ECON 1001 Tutorial 1 Q 1 The scarcity

- Slides: 36

ECON 1001 Tutorial 1

Q. 1 The scarcity principle implies that to have more of one thing usually means a. b. c. d. e. increasing resources limiting wants increasing the need for another having less of another none of the above Answer: d by definition

n n n Option a: if resources can be increased whenever we’ve scarcity, there’ll be no need to study economics! Option b: come on!! Admit it! Human wants are unlimited! Option c: If you need to increase your desire on B while you’re having more A… you’re facing a more severe ‘scarcity’ problem.

Q. 2 A sunk cost is a. b. c. d. e. the value of money sunk into investment beyond recovery at the moment a decision must be made important to consider when conducting cost-benefit analysis equal to the opportunity cost when the interest rate is zero the same as a marginal cost Answer: b definition (option d does not make sense, designed to confuse you. )

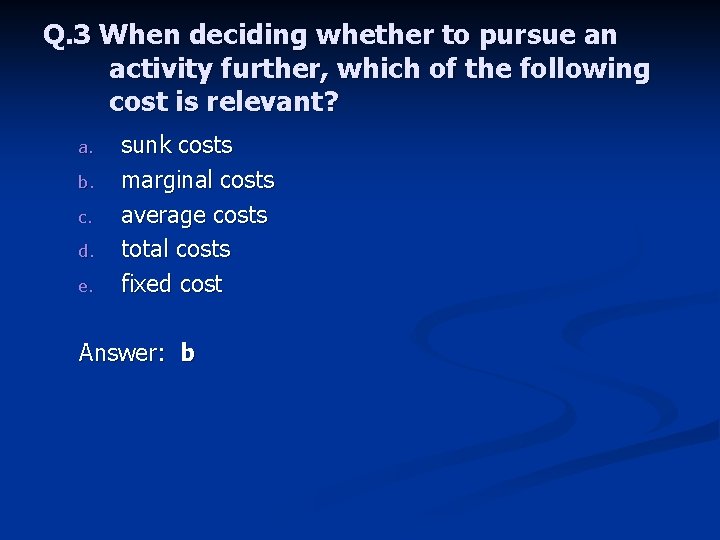

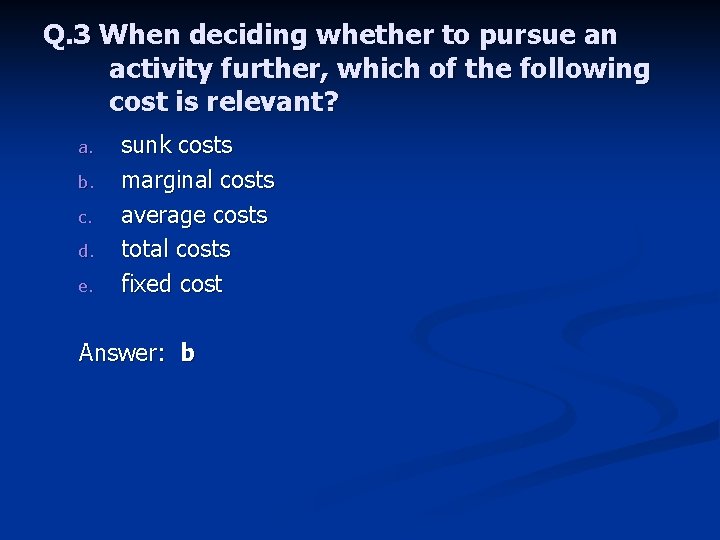

Q. 3 When deciding whether to pursue an activity further, which of the following cost is relevant? a. b. c. d. e. sunk costs marginal costs average costs total costs fixed cost Answer: b

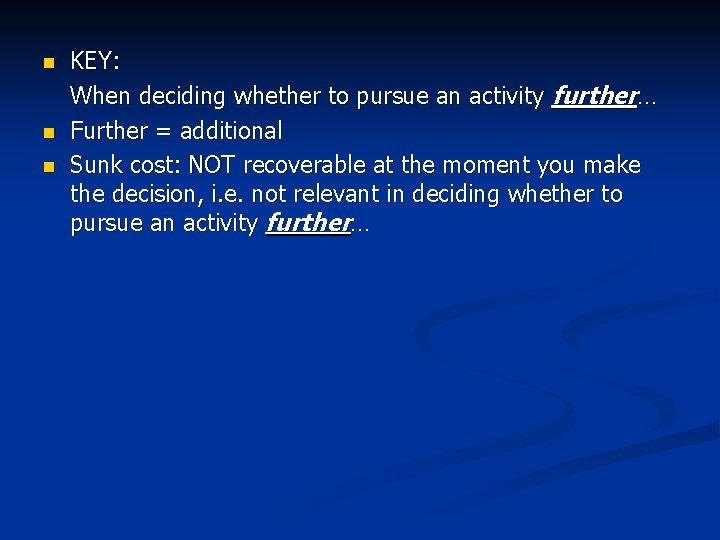

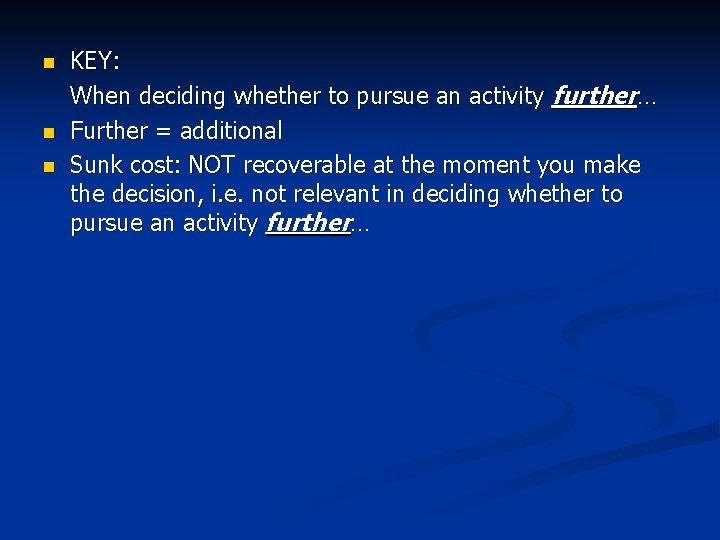

n n n KEY: When deciding whether to pursue an activity further… Further = additional Sunk cost: NOT recoverable at the moment you make the decision, i. e. not relevant in deciding whether to pursue an activity further…

n E. g. Isaac, who is the hottest guy among freshmen, asked you out AFTER one of the following situations: i. you’ve purchased a non-refundable $40 movie ticket. ii. you’ve purchased a non-refundable $2000 Madonna world tour concert ticket Assuming that the value of going out with Isaac is the highest among the 3 activities, Will there be any differences in your choice under the two situations?

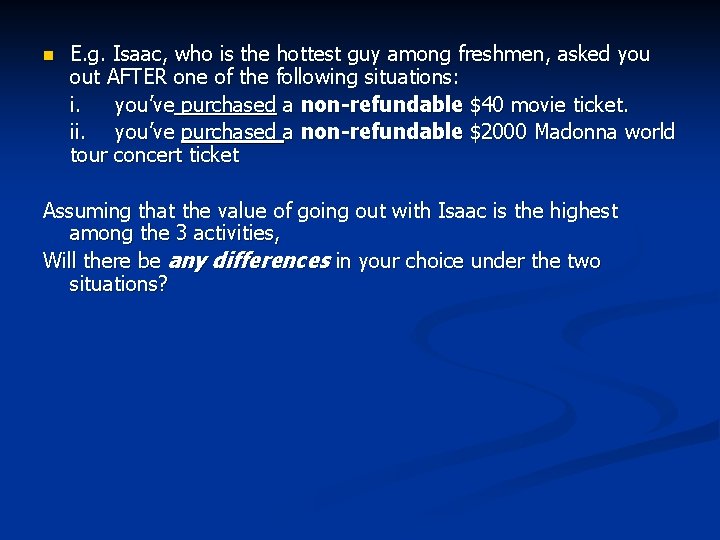

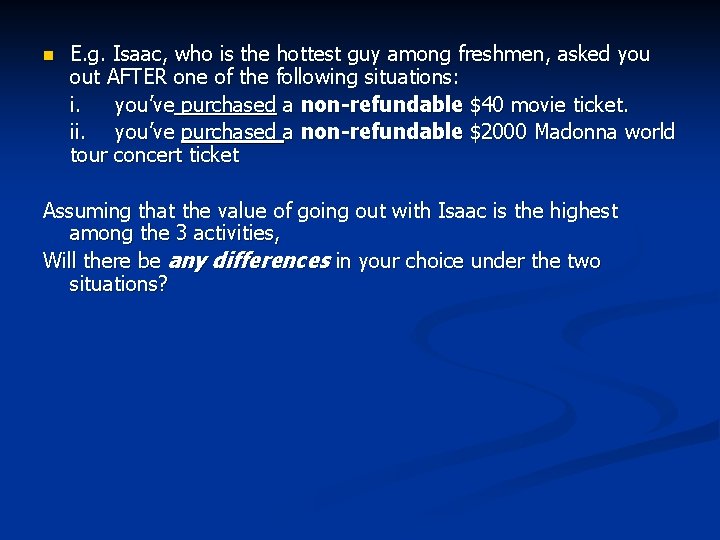

TC vs AC vs MC Q TC($) AC($) MC($) 0 0 0 1 3 3 3 2 7 3. 5 4 3 12 4 5 4 20 5 8 5 32 6. 4 12 n n n Assume: Each Unit can be sold at $6 Starting from zero unit, should you produce the 1 st unit? 2 nd? 3 rd? . . . 5 th? What happen if you evaluate the decision by looking at AC instead?

n n n Fixed Cost = costs that will not be varied with production plan/ scale n E. g. Rent, Management fee etc If, in previous example, the factory now faces a $10 increase in rent, will it increase/ decrease production plan? What if the rent is increased by $10000000?

Q. 5 In general, rational decision making requires one to choose the actions that yield the a. b. c. d. e. largest total benefit. smallest average cost. smallest total cost. largest economic surplus. smallest net benefit. Answer: d

n n Economists ADOPTED the Cost-Benefit Analysis in analyzing human behavior Thus, to know how action/behavior will change under different circumstances, we need to calculate BOTH cost AND benefit i. e. we consider ‘net benefit’/ ‘econ surplus’ definition: econ surplus = benefit - cost

Q. 4 Suppose the most you would be willing to pay for a plane ticket home is $250, but you buy one online for $175. The economic surplus of buying the online ticket is: a. b. c. d. e. $175. $250. $75 $50. $0. Answer: c

n n As defined in Q. 5 econ surplus = benefit – cost The economic surplus of buying the online ticket = willingness to pay – price Willingness to pay reflects how much you could benefit from the action Econ surplus = $250 - $175 = $75

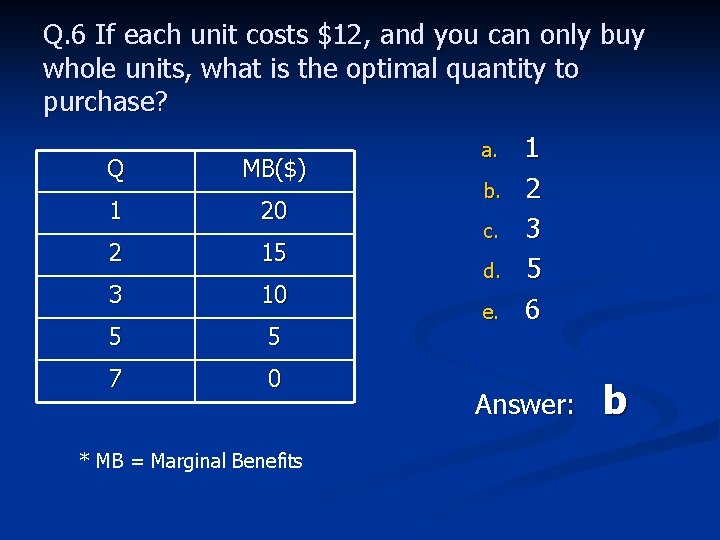

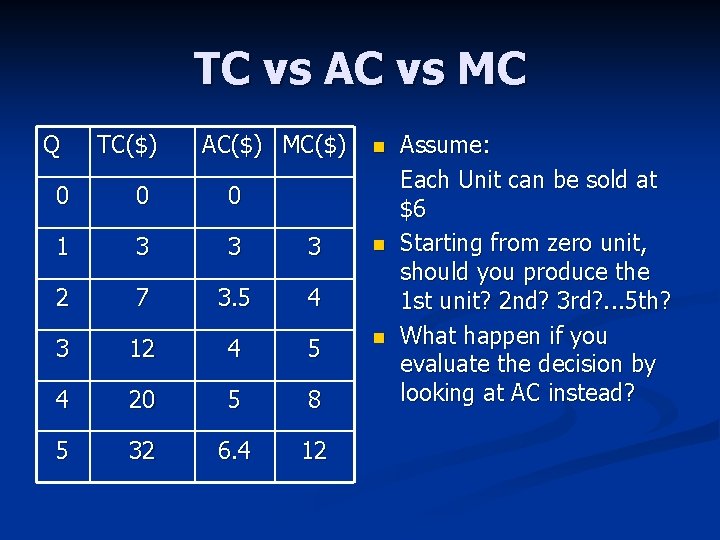

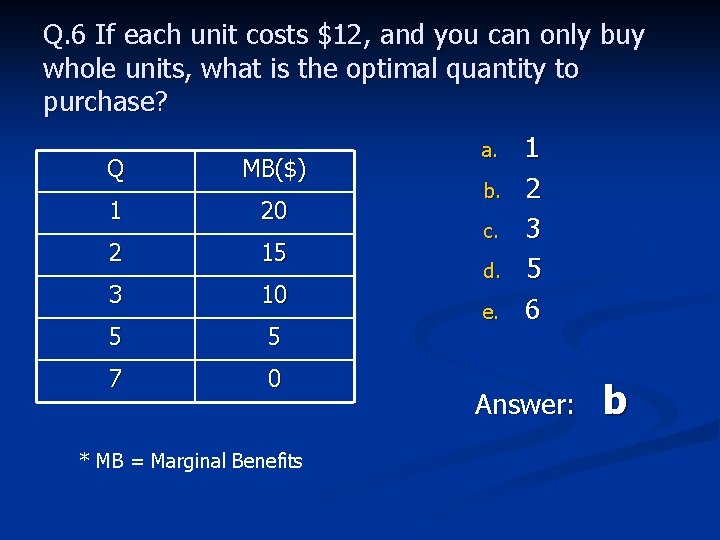

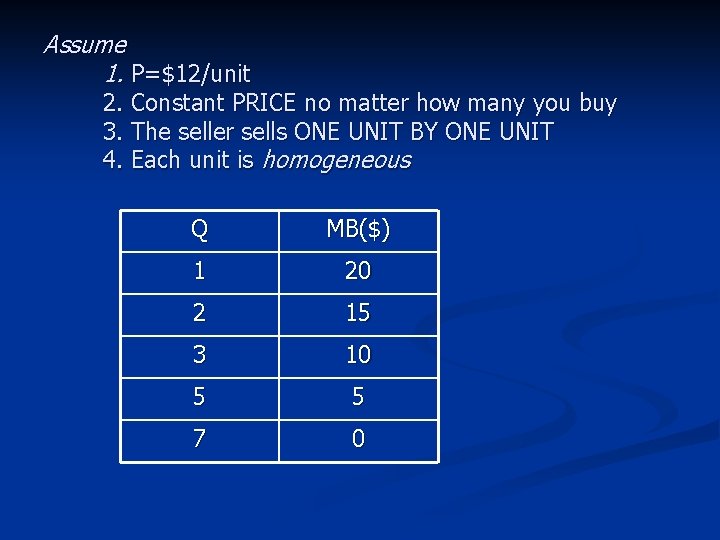

Q. 6 If each unit costs $12, and you can only buy whole units, what is the optimal quantity to purchase? Q MB($) 1 20 2 15 3 10 5 5 7 0 * MB = Marginal Benefits a. b. c. d. e. 1 2 3 5 6 Answer: b

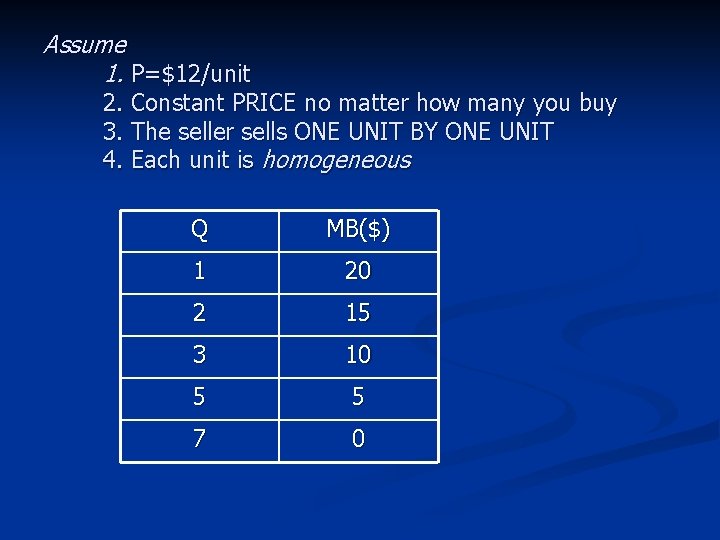

Assume 1. P=$12/unit 2. Constant PRICE no matter how many you buy 3. The seller sells ONE UNIT BY ONE UNIT 4. Each unit is homogeneous Q MB($) 1 20 2 15 3 10 5 5 7 0

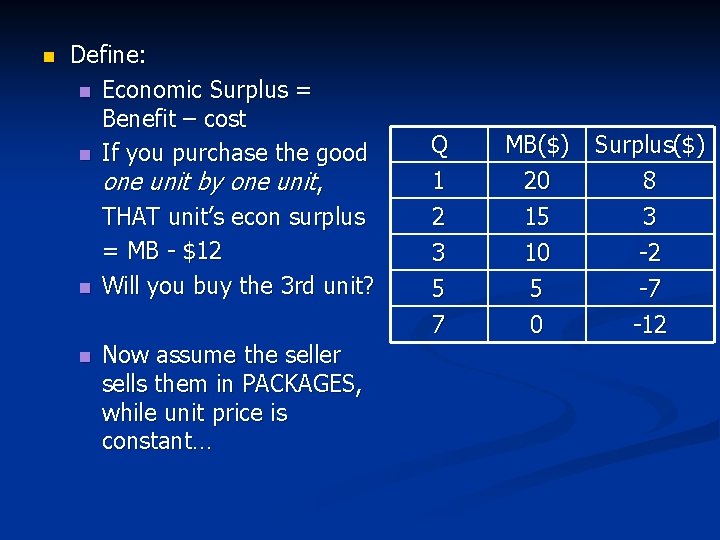

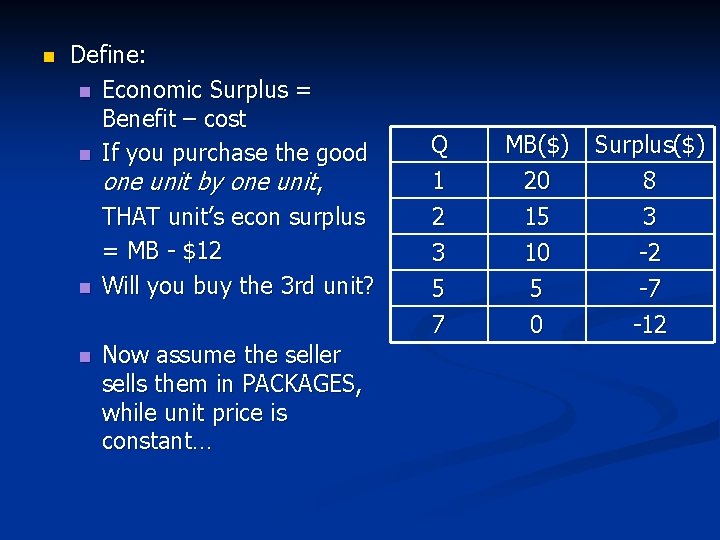

n Define: n Economic Surplus = Benefit – cost n If you purchase the good one unit by one unit, THAT unit’s econ surplus = MB - $12 n Will you buy the 3 rd unit? n Now assume the seller sells them in PACKAGES, while unit price is constant… Q 1 2 3 MB($) 20 15 10 Surplus($) 8 3 -2 5 7 5 0 -7 -12

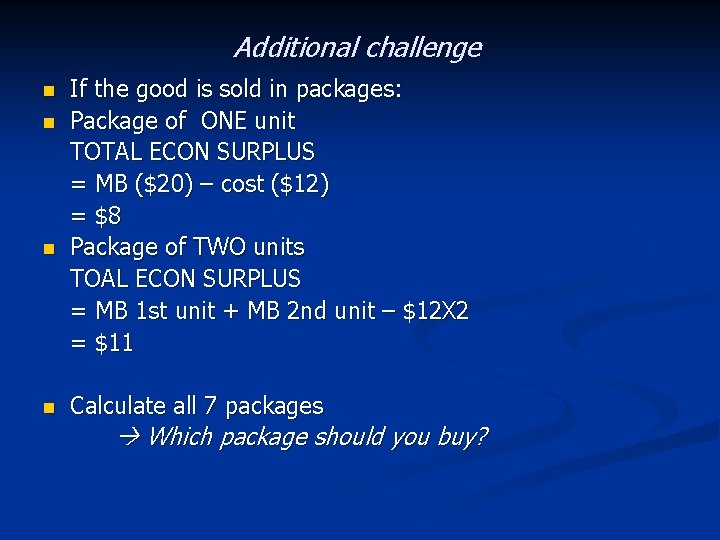

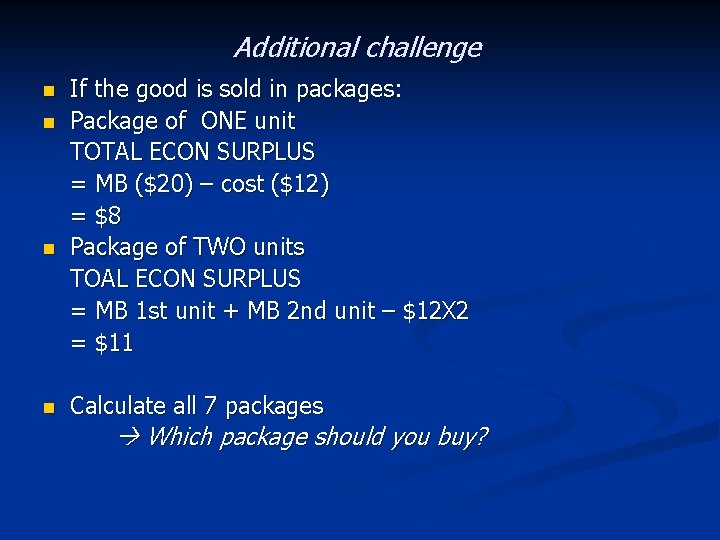

Additional challenge n n If the good is sold in packages: Package of ONE unit TOTAL ECON SURPLUS = MB ($20) – cost ($12) = $8 Package of TWO units TOAL ECON SURPLUS = MB 1 st unit + MB 2 nd unit – $12 X 2 = $11 Calculate all 7 packages Which package should you buy?

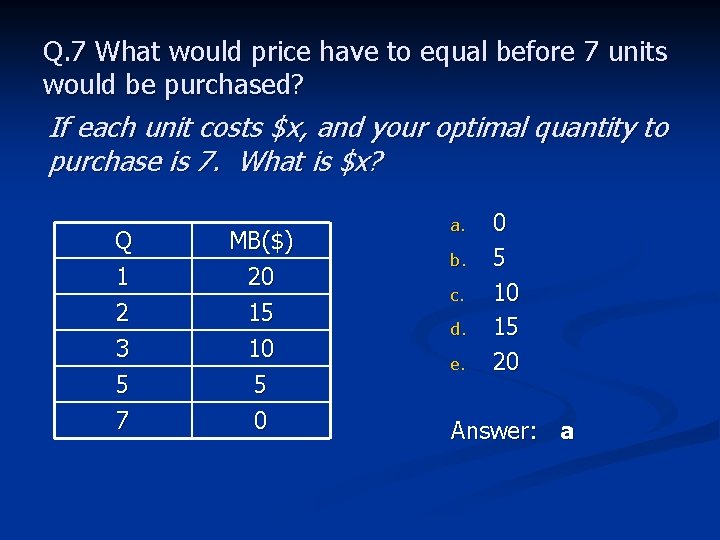

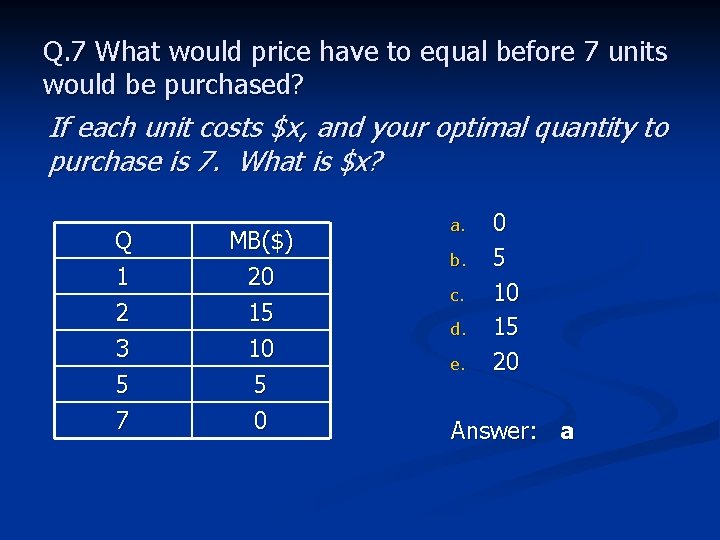

Q. 7 What would price have to equal before 7 units would be purchased? If each unit costs $x, and your optimal quantity to purchase is 7. What is $x? Q 1 2 3 MB($) 20 15 10 5 7 5 0 a. b. c. d. e. 0 5 10 15 20 Answer: a

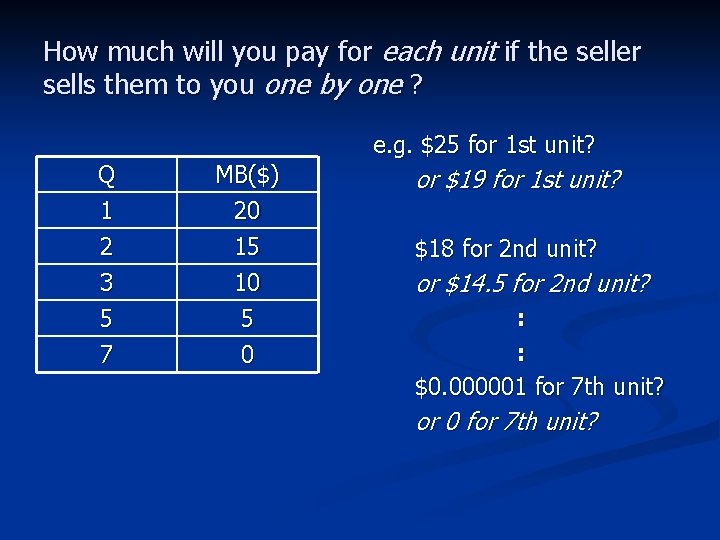

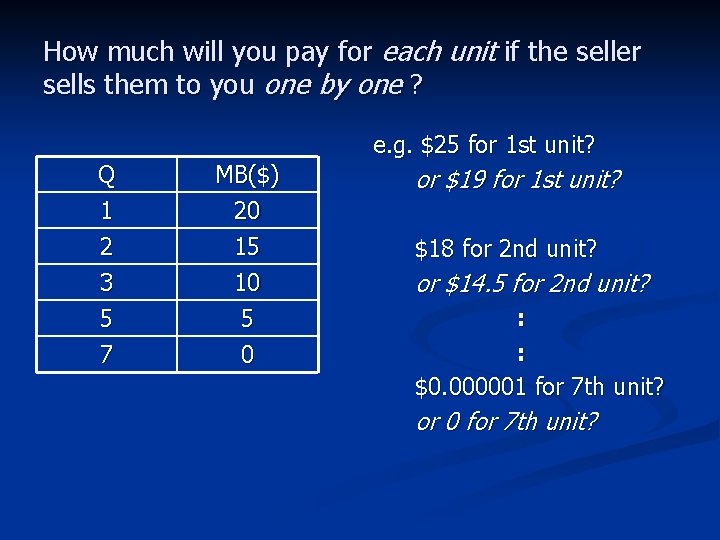

How much will you pay for each unit if the seller sells them to you one by one ? e. g. $25 for 1 st unit? Q 1 2 3 MB($) 20 15 10 5 7 5 0 or $19 for 1 st unit? $18 for 2 nd unit? or $14. 5 for 2 nd unit? : : $0. 000001 for 7 th unit? or 0 for 7 th unit?

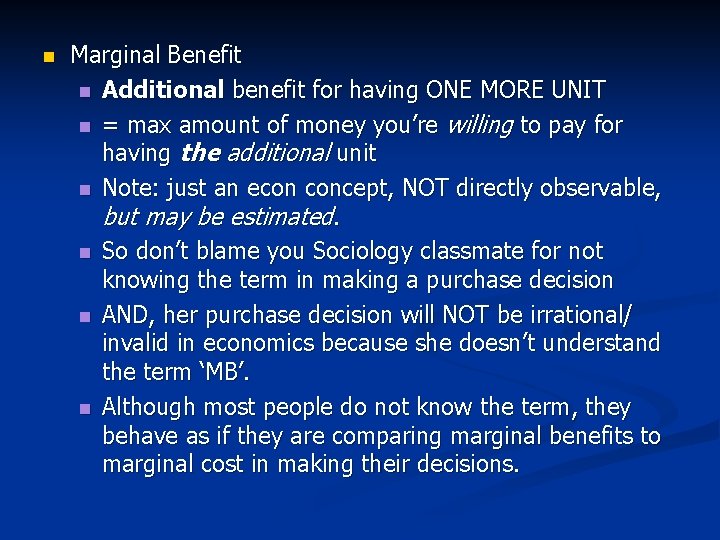

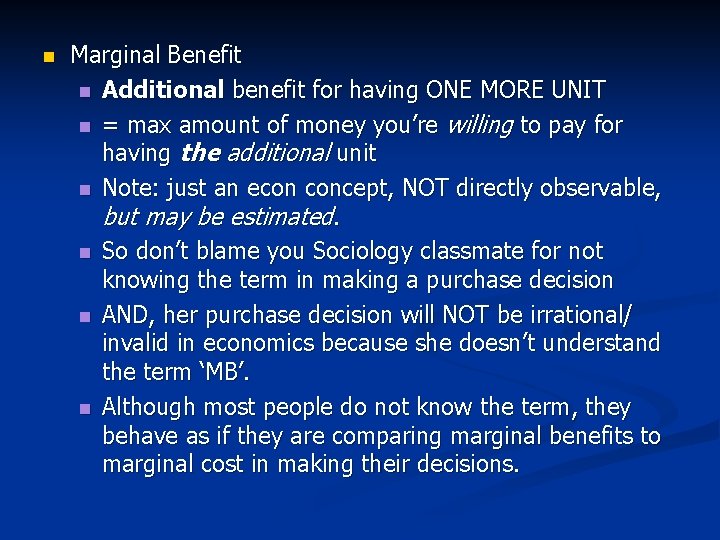

n Marginal Benefit n Additional benefit for having ONE MORE UNIT n = max amount of money you’re willing to pay for having the additional unit n Note: just an econ concept, NOT directly observable, but may be estimated. n So don’t blame you Sociology classmate for not knowing the term in making a purchase decision n AND, her purchase decision will NOT be irrational/ invalid in economics because she doesn’t understand the term ‘MB’. n Although most people do not know the term, they behave as if they are comparing marginal benefits to marginal cost in making their decisions.

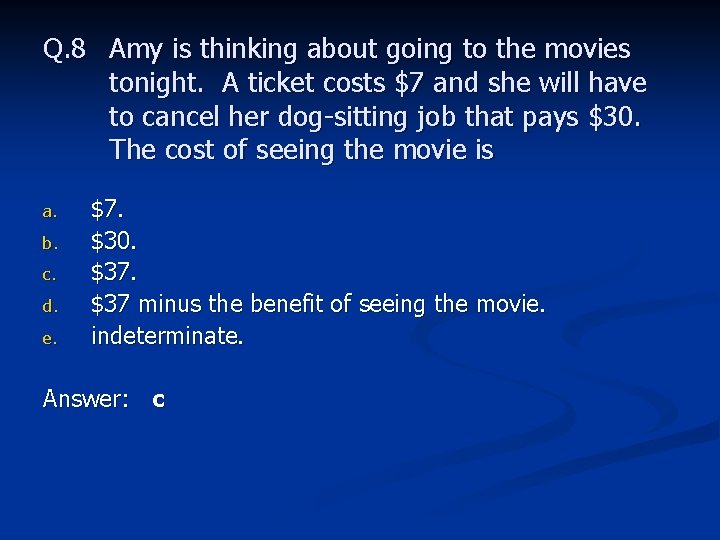

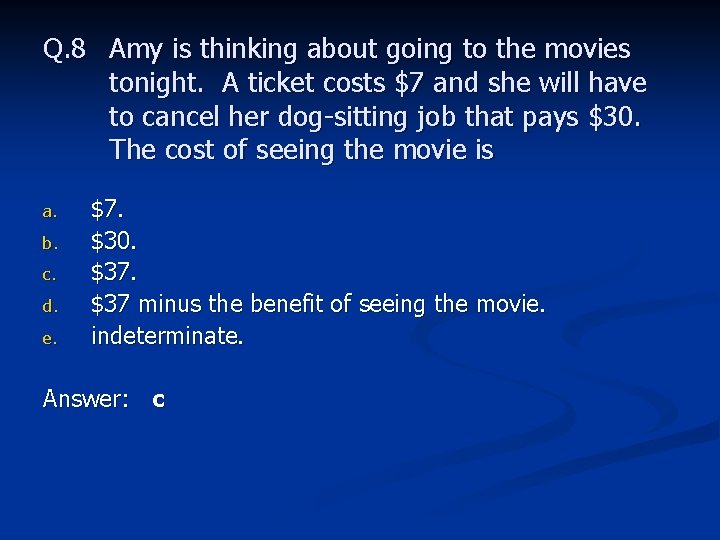

Q. 8 Amy is thinking about going to the movies tonight. A ticket costs $7 and she will have to cancel her dog-sitting job that pays $30. The cost of seeing the movie is a. b. c. d. e. $7. $30. $37 minus the benefit of seeing the movie. indeterminate. Answer: c

n Opportunity Cost = Value of best alternative forgone n Amy has to forgo i. $7 ii. One evening n Oppo. Cost for Amy to go movie = $7 + ‘value of one evening’/’value given by dog sitting’

n Oppo. Cost for Amy to go movie = $7 + ‘value of one evening’/’value given by dog sitting’ = explicit cost + implicit cost (implicit = not directly observable) = money cost + time cost

Modification #1 n IF Amy is thinking about going to the movies tonight. A ticket costs $7 and she has nothing to do that night. The cost of seeing the movie is ?

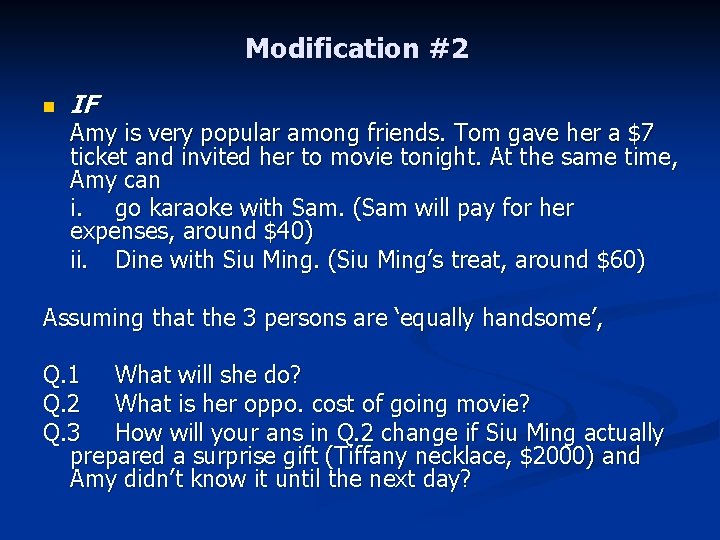

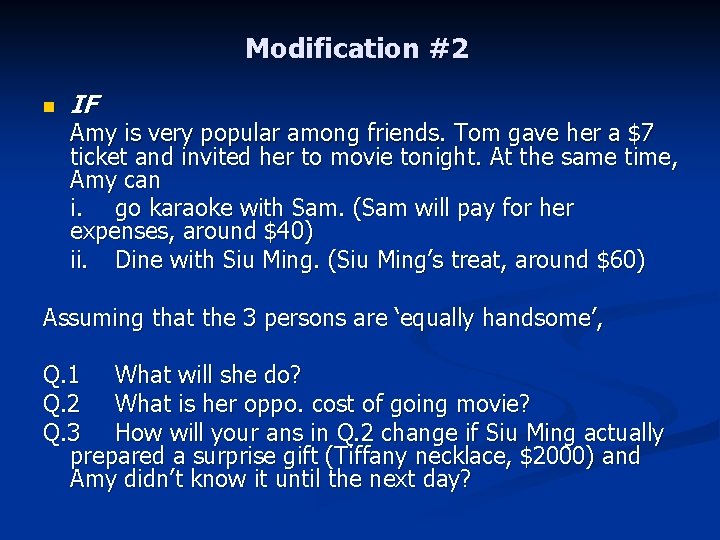

Modification #2 n IF Amy is very popular among friends. Tom gave her a $7 ticket and invited her to movie tonight. At the same time, Amy can i. go karaoke with Sam. (Sam will pay for her expenses, around $40) ii. Dine with Siu Ming. (Siu Ming’s treat, around $60) Assuming that the 3 persons are ‘equally handsome’, Q. 1 What will she do? Q. 2 What is her oppo. cost of going movie? Q. 3 How will your ans in Q. 2 change if Siu Ming actually prepared a surprise gift (Tiffany necklace, $2000) and Amy didn’t know it until the next day?

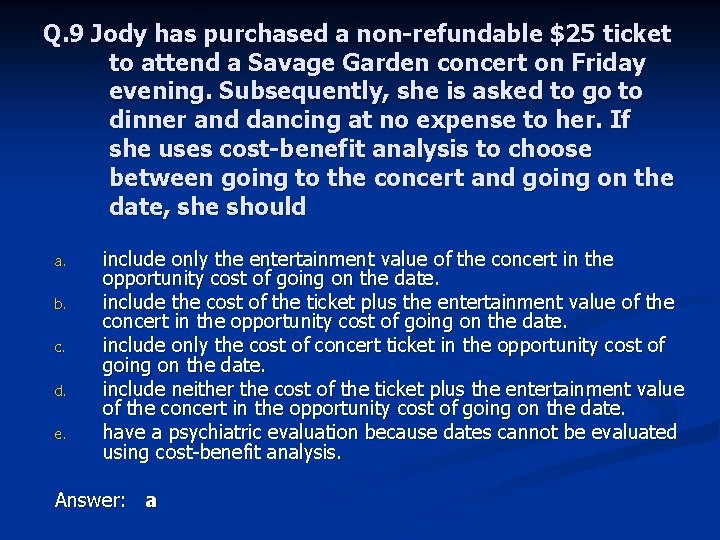

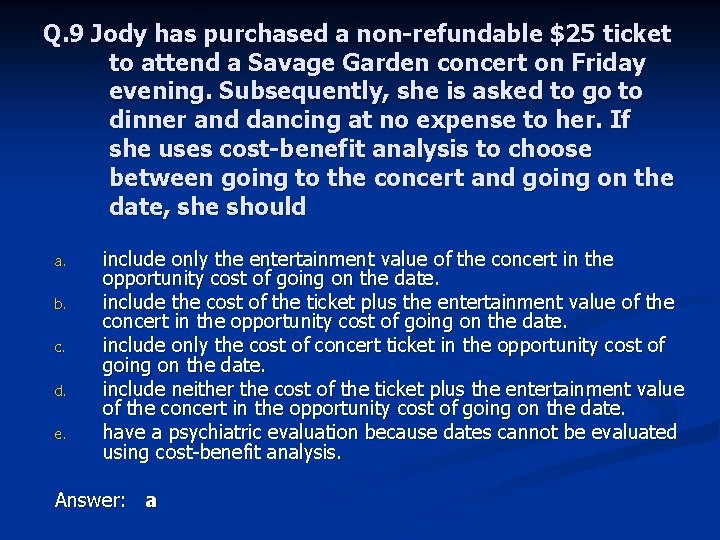

Q. 9 Jody has purchased a non-refundable $25 ticket to attend a Savage Garden concert on Friday evening. Subsequently, she is asked to go to dinner and dancing at no expense to her. If she uses cost-benefit analysis to choose between going to the concert and going on the date, she should a. b. c. d. e. include only the entertainment value of the concert in the opportunity cost of going on the date. include the cost of the ticket plus the entertainment value of the concert in the opportunity cost of going on the date. include only the cost of concert ticket in the opportunity cost of going on the date. include neither the cost of the ticket plus the entertainment value of the concert in the opportunity cost of going on the date. have a psychiatric evaluation because dates cannot be evaluated using cost-benefit analysis. Answer: a

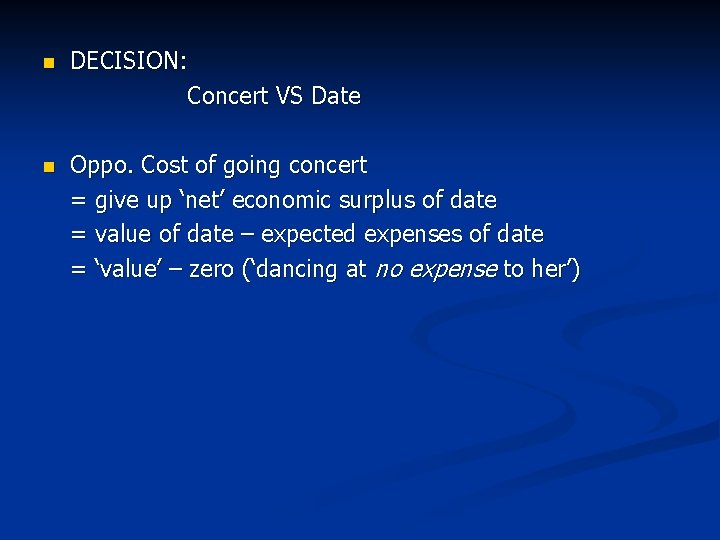

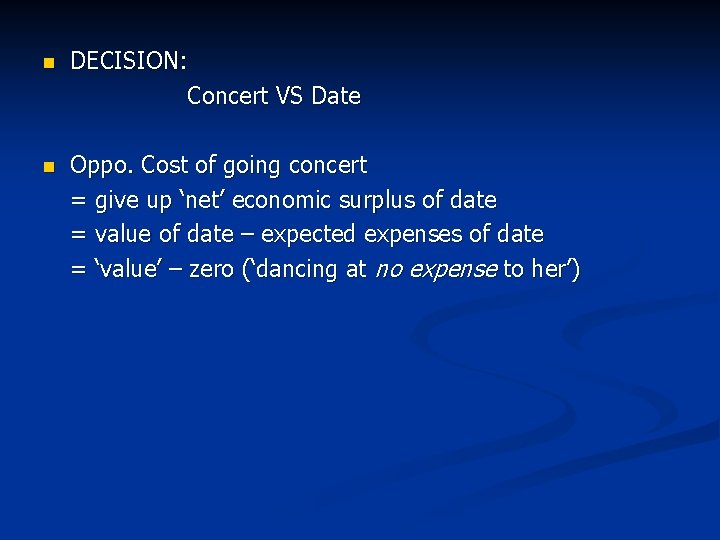

n DECISION: Concert VS Date n Oppo. Cost of going concert = give up ‘net’ economic surplus of date = value of date – expected expenses of date = ‘value’ – zero (‘dancing at no expense to her’)

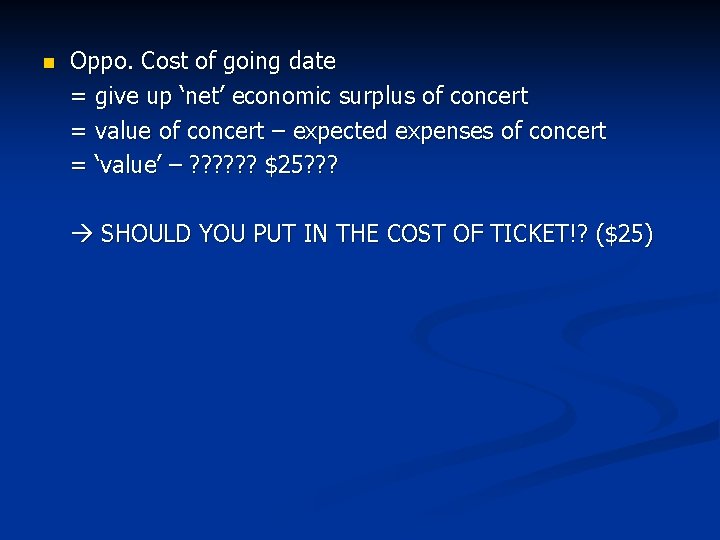

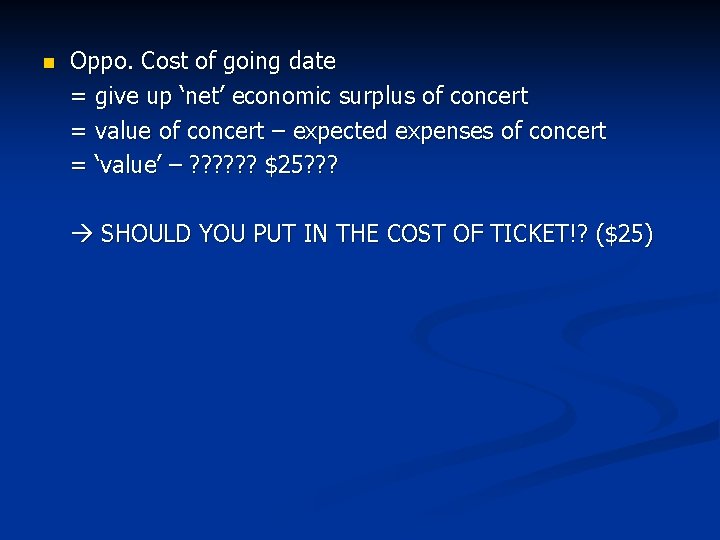

n Oppo. Cost of going date = give up ‘net’ economic surplus of concert = value of concert – expected expenses of concert = ‘value’ – ? ? ? $25? ? ? SHOULD YOU PUT IN THE COST OF TICKET!? ($25)

n SUNK COSTS are costs that - have already been incurred - cannot be recovered at that moment when you’re making decisions n Does that ‘$25’ fit in the above definitions?

n n n THEREFORE Oppo. Cost of going date = give up ‘net’ economic surplus of concert = value of concert – expected ADDITIONAL expenses of concert = ‘value’ – zero Try to analyze the question AGAIN by using MARGINAL Value/Cost

n IF the ticket is fully refundable, how would it affect Jody’s decision? n IF the ticket is refundable at a discounted price, how would it affect Jody’s decision?

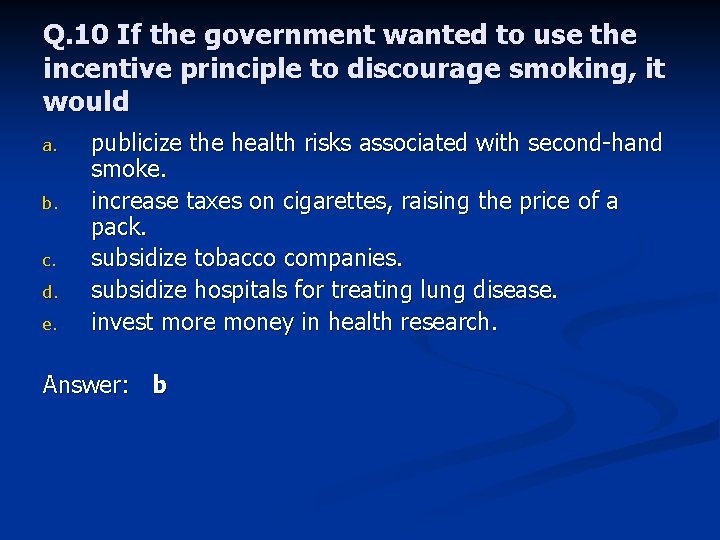

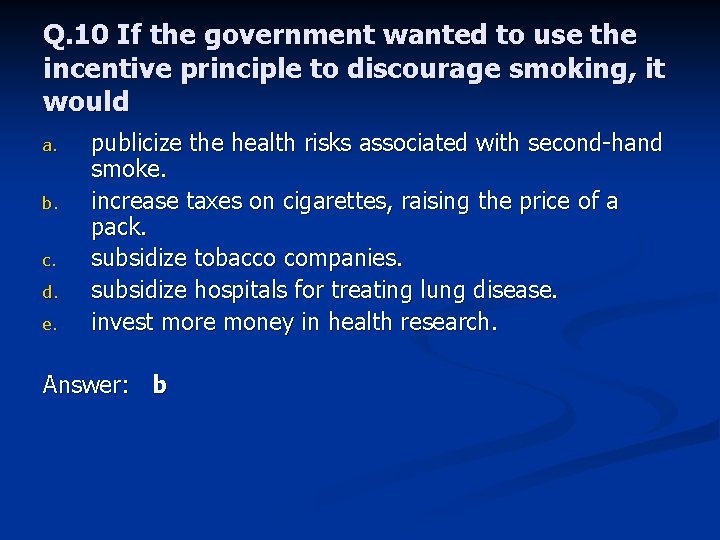

Q. 10 If the government wanted to use the incentive principle to discourage smoking, it would a. b. c. d. e. publicize the health risks associated with second-hand smoke. increase taxes on cigarettes, raising the price of a pack. subsidize tobacco companies. subsidize hospitals for treating lung disease. invest more money in health research. Answer: b

n Most DIRECT way to reduce smoking: Raise Price of cigarettes DISCOURAGE CONSUMPTION n Can be done by option b: impose tax on producers = increase production costs the market needs a higher market price to support the production (common sense argument)

n n n Option c & d: contradict to answer C: subsidize tobacco companies encourage productions D: subsidize hospitals for treating lung disease. lower opportunity cost to smoke, encourage consumption

n Option a & e: n also discourage smokers n but results NOT as direct as imposing taxes on producers reduce production + consumption

End