MARKETING MANAGEMENT 14 Developing Pricing Strategies and Programs

- Slides: 39

MARKETING MANAGEMENT 14 Developing Pricing Strategies and Programs

What is Price? Price: is the sum of all values that consumers exchange for the benefits of having or using the product or service. 2

Price has many names: • • • Rent Tuition Fare Rate Commission Wage • • • Fee Dues Interest Donation Salary 3

Common Pricing Mistakes • Determining costs and taking traditional industry margins • Failure to revise price to capitalize on market changes • Setting price independently of the rest of the marketing mix • Failure to vary price by product item, market segment, distribution channels, and purchase occasion 4

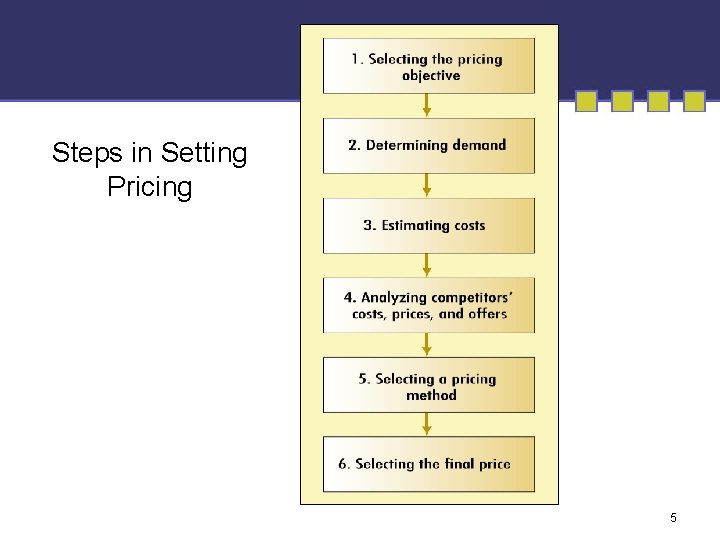

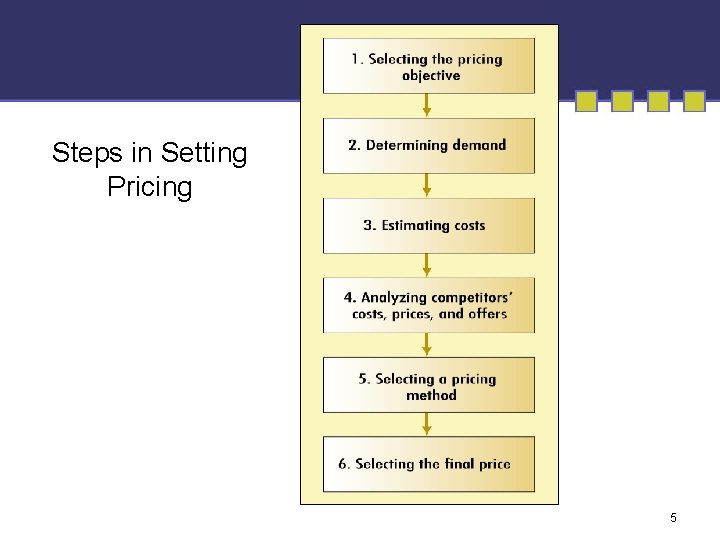

Steps in Setting Pricing 5

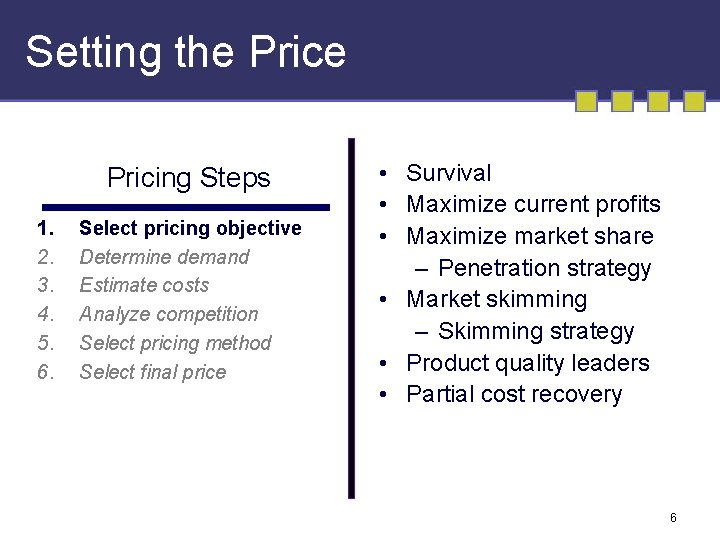

Setting the Pricing Steps 1. 2. 3. 4. 5. 6. Select pricing objective Determine demand Estimate costs Analyze competition Select pricing method Select final price • Survival • Maximize current profits • Maximize market share – Penetration strategy • Market skimming – Skimming strategy • Product quality leaders • Partial cost recovery 6

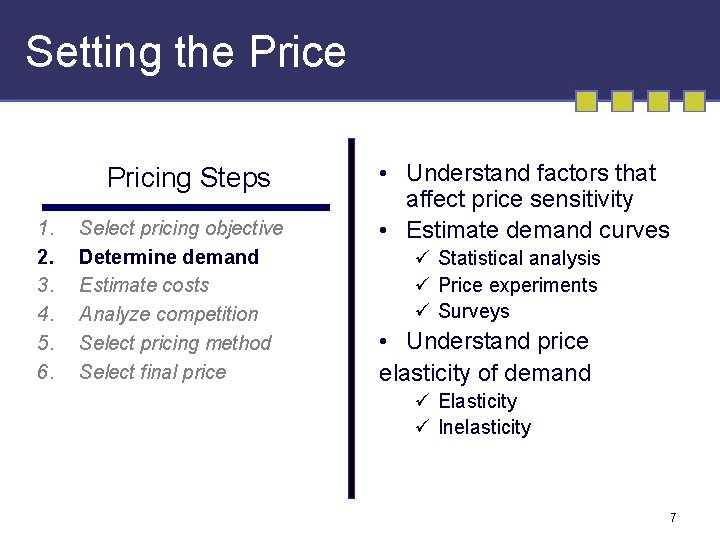

Setting the Pricing Steps 1. 2. 3. 4. 5. 6. Select pricing objective Determine demand Estimate costs Analyze competition Select pricing method Select final price • Understand factors that affect price sensitivity • Estimate demand curves ü Statistical analysis ü Price experiments ü Surveys • Understand price elasticity of demand ü Elasticity ü Inelasticity 7

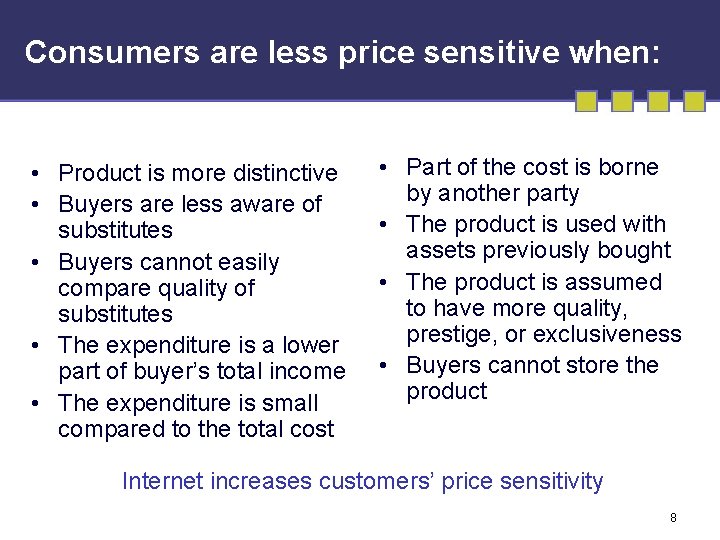

Consumers are less price sensitive when: • Product is more distinctive • Buyers are less aware of substitutes • Buyers cannot easily compare quality of substitutes • The expenditure is a lower part of buyer’s total income • The expenditure is small compared to the total cost • Part of the cost is borne by another party • The product is used with assets previously bought • The product is assumed to have more quality, prestige, or exclusiveness • Buyers cannot store the product Internet increases customers’ price sensitivity 8

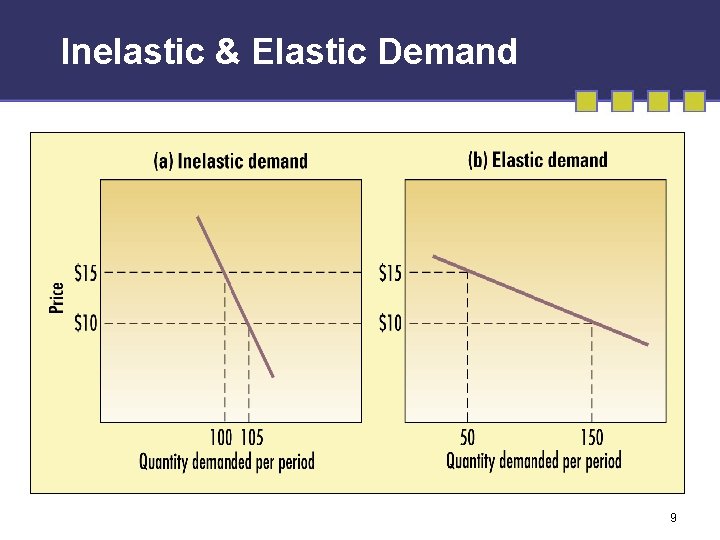

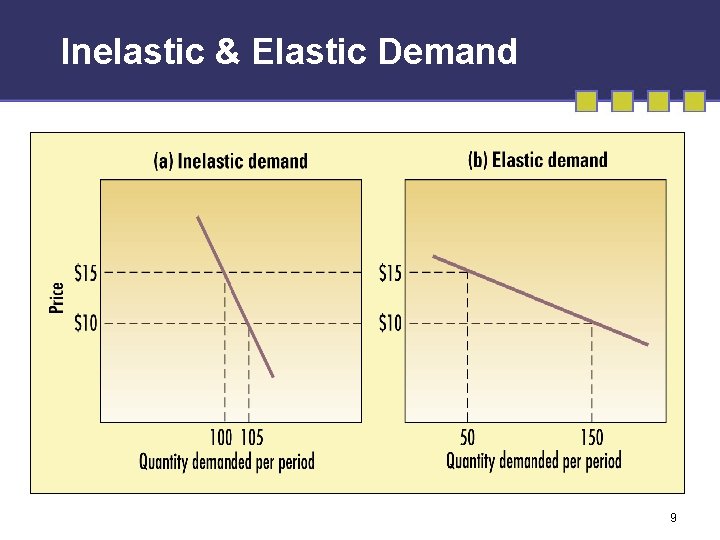

Inelastic & Elastic Demand 9

Demand is less elastic under these conditions: • There are few or no substitutes/competitors • Buyers do not readily notice the higher price • Buyers are slow to change their buying habits and search for lower prices • Buyers think higher prices are justified 10

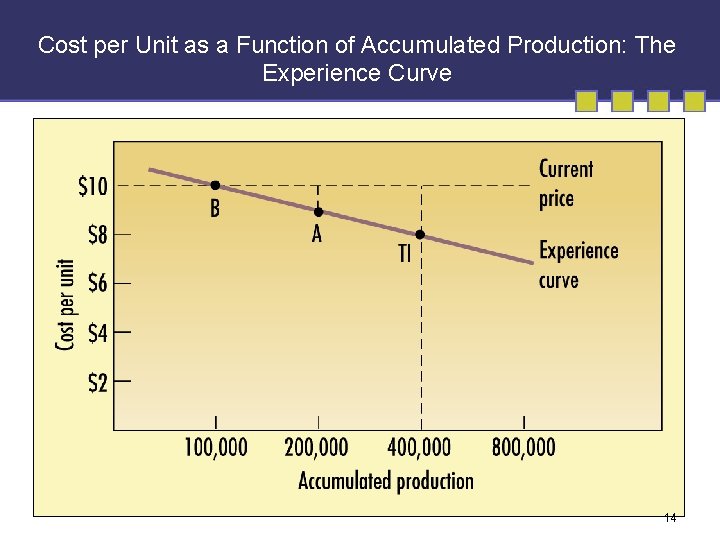

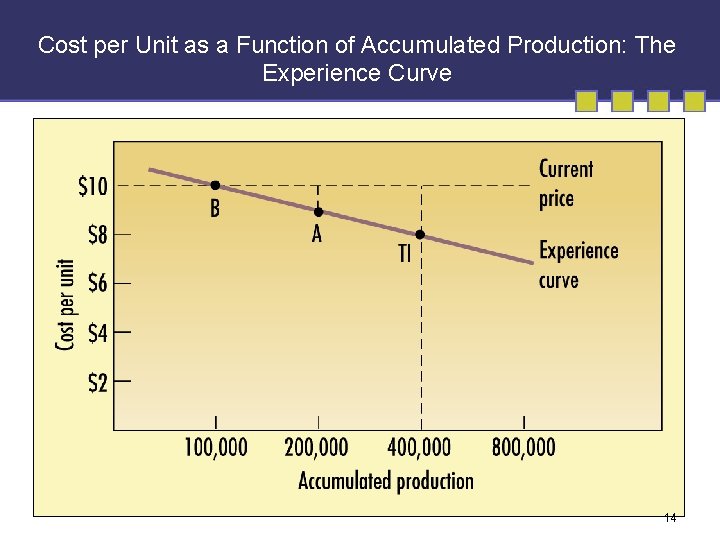

Setting the Pricing Steps 1. 2. 3. 4. 5. 6. Select pricing objective Determine demand Estimate costs Analyze competition Select pricing method Select final price • Types of costs and levels of production must be considered • Accumulated production leads to cost reduction via the experience curve • Differentiated marketing offers create different cost levels (Activitybased cost ABC) 11

Setting the Price Key Pricing Terms: § Fixed costs/overhead: costs that don’t vary with production or sales revenue. § Variable costs: vary with the level of production. § Total costs: sum of fixed and variable costs at a given level of production § Average cost: cost per unit at a given level of production = total cost/quantity of production. 12

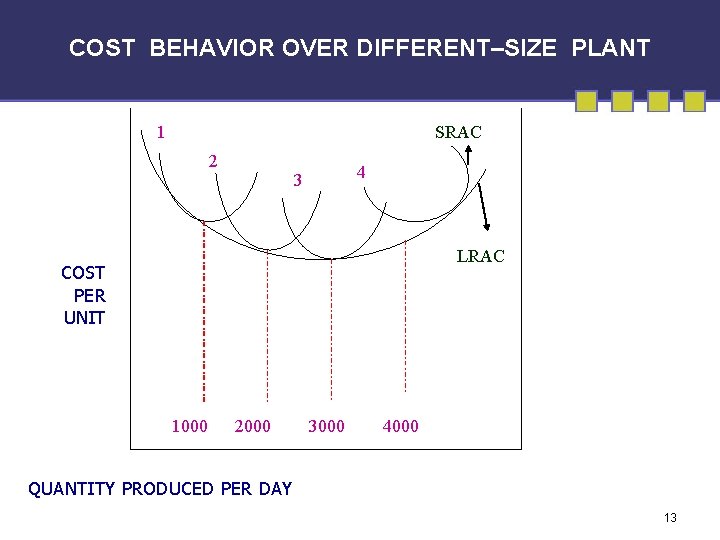

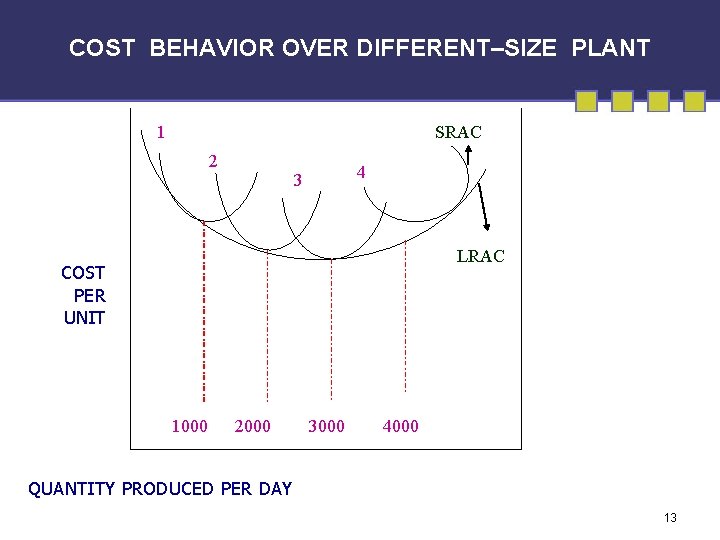

COST BEHAVIOR OVER DIFFERENT–SIZE PLANT 1 SRAC 2 4 3 LRAC COST PER UNIT 1000 2000 3000 4000 QUANTITY PRODUCED PER DAY 13

Cost per Unit as a Function of Accumulated Production: The Experience Curve 14

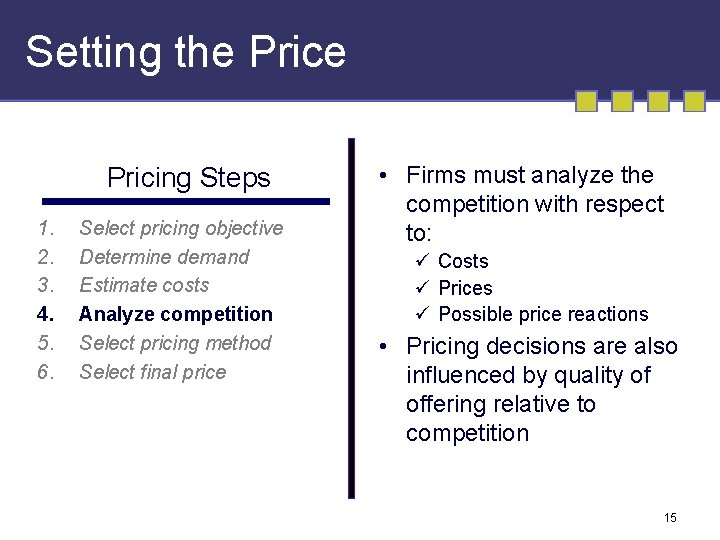

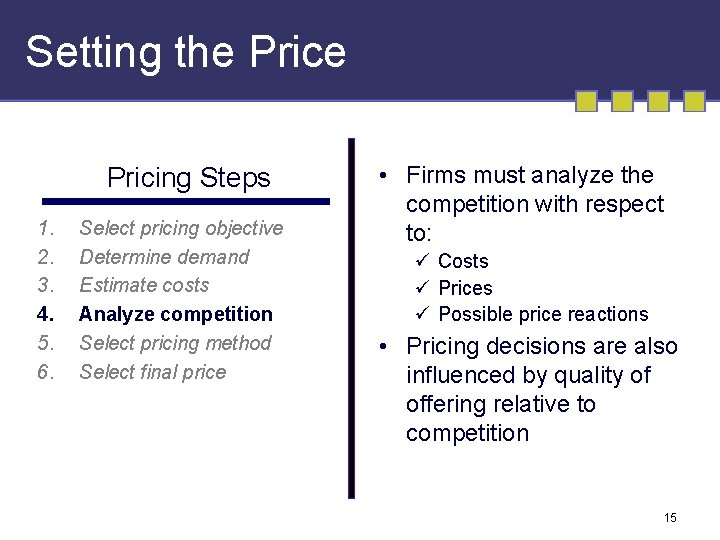

Setting the Pricing Steps 1. 2. 3. 4. 5. 6. Select pricing objective Determine demand Estimate costs Analyze competition Select pricing method Select final price • Firms must analyze the competition with respect to: ü Costs ü Prices ü Possible price reactions • Pricing decisions are also influenced by quality of offering relative to competition 15

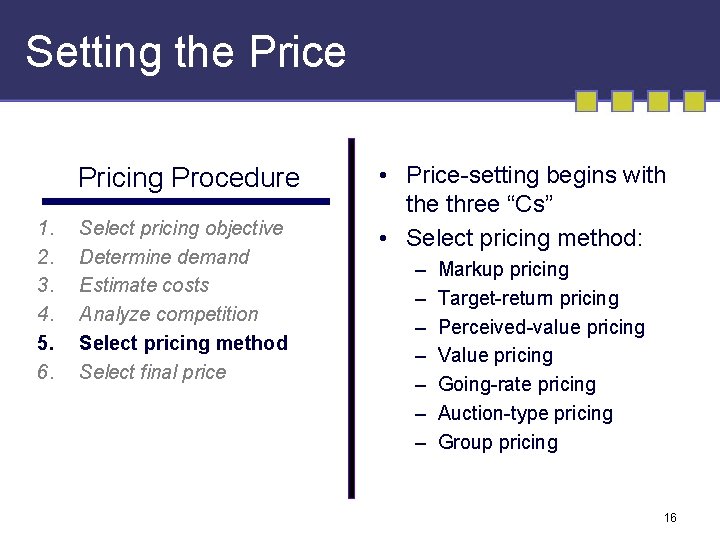

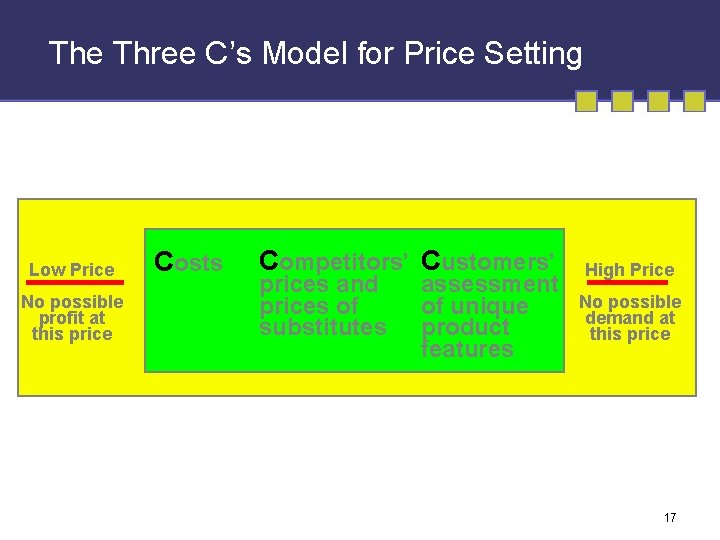

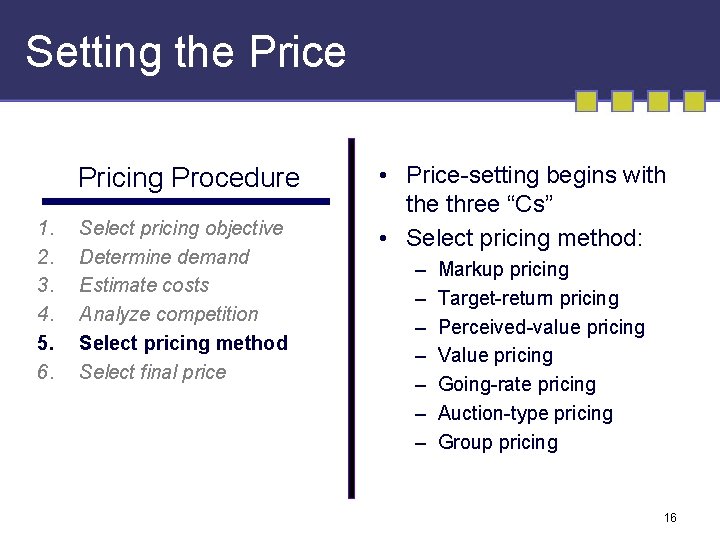

Setting the Pricing Procedure 1. 2. 3. 4. 5. 6. Select pricing objective Determine demand Estimate costs Analyze competition Select pricing method Select final price • Price-setting begins with the three “Cs” • Select pricing method: – – – – Markup pricing Target-return pricing Perceived-value pricing Value pricing Going-rate pricing Auction-type pricing Group pricing 16

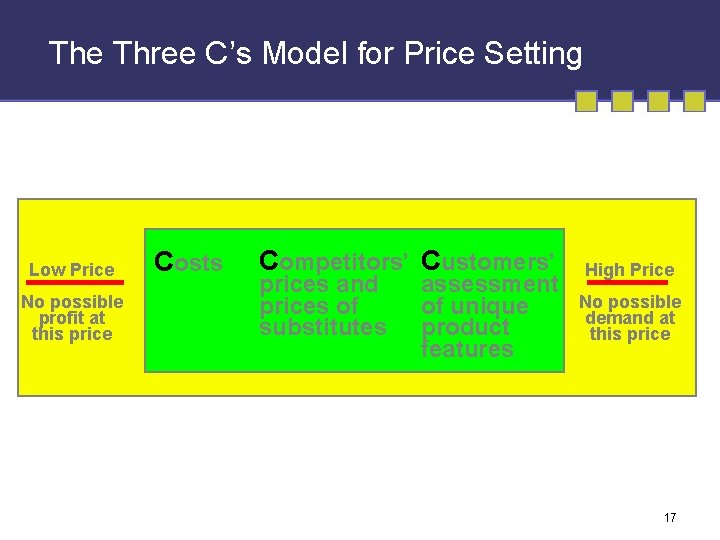

The Three C’s Model for Price Setting Low Price No possible profit at this price Costs Competitors’ Customers’ prices and prices of substitutes assessment of unique product features High Price No possible demand at this price 17

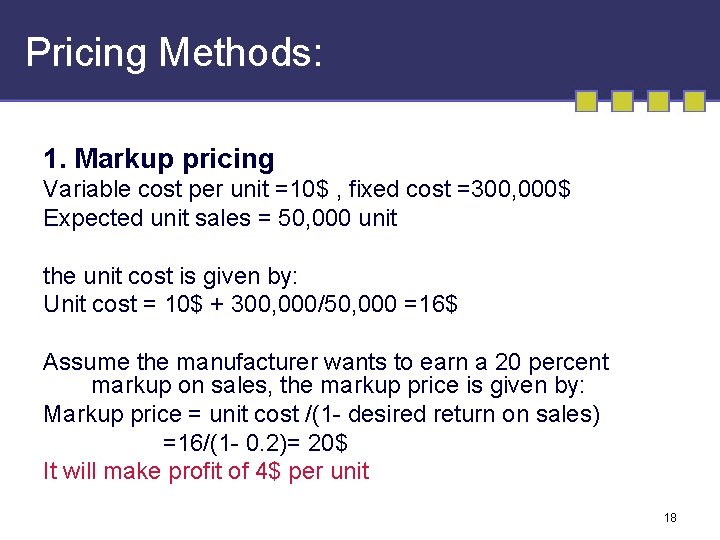

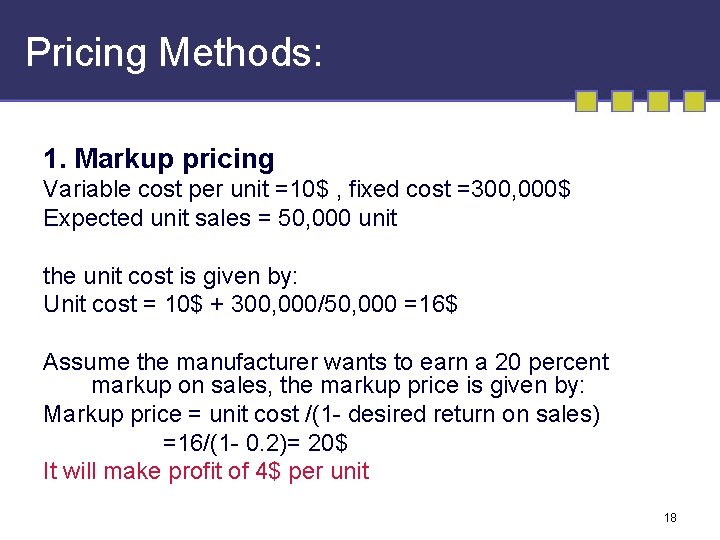

Pricing Methods: 1. Markup pricing Variable cost per unit =10$ , fixed cost =300, 000$ Expected unit sales = 50, 000 unit the unit cost is given by: Unit cost = 10$ + 300, 000/50, 000 =16$ Assume the manufacturer wants to earn a 20 percent markup on sales, the markup price is given by: Markup price = unit cost /(1 - desired return on sales) =16/(1 - 0. 2)= 20$ It will make profit of 4$ per unit 18

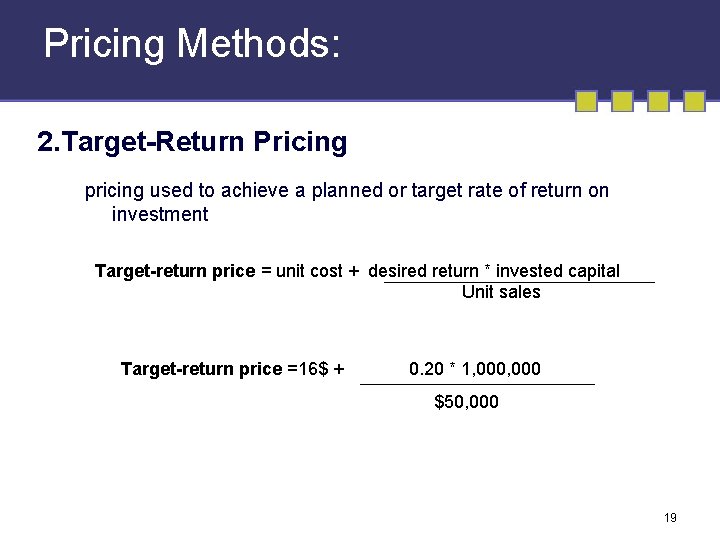

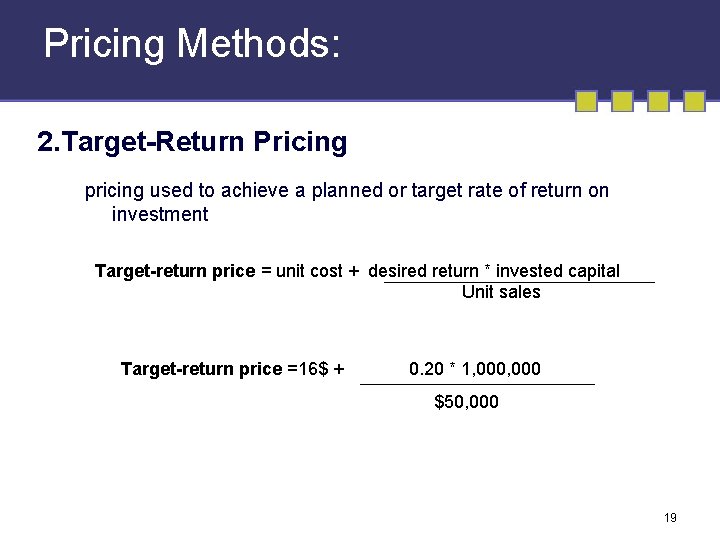

Pricing Methods: 2. Target-Return Pricing pricing used to achieve a planned or target rate of return on investment Target-return price = unit cost + desired return * invested capital Unit sales Target-return price =16$ + 0. 20 * 1, 000 $50, 000 19

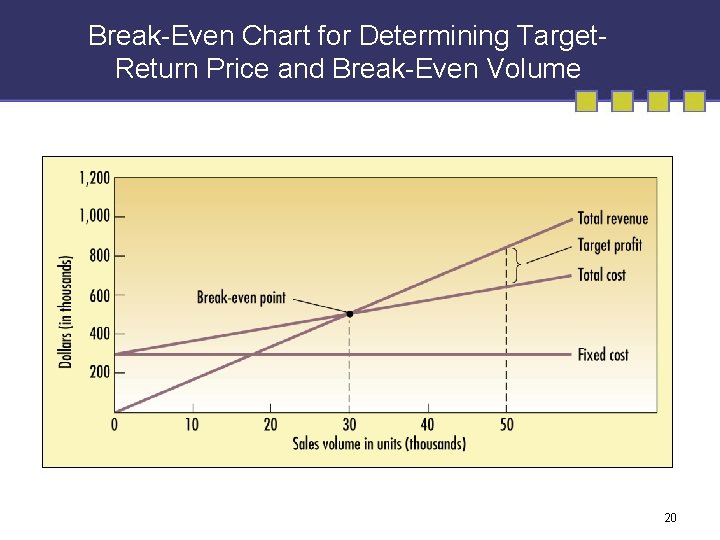

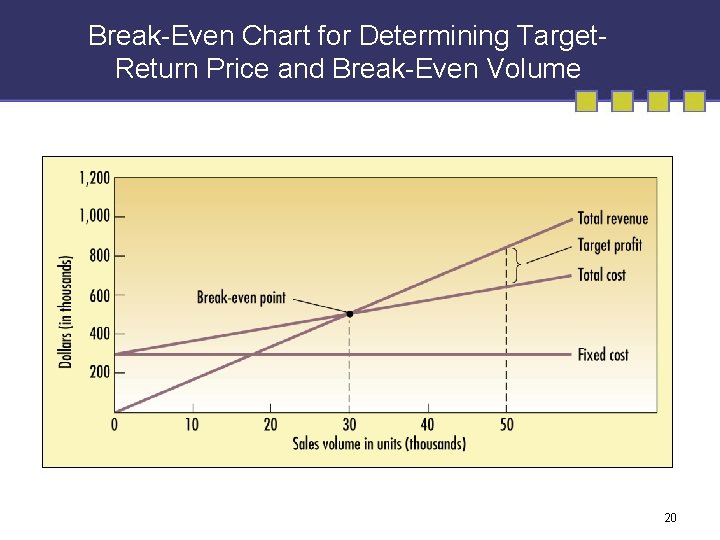

Break-Even Chart for Determining Target. Return Price and Break-Even Volume 20

Pricing Methods: 3. Perceived-Value Pricing • Companies base their price on the customer’s perceived value. • The key to perceived-value pricing is to deliver more value than the competitor and to demonstrate this to prospective buyers. • There are three groups of buyers : ü Price buyers ü Value buyers ü Loyal buyers 21

Pricing Methods: 4. Value Pricing • Win loyal customer by charging a fairly low price for a high-quality offering, that means : reengineering the companies operations to be low -cost without sacrificing quality. 5. Going-Rate Pricing • The firm bases its price largely on competitors’ prices. (smaller firms “follow the leader”). • It is quite popular where costs are difficult to measure or competitive response is uncertain. 22

Pricing Methods: 6. Auction-Type Pricing • • One major purpose of auctions is to dispose of excess inventories or used goods. Three major types of auctions: 1 - English auctions (ascending bids). 2 - Dutch auctions (descending bids). 3 - Sealed-bid auctions. 7. Group Pricing • Consumers and business buyers join groups to buy at a lower price (www. volumebuy. com). 23

Setting the Pricing Steps 1. 2. 3. 4. 5. 6. Select pricing objective Determine demand Estimate costs Analyze competition Select pricing method Select final price • Requires consideration of additional factors: – Psychological pricing – Influence of other marketing mix variables – Company pricing policies – Gain-and-risk-sharing pricing – Impact of price on other parties 24

Adapting the Price 1. Geographical Pricing § Barter: the direct exchange of goods with no money and no third party involved § Compensation deal: the seller receives some percentage of the payment in cash and the rest in products § Buyback arrangement: the seller sell a plant equipment or technology to another country and agrees to accept as partial payment products manufactured with the supplied equipment § Offset: the seller receives full payment in cash but agrees to spend a substantial amount of the money in that country within a stated time period. 25

Adapting the Price 2. Price Discounts and Allowances • Quantity discount: The more you buy, the cheaper it becomes-- cumulative and non-cumulative. • Trade discounts: Reductions from list for functions performed-- storage, promotion. • Cash discount: A deduction granted to buyers for paying their bills within a specified period of time, (after first deducting trade and quantity discounts from the base price) 26

Adapting the Price • Functional discount: discount offered by a manufacturer to trade-channel members if they will perform certain functions. • Seasonal discount: a price reduction to those who buy out of season. • Allowance: an extra payment designed to gain reseller participation in special programs. 27

Adapting the Price 3. Promotional Pricing • Loss-leader pricing: supermarkets and department stores often drop the price on well known brands to stimulate additional store traffic • Special-event pricing: sellers well establish special pricing in certain seasons to draw in more customers • Cash rebates: companies offer cash rebates to encourage purchase of the manufacturers products within a specified time period • Low-interest financing: the company can offer customers low-interest financing 28

Adapting the Price • Longer payment terms: sellers especially mortgage banks and auto companies stretch loans over longer periods and thus lower the monthly payment • Warranties and service contracts: companies can promote sales by adding a free or low cost warranty or service contract • Psychological discounting: this strategy involves setting an artificially high price and then offering the product at substantial savings 29

Adapting the Price 4. Discriminatory Pricing • Price discrimination works when: – Market segments show different intensities of demand – Consumers in lower-price segments can not resell to higher-price segments – Competitors can not undersell the firm in higher-price segments – Cost of segmenting and policing the market does not exceed extra revenue 30

Adapting the Price Discriminatory Pricing Tactics: – Customer segment pricing – Product-form pricing – Image pricing – Channel pricing – Location pricing – Time pricing 31

Adapting the Price 5. Discriminatory Pricing There are six situations involving product mix pricing: 1) Product line pricing: Companies normally develop product lines rather than single products and introduce price steps. 2) Optional feature pricing: Many companies offer optional products, features and service along with their main product. 3) Captive product pricing: Some products require the use of ancillary or captive products. 32

Adapting the Price 4) Two part pricing product: Service firms often engage in two-part pricing consisting of affixed fee plus variable usage fee. 5) By-product pricing: The production of certain goods-meat petroleum products often results in by-products. 6) Product bundling: Sellers often bundle products and features. 33

Initiating and Responding to Price Changes Key Considerations 1. 2. 3. 4. Initiating price cuts Initiating price increases Reactions to price changes Responding to competitor’s price changes • Circumstances leading to price cuts: – Excess plant capacity – Declining market share – Attempt to dominate the market via lower costs • Price cutting traps: – Price/quality perceptions – Low prices don’t create market loyalty – Competition may match or beat price cuts 34

Initiating and Responding to Price Changes Key Considerations 1. 2. 3. 4. Initiating price cuts Initiating price increases Reactions to price changes Responding to competitor’s price changes • Circumstances leading to price increases: – Cost inflation – Over demand • Methods of dealing with over demand: – – Delayed quotation pricing Escalator clauses Unbundling Reduction of discounts 35

Initiating and Responding to Price Changes Key Considerations 1. 2. 3. 4. Initiating price cuts Initiating price increases Reactions to price changes Responding to competitor’s price changes • Firms must monitor both customer and competitor reactions • Competitor reactions are common when: – Few firms offer the product – The product is homogeneous – Buyers are highly informed 36

Initiating and Responding to Price Changes Key Considerations 1. 2. 3. 4. Initiating price cuts Initiating price increases Reactions to price changes Responding to competitor’s price changes • The degree of product homogeneity affects how firms respond to price cuts initiated by the competition • Market leaders can respond to aggressive price cutting by smaller competitors in several ways 37

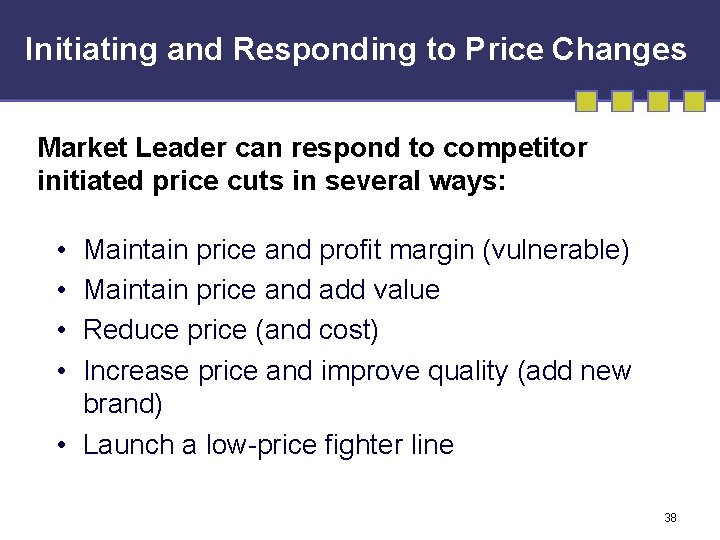

Initiating and Responding to Price Changes Market Leader can respond to competitor initiated price cuts in several ways: • • Maintain price and profit margin (vulnerable) Maintain price and add value Reduce price (and cost) Increase price and improve quality (add new brand) • Launch a low-price fighter line 38

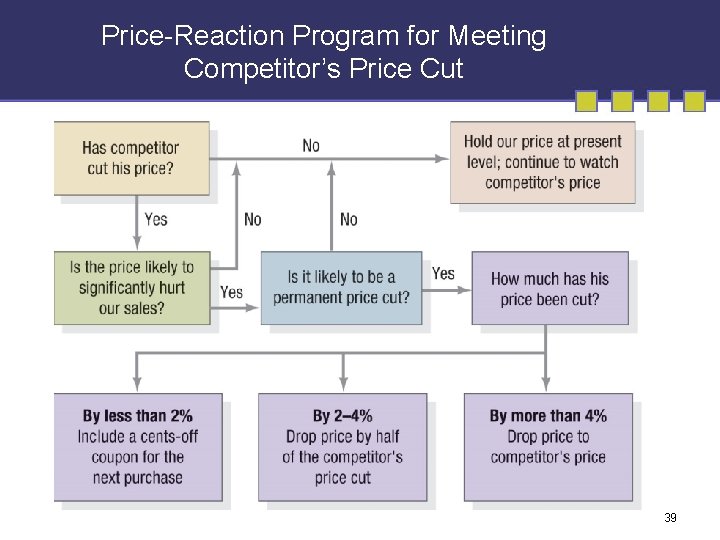

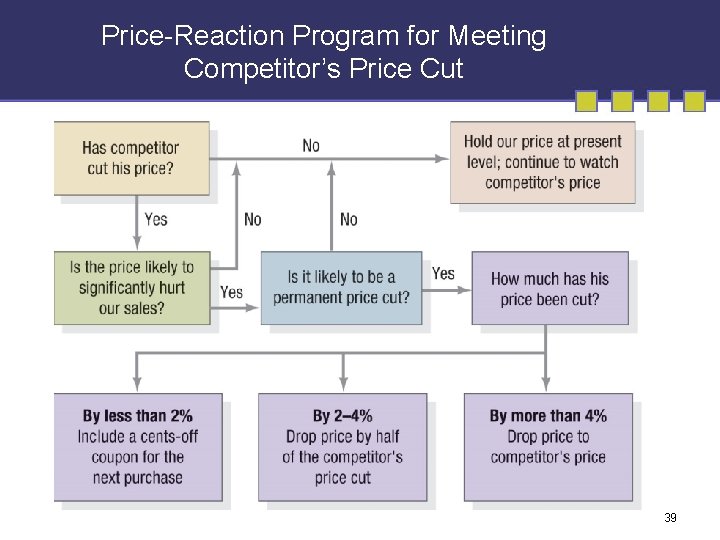

Price-Reaction Program for Meeting Competitor’s Price Cut 39