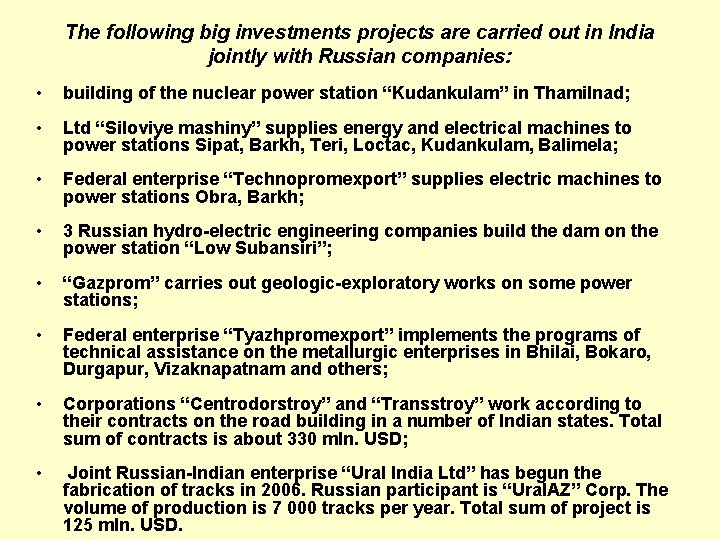

The following big investments projects are carried out in India jointly with Russian companies: • building of the nuclear power station “Kudankulam” in Thamilnad; • Ltd “Siloviye mashiny” supplies energy and electrical machines to power stations Sipat, Barkh, Teri, Loctac, Kudankulam, Balimela; • Federal enterprise “Technopromexport” supplies electric machines to power stations Obra, Barkh; • 3 Russian hydro-electric engineering companies build the dam on the power station “Low Subansiri”; • “Gazprom” carries out geologic-exploratory works on some power stations; • Federal enterprise “Tyazhpromexport” implements the programs of technical assistance on the metallurgic enterprises in Bhilai, Bokaro, Durgapur, Vizaknapatnam and others; • Corporations “Centrodorstroy” and “Transstroy” work according to their contracts on the road building in a number of Indian states. Total sum of contracts is about 330 mln. USD; • Joint Russian-Indian enterprise “Ural India Ltd” has begun the fabrication of tracks in 2006. Russian participant is “Ural. AZ” Corp. The volume of production is 7 000 tracks per year. Total sum of project is 125 mln. USD.

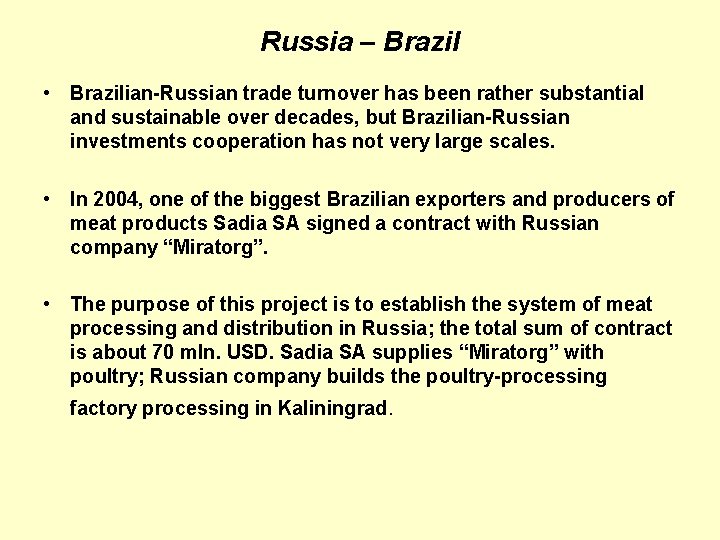

Russia – Brazil • Brazilian-Russian trade turnover has been rather substantial and sustainable over decades, but Brazilian-Russian investments cooperation has not very large scales. • In 2004, one of the biggest Brazilian exporters and producers of meat products Sadia SA signed a contract with Russian company “Miratorg”. • The purpose of this project is to establish the system of meat processing and distribution in Russia; the total sum of contract is about 70 mln. USD. Sadia SA supplies “Miratorg” with poultry; Russian company builds the poultry-processing factory processing in Kaliningrad.

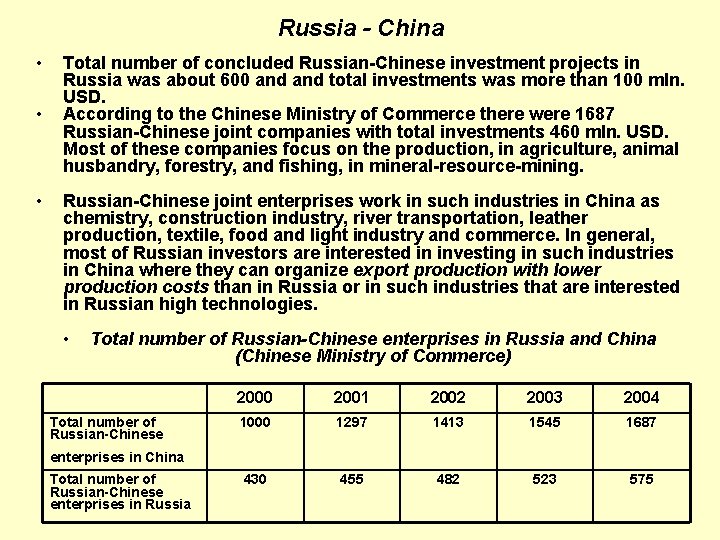

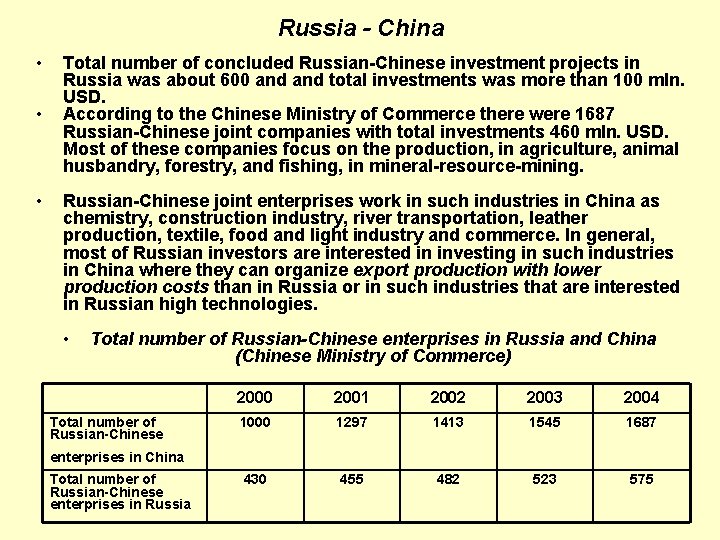

Russia - China • • • Total number of concluded Russian-Chinese investment projects in Russia was about 600 and total investments was more than 100 mln. USD. According to the Chinese Ministry of Commerce there were 1687 Russian-Chinese joint companies with total investments 460 mln. USD. Most of these companies focus on the production, in agriculture, animal husbandry, forestry, and fishing, in mineral-resource-mining. Russian-Chinese joint enterprises work in such industries in China as chemistry, construction industry, river transportation, leather production, textile, food and light industry and commerce. In general, most of Russian investors are interested in investing in such industries in China where they can organize export production with lower production costs than in Russia or in such industries that are interested in Russian high technologies. • Total number of Russian-Chinese enterprises in Russia and China (Chinese Ministry of Commerce) Total number of Russian-Chinese 2000 2001 2002 2003 2004 1000 1297 1413 1545 1687 430 455 482 523 575 enterprises in China Total number of Russian-Chinese enterprises in Russia

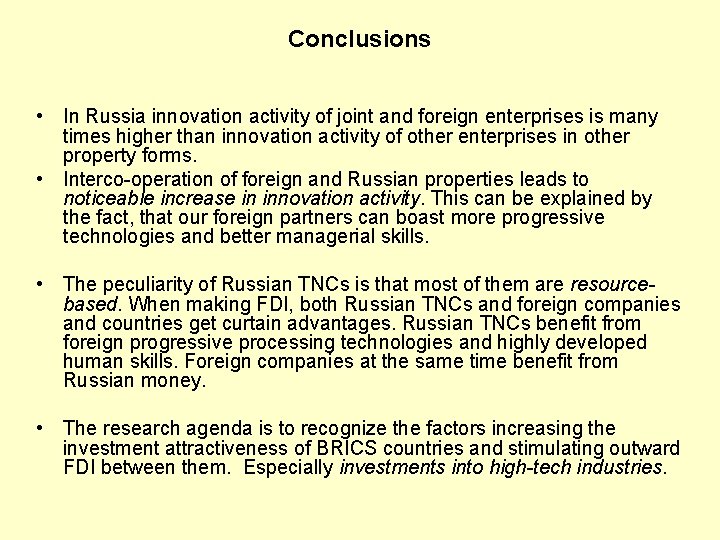

Conclusions • In Russia innovation activity of joint and foreign enterprises is many times higher than innovation activity of other enterprises in other property forms. • Interco-operation of foreign and Russian properties leads to noticeable increase in innovation activity. This can be explained by the fact, that our foreign partners can boast more progressive technologies and better managerial skills. • The peculiarity of Russian TNCs is that most of them are resourcebased. When making FDI, both Russian TNCs and foreign companies and countries get curtain advantages. Russian TNCs benefit from foreign progressive processing technologies and highly developed human skills. Foreign companies at the same time benefit from Russian money. • The research agenda is to recognize the factors increasing the investment attractiveness of BRICS countries and stimulating outward FDI between them. Especially investments into high-tech industries.

• Thank you for your attention!

A particle is moving in a circle of radius r

A particle is moving in a circle of radius r Mysterion sacramentum

Mysterion sacramentum Outward sign meaning

Outward sign meaning Outward sign of confirmation

Outward sign of confirmation Inward vs outward mindset

Inward vs outward mindset Russias capital

Russias capital Mirror that curves outward and use in convenience store

Mirror that curves outward and use in convenience store Uses of convex mirror

Uses of convex mirror Outward sloping terrace

Outward sloping terrace Stamp, sort, and distribute mail for an organization

Stamp, sort, and distribute mail for an organization Self-portrait with eyes turned inward, boston

Self-portrait with eyes turned inward, boston Head loss formula for sudden contraction

Head loss formula for sudden contraction Carriage outwards in income statement

Carriage outwards in income statement What does bernoullis principle state

What does bernoullis principle state Shower curtain blows inward

Shower curtain blows inward Inward manifest

Inward manifest A lens that bends light waves inward

A lens that bends light waves inward Inward projecting pipe entrance

Inward projecting pipe entrance