Import and Export Clearance Procedures of Korea Customs

- Slides: 15

Import and Export Clearance Procedures of Korea Customs Under Korea-EU FTA Taekon Sung Counselor for Customs Affairs Mission of the Republic of Korea to the EU

Contents 1 Features of Clearance Procedures under Korea-EU FTA 2 Origin Criterion 3 Approved Exporter 4 Export Clearance Procedure 5 Import Clearance Procedure 6 Origin Verification 7 Consideration Points

1. Features of Clearance Procedures under Korea-EU FTA Introduction of Self-Certification System - Target : Approved Exporters designated by Korean Customs issue Certificates of Origin (C/O). However, for goods under the value of 6, 000 Euros, companies can issue C/Os on their own even though they are not designated as an Approved Exporter. - Forms required : Invoice Declaration Simplification of Application Procedure for Preferential Tariff Treatment - In case where importing companies apply for Preferential Tariff Treatment, C/Os shall be submitted only when required by Customs. - C/O submission is not required when importing small packages or hand-carried goods of passengers up to the value of USD 1, 000 - If preferential tariff treatment is not applied at the time of import declaration made, post application shall be allowed for 1 year from the accepted declaration

1. Features of Clearance Procedures under Korea-EU FTA Adoptation of Indirect & Joint Verification - In principle, Customs Authority of the importing country requests for origin verification to Customs Authority of the exporting country. - However, customs officials of the importing country can be present as an observer during the course of origin verification with the prior approval of Customs Authority of the exporting country. Simplification of Import and Export Procedure (Trade Facilitation through Securing Transparency) - Expedited release of goods - Enhanced transparency of customs administration - Introduction of advanced ruling in tariff classification and origin - Review and appeal / Confidentiality of information - Restriction on concession charge in relation to import and export - Enlarged Customs Cooperation

2. Origin Criterion Wholly Obtained Criterion : Wholly obtained or produced goods within the territory of the Party - Animal, plants, mineral goods and sea-fishing goods obtained by vessels of the Party Substantial Transformation Criterion : If some materials used to make the goods are produced without the territory of the party - Change in Tariff Classification Method : HS code of non-originating materials and the products should be changed [Change in chapter(2), heading(4) and subheading(6)] - Value Added Rule : non-originating materials should be used up to a certain percentage * Ex-works Price : the price paid or payable for the product ex-works to the manufacturer in a Party in whose undertaking the last working or processing is carried out, provided the price includes the value of all the materials used, minus any internal taxes returned or repaid when the product obtained is exported - Specific Processing Method : the origin is certified when undergoing typical production processes including chemical reaction, purification and blending

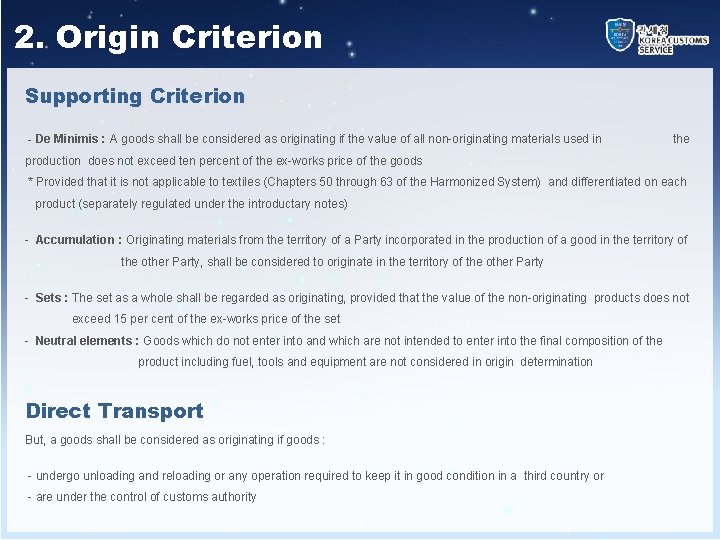

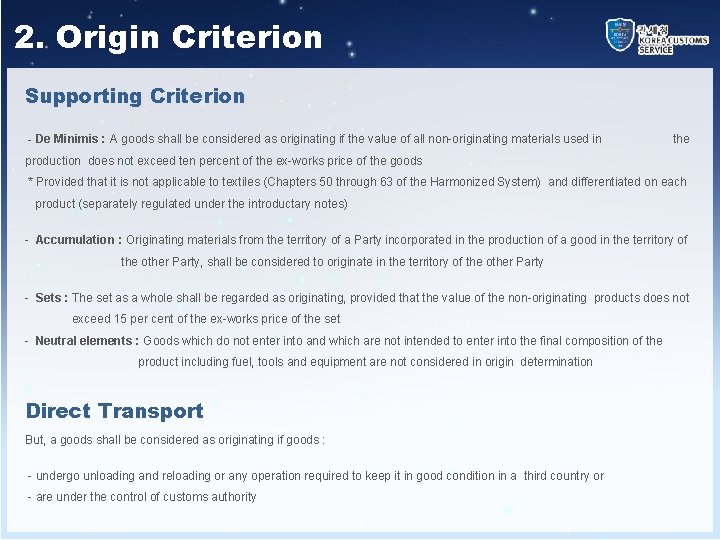

2. Origin Criterion Supporting Criterion - De Minimis : A goods shall be considered as originating if the value of all non-originating materials used in the production does not exceed ten percent of the ex-works price of the goods * Provided that it is not applicable to textiles (Chapters 50 through 63 of the Harmonized System) and differentiated on each product (separately regulated under the introductary notes) - Accumulation : Originating materials from the territory of a Party incorporated in the production of a good in the territory of the other Party, shall be considered to originate in the territory of the other Party - Sets : The set as a whole shall be regarded as originating, provided that the value of the non-originating products does not exceed 15 per cent of the ex-works price of the set - Neutral elements : Goods which do not enter into and which are not intended to enter into the final composition of the product including fuel, tools and equipment are not considered in origin determination Direct Transport But, a goods shall be considered as originating if goods : - undergo unloading and reloading or any operation required to keep it in good condition in a third country or - are under the control of customs authority

3. Approved Exporter Company-specific 1) Possessing origin management system or capable of proving country of origin Certification Criterion 2) Preparing and managing a list of C/Os and Product-specific 1) Exporting goods qualifying rules of origin (Tariff sub-heading) 2) Preparing and managing a list of C/Os and designating a person in charge of the C/O management 3) No rejection of origin verification for the past 2 years 4) Compliance with the record keeping requirement for the past 5 years 5) Issuance with no fraud for the past 2 years ☞ Origin declaration can be made for every exporting goods after certification ☞ Origin declaration can be made for certified goods after certification

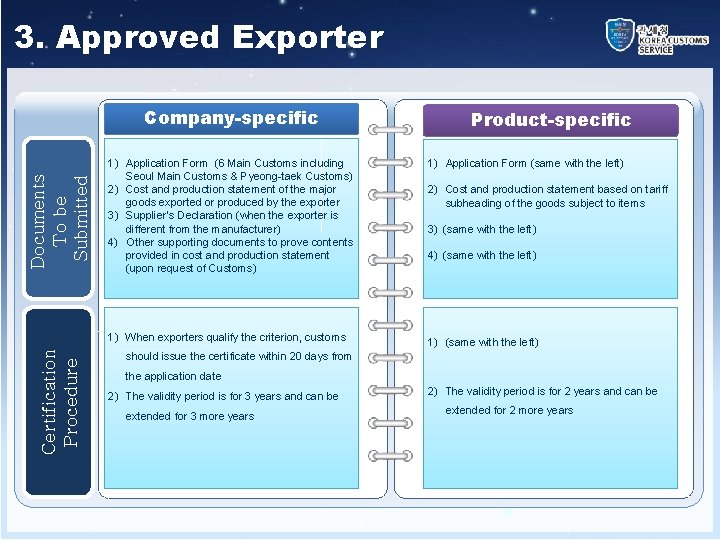

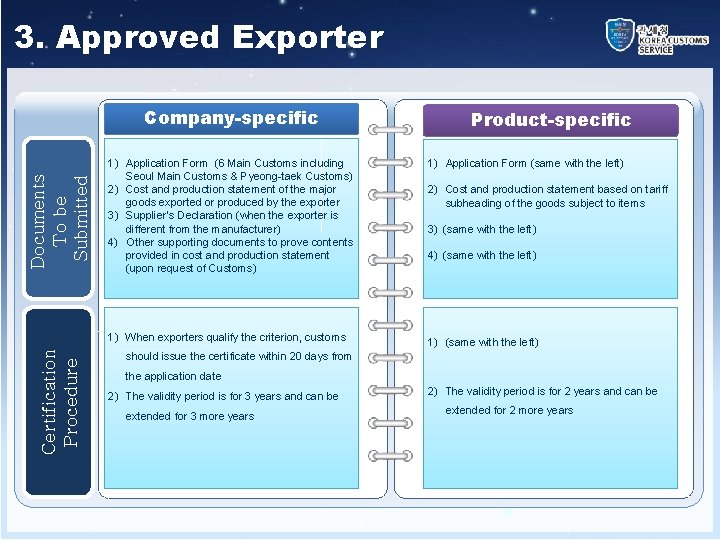

3. Approved Exporter Certification Procedure Documents To be Submitted Company-specific Product-specific 1) Application Form (6 Main Customs including Seoul Main Customs & Pyeong-taek Customs) 2) Cost and production statement of the major goods exported or produced by the exporter 3) Supplier’s Declaration (when the exporter is different from the manufacturer) 4) Other supporting documents to prove contents provided in cost and production statement (upon request of Customs) 1) Application Form (same with the left) 1) When exporters qualify the criterion, customs 1) (same with the left) 2) Cost and production statement based on tariff subheading of the goods subject to items 3) (same with the left) 4) (same with the left) should issue the certificate within 20 days from the application date 2) The validity period is for 3 years and can be extended for 3 more years 2) The validity period is for 2 years and can be extended for 2 more years

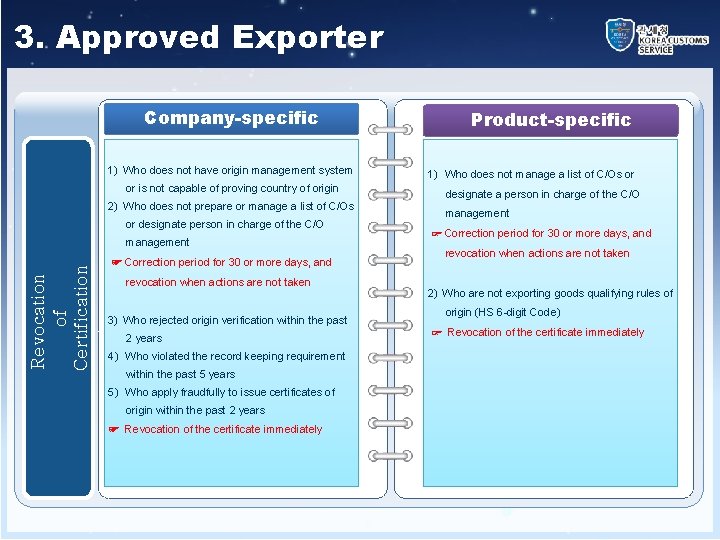

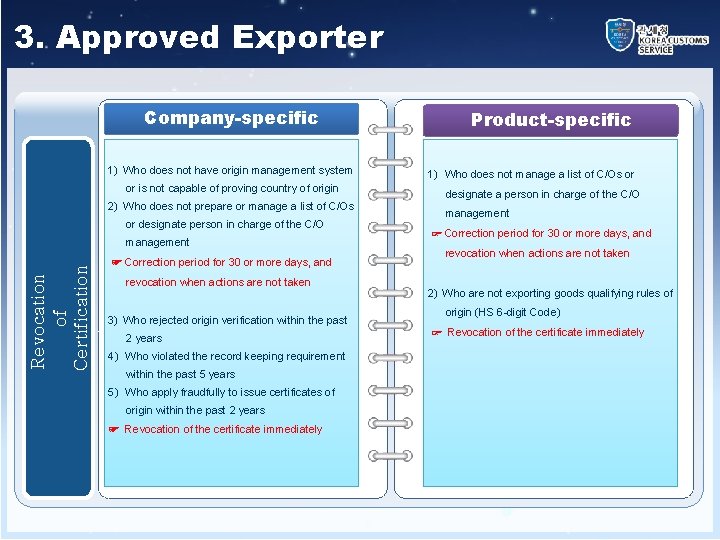

3. Approved Exporter Company-specific 1) Who does not have origin management system or is not capable of proving country of origin 2) Who does not prepare or manage a list of C/Os or designate person in charge of the C/O Revocation of Certification management ☞ Correction period for 30 or more days, and revocation when actions are not taken 3) Who rejected origin verification within the past 2 years 4) Who violated the record keeping requirement within the past 5 years 5) Who apply fraudfully to issue certificates of origin within the past 2 years ☞ Revocation of the certificate immediately Product-specific 1) Who does not manage a list of C/Os or designate a person in charge of the C/O management ☞ Correction period for 30 or more days, and revocation when actions are not taken 2) Who are not exporting goods qualifying rules of origin (HS 6 -digit Code) ☞ Revocation of the certificate immediately

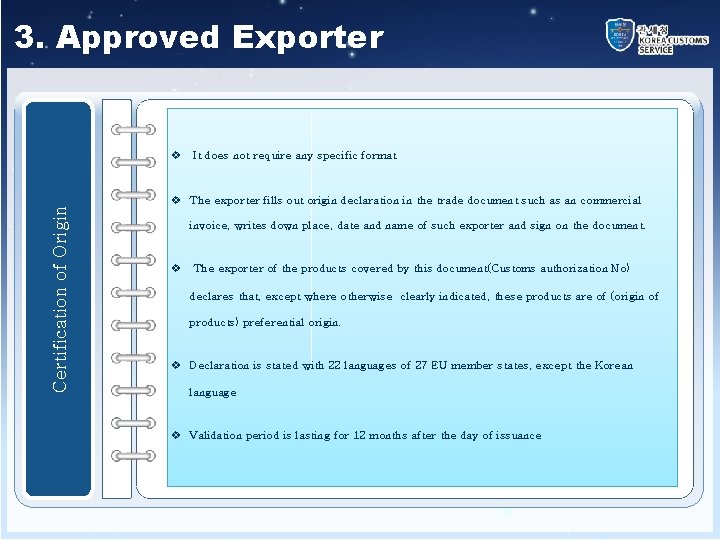

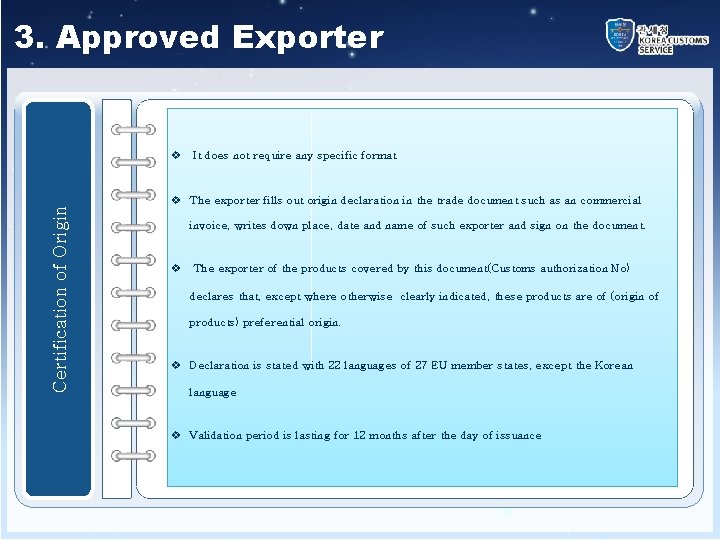

3. Approved Exporter Product-specific Certification of Origin v It does not require any specific format v The exporter fills out origin declaration in the trade document such as an commercial invoice, writes down place, date and name of such exporter and sign on the document. v The exporter of the products covered by this document(Customs authorization No) declares that, except where otherwise clearly indicated, these products are of (origin of products) preferential origin. v Declaration is stated with 22 languages of 27 EU member states, except the Korean language v Validation period is lasting for 12 months after the day of issuance

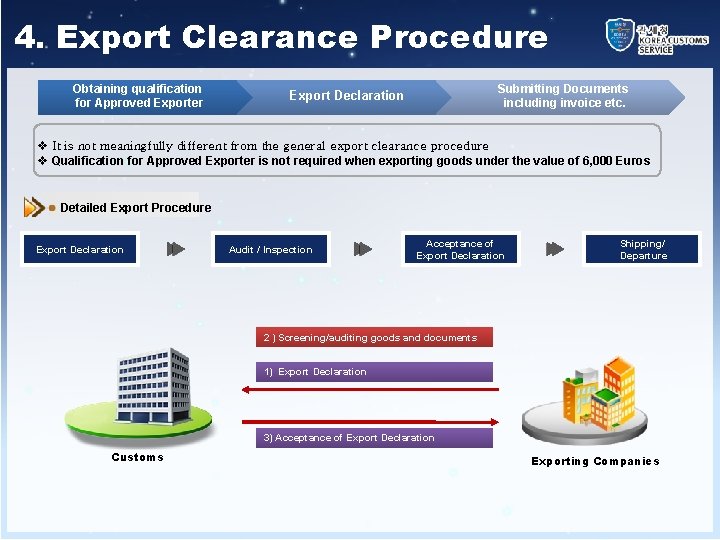

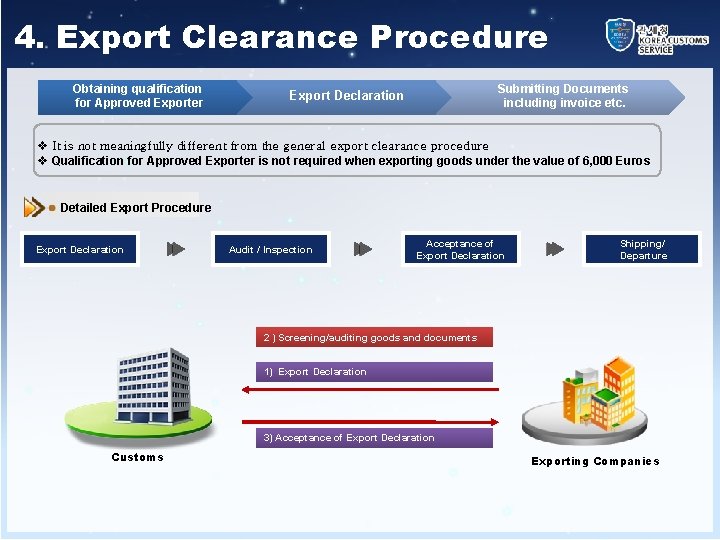

4. Export Clearance Procedure Obtaining qualification for Approved Exporter Submitting Documents including invoice etc. Export Declaration v It is not meaningfully different from the general export clearance procedure v Qualification for Approved Exporter is not required when exporting goods under the value of 6, 000 Euros Detailed Export Procedure Export Declaration Audit / Inspection Acceptance of Export Declaration Shipping/ Departure 2 ) Screening/auditing goods and documents 1) Export Declaration 3) Acceptance of Export Declaration Customs Exporting Companies

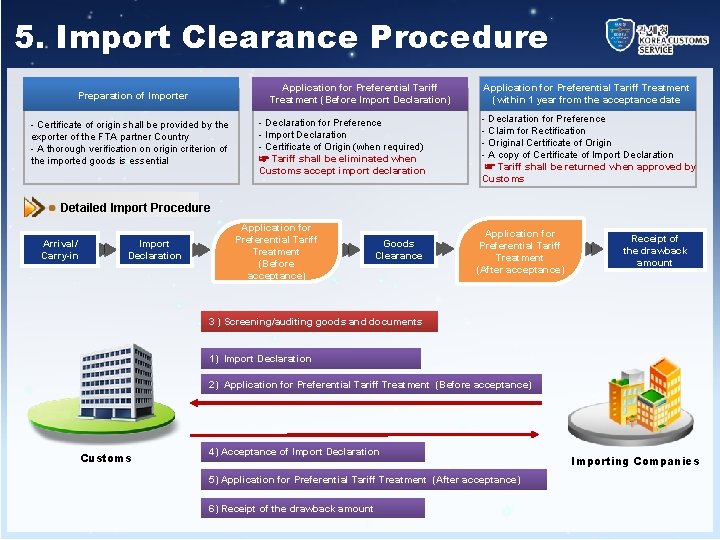

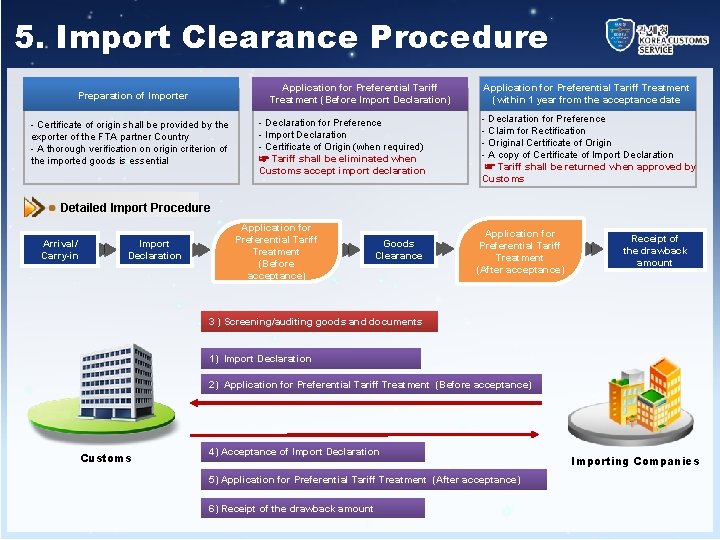

5. Import Clearance Procedure Application for Preferential Tariff Treatment (Before Import Declaration) Preparation of Importer - Certificate of origin shall be provided by the exporter of the FTA partner Country - A thorough verification on origin criterion of the imported goods is essential - Declaration for Preference - Import Declaration - Certificate of Origin (when required) ☞ Tariff shall be eliminated when Customs accept import declaration Application for Preferential Tariff Treatment (within 1 year from the acceptance date - Declaration for Preference - Claim for Rectification - Original Certificate of Origin - A copy of Certificate of Import Declaration ☞ Tariff shall be returned when approved by Customs Detailed Import Procedure Arrival/ Carry-in Import Declaration Application for Preferential Tariff Treatment (Before acceptance) Goods Clearance Application for Preferential Tariff Treatment (After acceptance) Receipt of the drawback amount 3 ) Screening/auditing goods and documents 1) Import Declaration 2) Application for Preferential Tariff Treatment (Before acceptance) Customs 4) Acceptance of Import Declaration 5) Application for Preferential Tariff Treatment (After acceptance) 6) Receipt of the drawback amount Importing Companies

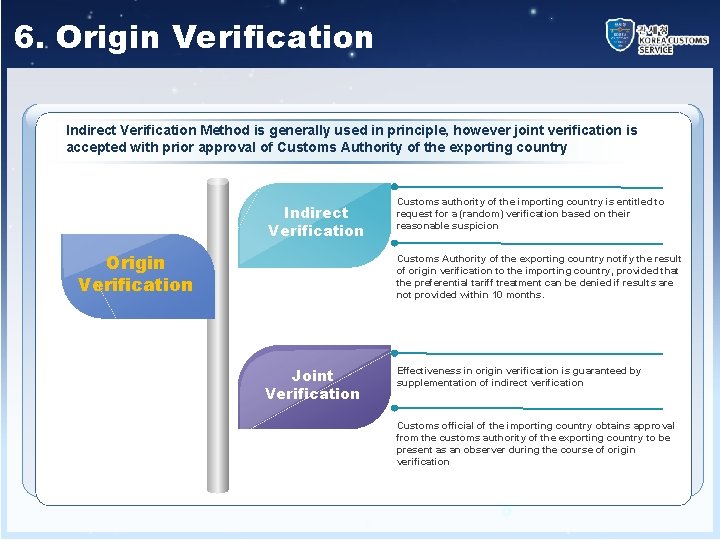

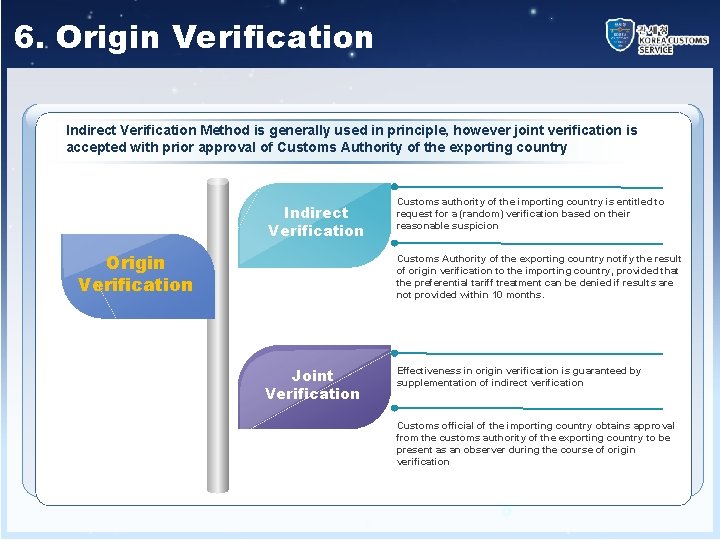

6. Origin Verification Indirect Verification Method is generally used in principle, however joint verification is accepted with prior approval of Customs Authority of the exporting country Indirect Verification Origin Verification Customs authority of the importing country is entitled to request for a (random) verification based on their reasonable suspicion Customs Authority of the exporting country notify the result of origin verification to the importing country, provided that the preferential tariff treatment can be denied if results are not provided within 10 months. Joint Verification Effectiveness in origin verification is guaranteed by supplementation of indirect verification Customs official of the importing country obtains approval from the customs authority of the exporting country to be present as an observer during the course of origin verification

7. Consideration Points 1) Documentary Evidence of Origin Required for Import Declaration (Application for Preferential Tariff Treatment) 2) Obligation to Keep Documentary Evidence of Origin for 5 Years from the Date of Import/Export Declaration Importer Exporter • A copy of Certificate of Origin (C/O) • Certificate of Import Declaration • Contracts related to import transactions • Contract in relation to transactions of Intellectual Property Rights • Documentation related to determination of customs value of the imported goods • Documentation related to international transportation of the imported goods • A copy of advance ruling and other supporting documents required for advance ruling (when issued) • A copy of C/O submitted to the importer of the FTA partner country • Certificate of Export Declaration • Certificate of Import Declaration of the raw material (when Import Declaration was made by the exporter) • Contracts related to export transactions • Other supporting documents in relation to production/purchase of the raw material or the goods • Cost Statement, List of raw materials, Description of production • Inventory Book for (incomings and outgoings of) raw materials and goods, Inventory Management Book • Any other documents submitted to the exporter by the producer or the supplier to prove the country of origin

Thank You e-Mail : tksung@customs. go. kr

Customs pga

Customs pga Type 86 cbp commerce

Type 86 cbp commerce Filosofi customs services dan customs controls

Filosofi customs services dan customs controls Objectives of import substitution

Objectives of import substitution Phases of export promotion

Phases of export promotion Export and import strategies

Export and import strategies Ck import export

Ck import export Vrf export map

Vrf export map Apa itu sales contract

Apa itu sales contract Timi import export

Timi import export Import export policy

Import export policy China international import export 2019

China international import export 2019 Import java.applet.applet

Import java.applet.applet Import java

Import java Import numpy as np import matplotlib.pyplot as plt

Import numpy as np import matplotlib.pyplot as plt Import java.awt.* import java.awt.event.*

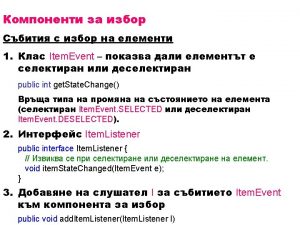

Import java.awt.* import java.awt.event.*