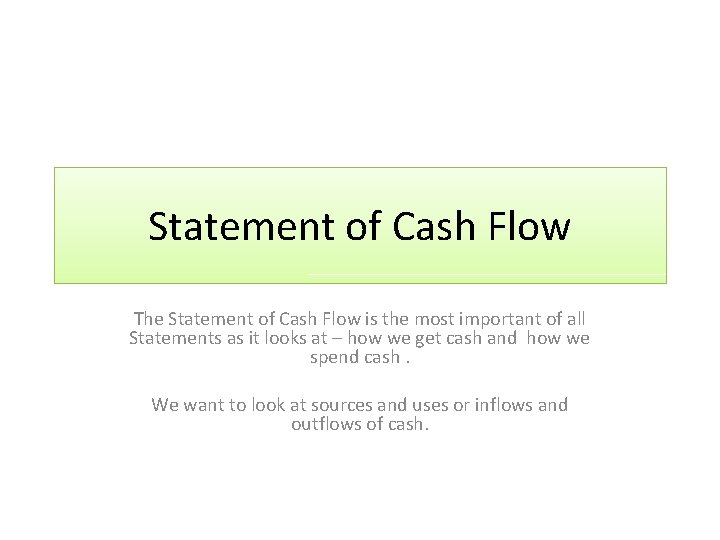

Statement of Cash Flow The Statement of Cash

- Slides: 28

Statement of Cash Flow The Statement of Cash Flow is the most important of all Statements as it looks at – how we get cash and how we spend cash. We want to look at sources and uses or inflows and outflows of cash.

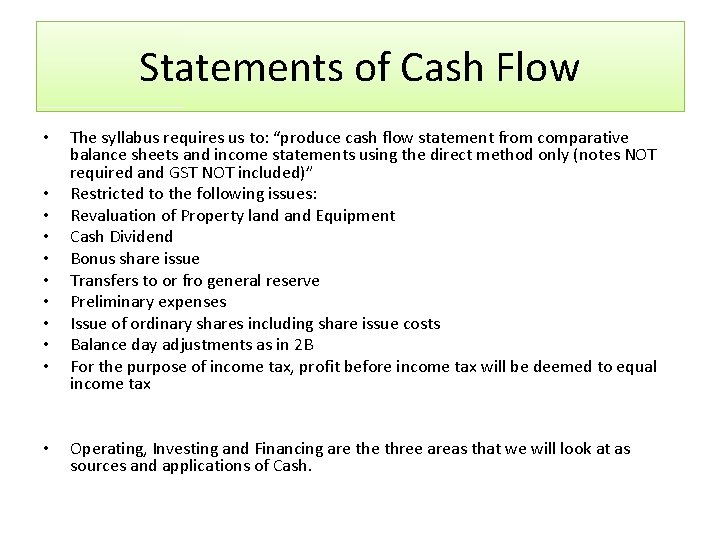

Statements of Cash Flow • • • The syllabus requires us to: “produce cash flow statement from comparative balance sheets and income statements using the direct method only (notes NOT required and GST NOT included)” Restricted to the following issues: Revaluation of Property land Equipment Cash Dividend Bonus share issue Transfers to or fro general reserve Preliminary expenses Issue of ordinary shares including share issue costs Balance day adjustments as in 2 B For the purpose of income tax, profit before income tax will be deemed to equal income tax Operating, Investing and Financing are three areas that we will look at as sources and applications of Cash.

Cash • People will make financial decisions based on the cash situation of an entity and assess the ability of the firm to generate cash and to use those cash flows. • The Accounting Standards AASB 107 was created to apply the International accounting standards to the Australian context. • It requires the company to inform members and other users of financial information about changes in cash and cash equivalents by producing a Cash Flow Statement. It also specifies that cash flows must be identified as operating, investing and financing activities.

Cash and Cash Equivalents • Cash comprises cash on hand cash on demand deposits. Cash equivalents are short term highly liquid investments that are convertible to known amounts of cash and areas subject to an insignificant risk of change in value. Usually a maximum of 3 month maturity – redemption( turning into cash) and shares must have a specific short term set date of redemption.

What do we get from a Statement of Cash Flow • This report lets us look at changes in net assets of the company. • Consider the firms financial structure particularly its liquidity position. • Assess the companies ability to affect cash flows to take advantage of internal and external opportunities. • Evaluate the ability of the company to generate cash and cash equivalents. • Assess and compare the future cash flows of different companies

Operating Sources and Applications • Operating activities are defined as the principle revenue producing activities of the company and other activities that are not investing and financing activities. Mostly shown in the Income statement so we start from the Income statement. • Inflows: Sales of goods, royalties, fees, commissions, sale of securities. • Outflows: Suppliers for goods and services, employees-wages, income tax, GST, Interest paid.

Investing Flows of cash • In looking at our fixed assets we can see another area of fluctuations in cash flows. • Cash Flows from Investing activities are defined as the acquisition and disposal of long term assets and other investments not included in cash equivalents. • They tend to be transactions affecting the assets of the company. We use the non current asset section of the balance sheet as the starting point. If we buy or sell fixed assets , machinery land, vehicles we are either sending out cash or swapping an asset for cash and bringing cash in.

Inflows and Outflows from Investing activities • Inflows: sale of – land , property, equipment , intangibles, any long term asset, loans from other entities. Sale of – equity(shares) in other companies, debt instruments-debentures. • Outflows: Acquisition of – Property, Plant, equipment, intangibles, any long term assets, Loans to other entities. Acquisition of equity( shares in other companies)Debt instruments

Financing changes in Cash Flows • We also can identify changes in our activities that result in changes to the size and composition of the capital and borrowings of the company. We use the Non current Liability and Equity section of the balance sheet to prepare the Financing section. to our Long term Liabilities – mortgages , Long term Loans. If we increase these we are receiving cash if we decrease these we are losing cash to pay them off. • We also assess Changes in Shareholders Equity to see other sources and applications. A new share issue means more cash in, a debenture paid off equals cash out as does a dividend payment.

Financing changes in Cash Flow • Inflows: Issuing of shares or other equity, Issuing loans , mortgages and other borrowings, issuing debentures • Outflows: Redeem the company’s own shares, repay loans mortgages and other borrowings, repay debentures, dividends paid

Statement of Cash Flow Format • The difference in our cash flow will be the difference between our cash at Bank Balance at the start and finish of the period. We then use this as our format for this report. • We list the inflows and outflows in each category and then provide totals. We then list the Cash at bank 30/6/2026 as the first figure and we should arrive at our closing Cash at bank figure at 30/6/2027.

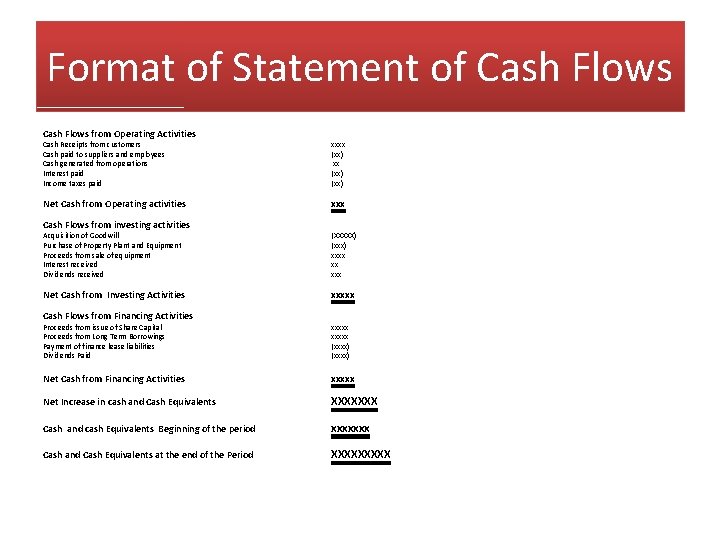

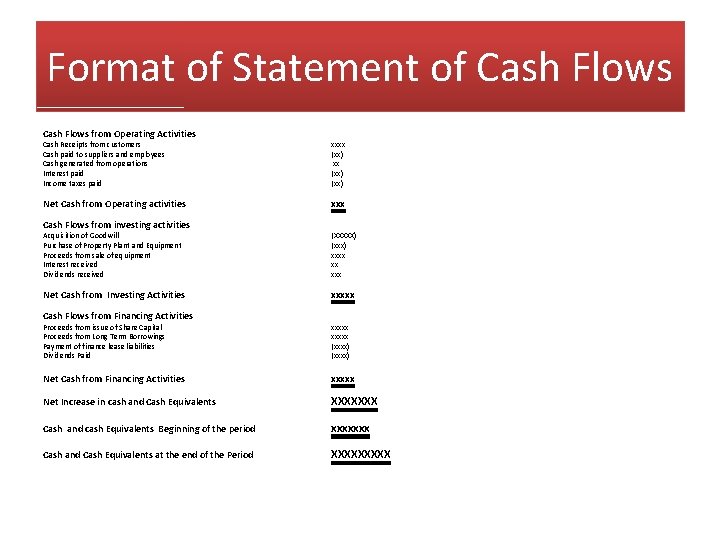

Format of Statement of Cash Flows from Operating Activities Cash Receipts from customers Cash paid to suppliers and employees Cash generated from operations Interest paid Income taxes paid xxxx (xx) Net Cash from Operating activities xxx Cash Flows from investing activities Acquisition of Goodwill Purchase of Property Plant and Equipment Proceeds from sale of equipment Interest received Dividends received (XXXXX) (xxx) xxxx xx xxx Net Cash from Investing Activities xxxxx Cash Flows from Financing Activities Proceeds from issue of Share Capital Proceeds from Long Term Borrowings Payment of finance lease liabilities Dividends Paid xxxxx (xxxx) Net Cash from Financing Activities xxxxx Net Increase in cash and Cash Equivalents XXXXXXX Cash and cash Equivalents Beginning of the period xxxxxxx Cash and Cash Equivalents at the end of the Period XXXXX

Format • Required to be shown separately by AASB 107 • • • Income tax paid Interest received Dividends paid Interest paid Dividends paid

Preparing a Cash Flow Statement • We are often only given the Income Statement and two comparative balance sheets and we have to find the cash items inflows and applications. • 1 Finding the Receipts from customers. • If there are no accounts receivable then the receipts from customers is the sales figure. If there accounts receivable then we must reconstruct to find the money paid to us by Accounts receivable – debtors.

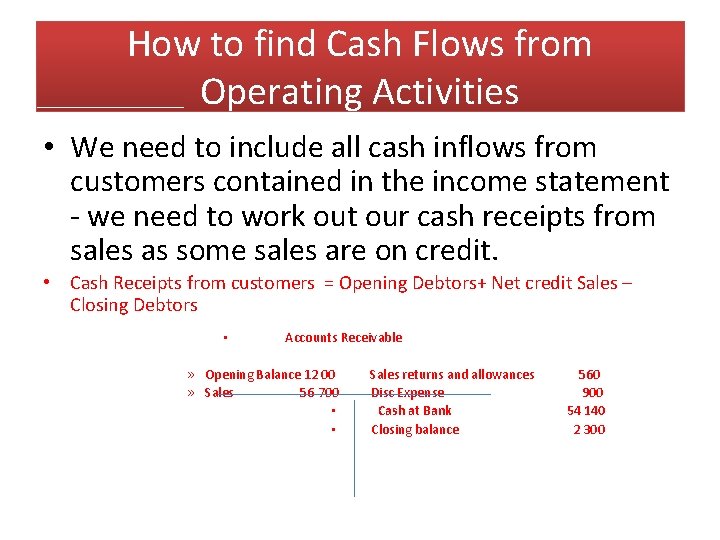

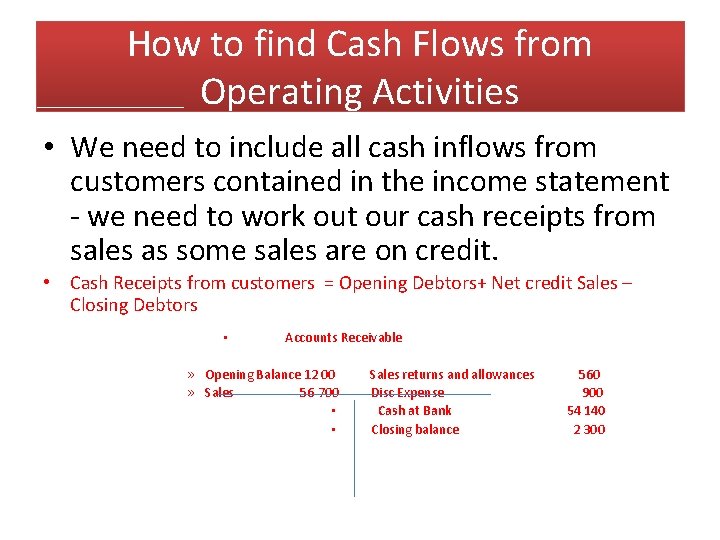

How to find Cash Flows from Operating Activities • We need to include all cash inflows from customers contained in the income statement - we need to work out our cash receipts from sales as some sales are on credit. • Cash Receipts from customers = Opening Debtors+ Net credit Sales – Closing Debtors • Accounts Receivable » Opening Balance 12 00 » Sales 56 700 • • Sales returns and allowances Disc Expense Cash at Bank Closing balance 560 900 54 140 2 300

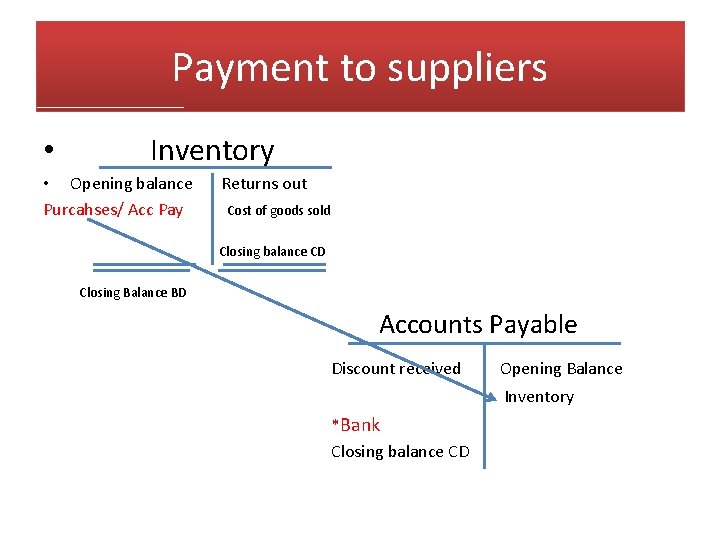

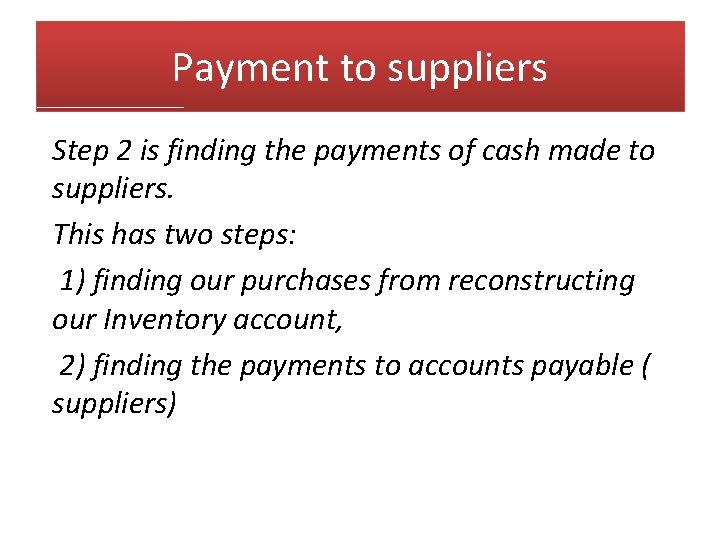

Payment to suppliers Step 2 is finding the payments of cash made to suppliers. This has two steps: 1) finding our purchases from reconstructing our Inventory account, 2) finding the payments to accounts payable ( suppliers)

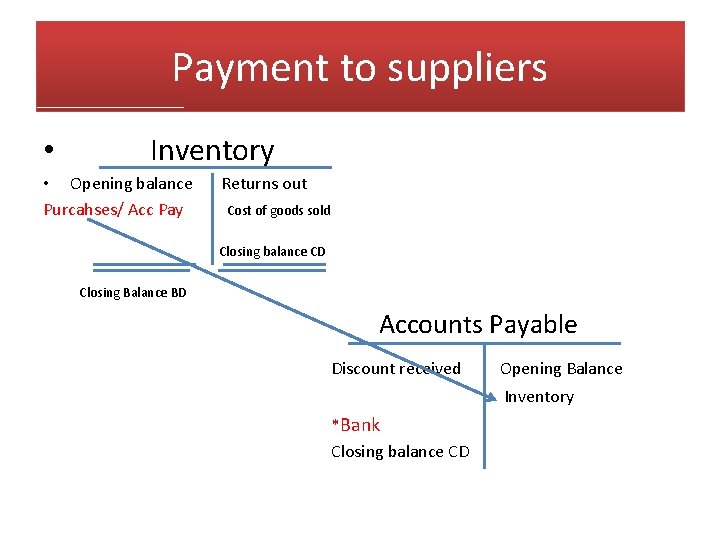

Payment to suppliers • Inventory • Opening balance Purcahses/ Acc Pay Returns out Cost of goods sold Closing balance CD Closing Balance BD Accounts Payable Discount received Opening Balance Inventory *Bank Closing balance CD

Payment to suppliers If there accrued or prepaid accounts in the balance sheet it means that we have made adjustments and we will now have to work back and find our cash payments and receipts from these figures. The cash flow for the expense or receipt figure will be different to the expense figure and we therefore have to reconstruct. If there are no pre paids or accrueds then we just use the expense figures and assume them to all be cash. Interest paid is shown separately.

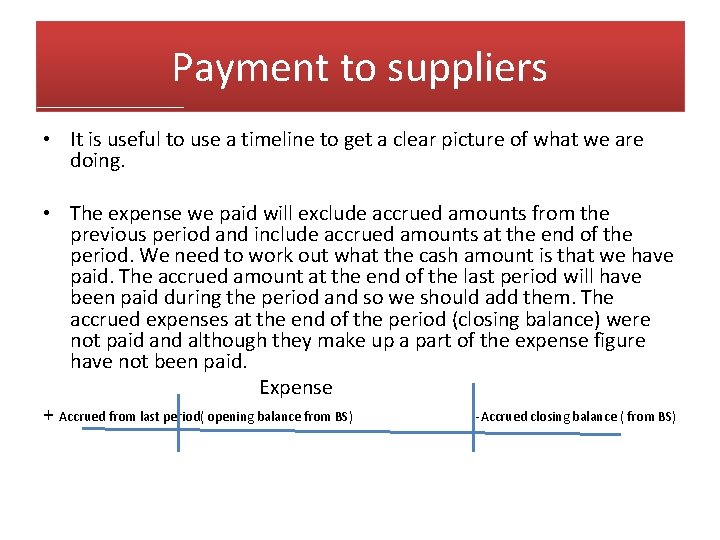

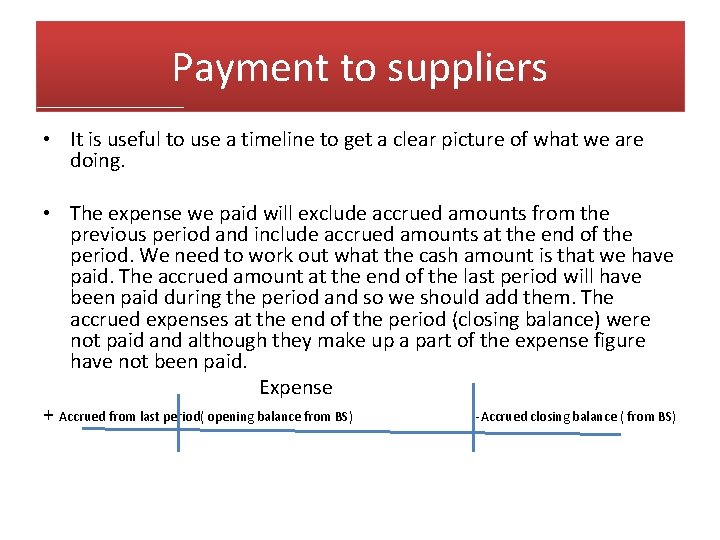

Payment to suppliers • It is useful to use a timeline to get a clear picture of what we are doing. • The expense we paid will exclude accrued amounts from the previous period and include accrued amounts at the end of the period. We need to work out what the cash amount is that we have paid. The accrued amount at the end of the last period will have been paid during the period and so we should add them. The accrued expenses at the end of the period (closing balance) were not paid and although they make up a part of the expense figure have not been paid. Expense + Accrued from last period( opening balance from BS) -Accrued closing balance ( from BS)

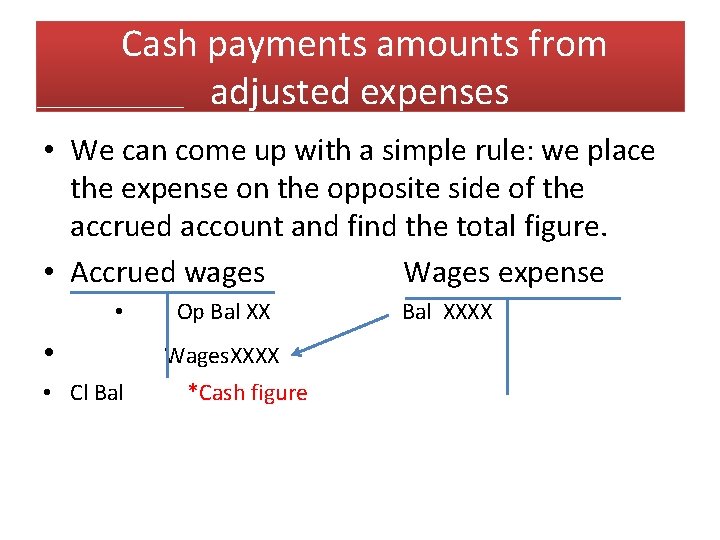

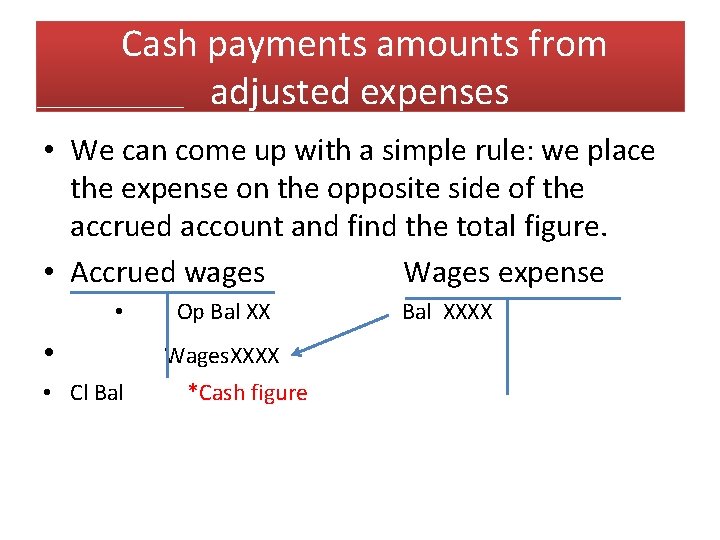

Cash payments amounts from adjusted expenses • We can come up with a simple rule: we place the expense on the opposite side of the accrued account and find the total figure. • Accrued wages Wages expense • • • Cl Bal Op Bal XX Wages. XXXX *Cash figure Bal XXXX

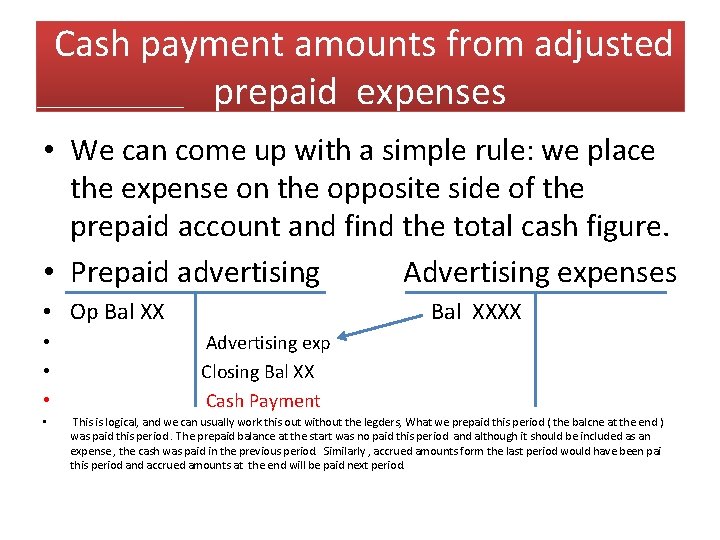

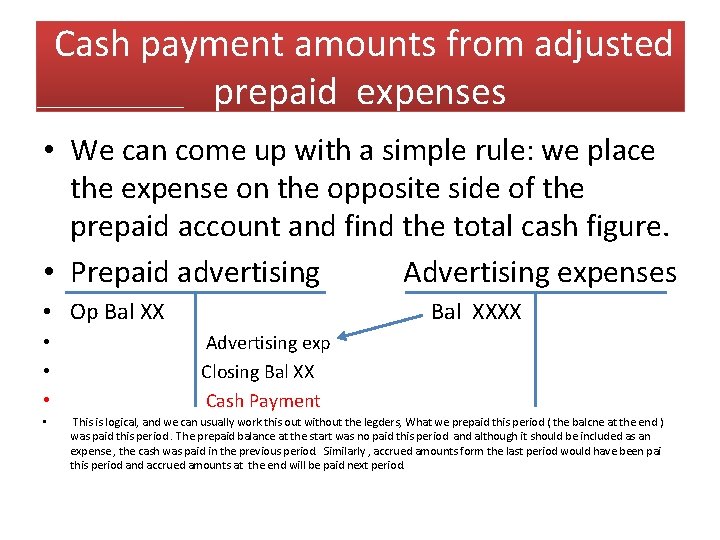

Cash payment amounts from adjusted prepaid expenses • We can come up with a simple rule: we place the expense on the opposite side of the prepaid account and find the total cash figure. • Prepaid advertising Advertising expenses • Op Bal XX • • Bal XXXX Advertising exp Closing Bal XX Cash Payment This is logical, and we can usually work this out without the legders, What we prepaid this period ( the balcne at the end ) was paid this period. The prepaid balance at the start was no paid this period and although it should be included as an expense , the cash was paid in the previous period. Similarly , accrued amounts form the last period would have been pai this period and accrued amounts at the end will be paid next period.

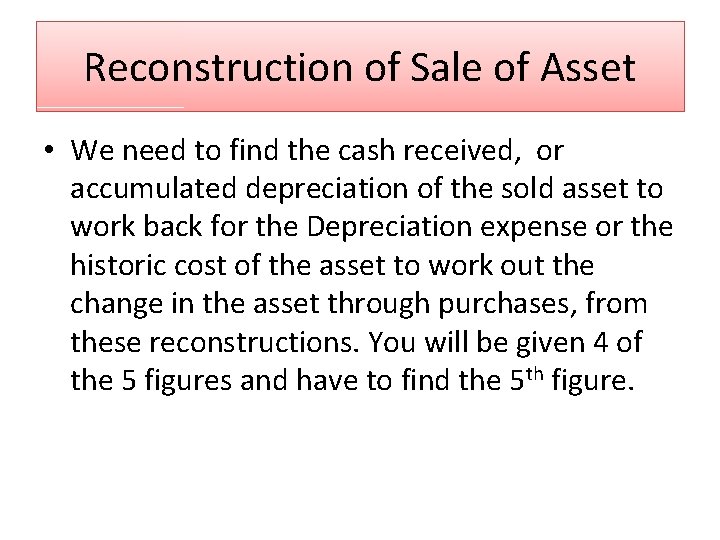

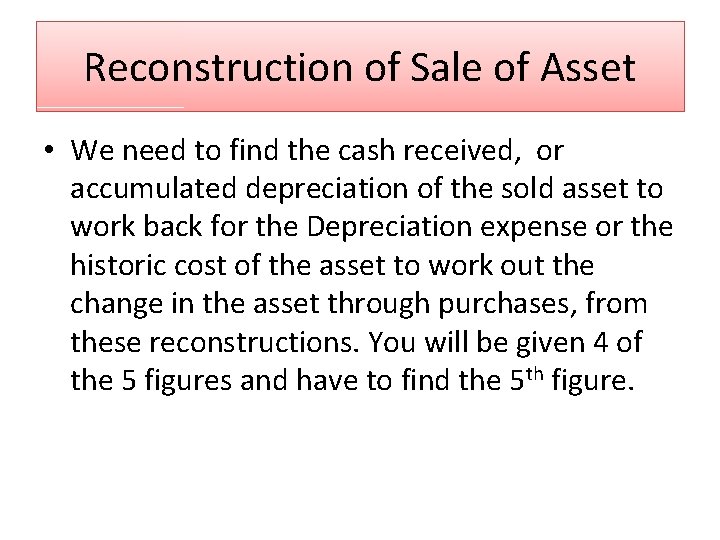

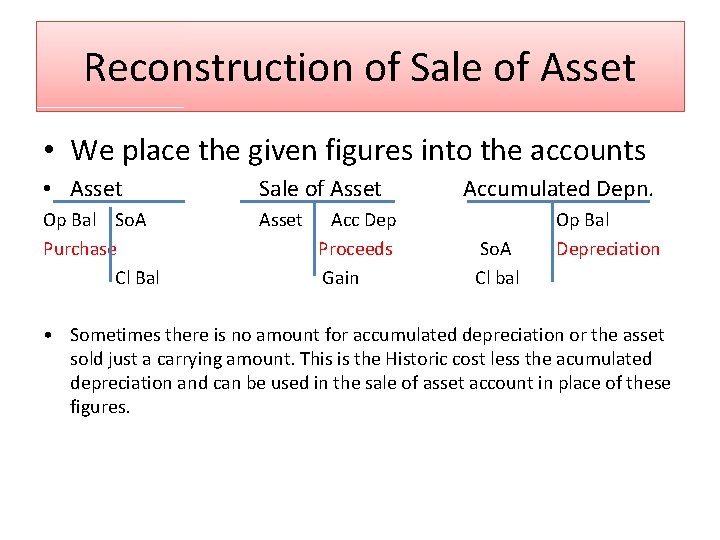

Reconstruction of Sale of Asset • We need to find the cash received, or accumulated depreciation of the sold asset to work back for the Depreciation expense or the historic cost of the asset to work out the change in the asset through purchases, from these reconstructions. You will be given 4 of the 5 figures and have to find the 5 th figure.

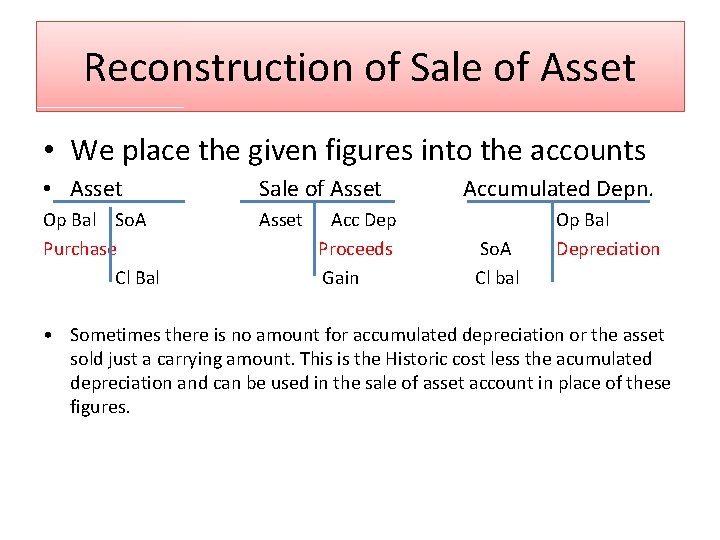

Reconstruction of Sale of Asset • We place the given figures into the accounts • Asset Sale of Asset Op Bal So. A Purchase Cl Bal Asset Acc Dep Proceeds Gain Accumulated Depn. So. A Cl bal Op Bal Depreciation • Sometimes there is no amount for accumulated depreciation or the asset sold just a carrying amount. This is the Historic cost less the acumulated depreciation and can be used in the sale of asset account in place of these figures.

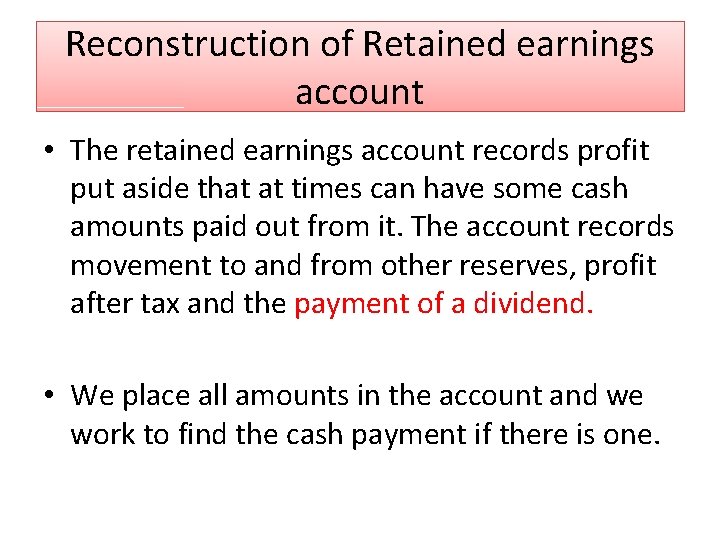

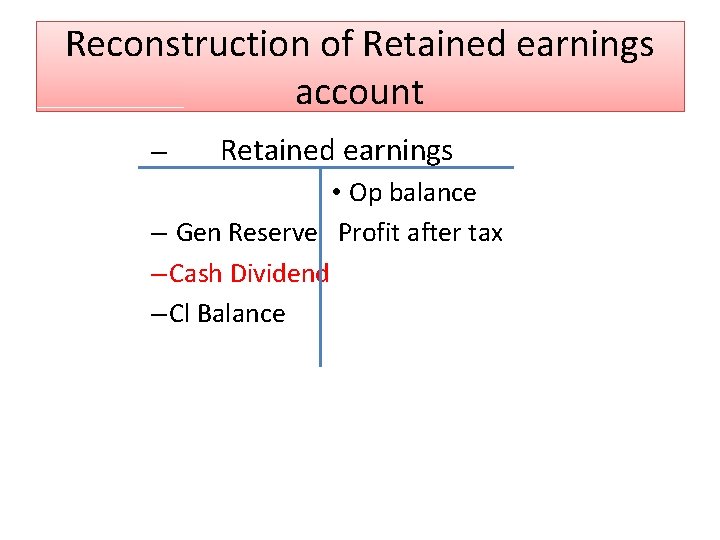

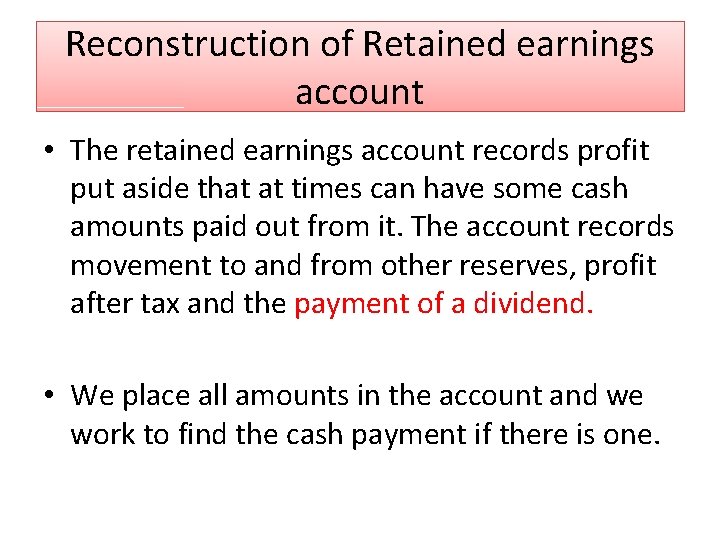

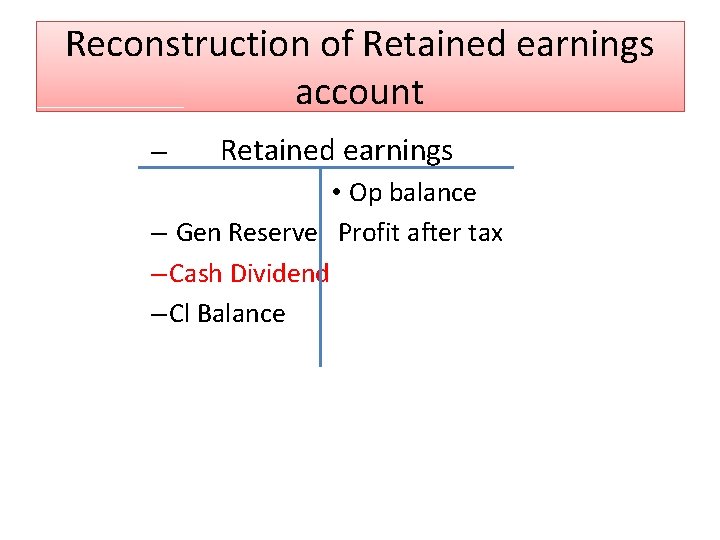

Reconstruction of Retained earnings account • The retained earnings account records profit put aside that at times can have some cash amounts paid out from it. The account records movement to and from other reserves, profit after tax and the payment of a dividend. • We place all amounts in the account and we work to find the cash payment if there is one.

Reconstruction of Retained earnings account – Retained earnings • Op balance – Gen Reserve Profit after tax – Cash Dividend – Cl Balance

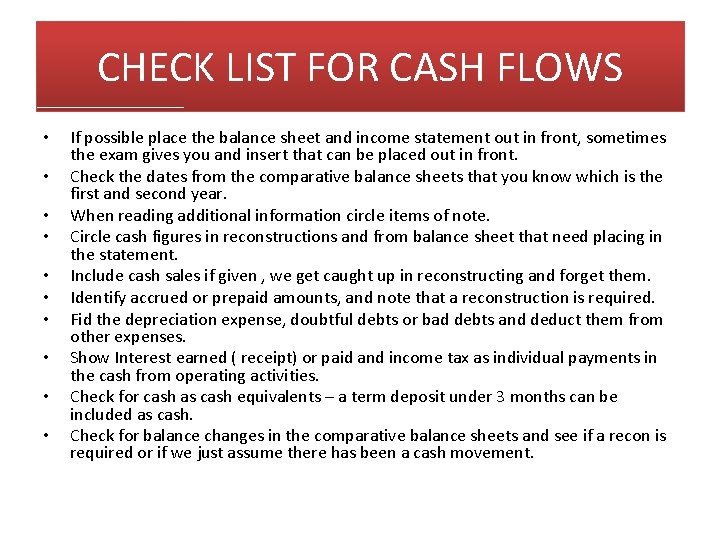

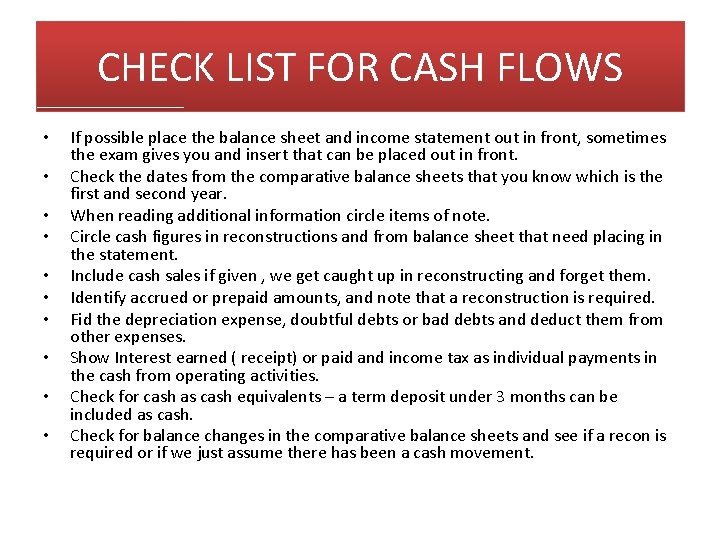

CHECK LIST FOR CASH FLOWS • • • If possible place the balance sheet and income statement out in front, sometimes the exam gives you and insert that can be placed out in front. Check the dates from the comparative balance sheets that you know which is the first and second year. When reading additional information circle items of note. Circle cash figures in reconstructions and from balance sheet that need placing in the statement. Include cash sales if given , we get caught up in reconstructing and forget them. Identify accrued or prepaid amounts, and note that a reconstruction is required. Fid the depreciation expense, doubtful debts or bad debts and deduct them from other expenses. Show Interest earned ( receipt) or paid and income tax as individual payments in the cash from operating activities. Check for cash as cash equivalents – a term deposit under 3 months can be included as cash. Check for balance changes in the comparative balance sheets and see if a recon is required or if we just assume there has been a cash movement.