CHAPTER 12 ACCOUNTING FOR A PAYROLL SYSTEM ACCOUNTING

- Slides: 13

CHAPTER 12 ACCOUNTING FOR A PAYROLL SYSTEM

ACCOUNTING FOR A PAYROLL SYSTEM CHAPTER OJECTIVES ü Importance of accurate payroll records. ü Calculate gross earnings using different methods. ü How to calculate different types of deductions from gross earnings. ü Prepare a payroll register. ü Prepare an employee’s earnings record. ü Knowledge of all accounting terms introduced in this chapter.

UNIT 1 CALCULATING GROSS EARNINGS IMPORTANCE OF PAYROLL RECORDS PAYROLL– is a list of the employees and the payments due to each employee or a specific time period. ü PAY PERIOD—is the amount of time over which an employee is paid. Most businesses use weekly, bi-weekly (every 2 -weeks) or semimonthly (2 times monthly) ü

UNIT 1 CALCULATING GROSS EARNINGS IMPORTANCE OF PAYROLL RECORDS 1) 2) The Payroll– is a major expense for most companies. A well designed payroll system serves 2 roles. The collection and processing of all data needed to prepare and issue payroll checks. The generation of payroll records needed for accounting purpose and reporting required information to government agencies, management and other board members.

UNIT 1 CALCULATING GROSS EARNINGS IMPORTANCE OF PAYROLL RECORDS PAYROLL CLERK– is the person responsible for processing and preparing the payroll. Their duties include: 1) Make sure all paid on time. 2) Ensure employee’s get the correct amount. 3) Completes all payroll records. 4) Submits all necessary payroll reports. 5) Pays payroll taxes. n

UNIT 1 CALCULATING GROSS EARNINGS n Gross Earnings—this calculation depends on the basis on which an employee is paid. The employee’s pay is based on the following: n SALARY n HOURLY WAGE n COMMISSION n SALARY PLUS COMMISSION/BONUS n OVERTIME PAY

UNIT 1 CALCULATING GROSS EARNINGS n SALARY—is a fixed amount of money paid to an employee for each pay period. Someone who gets paid on a salary basis gets paid the same amount of money regardless of the number of hours they work.

UNIT 1 CALCULATING GROSS EARNINGS n HOURLY WAGE—is an amount of money paid to an employee at a specified rate per each hour worked. Example: John worked 35 hours last week at $7. 25 per hour. GROSS EARNINGS: 35 x 7. 25==$253. 75 Therefore John’s gross earnings were n

UNIT 1 CALCULATING GROSS EARNINGS n TIME CARD—is a record of the times an employees reports to work each day. These times may be recorded manually or by an electronic clock.

UNIT 1 CALCULATING GROSS EARNINGS n COMMISSION—is an amount paid to an employee based on a certain percentage of the employee’s sales. These are used as incentive laden terms so that this encourages the employee to strive harder for sales because their earnings are directly related to their productivity.

UNIT 1 CALCULATING GROSS EARNINGS n SALARY & COMMISSION—is a way in which employee has a guaranteed “base” and additionally get a commission from their sales. EXAMPLE: : Mary gets paid $250. 00 per week plus %5 sales Mary had sales last week of $2500. 00 $250. 00 + ($2, 500. 00 x. 05) = $375. 00 Thus: Mary’s earnings for the week were $375. 00 n

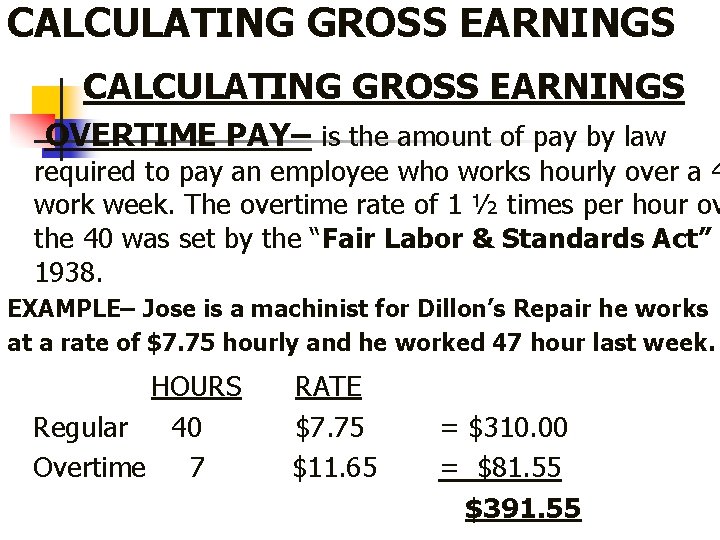

CALCULATING GROSS EARNINGS OVERTIME PAY– is the amount of pay by law required to pay an employee who works hourly over a 4 work week. The overtime rate of 1 ½ times per hour ov the 40 was set by the “Fair Labor & Standards Act” 1938. EXAMPLE– Jose is a machinist for Dillon’s Repair he works at a rate of $7. 75 hourly and he worked 47 hour last week. HOURS Regular 40 Overtime 7 RATE $7. 75 $11. 65 = $310. 00 = $81. 55 $391. 55

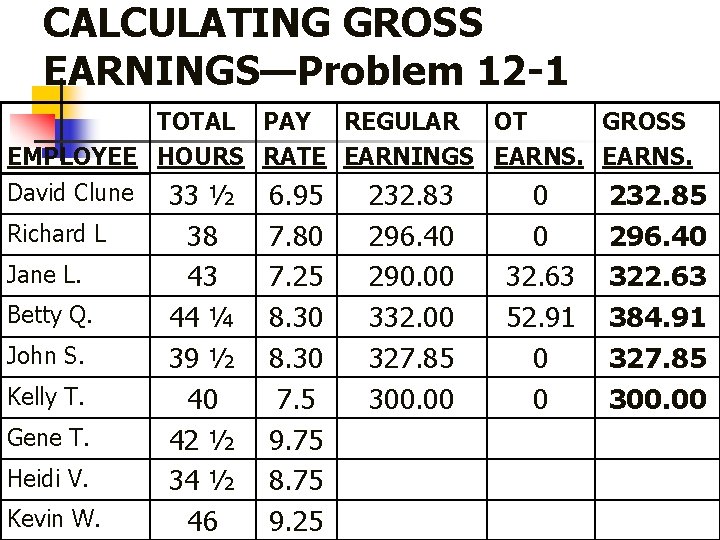

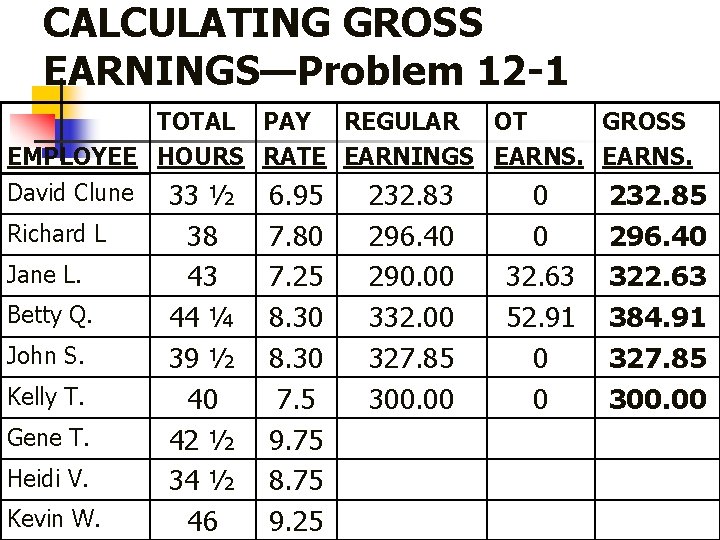

CALCULATING GROSS EARNINGS—Problem 12 -1 TOTAL PAY REGULAR OT GROSS EMPLOYEE HOURS RATE EARNINGS EARNS. David Clune 33 ½ 6. 95 232. 83 0 232. 85 Richard L Jane L. Betty Q. John S. Kelly T. Gene T. Heidi V. Kevin W. 38 43 44 ¼ 39 ½ 40 42 ½ 34 ½ 46 7. 80 7. 25 8. 30 7. 5 9. 75 8. 75 9. 25 296. 40 290. 00 332. 00 327. 85 300. 00 0 32. 63 52. 91 0 0 296. 40 322. 63 384. 91 327. 85 300. 00