FINDING SOURCES OF FINANCING FINDING SOURCES OF FINANCING

- Slides: 31

FINDING SOURCES OF FINANCING

FINDING SOURCES OF FINANCING • Three basic types of financing can be identified. These are: • Profit retention: • This is an approach where cash is not withdrawn in form of dividends but instead uses the cash to finance the business. • • Spontaneous financing: This is financing arising from increased sales. Increased income to buy more inventories and suppliers , Extend credits when they realize there is good business. • External financing: This comes from outside investors. The investors include creditors, equity investors(Angle investors, venture capitalists) or owner piping more finance in business.

THE NATURE OF A FIRM AND ITS FINANCING SOURCES: • Four basic factors determine how a firm is financed: 1. Economic value potential: • A firm with high growth and profit potential and large profit has more possible sources of financing than a firm that provides a good lifestyle for the owner. • Only firms providing higher rates than investor’s requirement would create value for the investor. • Most investors want firms that would offer high returns within a period of five to ten years

2. Company maturity: • • Startup businesses have difficult raising finances and have to depend of the owners for any potentials investment. As the firms grow and have good financial track records with bankers and other financiers, credit facilities becomes easier to acquire. Banks specifically dislike making loans to company with no history and only a few venture capitalists are willing to venture in startup companies. Even where a creditor is willing to finance, evidence of past record of financial management are essential.

3. Types of assets: • • There are basically two types of assets sort by the financial institutions (e. g. banks) before financing: tangible and intangible: i) Tangible assets – are assets that can be seen and touched e. g. inventories, equipment and buildings. These assets serve as great collateral when financing is required. 2) Intangible assets—include things like goodwill, research and development and even the quality of a firm’s employees.

4. SOURCES OF FINANCING: • • The primary source of equity financing are personal savings, friends and family, private investors in the community, large corporations, venture capitalists and the sale of stock in public equity markets (going public). i. Individual investors: The search for financial support usually begins close home. The inspiring entrepreneur frequently has three sources of early financing: – – – Personal savings Friends and relatives Other individual investors, e. g. informal venture capital.

ii) Business suppliers and asset-based lenders: Companies that have business dealings with a new firm are also possible sources of funds for financing inventories and equipment.

• a) Accounts payable (trade credit): Credit extended by suppliers is very important to a startup. Trade credit is the source of short-term funds most widely used by small firms. • Accounts payable (trade credit) is of short duration – 30 days is the customary credit period.

b) Equipment loans and leases: Some small businesses, such as restaurants, use equipment that is purchases on an installment basis through an equipment loan. A down payment of 25 to 35 percent is usually required and the contract period normally runs from three to five years. • The equipment manufacturer of supplier typically extends credit on the basis of a conditional sales contract (mortgage) on the equipment. During the loan period, the equipment cannot serve as collateral for another loan.

• c) Asset-based lending: As its name implies, an asset-based loan in a line of credit secured primarily by assets such as receivable, inventory or both. • The lender cushions its risk by advancing only a percentage of the value of a firm’s assets – generally, 65% to 85% against receivables and up to 55% against inventory. • Asset-based lending is a viable option for young, growing businesses caught in a cash flow problems.

d. Commercial Banks: These are primary providers of debt capital to small companies. Banks tend to limit their lending to providing for the working capital needs of established firms.

• • iii) Mortgages: These represent a longterm source of debt capital are of two types: chattel mortgages and real estate mortgages. • A chattel mortgage is a loan for which certain items of inventory or other movable property serve as collateral. The borrower retains title to the inventory but cannot sell it without the banker’s consent. • A real estate mortgage is a loan for which real property, such as land or a building, provides the collateral. Typically, these mortgages extend over 25 or 30 years.

Understanding a bankers’ perspective • All bankers have two fundamental concerns when they make a loan: – how much income the loan will provide the bank, either in interest income or in other forms of income such as fees, and – the likelihood that the borrower will default on the loan. A bank is not interested in taking large amount of risk and will therefore,

• In making a loan decision, a banker looks at the proverbial “five Cs of credit”: i) The borrower’s character – should be above reproach. A bad credit record or any indication of unethical behavior will make getting a loan extremely difficulty. ii) The borrower’s capacity to repay the loan – this is measured by the banker’s confidence in the firm’s ability to generate the cash flows necessary to repay the loan. iii) The capital being invested in the venture by the borrower – the banker looks at the equity investment of the owners in the business – the more the equity the better. iv) The conditions of the industry –if the industry is a stable one, the banks are willing to invest compared to volatile industries. v) The collateral available to secure the loan. This is important as a secondary source for repayment of the loan in case the firm’s cash flows are insufficient.

• To acquire a loan from a bank, an entrepreneur has to answer the following questions: – What are the strengths and qualities of the management team? – How has the firm performed financially? – How much money is needed? – What is the venture going to do with the money? – When is the money needed? – When and how will the money be paid back? – Does the borrower have qualified support people – such as a good public accountant and attorney?

• Loan negotiating: The entrepreneur must consider four major terms in loan negotiations: • • 1) Interest rates, 2) the loan maturity date, 3) the repayment schedule, and 4) the loan covenants – • these are restrictions to borrowers from certain activities that might lessen their ability to repay loan.

• • Government-sponsored programs and agencies: There are several government programs that provide finances to small businesses. Community-based financial institutions

STRATEGIES IMPORTANCE OF THE EXIT The EXIT

• Exiting – or harvesting, as it is frequently called is the method entrepreneurs and investors use to get out of the business and ideally, reap the value of their investment in the firm. Many entrepreneurs successfully grow their businesses but fail to develop effective exit strategies. As a result they are unable to capture the full value of the business that they have worked so hard to create.

METHODS OF EXITING A BUSINESS • There are four basic methods of exiting from a business for small business owners: – Selling the firm: • An entrepreneur’s motivation for selling a company relates to estate planning and the opportunity to diversify her or his portfolio investments. • Sale transactions can be reduced to three types based on the motives of the buyers. These are:

i ) Strategic acquisitions: from a seller’s perspective, the key point in a strategic acquisition is that the value buyers place on the business depends on the synergies they think they can create by combining the acquired firm with complementary businesses.

ii) Financial acquisitions: Unlike strategic buyers, buyers in financial acquisitions look primarily to a firm’s standalone cash generating potential as it source of value. The value hoped to be tapped relates to stimulating future sales growth, reducing costs or both.

iii) Employee Acquisitions – Employee stock ownership plans (ESOPs) provide a way for a business’s founder to cash out and for the employees to acquire on ownership interest in the company. • In an ESOP, employees’ retirement contributions are used to purchase shares in the firm. A wide variety of businesses have used these plans for many reasons. This is usually the last resort for most entrepreneurs.

II) Releasing the firm’s cash flows: This strategy involves the owner’s withdrawals of investment in the form of the firm’s cash flow. The withdrawals process could be immediate if the owner simply sold off the assets of the firm and ceased business operations. • For a value-creating firm – one that earns attractive rates on return for its investment, this does make economic sense. Instead, the owners might simply stop growing the business – by doing so, they increase the cash flows that can be returned to the investors. • Exiting by withdrawing a firm’s cash from the

• • • There are disadvantages: Reducing reinvestment when the firm faces valuable growth opportunities results in lost value creation and could leave a firm unable to sustain its competitive advantage. The end result may be an unintended reduction in harvestable value below the potential value of the firm as a long term going concern. Also there may be tax disadvantages to an orderly liquidation, compared with other exist methods.

• III. Going Public: • Many entrepreneurs consider the prospect of an initial public offering (IPO). Most entrepreneurs do not really understand the IPO process, especially when it comes to: 1) how going public relates to the exit and 2) the actual process by which a firm goes public.

• Lisa D. Stein, vice president of Salomon Smith Barney, offered the following reasons for going public: • To raise capital to reply outstanding debt • To support future growth • To fund future acquisitions • To create a liquid market for the company’s stock • To broaden the company’s shareholder base • To create ongoing interest in the company and it’s

The IPO Process: The basic steps in the IPO process are: • The firm’s owners decide to go public. • If not already completed, an audit of the last three years of financial statements is conducted • An investment banker is selected to guide management in the IPO process • An S-1 Registration statement is filed with the SEC. • Management responds to suggested comments by the SEC and issues describing the firm and the offering. • The firm spends the next 10 to 15 days “one the road”, explaining its attributes to potential investors. • One the day before the offering is released to the public, the actual offering price is decided upon. Based on the demand for the offering, the shares will be priced to create active trading of the stock. • Months of work come to fruition in a single event – offering stock to the public and seeing how it is received.

• • iv. Using private equity: The fourth method of exiting is the use of private equity. With an IPO, a portion of the firm’s equity is sold in public equity markets. There is, however, an alternative form of equity, in which private equity is infused to help a family-controlled firm transfer ownership from one generation to another and eventually to outside investors, while at the same time providing growth capital. Private equity is money provided by venture capitalists or private investors. The private investors may be individuals or small groups of individuals who act together to invest in companies. In the transfer of ownership within a family –owned firm, tradeoffs among three factors are of primary importance: • • • – – – Liquidity for exiting family members Continued financing for company growth, and Maintenance of family control of the firm.

DEVELOPING AN EFFECTIVE EXIT STRATEGY 1. Manage for exit: • • Having an exit plan in place is very important because the windows of opportunity can open and close quickly. The opportunity to exit is triggered by the arrival of a willing and able buyer, not just an interested seller. From the perspective of IPO, hot markets may offer very attractive opportunities and a seller must be ready to move when the opportunity arises. 2. Expect conflict – emotional and cultural: • • • The conflicts occur to varying degree wherever an entrepreneur remains with the company after the sale. Although the nature of the conflict varies, the intensity of the feelings does not. An entrepreneur who stays with the company should expect cultural conflict and be pleasantly surprised if it does not occur.

3. Get good advice: • Entrepreneurs learn to operate their businesses through experience gained in repeated day-to-day activities. However, they may engage in a harvest transaction only once in a lifetime. This means they need good advice both from experienced professionals and from those who have personally been through harvest. 4. Understand what you want: • Entrepreneurs should thing very carefully about their motives for exiting and what they plant to do after the exit. The exiting does not provide the long-sought liquidity, but some entrepreneur find managing money – in contrast to operating a business less rewarding than they had expected. • Entrepreneurs are also advised to be ware of potential problems that may arise after the exit. There are stories about people selling a firm or going public and then losing everything. Entrepreneurs should remember that nothing is more difficult than to establish a new order of things.

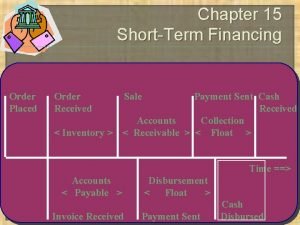

Short term financing sources

Short term financing sources Source of business finance

Source of business finance Spontaneous financing formula

Spontaneous financing formula Finding reliable internet sources

Finding reliable internet sources Print sources of information

Print sources of information Important of water resources

Important of water resources Long term financing

Long term financing Financing current assets

Financing current assets Management of current assets

Management of current assets Residual value

Residual value Chapter 8 financing a business

Chapter 8 financing a business Robert fugard

Robert fugard Working capital financing policy

Working capital financing policy Tax increment financing basics

Tax increment financing basics Warehouse finance

Warehouse finance 7 marketing functions

7 marketing functions Bncff

Bncff Partial statement of cash flows

Partial statement of cash flows Po financing basics

Po financing basics Optimal financing mix

Optimal financing mix Sharingqn

Sharingqn Mata kuliah manajemen resiko

Mata kuliah manajemen resiko Cross boarder transactions

Cross boarder transactions Capital financing requirement

Capital financing requirement Massachusetts educational financing authority

Massachusetts educational financing authority Ucfin card credit

Ucfin card credit Aggressive financing strategy

Aggressive financing strategy What is export financing

What is export financing Careington superior vision discount

Careington superior vision discount Project financing codice appalti

Project financing codice appalti Value chain financing models

Value chain financing models Green financing malaysia

Green financing malaysia