Discretionary Management Service June 2018 Portfolio Performance Your

- Slides: 2

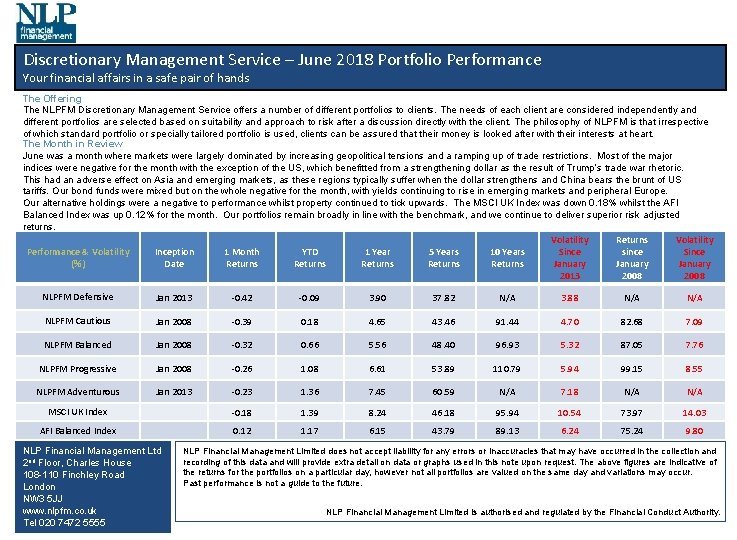

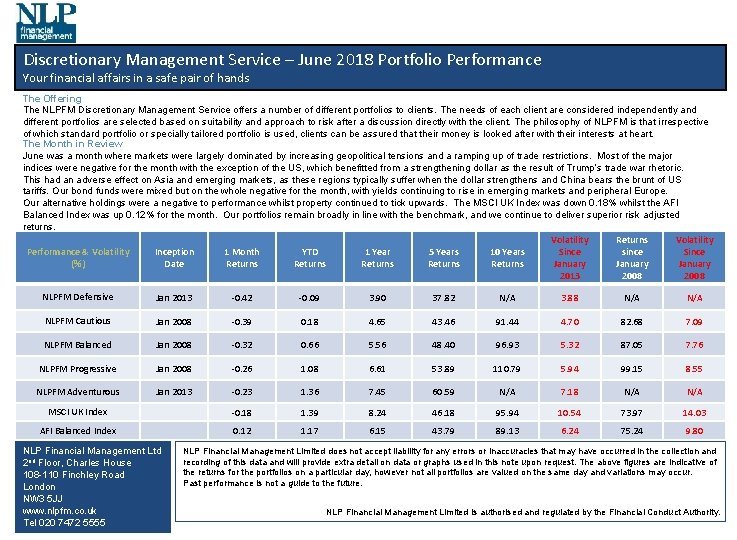

Discretionary Management Service – June 2018 Portfolio Performance Your financial affairs in a safe pair of hands The Offering The NLPFM Discretionary Management Service offers a number of different portfolios to clients. The needs of each client are considered independently and different portfolios are selected based on suitability and approach to risk after a discussion directly with the client. The philosophy of NLPFM is that irrespective of which standard portfolio or specially tailored portfolio is used, clients can be assured that their money is looked after with their interests at heart. The Month in Review June was a month where markets were largely dominated by increasing geopolitical tensions and a ramping up of trade restrictions. Most of the major indices were negative for the month with the exception of the US, which benefitted from a strengthening dollar as the result of Trump’s trade war rhetoric. This had an adverse effect on Asia and emerging markets, as these regions typically suffer when the dollar strengthens and China bears the brunt of US tariffs. Our bond funds were mixed but on the whole negative for the month, with yields continuing to rise in emerging markets and peripheral Europe. Our alternative holdings were a negative to performance whilst property continued to tick upwards. The MSCI UK Index was down 0. 18% whilst the AFI Balanced Index was up 0. 12% for the month. Our portfolios remain broadly in line with the benchmark, and we continue to deliver superior risk adjusted returns. Volatility Returns Volatility Performance & Volatility Inception 1 Month YTD 1 Year 5 Years 10 Years Since since Since (%) Date Returns Returns January 2013 2008 NLPFM Defensive Jan 2013 -0. 42 -0. 09 3. 90 37. 82 N/A 3. 88 N/A NLPFM Cautious Jan 2008 -0. 39 0. 18 4. 65 43. 46 91. 44 4. 70 82. 68 7. 09 NLPFM Balanced Jan 2008 -0. 32 0. 66 5. 56 48. 40 96. 93 5. 32 87. 05 7. 76 NLPFM Progressive Jan 2008 -0. 26 1. 08 6. 61 53. 89 110. 79 5. 94 99. 15 8. 55 NLPFM Adventurous Jan 2013 -0. 23 1. 36 7. 45 60. 59 N/A 7. 18 N/A MSCI UK Index -0. 18 1. 39 8. 24 46. 18 95. 94 10. 54 73. 97 14. 03 AFI Balanced Index 0. 12 1. 17 6. 15 43. 79 89. 13 6. 24 75. 24 9. 80 NLP Financial Management Ltd 2 nd Floor, Charles House 108 -110 Finchley Road London NW 3 5 JJ www. nlpfm. co. uk Tel 020 7472 5555 NLP Financial Management Limited does not accept liability for any errors or inaccuracies that may have occurred in the collection and recording of this data and will provide extra detail on data or graphs used in this note upon request. The above figures are indicative of the returns for the portfolios on a particular day, however not all portfolios are valued on the same day and variations may occur. Past performance is not a guide to the future. NLP Financial Management Limited is authorised and regulated by the Financial Conduct Authority.

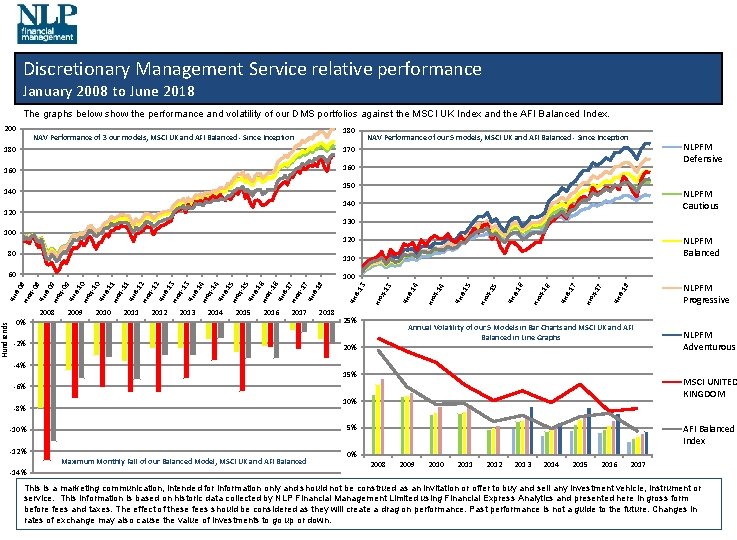

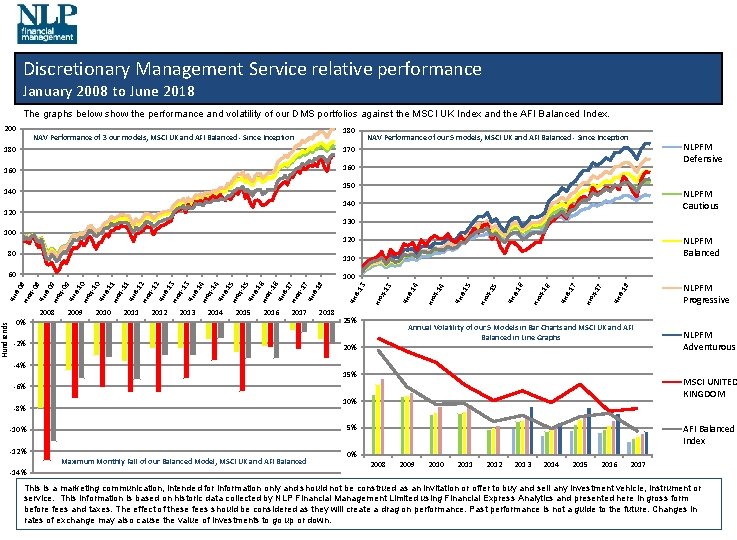

Discretionary Management Service relative performance January 2008 to June 2018 The graphs below show the performance and volatility of our DMS portfolios against the MSCI UK Index and the AFI Balanced Index. 200 180 NAV Performance of 3 our models, MSCI UK and AFI Balanced - Since Inception 180 170 160 NLPFM Defensive 150 140 NLPFM Cautious 140 120 130 100 NLPFM Balanced 120 80 110 60 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 0% 25% -2% 20% -4% в-1 8 NLPFM Progressive ян ию л-1 7 7 в-1 ян ию л-1 6 6 в-1 ян 5 5 ию л-1 в-1 ян 4 ию л-1 4 в-1 ян 3 ию л-1 ян в-1 3 100 ян в-0 ию 8 л-0 8 ян в-0 ию 9 л-0 9 ян в-1 ию 0 л-1 0 ян в-1 ию 1 л-1 1 ян в-1 ию 2 л-1 2 ян в-1 ию 3 л-1 3 ян в-1 ию 4 л-1 4 ян в-1 ию 5 л-1 5 ян в-1 ию 6 л-1 6 ян в-1 ию 7 л-1 7 ян в-1 8 Hundrends NAV Performance of our 5 models, MSCI UK and AFI Balanced - Since Inception Annual Volatility of our 5 Models in Bar Charts and MSCI UK and AFI Balanced in Line Graphs 15% MSCI UNITED KINGDOM -6% 10% -8% -12% -14% AFI Balanced Index 5% -10% Maximum Monthly Fall of our Balanced Model, MSCI UK and AFI Balanced NLPFM Adventurous 0% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 This is a marketing communication, intended for information only and should not be construed as an invitation or offer to buy and sell any investment vehicle, instrument or service. This information is based on historic data collected by NLP Financial Management Limited using Financial Express Analytics and presented here in gross form before fees and taxes. The effect of these fees should be considered as they will create a drag on performance. Past performance is not a guide to the future. Changes in rates of exchange may also cause the value of investments to go up or down.