Customer Insights Who is the Frozen Juice customer

- Slides: 4

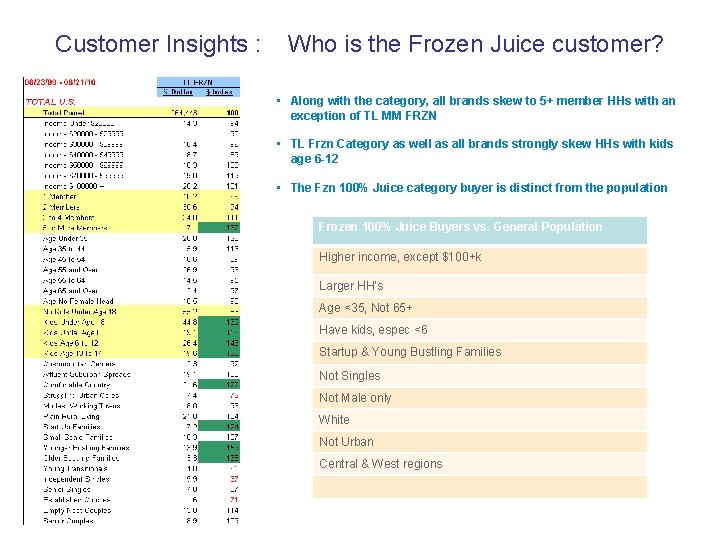

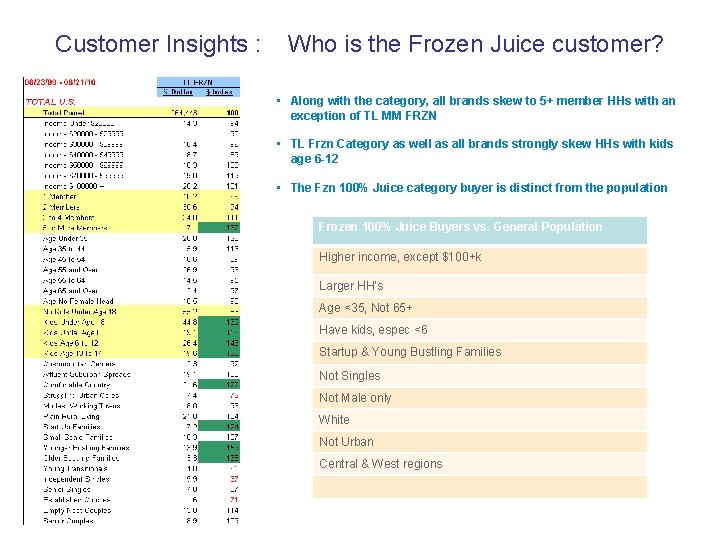

Customer Insights : Who is the Frozen Juice customer? • Along with the category, all brands skew to 5+ member HHs with an exception of TL MM FRZN • TL Frzn Category as well as all brands strongly skew HHs with kids age 6 -12 • The Fzn 100% Juice category buyer is distinct from the population Frozen 100% Juice Buyers vs. General Population Higher income, except $100+k Larger HH’s Age <35, Not 65+ Have kids, espec <6 Startup & Young Bustling Families Not Singles Not Male only White Not Urban Central & West regions

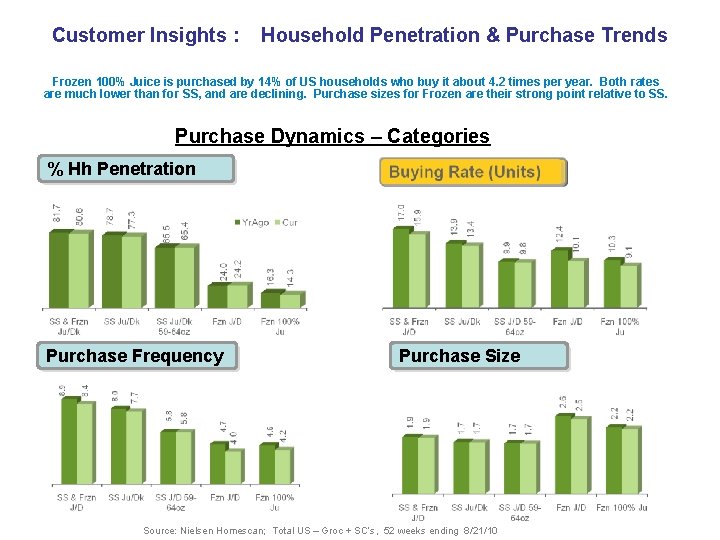

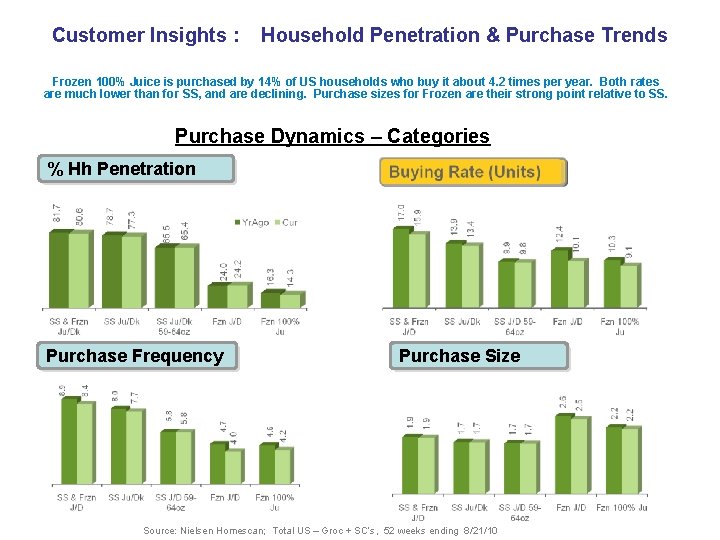

Customer Insights : Household Penetration & Purchase Trends Frozen 100% Juice is purchased by 14% of US households who buy it about 4. 2 times per year. Both rates are much lower than for SS, and are declining. Purchase sizes for Frozen are their strong point relative to SS. Purchase Dynamics – Categories % Hh Penetration Purchase Frequency Purchase Size Source: Nielsen Homescan; Total US – Groc + SC’s, 52 weeks ending 8/21/10

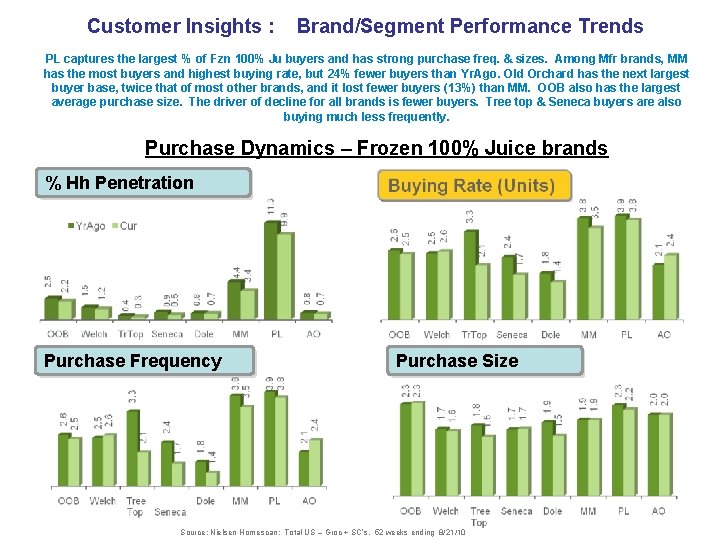

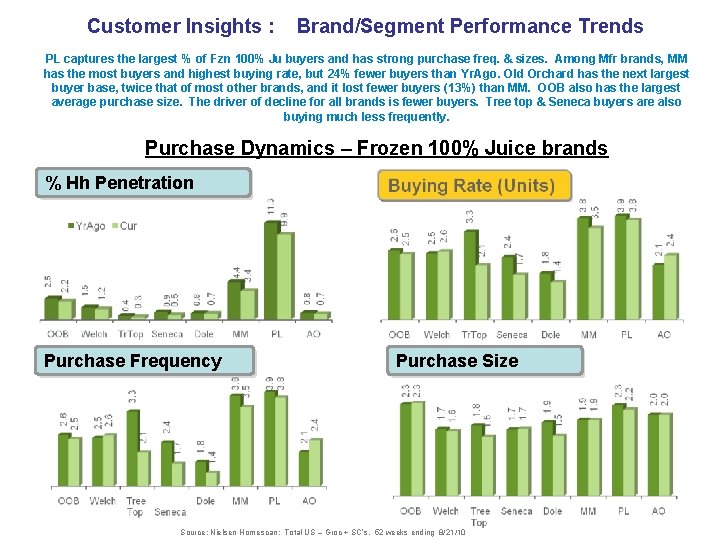

Customer Insights : Brand/Segment Performance Trends PL captures the largest % of Fzn 100% Ju buyers and has strong purchase freq. & sizes. Among Mfr brands, MM has the most buyers and highest buying rate, but 24% fewer buyers than Yr. Ago. Old Orchard has the next largest buyer base, twice that of most other brands, and it lost fewer buyers (13%) than MM. OOB also has the largest average purchase size. The driver of decline for all brands is fewer buyers. Tree top & Seneca buyers are also buying much less frequently. Purchase Dynamics – Frozen 100% Juice brands % Hh Penetration Purchase Frequency Purchase Size Source: Nielsen Homescan; Total US – Groc + SC’s, 52 weeks ending 8/21/10

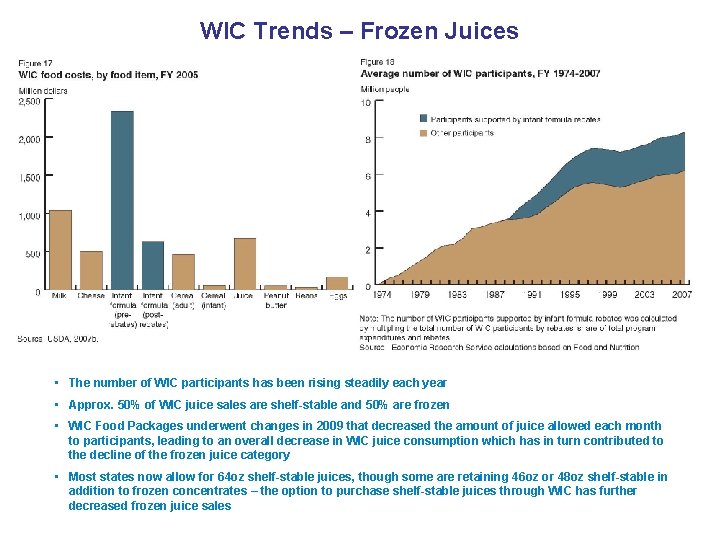

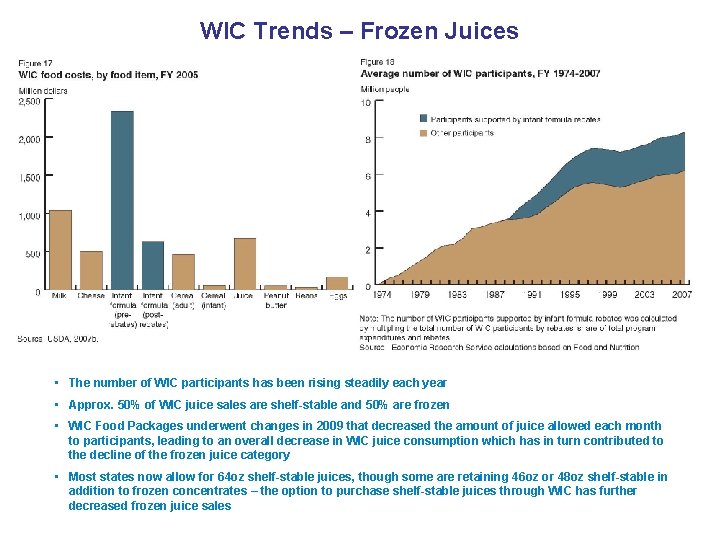

WIC Trends – Frozen Juices • The number of WIC participants has been rising steadily each year • Approx. 50% of WIC juice sales are shelf-stable and 50% are frozen • WIC Food Packages underwent changes in 2009 that decreased the amount of juice allowed each month to participants, leading to an overall decrease in WIC juice consumption which has in turn contributed to the decline of the frozen juice category • Most states now allow for 64 oz shelf-stable juices, though some are retaining 46 oz or 48 oz shelf-stable in addition to frozen concentrates – the option to purchase shelf-stable juices through WIC has further decreased frozen juice sales