Principles of Macroeconomics Spring 2010 Dr Andrew L

- Slides: 15

Principles of Macroeconomics Spring 2010 Dr. Andrew L. H. Parkes “A Macroeconomic Understanding for use in Business” May 13, 2010 Principles of Macroeconomics, Day 14 卜安吉

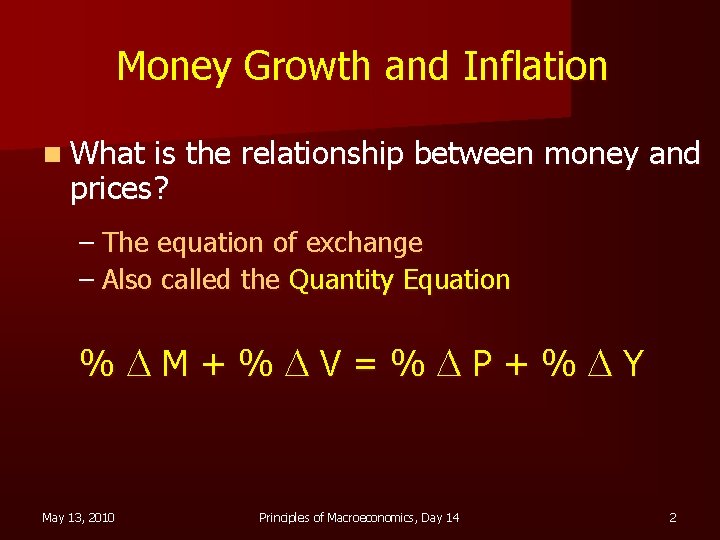

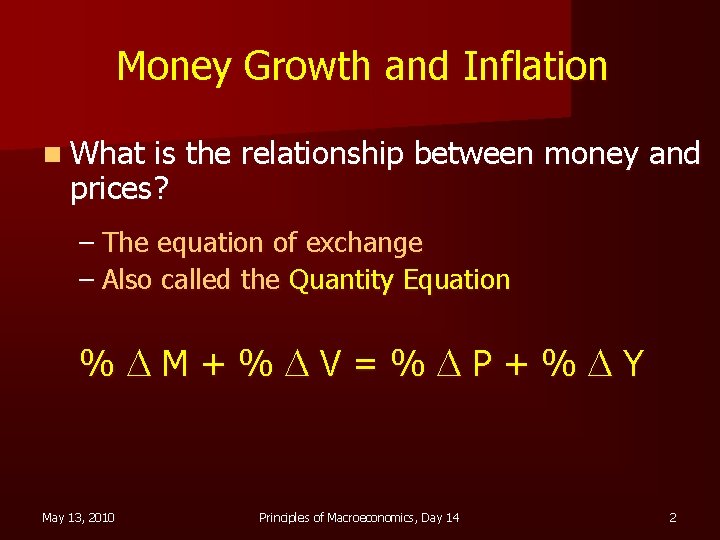

Money Growth and Inflation n What is the relationship between money and prices? – The equation of exchange – Also called the Quantity Equation %DM+%DV=%DP+%DY May 13, 2010 Principles of Macroeconomics, Day 14 2

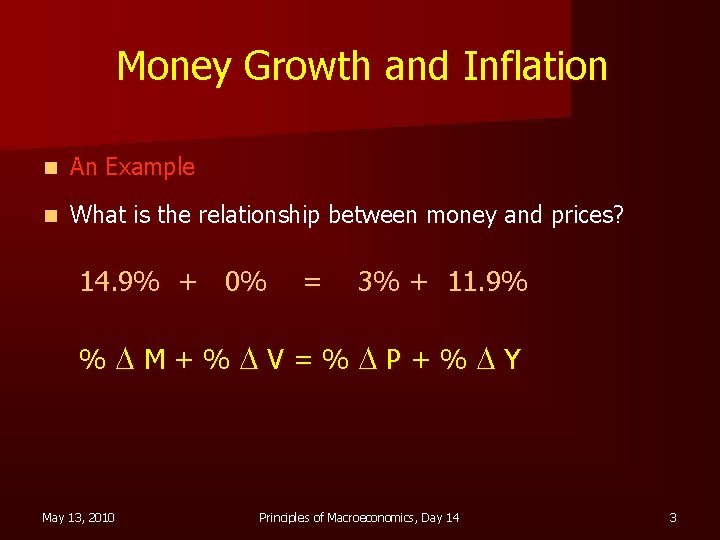

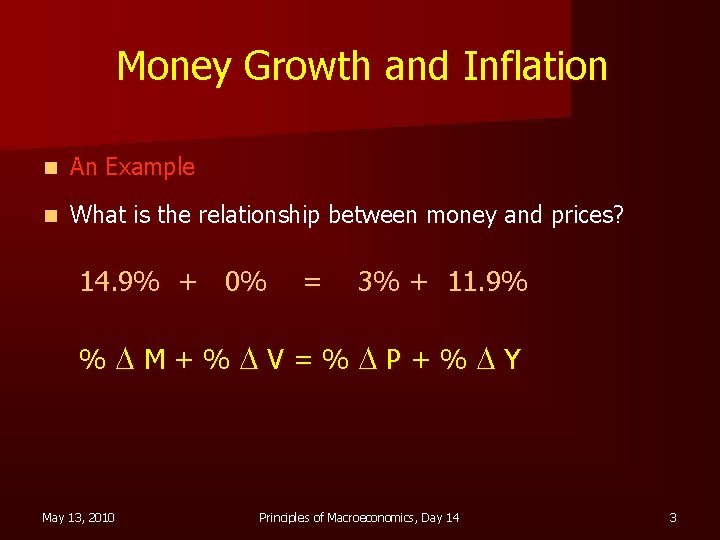

Money Growth and Inflation n An Example n What is the relationship between money and prices? 14. 9% + 0% = 3% + 11. 9% %DM+%DV=%DP+%DY May 13, 2010 Principles of Macroeconomics, Day 14 3

The Velocity of Money How many times does money change hands? OR How often does the same 10 yuan bill go through your hands? May 13, 2010 Principles of Macroeconomics, Day 14 4

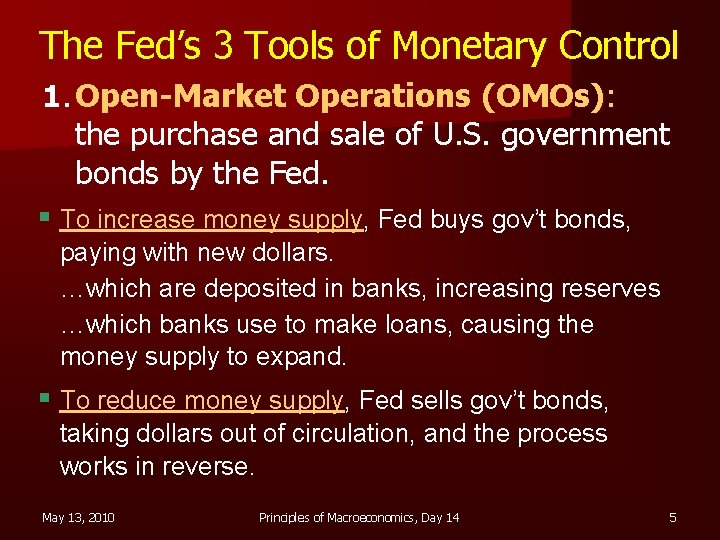

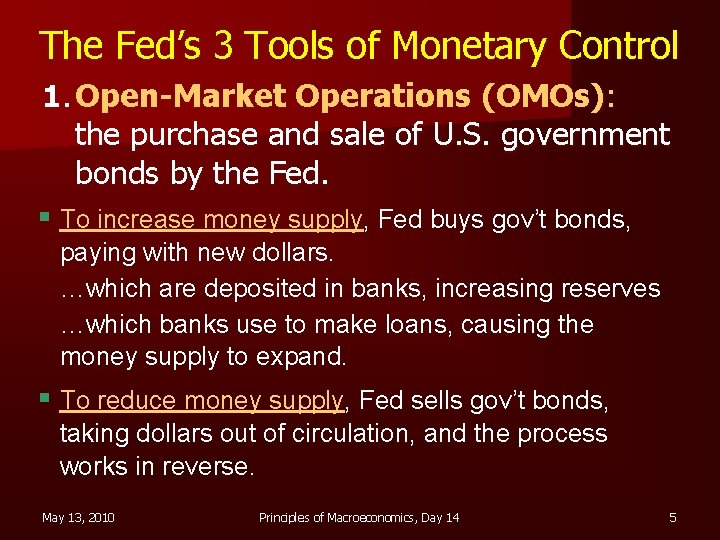

The Fed’s 3 Tools of Monetary Control 1. Open-Market Operations (OMOs): the purchase and sale of U. S. government bonds by the Fed. § To increase money supply, Fed buys gov’t bonds, paying with new dollars. …which are deposited in banks, increasing reserves …which banks use to make loans, causing the money supply to expand. § To reduce money supply, Fed sells gov’t bonds, taking dollars out of circulation, and the process works in reverse. May 13, 2010 Principles of Macroeconomics, Day 14 5

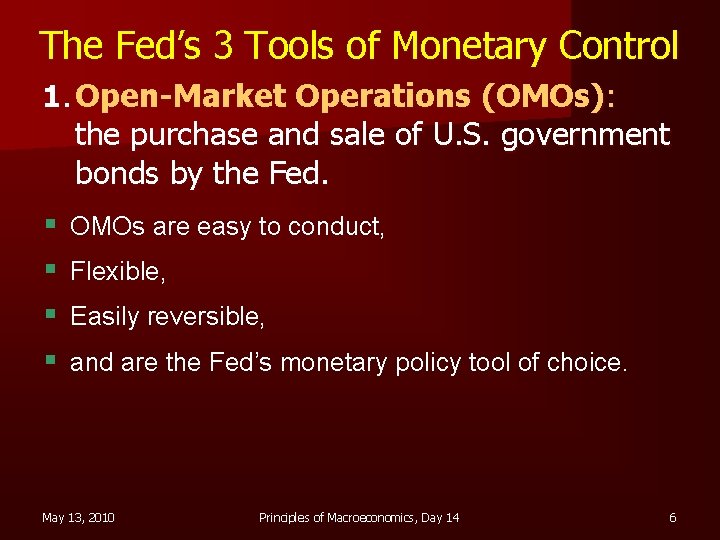

The Fed’s 3 Tools of Monetary Control 1. Open-Market Operations (OMOs): the purchase and sale of U. S. government bonds by the Fed. § § OMOs are easy to conduct, Flexible, Easily reversible, and are the Fed’s monetary policy tool of choice. May 13, 2010 Principles of Macroeconomics, Day 14 6

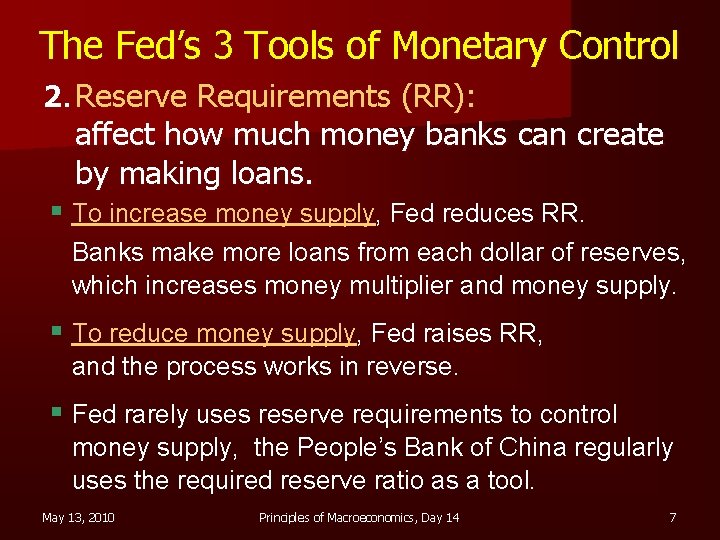

The Fed’s 3 Tools of Monetary Control 2. Reserve Requirements (RR): affect how much money banks can create by making loans. § To increase money supply, Fed reduces RR. Banks make more loans from each dollar of reserves, which increases money multiplier and money supply. § To reduce money supply, Fed raises RR, and the process works in reverse. § Fed rarely uses reserve requirements to control money supply, the People’s Bank of China regularly uses the required reserve ratio as a tool. May 13, 2010 Principles of Macroeconomics, Day 14 7

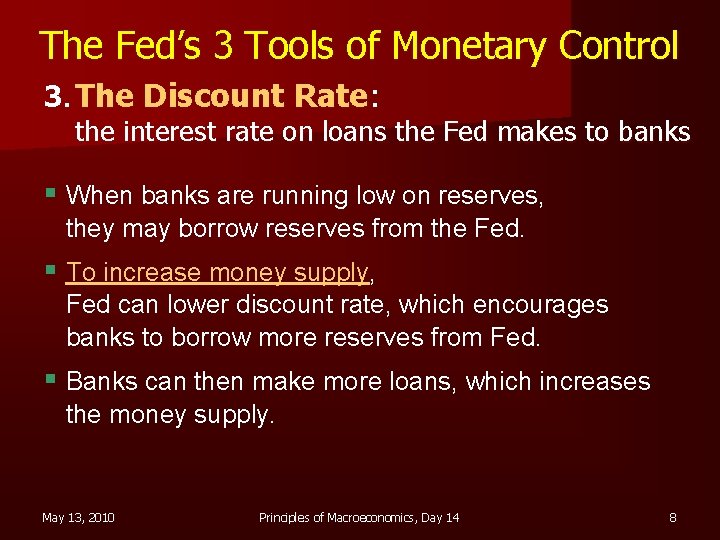

The Fed’s 3 Tools of Monetary Control 3. The Discount Rate: the interest rate on loans the Fed makes to banks § When banks are running low on reserves, they may borrow reserves from the Fed. § To increase money supply, Fed can lower discount rate, which encourages banks to borrow more reserves from Fed. § Banks can then make more loans, which increases the money supply. May 13, 2010 Principles of Macroeconomics, Day 14 8

The Fed’s 3 Tools of Monetary Control 3. The Discount Rate: the interest rate on loans the Fed makes to banks § To reduce money supply, Fed can raise discount rate. § The Fed uses discount lending to provide extra liquidity when financial institutions are in trouble, e. g. after the Oct. 1987 stock market crash. § If no crisis, Fed rarely uses discount lending – Fed is a “lender of last resort. ” May 13, 2010 Principles of Macroeconomics, Day 14 9

The Federal Funds Rate n On any given day, banks with insufficient reserves can borrow from banks with excess reserves. n The interest rate on these loans is the federal funds rate. n The FOMC uses OMOs to target the fed funds rate. n Many interest rates are highly correlated, so changes in the fed funds rate cause changes in other rates and have a big impact in the economy. May 13, 2010 Principles of Macroeconomics, Day 14 10

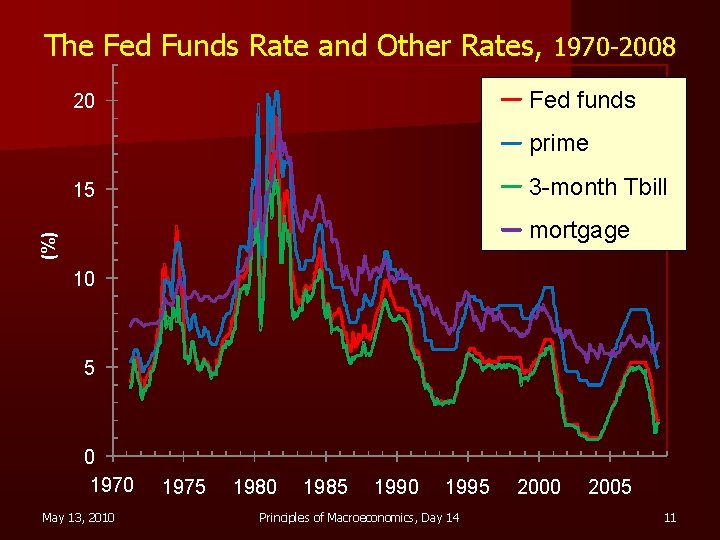

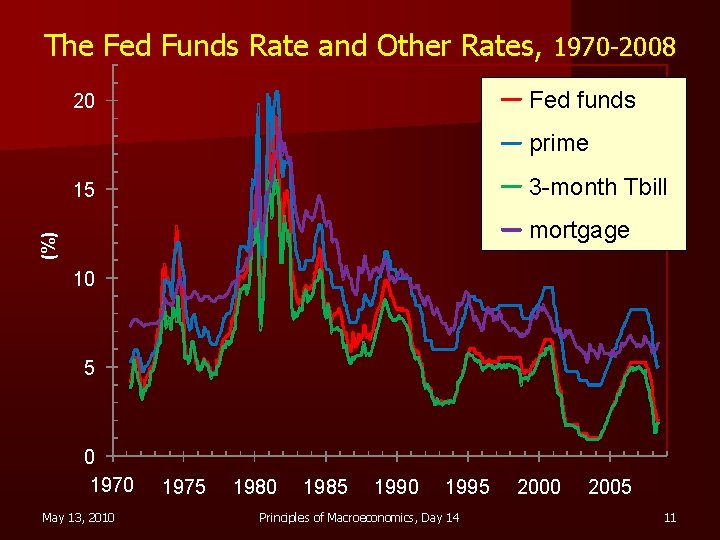

The Fed Funds Rate and Other Rates, 1970 -2008 Fed funds 20 prime 3 -month Tbill 15 (%) mortgage 10 5 0 1970 May 13, 2010 1975 1980 1985 1990 1995 Principles of Macroeconomics, Day 14 2000 2005 11

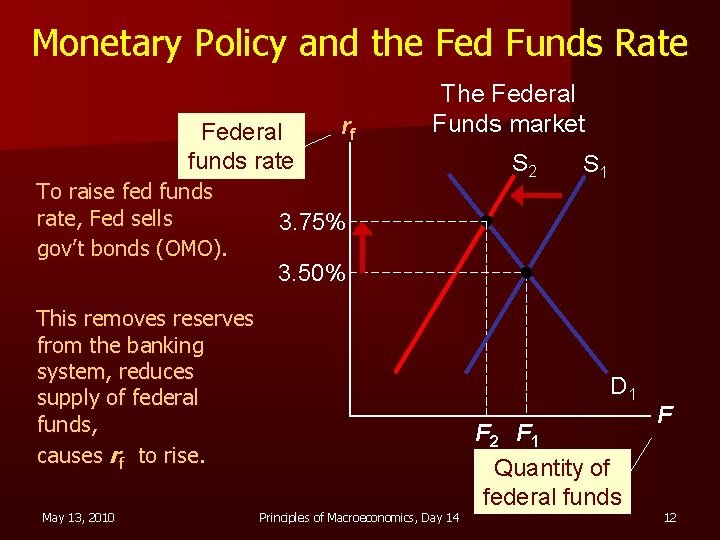

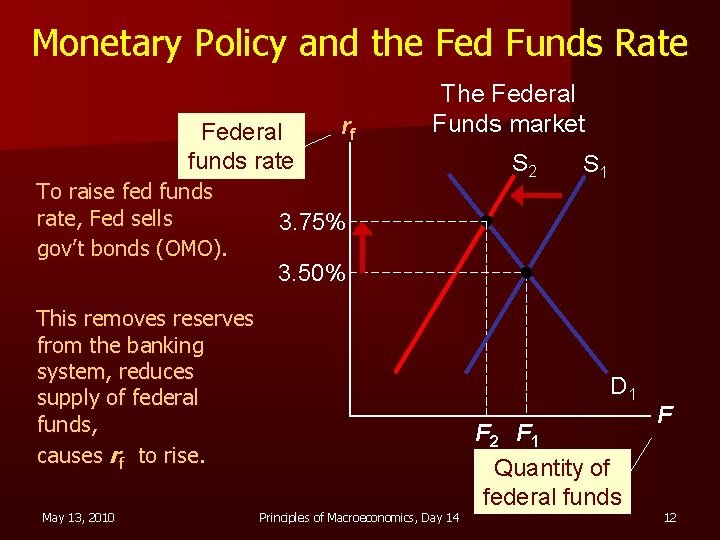

Monetary Policy and the Fed Funds Rate Federal funds rate To raise fed funds rate, Fed sells gov’t bonds (OMO). rf The Federal Funds market S 1 3. 75% 3. 50% This removes reserves from the banking system, reduces supply of federal funds, causes rf to rise. May 13, 2010 S 2 D 1 F 2 F 1 Quantity of federal funds Principles of Macroeconomics, Day 14 F 12

Problems Controlling the Money Supply n If households hold more of their money as currency, banks have fewer reserves, make fewer loans, and money supply falls. n If banks hold more reserves than required, they make fewer loans, and money supply falls. n Yet, Fed can compensate for household and bank behavior to retain fairly precise control over the money supply. May 13, 2010 Principles of Macroeconomics, Day 14 13

Bank Runs and the Money Supply n A run on banks: When people suspect their banks are in trouble, they may “run” to the bank to withdraw their funds, holding more currency and less deposits. n Under fractional-reserve banking, banks don’t have enough reserves to pay off ALL depositors, hence banks may have to close (illiquidity). n Also, banks may make fewer loans and hold more reserves to satisfy depositors. n These events increase R, reverse the process of money creation, cause money supply to fall. May 13, 2010 Principles of Macroeconomics, Day 14 14

Bank Runs and the Money Supply n n During 1929 -1933, a wave of bank runs and bank closings caused money supply to fall 28%. Many economists believe this contributed to the severity of the Great Depression. Since then, federal deposit insurance has helped prevent bank runs in the U. S. In the U. K. , though, Northern Rock bank experienced a classic bank run in 2007 and was eventually taken over by the British government. May 13, 2010 Principles of Macroeconomics, Day 14 15

Ap macroeconomics frq 2010

Ap macroeconomics frq 2010 Principles of macroeconomics case fair oster

Principles of macroeconomics case fair oster Kim ki duk spring summer fall winter

Kim ki duk spring summer fall winter Spring winter summer fall months

Spring winter summer fall months Unidroit principles 2010

Unidroit principles 2010 System of national accounting

System of national accounting Macroeconomics

Macroeconomics Crowding out effect macroeconomics

Crowding out effect macroeconomics Crowding out effect macroeconomics

Crowding out effect macroeconomics Contractionary money policy

Contractionary money policy Definition managerial economics

Definition managerial economics Unemployment diagram

Unemployment diagram Example microeconomics

Example microeconomics Nominal gdp

Nominal gdp New classical macroeconomics

New classical macroeconomics New classical macroeconomics

New classical macroeconomics