Legal Aspects of Finance Slide Set 3 Markets

- Slides: 30

Legal Aspects of Finance Slide Set 3 Markets, Parties and Trading • The Stock Exchange and Other Public Trading in Securities • (National) Regulation: Sources, Overview Matti Rudanko

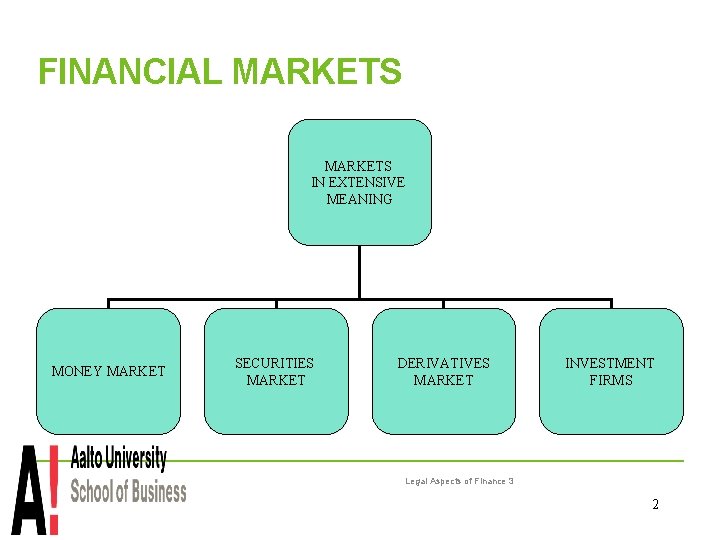

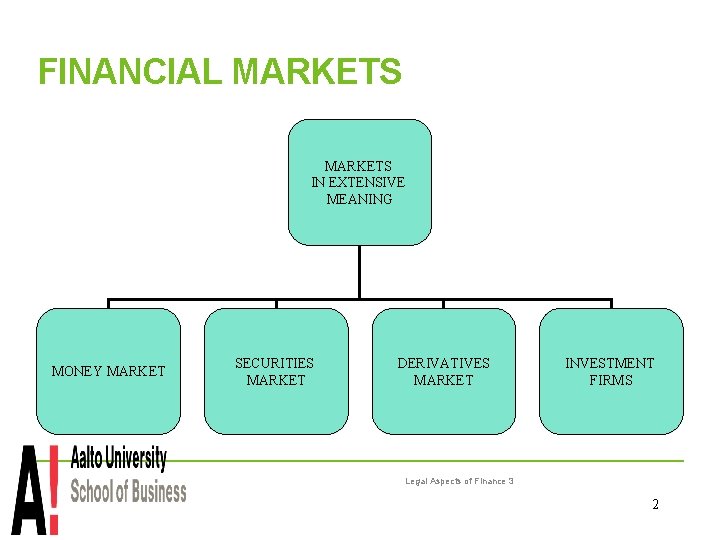

FINANCIAL MARKETS IN EXTENSIVE MEANING MONEY MARKET SECURITIES MARKET DERIVATIVES MARKET INVESTMENT FIRMS Legal Aspects of Finance 3 2

Money Market for short-term (usually less than a year) financial instruments Governments, banks and companies obtain their short-term funding and deal with fluctuations in their liquidity treasury bills, certificates of deposit and commercial papers Legal Aspects of Finance 3 3

Derivatives Options, futures, swaps, forward rate agreements and any other derivative contracts relating to securities, currencies, interest rates or yields, or other derivatives instruments, financial indices or financial measures which may be settled physically or in cash Options, futures, swaps, forward rate agreements and any other derivative contracts relating to commodities that must be settled in cash or may be settled in cash at the option of one of the parties or that can be physically settled provided that they are traded on a regulated market and/or an MTF (Multilateral Trading Facilities) Legal Aspects of Finance 3 4

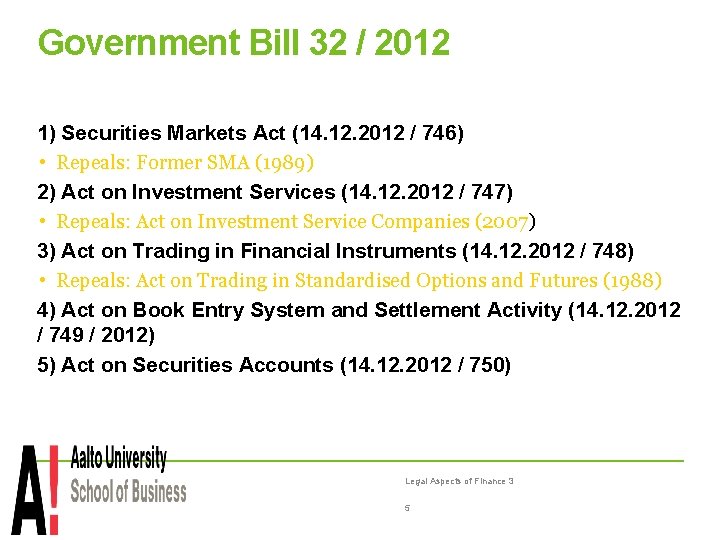

Government Bill 32 / 2012 1) Securities Markets Act (14. 12. 2012 / 746) • Repeals: Former SMA (1989) 2) Act on Investment Services (14. 12. 2012 / 747) • Repeals: Act on Investment Service Companies (2007) 3) Act on Trading in Financial Instruments (14. 12. 2012 / 748) • Repeals: Act on Trading in Standardised Options and Futures (1988) 4) Act on Book Entry System and Settlement Activity (14. 12. 2012 / 749 / 2012) 5) Act on Securities Accounts (14. 12. 2012 / 750) Legal Aspects of Finance 3 5

The Purpose of the Total Reform of the Finnish Securities Legislation In order to increase the attractiveness and competitiveness of the markets, regulation should ensure the high quality of investor protection. For this purpose, the propositions included in the Govenrnment Bill aim at strengthening investor protection i. a. by making the damages liability provisions clearer, obligating the investment service company to be a member of a body engaged in dealing wsith complaints of customers and imposing investment firms the duty to obtain a financial service licence for carrying on safekeeping of financial instruments Legal Aspects of Finance 3 6

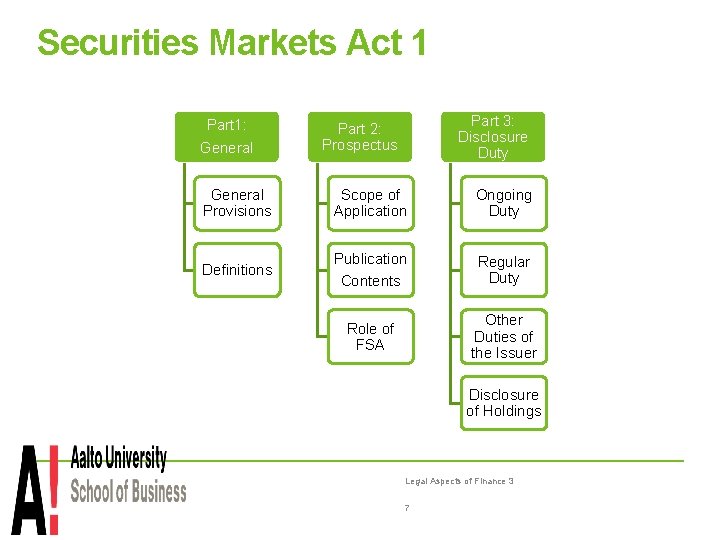

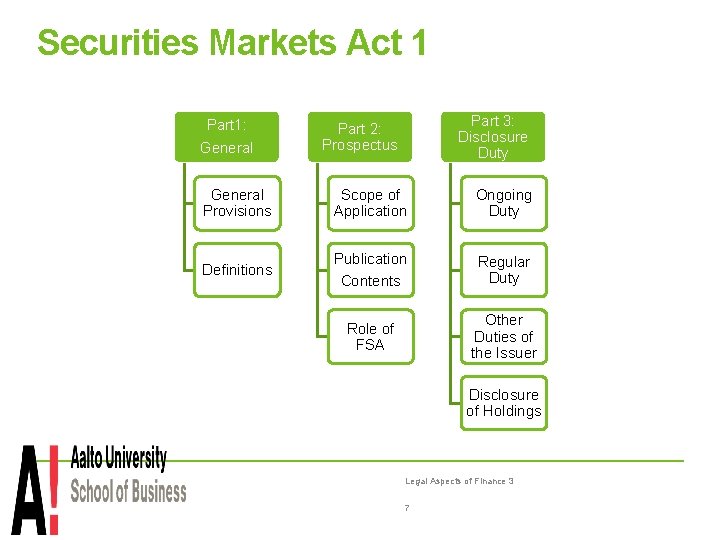

Securities Markets Act 1 Part 1: General Part 3: Disclosure Duty Part 2: Prospectus General Provisions Scope of Application Ongoing Duty Definitions Publication Contents Regular Duty Role of FSA Other Duties of the Issuer Disclosure of Holdings Legal Aspects of Finance 3 7

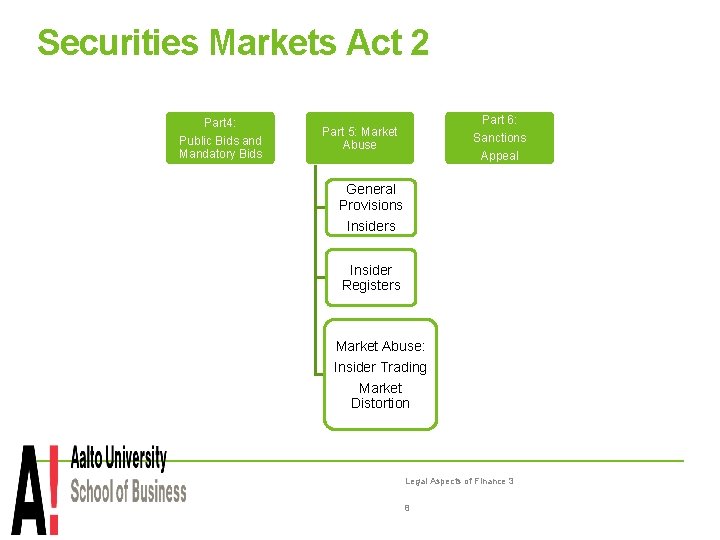

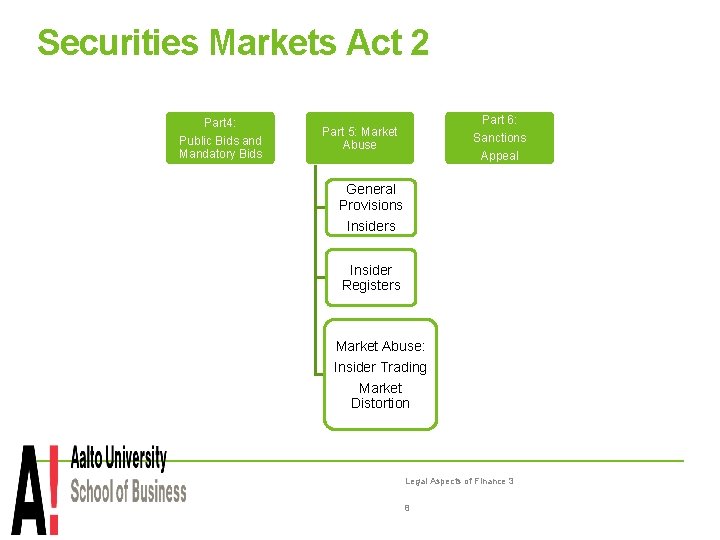

Securities Markets Act 2 Part 4: Public Bids and Mandatory Bids Part 6: Part 5: Market Abuse Sanctions Appeal General Provisions Insider Registers Market Abuse: Insider Trading Market Distortion Legal Aspects of Finance 3 8

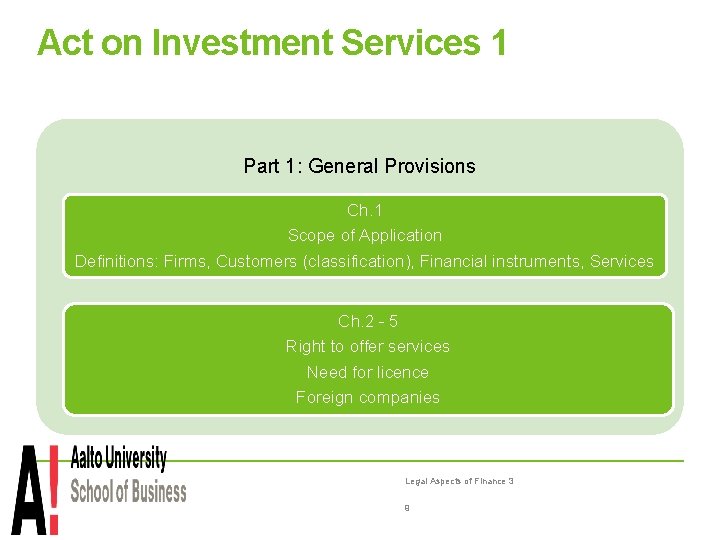

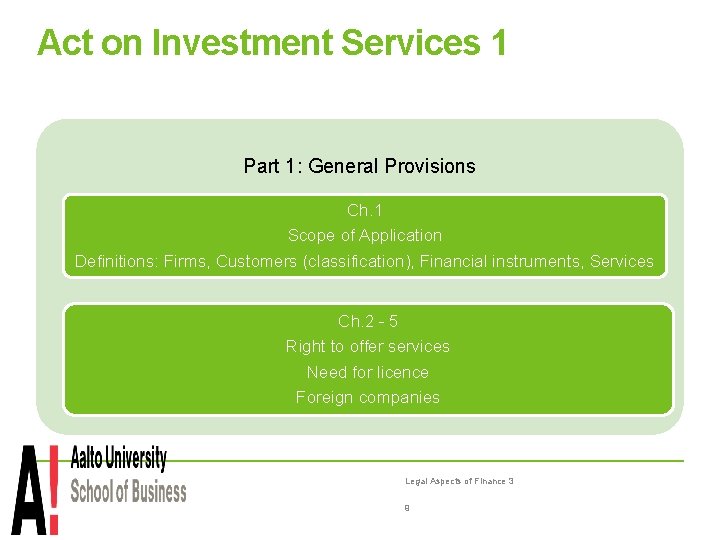

Act on Investment Services 1 Part 1: General Provisions Ch. 1 Scope of Application Definitions: Firms, Customers (classification), Financial instruments, Services Ch. 2 - 5 Right to offer services Need for licence Foreign companies Legal Aspects of Finance 3 9

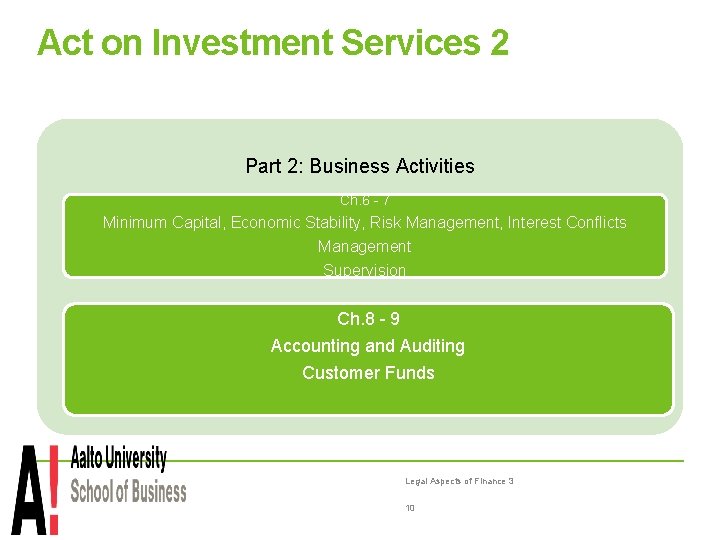

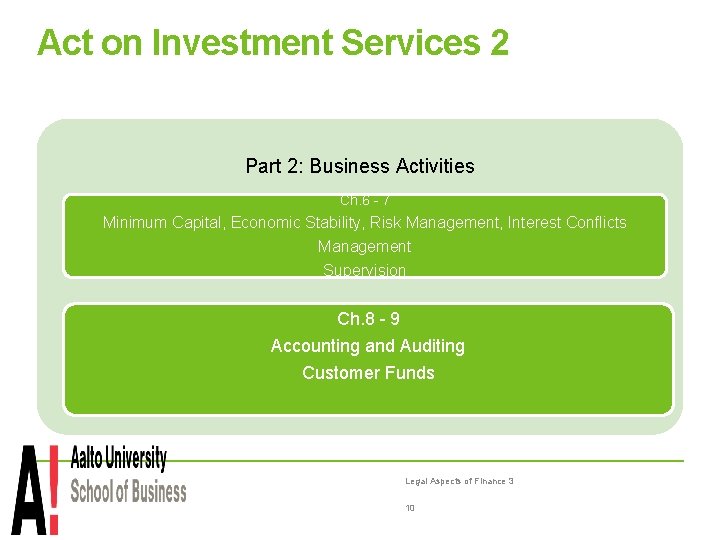

Act on Investment Services 2 Part 2: Business Activities Ch. 6 - 7 Minimum Capital, Economic Stability, Risk Management, Interest Conflicts Management Supervision Ch. 8 - 9 Accounting and Auditing Customer Funds Legal Aspects of Finance 3 10

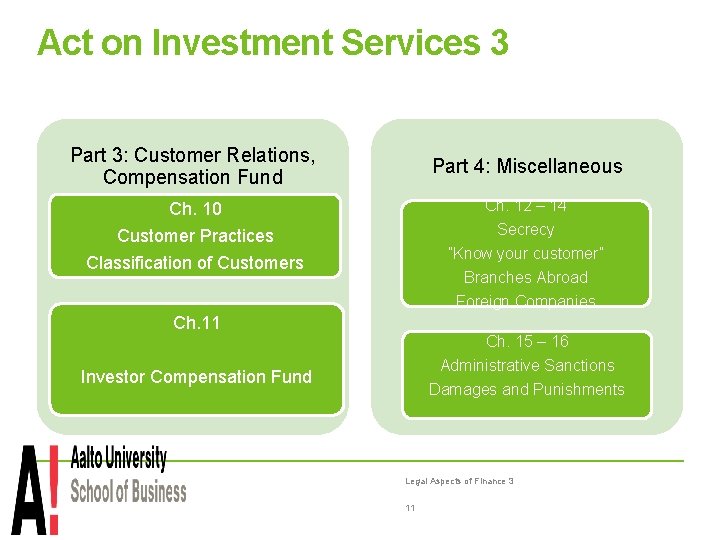

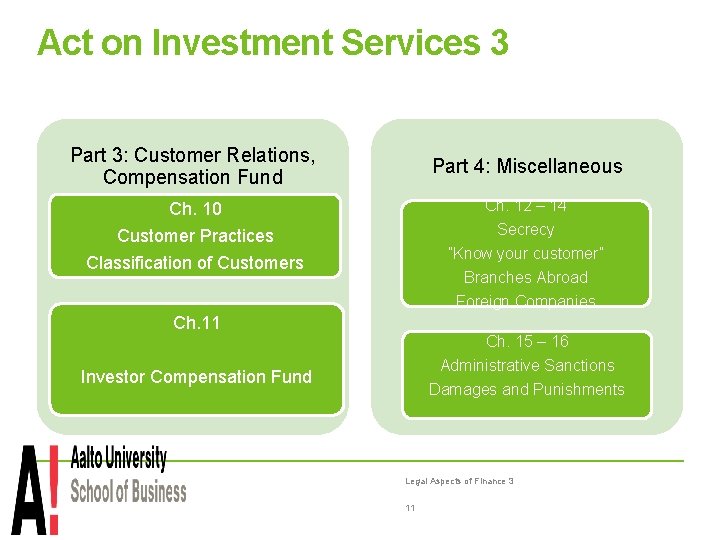

Act on Investment Services 3 Part 3: Customer Relations, Compensation Fund Part 4: Miscellaneous Ch. 10 Ch. 12 – 14 Customer Practices Classification of Customers Secrecy ”Know your customer” Branches Abroad Foreign Companies Ch. 11 Ch. 15 – 16 Administrative Sanctions Investor Compensation Fund Damages and Punishments Legal Aspects of Finance 3 11

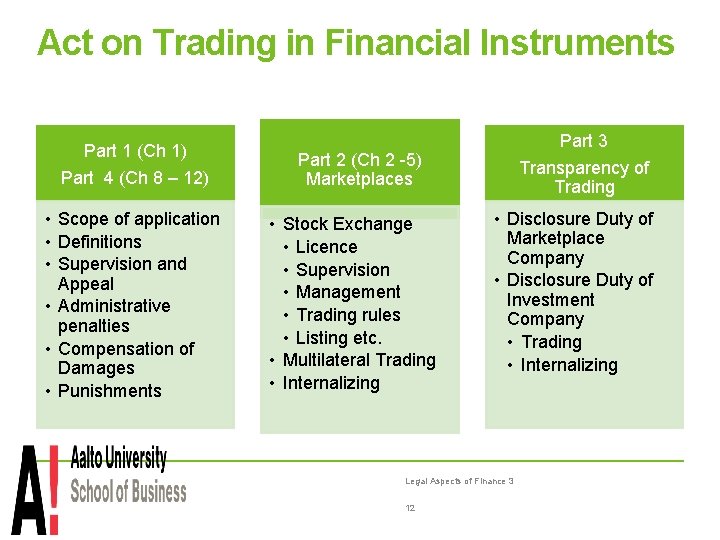

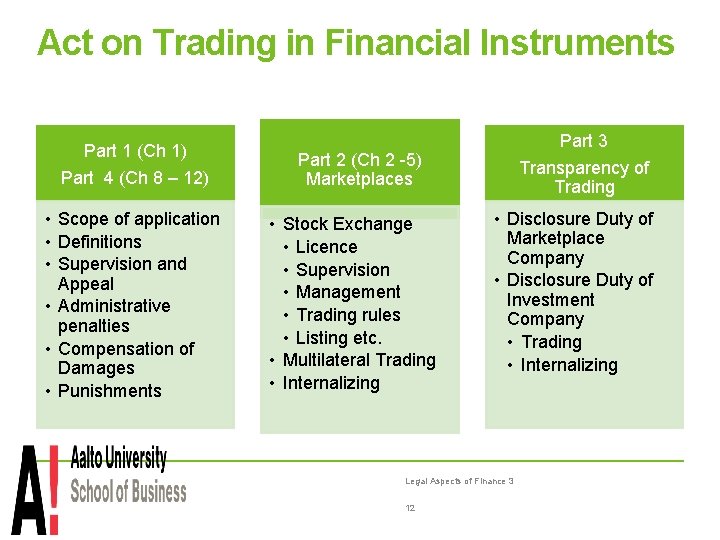

Act on Trading in Financial Instruments Part 1 (Ch 1) Part 4 (Ch 8 – 12) • Scope of application • Definitions • Supervision and Appeal • Administrative penalties • Compensation of Damages • Punishments Part 3 Part 2 (Ch 2 -5) Marketplaces • Stock Exchange • Licence • Supervision • Management • Trading rules • Listing etc. • Multilateral Trading • Internalizing Transparency of Trading • Disclosure Duty of Marketplace Company • Disclosure Duty of Investment Company • Trading • Internalizing Legal Aspects of Finance 3 12

NASDAQ OMX Nordic The NASDAQ OMX Group, Inc. An integrated marketplace for listing, trading and clearing of securities as well as information services, NASDAQ OMX Nordic includes the exchanges in Copenhagen, Stockholm, Helsinki, and Iceland. NASDAQ OMX Nordic offers ease of access to more than 75 percent of the exchange trading in the Nordic countries. Legal Aspects of Finance 3 13

NASDAQ OMX Nordic - the main market If you want maximum exposure for your company and can fulfill the listing requirements the main market is suitable for you. All kinds of investors operate on the main market, from international to local investors as well as retail and professional investors. The listing requirements for the NASDAQ OMX Nordic are based on European standards and EU directives, and devised for companies that are well established. Legal Aspects of Finance 3 14

NASDAQ OMX First North is the market for your company if you would like to take advantage of the capital market, but are not ready for a listing on the main market. NASDAQ OMX First North often serves as the first step towards the main market. NASDAQ OMX First North is tailored for small growth companies. The regulatory demands are less extensive than on the main market. The infrastructure for NASDAQ OMX First North is based on the current trading and settlement systems. Legal Aspects of Finance 3 15

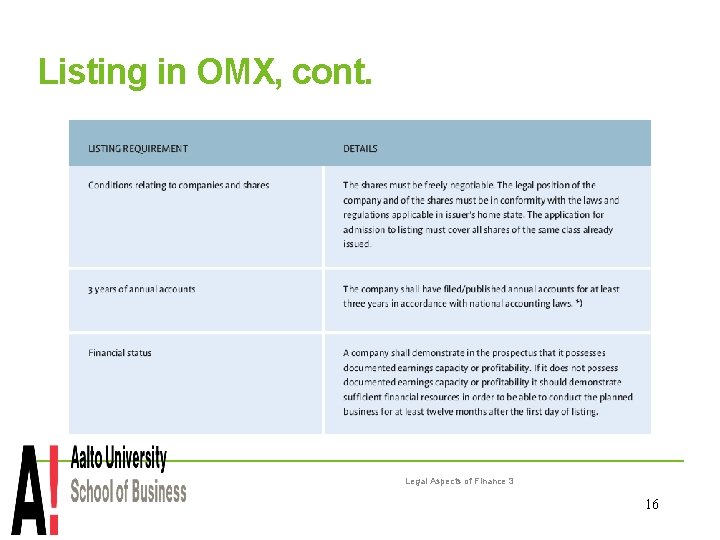

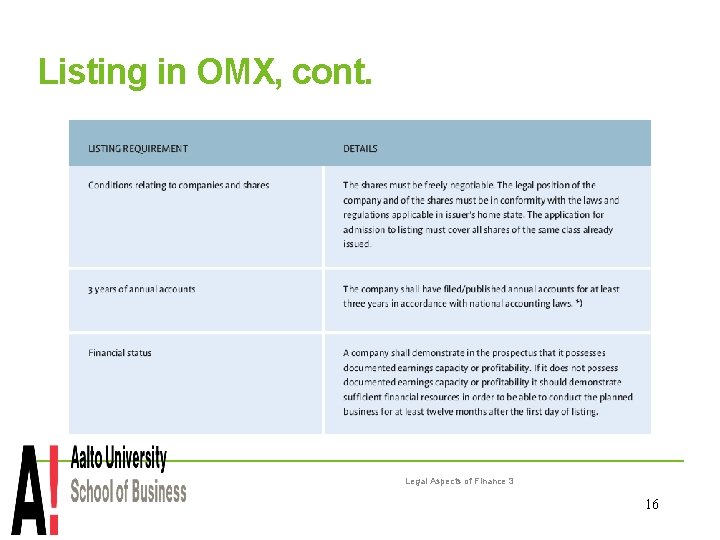

Listing in OMX, cont. Legal Aspects of Finance 3 16

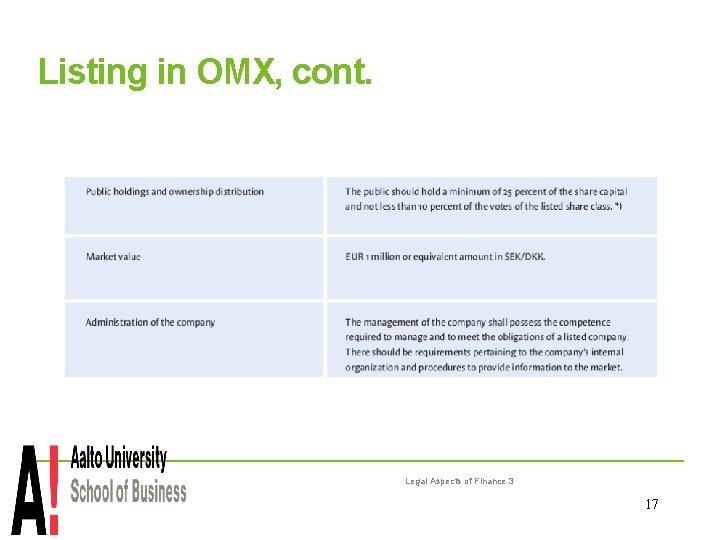

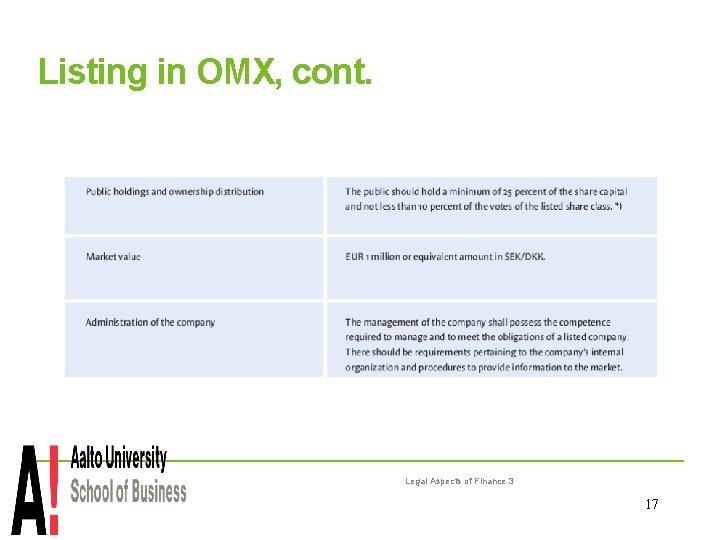

Listing in OMX, cont. Legal Aspects of Finance 3 17

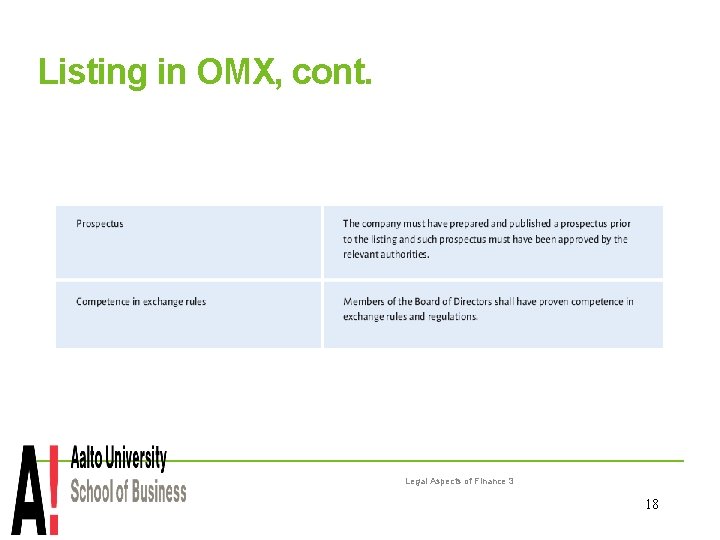

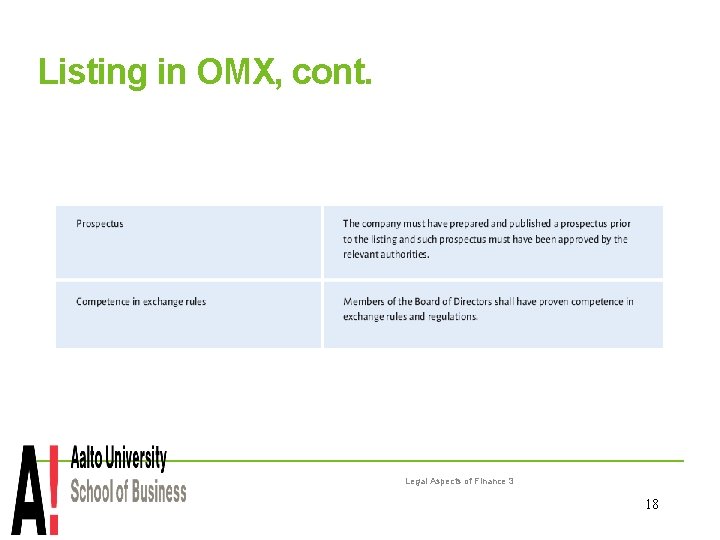

Listing in OMX, cont. Legal Aspects of Finance 3 18

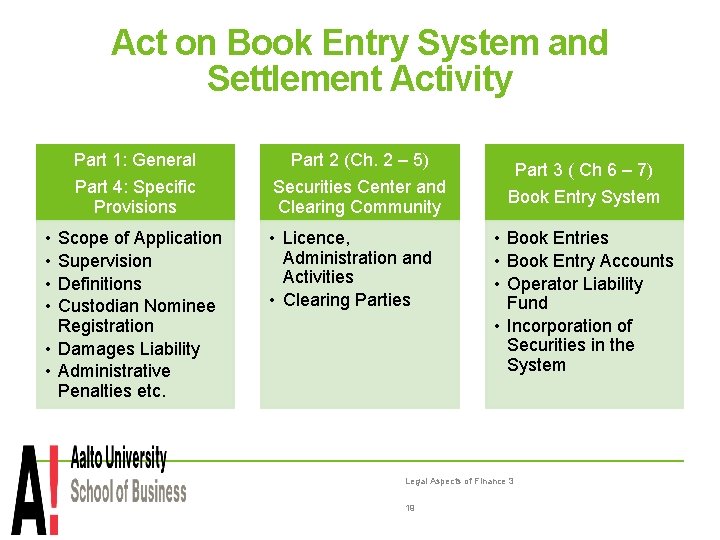

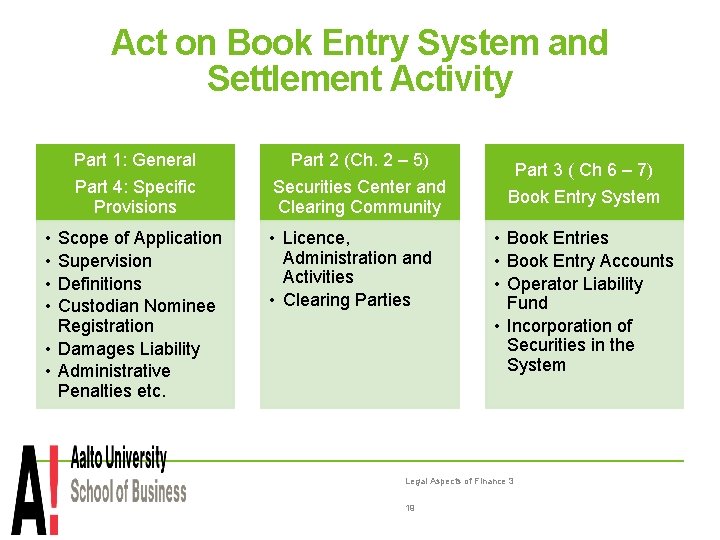

Act on Book Entry System and Settlement Activity • • Part 1: General Part 2 (Ch. 2 – 5) Part 4: Specific Provisions Securities Center and Clearing Community Scope of Application Supervision Definitions Custodian Nominee Registration • Damages Liability • Administrative Penalties etc. • Licence, Administration and Activities • Clearing Parties Part 3 ( Ch 6 – 7) Book Entry System • Book Entries • Book Entry Accounts • Operator Liability Fund • Incorporation of Securities in the System Legal Aspects of Finance 3 19

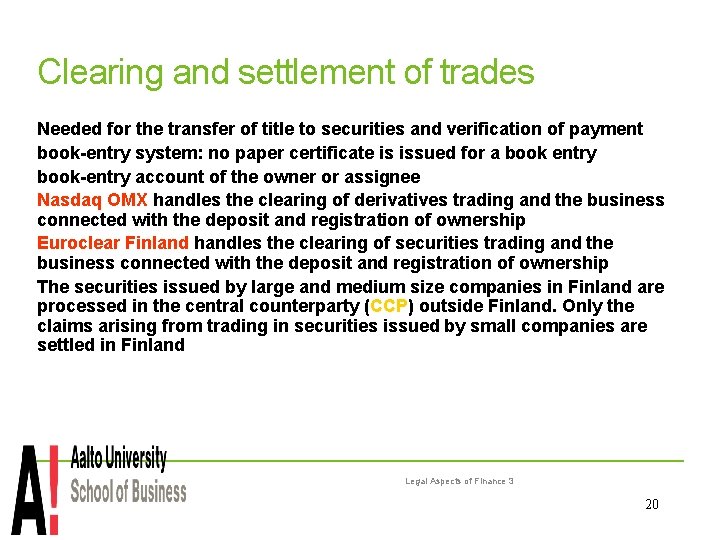

Clearing and settlement of trades Needed for the transfer of title to securities and verification of payment book-entry system: no paper certificate is issued for a book entry book-entry account of the owner or assignee Nasdaq OMX handles the clearing of derivatives trading and the business connected with the deposit and registration of ownership Euroclear Finland handles the clearing of securities trading and the business connected with the deposit and registration of ownership The securities issued by large and medium size companies in Finland are processed in the central counterparty (CCP) outside Finland. Only the claims arising from trading in securities issued by small companies are settled in Finland Legal Aspects of Finance 3 20

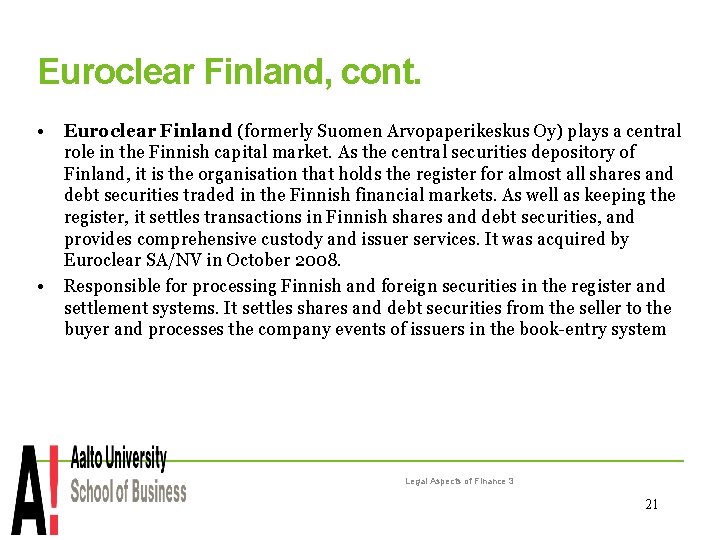

Euroclear Finland, cont. • • Euroclear Finland (formerly Suomen Arvopaperikeskus Oy) plays a central role in the Finnish capital market. As the central securities depository of Finland, it is the organisation that holds the register for almost all shares and debt securities traded in the Finnish financial markets. As well as keeping the register, it settles transactions in Finnish shares and debt securities, and provides comprehensive custody and issuer services. It was acquired by Euroclear SA/NV in October 2008. Responsible for processing Finnish and foreign securities in the register and settlement systems. It settles shares and debt securities from the seller to the buyer and processes the company events of issuers in the book-entry system Legal Aspects of Finance 3 21

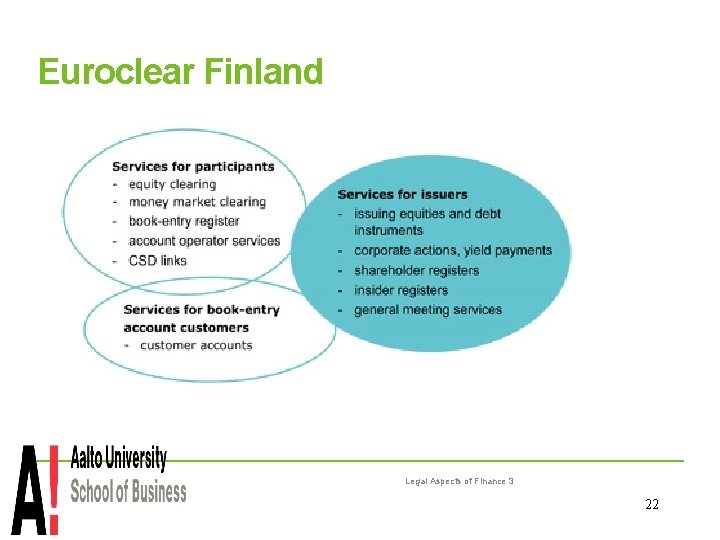

Euroclear Finland Legal Aspects of Finance 3 22

Most common corporate actions Private placement (New shares are issued in derogation from shareholders’ pre-emptive rights, for instance due to a corporate acquisition or initial public offering) Split / Reverse Split Bonus issue and Share issue against payment Acquisition of own shares Redeeming of own shares Increase in reserve funds Merger/demerger Redemption of minority shares Legal Aspects of Finance 3 23

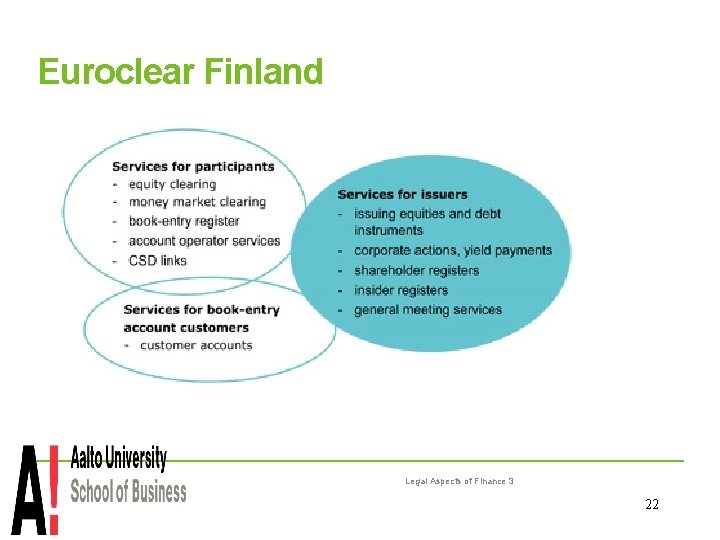

Business areas of Euroclear (Finland) consists of three business areas: Clearing & Settlement Services, Account Operator Services and Issuer Services Clearing & Settlement Services takes care of settlement services for equities and all issuing, depository and settlement services for money market instruments and wholesale market bonds. Account Operator Services operates central book-entry register and offers book-entry account services to account operators and individual investors. Issuer Services offers CSD services to security issuers. The main services are shareholder lists, insider register, general meeting services, corporate actions and yield payments. Legal Aspects of Finance 3 24

The European Multilateral Clearing Facility N. V. (EMCF), founded in March 2007, is Europe's largest cash equities clearing house and offers clients a cost-effective way of confidently managing settlement risks. EMCF offers Central Counterparty Clearing House, or CCP, services to more than 50 financial-service providers in 19 European countries, using ten Multilateral Trading Facilities (MTFs)and exchanges: e. g. NASDAQ OMX Nordics (Denmark, Finland & Sweden) Legal Aspects of Finance 3 25

What does Central Counterparty Clearing mean? Central counterparty clearing involves the legal transfer of obligations to a central counterparty, which becomes the buyer to the seller and the seller to the buyer. With the CCP counterparty risk - or the risk that one party to a trade suffers losses because the other party cannot fulfil its obligations - is mitigated. Central counterparty clearing enables netting of trades, which provides significant cost savings from lower margin requirements, fewer settlements, and simpler operations. Legal Aspects of Finance 3 26

What does Central Counterparty Clearing mean? (cont. ) The first stage in the clearing process, once the trade has been registered, is to replace the single contract between parties with two separate ones, linking EMCF to the buyer and the seller. This process, known as novation, allows the market to remain anonymous. Legal Aspects of Finance 3 27

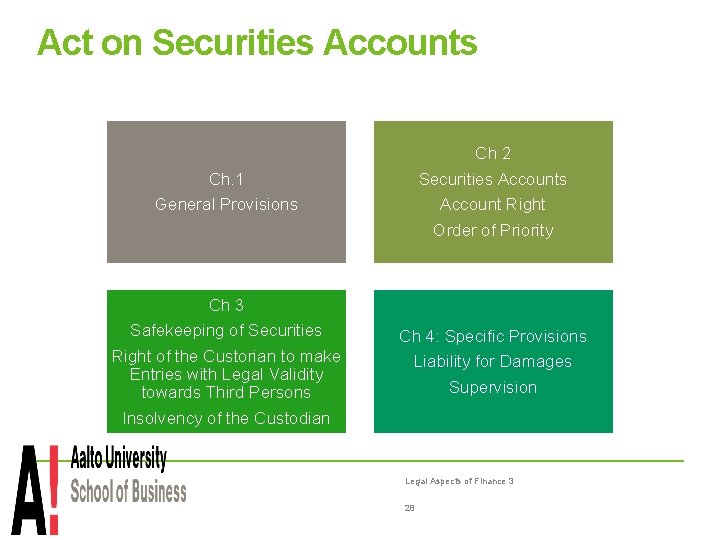

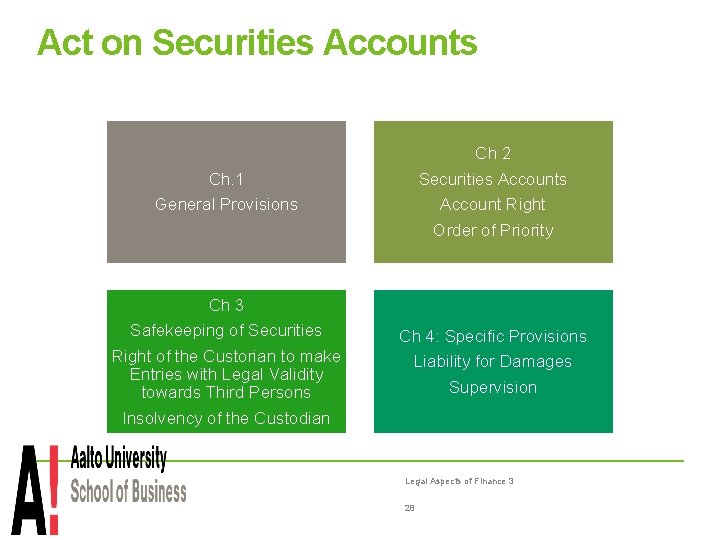

Act on Securities Accounts Ch. 1 General Provisions Ch 2 Securities Account Right Order of Priority Ch 3 Safekeeping of Securities Right of the Custorian to make Entries with Legal Validity towards Third Persons Insolvency of the Custodian Ch 4: Specific Provisions Liability for Damages Supervision Legal Aspects of Finance 3 28

The Panel on Takeovers and Mergers at The Central Chamber of Commerce of Finland Issues opinions and recommendations in takeover and public bid situations Finnish Code on Takeovers and Mergers (The Central Chamber of Commerce of Finland)n Legal Aspects of Finance 3 29

The Finnish Securities Complaint Board A self-regulatory body (private sector; only recommendations) The Securities Complaint Board offers consultative advice concerning the content of securities market legislation and related authority orders, the application of contractual terms, good commercial practices in securities trading and other issues related to securities practices. The service is free of charge and available to all non-professional investors, who are customers of banks, investment firms or mutual fund companies. The operations of the Securities Complaint Board abide by the principles of impartiality, transparency, reciprocity, efficiency, legality, freedom and representation defined in the Commission Recommendation (2001/310/EC) for out-of-court and alternative arbitration bodies and methods involved in the resolution of consumer disputes. These bodies and methods are characterised by their acting as an impartial third party recommending a settlement and bringing parties together for reconciliation. Legal Aspects of Finance 3 30

Heel toe polka dance steps

Heel toe polka dance steps Total set awareness set consideration set

Total set awareness set consideration set Training set validation set test set

Training set validation set test set Legal aspects of catering premises

Legal aspects of catering premises Legal aspects of software engineering

Legal aspects of software engineering Legal aspects of doing business in canada

Legal aspects of doing business in canada Chapter 2 legal and ethical aspects of nursing

Chapter 2 legal and ethical aspects of nursing Professional issues in cyber security

Professional issues in cyber security Irving isd v tatro

Irving isd v tatro Legal aspects of advertising

Legal aspects of advertising Aspek aspek manajemen proyek

Aspek aspek manajemen proyek Ethical and legal issues in community health nursing

Ethical and legal issues in community health nursing Legalities of nursing documentation

Legalities of nursing documentation Nursing legal terms

Nursing legal terms Legal aspects definition

Legal aspects definition From efficient markets theory to behavioral finance

From efficient markets theory to behavioral finance Pilbeam k. finance and financial markets

Pilbeam k. finance and financial markets Pilbeam finance and financial markets

Pilbeam finance and financial markets Finance for normal people: how investors and markets behave

Finance for normal people: how investors and markets behave Ratesetter legal finance

Ratesetter legal finance What is multinational finance

What is multinational finance International financial management 5th edition

International financial management 5th edition Expanded opportunity set international finance

Expanded opportunity set international finance Factoring trinomials slide and divide method

Factoring trinomials slide and divide method Bounded set vs centered set

Bounded set vs centered set Fuzzy theory

Fuzzy theory Crisp set vs fuzzy set

Crisp set vs fuzzy set Crisp set vs fuzzy set

Crisp set vs fuzzy set What is the overlap of data set 1 and data set 2?

What is the overlap of data set 1 and data set 2? Correspondence function examples

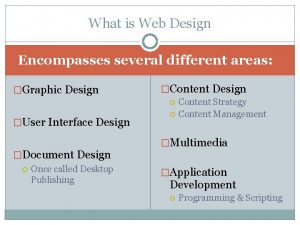

Correspondence function examples It encompasses several different aspects, including

It encompasses several different aspects, including