APPLICATIONS DEADWEIGHT LOSS ETP Economics 101 DEADWEIGHT LOSS

- Slides: 24

APPLICATIONS: DEADWEIGHT LOSS ETP Economics 101

DEADWEIGHT LOSS Changes in Welfare A deadweight loss is the fall in total surplus that results from a market distortion, such as government regulations on prices and tax.

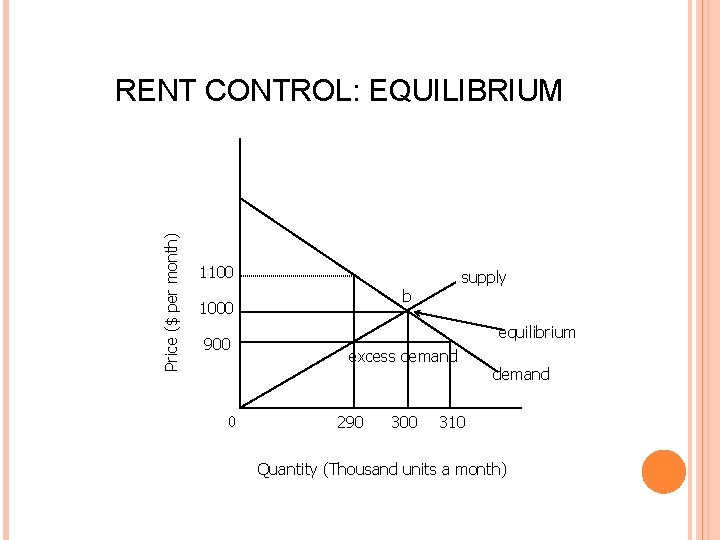

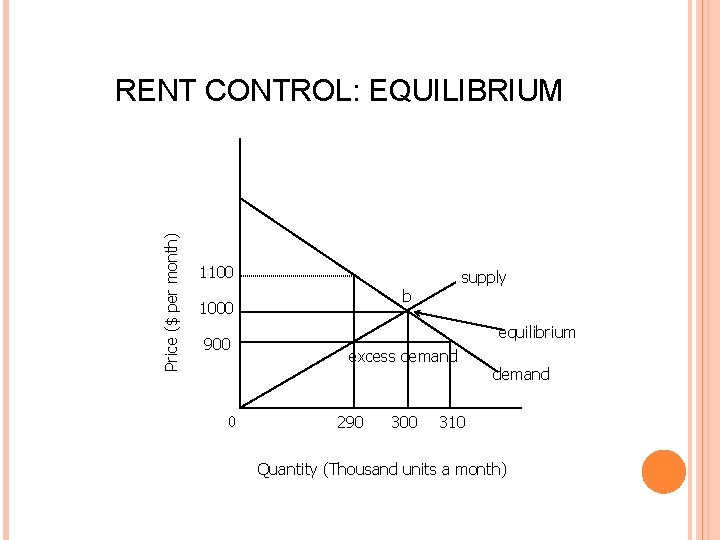

Price ($ per month) RENT CONTROL: EQUILIBRIUM 1100 b 1000 900 0 supply equilibrium excess demand 290 300 demand 310 Quantity (Thousand units a month)

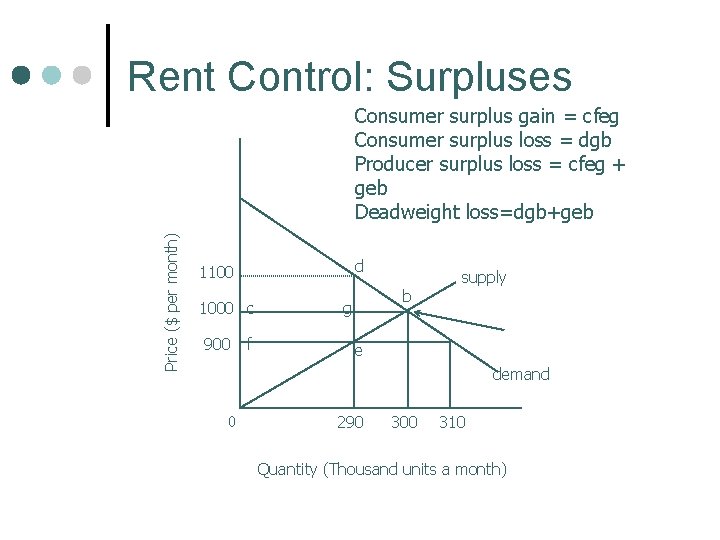

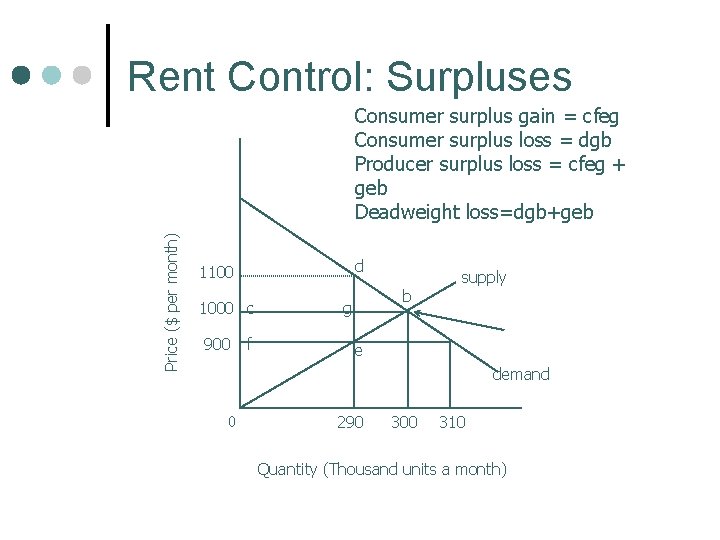

Rent Control: Surpluses Price ($ per month) Consumer surplus gain = cfeg Consumer surplus loss = dgb Producer surplus loss = cfeg + geb Deadweight loss=dgb+geb d 1100 1000 c 900 f b g supply e demand 0 290 300 310 Quantity (Thousand units a month)

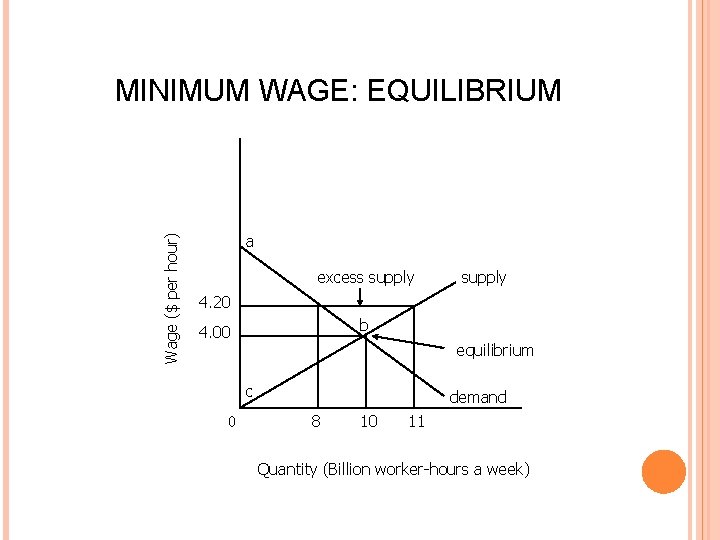

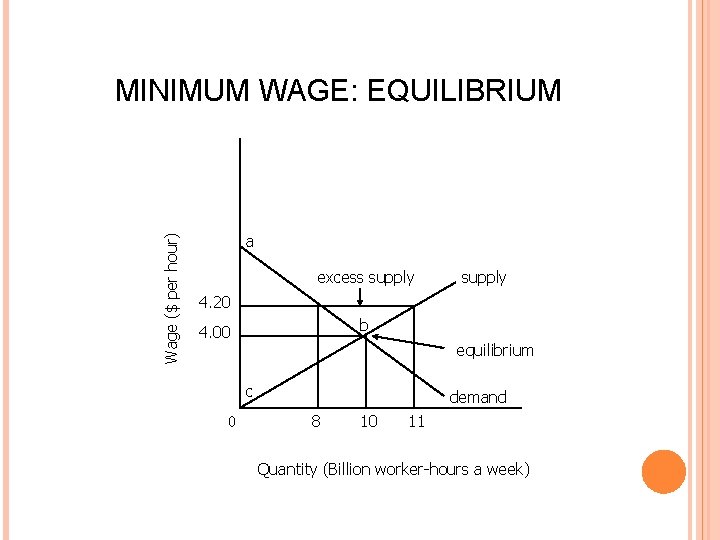

Wage ($ per hour) MINIMUM WAGE: EQUILIBRIUM a excess supply 4. 20 b 4. 00 equilibrium c 0 demand 8 10 11 Quantity (Billion worker-hours a week)

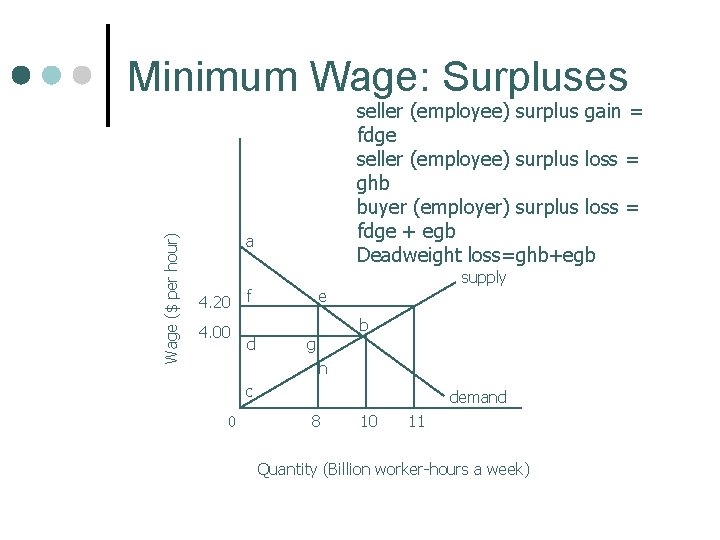

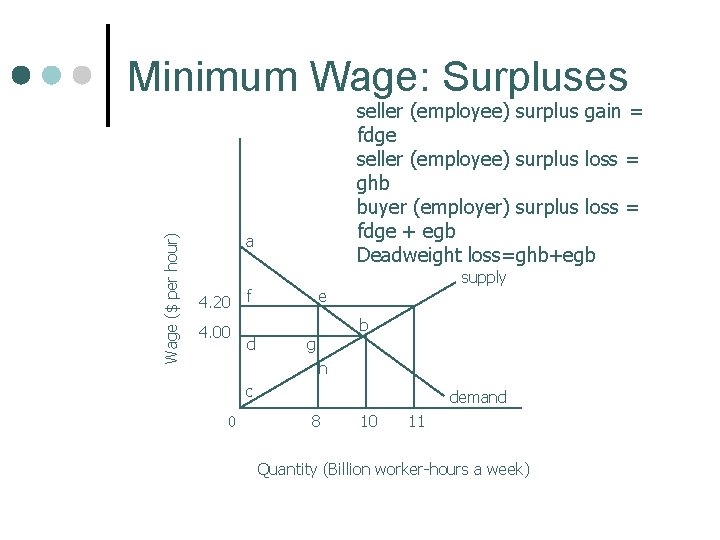

Wage ($ per hour) Minimum Wage: Surpluses seller (employee) surplus gain = fdge seller (employee) surplus loss = ghb buyer (employer) surplus loss = fdge + egb Deadweight loss=ghb+egb a 4. 20 4. 00 f d supply e b g h c 0 demand 8 10 11 Quantity (Billion worker-hours a week)

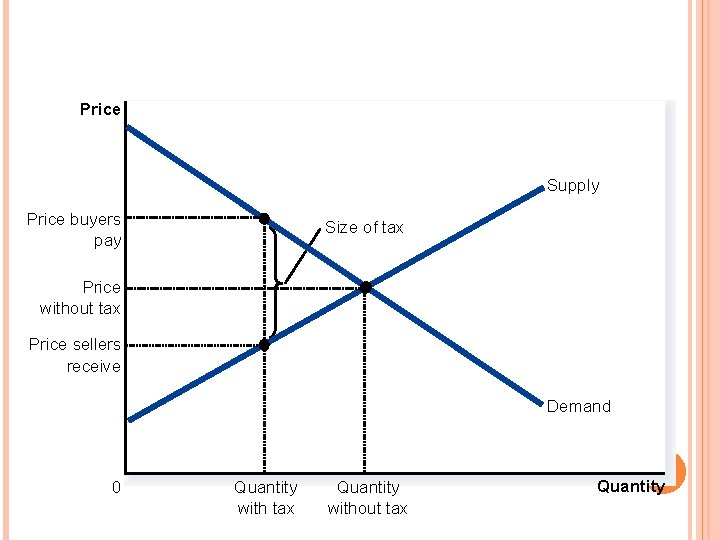

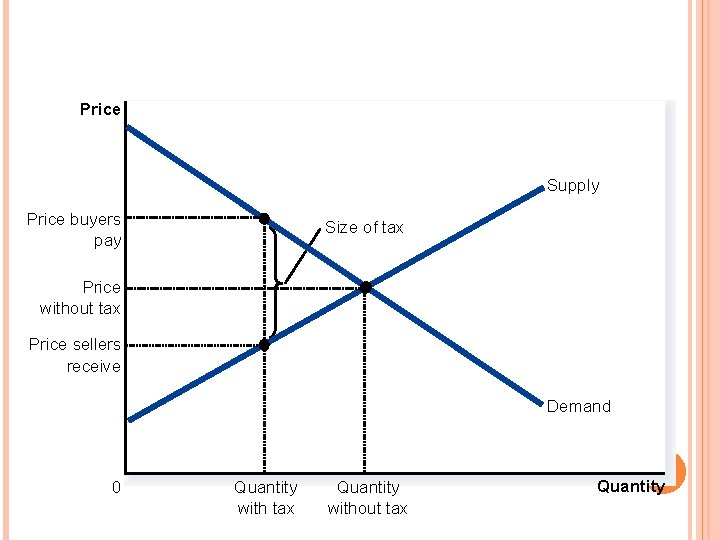

FIGURE 1 THE EFFECTS OF A TAX Price Supply Price buyers pay Size of tax Price without tax Price sellers receive Demand 0 Quantity with tax Quantity without tax Quantity Copyright © 2004 South-Western

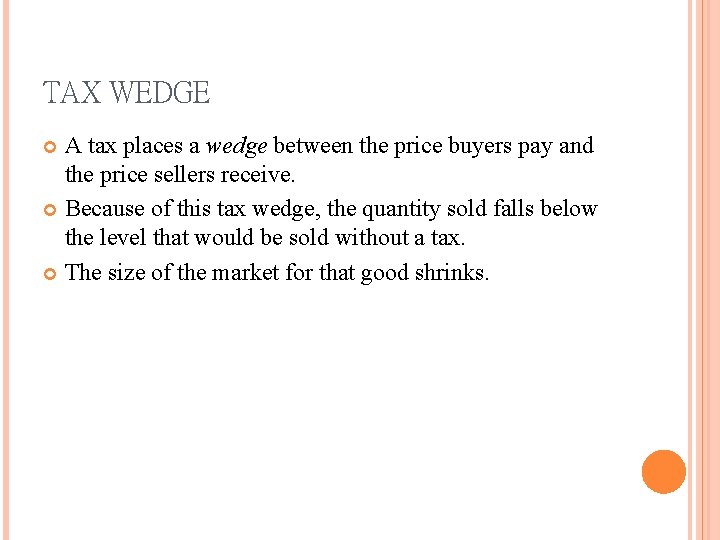

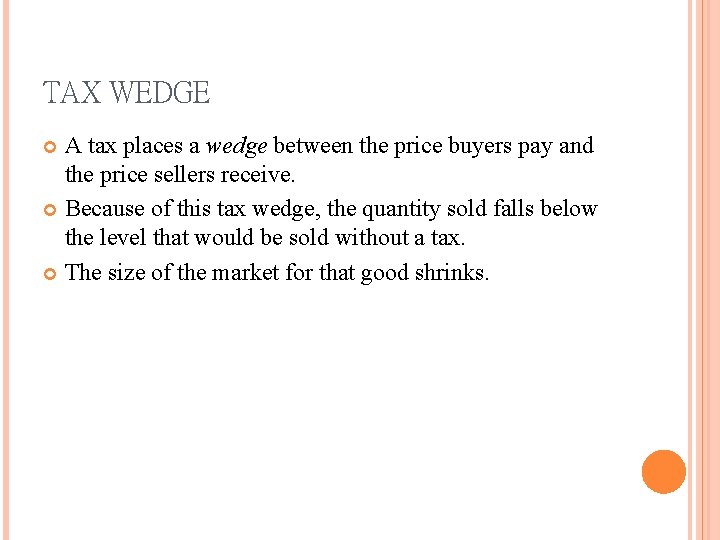

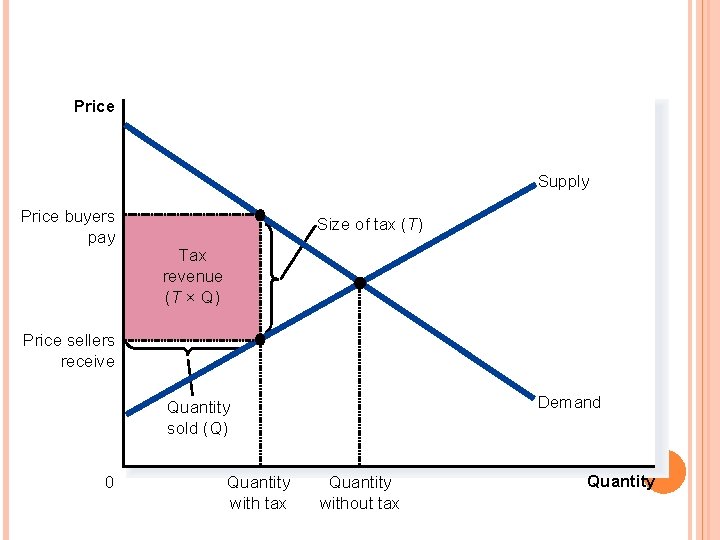

TAX WEDGE A tax places a wedge between the price buyers pay and the price sellers receive. Because of this tax wedge, the quantity sold falls below the level that would be sold without a tax. The size of the market for that good shrinks.

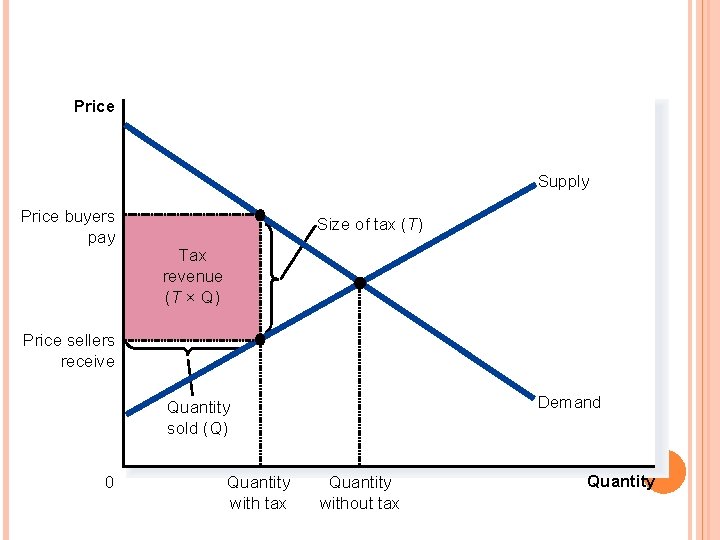

FIGURE 2 TAX REVENUE Price Supply Price buyers pay Size of tax (T) Tax revenue (T × Q) Price sellers receive Demand Quantity sold (Q) 0 Quantity with tax Quantity without tax Quantity Copyright © 2004 South-Western

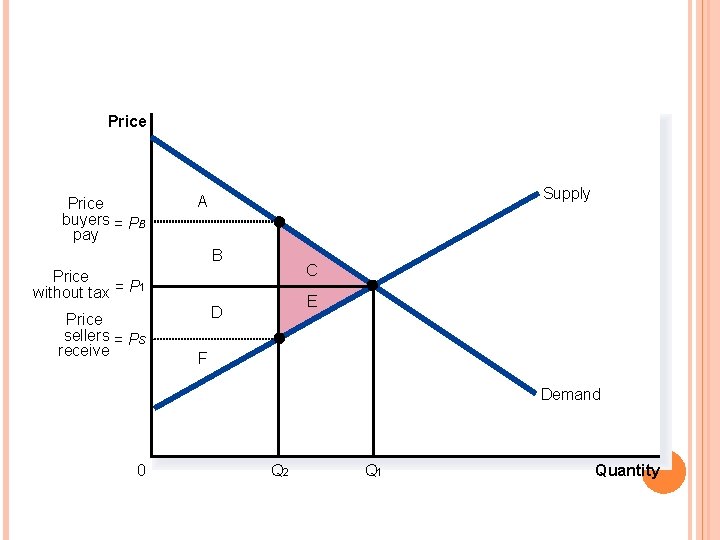

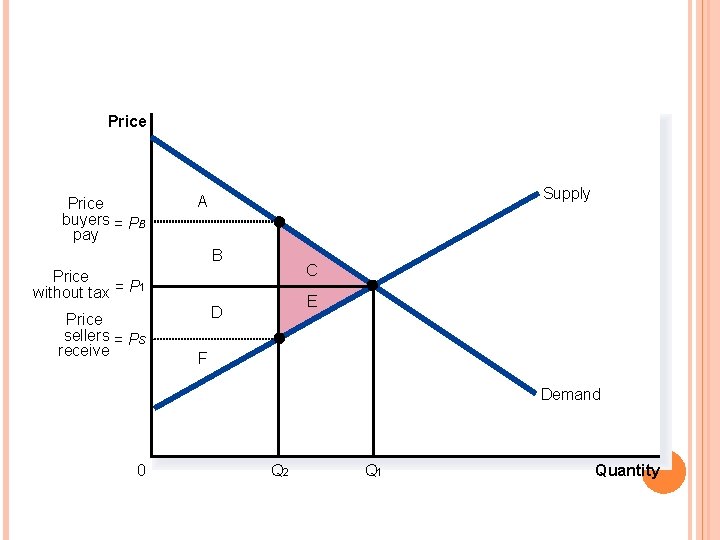

FIGURE 3 HOW A TAX EFFECTS WELFARE Price buyers = PB pay Supply A B C Price without tax = P 1 Price sellers = PS receive E D F Demand 0 Q 2 Q 1 Quantity Copyright © 2004 South-Western

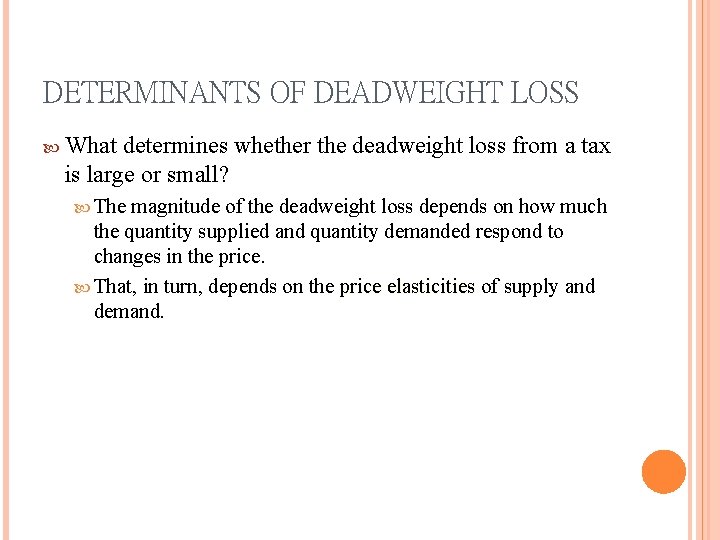

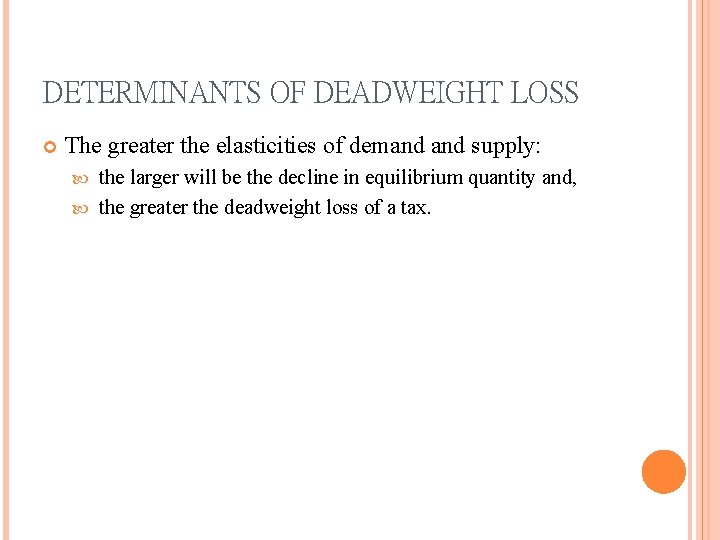

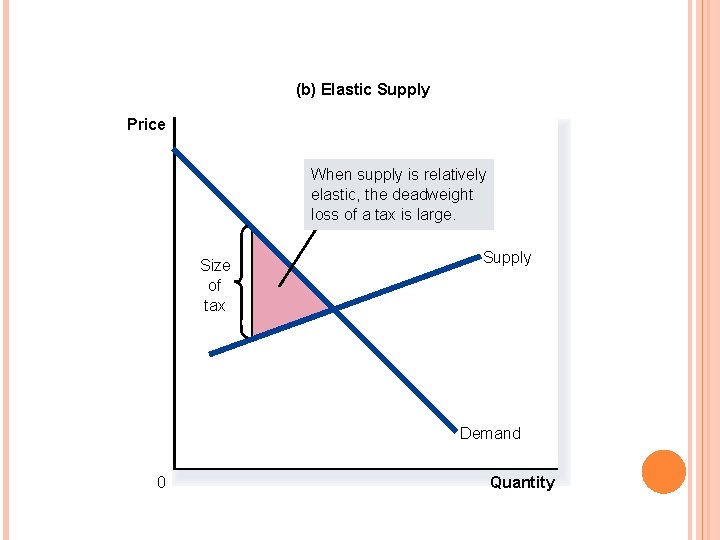

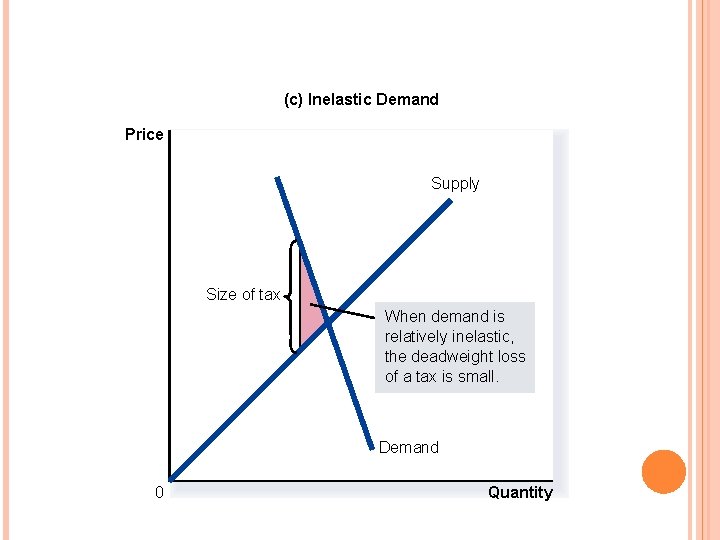

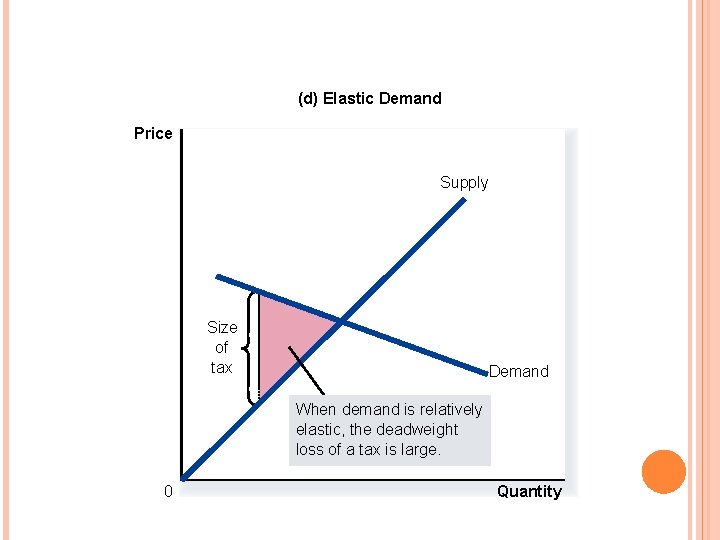

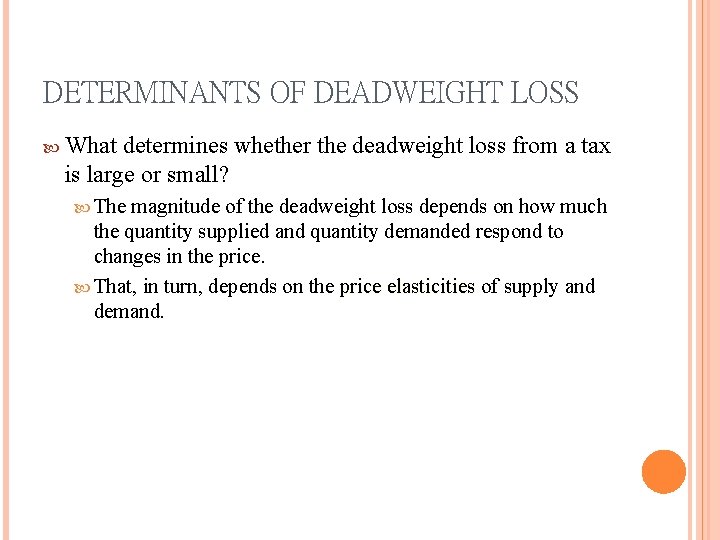

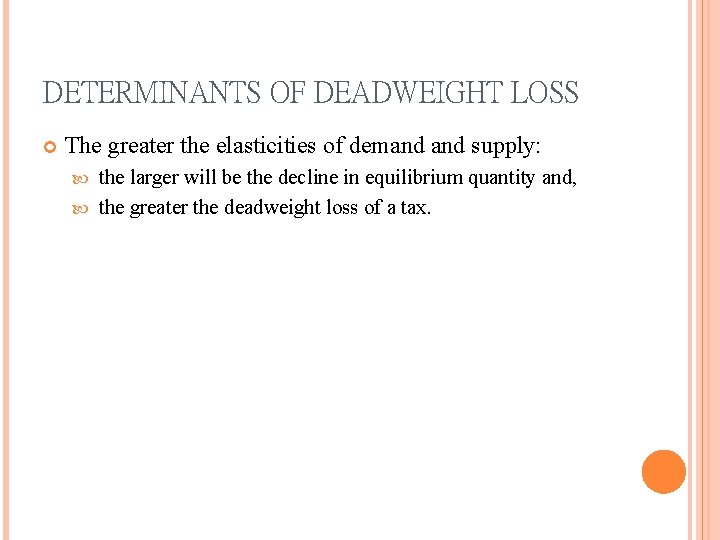

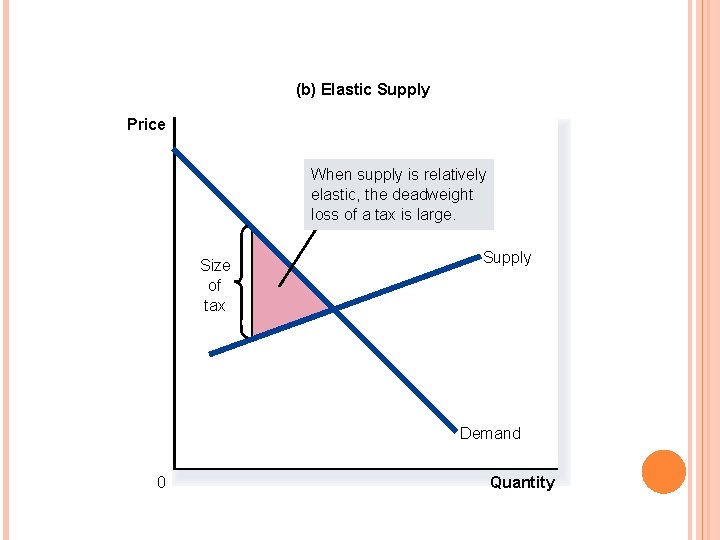

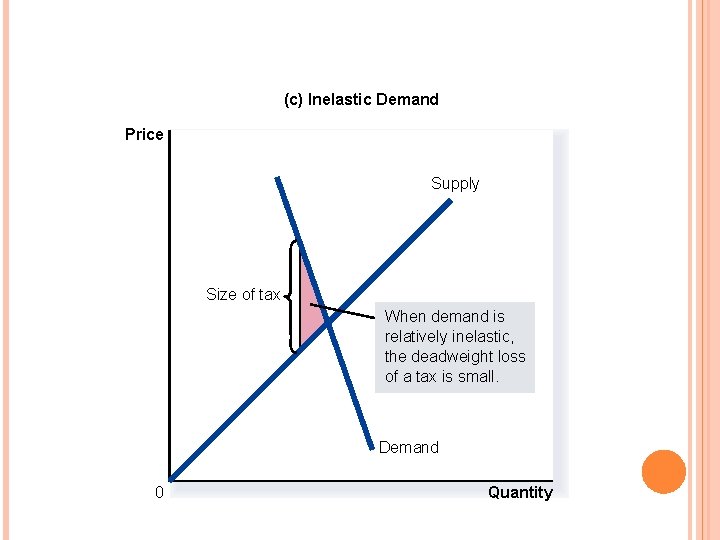

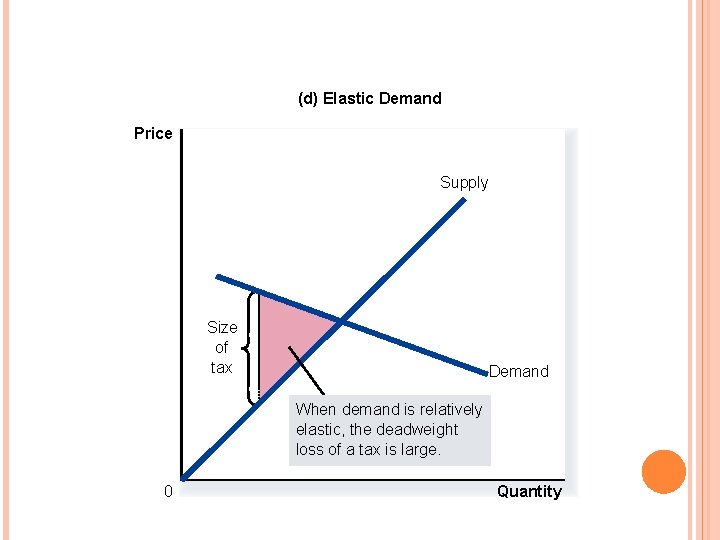

DETERMINANTS OF DEADWEIGHT LOSS What determines whether the deadweight loss from a tax is large or small? The magnitude of the deadweight loss depends on how much the quantity supplied and quantity demanded respond to changes in the price. That, in turn, depends on the price elasticities of supply and demand.

DETERMINANTS OF DEADWEIGHT LOSS The greater the elasticities of demand supply: the larger will be the decline in equilibrium quantity and, the greater the deadweight loss of a tax.

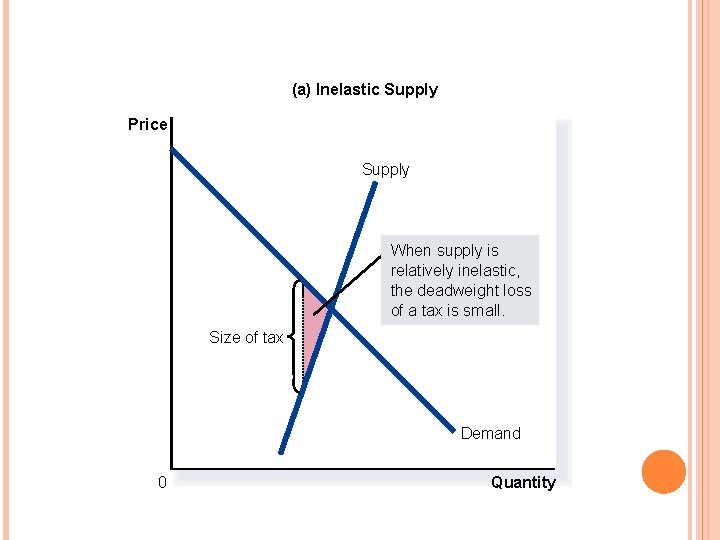

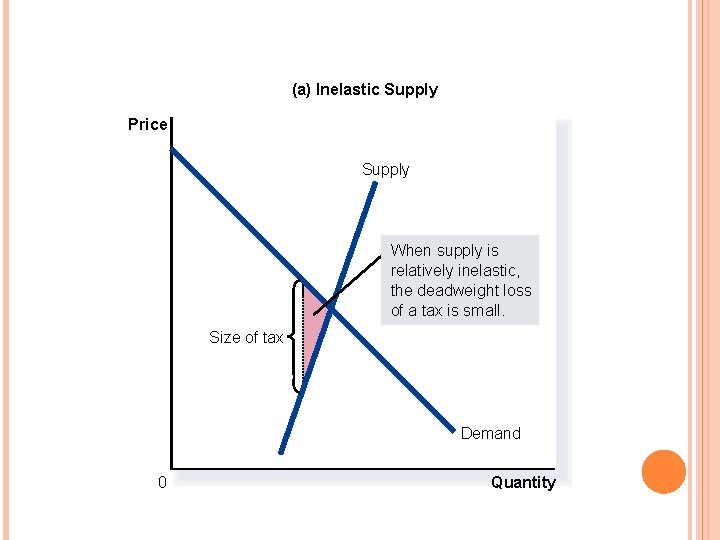

FIGURE 5 TAX DISTORTIONS AND ELASTICITIES (a) Inelastic Supply Price Supply When supply is relatively inelastic, the deadweight loss of a tax is small. Size of tax Demand 0 Quantity Copyright © 2004 South-Western

FIGURE 5 TAX DISTORTIONS AND ELASTICITIES (b) Elastic Supply Price When supply is relatively elastic, the deadweight loss of a tax is large. Size of tax Supply Demand 0 Quantity Copyright © 2004 South-Western

FIGURE 5 TAX DISTORTIONS AND ELASTICITIES (c) Inelastic Demand Price Supply Size of tax When demand is relatively inelastic, the deadweight loss of a tax is small. Demand 0 Quantity Copyright © 2004 South-Western

FIGURE 5 TAX DISTORTIONS AND ELASTICITIES (d) Elastic Demand Price Supply Size of tax Demand When demand is relatively elastic, the deadweight loss of a tax is large. 0 Quantity Copyright © 2004 South-Western

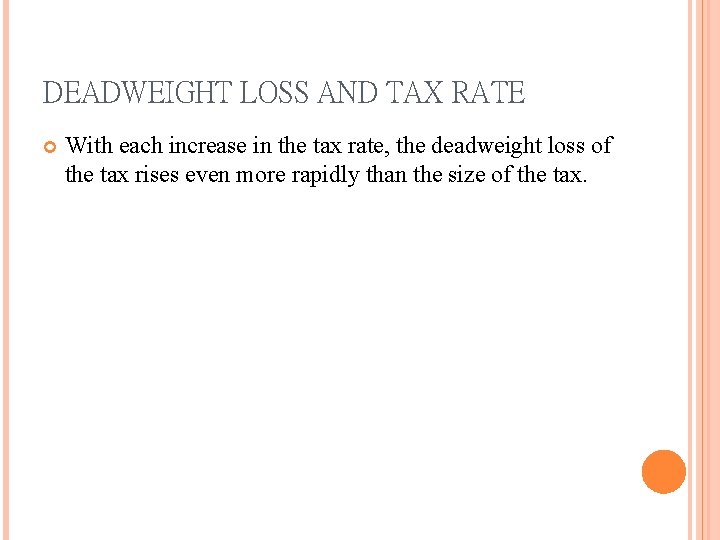

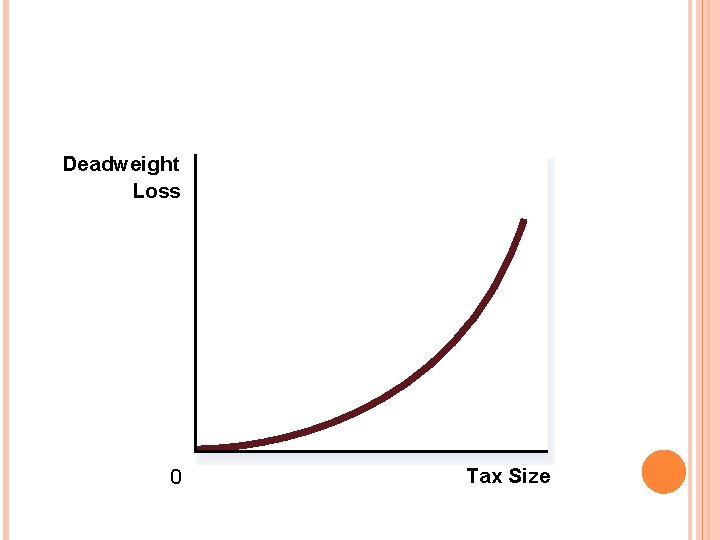

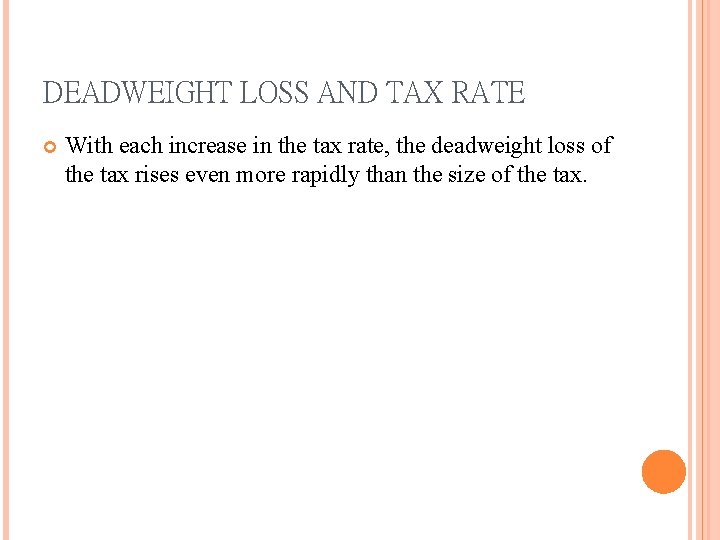

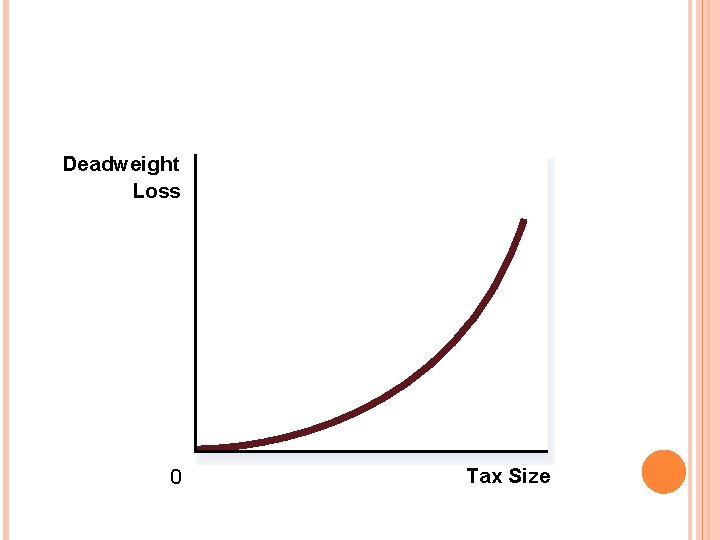

DEADWEIGHT LOSS AND TAX RATE With each increase in the tax rate, the deadweight loss of the tax rises even more rapidly than the size of the tax.

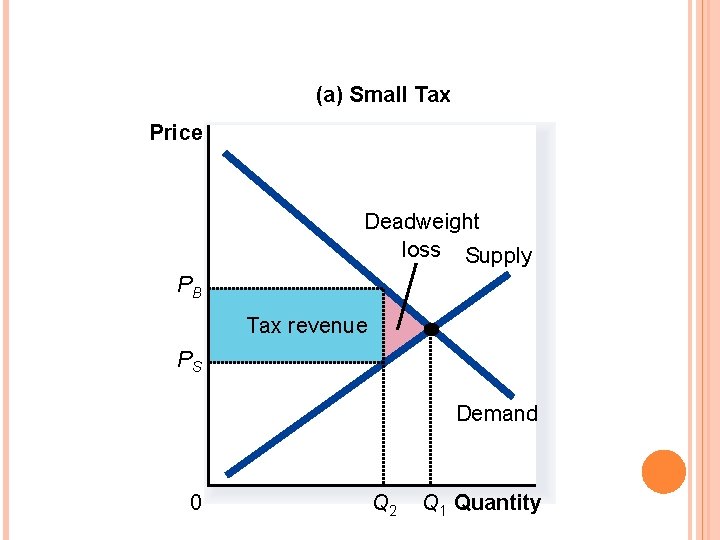

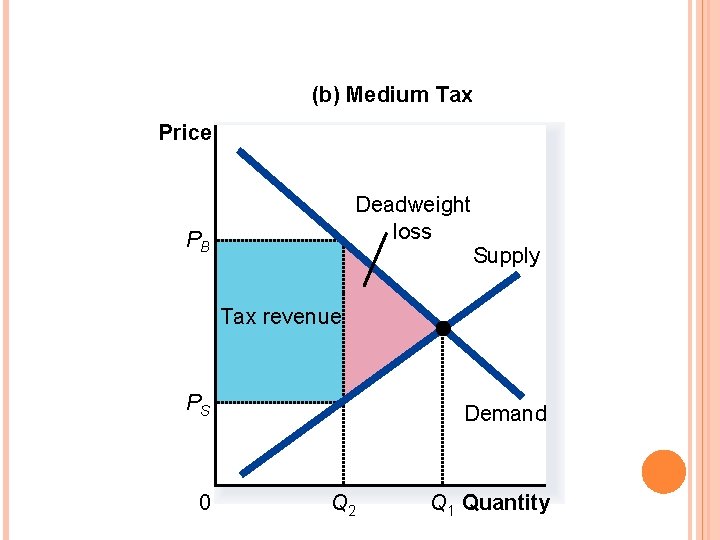

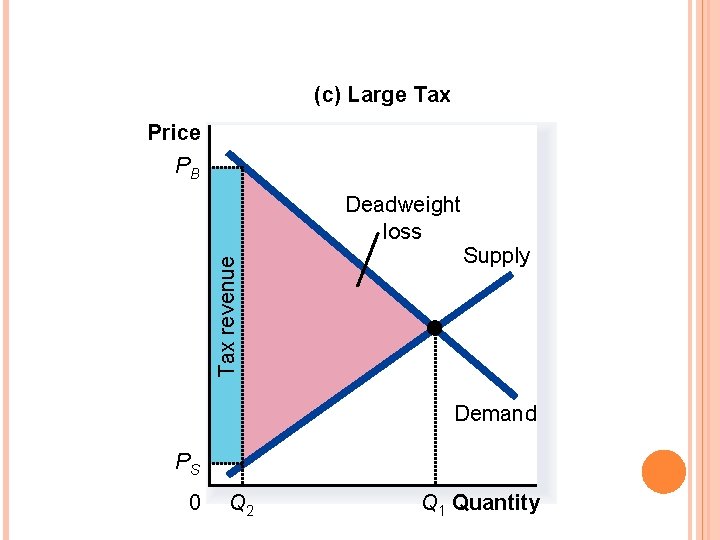

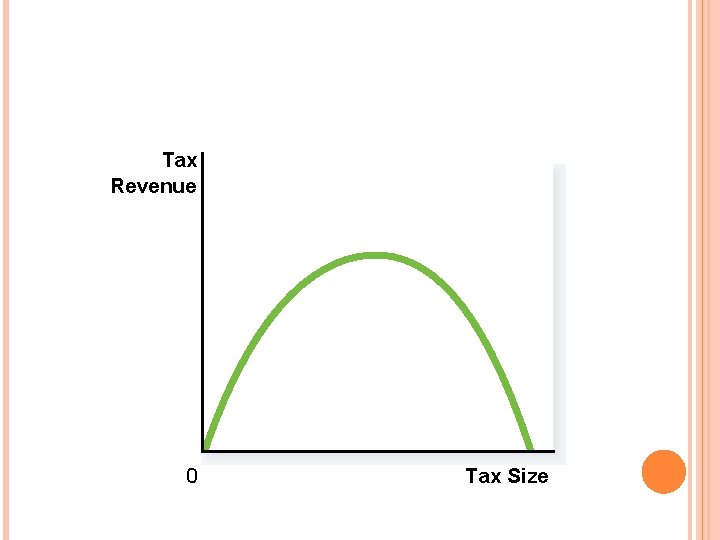

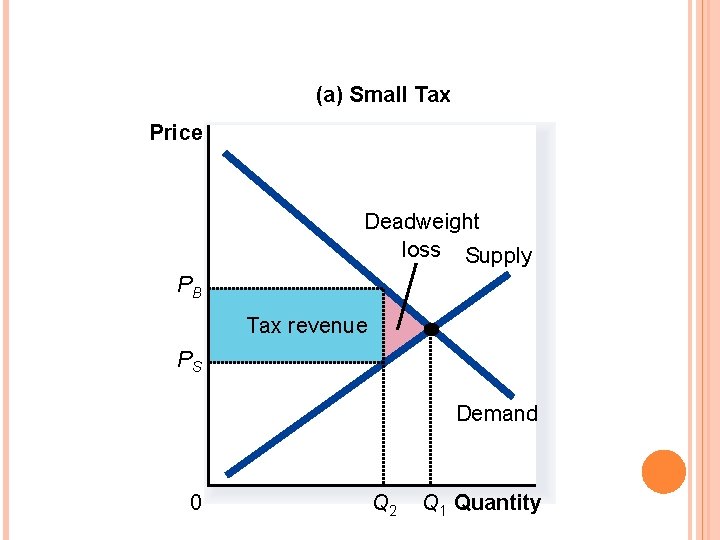

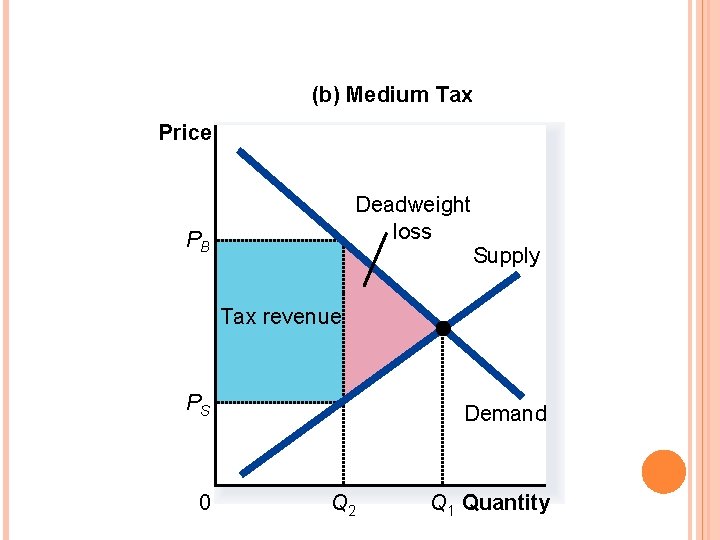

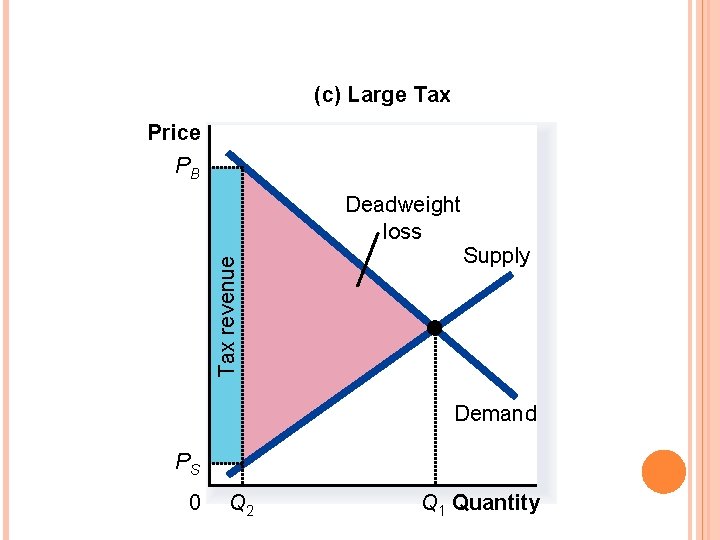

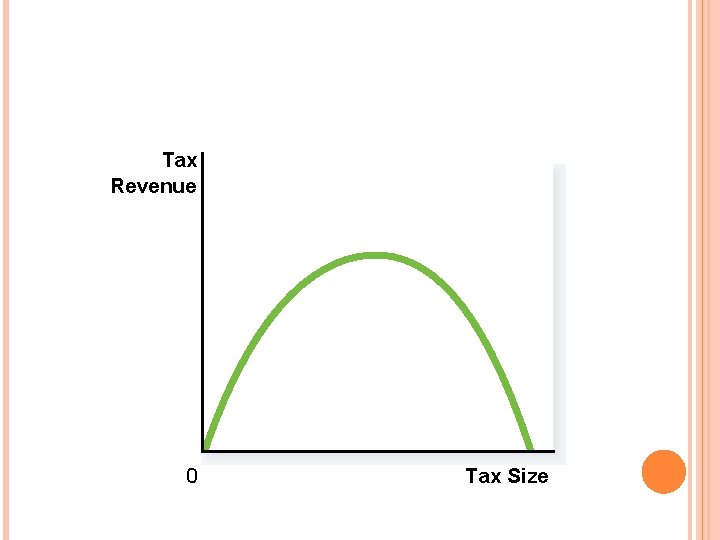

TAX REVENUE AND TAX RATE For the small tax, tax revenue is small. As the size of the tax rises, tax revenue grows. But as the size of the tax continues to rise, tax revenue falls because the higher tax reduces the size of the market.

FIGURE 6 DEADWEIGHT LOSS AND TAX REVENUE FROM THREE TAXES OF DIFFERENT SIZES (a) Small Tax Price Deadweight loss Supply PB Tax revenue PS Demand 0 Q 2 Q 1 Quantity Copyright © 2004 South-Western

FIGURE 6 DEADWEIGHT LOSS AND TAX REVENUE FROM THREE TAXES OF DIFFERENT SIZES (b) Medium Tax Price Deadweight loss PB Supply Tax revenue PS 0 Demand Q 2 Q 1 Quantity Copyright © 2004 South-Western

FIGURE 6 DEADWEIGHT LOSS AND TAX REVENUE FROM THREE TAXES OF DIFFERENT SIZES (c) Large Tax Price PB Tax revenue Deadweight loss Supply Demand PS 0 Q 2 Q 1 Quantity Copyright © 2004 South-Western

FIGURE 7 HOW DEADWEIGHT LOSS AND TAX REVENUE VARY WITH THE SIZE OF A TAX Deadweight Loss 0 Tax Size Copyright © 2004 South-Western

FIGURE 7 HOW DEADWEIGHT LOSS AND TAX REVENUE VARY WITH THE SIZE OF A TAX Tax Revenue 0 Tax Size Copyright © 2004 South-Western

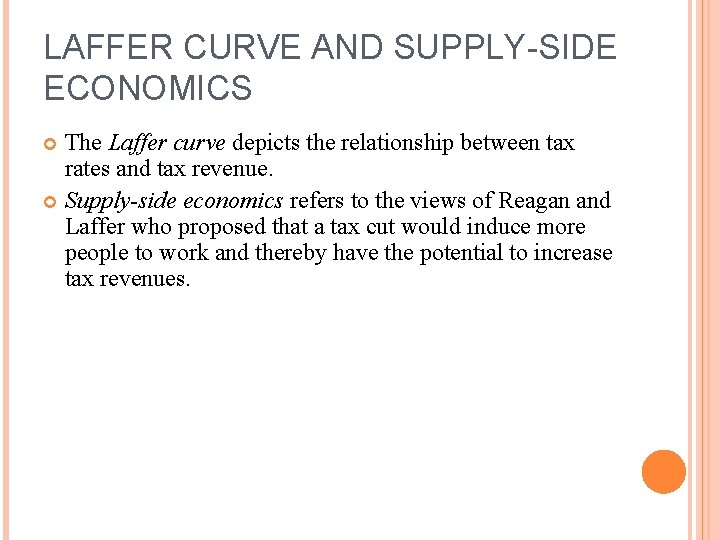

LAFFER CURVE AND SUPPLY-SIDE ECONOMICS The Laffer curve depicts the relationship between tax rates and tax revenue. Supply-side economics refers to the views of Reagan and Laffer who proposed that a tax cut would induce more people to work and thereby have the potential to increase tax revenues.

Etp pharmacy

Etp pharmacy California etp program

California etp program Strathclyde strategic themes

Strathclyde strategic themes Allocative efficiency in monopoly

Allocative efficiency in monopoly Price ceiling and deadweight loss

Price ceiling and deadweight loss Subsidy deadweight loss

Subsidy deadweight loss Subsidy deadweight loss

Subsidy deadweight loss Health externalities

Health externalities Deadweight loss tax

Deadweight loss tax Deadweight loss with positive externality

Deadweight loss with positive externality Monopoly pricing prevents some mutually beneficial

Monopoly pricing prevents some mutually beneficial Monopoly deadweight loss

Monopoly deadweight loss Producer

Producer Deadweight loss from tariff

Deadweight loss from tariff Deadweight loss tax

Deadweight loss tax Positive externality deadweight loss

Positive externality deadweight loss How to calculate deadweight loss

How to calculate deadweight loss Dead weight loss formula

Dead weight loss formula Deadweight loss in a monopoly

Deadweight loss in a monopoly Perfectly price discriminating monopoly

Perfectly price discriminating monopoly Hair loss 101

Hair loss 101 Managerial economics: theory, applications, and cases

Managerial economics: theory, applications, and cases Managerial economics applications strategy and tactics

Managerial economics applications strategy and tactics Scrap account

Scrap account Economics and business economics maastricht

Economics and business economics maastricht