Assets Concentration According to the Federal Deposit Insurance

- Slides: 10

Assets Concentration § According to the Federal Deposit Insurance Corporation (FDIC), total assets at all insured institutions increased from $15. 78 trillion at the end of March 2015 to $16. 29 trillion at the end of March 2016. § Fewer banks, however, held those March 2016 assets, with total insured institutions declining from 6, 419 to 6, 122 during the same one-year period. There were fewer commercial banks, savings institutions, agricultural banks and commercial lenders. § Q 1 2016 net incomes decreased for all insured institutions and commercial banks, but increased for savings institutions, agricultural banks and commercial lenders.

Banking Executives’ Growth Strategies § KPMG reported in its 2016 Banking Industry Outlook Survey that of the 100 US banking executives participating in the survey, 11% said they expected their 2016 revenues to increase by more than 20%; 25%, remain the same; and 2%, decrease. § Banking executives’ top 3 initiatives to increase revenues were developing/selling new capabilities for investment services, 51%; cross-selling services (IRAs, CDs, etc. ), 38%; and charging fees for innovative and valuable products (mobile wallets, etc. ), 36%. § Counter to recent trends, 48% of banking executives said they would increase the number of brick-and-mortar branches by 1% to 10% during the next 12– 18 months (with just 14% by more than 10%); 34%, remain the same; and 18%, decrease.

Customer Satisfaction Scorecard § The overall score of 76 (on a 100 -point scale) remained the same as 2014 in the latest (2015) American Customer Satisfaction Index (ACSI) for banks. Regions Bank (79), PNC Bank (78), and BB&T (77) had the highest scores, all mid-size banks. § Among the top 5 banks, US Bank had the highest score, or 76, while Wells Fargo was 75; Citibank, 73; JPMorgan Chase, 71, and Bank of America, 68. Wells Fargo improved its score from 2015; however, JPMorgan Chase and Bank of America had lower scores. § In the more recent J. D. Power 2016 US Retail Banking Study, the big banks actually improved their overall score from 790 for 2015 to 793 (on a 1, 000 -point scale), which is the sixth consecutive year of increasing consumer satisfaction.

Personal Service Still a Priority § Although there is growing usage of online and mobile banking, a March 2016 poll from Accenture of more than 4, 000 North American banking customers revealed that 86. 7% said they are likely to visit a brick-and-mortar bank branch during the next 2 years. § They cited the primary reason as “I trust my bank more when speaking to someone in-person, ” at 49%; followed by “I receive more value from my bank when speaking to someone in-person, ” at 47%; and “I like my bank’s overall branch experience, ” at 40%. § ASCI’s 2015 Industry Customer Experience Benchmarks found that regional and community banks (89), super regional banks (88) and national banks (85) scored highest for courtesy and helpfulness of staff.

Banking on the Go Keeps Growing § e. Marketer forecasts that 113. 5 million US adult mobile device banking users will access their bank, credit union, credit card or brokerage account through the Internet via any device at least once per month during 2016, and increasing to 131. 4 million by 2019. § According to data from Fiserv, the percentage of US Internet users who pay bills via a mobile device increased more than 500% during the most recent 5 -year period, from 6% during 2011 to 33% during 2015. § Capital One and Ally Bank (both online banks) have recently created and made available to non-customers financial advice apps (financial health, credit score, etc. ) as an innovative engagement channel since there is less customer engagement in branches.

Winning Wary Millennials § As more of the more than 80 million Millennials start careers and families and buy homes and other high-ticket consumer items, banks obviously are targeting them; however, approximately 5 million Millennials don’t have checking accounts. § Almost 50% of Millennials without a checking account say the primary reason is a distrust of banks. Millennials and their employers are opting to load their wages onto a paycard or payroll card, which acts as a debit card. § During 2016, 86. 3% of Millennials will be digital banking users, compared to 73. 9% of Generation Xers and 55. 0% of Baby Boomers. These percentages will increase to 94. 2%, 81. 2% and 61. 4%, respectively, by 2019.

Advertising Strategies § Banks that score at or near the top of ASCI and J. D. Power customer satisfaction reports should cite these results in the various marketing/advertising channels they use to maximize customer engagement and trust. § Banks creating financial advice apps for non-customers should aggressively market/advertise these apps in “traditional” and digital media channels to generate leads and open a dialogue with non-customers. § Banks can gather and utilize customer testimonials for use in TV spots and other media and advertising formats that present the reasons customers find the in-branch experience important and helpful.

New Media Strategies § To counter Millennials’ distrust of banks, banks can conduct and then post polls/surveys on social media asking why there is distrust. The results can then be used to create Website and social media content that will help to gain more trust among Millennials. § Banks should use their Websites and social media platforms to provide Millennials, lower-income families and immigrants with the financial education, especially investing for Millennials and budgeting for lower-income families, many studies show they need. § Banks can also position themselves positively with Generation Z by offering to present a personal finances seminar at local high schools or through community parent and youth groups. Encourage participants to share on social media what they learned via videos.

Key concept

Key concept 3 tier banking system

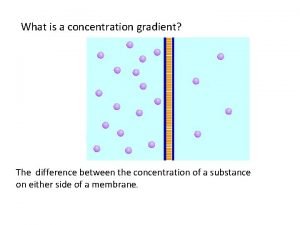

3 tier banking system Movement of high concentration to low concentration

Movement of high concentration to low concentration Concentration gradient

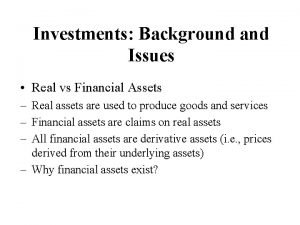

Concentration gradient Real assets definition

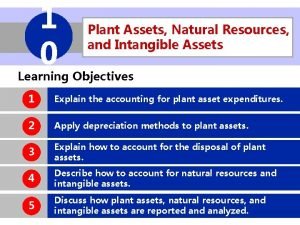

Real assets definition Plant assets, natural resources, and intangible assets

Plant assets, natural resources, and intangible assets Plant assets, natural resources, and intangible assets

Plant assets, natural resources, and intangible assets Real versus financial assets

Real versus financial assets Plant assets natural resources and intangible assets

Plant assets natural resources and intangible assets Real assets vs financial assets

Real assets vs financial assets Financial assets examples

Financial assets examples