18 th National Pension and Institutional Investor Summit

- Slides: 10

18 th National Pension and Institutional Investor Summit Tuesday, November 27, 2012 Panel: Role of hedge funds / direct or fund of funds Moderator: Dan O'Grady, AT&T, Inc. Panelists: Robert Mc. Cormish, Team. Co Advisers, LLC Tom Janisch, Asset Consulting Group J Germenis, Texas Treasury Safekeeping Trust Company “Enhancing Returns, Managing Risk” Combining Risk, Governance, and Return

The National Society of Institutional Investment Professionals– 2012 Summit November 27, 2012 © 2012 AT&T Intellectual Property. All rights reserved. AT&T and the AT&T logo are trademarks of AT&T Intellectual Property.

Panel Participants 3 Moderator: Daniel O’Grady, Executive Director AT&T, Inc. Panelist: J Germenis, Portfolio Manager Texas Treasury Safekeeping Trust Company Panelist: Tom Janisch, Director Asset Consulting Group Panelist: Robert Mc. Cormish, Senior Managing Director Team. Co Advisors, LLC © 2012 AT&T Intellectual Property. All rights reserved. AT&T and the AT&T logo are trademarks of AT&T Intellectual Property.

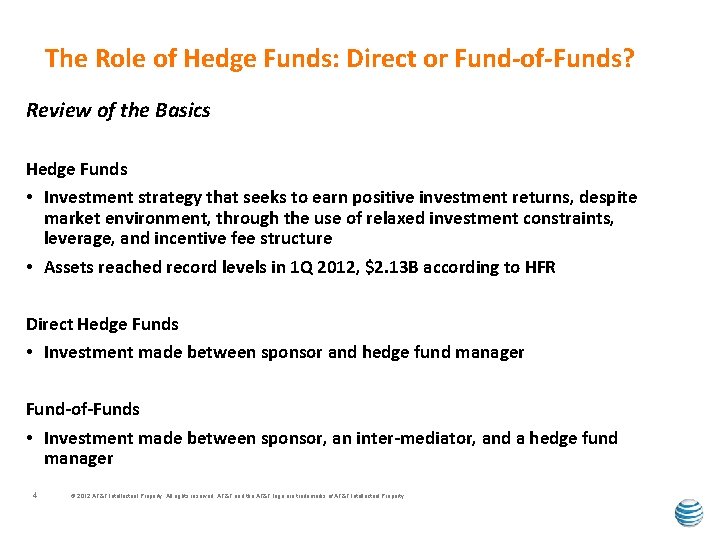

The Role of Hedge Funds: Direct or Fund-of-Funds? Review of the Basics Hedge Funds • Investment strategy that seeks to earn positive investment returns, despite market environment, through the use of relaxed investment constraints, leverage, and incentive fee structure • Assets reached record levels in 1 Q 2012, $2. 13 B according to HFR Direct Hedge Funds • Investment made between sponsor and hedge fund manager Fund-of-Funds • Investment made between sponsor, an inter-mediator, and a hedge fund manager 4 © 2012 AT&T Intellectual Property. All rights reserved. AT&T and the AT&T logo are trademarks of AT&T Intellectual Property.

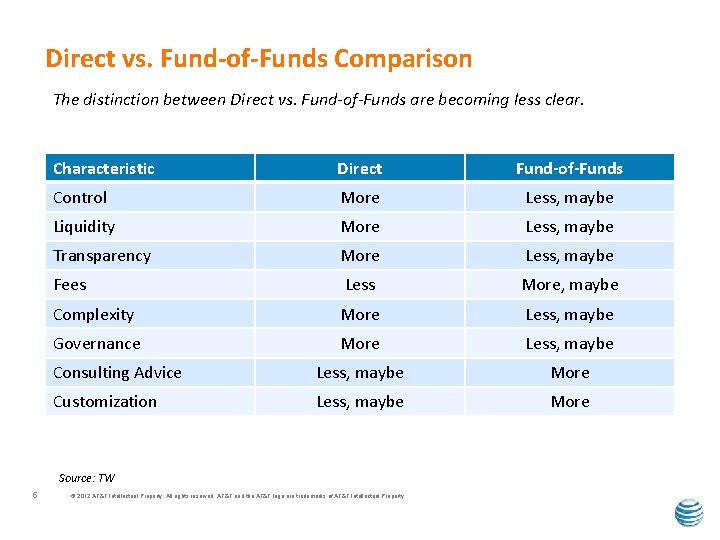

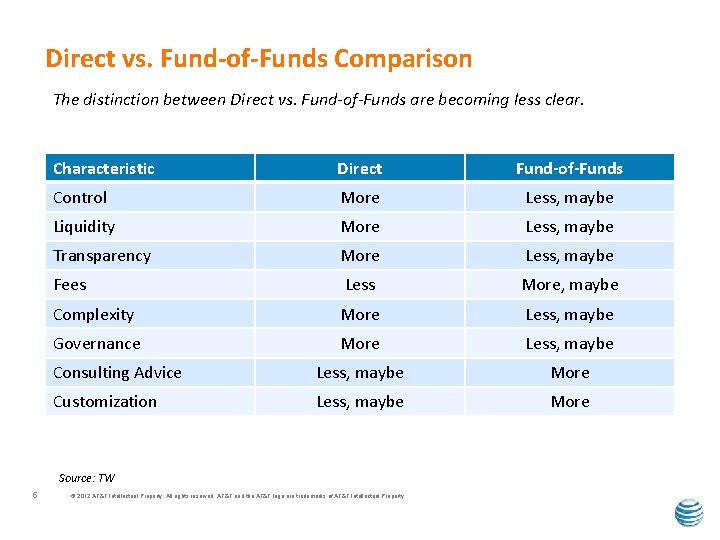

Direct vs. Fund-of-Funds Comparison The distinction between Direct vs. Fund-of-Funds are becoming less clear. Characteristic Direct Fund-of-Funds Control More Less, maybe Liquidity More Less, maybe Transparency More Less, maybe Fees Less More, maybe Complexity More Less, maybe Governance More Less, maybe Consulting Advice Less, maybe More Customization Less, maybe More Source: TW 5 © 2012 AT&T Intellectual Property. All rights reserved. AT&T and the AT&T logo are trademarks of AT&T Intellectual Property.

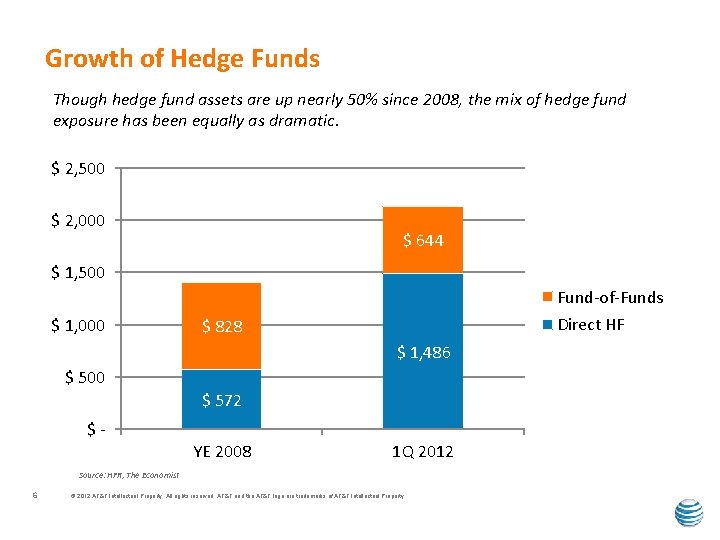

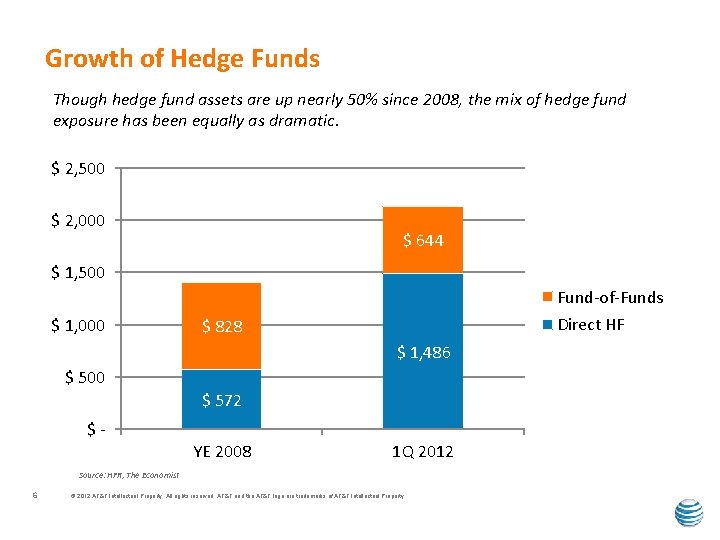

Growth of Hedge Funds Though hedge fund assets are up nearly 50% since 2008, the mix of hedge fund exposure has been equally as dramatic. $ 2, 500 $ 2, 000 $ 644 $ 1, 500 Fund-of-Funds $ 1, 000 Direct HF $ 828 $ 1, 486 $ 500 $ 572 $- YE 2008 1 Q 2012 Source: HFR, The Economist 6 © 2012 AT&T Intellectual Property. All rights reserved. AT&T and the AT&T logo are trademarks of AT&T Intellectual Property.

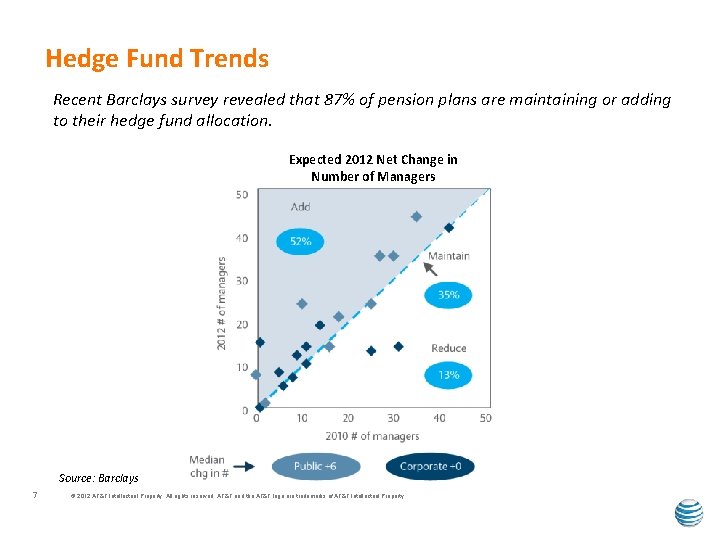

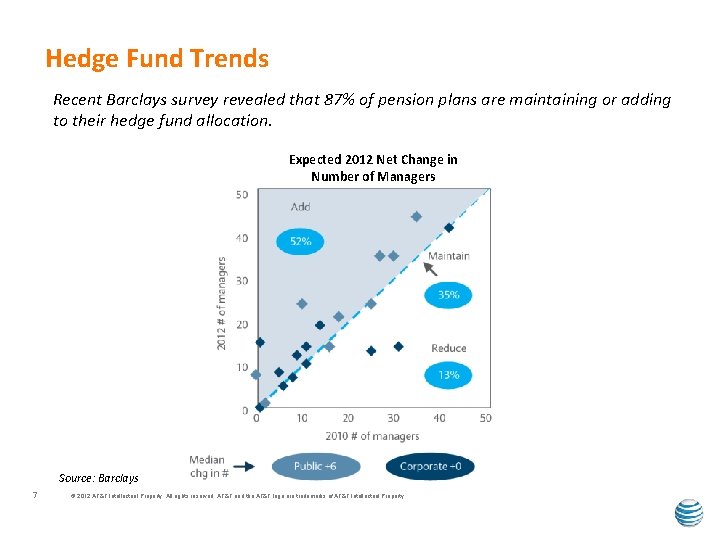

Hedge Fund Trends Recent Barclays survey revealed that 87% of pension plans are maintaining or adding to their hedge fund allocation. Expected 2012 Net Change in Number of Managers Source: Barclays 7 © 2012 AT&T Intellectual Property. All rights reserved. AT&T and the AT&T logo are trademarks of AT&T Intellectual Property.

Appendix 8 © 2012 AT&T Intellectual Property. All rights reserved. AT&T and the AT&T logo are trademarks of AT&T Intellectual Property.

Panel Questions • Given the differences between Direct and Fund-of-Funds may be blurring, how do you see the two offering value add business models for plan sponsors? • YTD October 2012, Dow Jones Credit Suisse Core Hedge Fund Index was up only +2. 03%, while the SP 500 was up 14. 29%. Given the disparity in returns, do you expect the trend in asset flows into HF to continue? § • A lot has been written on hedge fund replication strategies, how do you see plan sponsors adopting these strategies? § 9 Given your response, how do you see these flows impacting direct vs. fund-of-funds? Given your response, will it be in addition to Directs and Fund-of-Funds or in at the expense of one of the two? • According to a Barclay's study, nearly $300 B in hedge funds allocation is under advisement with consultants. Given the advisory role many Fund-of-Funds play, do you envision a symbiotic relationship between the two or a more Darwinian, winner-take-all model? • Given the allocation to hedge funds are up nearly 50% since 2008, while plan sponsors’ staff size is not, how do you see plan sponsors coping with the additional burden of managing hedge funds relative to their traditional asset classes? • Do you think hedge fund returns are more alpha or beta? Who is better equipped to allocate to hedge funds that derive more of their return from alpha, plan sponsors with Direct or through the use of Fundof-Funds? • Do certain hedge fund styles lend itself to fund-of-funds, such as reinsurance, over Direct? © 2012 AT&T Intellectual Property. All rights reserved. AT&T and the AT&T logo are trademarks of AT&T Intellectual Property.

18 th National Pension and Institutional Investor Summit Tuesday, November 27, 2012 Panel: Role of hedge funds / direct or fund of funds Moderator: Dan O'Grady, AT&T, Inc. Panelists: Robert Mc. Cormish, Team. Co Advisers, LLC Tom Janisch, Asset Consulting Group J Germenis, Texas Treasury Safekeeping Trust Company “Enhancing Returns, Managing Risk” Combining Risk, Governance, and Return

Commuted pension vs uncommuted pension

Commuted pension vs uncommuted pension Iam national pension fund

Iam national pension fund Institutions supporting entrepreneurship

Institutions supporting entrepreneurship Roles and importance of institutional investors

Roles and importance of institutional investors National unification and the national state

National unification and the national state Sppa pension

Sppa pension Rtd/atu 1001 pension plan

Rtd/atu 1001 pension plan Pension master trust

Pension master trust Projected benefit obligation

Projected benefit obligation Nmdc post retirement medical scheme

Nmdc post retirement medical scheme Www totalrewardstatements nhs uk

Www totalrewardstatements nhs uk