International Money Finance Chapter 5 The Eurocurrency Market

- Slides: 22

International Money & Finance Chapter 5: The Eurocurrency Market Michael Melvin and Stefan Norrbin

Outline of the Chapter �What is Eurocurrency market? �Reasons for offshore banking �Interest rate spreads and risk �LIBOR �International banking facilities �Offshore banking practices

What is Eurocurrency Market? �Eurocurrency market – a market in which international credit, deposits, and loans are exchanged, in a currency other than the domestic currency. �Eurobanks – banks that accepts these deposits and make loans. ◦ Example: Citibank in Aruba that accepts dollar deposits and make loans in dollars is referred to as a eurobank. �Note that the prefix “Euro” is just a historical nature. The eurocurrency market was initially started in Europe. ◦ European banks wanted to lend and deposit in U. S. dollars.

Eurocurrency �Funds deposited in a bank when those funds are denominated in a currency differing from the bank's own domestic currency. �Thus, if a Japanese company deposits yen in a Canadian bank, the yen will be considered Eurocurrency �Example: ◦ Eurodollar = dollar bank accounts outside the U. S. ◦ Euroyen = yen bank accounts outside Japan. ◦ Euroeuro = euro bank account outside the Eurozone.

History of Eurocurrency Market � Market originated in the 1950 s, when communist governments (mainly the Soviet Union) needed dollars for international trade and concerned about a potential freeze of their dollar accounts in US banks, shifted their deposits to London. � Due to political tension and economic boundaries, many people around the globe were looking for ways to avoid regulatory costs and restrictions set by the government. � In the 1960 s and 1970 s, US banks established offshore branches to escape US regulations and to make eurocurrency loans. � Specifically, these restrictions involved: special charges and taxes on domestic banking; requirements to lend money to certain borrowers at concessionary rates; interest rate ceilings; rules that prevented competition among banks; and reserve requirements.

The currency composition of the Eurocurrency market (2010) Europound 5% Euroyen 3% Others 13% Euroeuro 21% Source: Bank of International Settlements Eurodollar 58%

The major offshore financial center � Offshore Financial Center – countries that contain financial institutions that deal primarily with nonresidents and/or in foreign currency. � The host country usually grants complete freedom from hostcountry governmental banking regulations. � They are usually characterized by a low (or zero) tax environment and specializing in providing corporate and commercial services to non-resident entities on a confidential basis. � Example: The Bahamas Hong Kong Bahrain Bermuda The Cayman Islands Mauritius The Netherlands Antilles Panama Singapore Switzerland

Reasons for Offshore Banking �To avoid high costs of banking from domestic regulations. ◦ Ex: U. S. banks are required to hold required reserves, while the Eurobanks are unregulated and can hold much smaller reserves than their U. S. counterparts. The U. S. banks outside the U. S. can offer higher interest on deposits and lower interest on loans. �This does not mean that the countries hosting the Eurobanks do not have regulations. ◦ They do. �However, they have two sets of banking rules. ◦ More strict rules on banking in the domestic currency, whereas banking in foreign currencies are unregulated.

Definition: Spread – the difference between the deposit and loan interest rates. � The Eurobanks can offer narrower spread than their counterparts. � Ex. Citibank in Aruba can offer narrower interest rate spread on dollar banking than Citibank in New York. � Spread ◦ Lower rate on dollar loan the NY branch. ◦ Higher rate on dollar deposits than the NY branch.

Example: Deposit rates comparison (April 3, 2012)

Reasons for narrower spread � Without these differences, Citibank in Aruba would not exist. � Your dollar deposits in Aruba is considered riskier than dollar deposits in NY, because the Aruba branch does not have Federal deposit insurance and government supervision. Thus, to attract people to deposit at the Aruba branch, Citibank has to offer higher deposit rate than in the U. S. branch. � In terms of interest rate on loans, if Citibank in Aruba offers identical interest rate on a loan as in the NY branch, you would be less likely to take out a loan from the Aruba branch. � To attract borrowers, Citibank in Aruba will have to offer lower interest rate on a loan than in the NY branch.

More Reasons for Offshore Banking �To avoid interest rate controls and government-mandated credit allocations. �To avoid capital controls, such as quotas on foreign lending and deposits, and taxes on capital flows. �To avoid a threat to private property right (Ex: if the government threatens to confiscate foreign deposits). �To access more competitive banking. There is no restriction on entry of new banks in the external markets.

LIBOR �LIBOR = London Interbank Offered Rate = interest rate that a group of large London banks can borrow from each other each morning. �LIBOR world. is the most important interest rate in the ◦ Loans if $10 trillion and swaps contracts of $350 trillion around the world are directly tied to the LIBOR. ◦ Half of the U. S. adjustable mortgage rates are tied to LIBOR. � LIBOR is important because it is used by banks to scale loan rates (i. e. , as a benchmark rate) to clients.

How is LIBOR set? �Each morning a panel of banks submit their LIBOR data to the British Bankers’ Association (BBA). �BBA averages that data and sets a value of LIBOR each day at 11 a. m. of London time for each major currency. ◦ 10 currencies ◦ 15 maturities: overnight to 12 months. �Recently, there has been some questions about whether banks have tried to fix the LIBOR. �Since the number of participants are small, banks may have colluded in setting the LIBOR.

Example: LIBOR on April 3, 2012 Euro, US dollar, and Japanese yen � The US Dollar LIBOR interest rate is the average interbank interest rate at which a number of banks on the London money market are prepared to lend to one another in US Dollars.

Offshore Banking Practice: How to measure the net size of the Eurocurrency market? � Measuring the actual size of the Eurocurrency market can be difficult because a distinction needs to be made between the gross and net size of the Eurocurrency market. ◦ The gross measure includes both non-Eurobank and interbank deposits. ◦ The net measure excludes interbank deposits. � The gross measure gives an idea about the overall activity in the Euromarkets, while the net measure gives a better indication concerning the ability of the Eurobanking system to create credit. � If we only look at the total activities in the market, we would overstate the actual amount of activities. � The net size of the Eurocurrency market activity = the total deposits (or total loans) minus the interbank activity.

Example: Gross vs. net volume of Eurodollar activity �Suppose that IBM (American firm) in New York shifts $1 million from its U. S. bank to a Eurobank A (in Aruba) to get higher deposit rate.

Example: Gross vs. net volume of Eurodollar activity � Now suppose that Eurobank A deposits the $1 million with Eurobank B (in Bermuda).

Example: Gross vs. net volume of Eurodollar activity � Finally, suppose that Eurobank B makes a $1 million loan to BMW in Germany.

Example: Gross vs. net volume of Eurodollar activity � The total deposits in Eurobank =$2 million ($1 million from Eurobank A and $1 million from Eurobank B). � The net deposits = $2 million - $1 million (from interbank deposit between Eurobank A and Eurobank B) = $1 million. � This $1 million is the value of credit actually intermediated to nonbank borrowers.

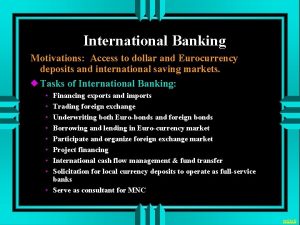

International Banking Facilities (IBFs) �In 1981, the Federal Reserve allowed U. S. banks to engage in a special type of Eurobanking activity on the U. S. soil. � International banking facilities (IBFs) allow depository institutions in the United States to offer services to foreign residents and institutions free of some Federal Reserve requirements and some state and local income taxes. � IBFs enable U. S. institutions to compete more effectively foreign-source deposits and loan business. � Banks may conduct their IBF activities in their existing quarters, but they must maintain separate IBF books.

Summary � � � � The Eurocurrency market is a banking market where commercial banks accept deposits and extend loans in a currency other than the domestic currency. The Eurodollar, the U. S. dollar-denominated deposits and loans outside the U. S. , has the highest volume of activity among other currency offshore banking. Compared to domestic banks, the Eurobanks have lower operating costs and are not regulated. Therefore, they are able to offer narrower spread than domestic banks. The Eurocurrency market improves efficiency of international financial market. Efficiency comes from access to low-cost borrowing, lack of government regulations, and strong competition among the Eurobanks. LIBOR is an important interest rate that is used as a benchmark interest rate to set loan rates. International banking facilities (IBFs) are divisions in U. S. banks that are permitted to engage in Eurocurrency type banking in dollars with foreign residents. The net size of the Eurodollar market measures the amount of credit actually extended to nonbanks.

Eurocurrency market definition

Eurocurrency market definition Dana damian

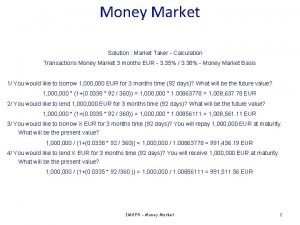

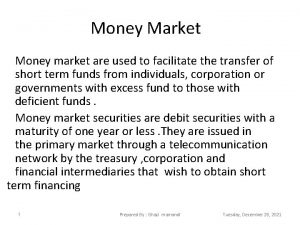

Dana damian Money market

Money market Conclusion of money market

Conclusion of money market Market follower

Market follower Segmentation levels

Segmentation levels Personal finance basics and the time value of money

Personal finance basics and the time value of money Symbols that represent jay gatsby

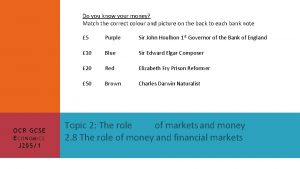

Symbols that represent jay gatsby Money smart money match

Money smart money match Money on money multiple

Money on money multiple Old money vs new money

Old money vs new money Context of the great gatsby

Context of the great gatsby Chapter 8 the international market selection process

Chapter 8 the international market selection process Large-scale strategic commitments may

Large-scale strategic commitments may Market entry modes for international businesses chapter 7

Market entry modes for international businesses chapter 7 International finance syllabus

International finance syllabus International business finance and economics

International business finance and economics Certificate in international trade and finance citf

Certificate in international trade and finance citf Nature of international finance

Nature of international finance Finance function in multinational firm

Finance function in multinational firm Logo lembaga keuangan

Logo lembaga keuangan Goals of international finance

Goals of international finance The current system of international finance is a *

The current system of international finance is a *