Georgia Association of Medical Equipment Suppliers Representing DMEPOS

- Slides: 15

Georgia Association of Medical Equipment Suppliers Representing DMEPOS Providers

GAMES-Who We Are • Volunteer Association Representing Medical Equipment Suppliers across Georgia • Teresa Tatum-Executive Director • Tyler Riddle-GAMES President; MRS Homecare, Inc. -Vice President • Charlie Barnes IV-GAMES President Elect; Barnes Healthcare Services-CEO • Laura Williard-GAMES Board Member; American Association for Homecare-VP of Payer Relations • Alexis Ward-GAMES Member; Numotion-Director of Medicaid Affairs

1, 993, 279 Enrollees 70. 8% of Population Enrolled in CMO Plans 4 CMO plans in Georgia all have discounts off Medicaid Fee Schedule 60% of Medicaid Population under 18 6 th in Country Georgia Medicaid Landscape

CURES Legislation • Will limit the federal contribution for DMEPOS for 255 select E, K, and A codes. • States can still set their own payment rates to ensure access to care. • States will have to complete annual reconciliation by 3/30/2019. • • • Primary Fee For Service Claims Only No MCO No secondary claims Aggregate expenditure for HCPCS code listing only Include area patient lives or reconciliation will occur to lowest Medicare allowable in the state • Medicare Rates Unsustainable Due to Flawed Competitive Bidding Program

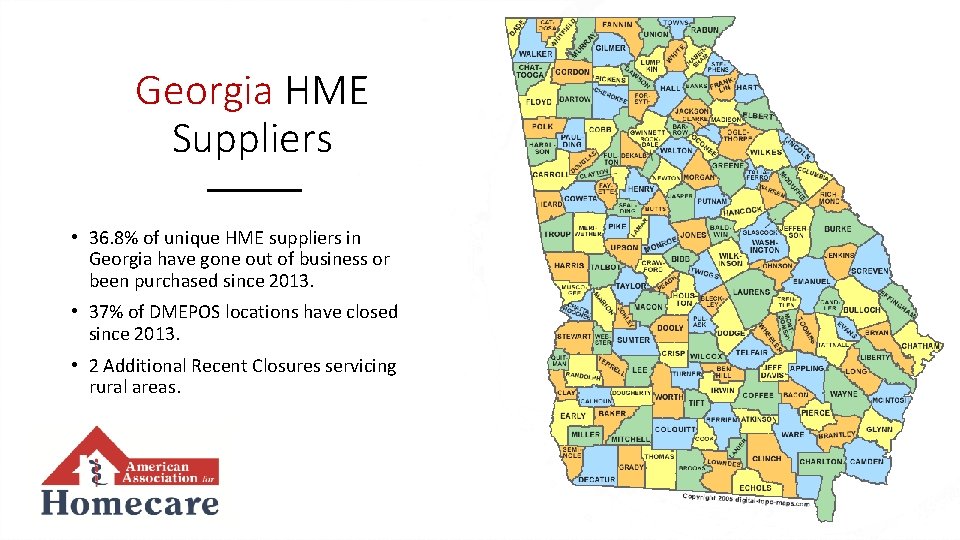

HME Suppliers Since 2013, 41. 8% of suppliers have gone out of business or been purchased due to unsustainable rates from the competitive bid program.

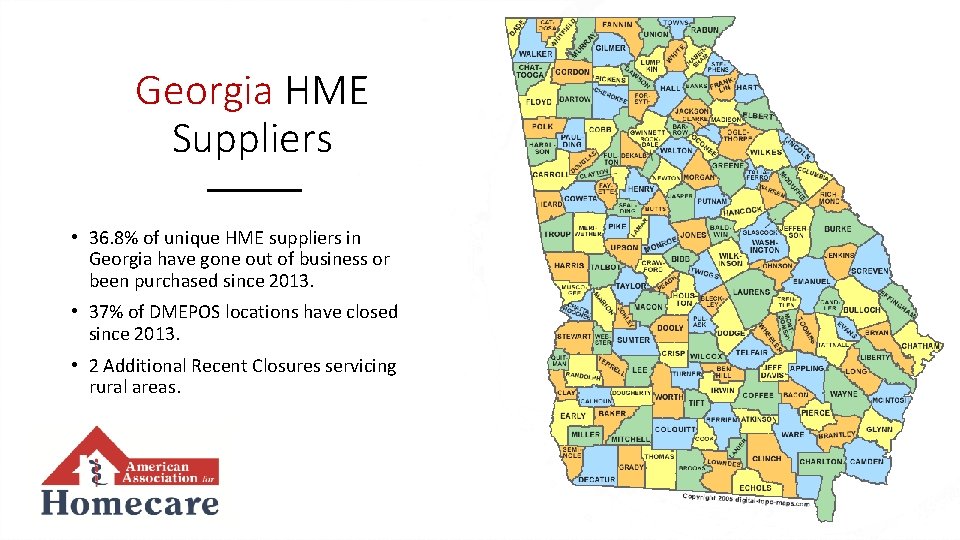

Georgia HME Suppliers • 36. 8% of unique HME suppliers in Georgia have gone out of business or been purchased since 2013. • 37% of DMEPOS locations have closed since 2013. • 2 Additional Recent Closures servicing rural areas.

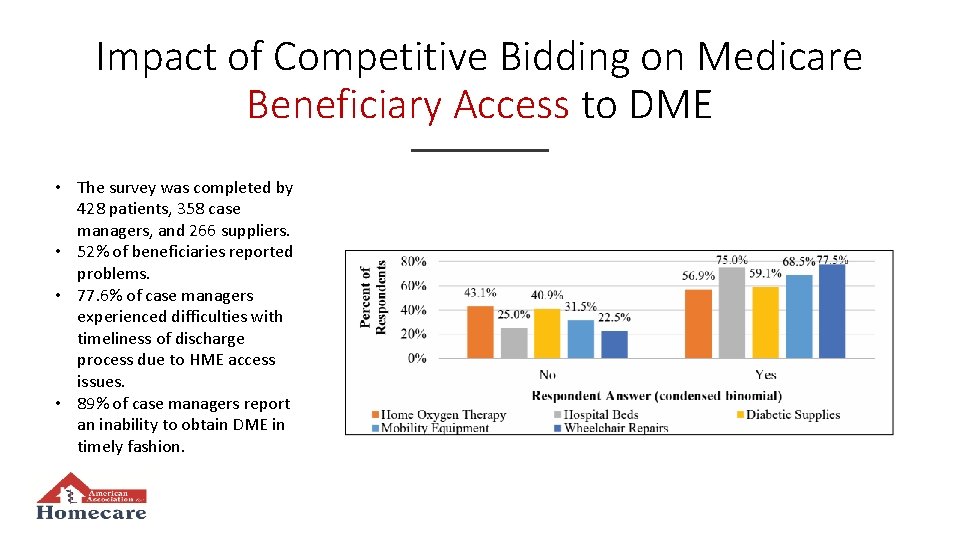

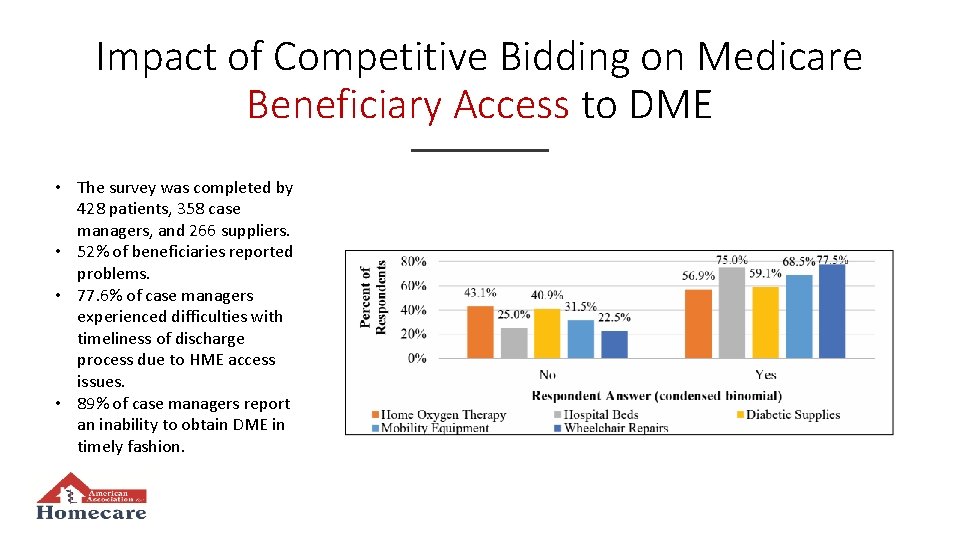

Impact of Competitive Bidding on Medicare Beneficiary Access to DME • The survey was completed by 428 patients, 358 case managers, and 266 suppliers. • 52% of beneficiaries reported problems. • 77. 6% of case managers experienced difficulties with timeliness of discharge process due to HME access issues. • 89% of case managers report an inability to obtain DME in timely fashion.

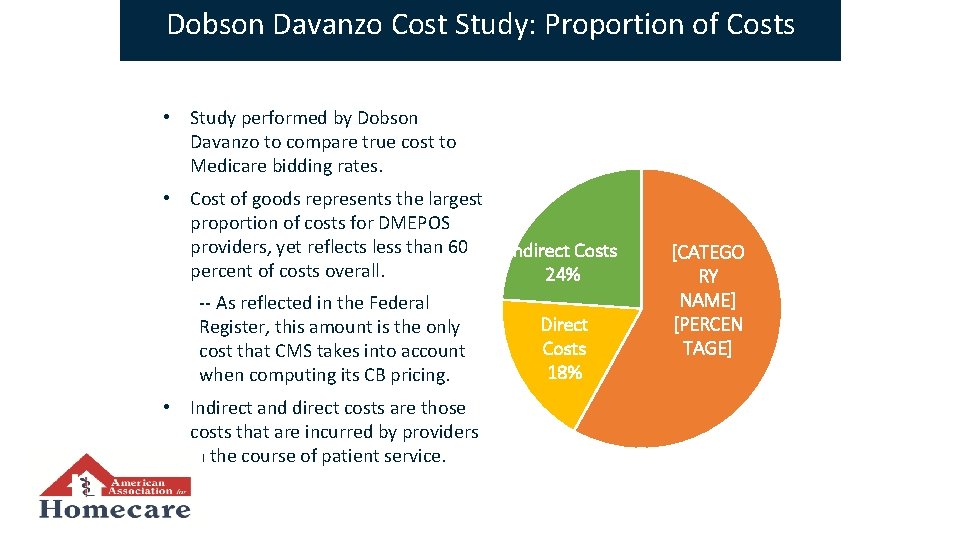

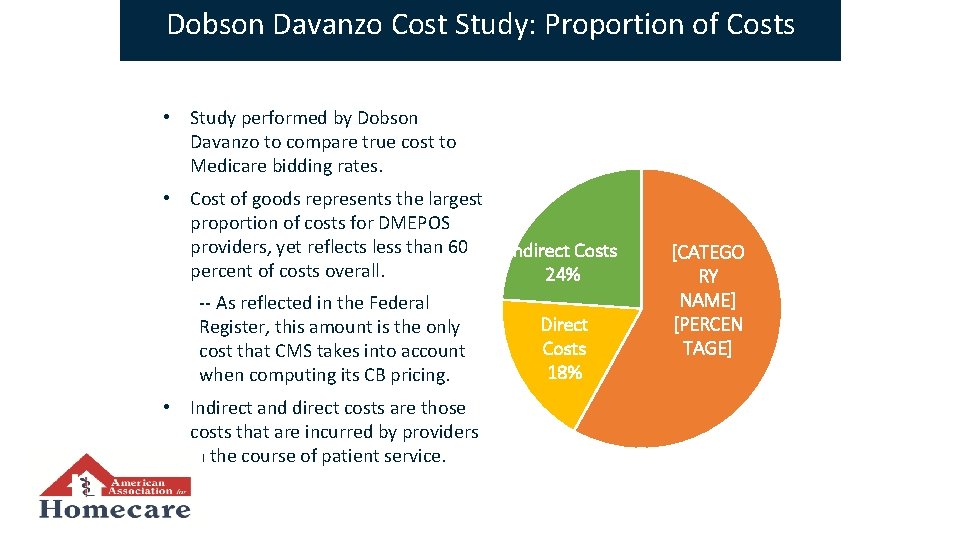

Dobson Davanzo Cost Study: Proportion of Costs • Study performed by Dobson Davanzo to compare true cost to Medicare bidding rates. • Cost of goods represents the largest proportion of costs for DMEPOS providers, yet reflects less than 60 percent of costs overall. -- As reflected in the Federal Register, this amount is the only cost that CMS takes into account when computing its CB pricing. • Indirect and direct costs are those costs that are incurred by providers in the course of patient service. Indirect Costs 24% Direct Costs 18% [CATEGO RY NAME] [PERCEN TAGE]

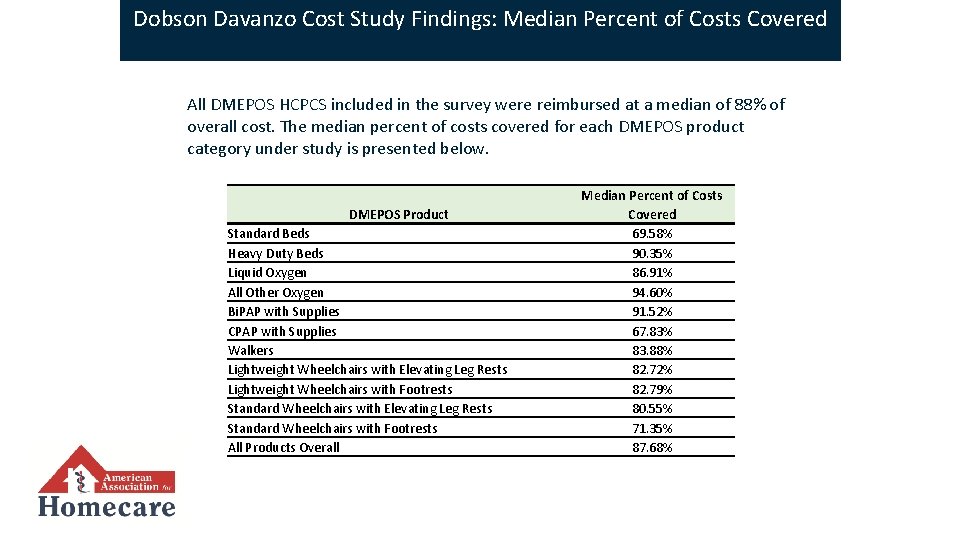

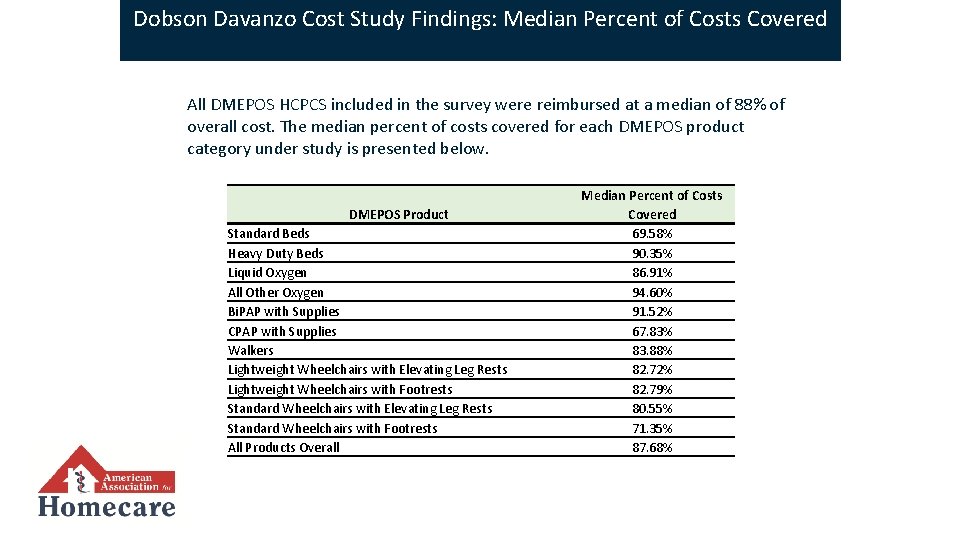

Dobson Davanzo Cost Study Findings: Median Percent of Costs Covered All DMEPOS HCPCS included in the survey were reimbursed at a median of 88% of overall cost. The median percent of costs covered for each DMEPOS product category under study is presented below. DMEPOS Product Standard Beds Heavy Duty Beds Liquid Oxygen All Other Oxygen Bi. PAP with Supplies CPAP with Supplies Walkers Lightweight Wheelchairs with Elevating Leg Rests Lightweight Wheelchairs with Footrests Standard Wheelchairs with Elevating Leg Rests Standard Wheelchairs with Footrests All Products Overall Median Percent of Costs Covered 69. 58% 90. 35% 86. 91% 94. 60% 91. 52% 67. 83% 83. 88% 82. 72% 82. 79% 80. 55% 71. 35% 87. 68%

Other Information • Distinct Populations and Diverse Missions • Community Verses Home Use • Pediatric Population Cost Differentials • Social Security Act Directive • Payments are consistent with efficiency, economy, and quality of care and are sufficient to enlist enough providers so that care and services are available under the plan.

Servicing the Pediatric Population • Medicare developed to address needs of an aging population losing mobility. Pediatrics who require DME long term never had mobility so the complex rehab equipment is working as an orthotic device verses aid to prevent falls. • Growth in pediatric population both physically and developmentally requires more time during all stages of equipment provision and requires more follow up after equipment provision to make adjustments and determine proper function of equipment and ensuring it meets the pediatric patient’s needs. • Cost of providing oxygen equipment to a pediatric patient is 4 times more than servicing an adult.

The World of Caring for a Pediatric Patient

Legislative Landscape on Medicare Rates • Legislative precedence for rate changes in Medicare program will create even more unstable reimbursement environment. • Cures Impact to July 1, 2016 fee schedule retroactive • Interim Final Rule-Published in OMB’s Fall Unified Agenda Listing • Retroactive to August 1, 2017 change of Medicare fee schedule to 50/50 blended rates • HR 4229 -Protecting HOME Access Act of 2017

Issues with SPA set to follow Medicare Rates • Retro fee schedule changes will have to be reprocessed at new allowables • Impacting 1149 codes-not just those in CURES mandate • Allowables already set below Medicare fee schedule will have to be increased • 308 codes will require allowable to be increased • 158 codes will require allowable to be decreased

GAMES Request • Freeze rates for 2018 calendar year. • Work with CMS and GAMES to analyze spend verses Medicare allowables. • CMS has agreed to perform initial and quarterly analysis to determine states risk.

Medical equipment suppliers association

Medical equipment suppliers association Professional association of georgia educators

Professional association of georgia educators Gafsed

Gafsed Georgia assisted living association

Georgia assisted living association Georgia high school association v. waddell

Georgia high school association v. waddell Georgia brownfield association

Georgia brownfield association Georgia government finance officers association

Georgia government finance officers association Georgia railroad association

Georgia railroad association Georgia young farmers association

Georgia young farmers association Georgia association of educational leaders

Georgia association of educational leaders Idaho irrigation equipment association

Idaho irrigation equipment association Georgia composite medical board aprn

Georgia composite medical board aprn Medical equipment inspection

Medical equipment inspection Medical equipment vocabulary

Medical equipment vocabulary Troubleshooting medical equipment

Troubleshooting medical equipment Troubleshooting medical equipment

Troubleshooting medical equipment