Import Finance Solution To xxxx Group of Companies

- Slides: 9

Import Finance Solution To: xxxx Group of Companies

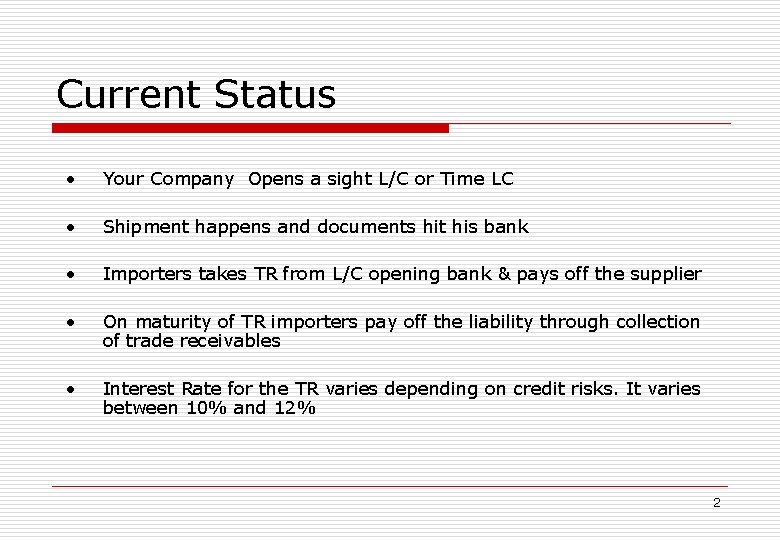

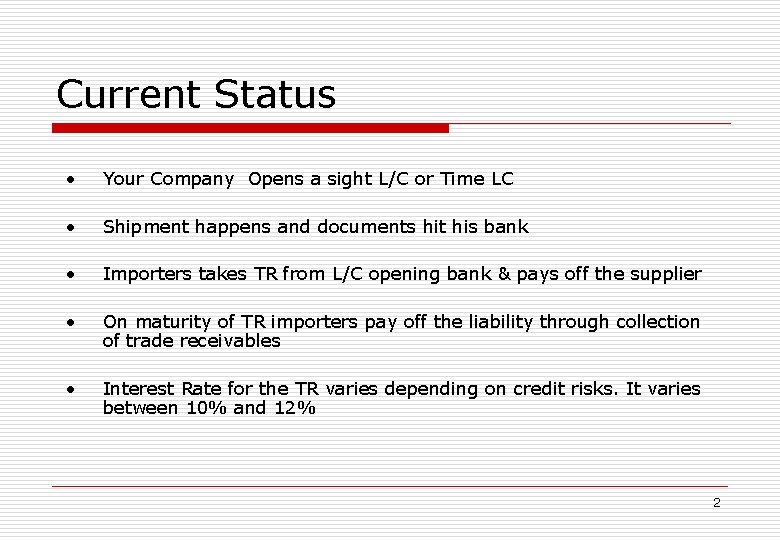

Current Status • Your Company Opens a sight L/C or Time LC • Shipment happens and documents hit his bank • Importers takes TR from L/C opening bank & pays off the supplier • On maturity of TR importers pay off the liability through collection of trade receivables • Interest Rate for the TR varies depending on credit risks. It varies between 10% and 12% 2

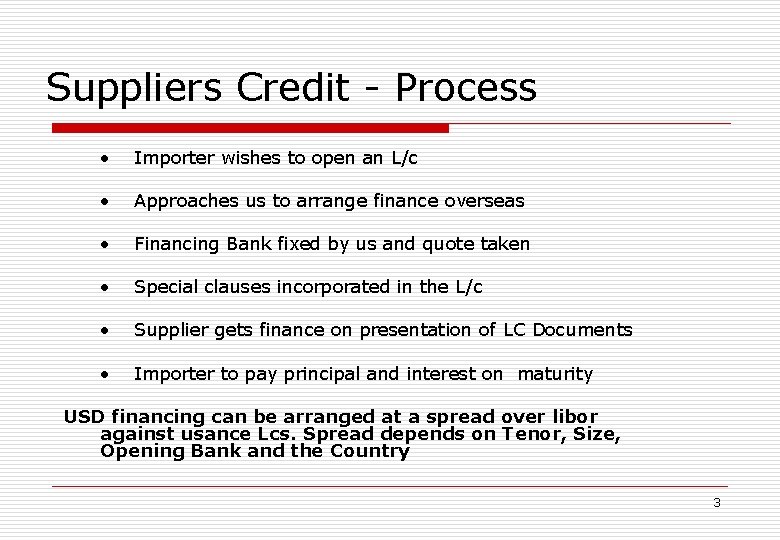

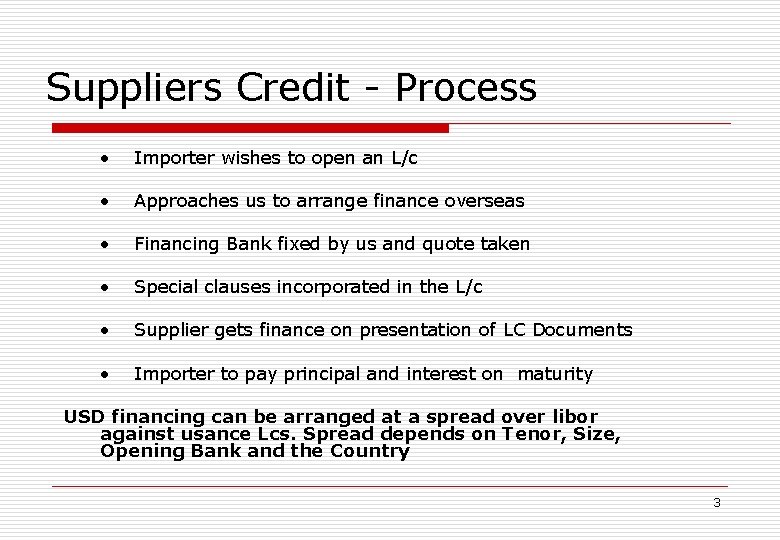

Suppliers Credit - Process • Importer wishes to open an L/c • Approaches us to arrange finance overseas • Financing Bank fixed by us and quote taken • Special clauses incorporated in the L/c • Supplier gets finance on presentation of LC Documents • Importer to pay principal and interest on maturity USD financing can be arranged at a spread over libor against usance Lcs. Spread depends on Tenor, Size, Opening Bank and the Country 3

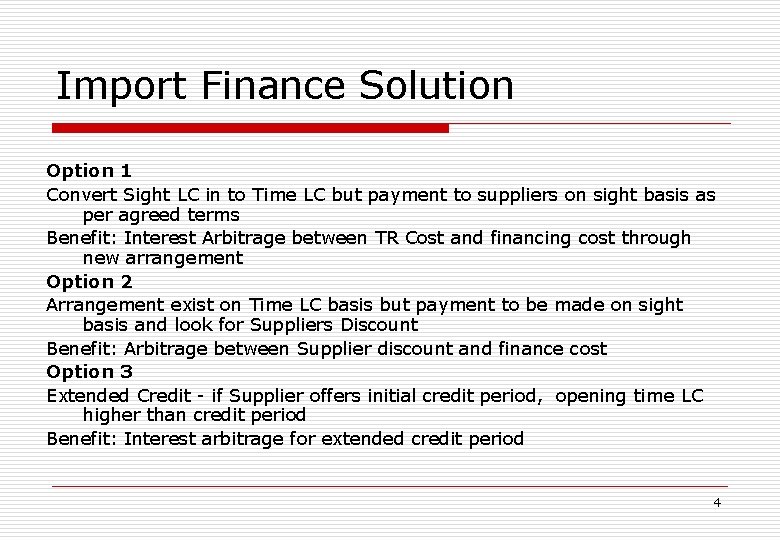

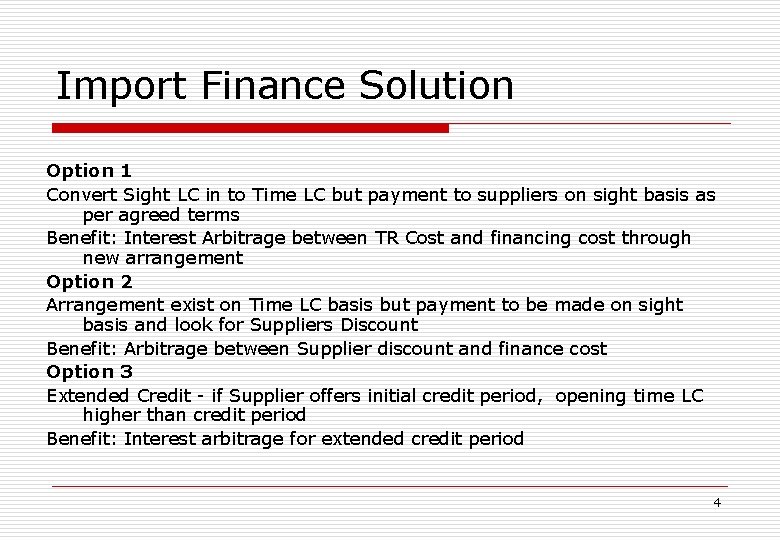

Import Finance Solution Option 1 Convert Sight LC in to Time LC but payment to suppliers on sight basis as per agreed terms Benefit: Interest Arbitrage between TR Cost and financing cost through new arrangement Option 2 Arrangement exist on Time LC basis but payment to be made on sight basis and look for Suppliers Discount Benefit: Arbitrage between Supplier discount and finance cost Option 3 Extended Credit - if Supplier offers initial credit period, opening time LC higher than credit period Benefit: Interest arbitrage for extended credit period 4

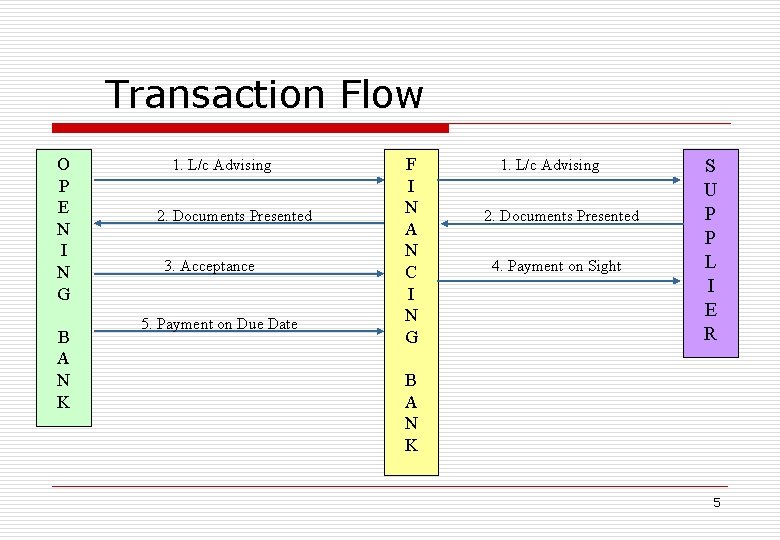

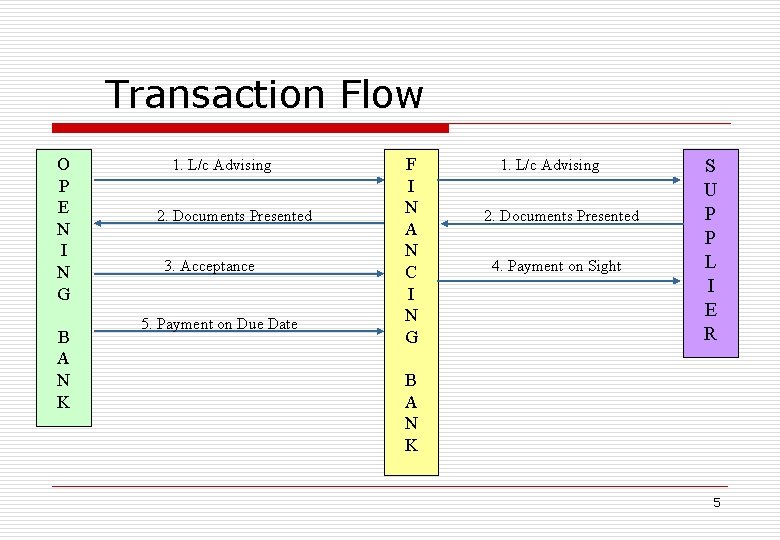

Transaction Flow O P E N I N G B A N K 1. L/c Advising 2. Documents Presented 3. Acceptance 5. Payment on Due Date F I N A N C I N G 1. L/c Advising 2. Documents Presented 4. Payment on Sight S U P P L I E R B A N K 5

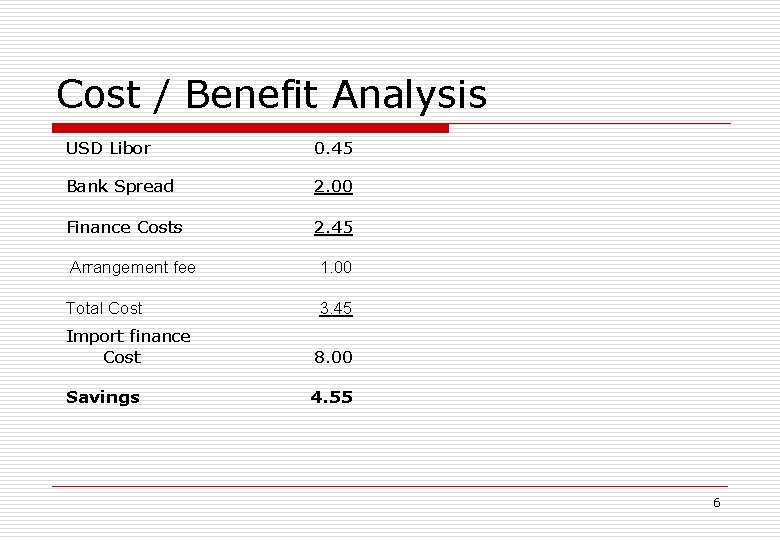

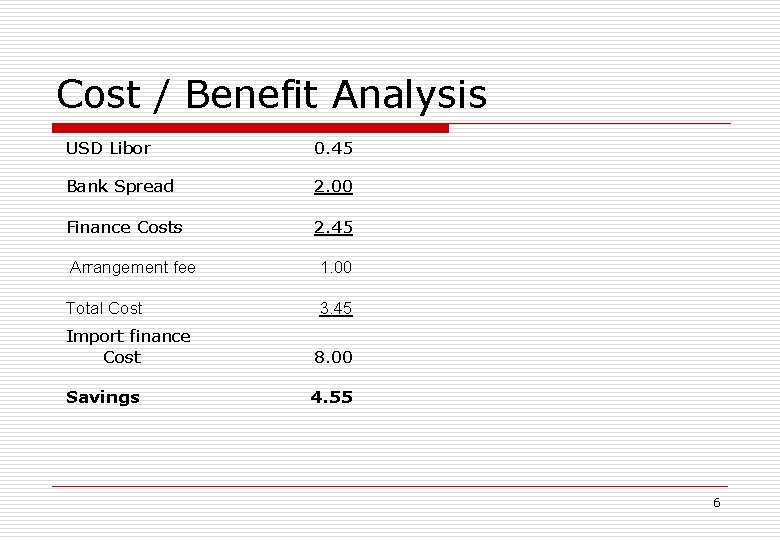

Cost / Benefit Analysis USD Libor 0. 45 Bank Spread 2. 00 Finance Costs 2. 45 Arrangement fee 1. 00 Total Cost 3. 45 Import finance Cost 8. 00 Savings 4. 55 6

Our Strengths • We are one of the leading Business Advisors in Dubai • Executed over $ 100 Million in UAE & Oman • Wide network of bankers across the Globe • Highly reputed Groups In UAE as our clients 7

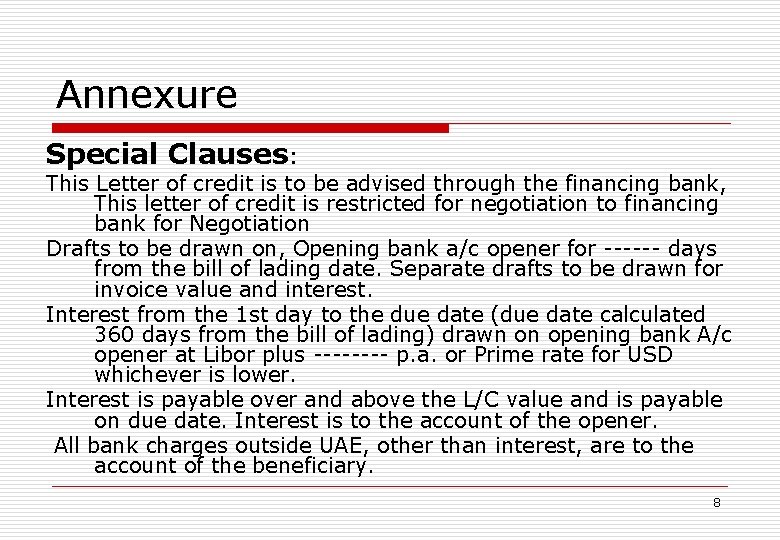

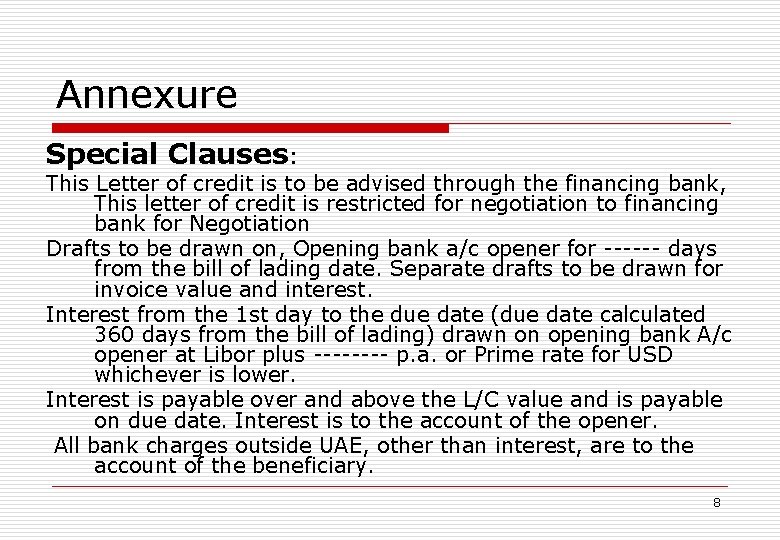

Annexure Special Clauses: This Letter of credit is to be advised through the financing bank, This letter of credit is restricted for negotiation to financing bank for Negotiation Drafts to be drawn on, Opening bank a/c opener for ------ days from the bill of lading date. Separate drafts to be drawn for invoice value and interest. Interest from the 1 st day to the due date (due date calculated 360 days from the bill of lading) drawn on opening bank A/c opener at Libor plus ---- p. a. or Prime rate for USD whichever is lower. Interest is payable over and above the L/C value and is payable on due date. Interest is to the account of the opener. All bank charges outside UAE, other than interest, are to the account of the beneficiary. 8

Thank you Contact in Dubai: Veeru Fortune Consulting P O Box 97439 Dubai Ph: 04 2552404 Fax: 04 2552403 Mobile: 0506598167 Email: veeru@fcgdubai. com