Cash Flow Statement 1 Cash flow statement Cash

- Slides: 22

Cash Flow Statement 1

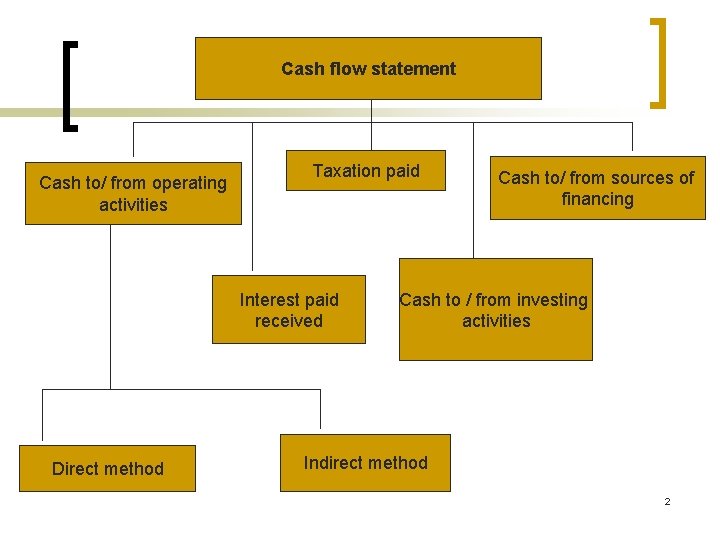

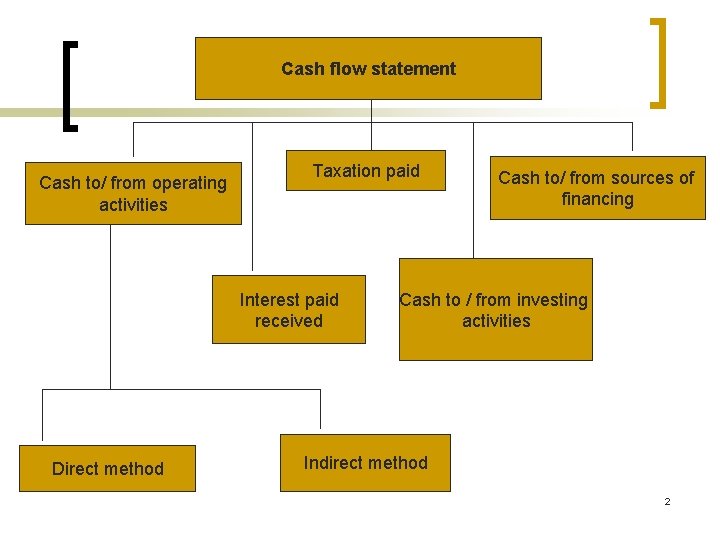

Cash flow statement Cash to/ from operating activities Taxation paid Interest paid received Direct method Cash to/ from sources of financing Cash to / from investing activities Indirect method 2

Cash It refers to cash-in-hand deposits repayable on demand with any bank either in local or foreign currencies. 3

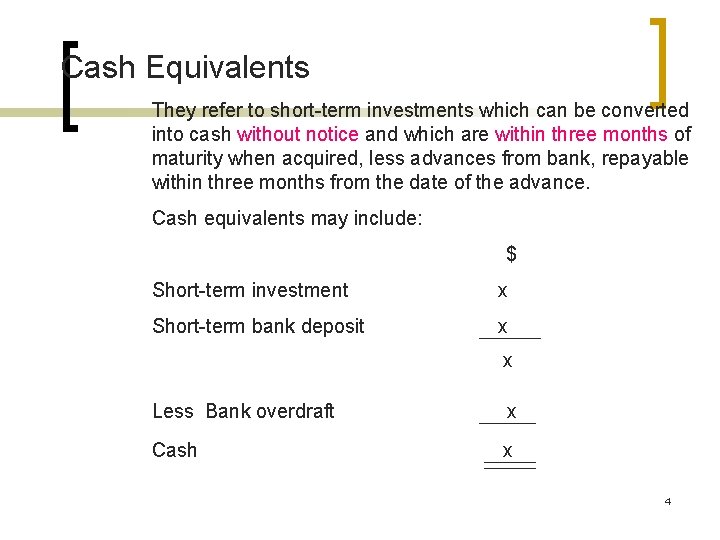

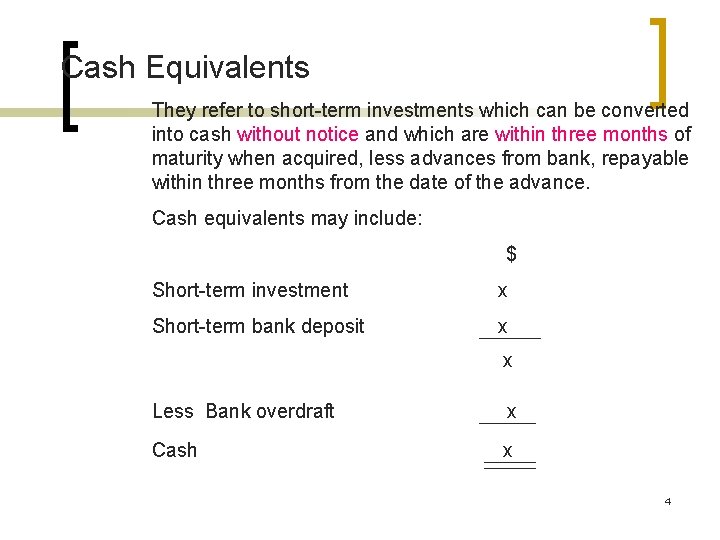

Cash Equivalents They refer to short-term investments which can be converted into cash without notice and which are within three months of maturity when acquired, less advances from bank, repayable within three months from the date of the advance. Cash equivalents may include: $ Short-term investment x Short-term bank deposit x x Less Bank overdraft x Cash x 4

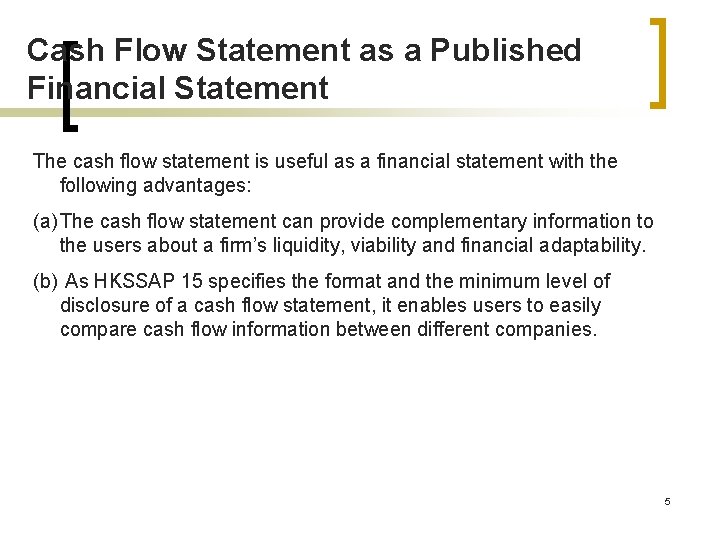

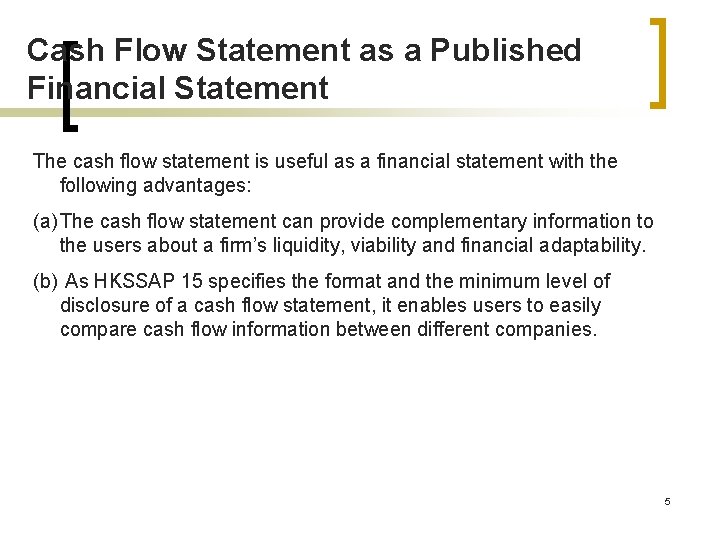

Cash Flow Statement as a Published Financial Statement The cash flow statement is useful as a financial statement with the following advantages: (a) The cash flow statement can provide complementary information to the users about a firm’s liquidity, viability and financial adaptability. (b) As HKSSAP 15 specifies the format and the minimum level of disclosure of a cash flow statement, it enables users to easily compare cash flow information between different companies. 5

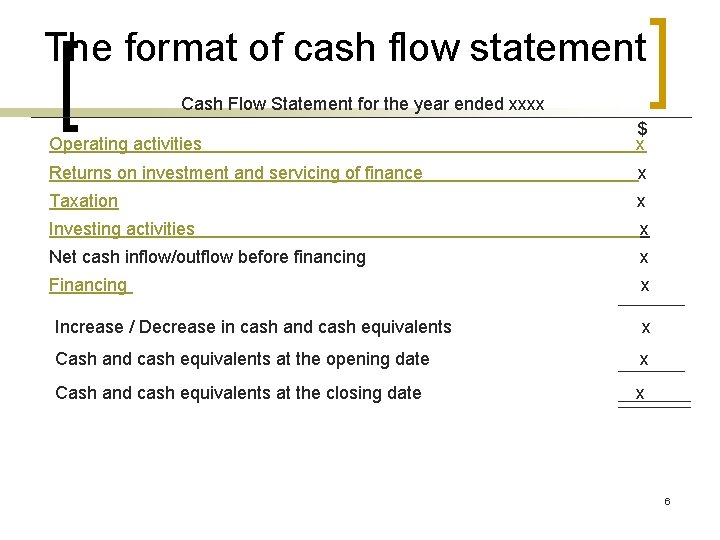

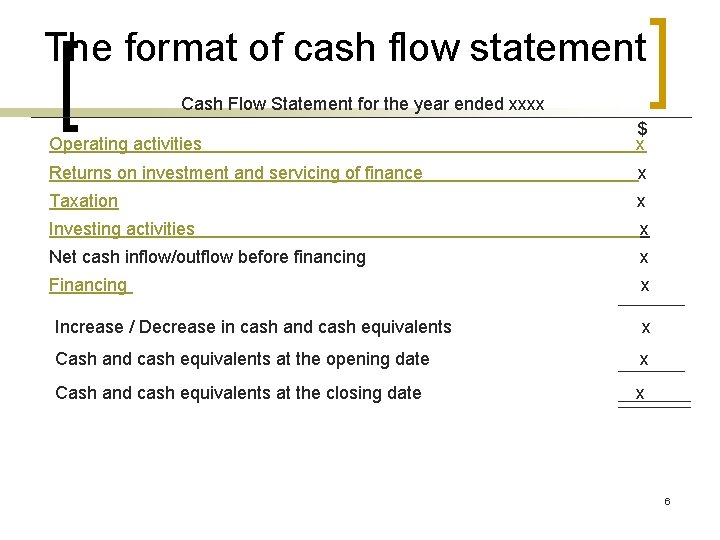

The format of cash flow statement Cash Flow Statement for the year ended xxxx Operating activities $ x Returns on investment and servicing of finance x Taxation x Investing activities x Net cash inflow/outflow before financing x Financing x Increase / Decrease in cash and cash equivalents x Cash and cash equivalents at the opening date x Cash and cash equivalents at the closing date x 6

Operating activities 7

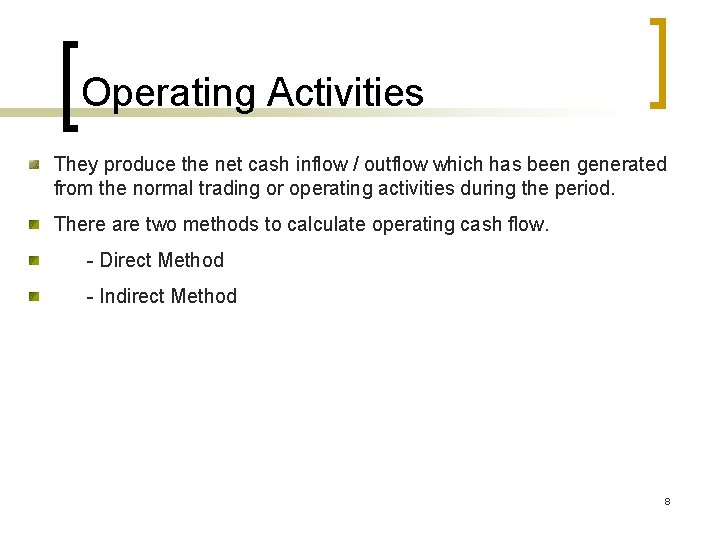

Operating Activities They produce the net cash inflow / outflow which has been generated from the normal trading or operating activities during the period. There are two methods to calculate operating cash flow. - Direct Method - Indirect Method 8

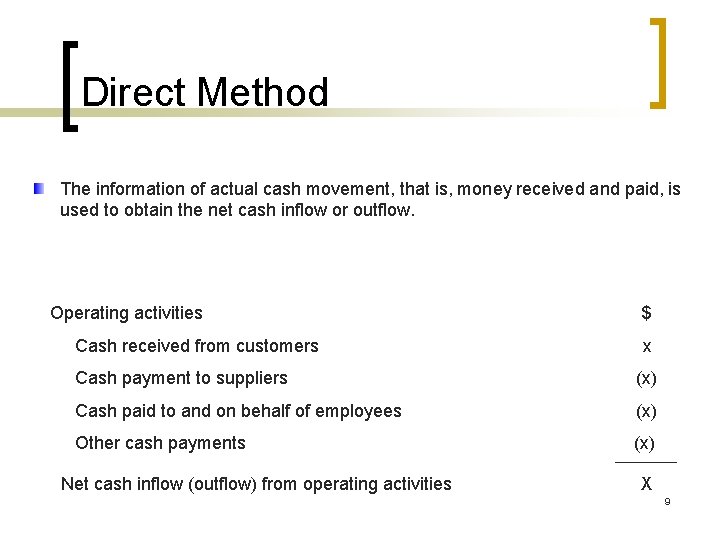

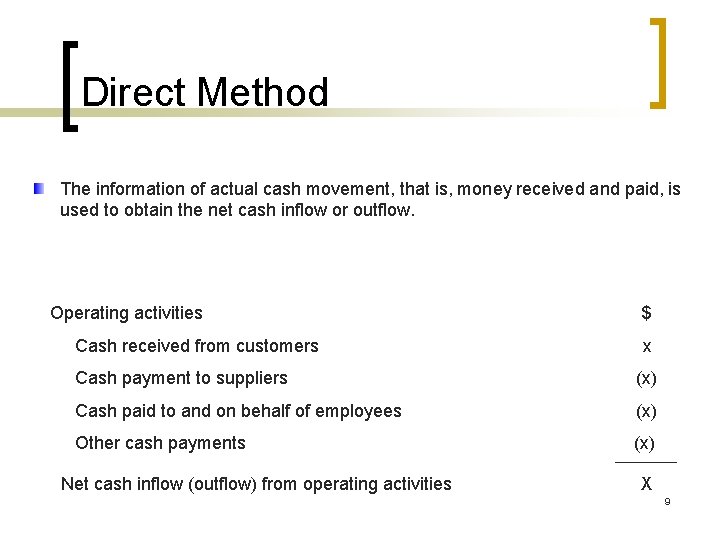

Direct Method The information of actual cash movement, that is, money received and paid, is used to obtain the net cash inflow or outflow. Operating activities Cash received from customers $ x Cash payment to suppliers (x) Cash paid to and on behalf of employees (x) Other cash payments (x) Net cash inflow (outflow) from operating activities X 9

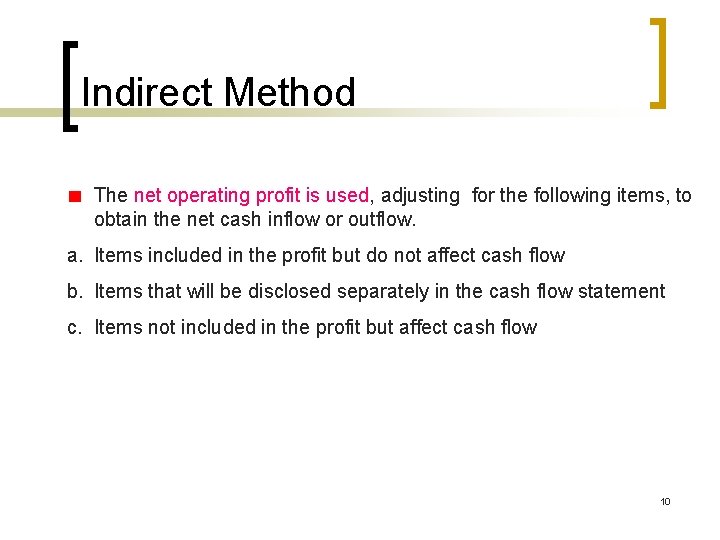

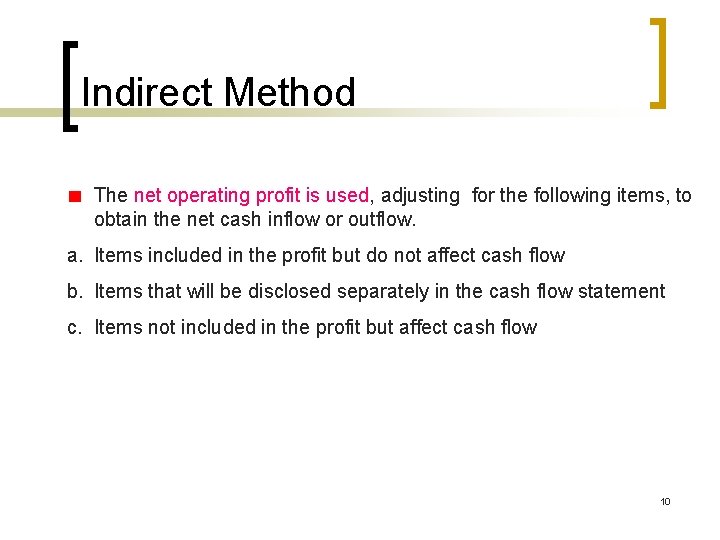

Indirect Method The net operating profit is used, adjusting for the following items, to obtain the net cash inflow or outflow. a. Items included in the profit but do not affect cash flow b. Items that will be disclosed separately in the cash flow statement c. Items not included in the profit but affect cash flow 10

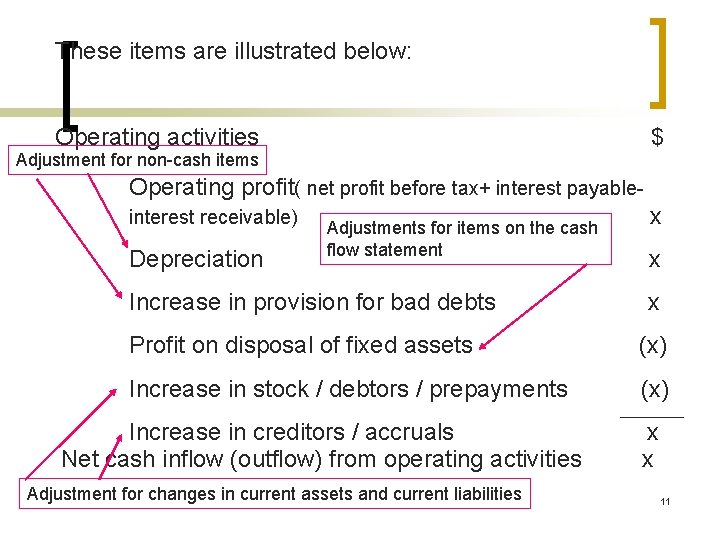

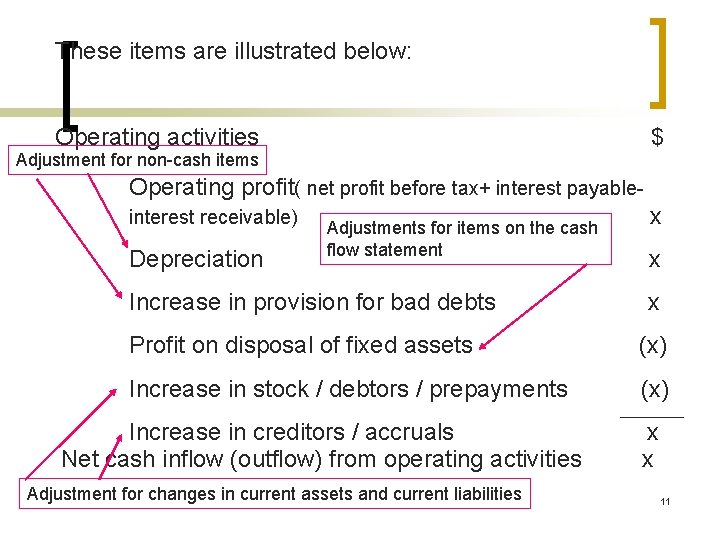

These items are illustrated below: Operating activities $ Adjustment for non-cash items Operating profit( net profit before tax+ interest payableinterest receivable) Depreciation Adjustments for items on the cash flow statement Increase in provision for bad debts x x x Profit on disposal of fixed assets (x) Increase in stock / debtors / prepayments (x) Increase in creditors / accruals Net cash inflow (outflow) from operating activities Adjustment for changes in current assets and current liabilities x x 11

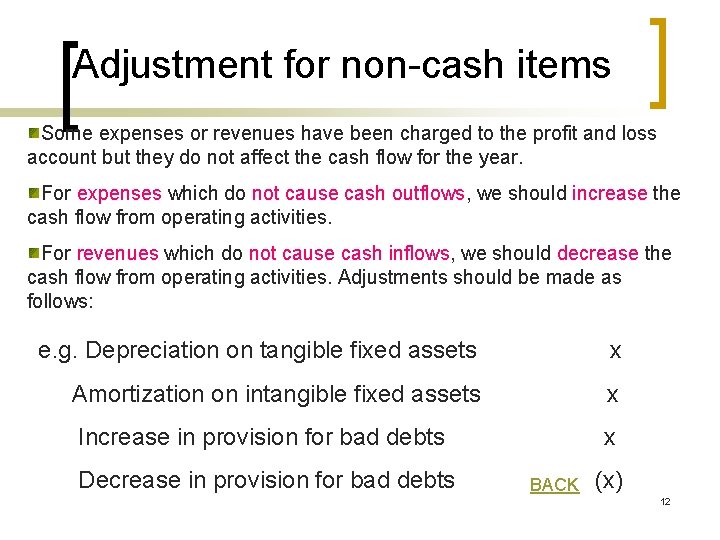

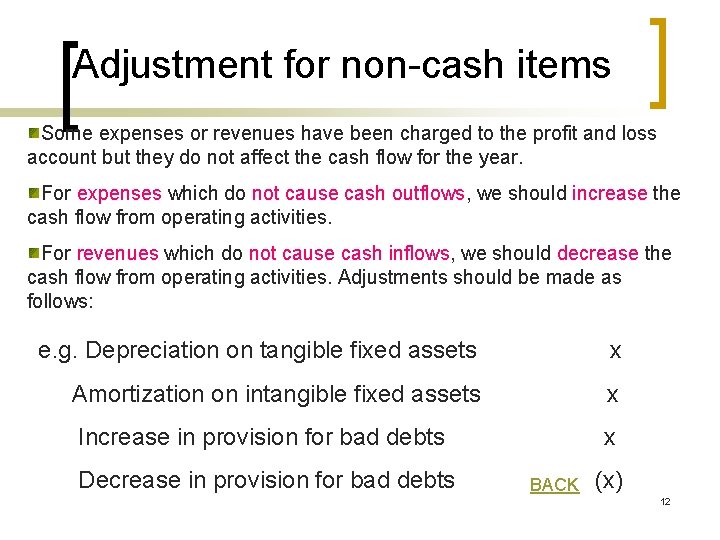

Adjustment for non-cash items Some expenses or revenues have been charged to the profit and loss account but they do not affect the cash flow for the year. For expenses which do not cause cash outflows, we should increase the cash flow from operating activities. For revenues which do not cause cash inflows, we should decrease the cash flow from operating activities. Adjustments should be made as follows: e. g. Depreciation on tangible fixed assets x Amortization on intangible fixed assets x Increase in provision for bad debts x Decrease in provision for bad debts BACK (x) 12

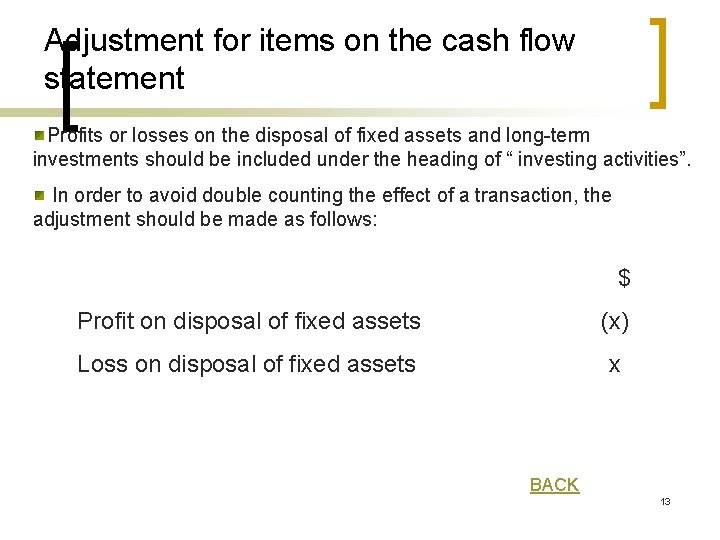

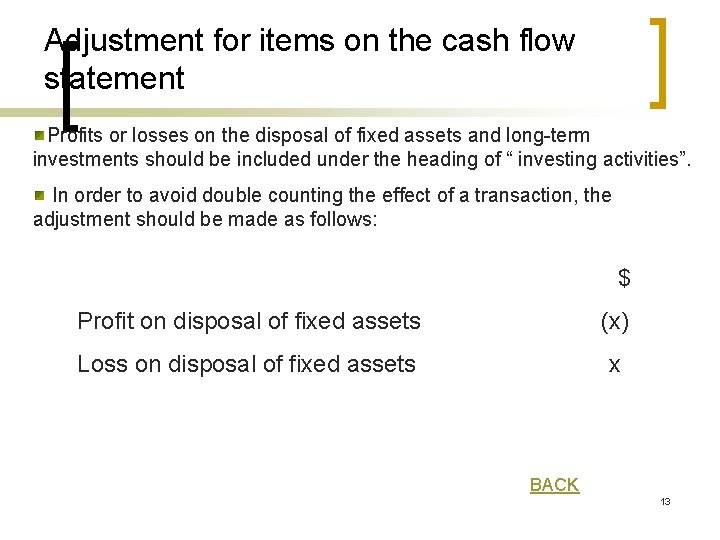

Adjustment for items on the cash flow statement Profits or losses on the disposal of fixed assets and long-term investments should be included under the heading of “ investing activities”. In order to avoid double counting the effect of a transaction, the adjustment should be made as follows: $ Profit on disposal of fixed assets (x) Loss on disposal of fixed assets x BACK 13

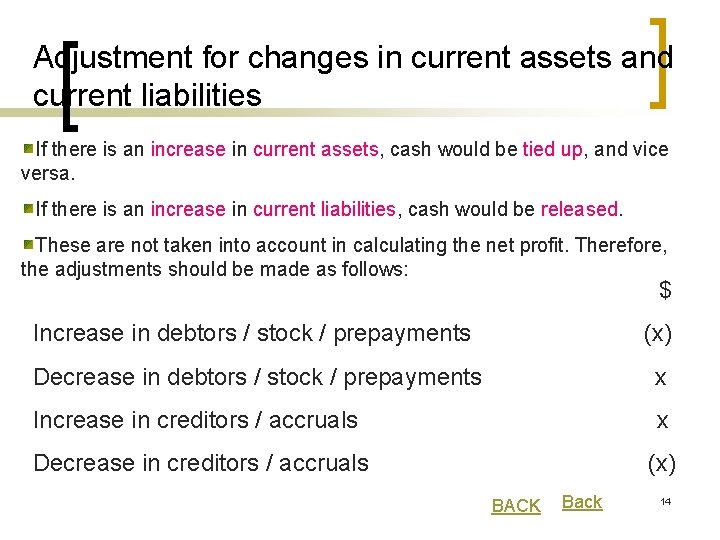

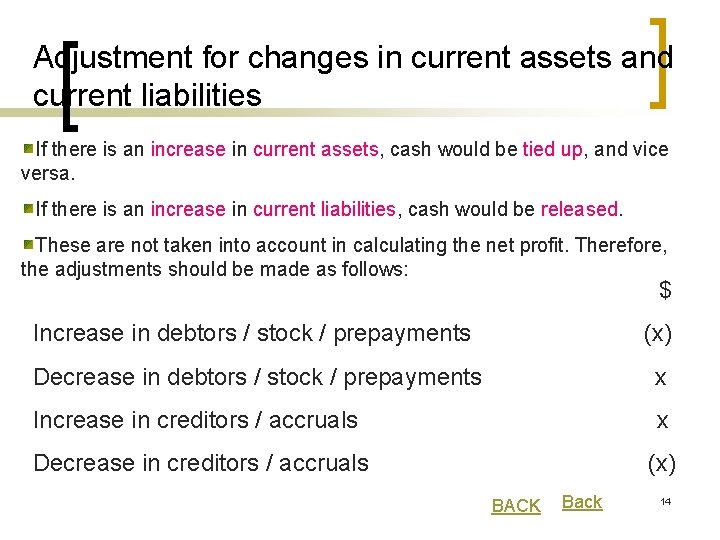

Adjustment for changes in current assets and current liabilities If there is an increase in current assets, cash would be tied up, and vice versa. If there is an increase in current liabilities, cash would be released. These are not taken into account in calculating the net profit. Therefore, the adjustments should be made as follows: $ Increase in debtors / stock / prepayments (x) Decrease in debtors / stock / prepayments x Increase in creditors / accruals x Decrease in creditors / accruals (x) BACK Back 14

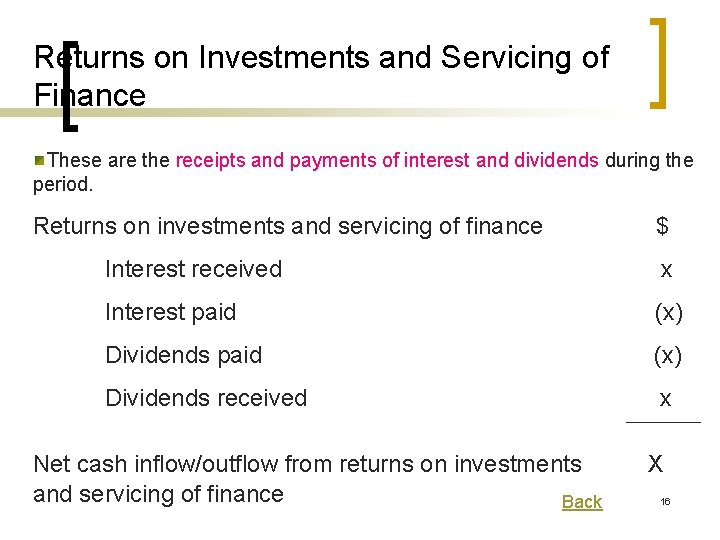

Returns on Investment and Servicing of Finance 15

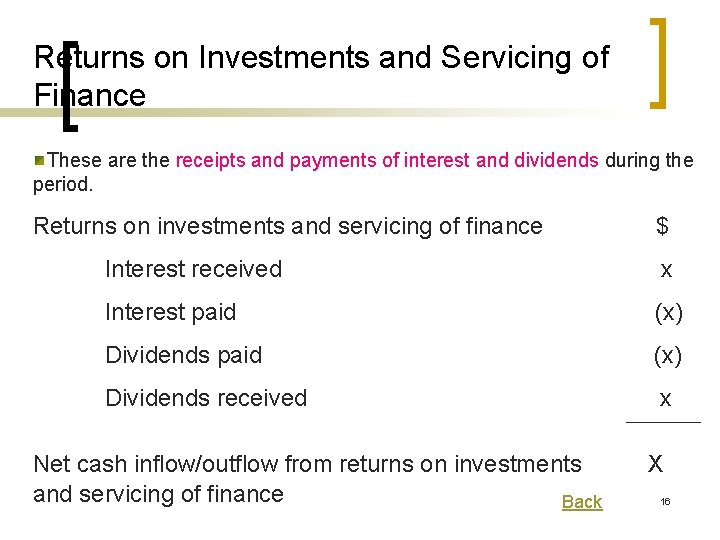

Returns on Investments and Servicing of Finance These are the receipts and payments of interest and dividends during the period. Returns on investments and servicing of finance $ Interest received x Interest paid (x) Dividends received x Net cash inflow/outflow from returns on investments and servicing of finance Back X 16

Taxation 17

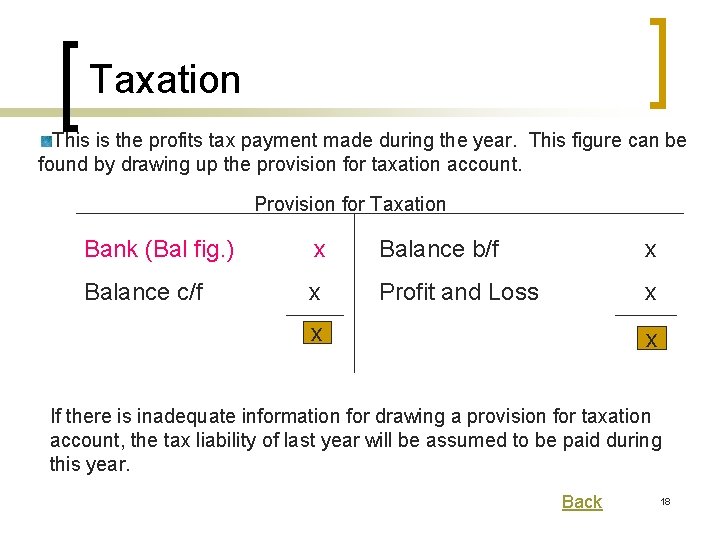

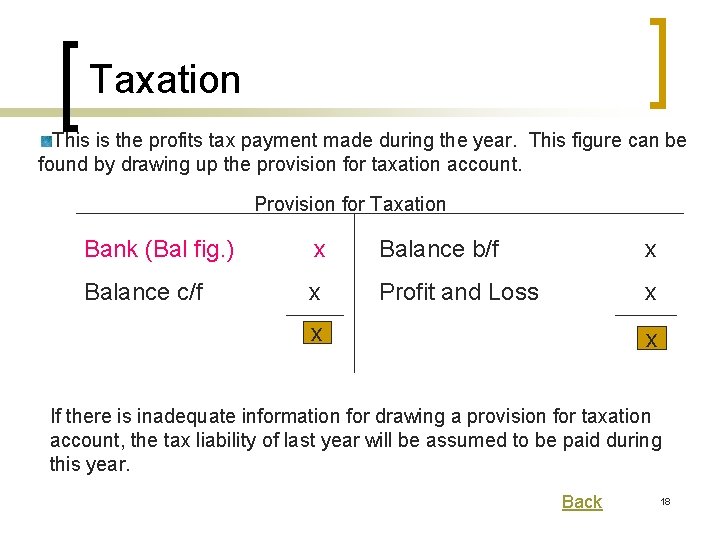

Taxation This is the profits tax payment made during the year. This figure can be found by drawing up the provision for taxation account. Provision for Taxation Bank (Bal fig. ) x Balance b/f x Balance c/f x Profit and Loss x x x If there is inadequate information for drawing a provision for taxation account, the tax liability of last year will be assumed to be paid during this year. Back 18

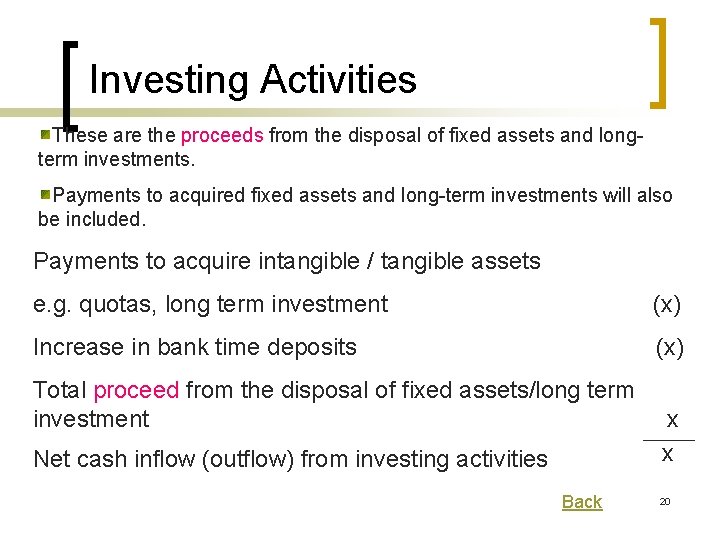

Investing Activities 19

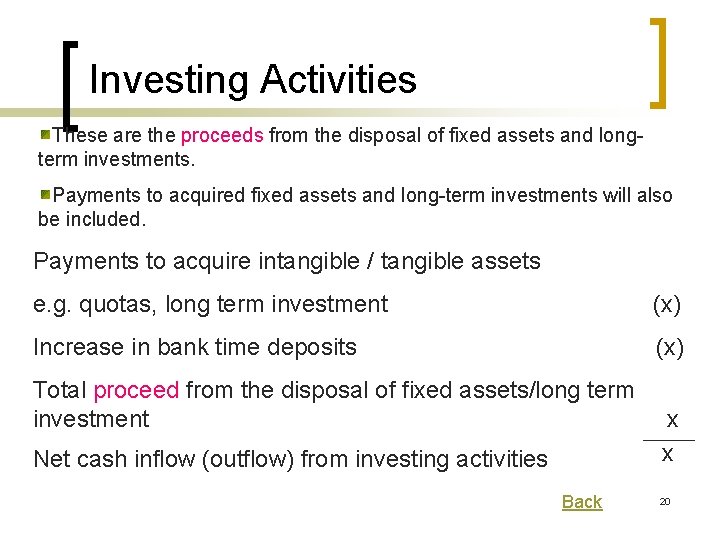

Investing Activities These are the proceeds from the disposal of fixed assets and longterm investments. Payments to acquired fixed assets and long-term investments will also be included. Payments to acquire intangible / tangible assets e. g. quotas, long term investment (x) Increase in bank time deposits (x) Total proceed from the disposal of fixed assets/long term investment Net cash inflow (outflow) from investing activities Back x x 20

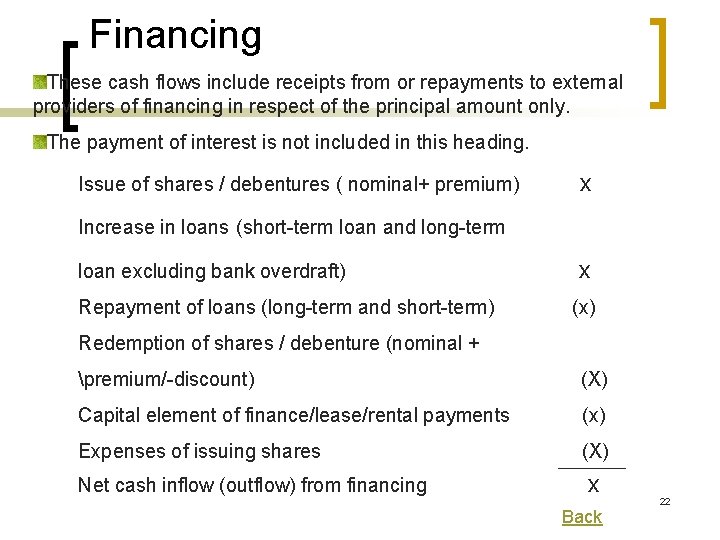

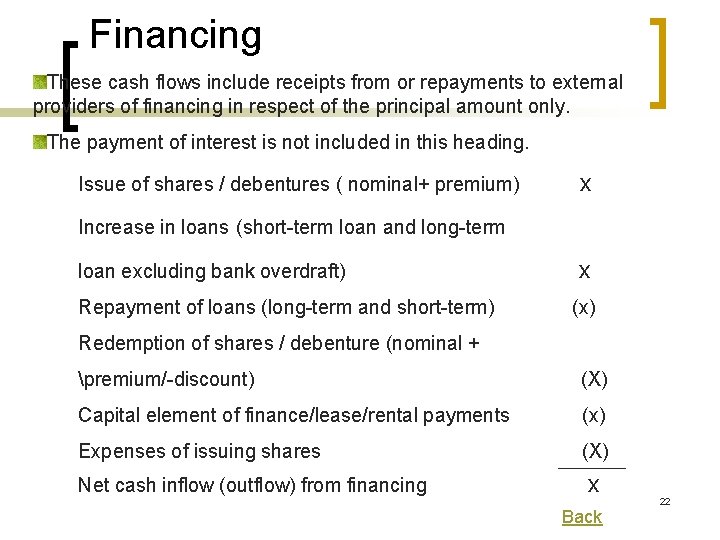

Financing 21

Financing These cash flows include receipts from or repayments to external providers of financing in respect of the principal amount only. The payment of interest is not included in this heading. Issue of shares / debentures ( nominal+ premium) x Increase in loans (short-term loan and long-term loan excluding bank overdraft) Repayment of loans (long-term and short-term) x (x) Redemption of shares / debenture (nominal + premium/-discount) (X) Capital element of finance/lease/rental payments (x) Expenses of issuing shares (X) Net cash inflow (outflow) from financing x Back 22