Corporate Governance Value Creation Ratings CRISIL GVC Ratings

- Slides: 9

Corporate Governance & Value Creation Ratings CRISIL GVC Ratings R Ravimohan, Managing Director and CEO, CRISIL, India The Fourth Asian Roundtable on Corporate Governance November 12 th 2002 The Credit Rating Information Services of India Limited

Background q q q To develop an output based model to measure corporate governance, wealth creation and management Addressing all stakeholders – shareholders, creditors, employees, customers, society & suppliers Forward looking CRISIL – India’s leading rating and research agency; strategic alliance with Standard & Poor’s USA. CRISIL well equipped to developed this new model 2

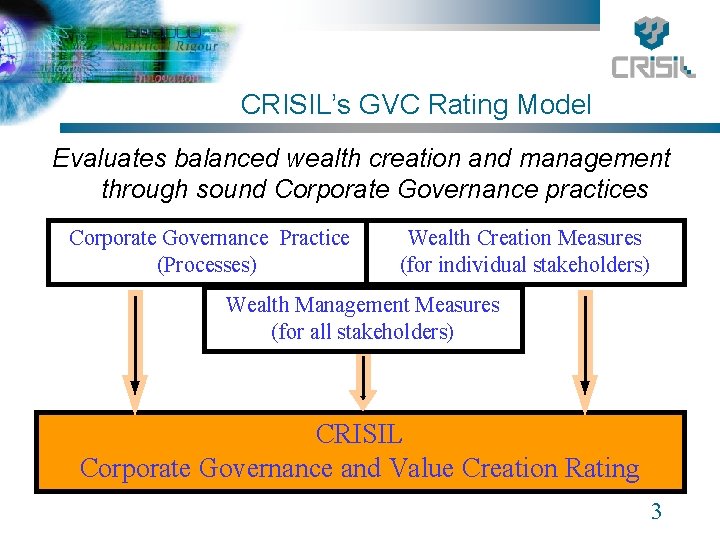

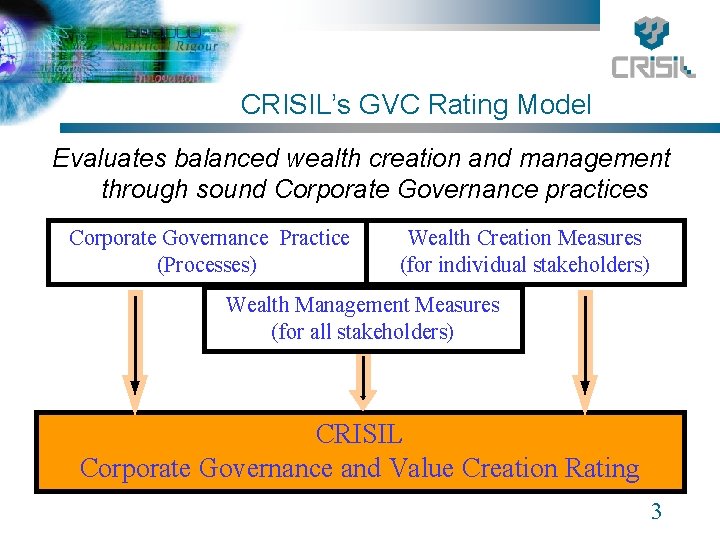

CRISIL’s GVC Rating Model Evaluates balanced wealth creation and management through sound Corporate Governance practices Corporate Governance Practice (Processes) Wealth Creation Measures (for individual stakeholders) Wealth Management Measures (for all stakeholders) CRISIL Corporate Governance and Value Creation Rating 3

CRISIL’s GVC Rating Model q q q Output / results based Addresses all stakeholders more equitably Appropriate balance of qualitative & quantitative parameters; past performance & future expectation Will differentiate two well governed companies with materially different financial performance Will differentiate companies who take care of all stakeholders vis-à-vis those addressing only one/two stakeholders 4

CRISIL Study q q q Study of top companies in India Evaluated on traditional methodology (TM) and CRISIL GVC Rating - based on public domain information Results were very revealing Company getting 2 nd rank on TM got the 10 th rank on value creation – composite GVC rank 7 th Company ranked Ist on value creation was ranked 8 th on TM – composite GVC rank 4 th. Incorporation of output based parameters clearly enhances value of the final evaluation 5

CRISIL GVC Ratings q q A globally unique model Evaluates effectiveness of corporate governance for all stakeholders Path breaking – existing models evaluate either CG practices or Wealth creation and management In consultation with industry association and regulator CRISIL GVC Level 1” is the highest rating & denotes that “The likelihood of the firm creating wealth for all its stakeholders while adopting sound corporate governance practices is the highest 6

Benefits to Investors q q To identify companies with effective corporate governance practices To differentiate two equally well governed companies on value creation To evaluate treatment of various stakeholders by management An independent insight into governance practices and their sustainability 7

Benefits to Corporates q q To attract investors by highlighting the effectiveness of its Corporate Governance practices To assess existing status and set up road map for further improvements To create visibility across all stakeholders An independent opinion into the governance practices and their sustainability 8

Thank You CRISIL Corporate Governance and Value Creation Rating CRISIL GVC Ratings The Credit Rating Information Services of India Limited