International Financial Reporting Standards 11 IFRS for SMEs

- Slides: 15

International Financial Reporting Standards • 11 IFRS for SMEs Joint DUBAI SME-ASCA-IFRS Foundation Workshop 27– 29 September 2011 Dubai, UAE Copyright © 2011 IFRS Foundation. All rights reserved. The Arab Society of Certified Accountants (ASCA)

2 This presentation may be modified from time to time. The latest version may be downloaded from: http: //www. ifrs. org/IFRS+for+SMEs/SME+Workshops. htm The accounting requirements applicable to small and medium‑sized entities (SMEs) are set out in the International Financial Reporting Standard (IFRS) for SMEs, which was issued by the IASB in July 2009. The IFRS Foundation, the authors, the presenters and the publishers do not accept responsibility for loss caused to any person who acts or refrains from acting in reliance on the material in this Power. Point presentation, whether such loss is caused by negligence or otherwise. The Arab Society of Certified Accountants (ASCA)

3 Questions about Section 2 Concepts and Pervasive Principles The Arab Society of Certified Accountants (ASCA)

4 Section 2 – Discussion questions Question 1: The objective of general purpose financial statements prepared in accordance with the IFRS for SMEs is: a. to inform government statistics? b. to support the entity’s tax return? c. to meet all the information needs of all the users of an entity’s financial statements? d. to inform economic decision-making by a broad range of users that are not in a position to demand reports tailored to their needs (eg investors and creditors)? The Arab Society of Certified Accountants (ASCA)

5 Section 2 – Discussion questions Question 1: The objective of general purpose financial statements prepared in accordance with the IFRS for SMEs is: a. to inform government statistics? b. to support the entity’s tax return? c. to meet all the information needs of all the users of an entity’s financial statements? d. to inform economic decision-making by a broad range of users that are not in a position to demand reports tailored to their needs (eg investors and creditors)? The Arab Society of Certified Accountants (ASCA)

Section 2 – Discussion questions Question 2: The qualitative characteristic ‘reliability’ means: a. free from material error and bias and a faithfully representation of the economic phenomenon? b. precision (eg little or no uncertainty in a measurement)? c. historic cost? d. fair value? The Arab Society of Certified Accountants (ASCA) 6

Section 2 – Discussion questions Question 2: The qualitative characteristic ‘reliability’ means: a. free from material error and bias and a faithfully representation of the economic phenomenon? b. precision (eg little or no uncertainty in a measurement)? c. historic cost? d. fair value? The Arab Society of Certified Accountants (ASCA) 7

8 Section 2 – Discussion questions Question 3: Expenses are recognised in comprehensive income (profit or OCI): a. using the matching basis—on the basis of a direct association between the costs incurred and the earning of specific items of income? b. using the accrual basis—items are recognised as assets, liabilities, equity, income or expenses when they satisfy the definitions and recognition criteria for those items? c. at the discretion of management? The Arab Society of Certified Accountants (ASCA)

9 Section 2 – Discussion questions Question 3: Expenses are recognised in comprehensive income (profit or OCI): a. using the matching basis—on the basis of a direct association between the costs incurred and the earning of specific items of income? b. using the accrual basis—items are recognised as assets, liabilities, equity, income or expenses when they satisfy the definitions and recognition criteria for those items? c. at the discretion of management? The Arab Society of Certified Accountants (ASCA)

10 Section 2 – Discussion questions Question 4: Prudence implies that in preparing financial statements management should: a. have a bias toward understating assets and income and overstating liabilities and expenses? b. have a bias toward understating liabilities and expenses and overstating assets and income? c. be neutral (ie no bias) and cautious in the exercise of judgements needed in making estimates? The Arab Society of Certified Accountants (ASCA)

11 Section 2 – Discussion questions Question 4: Prudence implies that in preparing financial statements management should: a. have a bias toward understating assets and income and overstating liabilities and expenses? b. have a bias toward understating liabilities and expenses and overstating assets and income? c. be neutral (ie no bias) and cautious in the exercise of judgements needed in making estimates? The Arab Society of Certified Accountants (ASCA)

Section 2 – Discussion questions 12 Question 5: Recognition criteria determine when to recognise an item. Measurement is determining the monetary amounts at which to measure an item. Uncertainties about the extent of future cash flows: a. only affect the decision about whether to recognise? b. only affect the estimation of the amount at which to measure the item? c. could affect both recognition and measurement? The Arab Society of Certified Accountants (ASCA)

Section 2 – Discussion questions 13 Question 5: Recognition criteria determine when to recognise an item. Measurement is determining the monetary amounts at which to measure an item. Uncertainties about the extent of future cash flows: a. only affect the decision about whether to recognise? b. only affect the estimation of the amount at which to measure the item? c. could affect both recognition and measurement? The Arab Society of Certified Accountants (ASCA)

Section 2 – Discussion questions 14 Question 6: How many measurement bases does the IFRS for SMEs specify for the measurement of assets? a. one—historical cost b. one—fair value c. two—historical cost and fair value d. many—including historical cost, fair value, value in use, estimated selling price less costs to complete and sell, etc The Arab Society of Certified Accountants (ASCA)

Section 2 – Discussion questions 15 Question 6: How many measurement bases does the IFRS for SMEs specify for the measurement of assets? a. one—historical cost b. one—fair value c. two—historical cost and fair value d. many—including historical cost, fair value, value in use, estimated selling price less costs to complete and sell, etc The Arab Society of Certified Accountants (ASCA)

International financial reporting standards 9

International financial reporting standards 9 Různorodá směs navzájem rozptýlených kapalin

Různorodá směs navzájem rozptýlených kapalin Polymerbeton směs

Polymerbeton směs Green action plan for smes

Green action plan for smes Různorodá směs nerostů

Různorodá směs nerostů Heterogenní směs

Heterogenní směs Frf for smes vs gaap

Frf for smes vs gaap Financial assets ifrs

Financial assets ifrs Pwc ifrs 17

Pwc ifrs 17 Financial accounting ifrs 4th edition chapter 12

Financial accounting ifrs 4th edition chapter 12 Frx report wizard

Frx report wizard Accounting and audit board of ethiopia

Accounting and audit board of ethiopia Financial statements purpose

Financial statements purpose Essbase financial reporting studio

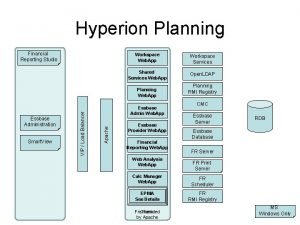

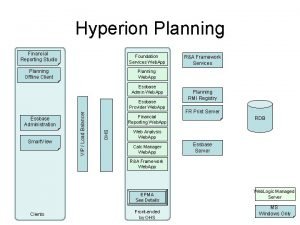

Essbase financial reporting studio Essbase financial reporting studio

Essbase financial reporting studio First level of conceptual framework

First level of conceptual framework