Financial Management I 2204 Market A market is

- Slides: 30

Financial Management I 2204

Market • A market is the means through which buyers and sellers are brought together to aid in the transfer of goods and services.

Market • A market need not have a physical location. • The market does not necessarily own the goods and services involved. Those who establish and administer the market need only provide a cheap, smooth transfer of goods and services. • A market can deal in any variety of goods and services.

Characteristics of a good Market • Availability of information • Liquidity • Low transaction cost or internal efficiency • External / informational Efficiency

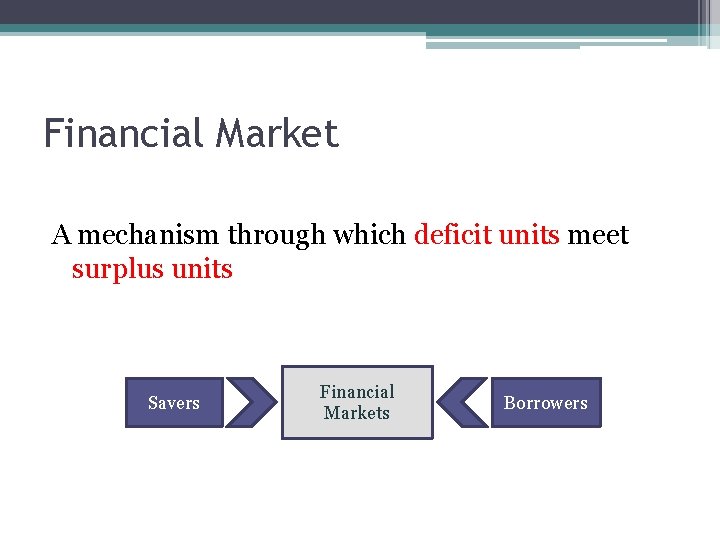

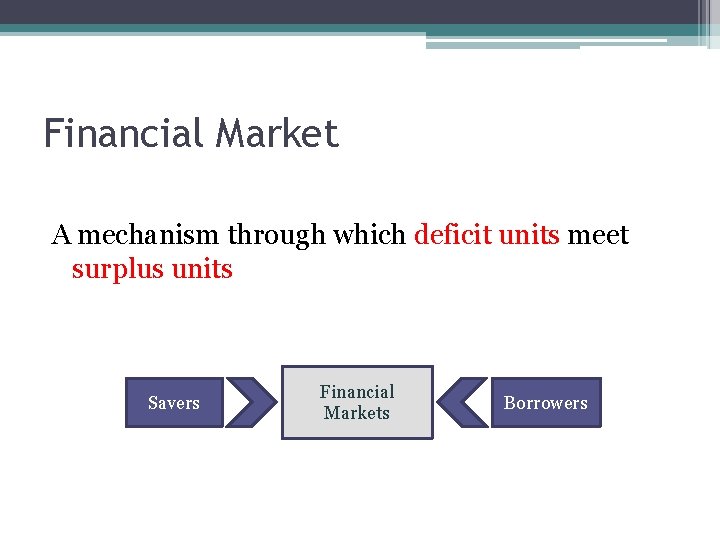

Financial Market A mechanism through which deficit units meet surplus units Savers Financial Markets Borrowers

Financial Market • A financial market is the mechanics through which buyers and sellers are brought together to facilitate the exchange of financial assets. • Financial assets are often known as securities or financial investments. • Thus, Financial markets which exist in order to bring together buyers and sellers of securities.

Importance of financial markets Flow of funds - Across units - Across time

Capital formation process • Direct transfer • Indirect transfer through an investment banker • Indirect transfer through a financial intermediary

Investment Bank • An investment bank is a financial institution that assists individuals, corporations and governments in raising capital by underwriting and/or acting as the client's agent in the issuance of securities. • An investment bank may also assist companies involved in mergers and acquisitions, and provide services such as trading of securities , foreign exchange and equity securities.

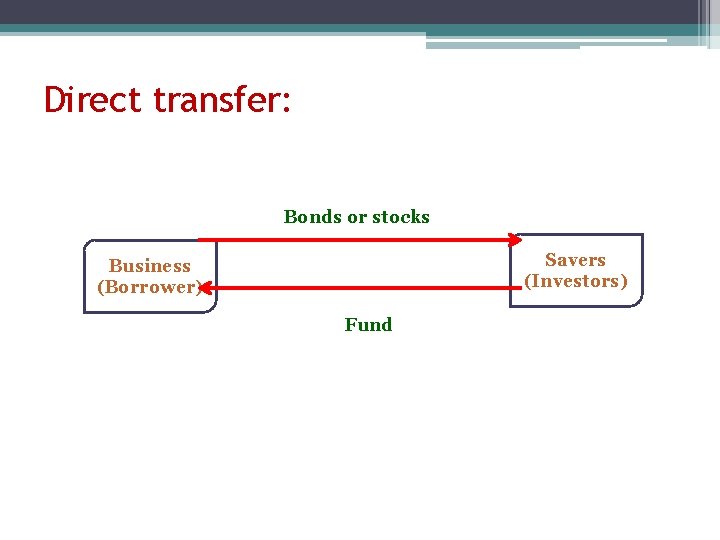

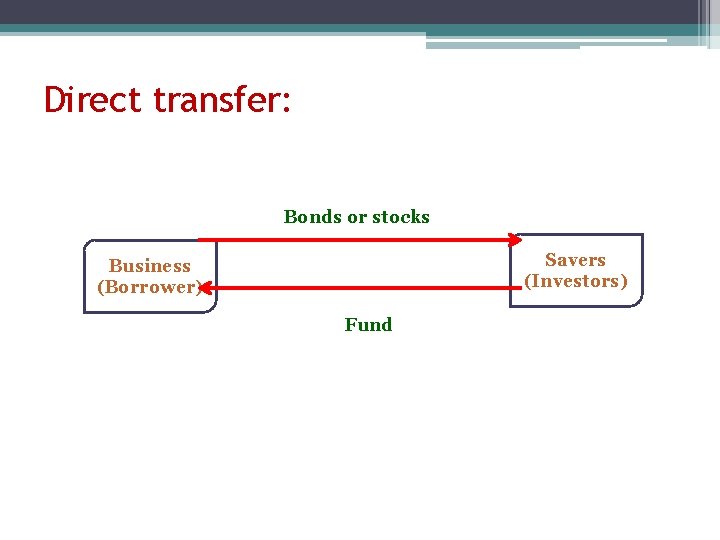

Direct transfer: Bonds or stocks Savers (Investors) Business (Borrower) Fund

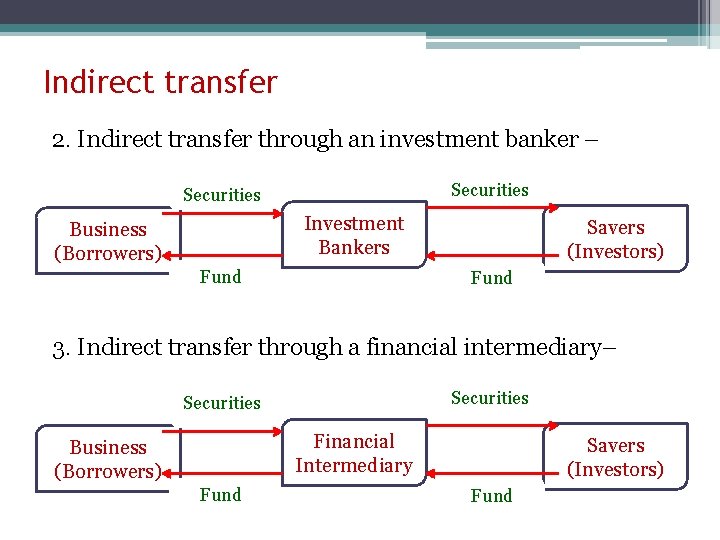

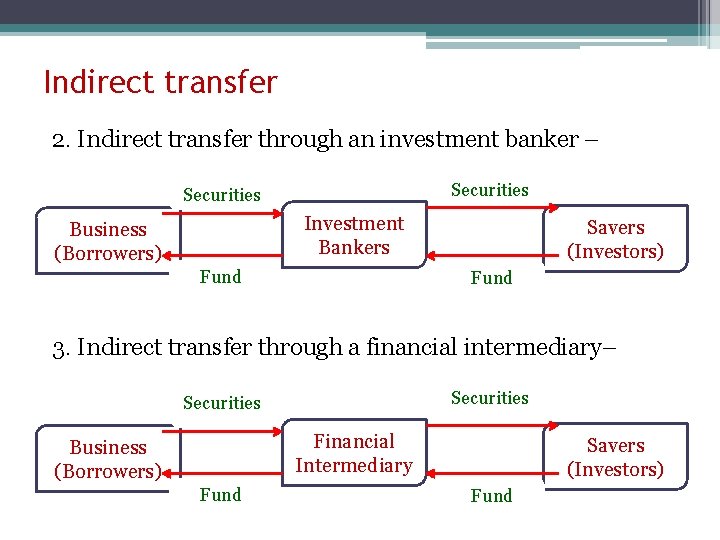

Indirect transfer 2. Indirect transfer through an investment banker – Securities Investment Bankers Business (Borrowers) Fund Savers (Investors) Fund 3. Indirect transfer through a financial intermediary– Securities Financial Intermediary Business (Borrowers) Fund Savers (Investors) Fund

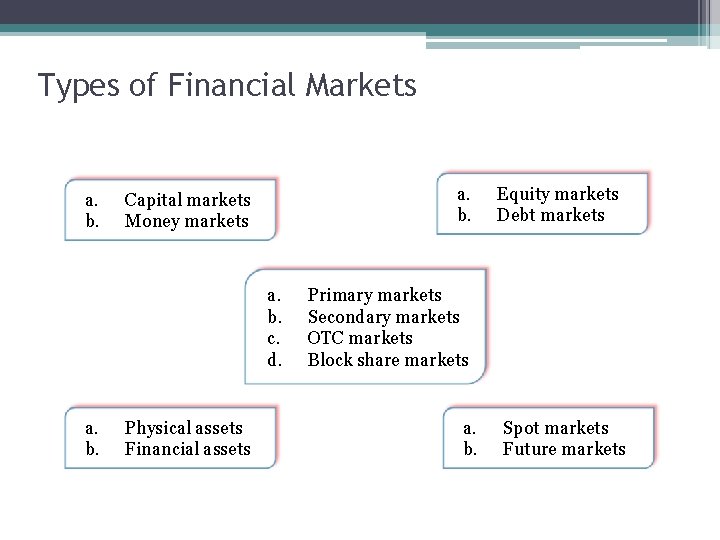

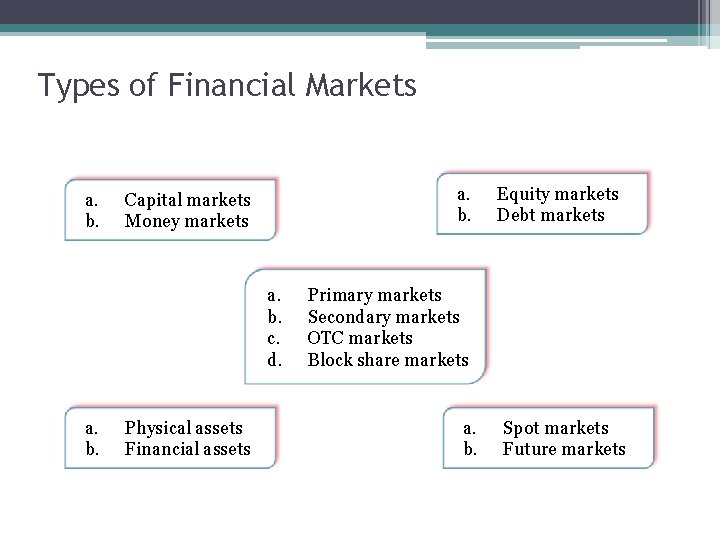

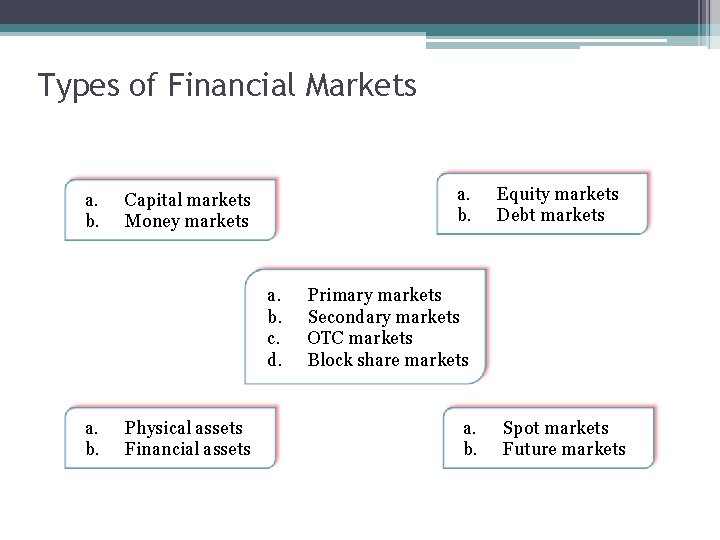

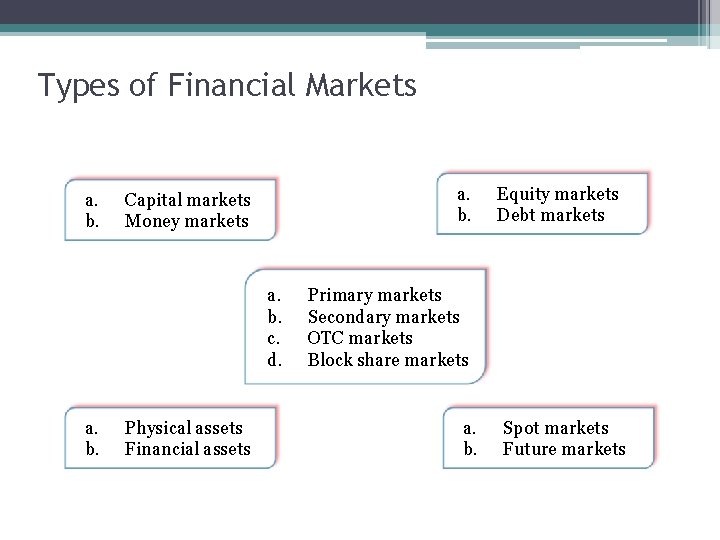

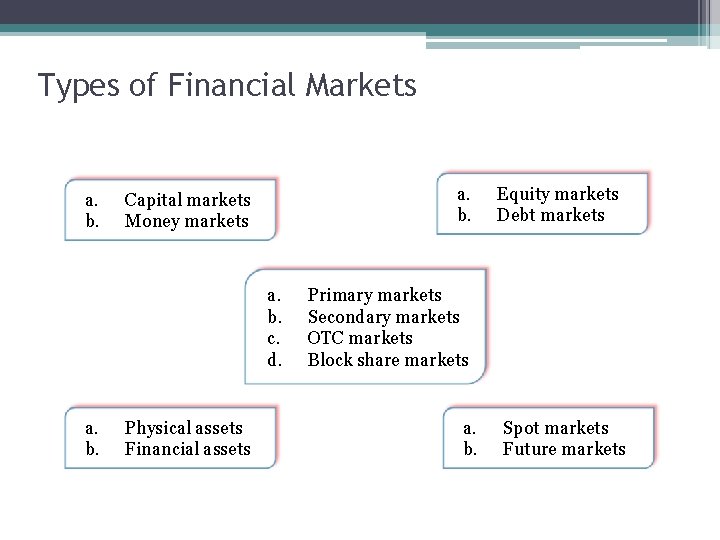

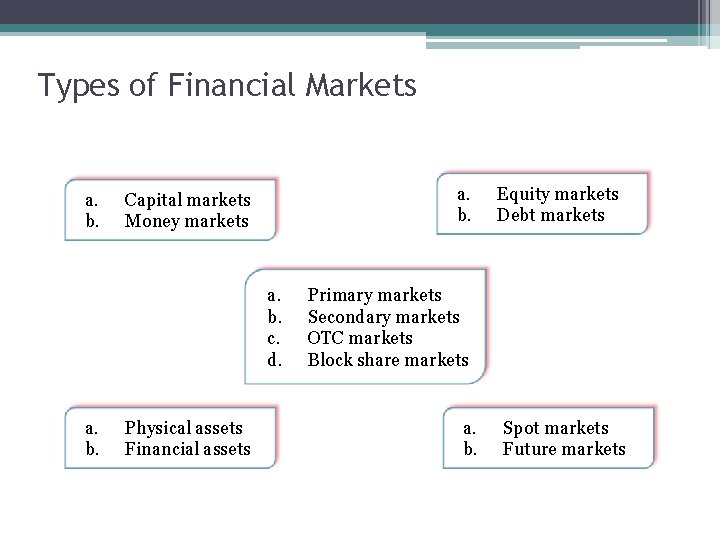

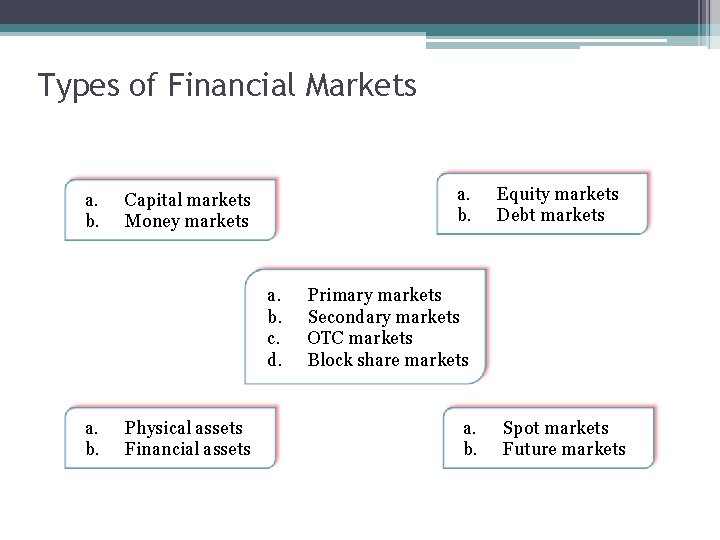

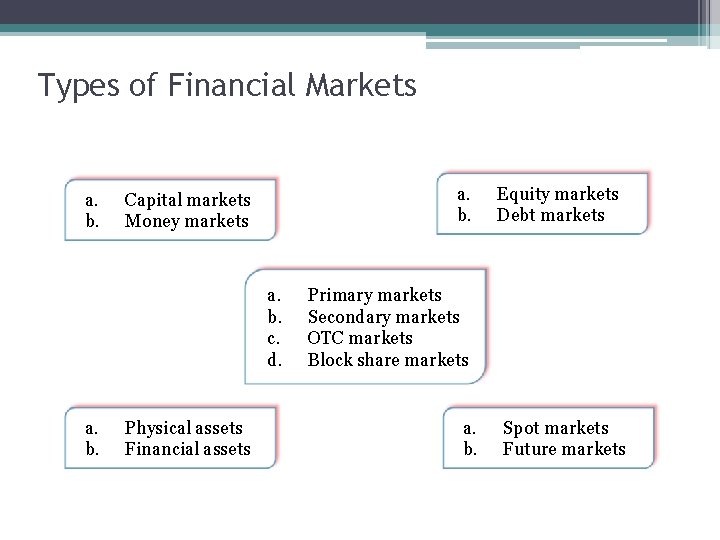

Types of Financial Markets a. b. Capital markets Money markets a. b. c. d. a. b. Physical assets Financial assets Equity markets Debt markets Primary markets Secondary markets OTC markets Block share markets a. b. Spot markets Future markets

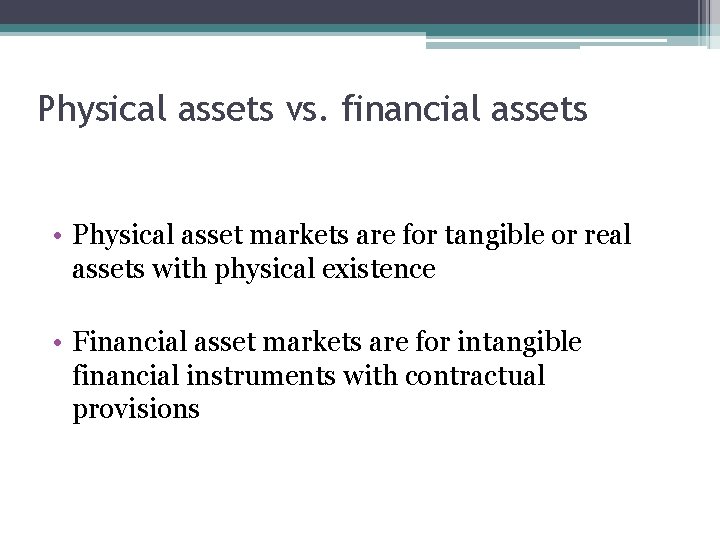

Physical assets vs. financial assets • Physical asset markets are for tangible or real assets with physical existence • Financial asset markets are for intangible financial instruments with contractual provisions

Types of Financial Markets a. b. Capital markets Money markets a. b. c. d. a. b. Physical assets Financial assets Equity markets Debt markets Primary markets Secondary markets OTC markets Block share markets a. b. Spot markets Future markets

Capital market vs. money market • Capital market instruments have longer maturity • Money market instruments have shorter maturity

Capital Market • Capital markets involve financial assets that have life spans of greater than one year. • It is the market from which long term capital raised for the setting up and sustained growth of business organizations.

Money Market • Money markets involve financial assets that have life spans of one year or less. • It is the market of short term borrowing instruments.

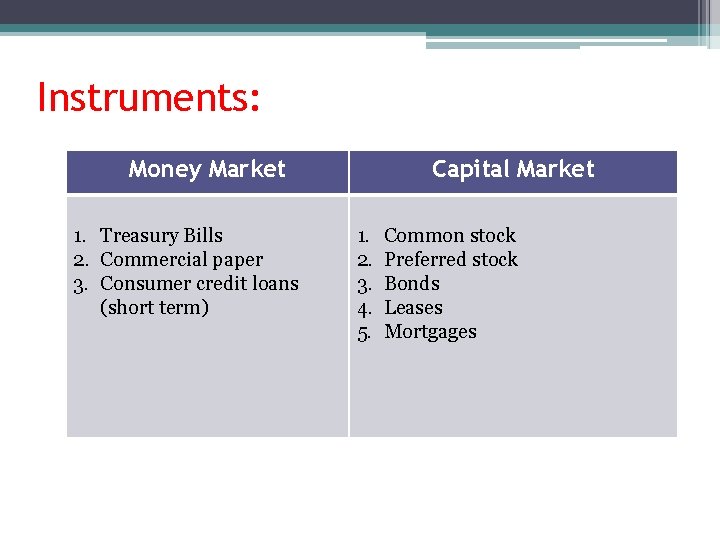

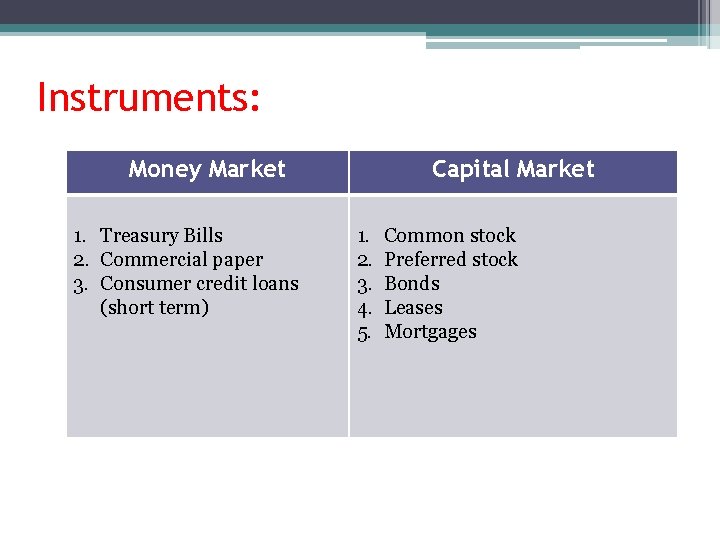

Instruments: Money Market 1. Treasury Bills 2. Commercial paper 3. Consumer credit loans (short term) Capital Market 1. 2. 3. 4. 5. Common stock Preferred stock Bonds Leases Mortgages

a. b. c. d. Primary markets Secondary markets OTC markets Block share markets

Primary Market • It is market where new issues are sold by corporations to acquire new capital via the sale of common stock, preferred stocks or bonds. • The sale take place through an investment banker.

Primary Market • In which corporations raise new capital �Initial Public Offering (IPO) – GO PUBLIC �Seasoned Offering

• Unseasoned new issue market/ IPO • An unseasoned new issue shares involves the initial offering for a security to the public. • Seasoned New issue market • A seasoned new issue refers to the offering of an additional amount of an already existing security.

Secondary Market • It involves between owners after the issue has been sold to the public by the company. • Consequently, the proceeds from the sale in the secondary market do not go to the company. , as in the case with the primary offering. • In which existing securities are traded among investors �DSE �CSE

Over-the-counter market/ Third market • OTC market is market for securities (usually unlisted) outside the control of the official stock exchange. • Trading of securities not listed in the physical stock exchange. • The broker-dealers are linked by a network of telephones and computer terminals through which they deal directly with one another and with customers.

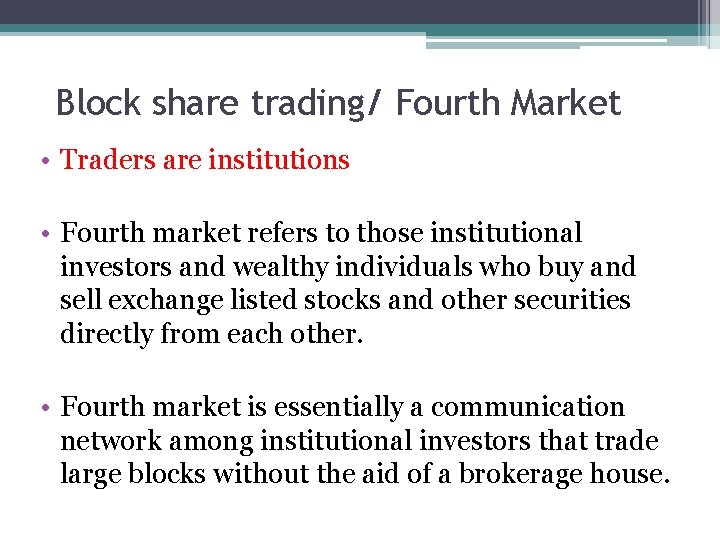

Block share trading/ Fourth Market • Traders are institutions • Fourth market refers to those institutional investors and wealthy individuals who buy and sell exchange listed stocks and other securities directly from each other. • Fourth market is essentially a communication network among institutional investors that trade large blocks without the aid of a brokerage house.

Types of Financial Markets a. b. Capital markets Money markets a. b. c. d. a. b. Physical assets Financial assets Equity markets Debt markets Primary markets Secondary markets OTC markets Block share markets a. b. Spot markets Future markets

Equity Markets vs. Debt Markets • In equity markets, corporate stocks or ownerships are traded • In debt markets, bonds or corporate liabilities are traded

Types of Financial Markets a. b. Capital markets Money markets a. b. c. d. a. b. Physical assets Financial assets Equity markets Debt markets Primary markets Secondary markets OTC markets Block share markets a. b. Spot markets Future markets

Spot Markets vs. Future Markets • In spot markets instruments are traded for immediate delivery of assets • In future markets instruments are traded for future delivery of assets

Market efficiency Informational efficiency �Weak form efficiency �Semi-strong form efficiency �Strong form efficiency

Physics 2204 unit 3: work, power, energy

Physics 2204 unit 3: work, power, energy 2204 başvuru

2204 başvuru Tübitak 2204-b proje örnekleri matematik

Tübitak 2204-b proje örnekleri matematik Haldun hadimioglu

Haldun hadimioglu Market leader challenger follower nicher examples

Market leader challenger follower nicher examples Bases of market segmentation

Bases of market segmentation Financial motivators

Financial motivators Classification of financial markets

Classification of financial markets Objectives of financial market

Objectives of financial market Why study financial markets

Why study financial markets Market segmentation theory

Market segmentation theory Feature of capital market

Feature of capital market Segments of money market

Segments of money market Financial literacy and stock market participation

Financial literacy and stock market participation The financial market environment chapter 2

The financial market environment chapter 2 Top management and middle management

Top management and middle management Management pyramid

Management pyramid Top management middle management first line management

Top management middle management first line management Management subject code

Management subject code Retail financial strategy

Retail financial strategy Explain the mechanics of public issue management

Explain the mechanics of public issue management Strategic financial management definition

Strategic financial management definition Nature and scope financial management

Nature and scope financial management Daibb management accounting question solution

Daibb management accounting question solution Public finance modules

Public finance modules International financial management jeff madura ppt

International financial management jeff madura ppt Introduction to financial risk

Introduction to financial risk Cash flow at risk definition

Cash flow at risk definition School based financial management deped

School based financial management deped What is working capital in financial management

What is working capital in financial management Financial management definitions

Financial management definitions