FIN 303 Vicentiu Covrig Interest rates Chapter 6

- Slides: 18

FIN 303 Vicentiu Covrig Interest rates (Chapter 6) 1

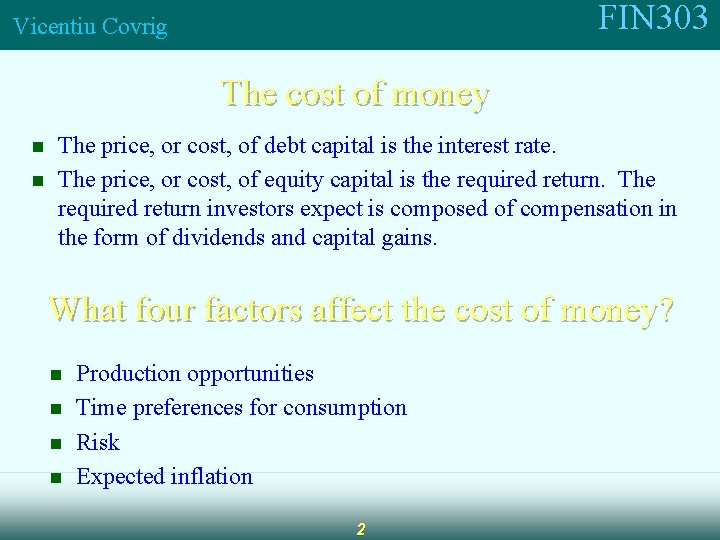

FIN 303 Vicentiu Covrig The cost of money n n The price, or cost, of debt capital is the interest rate. The price, or cost, of equity capital is the required return. The required return investors expect is composed of compensation in the form of dividends and capital gains. What four factors affect the cost of money? n n Production opportunities Time preferences for consumption Risk Expected inflation 2

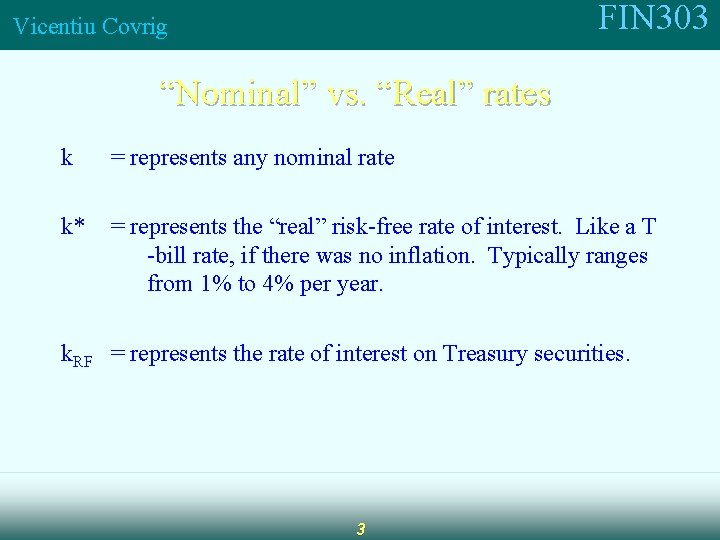

FIN 303 Vicentiu Covrig “Nominal” vs. “Real” rates k = represents any nominal rate k* = represents the “real” risk-free rate of interest. Like a T -bill rate, if there was no inflation. Typically ranges from 1% to 4% per year. k. RF = represents the rate of interest on Treasury securities. 3

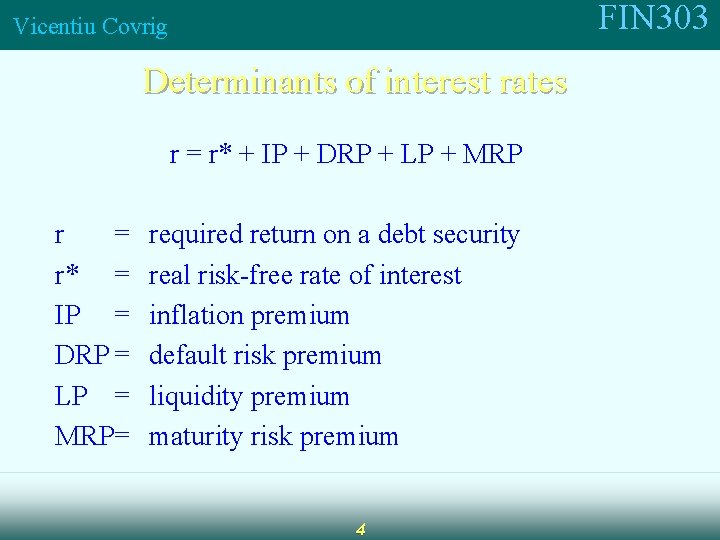

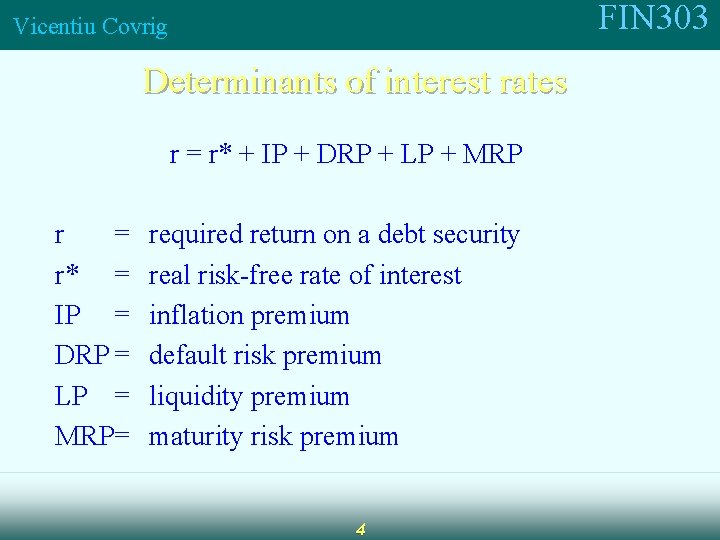

FIN 303 Vicentiu Covrig Determinants of interest rates r = r* + IP + DRP + LP + MRP r = r* = IP = DRP = LP = MRP= required return on a debt security real risk-free rate of interest inflation premium default risk premium liquidity premium maturity risk premium 4

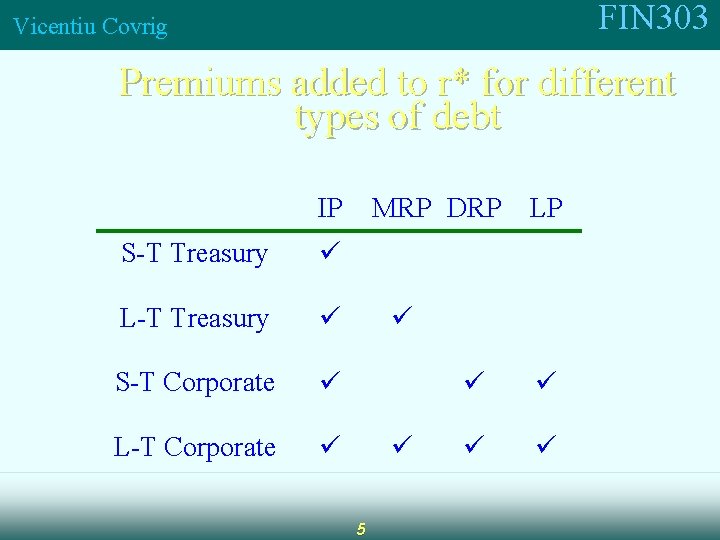

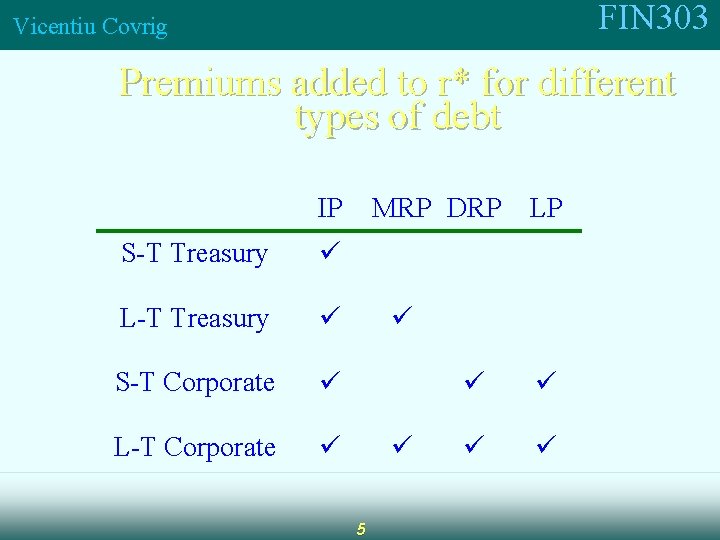

FIN 303 Vicentiu Covrig Premiums added to r* for different types of debt IP S-T Treasury L-T Treasury S-T Corporate L-T Corporate MRP DRP LP 5

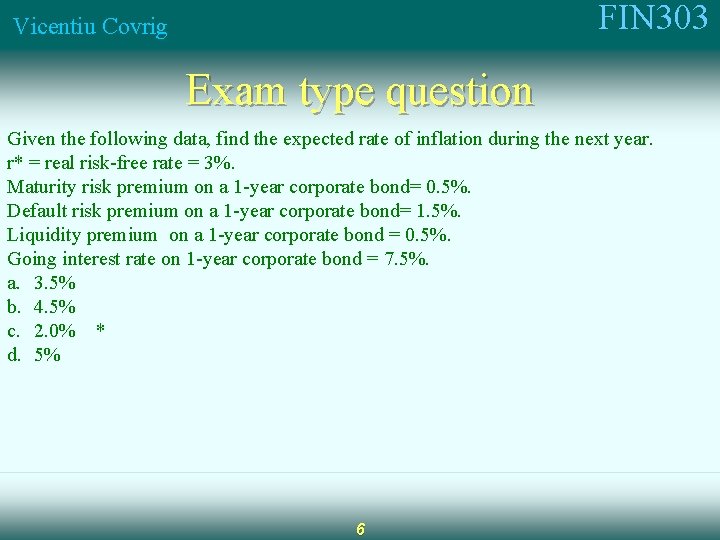

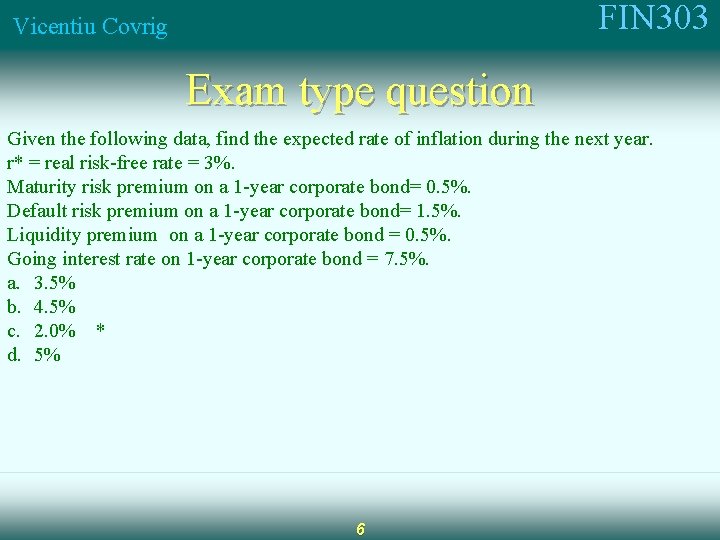

FIN 303 Vicentiu Covrig Exam type question Given the following data, find the expected rate of inflation during the next year. r* = real risk-free rate = 3%. Maturity risk premium on a 1 -year corporate bond= 0. 5%. Default risk premium on a 1 -year corporate bond= 1. 5%. Liquidity premium on a 1 -year corporate bond = 0. 5%. Going interest rate on 1 -year corporate bond = 7. 5%. a. 3. 5% b. 4. 5% c. 2. 0% * d. 5% 6

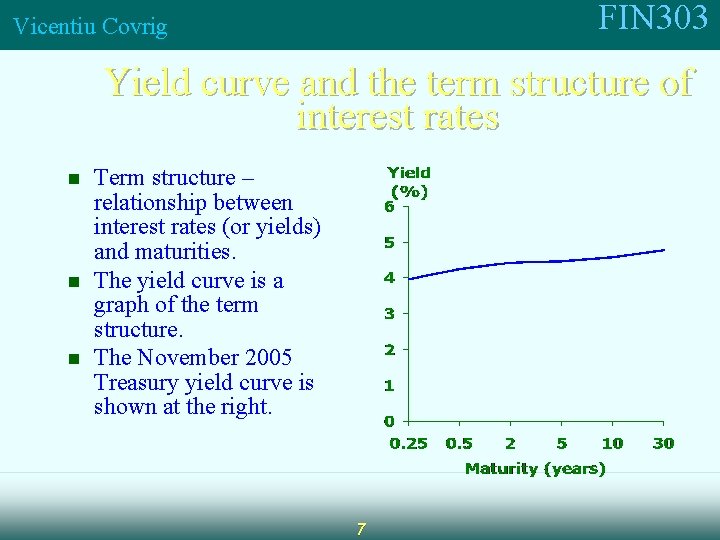

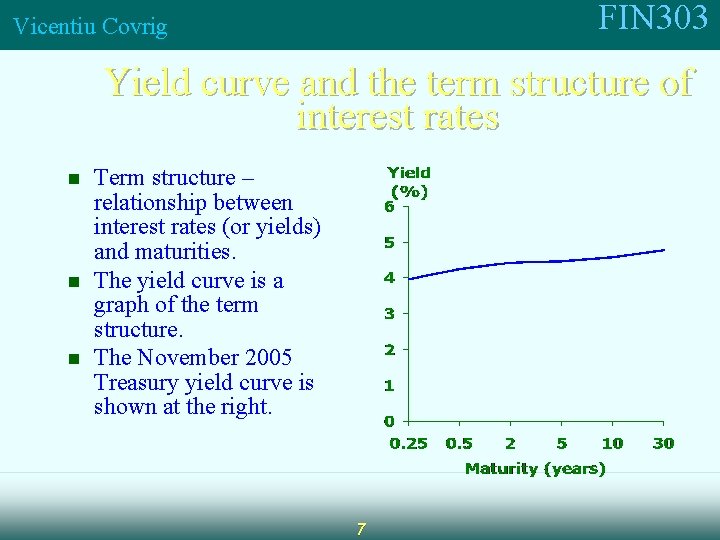

FIN 303 Vicentiu Covrig Yield curve and the term structure of interest rates n n n Term structure – relationship between interest rates (or yields) and maturities. The yield curve is a graph of the term structure. The November 2005 Treasury yield curve is shown at the right. 7

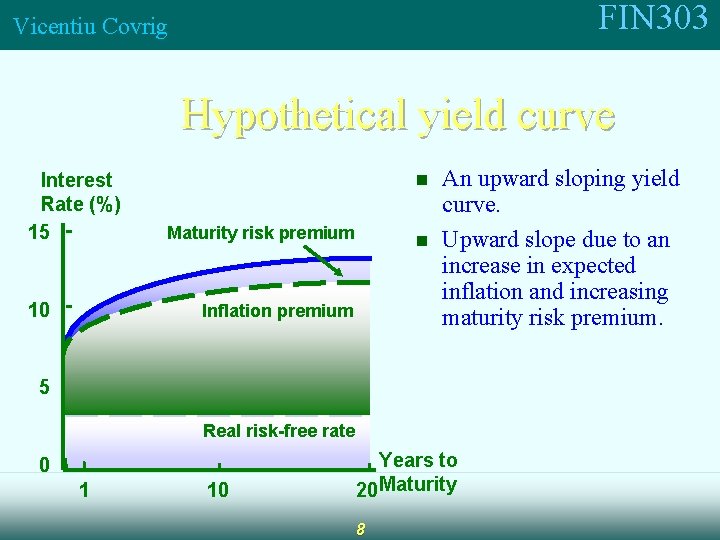

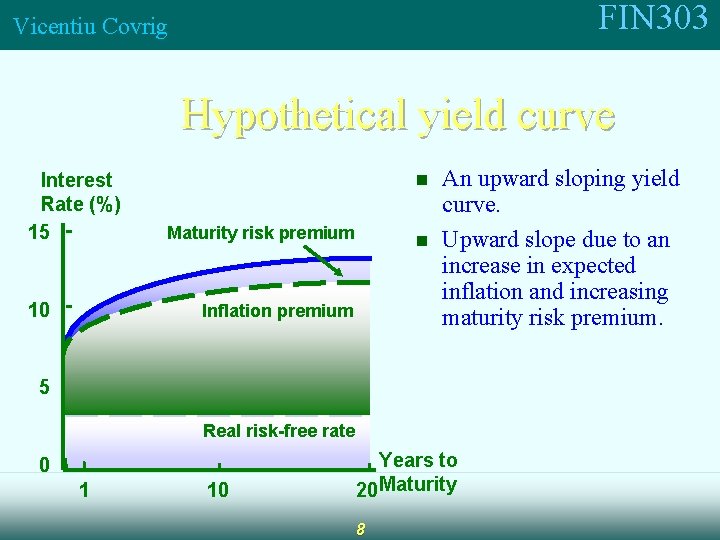

FIN 303 Vicentiu Covrig Hypothetical yield curve Interest Rate (%) 15 10 n Maturity risk premium n Inflation premium An upward sloping yield curve. Upward slope due to an increase in expected inflation and increasing maturity risk premium. 5 Real risk-free rate 0 1 10 Years to 20 Maturity 8

FIN 303 Vicentiu Covrig What is the relationship between the Treasury yield curve and the yield curves for corporate issues? Corporate yield curves are higher than that of Treasury securities, though not necessarily parallel to the Treasury curve. n The spread between corporate and Treasury yield curves widens as the corporate bond rating decreases. n 9

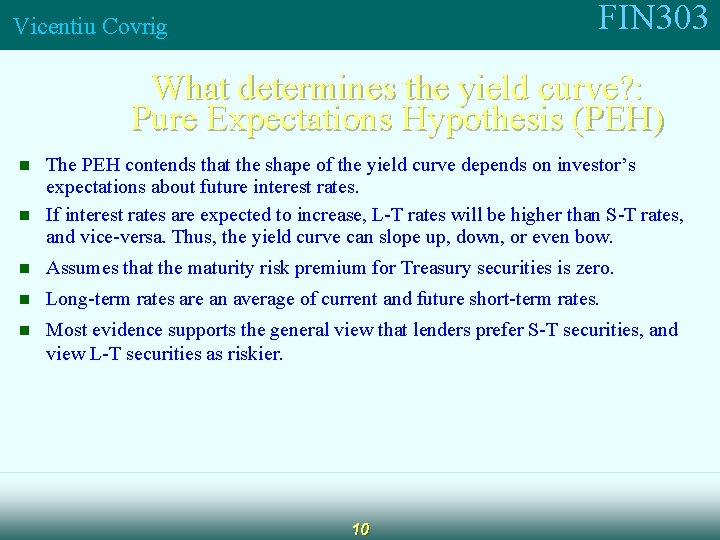

FIN 303 Vicentiu Covrig What determines the yield curve? : Pure Expectations Hypothesis (PEH) n n The PEH contends that the shape of the yield curve depends on investor’s expectations about future interest rates. If interest rates are expected to increase, L-T rates will be higher than S-T rates, and vice-versa. Thus, the yield curve can slope up, down, or even bow. n Assumes that the maturity risk premium for Treasury securities is zero. n Long-term rates are an average of current and future short-term rates. n Most evidence supports the general view that lenders prefer S-T securities, and view L-T securities as riskier. 10

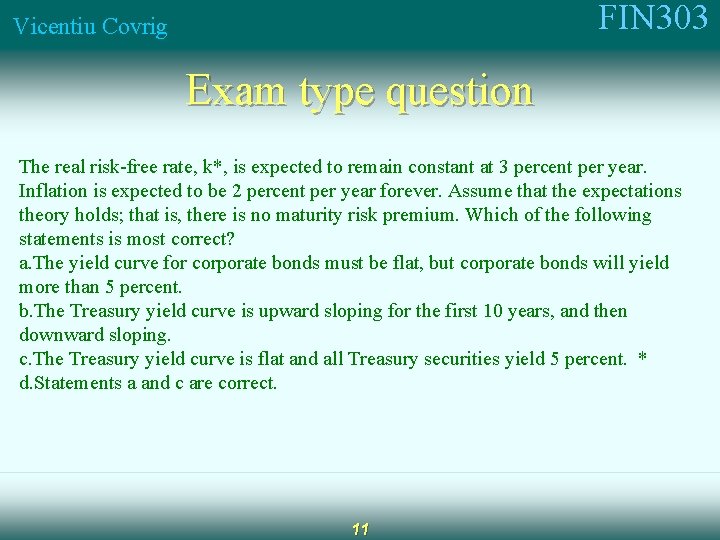

FIN 303 Vicentiu Covrig Exam type question The real risk-free rate, k*, is expected to remain constant at 3 percent per year. Inflation is expected to be 2 percent per year forever. Assume that the expectations theory holds; that is, there is no maturity risk premium. Which of the following statements is most correct? a. The yield curve for corporate bonds must be flat, but corporate bonds will yield more than 5 percent. b. The Treasury yield curve is upward sloping for the first 10 years, and then downward sloping. c. The Treasury yield curve is flat and all Treasury securities yield 5 percent. * d. Statements a and c are correct. 11

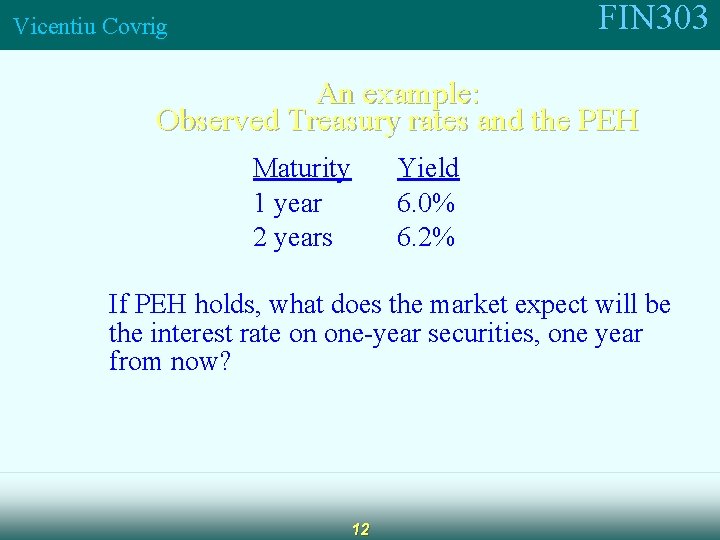

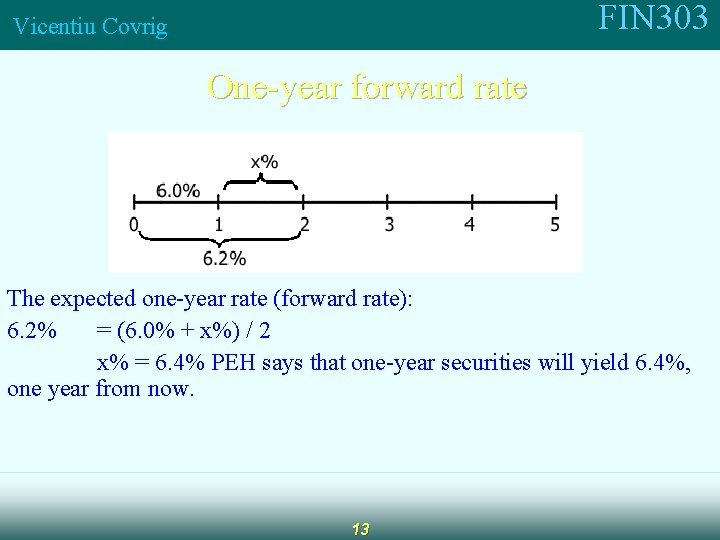

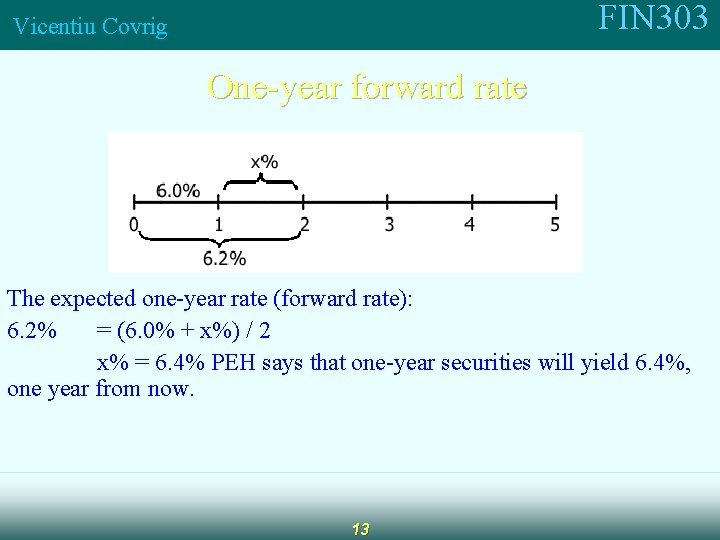

FIN 303 Vicentiu Covrig An example: Observed Treasury rates and the PEH Maturity 1 year 2 years Yield 6. 0% 6. 2% If PEH holds, what does the market expect will be the interest rate on one-year securities, one year from now? 12

FIN 303 Vicentiu Covrig One-year forward rate The expected one-year rate (forward rate): 6. 2% = (6. 0% + x%) / 2 x% = 6. 4% PEH says that one-year securities will yield 6. 4%, one year from now. 13

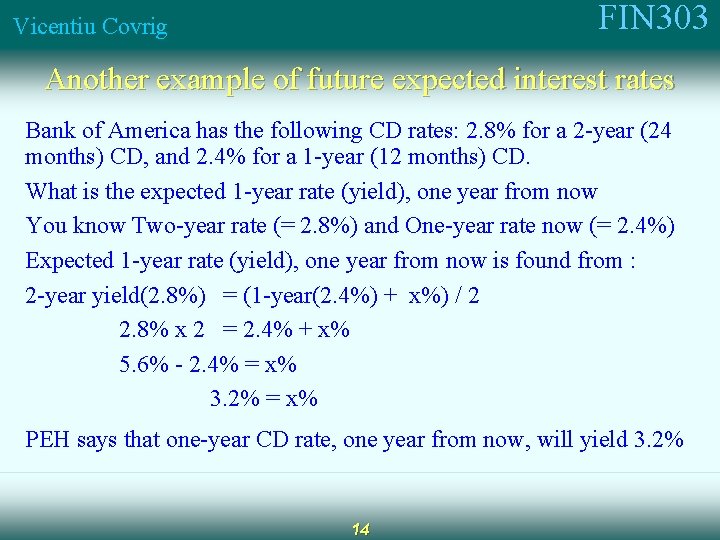

FIN 303 Vicentiu Covrig Another example of future expected interest rates Bank of America has the following CD rates: 2. 8% for a 2 -year (24 months) CD, and 2. 4% for a 1 -year (12 months) CD. What is the expected 1 -year rate (yield), one year from now You know Two-year rate (= 2. 8%) and One-year rate now (= 2. 4%) Expected 1 -year rate (yield), one year from now is found from : 2 -year yield(2. 8%) = (1 -year(2. 4%) + x%) / 2 2. 8% x 2 = 2. 4% + x% 5. 6% - 2. 4% = x% 3. 2% = x% PEH says that one-year CD rate, one year from now, will yield 3. 2% 14

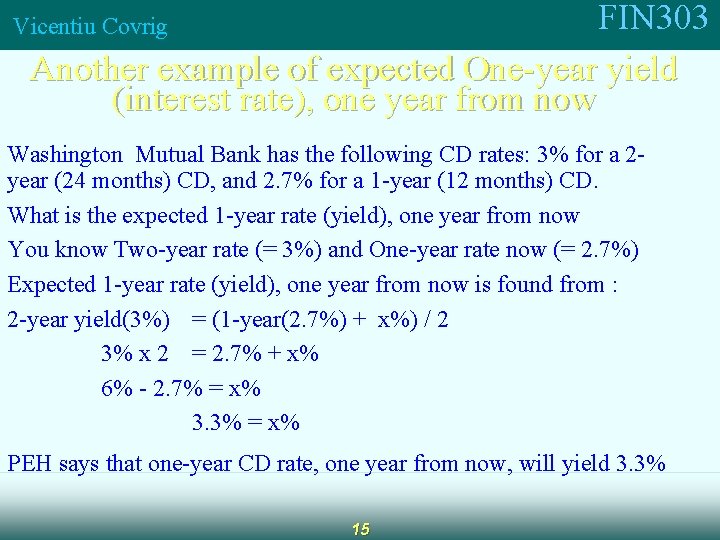

FIN 303 Another example of expected One-year yield (interest rate), one year from now Vicentiu Covrig Washington Mutual Bank has the following CD rates: 3% for a 2 year (24 months) CD, and 2. 7% for a 1 -year (12 months) CD. What is the expected 1 -year rate (yield), one year from now You know Two-year rate (= 3%) and One-year rate now (= 2. 7%) Expected 1 -year rate (yield), one year from now is found from : 2 -year yield(3%) = (1 -year(2. 7%) + x%) / 2 3% x 2 = 2. 7% + x% 6% - 2. 7% = x% 3. 3% = x% PEH says that one-year CD rate, one year from now, will yield 3. 3% 15

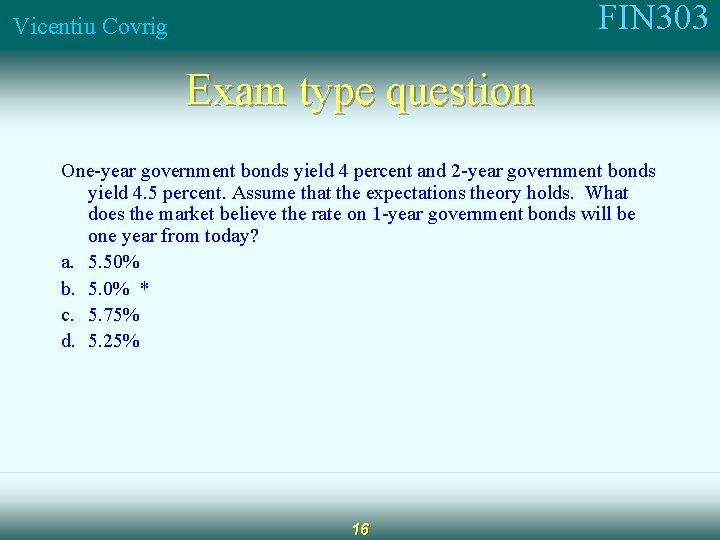

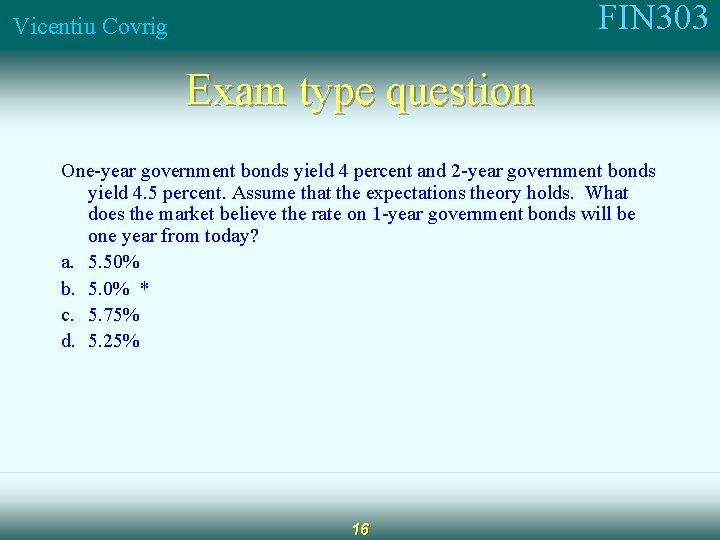

FIN 303 Vicentiu Covrig Exam type question One-year government bonds yield 4 percent and 2 -year government bonds yield 4. 5 percent. Assume that the expectations theory holds. What does the market believe the rate on 1 -year government bonds will be one year from today? a. 5. 50% b. 5. 0% * c. 5. 75% d. 5. 25% 16

FIN 303 Vicentiu Covrig Other factors that influence interest rate levels n Federal reserve policy n Federal budget surplus or deficit n Level of business activity n International factors 17

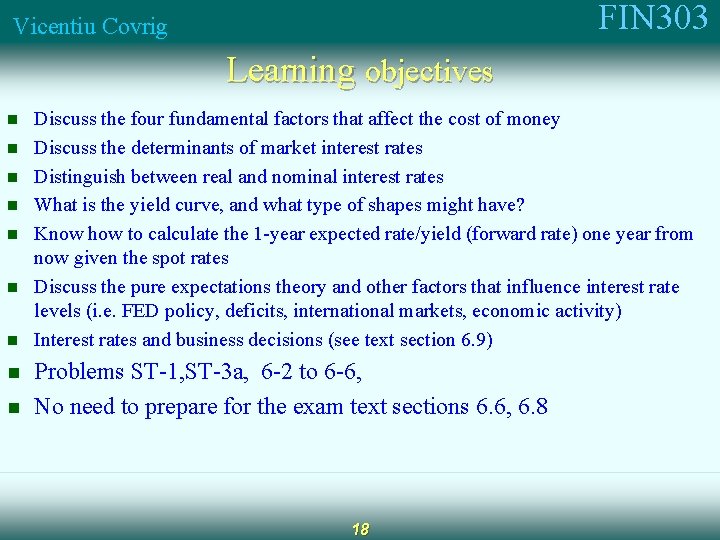

FIN 303 Vicentiu Covrig Learning objectives n n n n n Discuss the four fundamental factors that affect the cost of money Discuss the determinants of market interest rates Distinguish between real and nominal interest rates What is the yield curve, and what type of shapes might have? Know how to calculate the 1 -year expected rate/yield (forward rate) one year from now given the spot rates Discuss the pure expectations theory and other factors that influence interest rate levels (i. e. FED policy, deficits, international markets, economic activity) Interest rates and business decisions (see text section 6. 9) Problems ST-1, ST-3 a, 6 -2 to 6 -6, No need to prepare for the exam text sections 6. 6, 6. 8 18

Vicentiu covrig

Vicentiu covrig Vicentiu covrig

Vicentiu covrig Vicentiu covrig

Vicentiu covrig Covrig,vicentiu m

Covrig,vicentiu m Covrig,vicentiu m

Covrig,vicentiu m Vicentiu covrig

Vicentiu covrig Vicentiu covrig

Vicentiu covrig Vicentiu covrig

Vicentiu covrig Vicentiu covrig

Vicentiu covrig Vicentiu covrig

Vicentiu covrig Vicentiu covrig

Vicentiu covrig Vicentiu covrig

Vicentiu covrig Vicentiu covrig

Vicentiu covrig Vicentiu covrig

Vicentiu covrig Chapter 7 interest rates and bond valuation

Chapter 7 interest rates and bond valuation Chapter 5 bonds bond valuation and interest rates solutions

Chapter 5 bonds bond valuation and interest rates solutions Chapter 6 interest rates and bond valuation

Chapter 6 interest rates and bond valuation Chapter 7 interest rates and bond valuation

Chapter 7 interest rates and bond valuation Chapter 6 interest rates and bond valuation

Chapter 6 interest rates and bond valuation