Indias Experience in Investment Encouragement Anjan Roy Chief

- Slides: 13

India’s Experience in Investment Encouragement Anjan Roy Chief Economist and Head of Research FICCI 12 th Industrialists’ Conference Doha, Qatar November 22 -23, 2009

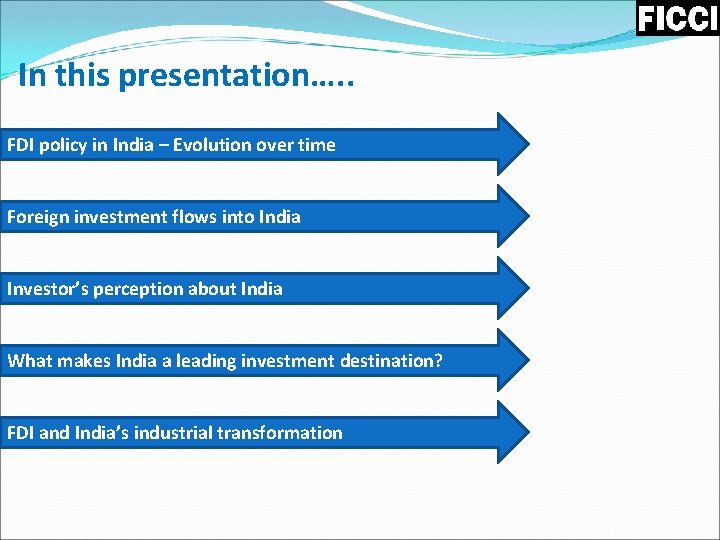

In this presentation…. . FDI policy in India – Evolution over time Foreign investment flows into India Investor’s perception about India What makes India a leading investment destination? FDI and India’s industrial transformation

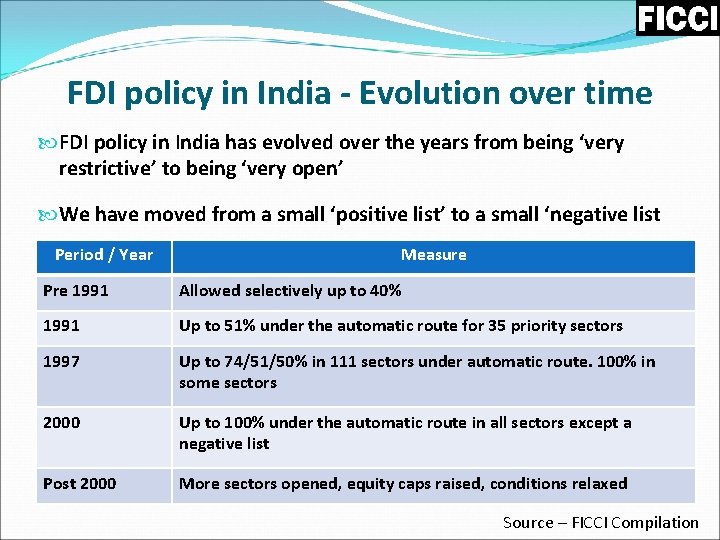

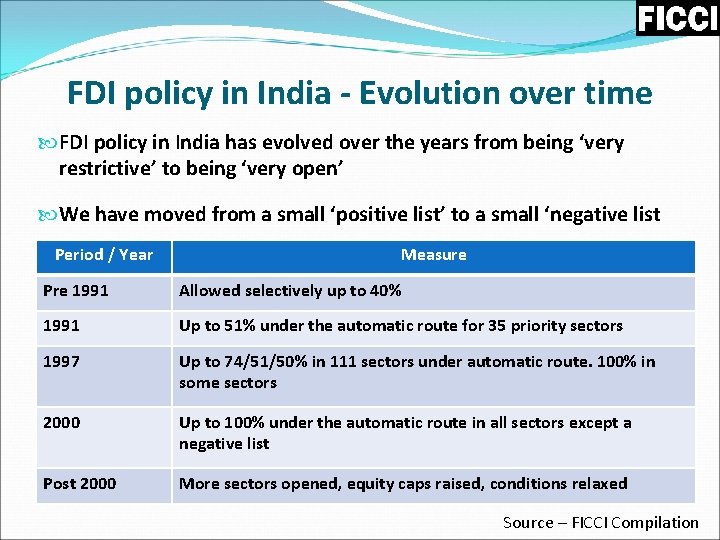

FDI policy in India - Evolution over time FDI policy in India has evolved over the years from being ‘very restrictive’ to being ‘very open’ We have moved from a small ‘positive list’ to a small ‘negative list Period / Year Measure Pre 1991 Allowed selectively up to 40% 1991 Up to 51% under the automatic route for 35 priority sectors 1997 Up to 74/51/50% in 111 sectors under automatic route. 100% in some sectors 2000 Up to 100% under the automatic route in all sectors except a negative list Post 2000 More sectors opened, equity caps raised, conditions relaxed Source – FICCI Compilation

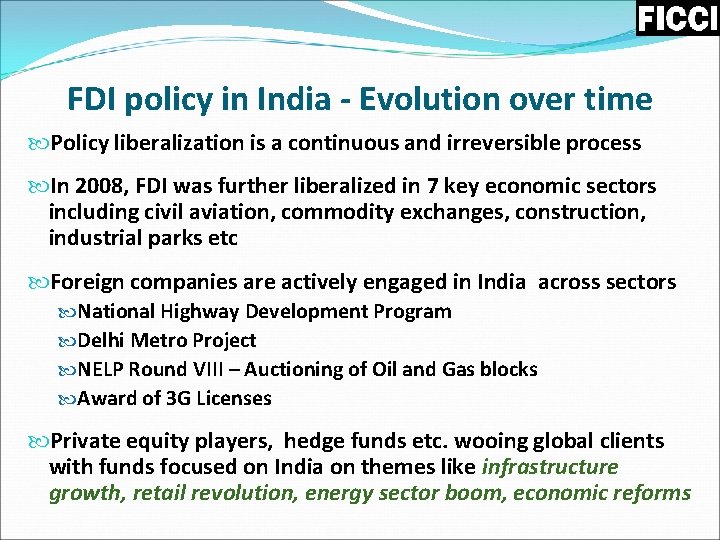

FDI policy in India - Evolution over time Policy liberalization is a continuous and irreversible process In 2008, FDI was further liberalized in 7 key economic sectors including civil aviation, commodity exchanges, construction, industrial parks etc Foreign companies are actively engaged in India across sectors National Highway Development Program Delhi Metro Project NELP Round VIII – Auctioning of Oil and Gas blocks Award of 3 G Licenses Private equity players, hedge funds etc. wooing global clients with funds focused on India on themes like infrastructure growth, retail revolution, energy sector boom, economic reforms

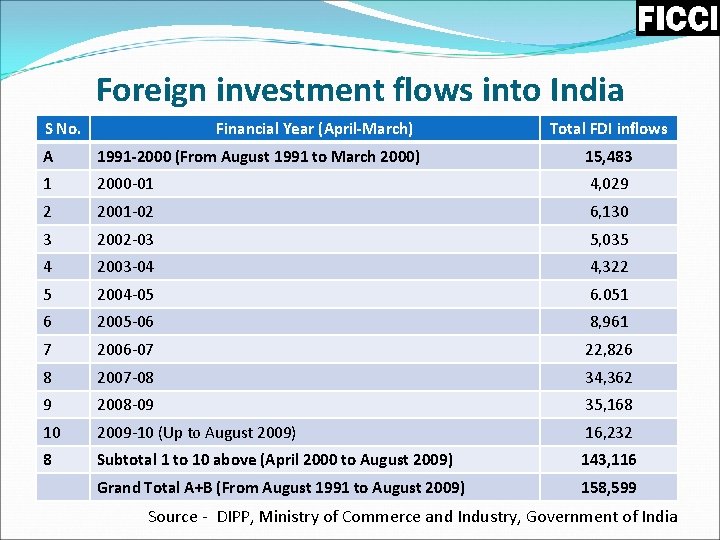

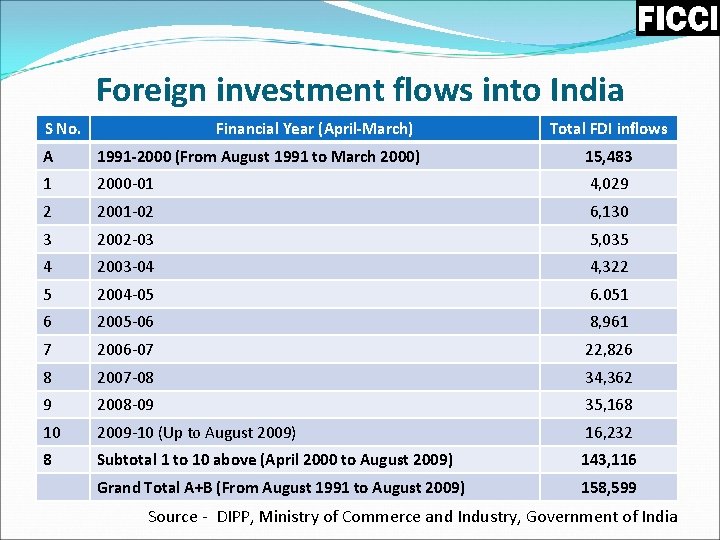

Foreign investment flows into India S No. Financial Year (April-March) Total FDI inflows A 1991 -2000 (From August 1991 to March 2000) 15, 483 1 2000 -01 4, 029 2 2001 -02 6, 130 3 2002 -03 5, 035 4 2003 -04 4, 322 5 2004 -05 6. 051 6 2005 -06 8, 961 7 2006 -07 22, 826 8 2007 -08 34, 362 9 2008 -09 35, 168 10 2009 -10 (Up to August 2009) 16, 232 8 Subtotal 1 to 10 above (April 2000 to August 2009) 143, 116 Grand Total A+B (From August 1991 to August 2009) 158, 599 Source - DIPP, Ministry of Commerce and Industry, Government of India

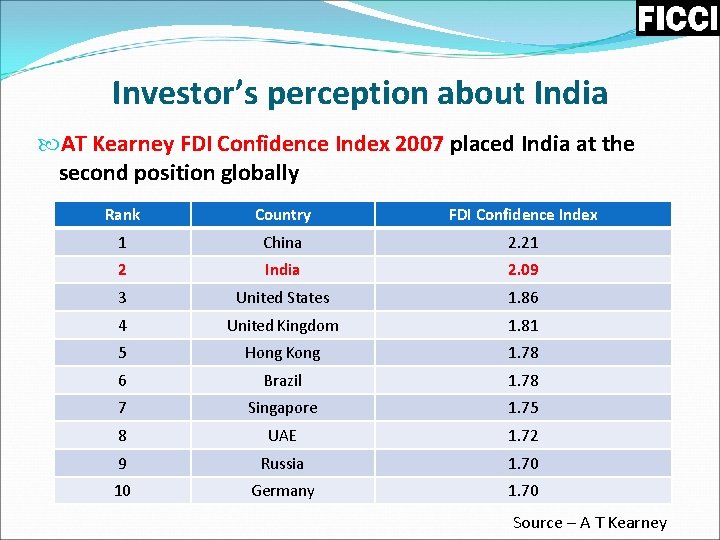

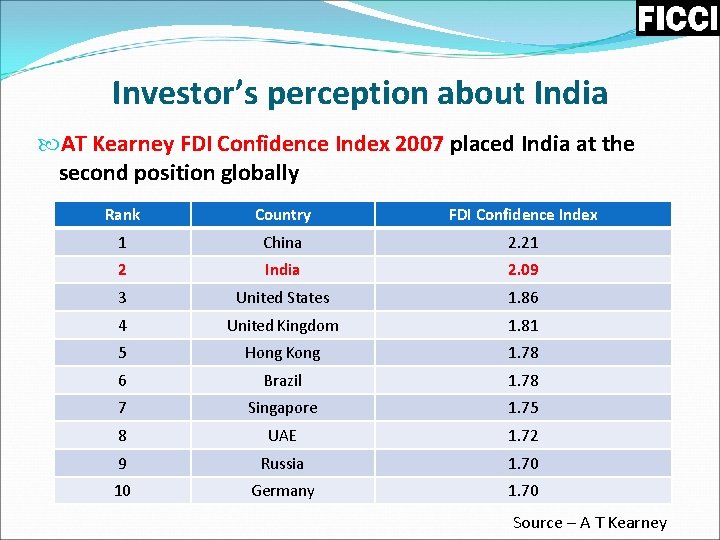

Investor’s perception about India AT Kearney FDI Confidence Index 2007 placed India at the second position globally Rank Country FDI Confidence Index 1 China 2. 21 2 India 2. 09 3 United States 1. 86 4 United Kingdom 1. 81 5 Hong Kong 1. 78 6 Brazil 1. 78 7 Singapore 1. 75 8 UAE 1. 72 9 Russia 1. 70 10 Germany 1. 70 Source – A T Kearney

Investor’s perception about India FICCI Survey of Foreign Direct Investors in India shows that MNCs are BULLISH on India Our last survey, findings of which were released in early 2007 showed Almost seven in ten foreign investors are making profits in their Indian operations. 91% of the companies making profits were successful in meeting their profitability targets in India. An overwhelming 87% of the respondents feel that there exist opportunities for greater FDI in India. Nearly 83% of the respondents are considering expansion of their Indian operations. Source – FICCI FDI Survey

What makes India a leading investment destination? ü India is world’s largest functional democracy, with a population of over billion people ü India is second fastest growing economy after China ü India has followed a calibrated globalization process § § § liberalization of FDI regime reduction in import tariff fully convertible current account moving towards fuller capital account convertibility compliance with WTO norms India’s commitment towards reforms continues…. .

What makes India a leading investment destination? ü India has the advantage of being one of the youngest country… Size of 15 -59 age group in 2007 (in million) in 2050 (in million) Growth of 15 -59 age group ( in million) India 696 1020 324 United States 191 225 34 Japan 76 45 -31 Germany 50 36 -14 United Kingdom 36 36 0 France 37 35 -2 China 895 755 -140 Source: United Nations § In the year 2006, about 52% of India’s population was below 25 years § Median age would be 30 years even as late as 2025 § India’s work force (15 -59 years) would go up by around 324 million by 2050.

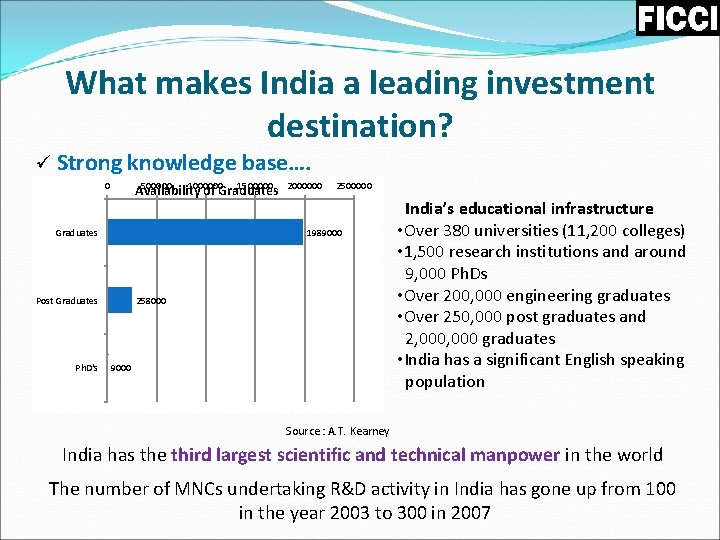

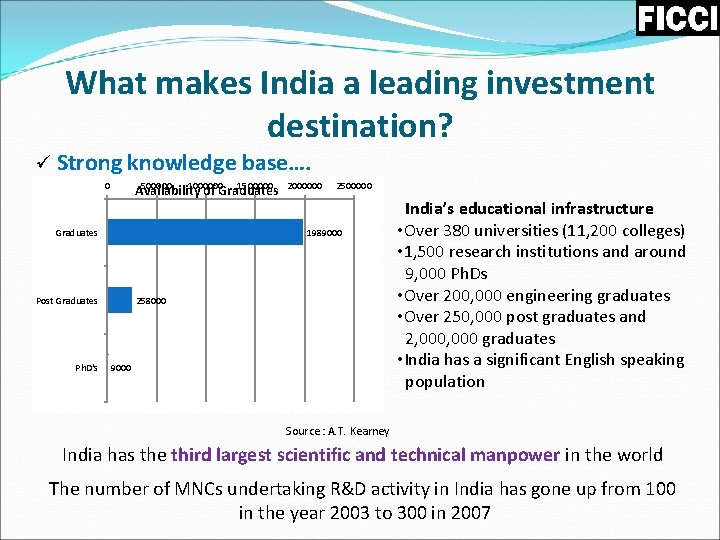

What makes India a leading investment destination? ü Strong knowledge base…. 0 500000 1000000 1500000 Availability of Graduates 2500000 1989000 Post Graduates Ph. D's 2000000 258000 9000 India’s educational infrastructure • Over 380 universities (11, 200 colleges) • 1, 500 research institutions and around 9, 000 Ph. Ds • Over 200, 000 engineering graduates • Over 250, 000 post graduates and 2, 000 graduates • India has a significant English speaking population Source : A. T. Kearney India has the third largest scientific and technical manpower in the world The number of MNCs undertaking R&D activity in India has gone up from 100 in the year 2003 to 300 in 2007

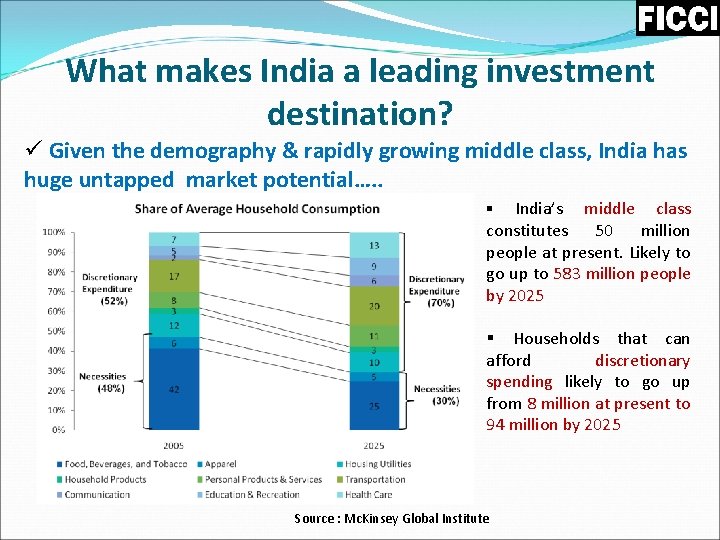

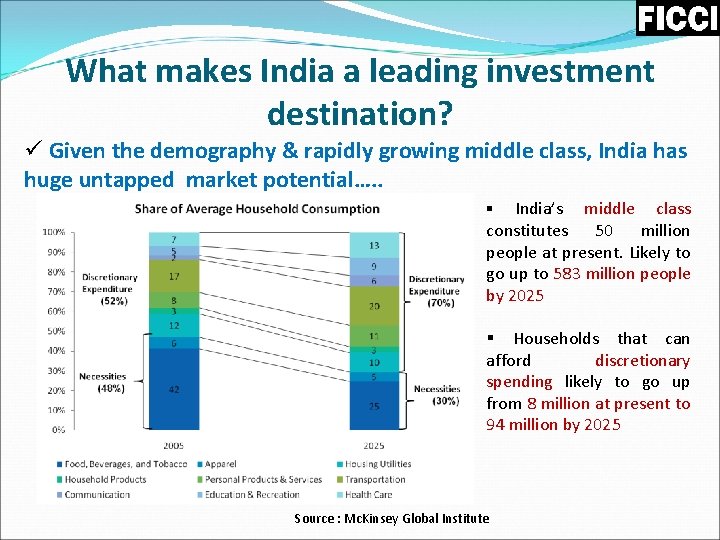

What makes India a leading investment destination? ü Given the demography & rapidly growing middle class, India has huge untapped market potential…. . India’s middle class constitutes 50 million people at present. Likely to go up to 583 million people by 2025 § § Households that can afford discretionary spending likely to go up from 8 million at present to 94 million by 2025 Source : Mc. Kinsey Global Institute

FDI and India’s industrial transformation FDI’s contribution to economy and industry has been immense There are cases where the face of Indian industry changed completely after FDI was allowed Example – Automobile sector Volumes have increased; Quality has improved tremendously; Auto exports have started on a large scale; Auto ancillary industry has got a boost; Consumer is spoilt for choice – Numerous offerings increasing by the day We have absorbed FDI flows because of our manpower and a strong base of professionals India’s economic milieu has cross fertilized with the positives of FDI and led to advancement of knowledge industries

Thank you FICCI Federation House, 1, Tansen Marg, New Delhi 110001 ficci@ficci. com www. ficci. com

Chapter 9 lesson 3 commander in chief and chief diplomat

Chapter 9 lesson 3 commander in chief and chief diplomat Champs classroom management

Champs classroom management Son of encouragement

Son of encouragement The spiritual gift of encouragement

The spiritual gift of encouragement Son of encouragement

Son of encouragement Paul to timothy encouragement

Paul to timothy encouragement Tithe in new testament

Tithe in new testament Flota de indias ruta

Flota de indias ruta What is indias main religion

What is indias main religion Powerful caste in india

Powerful caste in india Indias first empire

Indias first empire Indias first empire

Indias first empire Que es el real consejo de indias

Que es el real consejo de indias Indias religions

Indias religions