Mergers Acquisitions When Do They Work Prof Ian

- Slides: 37

Mergers & Acquisitions When Do They Work? Prof. Ian Giddy New York University

Mergers and Acquisitions l Mergers & Acquisitions l Divestitures l Valuation l Implementation Concept: Is a division or firm worth more within the company, or outside it? Copyright © 1999 Ian H. Giddy M&A 2

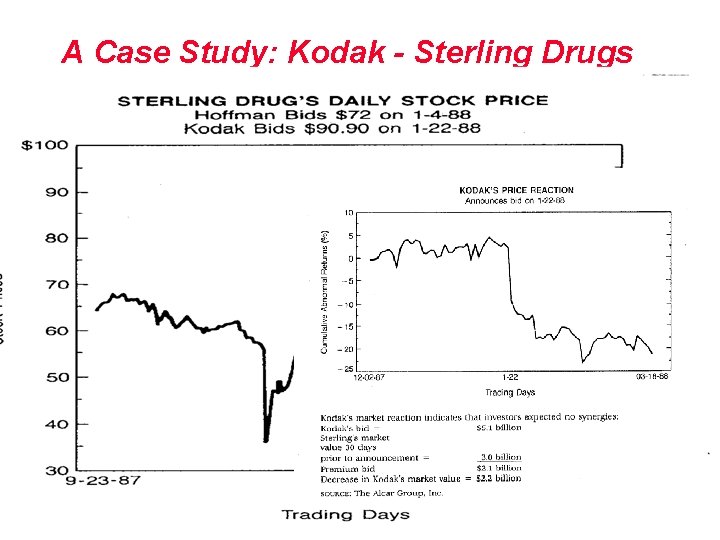

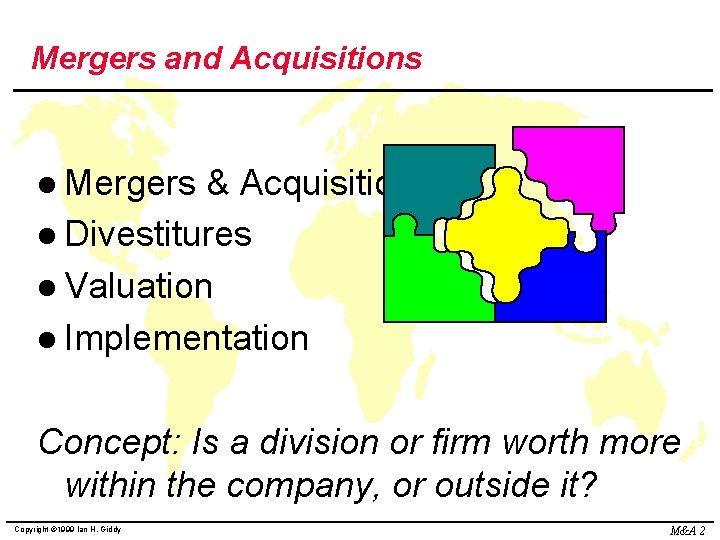

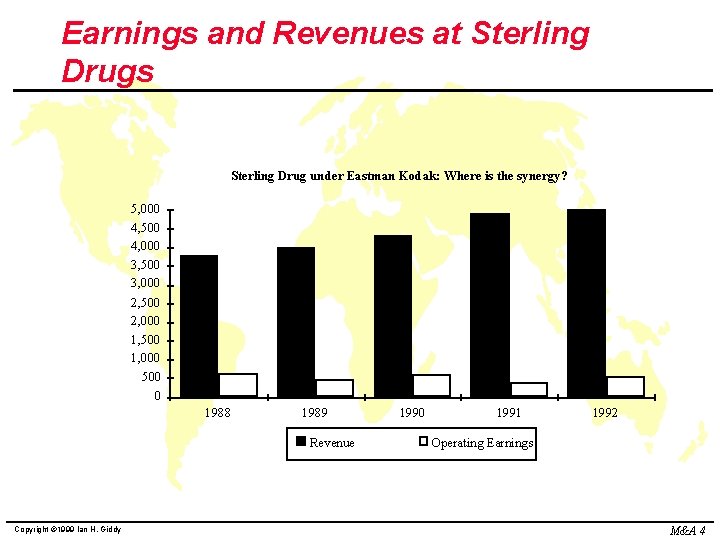

A Case Study: Kodak - Sterling Drugs l Eastman Kodak’s Great Victory Copyright © 1999 Ian H. Giddy M&A 3

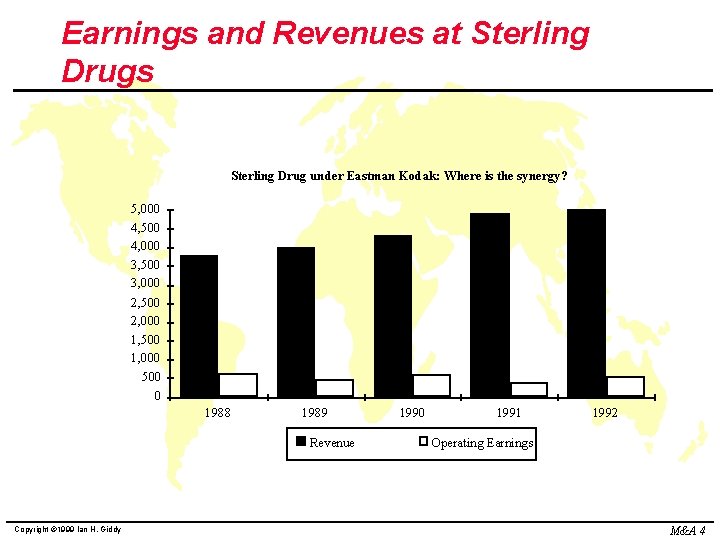

Earnings and Revenues at Sterling Drugs Sterling Drug under Eastman Kodak: Where is the synergy? 5, 000 4, 500 4, 000 3, 500 3, 000 2, 500 2, 000 1, 500 1, 000 500 0 1988 1989 Revenue Copyright © 1999 Ian H. Giddy 1990 1991 1992 Operating Earnings M&A 4

Kodak Says Drug Unit Is Not for Sale (NYTimes, 8/93) Eastman Kodak officials say they have no plans to sell Kodak’s Sterling Winthrop drug unit. l Louis Mattis, Chairman of Sterling Winthrop, dismissed the rumors as “massive speculation, which flies in the face of the stated intent of Kodak that it is committed to be in the health business. ” l Copyright © 1999 Ian H. Giddy M&A 5

Sanofi to Get Part of Kodak Drug Unit (6/94) l Taking a long stride on its way out of the drug business, Eastman Kodak said yesterday that the Sanofi Group, a French pharmaceutical company, had agreed to buy the prescription drug business of Sterling Winthrop, a Kodak subsidiary, for $1. 68 billion. Shares of Eastman Kodak rose 75 cents yesterday, closing at $47. 50 on the New York Stock Exchange. u Samuel D. Isaly an analyst , said the announcement was “very good for Sanofi and very good for Kodak. ” u “When the divestitures are complete, Kodak will be entirely focused on imaging, ” said George M. C. Fisher, the company's chairman and chief executive. u Copyright © 1999 Ian H. Giddy M&A 6

Smithkline to Buy Kodak’s Drug Business for $2. 9 Billion Smithkline Beecham agreed to buy Eastman Kodak’s Sterling Winthrop Inc. for $2. 9 billion. l For Kodak, the sale almost completes a restructuring intended to refocus the company on its photography business. l Kodak’s stock price rose $1. 25 to $50. 625, the highest price since December. l Copyright © 1999 Ian H. Giddy M&A 7

Fallacies of Acquisitions Size (shareholders would rather have their money back, eg Credit Lyonnais) l Downstream/upstream integration (internal transfer at nonmarket prices, eg Dow/Conoco, Aramco/Texaco) l Diversification into unrelated industries (Kodak/Sterling Drug) l Copyright © 1999 Ian H. Giddy M&A 8

Who Gains What? Target firm shareholders? l Bidding firm shareholders? l Lawyers and bankers? l Are there overall gains? l Changes in corporate control increase the combined market value of assets of the bidding and target firms. The average is a 10. 5% increase in total value. Copyright © 1999 Ian H. Giddy M&A 9

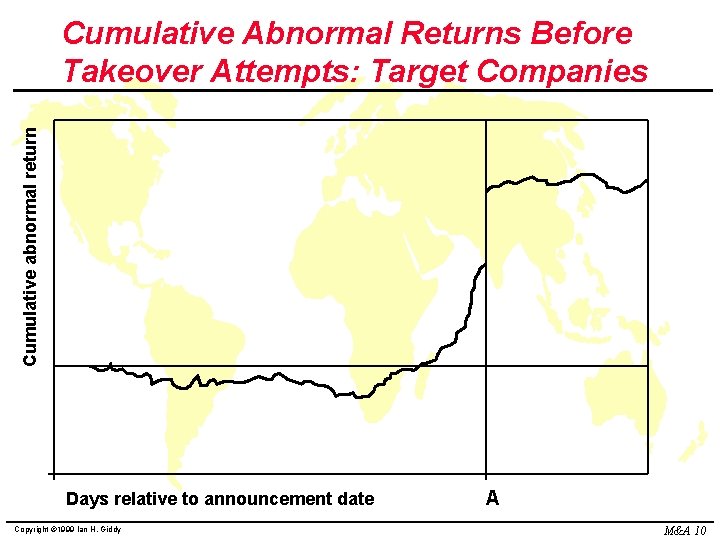

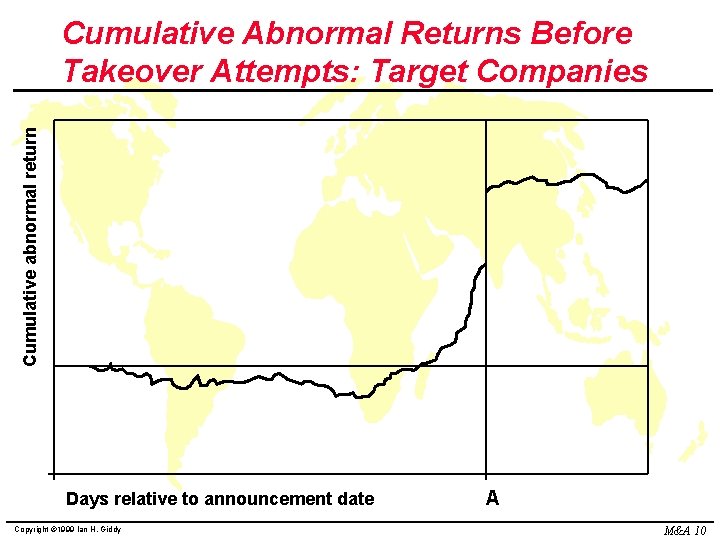

Cumulative abnormal return Cumulative Abnormal Returns Before Takeover Attempts: Target Companies Days relative to announcement date Copyright © 1999 Ian H. Giddy A M&A 10

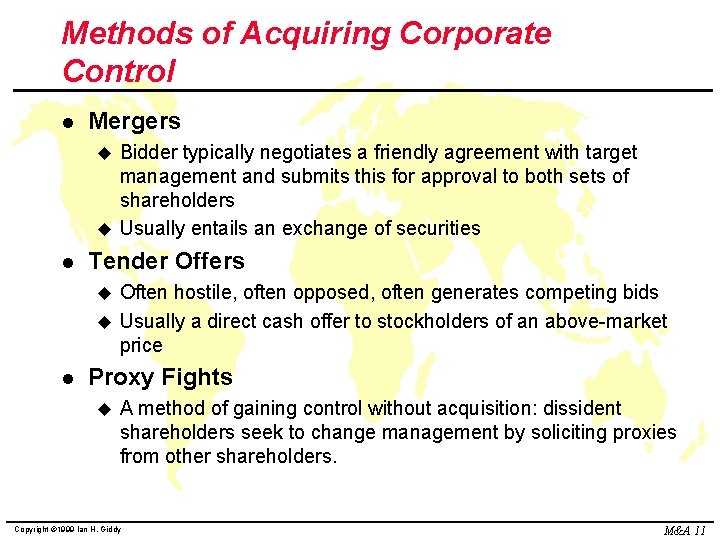

Methods of Acquiring Corporate Control l Mergers Bidder typically negotiates a friendly agreement with target management and submits this for approval to both sets of shareholders u Usually entails an exchange of securities u l Tender Offers Often hostile, often opposed, often generates competing bids u Usually a direct cash offer to stockholders of an above-market price u l Proxy Fights u A method of gaining control without acquisition: dissident shareholders seek to change management by soliciting proxies from other shareholders. Copyright © 1999 Ian H. Giddy M&A 11

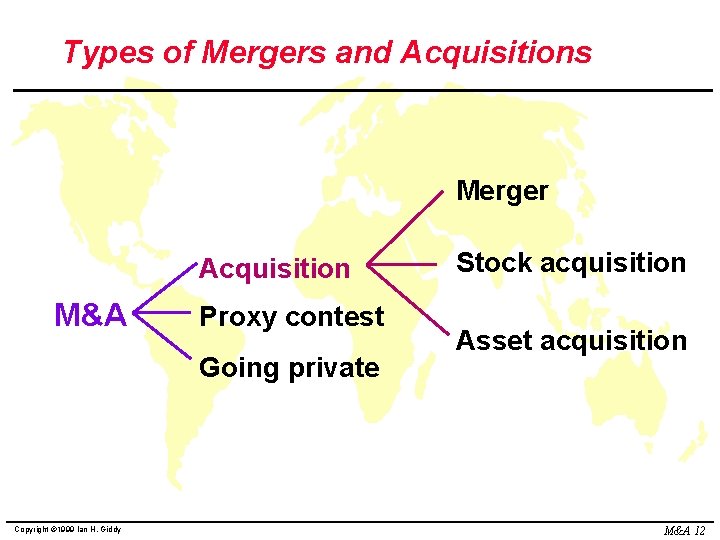

Types of Mergers and Acquisitions Merger Acquisition M&A Proxy contest Going private Copyright © 1999 Ian H. Giddy Stock acquisition Asset acquisition M&A 12

Types of Takeover Activity l See Table 7. 2: A Taxonomy of Types of Takeover Activity u. Mergers: Friendly, negotiated u. Tender offers, friendly u. Tender offers, hostile What are the key differences between these? Copyright © 1999 Ian H. Giddy M&A 13

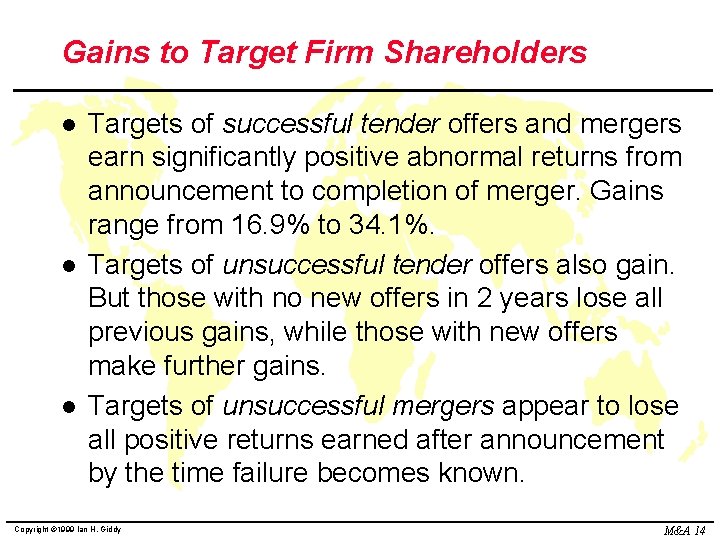

Gains to Target Firm Shareholders l l l Targets of successful tender offers and mergers earn significantly positive abnormal returns from announcement to completion of merger. Gains range from 16. 9% to 34. 1%. Targets of unsuccessful tender offers also gain. But those with no new offers in 2 years lose all previous gains, while those with new offers make further gains. Targets of unsuccessful mergers appear to lose all positive returns earned after announcement by the time failure becomes known. Copyright © 1999 Ian H. Giddy M&A 14

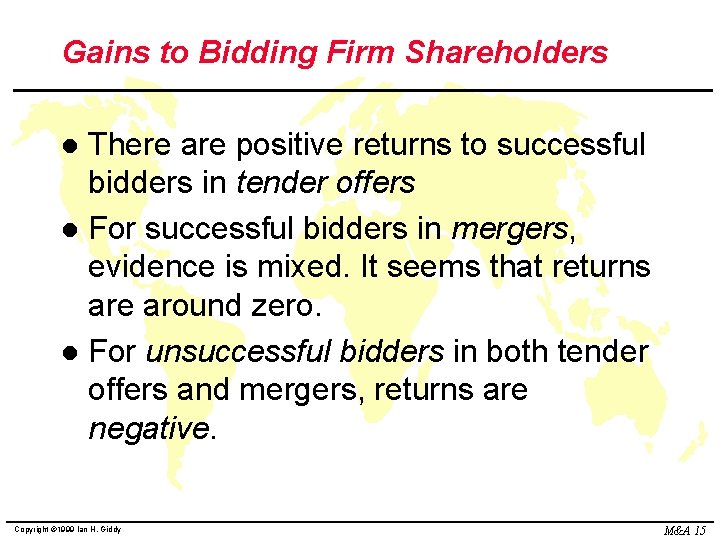

Gains to Bidding Firm Shareholders There are positive returns to successful bidders in tender offers l For successful bidders in mergers, evidence is mixed. It seems that returns are around zero. l For unsuccessful bidders in both tender offers and mergers, returns are negative. l Copyright © 1999 Ian H. Giddy M&A 15

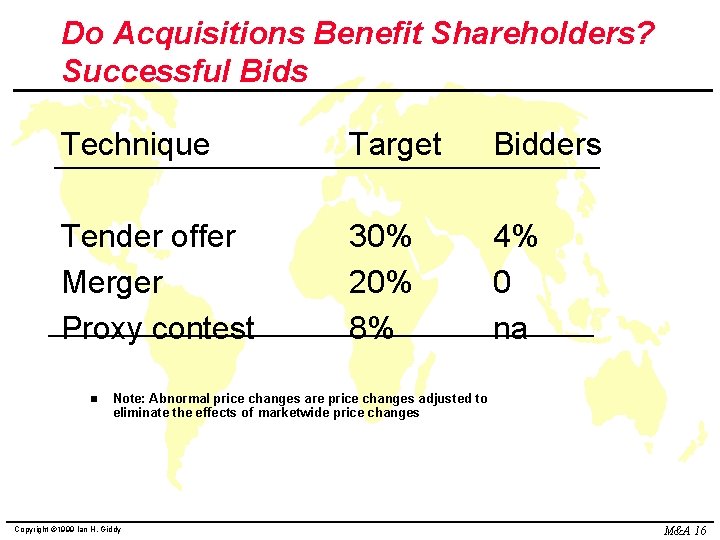

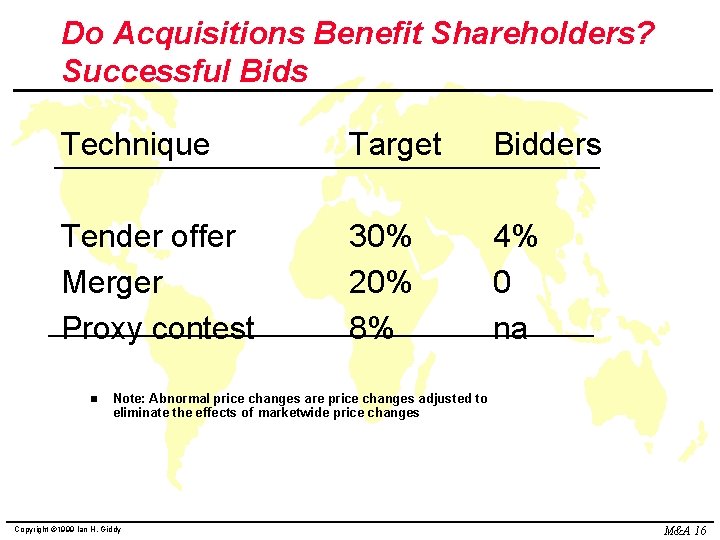

Do Acquisitions Benefit Shareholders? Successful Bids Technique Target Bidders Tender offer Merger Proxy contest 30% 20% 8% 4% 0 na n Note: Abnormal price changes are price changes adjusted to eliminate the effects of marketwide price changes Copyright © 1999 Ian H. Giddy M&A 16

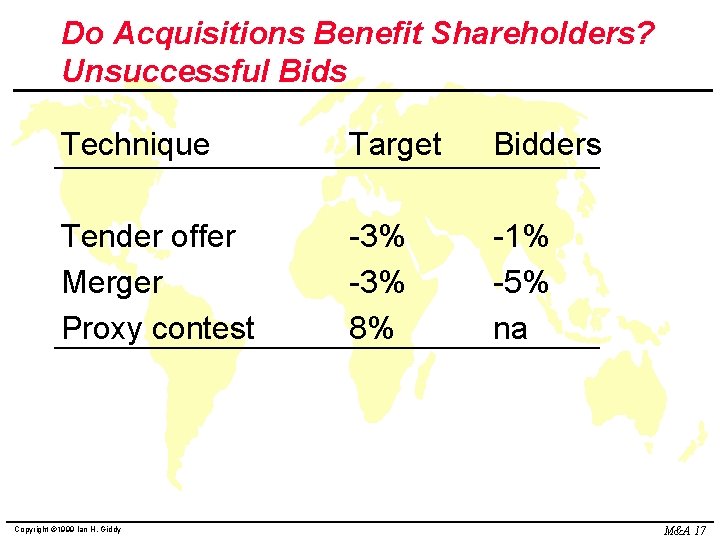

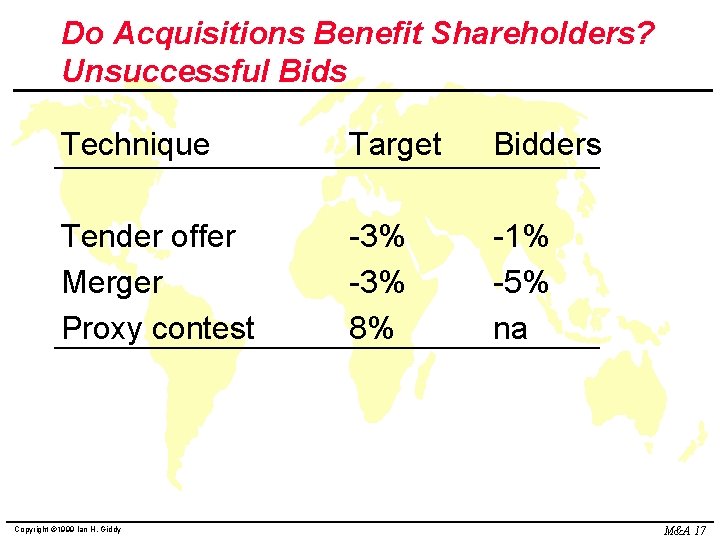

Do Acquisitions Benefit Shareholders? Unsuccessful Bids Technique Target Bidders Tender offer Merger Proxy contest -3% 8% -1% -5% na Copyright © 1999 Ian H. Giddy M&A 17

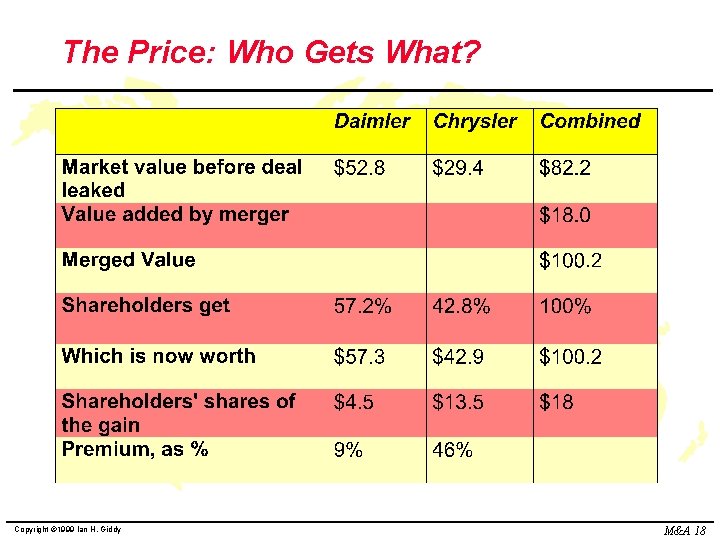

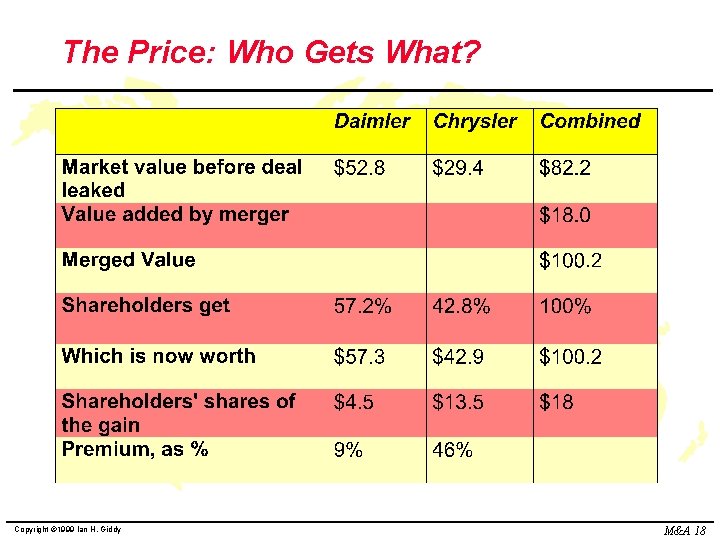

The Price: Who Gets What? Copyright © 1999 Ian H. Giddy M&A 18

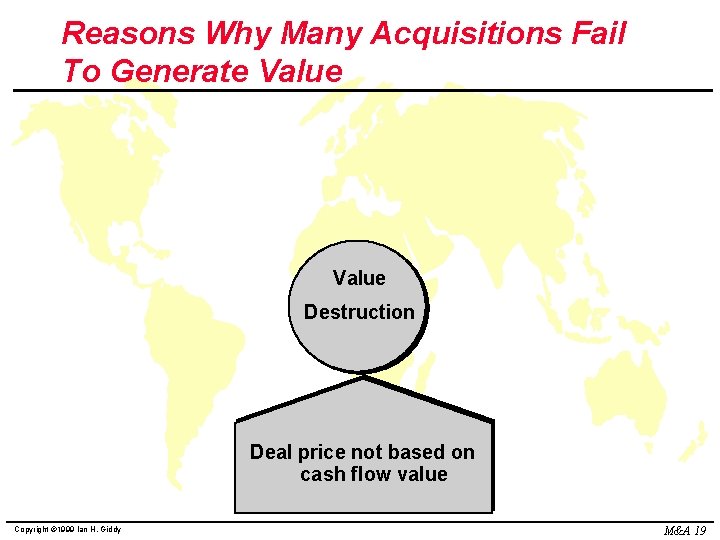

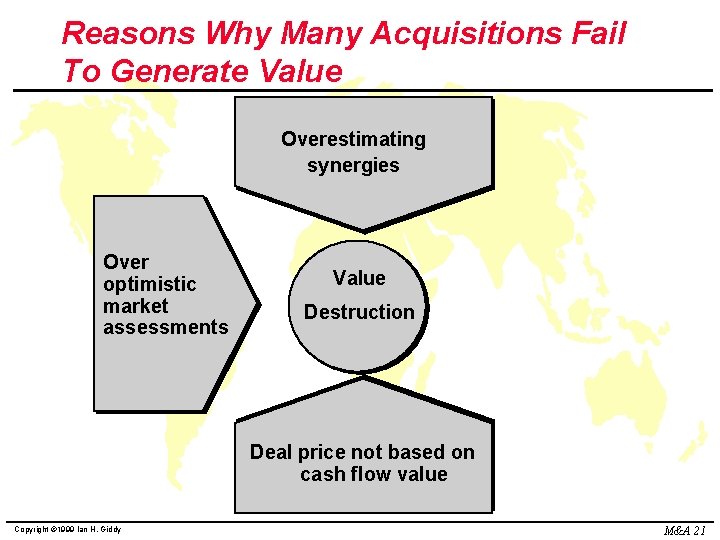

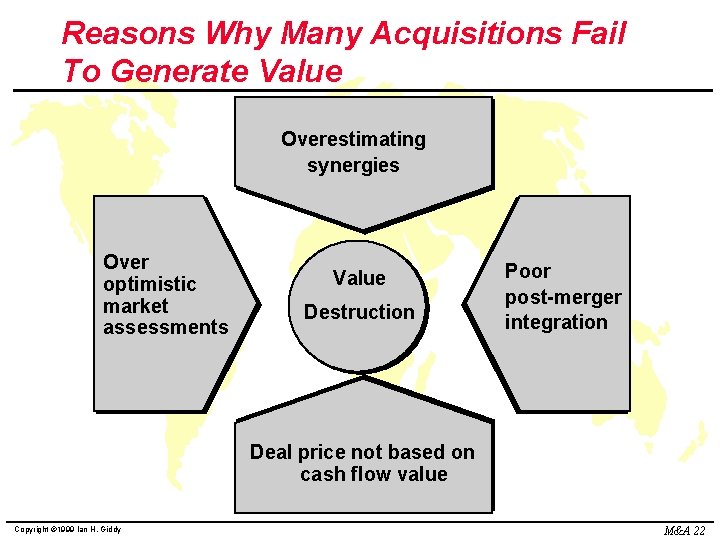

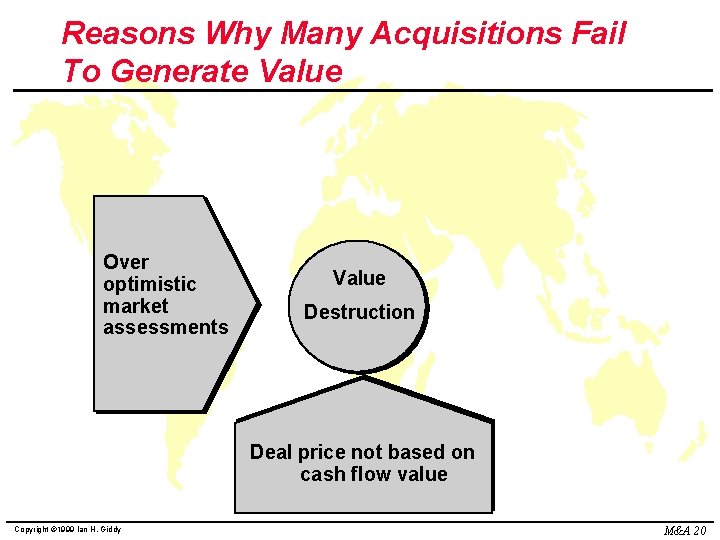

Reasons Why Many Acquisitions Fail To Generate Value Destruction Deal price not based on cash flow value Copyright © 1999 Ian H. Giddy M&A 19

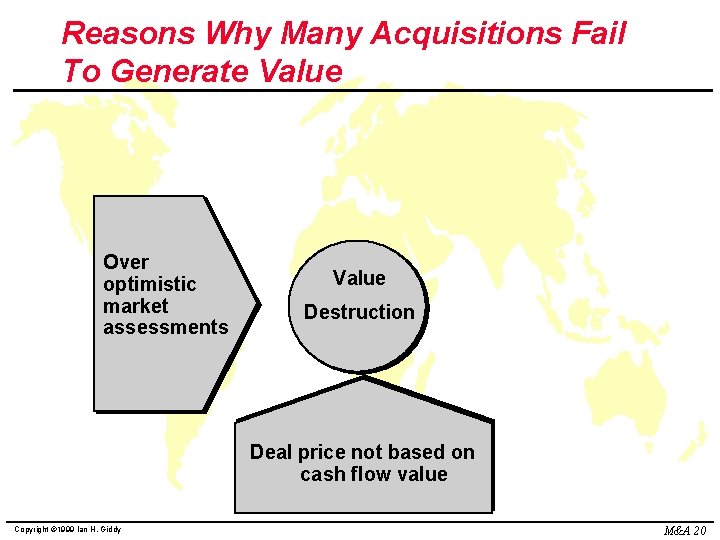

Reasons Why Many Acquisitions Fail To Generate Value Over optimistic market assessments Value Destruction Deal price not based on cash flow value Copyright © 1999 Ian H. Giddy M&A 20

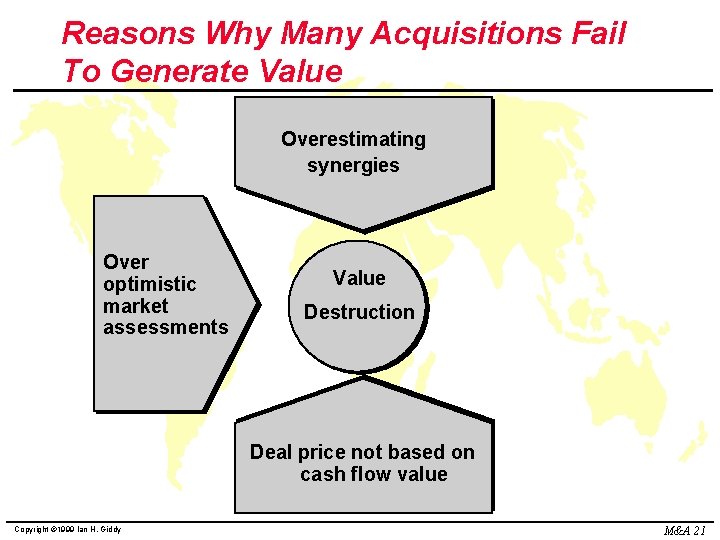

Reasons Why Many Acquisitions Fail To Generate Value Overestimating synergies Over optimistic market assessments Value Destruction Deal price not based on cash flow value Copyright © 1999 Ian H. Giddy M&A 21

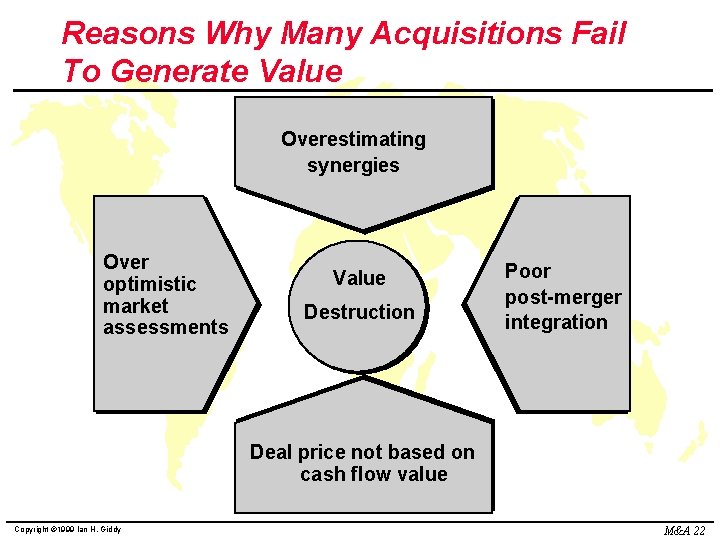

Reasons Why Many Acquisitions Fail To Generate Value Overestimating synergies Over optimistic market assessments Value Destruction Poor post-merger integration Deal price not based on cash flow value Copyright © 1999 Ian H. Giddy M&A 22

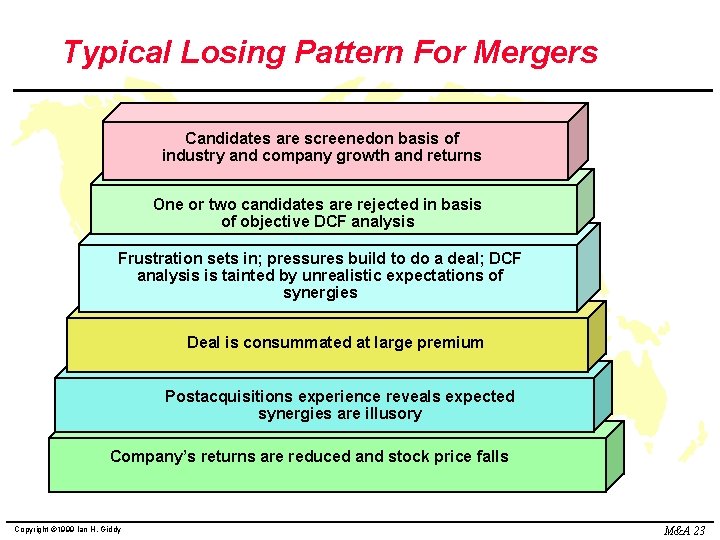

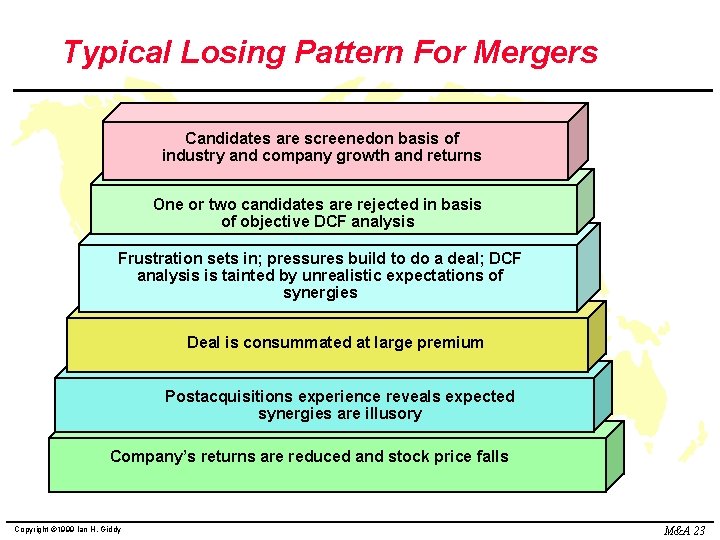

Typical Losing Pattern For Mergers Candidates are screenedon basis of industry and company growth and returns One or two candidates are rejected in basis of objective DCF analysis Frustration sets in; pressures build to do a deal; DCF analysis is tainted by unrealistic expectations of synergies Deal is consummated at large premium Postacquisitions experience reveals expected synergies are illusory Company’s returns are reduced and stock price falls Copyright © 1999 Ian H. Giddy M&A 23

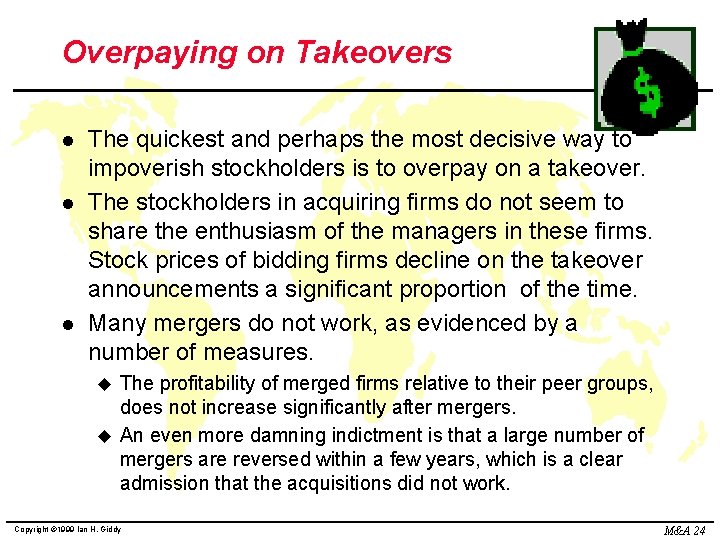

Overpaying on Takeovers l l l The quickest and perhaps the most decisive way to impoverish stockholders is to overpay on a takeover. The stockholders in acquiring firms do not seem to share the enthusiasm of the managers in these firms. Stock prices of bidding firms decline on the takeover announcements a significant proportion of the time. Many mergers do not work, as evidenced by a number of measures. The profitability of merged firms relative to their peer groups, does not increase significantly after mergers. u An even more damning indictment is that a large number of mergers are reversed within a few years, which is a clear admission that the acquisitions did not work. u Copyright © 1999 Ian H. Giddy M&A 24

BETHESDA, Maryland, September 20, 1998 -- The boards of directors of Lockheed Martin Corporation and COMSAT jointly announced today their two companies have entered into a definitive merger agreement providing for the combination of COMSAT with Lockheed Martin in a two-phase transaction valued at approximately $2. 7 billion. Vance Coffman, Lockheed Martin chairman and CEO, said, "This initiative will unite two advanced-technology companies with complementary capabilities in the commercial, space-based telecommunications industry. The new subsidiary will benefit communications users in the United States and around the world by creating a dynamic new global competitor. ” Copyright © 1999 Ian H. Giddy M&A 25

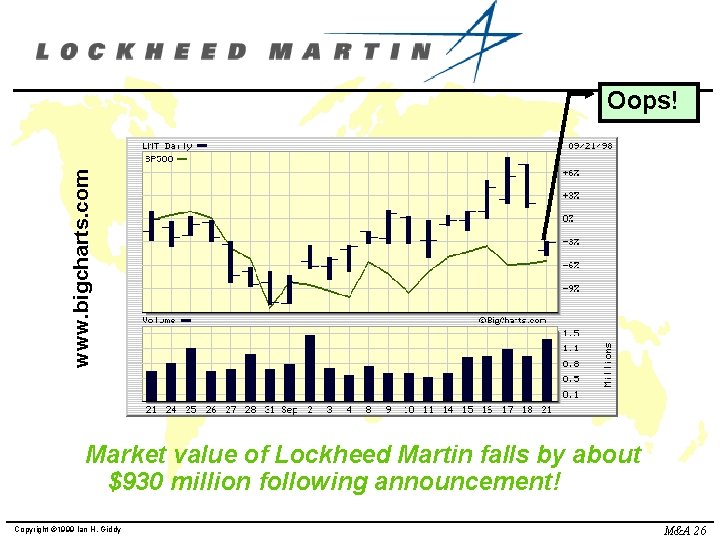

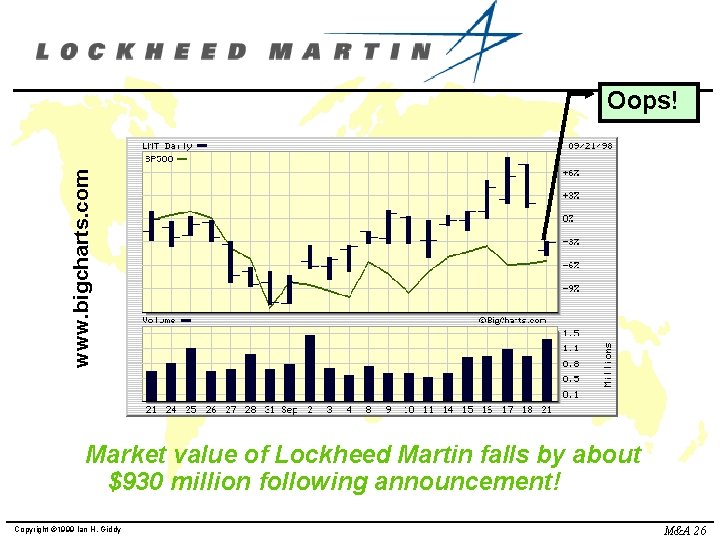

www. bigcharts. com Oops! Market value of Lockheed Martin falls by about $930 million following announcement! Copyright © 1999 Ian H. Giddy M&A 26

Lockheed Shares Fall 4. 9%. Shares of the Lockheed Martin Corporation fell 4. 9 percent amid concern that the world's largest defense company is putting earnings at risk with its $2. 7 billion bid for Comsat Corp. , a provider of satellite services. Lockheed's revenue is generated primarily by the sale of military equipment to the Federal Government. While the business of selling time on satellites is growing far faster than defense spending, investors are concerned that Lockheed, which makes satellites, is now moving away from a defense business that provides steady earnings. Lockheed's investors tend to own the stock because of the steady earnings, an analyst said. They would rather see the money used to pay down debt or buy back stock, he said. Issuing shares to buy Comsat also raises concern that Lockheed's per-share earnings would be diluted. www. nytimes. com Copyright © 1999 Ian H. Giddy M&A 27

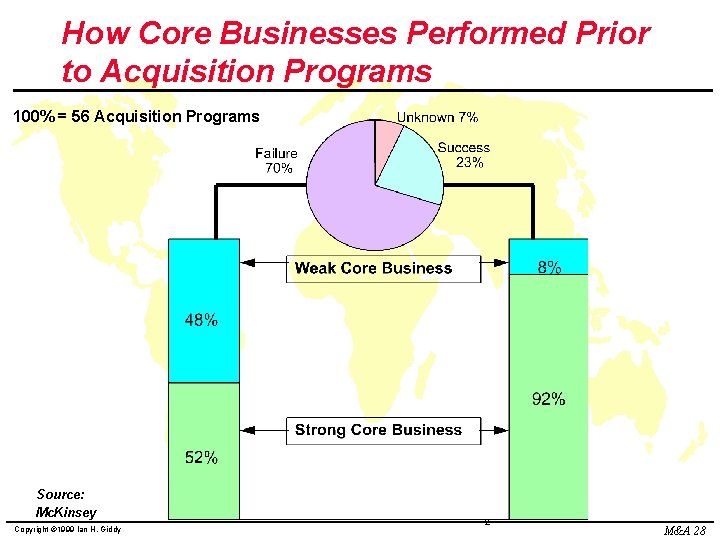

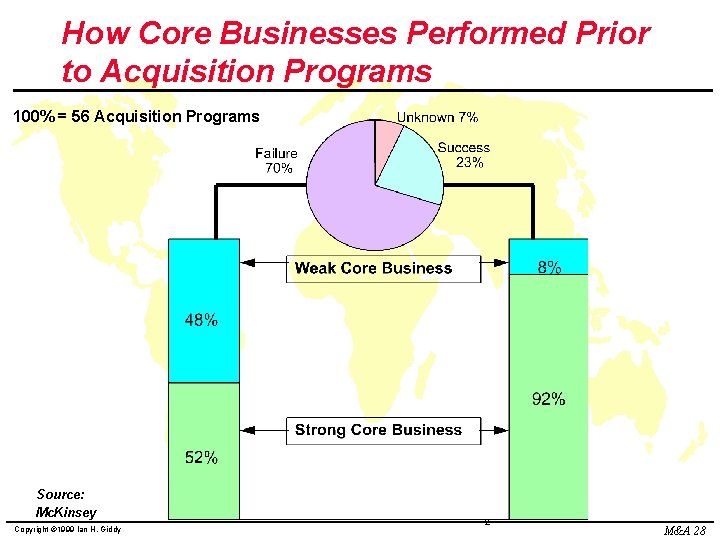

How Core Businesses Performed Prior to Acquisition Programs 100% = 56 Acquisition Programs Source: Mc. Kinsey Copyright © 1999 Ian H. Giddy 2 M&A 28

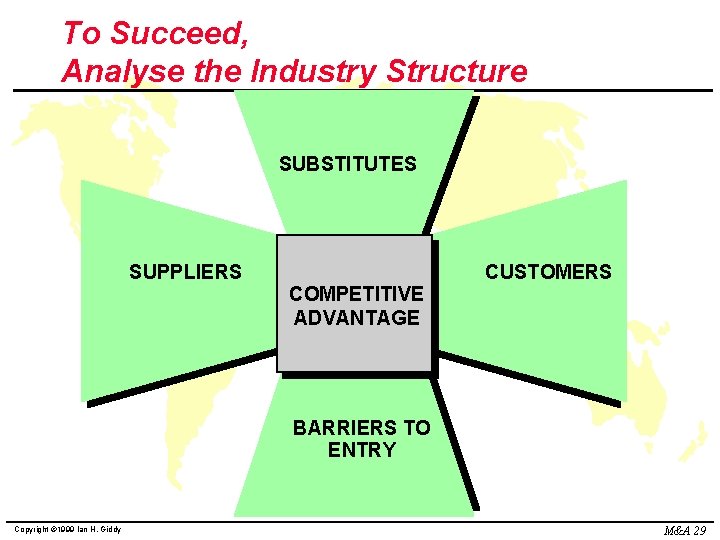

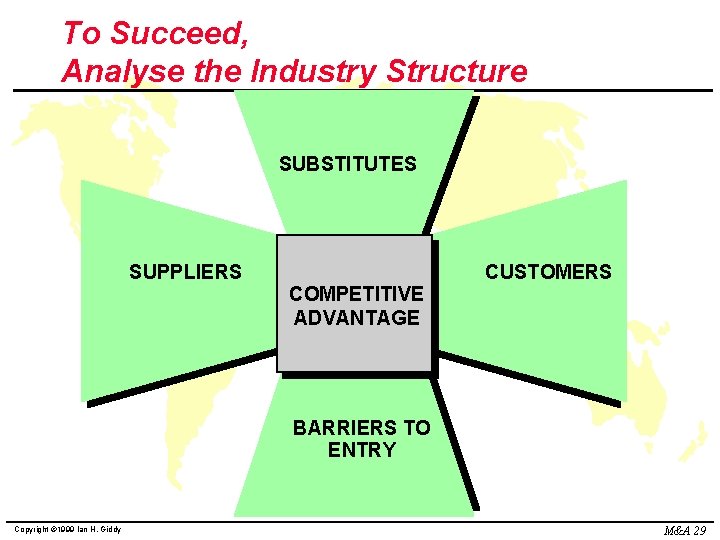

To Succeed, Analyse the Industry Structure SUBSTITUTES SUPPLIERS COMPETITIVE ADVANTAGE CUSTOMERS BARRIERS TO ENTRY Copyright © 1999 Ian H. Giddy M&A 29

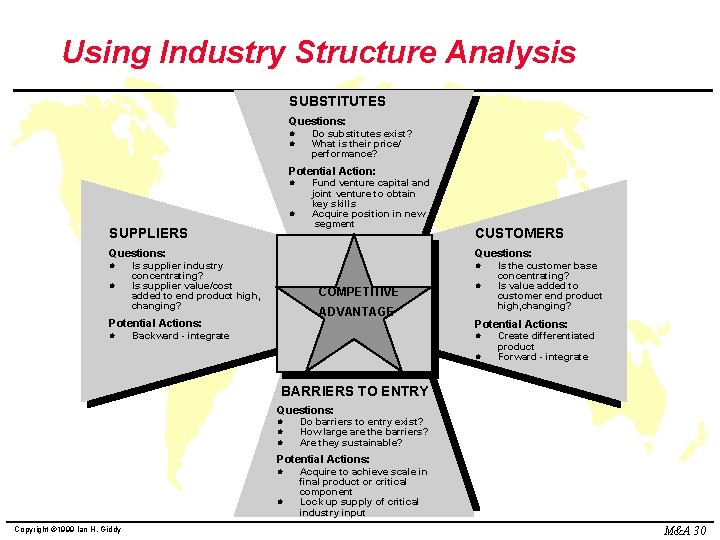

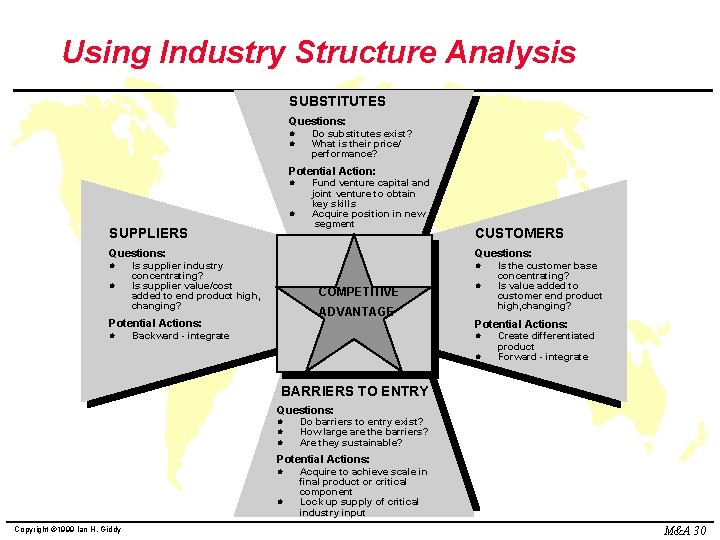

Using Industry Structure Analysis SUBSTITUTES Questions: l l Do substitutes exist? What is their price/ performance? Potential Action: l l SUPPLIERS Fund venture capital and joint venture to obtain key skills Acquire position in new segment Questions: l l Questions: Is supplier industry concentrating? Is supplier value/cost added to end product high, changing? l COMPETITIVE ADVANTAGE Potential Actions: l CUSTOMERS Backward - integrate l Is the customer base concentrating? Is value added to customer end product high, changing? Potential Actions: l l Create differentiated product Forward - integrate BARRIERS TO ENTRY Questions: l l l Do barriers to entry exist? How large are the barriers? Are they sustainable? Potential Actions: l l Copyright © 1999 Ian H. Giddy Acquire to achieve scale in final product or critical component Lock up supply of critical industry input M&A 30

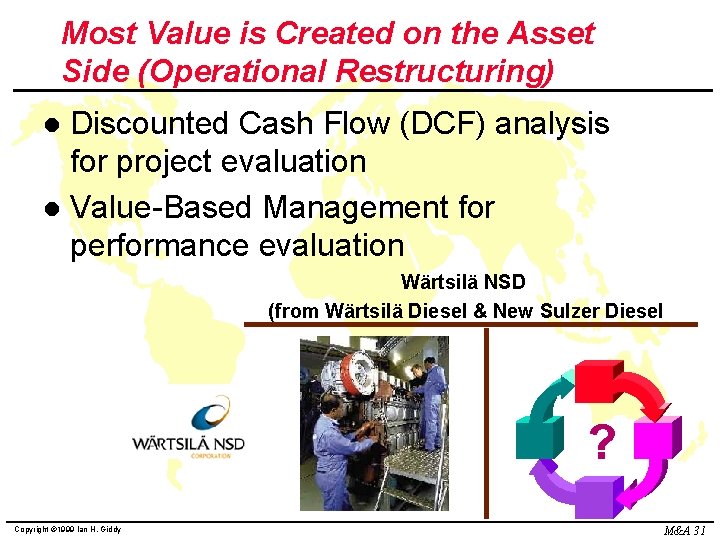

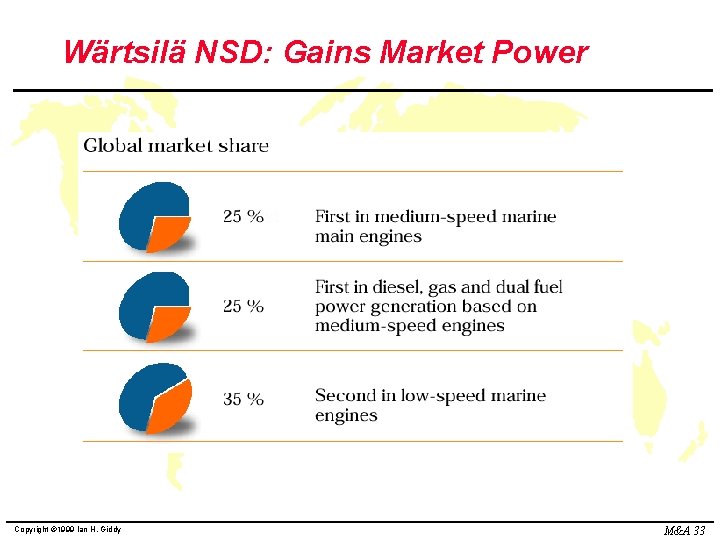

Most Value is Created on the Asset Side (Operational Restructuring) Discounted Cash Flow (DCF) analysis for project evaluation l Value-Based Management for performance evaluation l Wärtsilä NSD (from Wärtsilä Diesel & New Sulzer Diesel ? Copyright © 1999 Ian H. Giddy M&A 31

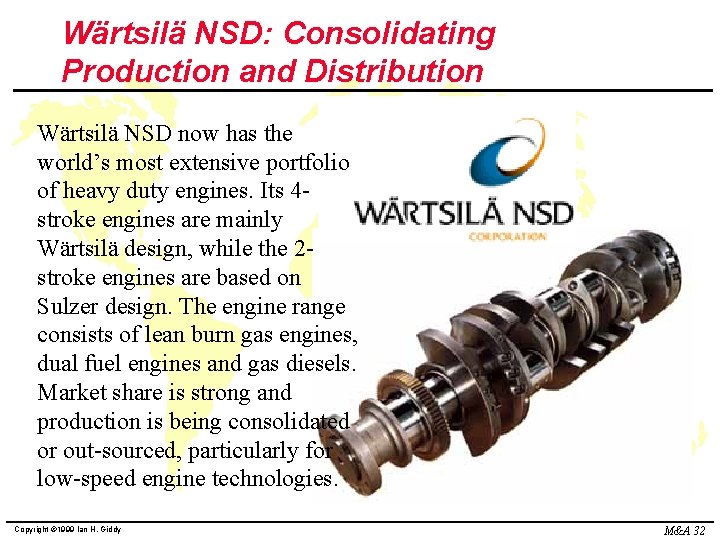

Wärtsilä NSD: Consolidating Production and Distribution Wärtsilä NSD now has the world’s most extensive portfolio of heavy duty engines. Its 4 stroke engines are mainly Wärtsilä design, while the 2 stroke engines are based on Sulzer design. The engine range consists of lean burn gas engines, dual fuel engines and gas diesels. Market share is strong and production is being consolidated or out-sourced, particularly for low-speed engine technologies. Copyright © 1999 Ian H. Giddy M&A 32

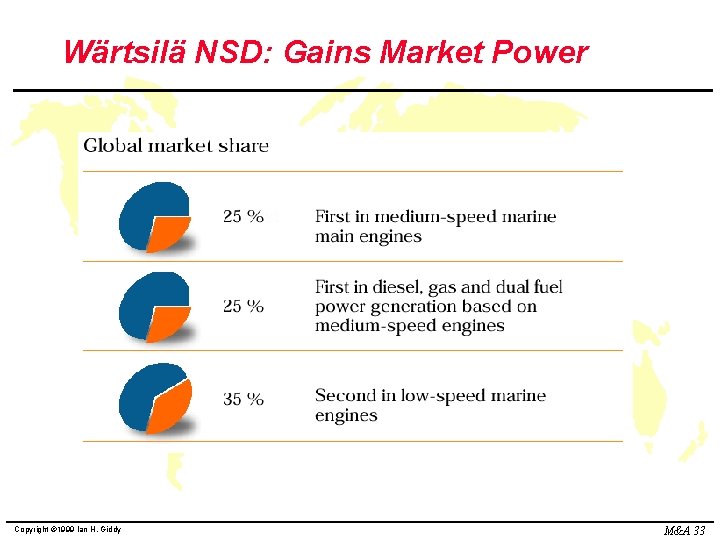

Wärtsilä NSD: Gains Market Power Copyright © 1999 Ian H. Giddy M&A 33

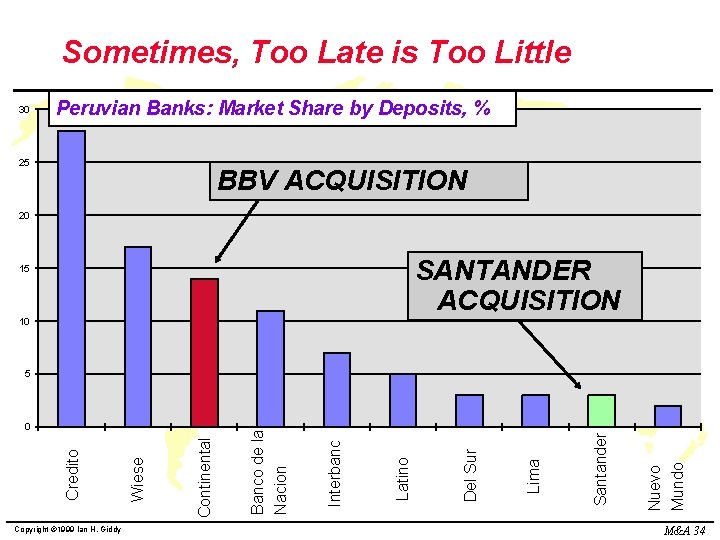

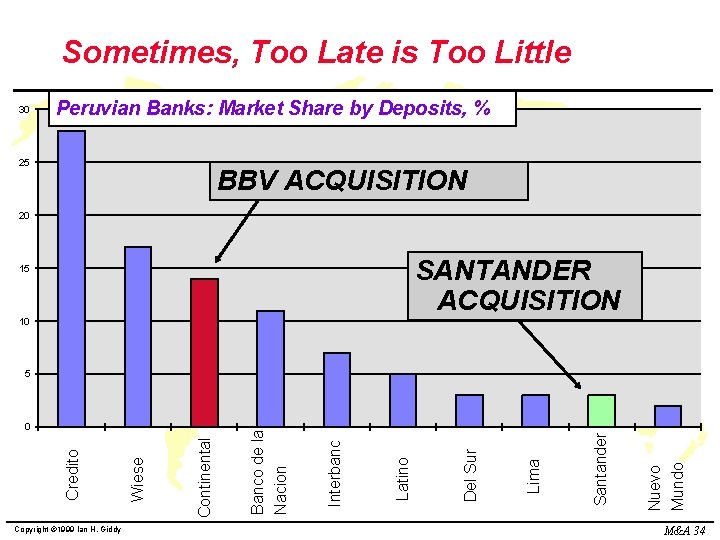

Sometimes, Too Late is Too Little 30 Peruvian Banks: Market Share by Deposits, % 25 BBV ACQUISITION 20 SANTANDER ACQUISITION 15 10 Copyright © 1999 Ian H. Giddy Nuevo Mundo Santander Lima Del Sur Latino Interbanc Continental Wiese Credito 0 Banco de la Nacion 5 M&A 34

Goals of Acquisitions Rationale: Firm A should merge with Firm B if [Value of AB > Value of A + Value of B + Cost of transaction] l Synergy l Gain market power l Discipline Example: l Taxes Ciba-Geigy/ l Financing Sandoz Copyright © 1999 Ian H. Giddy M&A 35

Case Study: Ciba-Geigy-Sandoz Questions: l What kind of merger was this? l What was the motivation for the merger? l What were the potential sources of synergy? l Where do you think value added woul come from in this merger? l What might go wrong? Copyright © 1999 Ian H. Giddy M&A 36

www. giddy. org Ian Giddy NYU Stern School of Business Tel 212 -998 -0332; Fax 212 -995 -4233 ian. giddy@nyu. edu http: //www. giddy. org Copyright © 1999 Ian H. Giddy M&A 41