Form of partnership in Islam Nuradli RS Musharakah

- Slides: 14

Form of partnership in Islam Nuradli RS

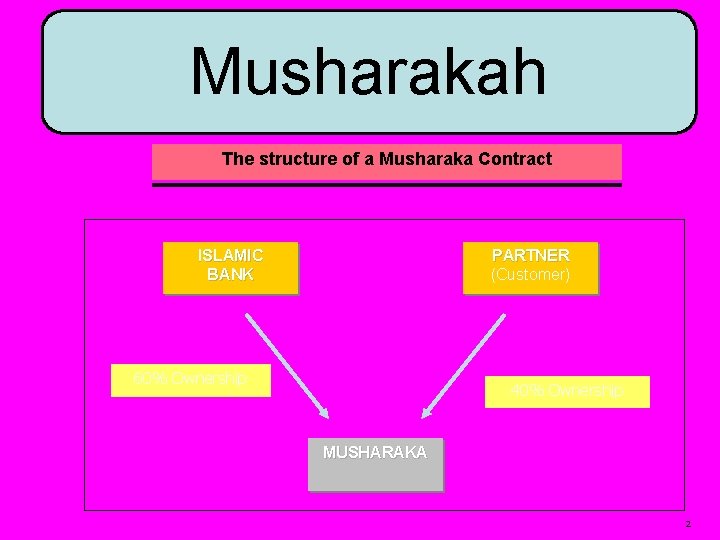

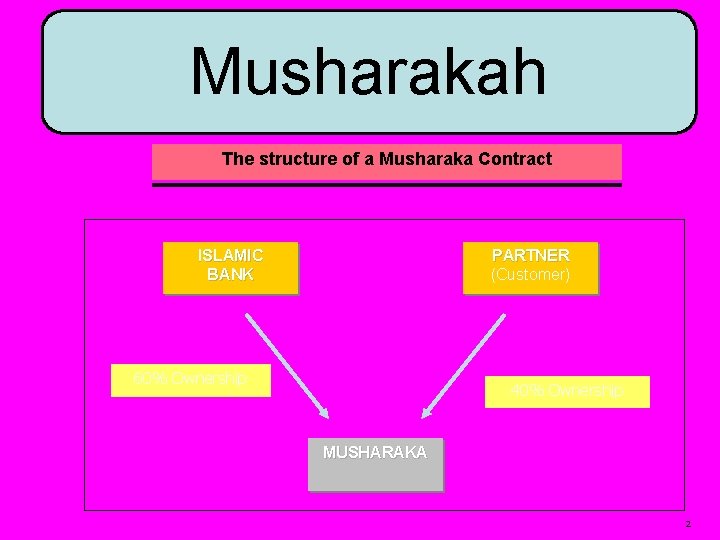

Musharakah The structure of a Musharaka Contract ISLAMIC BANK PARTNER (Customer) 60% Ownership 40% Ownership MUSHARAKA 2

• Both the Bank and the customer contributes towards the capital of the enterprise • Under a “diminishing” musharakah, the customer buys out the bank`s share over a period of time. • The customer and the bank share in the profits according to the agreed proportions, which may be different from the proportions of capital contributed. Any losses of the enterprise will be borne by the customer and the bank according to their capital contributions. 3

SHIRKAH PARTNERSHIP

DEFINITION • Shirk or Shirkah in Arabic means partnership • In classical Islamic law, partnerships are referred to as Shirkah. In the parlance of contemporary jurists, the term Musharakah (sharing) is more commonly used • In its broader sense Musharakah means a joint enterprise formed for conducting some business in which all partners share the profit according to a specific ratio while the loss is shared

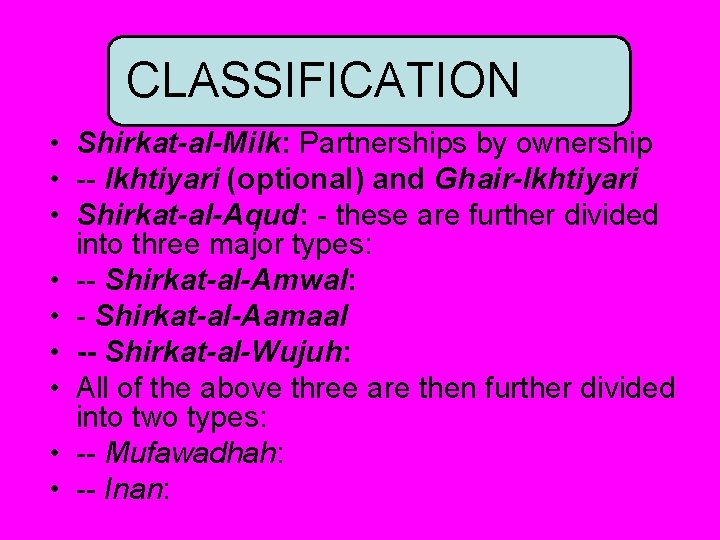

CLASSIFICATION • Shirkat-al-Milk: Partnerships by ownership • -- Ikhtiyari (optional) and Ghair-Ikhtiyari • Shirkat-al-Aqud: - these are further divided into three major types: • -- Shirkat-al-Amwal: • - Shirkat-al-Aamaal • -- Shirkat-al-Wujuh: • All of the above three are then further divided into two types: • -- Mufawadhah: • -- Inan:

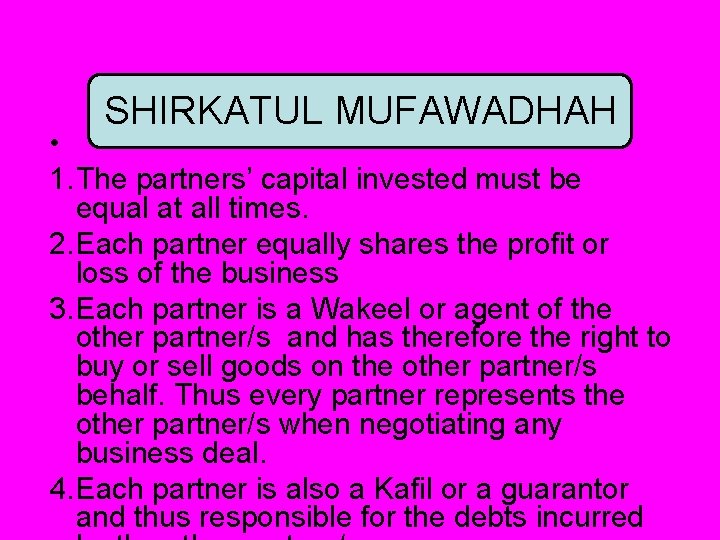

SHIRKATUL MUFAWADHAH • 1. The partners’ capital invested must be equal at all times. 2. Each partner equally shares the profit or loss of the business 3. Each partner is a Wakeel or agent of the other partner/s and has therefore the right to buy or sell goods on the other partner/s behalf. Thus every partner represents the other partner/s when negotiating any business deal. 4. Each partner is also a Kafil or a guarantor and thus responsible for the debts incurred

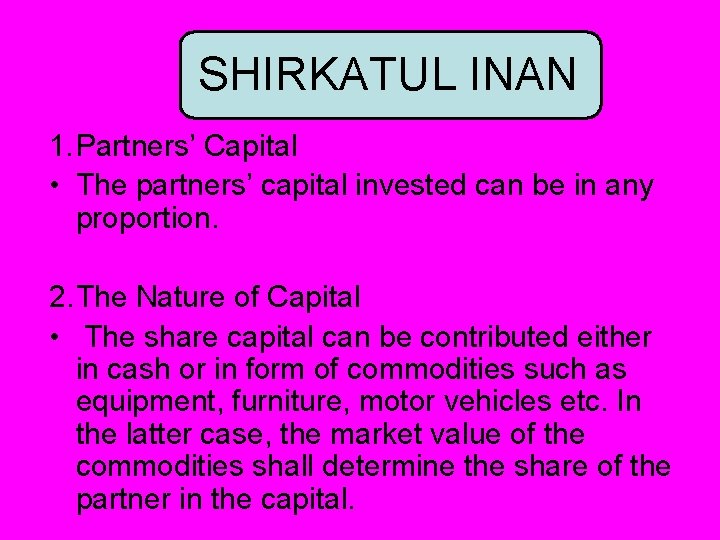

SHIRKATUL INAN 1. Partners’ Capital • The partners’ capital invested can be in any proportion. 2. The Nature of Capital • The share capital can be contributed either in cash or in form of commodities such as equipment, furniture, motor vehicles etc. In the latter case, the market value of the commodities shall determine the share of the partner in the capital.

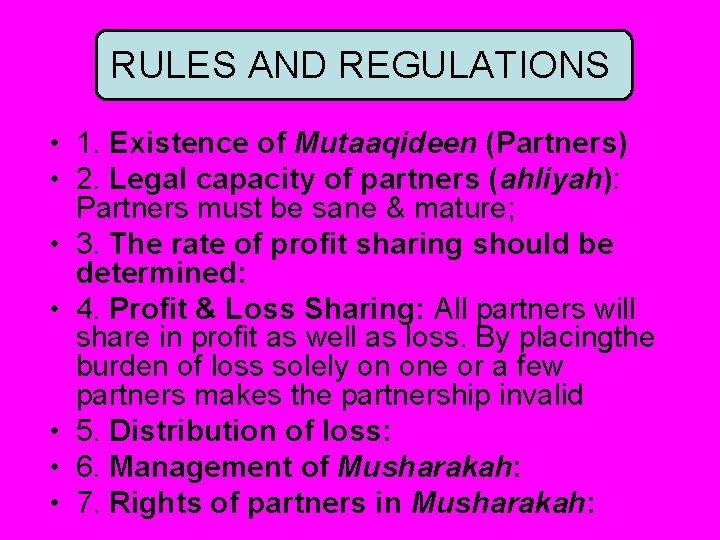

RULES AND REGULATIONS • 1. Existence of Mutaaqideen (Partners) • 2. Legal capacity of partners (ahliyah): Partners must be sane & mature; • 3. The rate of profit sharing should be determined: • 4. Profit & Loss Sharing: All partners will share in profit as well as loss. By placingthe burden of loss solely on one or a few partners makes the partnership invalid • 5. Distribution of loss: • 6. Management of Musharakah: • 7. Rights of partners in Musharakah:

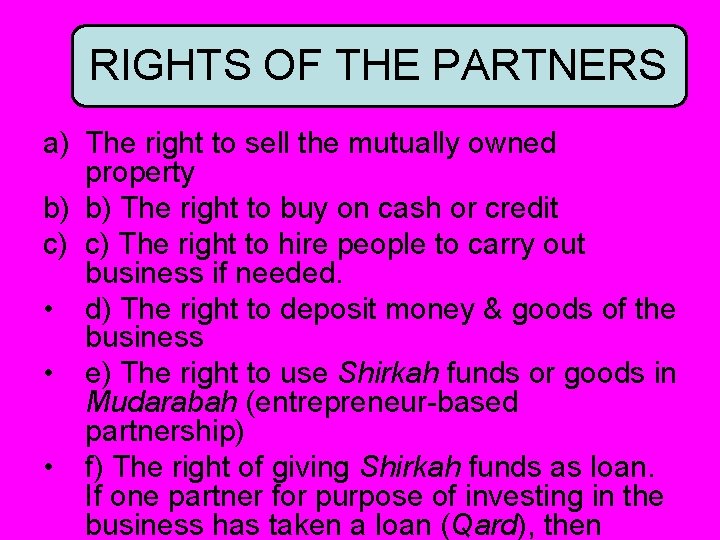

RIGHTS OF THE PARTNERS a) The right to sell the mutually owned property b) b) The right to buy on cash or credit c) c) The right to hire people to carry out business if needed. • d) The right to deposit money & goods of the business • e) The right to use Shirkah funds or goods in Mudarabah (entrepreneur-based partnership) • f) The right of giving Shirkah funds as loan. If one partner for purpose of investing in the business has taken a loan (Qard), then

TERMINATION • Musharakah will terminate if the purpose of formingthe Shirkah has been achieved; if any of the partners applies for termination; if any ofthe partners die or becomes insane or incapable of effecting commercial transaction

VALUATION AT TERMINATION • MARKET VALUE • ACTUAL LIQUIDATION • CONSTRUCTIVE LIQUIDATION

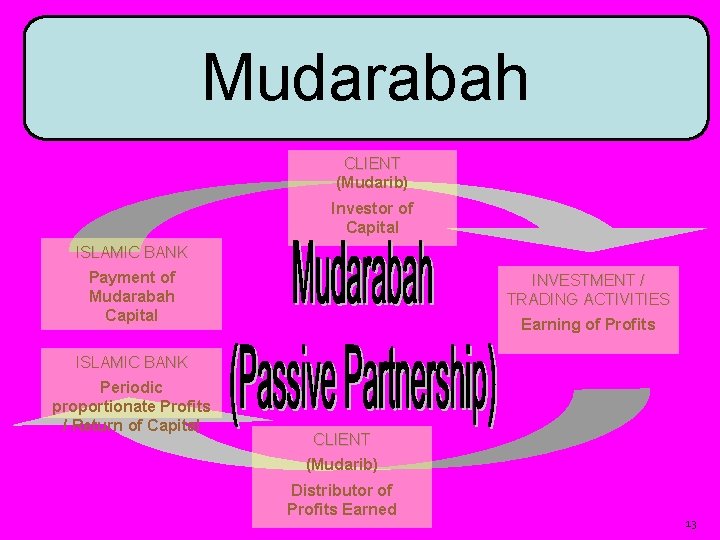

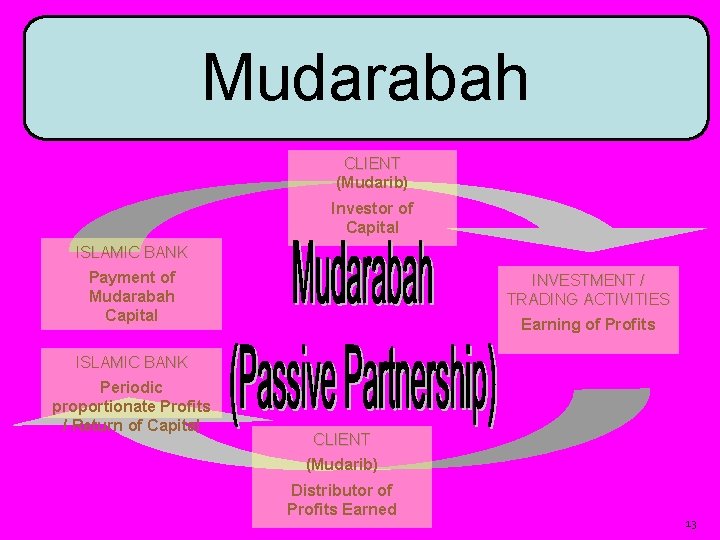

Mudarabah CLIENT (Mudarib) Investor of Capital ISLAMIC BANK Payment of Mudarabah Capital INVESTMENT / TRADING ACTIVITIES Earning of Profits ISLAMIC BANK Periodic proportionate Profits / Return of Capital CLIENT (Mudarib) Distributor of Profits Earned 13

Narrative description of Mudarabah • The bank provides to the customer (mudarib) all the capital to fund a specified enterprise • The customer contributes only entrepreneurship. • The customer is responsible for the day to day management of the enterprise and is entitled to deduct its management fee(mudarib fee) from the enterprise`s profits. • The mudarib fee could be a fixed fee (to cover management expenses) and a percentage of the profits or a combination of the two. A classical mudarib fee is based on a percentage of the profits only. • The balance of the profit of the enterprise is payable to the bank • If the enterprise makes a loss, the bank (as the fund provider or Rabbul Mal) has to bear all the losses unless the loss has resulted from negligence on the part of the mudarib. 14

Musdarabah

Musdarabah Maksud fikah tasawwur islam

Maksud fikah tasawwur islam Matlamat perundangan islam

Matlamat perundangan islam Penyebaran islam pada zaman kerajaan islam

Penyebaran islam pada zaman kerajaan islam Example of diminishing musharakah

Example of diminishing musharakah Features of musharakah

Features of musharakah What is ijtihad

What is ijtihad Musharakah

Musharakah Permanent musharakah

Permanent musharakah Pillars of islamic contract

Pillars of islamic contract Diminishing musharakah agreement

Diminishing musharakah agreement Musharakah definition

Musharakah definition Negative form present continuous

Negative form present continuous Behavioral health training partnership

Behavioral health training partnership Institutional medicaid

Institutional medicaid